Deck 15: Financing Corporate Real Estate

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/24

العب

ملء الشاشة (f)

Deck 15: Financing Corporate Real Estate

1

Which of the following factors does NOT represent an effect of corporate real estate ownership on corporate financial statements?

A) The unrealized source of potential gain from the sale of property is not represented on annual income statements

B) Income represented on accounting statements may underestimate the actual cash flows provided by property

C) The book value of property on the balance sheet may not represent the actual market value.

D) The corporation's overall debt ratio may be reduced,property is carried at book value but financed at market value.

A) The unrealized source of potential gain from the sale of property is not represented on annual income statements

B) Income represented on accounting statements may underestimate the actual cash flows provided by property

C) The book value of property on the balance sheet may not represent the actual market value.

D) The corporation's overall debt ratio may be reduced,property is carried at book value but financed at market value.

The corporation's overall debt ratio may be reduced,property is carried at book value but financed at market value.

2

Which of the following could be affected,if a corporation acquired a parcel of real estate?

A) Earnings per share ratio

B) Corporate liquidity

C) Corporate risk

D) All of the above

A) Earnings per share ratio

B) Corporate liquidity

C) Corporate risk

D) All of the above

All of the above

3

The residual value at the end of the holding period should be based on the market value of the real estate and not the book value.

True

4

A company sells an office building that has appreciated in value and subsequently leases the space.Which of the following scenarios represents an impact that sale-leasebacks may have on corporate financial statements?

A) Lower total income will be realized in the year of sale because of capital gains tax

B) Higher taxable income will be realized in the year of sale because of a gain on sale

C) Earnings per share increases because the mortgage has been paid off

D) Higher taxable income will be realized because lease payments cannot be deducted

A) Lower total income will be realized in the year of sale because of capital gains tax

B) Higher taxable income will be realized in the year of sale because of a gain on sale

C) Earnings per share increases because the mortgage has been paid off

D) Higher taxable income will be realized because lease payments cannot be deducted

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

5

It is estimated that corporate users control as much as ___ percent of all commercial real estate.

A) 10

B) 25

C) 75

D) 100

A) 10

B) 25

C) 75

D) 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

6

All other factors being equal,a company would prefer to own rather than lease under which of the following conditions?

A) The expected life of an asset far exceeds the company's projected period of use

B) The real estate investment represents a large proportion of the company's total capital

C) The corporate needs for the property are not highly sensitive to the level of maintenance

D) The corporation needs a specialized research and development building

A) The expected life of an asset far exceeds the company's projected period of use

B) The real estate investment represents a large proportion of the company's total capital

C) The corporate needs for the property are not highly sensitive to the level of maintenance

D) The corporation needs a specialized research and development building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

7

Similar to decisions about owning or leasing equipment,the decision to own or lease a property is basically just a choice between two financing alternatives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is FALSE,concerning operating leases?

A) It is recorded as present value of lease on the balance sheet.

B) It does not have any real effect the balance sheet.

C) It must not extend for at least 75 percent of the asset's life.

D) It is usually the preferred form of accounting for leases.

A) It is recorded as present value of lease on the balance sheet.

B) It does not have any real effect the balance sheet.

C) It must not extend for at least 75 percent of the asset's life.

D) It is usually the preferred form of accounting for leases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

9

Non-recourse debt,such as a mortgage on a specific property,typically has a lower rate than the unsecured debt of companies with high credit ratings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following does NOT represent a potential benefit of selling and leasing back a property?

A) Provides a source of capital

B) Can be used to return excess capital to investors

C) Demonstrates the value of the real estate to the marketplace

D) Increases the firm's depreciation deductions

A) Provides a source of capital

B) Can be used to return excess capital to investors

C) Demonstrates the value of the real estate to the marketplace

D) Increases the firm's depreciation deductions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is true for a corporation with a high credit rating considering owning versus leasing corporate real estate

A) The company should probably use a mortgage.

B) The company can probably issue corporate debt at a more favorable rate

C) The company is probably better off leasing the property from someone with a lower credit rating.

D) The company's credit rating does not effect the own versus lease decision.

A) The company should probably use a mortgage.

B) The company can probably issue corporate debt at a more favorable rate

C) The company is probably better off leasing the property from someone with a lower credit rating.

D) The company's credit rating does not effect the own versus lease decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

12

When doing a sale versus lease analysis,how should the residual value of the property be estimated?

A) Assume it is worthless.

B) Set it equal to the book value of the property.

C) Assume that it is equal to the original purchase price.

D) Assume it is equal to the market value of the real estate.

A) Assume it is worthless.

B) Set it equal to the book value of the property.

C) Assume that it is equal to the original purchase price.

D) Assume it is equal to the market value of the real estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

13

The cash flows considered in a sale-leaseback analysis are:

A) purchase price,differences in operating expenses over the holding period,cash flow from sale in the future.

B) purchase price,lease payments,cash flow from future sale.

C) cash flow from sale,differences in future cash flow from operations,potential cash flow from future sale.

D) cash flow from sale,future lease payments,difference in future operating expenses.

A) purchase price,differences in operating expenses over the holding period,cash flow from sale in the future.

B) purchase price,lease payments,cash flow from future sale.

C) cash flow from sale,differences in future cash flow from operations,potential cash flow from future sale.

D) cash flow from sale,future lease payments,difference in future operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

14

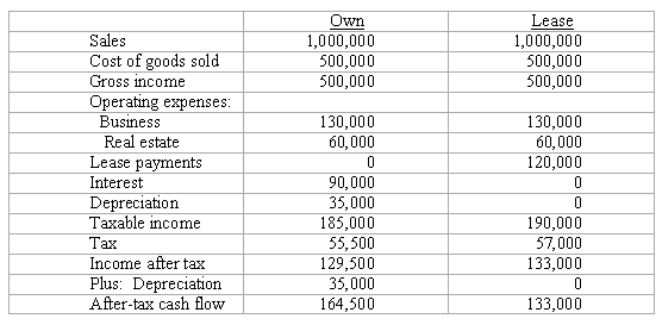

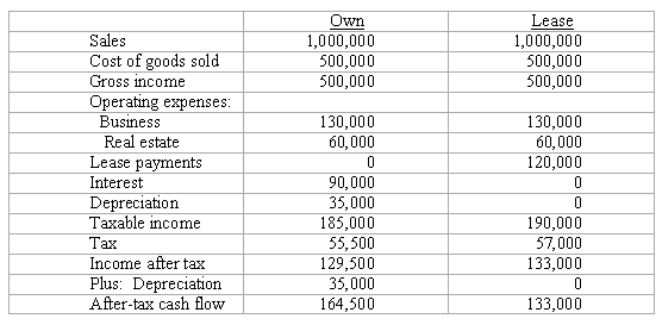

A company is planning to move to a larger office and is trying to decide if the new office should be owned or leased.Cash flows for owning versus leasing are estimated as follows.Assume that the cash flows from operations will remain level over a 10 year holding period.If purchased,the company will invest $385,000 in equity and finance the remainder with an interest-only loan that has a balloon payment due in year 10.The after-tax cash flow from sale of the property at the end of year 10 is expected to be $750,000.What is the incremental rate of return on equity to the company,if the property is owned instead of leased?

A) 17.99%

B) 13.26%

C) 10.32%

D) 12.62%

A) 17.99%

B) 13.26%

C) 10.32%

D) 12.62%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following tax law changes has reduced the incentive for individuals to lease to corporations as a part of the Tax Reform Act of 1986?

A) Depreciation lives were lengthened

B) The highest marginal tax rate for corporations is much lower than the highest marginal tax rate for individuals

C) Individuals are subject to limitations on "passive" losses used to offset other taxable income

D) Income from corporations are no longer double taxed

A) Depreciation lives were lengthened

B) The highest marginal tax rate for corporations is much lower than the highest marginal tax rate for individuals

C) Individuals are subject to limitations on "passive" losses used to offset other taxable income

D) Income from corporations are no longer double taxed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

16

A company estimates that the incremental cost of owning a parcel of real estate vs.leasing will be 10%.The company expects a 12% rate of return on investments.Therefore real estate should be owned and not leased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

17

An operating lease does not affect a corporate balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

18

The cash flow to be considered in a lease versus own analysis are:

A) purchase price,difference in cash flow from operations over the holding period,cash flow from sale.

B) purchase price,lease payments,cash flow from future sale.

C) cash flow from sale,difference in future operating expenses,cash flow from future sale.

D) cash flow from sale,future lease payments,difference in future operating expenses.

A) purchase price,difference in cash flow from operations over the holding period,cash flow from sale.

B) purchase price,lease payments,cash flow from future sale.

C) cash flow from sale,difference in future operating expenses,cash flow from future sale.

D) cash flow from sale,future lease payments,difference in future operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

19

In general,if a company assumes that the residual value at the end of the holding period is always equal to the book value,the decision to own versus lease will be biased towards owning.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following conditions will NOT cause a lease to be categorized as a capital lease?

A) It extends for at least 90 percent of the asset's life

B) It transfers ownership to the lessee at the end of the lease term

C) It seems likely that ownership will be transferred to the lessee at the end of the lease term because of a "bargain purchase" option

D) The present value of the contractual lease payments equals or exceeds 90 percent of the fair market value of the asset at the time the lease is signed

A) It extends for at least 90 percent of the asset's life

B) It transfers ownership to the lessee at the end of the lease term

C) It seems likely that ownership will be transferred to the lessee at the end of the lease term because of a "bargain purchase" option

D) The present value of the contractual lease payments equals or exceeds 90 percent of the fair market value of the asset at the time the lease is signed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

21

Because accounting depreciation charges often exceed the true economic depreciation of real estate,the earnings of companies owning real estate typically understate the level of operating cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

22

If a company's space requirements are far less than what is optimal to develop on a given site,leasing would tend to be more favorable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company can diversify its business activities by developing,owning and subsequently leasing real estate to other companies.Because of the diversification benefits,shareholder value is always increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the incremental cash flows from owning versus leasing are compared without explicitly considering debt financing,these returns should be compared to the firm's cost of equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 24 في هذه المجموعة.

فتح الحزمة

k this deck