Deck 26: Oligopoly and Strategic Behavior

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/306

العب

ملء الشاشة (f)

Deck 26: Oligopoly and Strategic Behavior

1

Which of the following is NOT a common characteristic of oligopoly?

A) strategic dependence among firms in the industry

B) product differentiation

C) barriers to entry

D) marginal cost pricing.

A) strategic dependence among firms in the industry

B) product differentiation

C) barriers to entry

D) marginal cost pricing.

D

2

Oligopolies can result from any of the following EXCEPT

A) economies of scale.

B) vertical mergers.

C) government regulation.

D) diseconomies of scale.

A) economies of scale.

B) vertical mergers.

C) government regulation.

D) diseconomies of scale.

D

3

Which of the following is NOT a necessary condition for oligopoly?

A) Barriers to entry

B) Strategic dependence of firms

C) Differentiated products

D) Either a small number of firms or market dominance by a small number of firms

A) Barriers to entry

B) Strategic dependence of firms

C) Differentiated products

D) Either a small number of firms or market dominance by a small number of firms

C

4

Strategic behavior and game theory are features of which market structure?

A) Perfect competition

B) Monopoly

C) Monopolistic competition

D) Oligopoly

A) Perfect competition

B) Monopoly

C) Monopolistic competition

D) Oligopoly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

5

Managers in oligopoly firms must

A) eliminate any barriers to entry if they hope to make short-run profits.

B) advertise heavily in order to differentiate their product.

C) anticipate the reaction of rival firms.

D) establish many varieties of their products to cover the spectrum of consumer tastes.

A) eliminate any barriers to entry if they hope to make short-run profits.

B) advertise heavily in order to differentiate their product.

C) anticipate the reaction of rival firms.

D) establish many varieties of their products to cover the spectrum of consumer tastes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

6

The measurement of industry concentration which calculates the percentage of all sales contributed by a specific number of leading firms is called the

A) Herfindahl-Hirschman Index.

B) concentration ratio.

C) producer price index.

D) P/E ratio.

A) Herfindahl-Hirschman Index.

B) concentration ratio.

C) producer price index.

D) P/E ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

7

An oligopoly is a market situation in which

A) there are many firms producing differentiated products.

B) there is a single firm producing several varieties of a product.

C) all the sellers act independently of the others.

D) there are very few sellers and they recognize their strategic dependence on one another.

A) there are many firms producing differentiated products.

B) there is a single firm producing several varieties of a product.

C) all the sellers act independently of the others.

D) there are very few sellers and they recognize their strategic dependence on one another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is most likely to be sold in an oligopoly market?

A) Pizza

B) Cell phone service

C) Electricity

D) Computer software

A) Pizza

B) Cell phone service

C) Electricity

D) Computer software

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

9

In an oligopolistic market, each firm

A) has a constant marginal cost.

B) faces a perfectly elastic demand function.

C) must consider the reaction of rival firms when making a pricing or output decision.

D) produces at minimum average cost in the long run.

A) has a constant marginal cost.

B) faces a perfectly elastic demand function.

C) must consider the reaction of rival firms when making a pricing or output decision.

D) produces at minimum average cost in the long run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

10

When U.S. Steel, a steel producer, bought control of iron ore companies at the beginning of the 20th century, the company was initiating

A) a horizontal merger.

B) a vertical merger.

C) a cartel.

D) an expropriation.

A) a horizontal merger.

B) a vertical merger.

C) a cartel.

D) an expropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following does NOT help explain why oligopolies exist?

A) Economies of scale

B) Mergers

C) Product homogeneity

D) Barriers to entry

A) Economies of scale

B) Mergers

C) Product homogeneity

D) Barriers to entry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is NOT a characteristic of oligopoly firms?

A) Strategic dependence

B) Product differentiation

C) Non-price competition, such as advertising and promotions

D) Perfectly elastic demand curves

A) Strategic dependence

B) Product differentiation

C) Non-price competition, such as advertising and promotions

D) Perfectly elastic demand curves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

13

If Ford Motor Company and General Motors Corporation were to merge, this would represent

A) a vertical merger.

B) a horizontal merger.

C) a cartel.

D) an up-and-down merger.

A) a vertical merger.

B) a horizontal merger.

C) a cartel.

D) an up-and-down merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

14

Monopolies and oligopolies both erect barriers to entry through the use of

A) price cutting.

B) patents.

C) franchising.

D) advertising.

A) price cutting.

B) patents.

C) franchising.

D) advertising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

15

A merger between firms in which one firm purchases an input from the other is called a

A) conglomerate merger.

B) horizontal merger.

C) vertical merger.

D) none of the above.

A) conglomerate merger.

B) horizontal merger.

C) vertical merger.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which one of the following industries could be classified as an oligopoly?

A) Tobacco production

B) Retailing

C) Farming

D) Fast food restaurants

A) Tobacco production

B) Retailing

C) Farming

D) Fast food restaurants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

17

A merger between firms that are in the same industry is called a

A) conglomerate merger.

B) horizontal merger.

C) vertical merger.

D) none of the above.

A) conglomerate merger.

B) horizontal merger.

C) vertical merger.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a firm is an oligopolist, which is NOT true?

A) It must pay attention to other firms' prices.

B) It is one of a relatively small number of firms dominating its industry.

C) It can sell all the units it wants at the going market price.

D) It is engaged in a strategic game.

A) It must pay attention to other firms' prices.

B) It is one of a relatively small number of firms dominating its industry.

C) It can sell all the units it wants at the going market price.

D) It is engaged in a strategic game.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

19

The most common reason for the existence of oligopolies is

A) ease of entry.

B) economies of scale.

C) diseconomies of scale.

D) advertising.

A) ease of entry.

B) economies of scale.

C) diseconomies of scale.

D) advertising.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

20

In oligopoly, any action by one firm to change price, output, or quality causes

A) a reaction by other firms.

B) no reaction from the other firms.

C) a profit gain for the other firms.

D) loss of market share by the acting firm.

A) a reaction by other firms.

B) no reaction from the other firms.

C) a profit gain for the other firms.

D) loss of market share by the acting firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

21

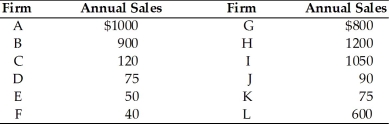

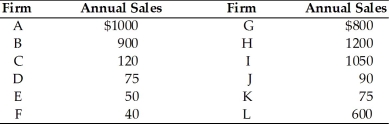

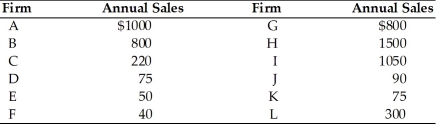

According to the above table, the four-firm concentration ratio of this industry is

A) 69.2 percent.

B) 35.1 percent.

C) 66.7 percent.

D) 67.5 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

22

How do economies of scale contribute to the development of an oligopoly?

A) Economies of scale make it legally difficult for new firms to enter.

B) Economies of scale make small-scale producers inefficient.

C) Economies of scale are based on control of a key resource, without which other firms cannot enter an industry.

D) Economies of scale are guaranteed when a patent is granted.

A) Economies of scale make it legally difficult for new firms to enter.

B) Economies of scale make small-scale producers inefficient.

C) Economies of scale are based on control of a key resource, without which other firms cannot enter an industry.

D) Economies of scale are guaranteed when a patent is granted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following combinations would constitute a vertical merger?

A) General Motors and Bridgestone Tire Company

B) General Motors and Ford Motor Company

C) Philip Morris and RJ Reynolds

D) Philip Morris and Barnes & Nobles Booksellers

A) General Motors and Bridgestone Tire Company

B) General Motors and Ford Motor Company

C) Philip Morris and RJ Reynolds

D) Philip Morris and Barnes & Nobles Booksellers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose an industry has total sales of $25 million per year. The two largest firms have sales of $6 million each, the third largest firm has sales of $2 million, and the fourth largest firm has sales of $1 million. The four-firm concentration ratio for this industry is

A) 36 percent.

B) 60 percent.

C) 50 percent.

D) 25 percent.

A) 36 percent.

B) 60 percent.

C) 50 percent.

D) 25 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

25

According to the above table, if the fourth and fifth largest firms in the industry merge, the four-firm concentration ratio in the industry will be

A) 82.5 percent.

B) 35.8 percent.

C) 69.0 percent.

D) 84.1 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

26

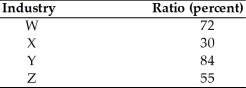

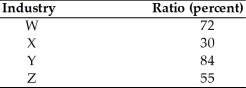

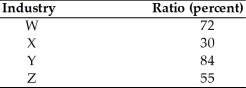

Four-Firm Concentration Ratios

The most competitive industry of those presented in the above table is likely to be industry

A) W.

B) X.

C) Y.

D) Z.

The most competitive industry of those presented in the above table is likely to be industry

A) W.

B) X.

C) Y.

D) Z.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose that an industry consists of 100 firms, and the top 4 firms have annual sales of $1 million, $1.5 million, $2 million, and $2.5 million, respectively. If the entire industry has annual sales of $8.5 million, the four-firm concentration ratio is approximately

A) 82 percent.

B) 50 percent.

C) 94 percent.

D) 70 percent.

A) 82 percent.

B) 50 percent.

C) 94 percent.

D) 70 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

28

The industry concentration ratio measures the

A) value of the assets owned by the largest corporations in the market.

B) percentage of industry sales accounted for by the top four or eight firms.

C) difference between price and marginal cost for the largest firms in the industry.

D) degree of product differentiation in the market.

A) value of the assets owned by the largest corporations in the market.

B) percentage of industry sales accounted for by the top four or eight firms.

C) difference between price and marginal cost for the largest firms in the industry.

D) degree of product differentiation in the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

29

Suppose a ten firm industry has total sales of $35 million per year. The largest firm have sales of $10 million, the third largest firm has sales of $4 million, and the fourth largest firm has sales of $2 million. If fifth through tenth largest firms combined have annual sales of $12 million, the four-firm concentration ratio for this industry is

A) 45.7 percent.

B) 80 percent.

C) 65.7 percent.

D) none of the above.

A) 45.7 percent.

B) 80 percent.

C) 65.7 percent.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

30

The combining of First Union National Bank and The National Bank of Memphis is an example of

A) a vertical merger.

B) a horizontal merger.

C) a downstream formation.

D) a conglomerate merger.

A) a vertical merger.

B) a horizontal merger.

C) a downstream formation.

D) a conglomerate merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

31

A concentration ratio gives

A) the average size of the firms in an industry.

B) the total sales of four or eight of the mid-sized firms in the industry.

C) the percentage of all sales contributed by the four or eight largest firms in the industry.

D) the sales of the four largest firms in the industry divided by the sales of the eight largest firms in the industry.

A) the average size of the firms in an industry.

B) the total sales of four or eight of the mid-sized firms in the industry.

C) the percentage of all sales contributed by the four or eight largest firms in the industry.

D) the sales of the four largest firms in the industry divided by the sales of the eight largest firms in the industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

32

The joining of firms that are producing or selling a similar product is

A) a conglomerate merger.

B) a horizontal merger.

C) a vertical merger.

D) always an illegal merger.

A) a conglomerate merger.

B) a horizontal merger.

C) a vertical merger.

D) always an illegal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

33

If industry sales are $2,000, and the top four firms have sales of $170, $140, $100, and $80, respectively, what will be the four-firm concentration ratio?

A) 49 percent

B) 24.5 percent

C) 490 percent

D) 200/49

A) 49 percent

B) 24.5 percent

C) 490 percent

D) 200/49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

34

A horizontal merger involves

A) the joining of two firms at different stages of the production process.

B) the separation of management from ownership.

C) the joining of two firms selling similar products.

D) the exchange of debt for stock.

A) the joining of two firms at different stages of the production process.

B) the separation of management from ownership.

C) the joining of two firms selling similar products.

D) the exchange of debt for stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Herfindahl-Hirschman index is measured by

A) adding the market shares of all firms in an industry.

B) adding the squares of the market shares of all firms in an industry.

C) squaring the sum of the market shares of the all firms in an industry.

D) adding the market shares of the four largest firms in an industry.

A) adding the market shares of all firms in an industry.

B) adding the squares of the market shares of all firms in an industry.

C) squaring the sum of the market shares of the all firms in an industry.

D) adding the market shares of the four largest firms in an industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

36

Suppose a ten firm industry has total sales of $35 million per year. The largest firm have sales of $10 million, the third largest firm has sales of $4 million, and the fourth largest firm has sales of $2 million. If the rest of the industry has annual sales of $12 million, the second largest firm has sales of

A) $8 million.

B) $7 million.

C) $4 million.

D) none of the above.

A) $8 million.

B) $7 million.

C) $4 million.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

37

Four-Firm Concentration Ratios

The most oligopolistic industry of those presented in the above table is likely to be industry

A) W.

B) X.

C) Y.

D) Z.

The most oligopolistic industry of those presented in the above table is likely to be industry

A) W.

B) X.

C) Y.

D) Z.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

38

In general, horizontal mergers will

A) increase the number of firms in an industry.

B) decrease the number of firms in an industry.

C) increase competition in an industry.

D) reduce economic profits in an industry.

A) increase the number of firms in an industry.

B) decrease the number of firms in an industry.

C) increase competition in an industry.

D) reduce economic profits in an industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

39

As the definition of products narrows (i.e., becomes more specific), the concentration ratio

A) is not valid.

B) tends to decrease.

C) tends to increase.

D) does not change in any predictable manner.

A) is not valid.

B) tends to decrease.

C) tends to increase.

D) does not change in any predictable manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the United States' largest bakery buys an agricultural firm that specializes in growing wheat, we would have an example of

A) a horizontal merger.

B) a vertical merger.

C) a monopoly.

D) excessive product differentiation.

A) a horizontal merger.

B) a vertical merger.

C) a monopoly.

D) excessive product differentiation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

41

Straight Cut beauty salon merges with Clean-Cut beauty salon. This is an example of

A) conglomerate merger.

B) concentration ratio.

C) vertical merger.

D) horizontal merger.

A) conglomerate merger.

B) concentration ratio.

C) vertical merger.

D) horizontal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

42

There are 30 firms in an industry. What happens to that industry's four-firm concentration when the third- and fourth-largest firms merge?

A) Nothing, because their shares are already included in the concentration calculation.

B) The industry's concentration ratio will fall.

C) The industry's concentration ratio will increase.

D) It is impossible to know without more information.

A) Nothing, because their shares are already included in the concentration calculation.

B) The industry's concentration ratio will fall.

C) The industry's concentration ratio will increase.

D) It is impossible to know without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is an example of a horizontal merger?

A) Northeastern Illinois University merging with McDonald's.

B) Northeastern Illinois University merging with a training academy for new professors.

C) Northeastern Illinois University merging with Roosevelt University.

D) Northeastern Illinois University going from a public to a private university.

A) Northeastern Illinois University merging with McDonald's.

B) Northeastern Illinois University merging with a training academy for new professors.

C) Northeastern Illinois University merging with Roosevelt University.

D) Northeastern Illinois University going from a public to a private university.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

44

Horizontal merger occurs when

A) two firms merge where one had sold its output to the other as an input.

B) the merger moves the combined firm onto the horizontal portion of its long-run average cost curve.

C) two firms merge where each is about the same size.

D) two firms producing a similar product merge.

A) two firms merge where one had sold its output to the other as an input.

B) the merger moves the combined firm onto the horizontal portion of its long-run average cost curve.

C) two firms merge where each is about the same size.

D) two firms producing a similar product merge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

45

A situation in which one firm's actions with respect to price, quality, advertising and related changes may be strategically countered by the reactions of one or more other firms in the industry is known as

A) strategic dependence.

B) economies of scale.

C) the concentration ratio.

D) barriers to entry.

A) strategic dependence.

B) economies of scale.

C) the concentration ratio.

D) barriers to entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is true of an oligopoly?

A) They engage in nonprice competition.

B) They do not react to actions of their competitors.

C) Each firm produces a small portion of the total output.

D) Firms do not care what their competitors do.

A) They engage in nonprice competition.

B) They do not react to actions of their competitors.

C) Each firm produces a small portion of the total output.

D) Firms do not care what their competitors do.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

47

The joining of firms that are producing or selling a similar product is known as

A) a conglomerate merger.

B) a horizontal merger.

C) a vertical merger.

D) economies to scale.

A) a conglomerate merger.

B) a horizontal merger.

C) a vertical merger.

D) economies to scale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

48

Oligopoly is a situation when there

A) is one firm in the industry that is fairly large.

B) are a few large firms in the industry.

C) are too many firms in the industry and there is excess capacity.

D) is one giant firm and many smaller firms forming a competitive fringe.

A) is one firm in the industry that is fairly large.

B) are a few large firms in the industry.

C) are too many firms in the industry and there is excess capacity.

D) is one giant firm and many smaller firms forming a competitive fringe.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

49

Over the past several decades, U.S. firms have faced more competition from overseas firms. Does this have any impact on the market power of U.S. oligopoly firms?

A) No, because domestic firms in oligopoly markets are always so dominant that overseas producers have little or no impact on those markets.

B) No, because the United States government has effectively blocked all imports that might compete with domestic firms in oligopoly industries.

C) Yes, competition from overseas firms can substantially limit domestic firms' market power.

D) There is no way to know.

A) No, because domestic firms in oligopoly markets are always so dominant that overseas producers have little or no impact on those markets.

B) No, because the United States government has effectively blocked all imports that might compete with domestic firms in oligopoly industries.

C) Yes, competition from overseas firms can substantially limit domestic firms' market power.

D) There is no way to know.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

50

A concentration ratio measures

A) the average size of the firms in the industry.

B) the sales of the three largest firms in the industry minus the costs of these three largest firms in the industry.

C) the share of industry sales accounted for by the largest firms in the industry.

D) the excess capacity found in a particular oligopolistic industry.

A) the average size of the firms in the industry.

B) the sales of the three largest firms in the industry minus the costs of these three largest firms in the industry.

C) the share of industry sales accounted for by the largest firms in the industry.

D) the excess capacity found in a particular oligopolistic industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

51

The joining of a firm with another to which it sells an output or from which it buys an input is known as

A) a conglomerate merger.

B) a horizontal merger.

C) a vertical merger.

D) economies to scale.

A) a conglomerate merger.

B) a horizontal merger.

C) a vertical merger.

D) economies to scale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

52

When managers in oligopolistic firms make decisions that affect output or price, they must

A) also be sure they erect barriers to entry to prevent new entrants from affecting their plans.

B) anticipate the reactions of their rivals and plan accordingly.

C) register with the Antitrust Division of the Department of Justice.

D) inform the regulators of their industry about their plans.

A) also be sure they erect barriers to entry to prevent new entrants from affecting their plans.

B) anticipate the reactions of their rivals and plan accordingly.

C) register with the Antitrust Division of the Department of Justice.

D) inform the regulators of their industry about their plans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

53

Joe's hotdog stand merges with a company that supplies the condiments to Joe's. This is an example of

A) conglomerate merger.

B) concentration ratio.

C) vertical merger.

D) horizontal merger.

A) conglomerate merger.

B) concentration ratio.

C) vertical merger.

D) horizontal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

54

All of the following are reasons for an oligopoly to occur EXCEPT

A) economies to scale.

B) barriers to entry.

C) independence among firms.

D) merger.

A) economies to scale.

B) barriers to entry.

C) independence among firms.

D) merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

55

The existence of economies of scale is one reason oligopolies exist because

A) a firm is able to increase price leading to increased profits.

B) the marginal cost decreases as output increases.

C) of strategic dependence.

D) as output increases average total cost decreases leading to large-scale firms.

A) a firm is able to increase price leading to increased profits.

B) the marginal cost decreases as output increases.

C) of strategic dependence.

D) as output increases average total cost decreases leading to large-scale firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is an example of a vertical merger?

A) Northeastern Illinois University merging with McDonald's.

B) Northeastern Illinois University merging with a training academy for new professors.

C) Northeastern Illinois University merging with Roosevelt University.

D) Northeastern Illinois University going from a public to a private university.

A) Northeastern Illinois University merging with McDonald's.

B) Northeastern Illinois University merging with a training academy for new professors.

C) Northeastern Illinois University merging with Roosevelt University.

D) Northeastern Illinois University going from a public to a private university.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is not true of an oligopoly?

A) They advertise their product.

B) The firms recognize their interdependence.

C) A few firm account for a large portion of the total output.

D) Firms are price takers.

A) They advertise their product.

B) The firms recognize their interdependence.

C) A few firm account for a large portion of the total output.

D) Firms are price takers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

58

Vertical merger occurs when

A) two firms merge where one had sold its output to the other as an input.

B) the merger moves the combined firm onto the horizontal portion of its long-run average cost curve.

C) two firms merge where each is about the same size.

D) two firms producing a similar product merge.

A) two firms merge where one had sold its output to the other as an input.

B) the merger moves the combined firm onto the horizontal portion of its long-run average cost curve.

C) two firms merge where each is about the same size.

D) two firms producing a similar product merge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is a characteristic of oligopoly?

A) Mutual firm independence

B) Zero economic profits in the short run

C) Marginal cost pricing

D) Only a few firms in the industry

A) Mutual firm independence

B) Zero economic profits in the short run

C) Marginal cost pricing

D) Only a few firms in the industry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is NOT a reason why some industries are oligopolies?

A) Economies of scale

B) Barriers to entry

C) Strategic independence

D) Mergers

A) Economies of scale

B) Barriers to entry

C) Strategic independence

D) Mergers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following has the highest Herfindahl-Hirschman index?

A) monopoly

B) monopolistic competition

C) oligopoly

D) any of the above, depending on the size of firm sales

A) monopoly

B) monopolistic competition

C) oligopoly

D) any of the above, depending on the size of firm sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

62

The Herfindahl-Hirschman index is a measure of

A) the profit margin of an industry.

B) market size.

C) the degree of collusion among firms in a market.

D) the degree of concentration among firms in a market.

A) the profit margin of an industry.

B) market size.

C) the degree of collusion among firms in a market.

D) the degree of concentration among firms in a market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

63

The market power of a firm refers to its ability to

A) erect entry barriers in the industry.

B) make a profit even when other firms in the industry are making losses.

C) control its own output level while keeping its price the same as the prices charged by other firms.

D) affect the market price for its industry's output.

A) erect entry barriers in the industry.

B) make a profit even when other firms in the industry are making losses.

C) control its own output level while keeping its price the same as the prices charged by other firms.

D) affect the market price for its industry's output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

64

Suppose there are four firms in an industry. The market shares of the four firms are 5 percent, 20 percent, 35 percent, and 40 percent. The Herfindahl-Hirschman index for that industry is

A) 6,650.

B) 3,250.

C) 1,250.

D) 100.

A) 6,650.

B) 3,250.

C) 1,250.

D) 100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

65

Between World War II and the 1970s, three firms-General Motors, Chrysler, and Ford-produced and sold nearly all the output of the U.S. auto industry. These three firms had

A) an oligopoly.

B) monopolistic competition.

C) colluded.

D) a pure monopoly.

A) an oligopoly.

B) monopolistic competition.

C) colluded.

D) a pure monopoly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

66

The percentage of all sales contributed by the leading four or leading eight firms in an industry is known as

A) a horizontal merger.

B) a vertical merger.

C) economies to scale.

D) the concentration ratio.

A) a horizontal merger.

B) a vertical merger.

C) economies to scale.

D) the concentration ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is NOT a cause for an oligopoly to exist?

A) economies of scale

B) structural dependence

C) barriers to entry

D) horizontal mergers

A) economies of scale

B) structural dependence

C) barriers to entry

D) horizontal mergers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following would be the best example of an oligopolistic industry?

A) agriculture

B) large aircraft manufacturing

C) confections

D) retail convenience stores

A) agriculture

B) large aircraft manufacturing

C) confections

D) retail convenience stores

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

69

There are fewer than half as many publishers of college textbooks in the United States now as a generation ago. Three companies alone account for almost two-thirds of the sale of new textbooks. This market situation characterized by very few sellers is known as

A) an oligopoly.

B) perfect competition.

C) pure monopoly.

D) monopolistic competition.

A) an oligopoly.

B) perfect competition.

C) pure monopoly.

D) monopolistic competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

70

A concentration ratio is used to

A) determine whether a market structure is oligopoly.

B) determine the importance of labor in the production process.

C) determine the degree of homogeneity in the market.

D) see if a firm qualifies for federal assistance.

A) determine whether a market structure is oligopoly.

B) determine the importance of labor in the production process.

C) determine the degree of homogeneity in the market.

D) see if a firm qualifies for federal assistance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

71

Industry X has four firms. The largest firm in Industry X has more than 90 percent of the market share. Industry Y also has four firms, but each of those four firms in Industry Y has 25 percent of the market share. The Herfindahl-Hirschman index will be

A) the same for both industries, but the four-firm concentration will be larger for Industry Y than Industry X.

B) the same for both industries, but the four-firm concentration will be larger for Industry X than Industry Y.

C) larger for Industry Y than Industry X, but the four-firm concentration will be the same.

D) larger for Industry X than Industry Y, but the four-firm concentration will be the same.

A) the same for both industries, but the four-firm concentration will be larger for Industry Y than Industry X.

B) the same for both industries, but the four-firm concentration will be larger for Industry X than Industry Y.

C) larger for Industry Y than Industry X, but the four-firm concentration will be the same.

D) larger for Industry X than Industry Y, but the four-firm concentration will be the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which does NOT cause an industry that might otherwise be competitive to tend toward oligopoly?

A) economies of scale

B) barriers to entry

C) mergers

D) strategic independence

A) economies of scale

B) barriers to entry

C) mergers

D) strategic independence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

73

Suppose that Industry X has two firms with equal market shares, and Industry Y has three firms with 65 percent, 30 percent, and 5 percent market shares, respectively. Which of the following is true?

A) The HHI for Industry X is 50 higher than the HHI for Industry Y.

B) The HHI for Industry X is 150 lower than the HHI for Industry Y.

C) The HHI for Industry X is 100 higher than the HHI for Industry Y.

D) The HHI is the same between Industry X and Industry Y.

A) The HHI for Industry X is 50 higher than the HHI for Industry Y.

B) The HHI for Industry X is 150 lower than the HHI for Industry Y.

C) The HHI for Industry X is 100 higher than the HHI for Industry Y.

D) The HHI is the same between Industry X and Industry Y.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements about concentration ratios is correct?

A) A high concentration ratio indicates that the industry is a monopoly.

B) A high concentration ratio indicates that the industry is monopolistically competitive.

C) A high concentration ratio suggests that the industry is characterized by strategic independence.

D) A high concentration ratio suggests that the industry is characterized by strategic dependence.

A) A high concentration ratio indicates that the industry is a monopoly.

B) A high concentration ratio indicates that the industry is monopolistically competitive.

C) A high concentration ratio suggests that the industry is characterized by strategic independence.

D) A high concentration ratio suggests that the industry is characterized by strategic dependence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

75

In a 50-firm industry, two of the smallest firms merge. Yet the 4-firm concentration ratio and the 8-firm concentration ratio did not change. All things considered, we can say that the industry has

A) moved closer to pure competition because the number of firms decreased.

B) moved farther away from competition because the number of firms decreased.

C) experienced no change in competition even though the number of firms decreased.

D) to be identified first; otherwise there is no way to tell.

A) moved closer to pure competition because the number of firms decreased.

B) moved farther away from competition because the number of firms decreased.

C) experienced no change in competition even though the number of firms decreased.

D) to be identified first; otherwise there is no way to tell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

76

A market structure characterized by a small number of interdependent sellers is called a(n)

A) monopoly.

B) monopolistic competition.

C) monopsony.

D) oligopoly.

A) monopoly.

B) monopolistic competition.

C) monopsony.

D) oligopoly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

77

The recent merger of Southwest Bell (SBC) and AT&T companies is an example of a

A) horizontal merger.

B) vertical merger.

C) consolidation merger.

D) cooperative merger.

A) horizontal merger.

B) vertical merger.

C) consolidation merger.

D) cooperative merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

78

If a retail food chain merged with a meat packing company, this would be an example of a

A) horizontal merger.

B) conglomerate merger.

C) vertical merger.

D) diagonal merger.

A) horizontal merger.

B) conglomerate merger.

C) vertical merger.

D) diagonal merger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

79

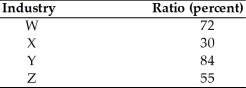

Refer to the above table. The four-firm concentration ratio is

A) 85.8 percent.

B) 75 percent.

C) 72.5 percent.

D) 59.2 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck

80

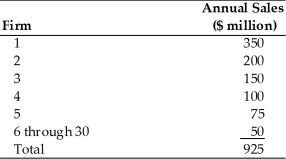

Refer to the above table. The four-firm concentration ratio is

A) 86.5 percent.

B) 33.3 percent.

C) 13.3 percent.

D) 11.6 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 306 في هذه المجموعة.

فتح الحزمة

k this deck