Deck 8: Application: The Costs of Taxation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

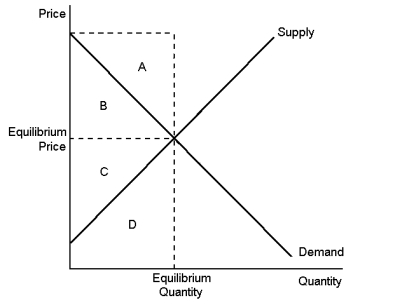

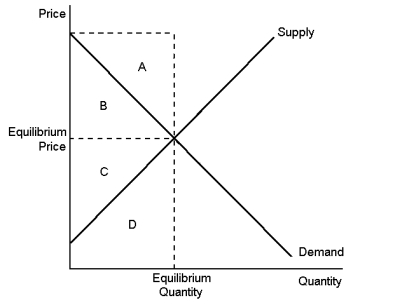

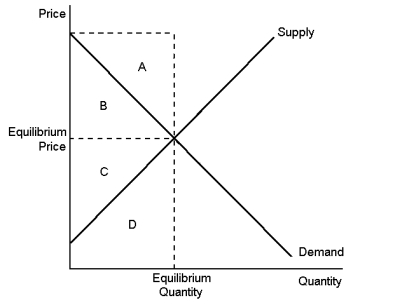

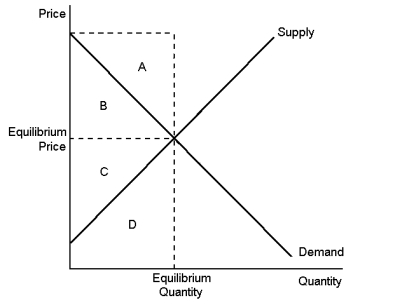

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/141

العب

ملء الشاشة (f)

Deck 8: Application: The Costs of Taxation

1

Suppose the demand curve becomes more elastic, but nothing else changes, this implies that the deadweight loss from a given tax will be smaller.

False

2

If a tax did not induce buyers or sellers to change their behaviour, it would not cause a deadweight loss.

True

3

Suppose the supply curve becomes more inelastic, but nothing else changes. This implies that the deadweight loss of a tax will be smaller.

True

4

The deadweight loss of a tax is the reduction in total surplus in excess of the tax revenue collected that results from the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

5

A tax on luxuries will create a smaller deadweight loss than will the same tax on necessities, ceteris paribus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

6

Labour taxes encourage workers to work fewer hours, second earners to stay at home, the elderly to retire early, and the unscrupulous to engage in illegal activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

7

Taxes cause deadweight losses because they prevent buyers and sellers from realising some of the gains from trade.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the supply of labour is inelastic, the deadweight loss from labour taxes is large.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

9

The effect of a tax on a good and make both sellers and buyers better off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

10

When a tax is imposed on a market, the government collects revenues. These revenues however, are less than the loss in consumer surplus and producer surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

11

Because taxes distort incentives, they cause markets to allocate resources inefficiently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

12

The deadweight loss of a tax increases as demand and supply curves become more inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

13

The demand for bread is less elastic than the demand for donuts; hence, ceteris paribus, a tax on bread will create a larger deadweight loss than will the same tax on donuts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

14

A tax raises the price received by sellers and lowers the price paid by buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

15

The underground economy refers to the extractive mining and petroleum industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

16

Economists disagree on whether labour taxes have a small or a large deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

17

A tax places a wedge between the price buyers pay and the price sellers receive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

18

One of the important economic costs of imposing taxes on a market is the deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

19

One result of a tax on a good is that the equilibrium quantity sold tends to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

20

Often the tax revenue collected by the government equals the reduced welfare of buyers and sellers caused by the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

21

A tax on land will distort economic incentives unless the tax applies only to raw (unimproved) land.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

22

Because the supply of land is perfectly inelastic, the deadweight loss of a tax on land is high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

23

As the size of a tax increases the deadweight loss from the tax remains constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

24

A tax on unimproved land falls entirely on landowners, because the supply of land is perfectly inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

25

When a tax is levied on a good buyers are worse off but not sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

26

Although tax revenue eventually begins to fall as tax rates increase, the revenue will always be greater than zero, no matter how large the tax is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

27

The deadweight loss of a tax rises even more rapidly than the size of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

28

If there is a decrease in the deadweight loss of a tax, this means that the tax has an increased economic cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

29

The more inelastic the supply and demand curves in a market, the more taxes in that market distort behaviour, and the more likely it is that a tax cut will raise tax revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

30

A tax on insulin is likely to cause a tremendous deadweight loss to society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

31

The revenue from a tax always increases when the government increases the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

32

A tax levied on the supplier of a product shifts the demand curve downward or to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

33

Supply-side economics can be a winning strategy in many computer games.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

34

Taxes are costly to market participants because they transfer resources from those participants to the government, even though they do not usually distort incentives or resource allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Laffer curve is the curve showing how tax revenue varies as income rates vary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

36

A tax levied on the buyers of a product shifts the demand curve downward or to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

37

Of all the possible types of taxes, Milton Friedman believed that the property tax on unimproved land is the least bad tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

38

If the size of a tax doubles, the deadweight loss rises by a factor of six.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

39

Other things being equal, as the size of a tax varies, the deadweight loss from the tax varies according to the square root of the size of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

40

When the government imposes taxes on buyers and sellers of a good, society loses some of the benefits of market efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

41

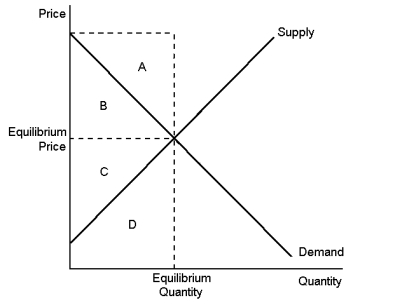

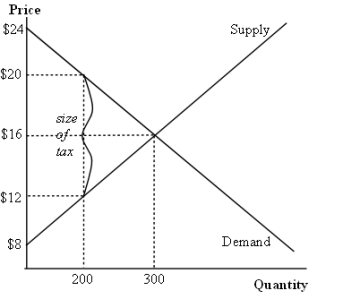

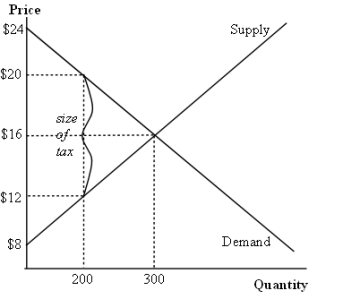

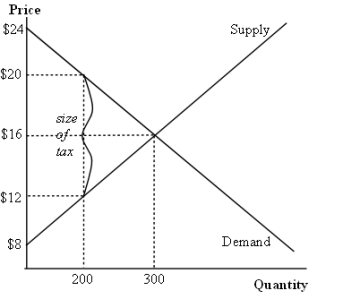

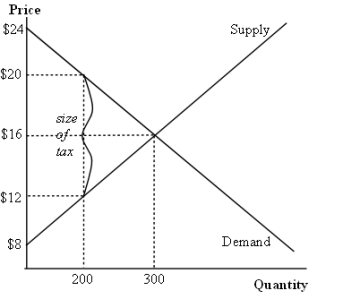

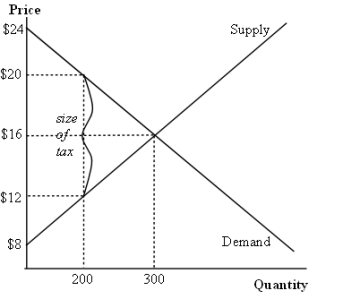

Graph 8-1

According to Graph 8-1, the total surplus (consumer, producer, and government) with the tax is represented by area:

A) A + B + C

B) D + E + F

C) A + B + D + F

D) C + E

According to Graph 8-1, the total surplus (consumer, producer, and government) with the tax is represented by area:

A) A + B + C

B) D + E + F

C) A + B + D + F

D) C + E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

42

To evaluate the welfare effects of taxes on economic activity, economists:

A) do nothing because taxes provide public services that are always valued

B) measure changes to consumer and producer surplus

C) measure changes to equilibrium price and quantity

D) measure expenditures on social welfare by the government

A) do nothing because taxes provide public services that are always valued

B) measure changes to consumer and producer surplus

C) measure changes to equilibrium price and quantity

D) measure expenditures on social welfare by the government

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

43

Graph 8-1

According to Graph 8-1, the tax caused a reduction in producer surplus, it is represented by area:

A) A

B) B + C

C) D + E

D) F

According to Graph 8-1, the tax caused a reduction in producer surplus, it is represented by area:

A) A

B) B + C

C) D + E

D) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

44

A tax on a good:

A) raises the price buyers pay and lowers the price sellers receive

B) raises the price buyers pay and raises the price sellers receive

C) lowers the price buyers pay and lowers the price sellers receive

D) lowers the price buyers pay and raises the price sellers receive

A) raises the price buyers pay and lowers the price sellers receive

B) raises the price buyers pay and raises the price sellers receive

C) lowers the price buyers pay and lowers the price sellers receive

D) lowers the price buyers pay and raises the price sellers receive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

45

Graph 8-1

According to Graph 8-1, the equilibrium market price before the tax is imposed is:

A) P3

B) P2

C) P1

D) impossible to determine

According to Graph 8-1, the equilibrium market price before the tax is imposed is:

A) P3

B) P2

C) P1

D) impossible to determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

46

Graph 8-1

According to Graph 8-1, producer surplus before the tax is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

According to Graph 8-1, producer surplus before the tax is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

47

A tax levied on the supplier of a product shifts the:

A) supply curve upwards or to the left

B) supply curve downwards or to the right

C) demand curve upwards or to the right

D) demand curve downwards or to the left

A) supply curve upwards or to the left

B) supply curve downwards or to the right

C) demand curve upwards or to the right

D) demand curve downwards or to the left

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

48

Graph 8-1

According to Graph 8-1, consumer surplus before the tax was levied is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

According to Graph 8-1, consumer surplus before the tax was levied is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

49

Graph 8-1

According to Graph 8-1, the price buyers pay after the tax is:

A) P3

B) P2

C) P1

D) impossible to determine

According to Graph 8-1, the price buyers pay after the tax is:

A) P3

B) P2

C) P1

D) impossible to determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

50

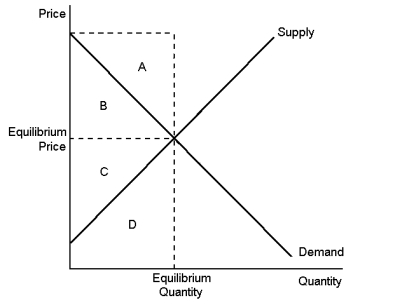

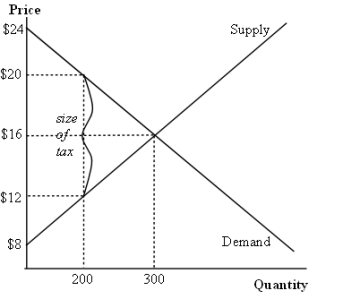

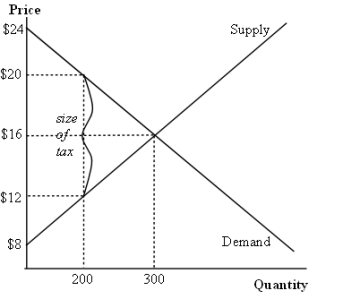

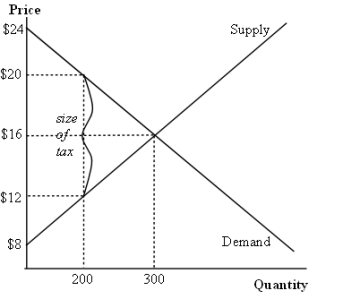

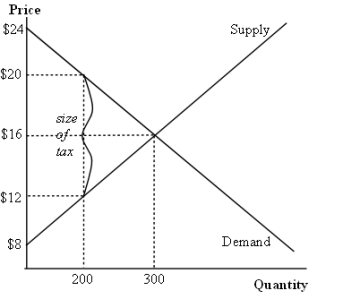

Graph 8-2

This graph shows supply and demand in a free market.

This graph shows supply and demand in a free market.

According to Graph 8-2, if the market is in equilibrium, consumer surplus is represented by area:

A) A

B) B

C) C

D) D

This graph shows supply and demand in a free market.

This graph shows supply and demand in a free market.According to Graph 8-2, if the market is in equilibrium, consumer surplus is represented by area:

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

51

Graph 8-1

According to Graph 8-1, the loss in total welfare resulting from the levying of the tax is represented by area:

A) A + B + C

B) C + E

C) D + E + F

D) A + B + D + F

According to Graph 8-1, the loss in total welfare resulting from the levying of the tax is represented by area:

A) A + B + C

B) C + E

C) D + E + F

D) A + B + D + F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

52

Graph 8-2

This graph shows supply and demand in a free market.

This graph shows supply and demand in a free market.

According to Graph 8-2, total economic surplus would be represented by area:

A) A + B

B) B + C

C) C + D

D) A + D

This graph shows supply and demand in a free market.

This graph shows supply and demand in a free market.According to Graph 8-2, total economic surplus would be represented by area:

A) A + B

B) B + C

C) C + D

D) A + D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

53

Graph 8-1

According to Graph 8-1, the price sellers receive after the tax is:

A) P3

B) P2

C) P1

D) impossible to determine

According to Graph 8-1, the price sellers receive after the tax is:

A) P3

B) P2

C) P1

D) impossible to determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

54

Graph 8-1

According to Graph 8-1, after the tax is levied, consumer surplus is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

According to Graph 8-1, after the tax is levied, consumer surplus is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

55

Graph 8-1

According to Graph 8-1, the tax caused a reduction in consumer surplus, it is represented by area:

A) A

B) B + C

C) D + E

D) F

According to Graph 8-1, the tax caused a reduction in consumer surplus, it is represented by area:

A) A

B) B + C

C) D + E

D) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a tax is levied on the sellers of a good:

A) both buyers and sellers are economically worse off

B) only sellers are worse off because they have to pay the tax

C) only buyers are worse off because sellers pass the tax on to them

D) there is no change because sellers will produce a different good for buyers to purchase

A) both buyers and sellers are economically worse off

B) only sellers are worse off because they have to pay the tax

C) only buyers are worse off because sellers pass the tax on to them

D) there is no change because sellers will produce a different good for buyers to purchase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

57

A tax levied on the buyers of a product shifts the:

A) supply curve upwards or to the left

B) supply curve downwards or to the right

C) demand curve upwards or to the right

D) demand curve downwards or to the left

A) supply curve upwards or to the left

B) supply curve downwards or to the right

C) demand curve upwards or to the right

D) demand curve downwards or to the left

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

58

Graph 8-1

According to Graph 8-1, after the tax is levied, producer surplus is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

According to Graph 8-1, after the tax is levied, producer surplus is represented by area:

A) A

B) A + B + C

C) D + E + F

D) F

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

59

Graph 8-1

According to Graph 8-1, the benefits to the government (total tax revenue) is represented by area:

A) A + B

B) B + D

C) D + F

D) C + E

According to Graph 8-1, the benefits to the government (total tax revenue) is represented by area:

A) A + B

B) B + D

C) D + F

D) C + E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

60

Graph 8-2

This graph shows supply and demand in a free market.

This graph shows supply and demand in a free market.

According to Graph 8-2, when the market is in equilibrium, producer surplus is represented by area:

A) A

B) B

C) C

D) D

This graph shows supply and demand in a free market.

This graph shows supply and demand in a free market.According to Graph 8-2, when the market is in equilibrium, producer surplus is represented by area:

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

61

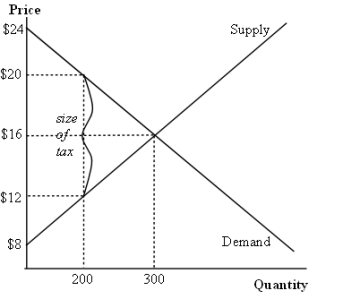

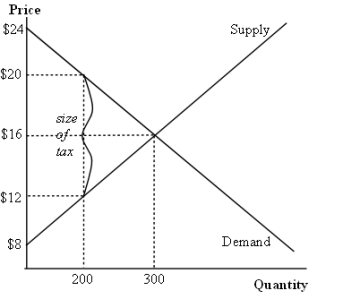

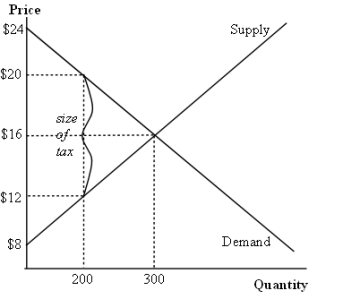

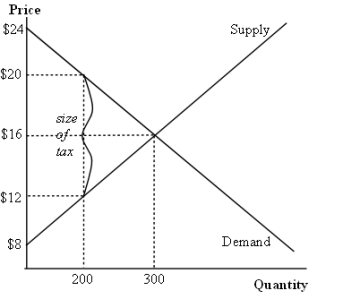

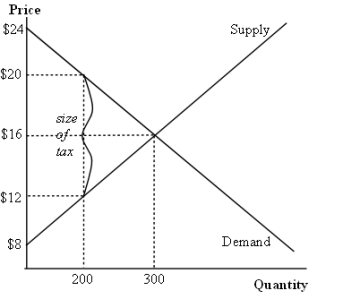

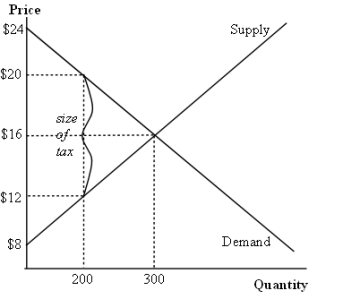

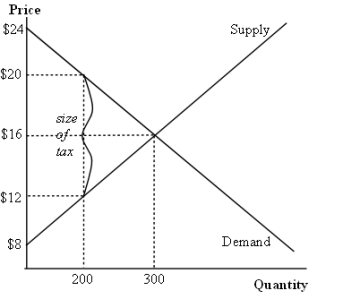

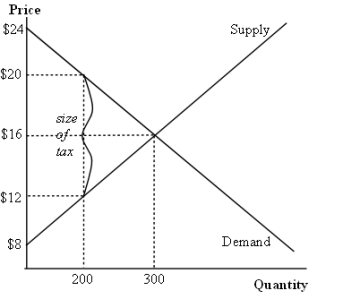

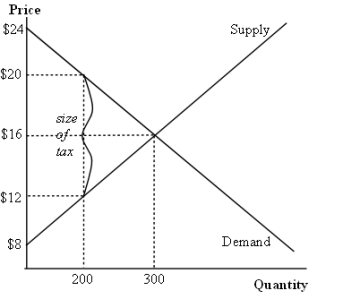

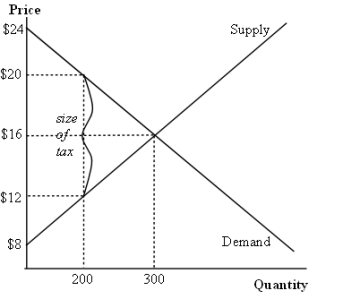

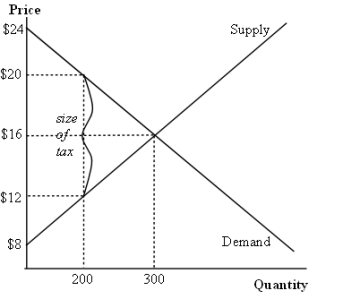

Graph 8-3

According to Graph 8-3, the reduction in producer surplus caused by the tax is:

A) $1600

B) $800

C) $400

D) $200

According to Graph 8-3, the reduction in producer surplus caused by the tax is:

A) $1600

B) $800

C) $400

D) $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

62

The benefit received by buyers in the market for good X is measured by:

A) the market price

B) the total expenditure of buyers

C) consumer surplus

D) the total cost to sellers of producing the good X

A) the market price

B) the total expenditure of buyers

C) consumer surplus

D) the total cost to sellers of producing the good X

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

63

Deadweight loss is the:

A) reduction in total surplus that results from a tax

B) loss of profit to businesses when a tax is imposed

C) reduction in consumer surplus when a tax is placed on buyers

D) decline in government revenue when taxes are reduced in a market

A) reduction in total surplus that results from a tax

B) loss of profit to businesses when a tax is imposed

C) reduction in consumer surplus when a tax is placed on buyers

D) decline in government revenue when taxes are reduced in a market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

64

Graph 8-3

According to Graph 8-3, after the tax is levied, producer surplus is:

A) $2400

B) $1600

C) $800

D) $400

According to Graph 8-3, after the tax is levied, producer surplus is:

A) $2400

B) $1600

C) $800

D) $400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

65

Graph 8-3

According to Graph 8-3, consumer surplus before the tax is levied equals:

A) $1200

B) $2400

C) $3200

D) $4800

According to Graph 8-3, consumer surplus before the tax is levied equals:

A) $1200

B) $2400

C) $3200

D) $4800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

66

The appropriate measure of the benefit from a tax is the:

A) consumer surplus

B) benefit received by those people who gain from government's expenditure of the tax revenue

C) producer surplus

D) government's budget balance, which is increased with more taxes

A) consumer surplus

B) benefit received by those people who gain from government's expenditure of the tax revenue

C) producer surplus

D) government's budget balance, which is increased with more taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

67

When a tax is levied on a good:

A) the market price falls because demand declines

B) the market price falls because supply falls

C) a wedge is placed between the price buyers pay and the price sellers receive

D) the market price rises because demand falls

A) the market price falls because demand declines

B) the market price falls because supply falls

C) a wedge is placed between the price buyers pay and the price sellers receive

D) the market price rises because demand falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

68

Suppose a tax is placed on wine, this will mean:

A) the quantity of wine sold in the market will be unchanged because wine has perfectly inelastic supply

B) the tax will be entirely passed on to the buyers

C) the quantity of wine sold in the market will fall

D) the tax will be paid entirely by the sellers

A) the quantity of wine sold in the market will be unchanged because wine has perfectly inelastic supply

B) the tax will be entirely passed on to the buyers

C) the quantity of wine sold in the market will fall

D) the tax will be paid entirely by the sellers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

69

When a tax is levied on the sellers of a good, the supply curve:

A) shifts right and down by less than the tax

B) shifts left and up by an amount equal to the tax

C) shifts left and down by an amount less than the tax

D) shifts right and up by an amount equal to the tax

A) shifts right and down by less than the tax

B) shifts left and up by an amount equal to the tax

C) shifts left and down by an amount less than the tax

D) shifts right and up by an amount equal to the tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

70

Graph 8-3

According to Graph 8-3, the equilibrium market price before the tax is imposed is:

A) $8

B) $12

C) $16

D) $20

According to Graph 8-3, the equilibrium market price before the tax is imposed is:

A) $8

B) $12

C) $16

D) $20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

71

Graph 8-3

According to Graph 8-3, the price buyers pay after the tax is:

A) $8

B) $12

C) $16

D) $20

According to Graph 8-3, the price buyers pay after the tax is:

A) $8

B) $12

C) $16

D) $20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

72

Graph 8-3

According to Graph 8-3, the reduction in consumer surplus caused by the tax is:

A) $200

B) $400

C) $800

D) $1600

According to Graph 8-3, the reduction in consumer surplus caused by the tax is:

A) $200

B) $400

C) $800

D) $1600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

73

Graph 8-3

According to Graph 8-3, the price sellers receive after the tax is:

A) $8

B) $12

C) $16

D) $20

According to Graph 8-3, the price sellers receive after the tax is:

A) $8

B) $12

C) $16

D) $20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

74

Graph 8-3

According to Graph 8-3, producer surplus before the tax equals:

A) $1200

B) $2400

C) $3200

D) $4800

According to Graph 8-3, producer surplus before the tax equals:

A) $1200

B) $2400

C) $3200

D) $4800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

75

Graph 8-3

According to Graph 8-3, after the tax is levied, consumer surplus is:

A) $2400

B) $1600

C) $800

D) $400

According to Graph 8-3, after the tax is levied, consumer surplus is:

A) $2400

B) $1600

C) $800

D) $400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

76

When a tax on a good is enacted:

A) buyers always bear the full burden of the tax

B) sellers always bear the full burden of the tax

C) buyers and sellers share the burden of the tax regardless of whom it is levied on

D) sellers bear the full burden if the tax is levied on them, but buyers bear the full burden if the tax is levied on them

A) buyers always bear the full burden of the tax

B) sellers always bear the full burden of the tax

C) buyers and sellers share the burden of the tax regardless of whom it is levied on

D) sellers bear the full burden if the tax is levied on them, but buyers bear the full burden if the tax is levied on them

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

77

The benefit received by the sellers of a good in a market is measured by:

A) consumer surplus

B) producer surplus

C) the amount buyers pay for the good in excess of the amount the good is actually worth

D) the amount it costs producers to produce the good

A) consumer surplus

B) producer surplus

C) the amount buyers pay for the good in excess of the amount the good is actually worth

D) the amount it costs producers to produce the good

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

78

The benefit received by the government from a tax is measured by:

A) deadweight loss

B) tax revenue

C) equilibrium price

D) total surplus

A) deadweight loss

B) tax revenue

C) equilibrium price

D) total surplus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

79

Suppose a tax is imposed on a good, this generates a loss in total surplus called:

A) opportunity cost

B) tax evasion

C) deadweight loss

D) public sector employee wages

A) opportunity cost

B) tax evasion

C) deadweight loss

D) public sector employee wages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck

80

Graph 8-3

According to Graph 8-3, the benefits to the government (total tax revenue) is:

A) $4000

B) $3600

C) $2400

D) $1600

According to Graph 8-3, the benefits to the government (total tax revenue) is:

A) $4000

B) $3600

C) $2400

D) $1600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 141 في هذه المجموعة.

فتح الحزمة

k this deck