Deck 12: Budgeting and Performance Measurement

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 12: Budgeting and Performance Measurement

1

The type of budgeting that relates input of resources to output of services is zero-based budgeting.

False

Explanation: Performance budgeting is one of the approaches to budgeting that links resource inputs to service outputs to facilitate measuring operational efficiency. Zero-based budgeting requires that all proposed expenditures are justified each year; there is no explicit attempt to match these expenditures with the output of services.

Explanation: Performance budgeting is one of the approaches to budgeting that links resource inputs to service outputs to facilitate measuring operational efficiency. Zero-based budgeting requires that all proposed expenditures are justified each year; there is no explicit attempt to match these expenditures with the output of services.

2

Governmental budgets must be made available for public scrutiny,and public hearings must be held to provide adequate opportunity for citizens' input,prior to legislative adoption of the budget.

True

Explanation: Most governments are required by law to provide for public input to the budgeting process.

Explanation: Most governments are required by law to provide for public input to the budgeting process.

3

Budget appropriations for governmental funds ordinarily cover only one year,however; there is also a need to develop multi-year capital budgets.

True

Explanation: Effectively managed capital improvement programs must include the current year's capital budget (both intermediate and long-range plans) and mid- to long-term plans for acquisition and construction of major capital assets. Many governmental capital activities require sustained effort over a number of years.

Explanation: Effectively managed capital improvement programs must include the current year's capital budget (both intermediate and long-range plans) and mid- to long-term plans for acquisition and construction of major capital assets. Many governmental capital activities require sustained effort over a number of years.

4

A major advantage of activity-based costing (ABC)is that it reduces unit cost distortions arising from overhead allocations that often occur using traditional cost accounting systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

5

A government must select and maintain one budgeting approach across all departments and programs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

Service efforts and accomplishments measures suffer from the same problem as line-item or object-of-expenditures budgeting; that is,focusing only on resource inputs while ignoring outputs and outcomes of governmental activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

Line-item budgeting has remained a popular tool due to its simplicity and the accountability it allows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

Total quality management (TQM)seeks to continuously improve an organization's ability to meet or exceed customers' demands,and,as such,is useful in a government setting as well as a business setting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

The concepts of total quality management (TQM)are consistent with earlier budget approaches such as performance budgeting and PPBS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

10

Under GASB standards,every government,regardless of its size,is instructed to prepare a cash budget for each month of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

A generally unallowable cost may be allowable under certain circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

In budgeting for the inflow of financial resources,government officials must concern themselves with revenues and other financing sources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

To determine which costs are unallowable for charging to a federal assistance program,one should refer to the appropriate cost circular published by the Government Accountability Office (GAO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

Despite its initial popularity,service efforts and accomplishments reporting has lost favor in recent years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

In governments,the budget has always played a role in external financial reports through the required budget-to-actual comparison schedules or statements for those funds that have a legally approved budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

Some of the budgeting approaches governments have experimented with as alternatives to line-item,incremental budgeting include performance budgeting,program budgeting,the planning-programming-budgeting system,and zero-based budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

17

The sole purpose of preparing a governmental budget is to show compliance with laws and regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

Cash planning and budgeting are important in government because the timing of cash inflows often do not coincide with the timing of cash outflows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

19

A major disadvantage of activity-based costing in a governmental setting is the very limited number of activities for which it can be used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

20

Accounting for federal and nonfederal grants and contracts requires an accounting system that can associate line-item expenses with functional programs with funding sources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

The schedule of legally required events in the budgeting process is generally referred to as the

A) Budget docket.

B) Legal timetable.

C) Hearing schedule.

D) Budget calendar.

A) Budget docket.

B) Legal timetable.

C) Hearing schedule.

D) Budget calendar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

State and local governments and not-for-profit organizations that receive grants or contracts from the federal government should charge costs of these grants or contracts in conformity with

A) Cost Accounting Standards Board standards.

B) Office of Management and Budget cost circulars.

C) Financial Accounting Standards Board standards.

D) Governmental Accounting Standards Board standards.

A) Cost Accounting Standards Board standards.

B) Office of Management and Budget cost circulars.

C) Financial Accounting Standards Board standards.

D) Governmental Accounting Standards Board standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

Cash disbursements budgets

A) Need to be prepared because GASB standards specify the use of the accrual basis of accounting for governments.

B) Should usually be prepared for each month of the year,or for shorter intervals,in order to facilitate planning short-term borrowings and investments.

C) Should be prepared only for funds not required to operate under legal appropriation budgets.

D) Should be prepared only for each fiscal year because disbursements for each month are approximately equal.

A) Need to be prepared because GASB standards specify the use of the accrual basis of accounting for governments.

B) Should usually be prepared for each month of the year,or for shorter intervals,in order to facilitate planning short-term borrowings and investments.

C) Should be prepared only for funds not required to operate under legal appropriation budgets.

D) Should be prepared only for each fiscal year because disbursements for each month are approximately equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

In budgeting revenues,state and local government administrators should

A) Be careful not to utilize unauthorized sources or exceed authorized ceilings on revenues from specific sources.

B) Ensure that at least the amount of revenues needed to meet spending needs are raised,even if authorized ceilings on some revenue sources must be exceeded.

C) Utilize all authorized revenues sources and at the maximum amount allowed by law.

D) Ignore "other financing sources" since these resource inflows are not available for appropriation.

A) Be careful not to utilize unauthorized sources or exceed authorized ceilings on revenues from specific sources.

B) Ensure that at least the amount of revenues needed to meet spending needs are raised,even if authorized ceilings on some revenue sources must be exceeded.

C) Utilize all authorized revenues sources and at the maximum amount allowed by law.

D) Ignore "other financing sources" since these resource inflows are not available for appropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements regarding government budgets is not true?

A) A budget should be enacted before the fiscal year begins and be integrated with the financial accounting system so that actual results can be compared to budgeted plans at regular intervals.

B) The budget's role is limited to inclusion in internal financial reports and budgetary compliance monitoring for those funds that have a legally approved budget.

C) Integrating the budget into the accounting system allows management to oversee individual unit performance and react quickly to variances between actual results and budgeted plans.

D) A budget is a plan of financial operation embodying an estimate of proposed expenditures for a given period of time and the proposed means of financing them.

A) A budget should be enacted before the fiscal year begins and be integrated with the financial accounting system so that actual results can be compared to budgeted plans at regular intervals.

B) The budget's role is limited to inclusion in internal financial reports and budgetary compliance monitoring for those funds that have a legally approved budget.

C) Integrating the budget into the accounting system allows management to oversee individual unit performance and react quickly to variances between actual results and budgeted plans.

D) A budget is a plan of financial operation embodying an estimate of proposed expenditures for a given period of time and the proposed means of financing them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is not true?

A) A balanced scorecard is an integrated set of performance targets,both financial and nonfinancial,that are derived from an organization's strategies about how to achieve its goals.

B) Total quality management (TQM)seeks to continuously improve the government's ability to meet or exceed demands from customers who might be external,such as taxpayers and service recipients,or internal,such as the customers of an internal service fund.

C) Service efforts and accomplishments (SEA)reporting links customer (taxpayer and other resource provider)satisfaction to improvements in the operating systems and processes used to provide goods and services.

D) Customer relationship management (CRM)systems create an integrated view of a customer to coordinate services from all channels of the organization with the intent to improve the long-term relationship the organization has with its customer.

A) A balanced scorecard is an integrated set of performance targets,both financial and nonfinancial,that are derived from an organization's strategies about how to achieve its goals.

B) Total quality management (TQM)seeks to continuously improve the government's ability to meet or exceed demands from customers who might be external,such as taxpayers and service recipients,or internal,such as the customers of an internal service fund.

C) Service efforts and accomplishments (SEA)reporting links customer (taxpayer and other resource provider)satisfaction to improvements in the operating systems and processes used to provide goods and services.

D) Customer relationship management (CRM)systems create an integrated view of a customer to coordinate services from all channels of the organization with the intent to improve the long-term relationship the organization has with its customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

GASB Concepts Statement No.2 requires state and local governments to include service efforts and accomplishments measures within the comprehensive annual financial report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

The number of lane-miles of road repaired to a specified minimum condition is an example of an

A) Output measure.

B) Input measure.

C) Outcome measure.

D) Efficiency measure.

A) Output measure.

B) Input measure.

C) Outcome measure.

D) Efficiency measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

Cash receipts and cash disbursement budgets for a government

A) Should be prepared for all funds for the entire fiscal year.

B) Should be prepared as needed to enhance cash management,investment management,and short-term debt management.

C) Should be prepared for only those funds for which appropriations budgets are required by law to be prepared on the accrual basis or the modified accrual basis.

D) Should be prepared for only those funds for which appropriations budgets are not required by law.

A) Should be prepared for all funds for the entire fiscal year.

B) Should be prepared as needed to enhance cash management,investment management,and short-term debt management.

C) Should be prepared for only those funds for which appropriations budgets are required by law to be prepared on the accrual basis or the modified accrual basis.

D) Should be prepared for only those funds for which appropriations budgets are not required by law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following budgetary approaches starts with line-item expenditures and applies a factor approximating the inflation rate to most items,unless specific information is available to suggest a different factor be applied?

A) Performance budgeting.

B) Zero-based budgeting.

C) Program budgeting.

D) Incremental budgeting.

A) Performance budgeting.

B) Zero-based budgeting.

C) Program budgeting.

D) Incremental budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements is not consistent with the GASB's "Budgeting,Budgetary Control,and Budgetary Reporting Principle?"

A) An annual budget must be adopted using generally accepted accounting principles.

B) The accounting system should provide the basis for appropriate budgetary control.

C) Budgetary comparison schedules should be presented as required supplementary information for the General Fund and each major special revenue fund for which an annual budget has been adopted.

D) The budgetary comparison schedule should present both the original and the final appropriated budgets for the reporting period.

A) An annual budget must be adopted using generally accepted accounting principles.

B) The accounting system should provide the basis for appropriate budgetary control.

C) Budgetary comparison schedules should be presented as required supplementary information for the General Fund and each major special revenue fund for which an annual budget has been adopted.

D) The budgetary comparison schedule should present both the original and the final appropriated budgets for the reporting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following costs would be allowable under OMB Circular A-87?

A) Advertising on the Internet by a defense contractor.

B) Lobbying for continuation of an educational program by the school administrator.

C) Indirect costs of the state legislature.

D) Depreciation expense on the equipment used in a federal research grant.

A) Advertising on the Internet by a defense contractor.

B) Lobbying for continuation of an educational program by the school administrator.

C) Indirect costs of the state legislature.

D) Depreciation expense on the equipment used in a federal research grant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

Service efforts and accomplishments (SEA)reporting helps citizens,elected officials,appointed officials,investors and creditors,and other interested parties evaluate the government's performance in the absence of a "bottom line" measure such as exists for for-profit entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following might appropriately be termed an outcome indicator for a police department that reports service efforts and accomplishments (SEA)indicators?

A) Number of crimes investigated.

B) Value of property lost due to crime.

C) Hours of patrol.

D) Number of personnel hours expended.

A) Number of crimes investigated.

B) Value of property lost due to crime.

C) Hours of patrol.

D) Number of personnel hours expended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not a typical step in the budgeting process for a state or local government?

A) Request by management for input on the budget.

B) Review and revisions of the budget by the administrative staff of each unit.

C) Public hearings for citizen input.

D) Approval by a majority vote of the citizenry.

A) Request by management for input on the budget.

B) Review and revisions of the budget by the administrative staff of each unit.

C) Public hearings for citizen input.

D) Approval by a majority vote of the citizenry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

The government official typically responsible for providing department heads with such technical support as clerical assistance with budget computation and maintenance of document files relating to the budget is

A) The chief financial officer.

B) The legislative budget analyst.

C) The budget officer.

D) The director of finance.

A) The chief financial officer.

B) The legislative budget analyst.

C) The budget officer.

D) The director of finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

Effective capital budgeting for general capital assets of a government requires

A) Intermediate and long-range capital improvement plans for general capital assets.

B) Nonfinancial information on physical measures and service condition of capital assets of component units.

C) Consideration of how proprietary fund capital projects will be financed.

D) Information about the capital asset needs of a motor pool accounted for as an internal service fund.

A) Intermediate and long-range capital improvement plans for general capital assets.

B) Nonfinancial information on physical measures and service condition of capital assets of component units.

C) Consideration of how proprietary fund capital projects will be financed.

D) Information about the capital asset needs of a motor pool accounted for as an internal service fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

The GASB "Budgeting Principle" states that an annual budget should be adopted by (for)every

A) Governmental fund type.

B) Fund of a government.

C) Government.

D) Governmental fund type except capital projects funds.

A) Governmental fund type.

B) Fund of a government.

C) Government.

D) Governmental fund type except capital projects funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

An often used approach to budgeting that simply derives the subsequent year's budget from the current year's budget is called:

A) Planning-programming-budgeting.

B) Incremental budgeting.

C) Zero-based budgeting.

D) Performance budgeting.

A) Planning-programming-budgeting.

B) Incremental budgeting.

C) Zero-based budgeting.

D) Performance budgeting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

Service efforts and accomplishments (SEA)information

A) Includes indicators of a government's actual performance in providing services to its citizens.

B) Aids users in assessing the economy,efficiency,and effectiveness of government.

C) Is required for all governments that issue a CAFR.

D) Both A and B are true.

A) Includes indicators of a government's actual performance in providing services to its citizens.

B) Aids users in assessing the economy,efficiency,and effectiveness of government.

C) Is required for all governments that issue a CAFR.

D) Both A and B are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

Name at least three criteria that must be met for costs to be allowable under OMB circulars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

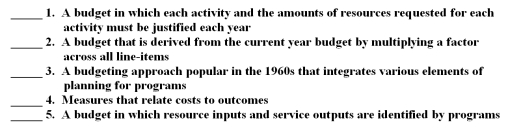

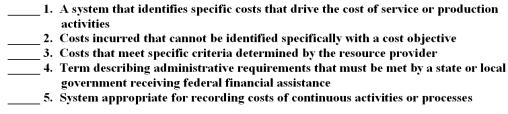

The following are key terms in Chapter 12 that relate to budgeting of government services:

A.Efficiency measures

B.Effectiveness measures

C.Planning-programming-budgeting system

D.Zero-based budgeting

E.Program budgeting

F.Flexible budgeting

G.Incremental budgeting

H.Budget calendar

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition

A.Efficiency measures

B.Effectiveness measures

C.Planning-programming-budgeting system

D.Zero-based budgeting

E.Program budgeting

F.Flexible budgeting

G.Incremental budgeting

H.Budget calendar

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

If the revenues budget of a government is prepared on the modified accrual basis is there any reason why the revenues budget should be converted to a cash receipts budget? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

All of the following are objectives of activity-based cost (ABC)accounting in government except

A) To preserve,at a minimum,the present quality and availability of services.

B) To help find lower cost alternatives to providing services.

C) To link customer (taxpayer)satisfaction to improvements in the operating systems used to provide goods and services.

D) To make increases in the volume of services dependent on reducing costs.

A) To preserve,at a minimum,the present quality and availability of services.

B) To help find lower cost alternatives to providing services.

C) To link customer (taxpayer)satisfaction to improvements in the operating systems used to provide goods and services.

D) To make increases in the volume of services dependent on reducing costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following has contributed most to governments' increased interest in activity-based accounting?

A) GASB standards.

B) Implementation of innovative management approaches (such as TQM and SEA measures)in response to public demand for greater accountability and productivity.

C) Increased demand for high profile management tools to bolster the image of government.

D) The Single Audit Act of 1984 (and 1996 Amendments).

A) GASB standards.

B) Implementation of innovative management approaches (such as TQM and SEA measures)in response to public demand for greater accountability and productivity.

C) Increased demand for high profile management tools to bolster the image of government.

D) The Single Audit Act of 1984 (and 1996 Amendments).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following statements regarding service efforts and accomplishments (SEA)is not true?

A) Measures of service efforts,or input measures,relate to the amount of financial and nonfinancial resources (such as money and materials)used in a program or process.

B) Effort measures relate service efforts to outputs of service and to outcomes or results of services.

C) Output measures are quantity measures that reflect either the quantity of a service provided or the quantity of service provided that meets a specified quality requirement.

D) Outcome measures gauge accomplishments,or the results of services provided.

A) Measures of service efforts,or input measures,relate to the amount of financial and nonfinancial resources (such as money and materials)used in a program or process.

B) Effort measures relate service efforts to outputs of service and to outcomes or results of services.

C) Output measures are quantity measures that reflect either the quantity of a service provided or the quantity of service provided that meets a specified quality requirement.

D) Outcome measures gauge accomplishments,or the results of services provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

The GASB identifies which of the following three broad categories of service efforts and accomplishments (SEA)measures:

A) Measures of service efforts,measures of service accomplishments,and measures of efficiency.

B) Measures of service efforts and accomplishments,measures of service efficiency,and measures of service effectiveness.

C) Measures of service efforts,measures of service accomplishments,and measures of the costs of service efforts and accomplishments.

D) Measures of service efforts,measures of service accomplishments,and measures that relate efforts to accomplishments.

A) Measures of service efforts,measures of service accomplishments,and measures of efficiency.

B) Measures of service efforts and accomplishments,measures of service efficiency,and measures of service effectiveness.

C) Measures of service efforts,measures of service accomplishments,and measures of the costs of service efforts and accomplishments.

D) Measures of service efforts,measures of service accomplishments,and measures that relate efforts to accomplishments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

How can service efforts and accomplishments (SEA)indicators be useful in improving budgeting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

"The sole objective of budgeting in a governmental entity is to demonstrate compliance with appropriation legislation." Do you agree or disagree? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the role of cost drivers in an activity-based cost (ABC)system? Explain how analysis of cost drivers can be useful in identifying inefficient activities and the cause(s)of the inefficiency?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is the name of the type of budgeting in which the very existence of each activity should be justified each year? Elaborate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

What advantages does total quality management (TQM)offer a government? Is it fundamentally a budget approach?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

"Because a budgetary comparison statement is required for conformity with GAAP (under GASBS 34),resource management purposes are best served by preparation of the budget on the same basis as the accounts." Do you agree? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

Balanced scorecards integrate all of the following into a document that can be shared with employees and stakeholders except

A) GASB financial reporting standards.

B) Internal business processes measures.

C) Nonfinancial measures,such as customer satisfaction.

D) Financial performance measures.

A) GASB financial reporting standards.

B) Internal business processes measures.

C) Nonfinancial measures,such as customer satisfaction.

D) Financial performance measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

Discuss the implications of GASB governmental fund and government-wide financial reporting on the budgeting process in a city.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

Efficiency measures,as the term is used in the service efforts and accomplishments (SEA)literature,can be described as:

A) Measures that relate the quantity or cost of resources used to units of output.

B) Measures that relate to the amount of financial and nonfinancial resources used in a program or process.

C) Measures that relate costs to outcomes.

D) Measures that reflect either the quantity or quality of a service provided.

A) Measures that relate the quantity or cost of resources used to units of output.

B) Measures that relate to the amount of financial and nonfinancial resources used in a program or process.

C) Measures that relate costs to outcomes.

D) Measures that reflect either the quantity or quality of a service provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

Describe what is meant by the direct costs of a program (for example,a fire prevention program)and why it is important to distinguish direct costs from indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

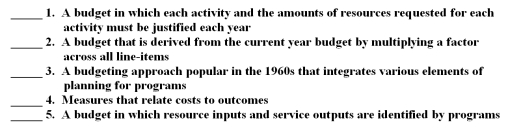

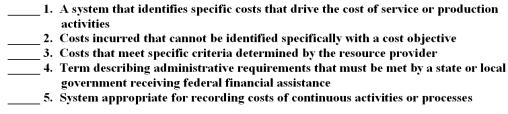

The following are key terms in Chapter 12 that relate to costing of government services:

A.Allowable costs

B.Job order costing

C.Common rule

D.Cost objective

E.Indirect costs

F.Direct costs

G.Process costing

H.Activity-based costing

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

A.Allowable costs

B.Job order costing

C.Common rule

D.Cost objective

E.Indirect costs

F.Direct costs

G.Process costing

H.Activity-based costing

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

Explain what is required to develop an effective total quality management (TQM)program for a government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

Why should persons who manage,advise,or audit governments and not-for-profit organizations be generally familiar with OMB Circulars A-87,A-21,and A-122? In your answer explain what "OMB" means,and why its circulars should be of concern to those involved with management,advisement,or auditing of state and local governments and not-for-profit organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

Identify and discuss the three broad categories of service efforts and accomplishments (SEA)measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

Explain the benefits to a government of integrating strategic planning,budgeting,and performance measurement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck