Deck 9: Flexible Budgets and Overhead Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/145

العب

ملء الشاشة (f)

Deck 9: Flexible Budgets and Overhead Analysis

1

In the target costing approach to pricing,the total cost of a product is first determined and then an expected level of mark-up is added to get the desired selling price.

False

2

One of the dangers of allocating common fixed costs to a product line is that such allocations can make the line appear less profitable than it really is.

True

3

Future costs that do not differ among the alternatives are not relevant in a decision.

True

4

The cost of a resource that has no alternative use in a make or buy decision problem has an opportunity cost of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

5

A sunk cost is a cost that has already been incurred and that cannot be avoided regardless of what action is chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

6

In deciding the profitability of processing joint products further after the split-off point,all costs should be considered including joint costs incurred prior to the split-off point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

7

Costs that are always relevant in decision-making are:

A) future costs.

B) avoidable costs.

C) sunk costs.

D) fixed costs.

A) future costs.

B) avoidable costs.

C) sunk costs.

D) fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

8

Managers will always seek to eliminate all unprofitable product lines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

9

Consider a decision facing a firm of either accepting or rejecting a special offer for one of its products.A cost that is not relevant is:

A) direct materials.

B) variable overhead.

C) fixed overhead that will be avoided if the special offer is accepted.

D) common fixed overhead that will continue if the special offer is not accepted.

A) direct materials.

B) variable overhead.

C) fixed overhead that will be avoided if the special offer is accepted.

D) common fixed overhead that will continue if the special offer is not accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

10

If by dropping a product a firm can avoid more in fixed costs than it loses in contribution margin,then the firm is better off economically if the product is dropped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

11

To maximize total contribution margin,a firm faced with a production constraint should:

A) promote those products having the highest unit contribution margins.

B) promote those products having the highest contribution margin ratios.

C) promote those products having the highest contribution margin per unit of constrained resource.

D) promote those products having the highest contribution margins and contribution margin ratios.

A) promote those products having the highest unit contribution margins.

B) promote those products having the highest contribution margin ratios.

C) promote those products having the highest contribution margin per unit of constrained resource.

D) promote those products having the highest contribution margins and contribution margin ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

12

The split-off point is the stage in production of joint products at which the different end products are identified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

13

Only the variable costs identified with a product are relevant in a decision concerning whether to eliminate,or to accept the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

14

Assuming all units that are produced can be sold,in deciding which of alternative products to produce in circumstances of constrained resources,managers will always seek to maximize the production of the product with the highest per-unit contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

15

Variable costs are always relevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

16

Opportunity costs are recorded in the accounts of an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

17

An avoidable cost is a cost that can be eliminated (in whole or in part)as a result of choosing one alternative over another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

18

The book value of old equipment is not a relevant cost in an equipment replacement decision problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

19

Existing fixed manufacturing overhead costs are not relevant in deciding whether to accept a special order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

20

Managers should pay little attention to bottleneck operations since they have limited capacity for producing output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

21

A study has been conducted to determine if Product A should be dropped.Sales of the product total $200,000 per year;variable expenses total $140,000 per year.Fixed expenses charged to the product total $90,000 per year.The company estimates that $40,000 of these fixed expenses will continue even if the product is dropped.These data indicate that if Product A is dropped,the company's overall net operating income would:

A) decrease by $10,000 per year.

B) increase by $20,000 per year.

C) decrease by $20,000 per year.

D) increase by $30,000 per year.

A) decrease by $10,000 per year.

B) increase by $20,000 per year.

C) decrease by $20,000 per year.

D) increase by $30,000 per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

22

Gata Co.plans to discontinue a department that has a $48,000 contribution margin and $96,000 of fixed costs.Of these fixed costs,$42,000 cannot be avoided.What would be the effect of this discontinuance on Gata's overall net operating income?

A) Increase of $6,000.

B) Decrease of $6,000.

C) Increase of $48,000.

D) Decrease of $48,000.

A) Increase of $6,000.

B) Decrease of $6,000.

C) Increase of $48,000.

D) Decrease of $48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

23

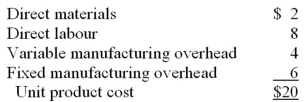

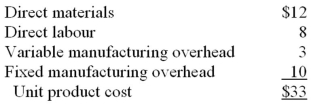

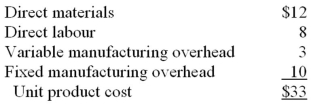

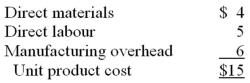

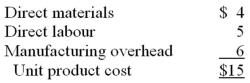

Golden,Inc.has been manufacturing 5,000 units of Part 10541 which is used in one of its products.At this level of production,the unit product cost of Part 10541 is as follows:  Brown Company has offered to sell Golden 5,000 units of Part 10541 for $19 a unit.Golden has determined that two thirds of the fixed manufacturing overhead will continue even if Part 10541 is purchased from Brown.Assume that direct labour is an avoidable cost in this decision.To determine whether to accept Brown's offer,the relevant costs to Golden of manufacturing the parts internally are:

Brown Company has offered to sell Golden 5,000 units of Part 10541 for $19 a unit.Golden has determined that two thirds of the fixed manufacturing overhead will continue even if Part 10541 is purchased from Brown.Assume that direct labour is an avoidable cost in this decision.To determine whether to accept Brown's offer,the relevant costs to Golden of manufacturing the parts internally are:

A) $70,000.

B) $80,000.

C) $90,000.

D) $95,000.

Brown Company has offered to sell Golden 5,000 units of Part 10541 for $19 a unit.Golden has determined that two thirds of the fixed manufacturing overhead will continue even if Part 10541 is purchased from Brown.Assume that direct labour is an avoidable cost in this decision.To determine whether to accept Brown's offer,the relevant costs to Golden of manufacturing the parts internally are:

Brown Company has offered to sell Golden 5,000 units of Part 10541 for $19 a unit.Golden has determined that two thirds of the fixed manufacturing overhead will continue even if Part 10541 is purchased from Brown.Assume that direct labour is an avoidable cost in this decision.To determine whether to accept Brown's offer,the relevant costs to Golden of manufacturing the parts internally are:A) $70,000.

B) $80,000.

C) $90,000.

D) $95,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

24

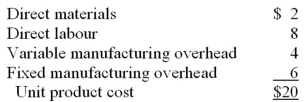

Wagner Company sells product A for $21 per unit.Wagner's unit product cost based on the full capacity of 200,000 units is as follows:  A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:

A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:

A) $14.

B) $15.

C) $16.

D) $18.

A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:

A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:A) $14.

B) $15.

C) $16.

D) $18.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

25

A plant operating at capacity would suggest that most likely:

A) every machine and person in the plant is working at the maximum possible rate.

B) only some specific machines or processes are operating at the maximum rate possible.

C) fixed costs will need to change to accommodate increased demand.

D) managers should produce those products with the highest contribution margin in order to deal with the constrained resource.

A) every machine and person in the plant is working at the maximum possible rate.

B) only some specific machines or processes are operating at the maximum rate possible.

C) fixed costs will need to change to accommodate increased demand.

D) managers should produce those products with the highest contribution margin in order to deal with the constrained resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

26

Relay Corporation manufactures batons.Relay can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed cost of $450,000.Based on Relay's predictions for next year,240,000 batons will be sold at the regular price of $5.00 each.In addition,a special order was placed for 60,000 batons to be sold at a 40% discount off the regular price.Total fixed costs would be unaffected by this order.By what amount would the company's net operating income be increased or decreased as a result of the special order?

A) $30,000 increase.

B) $36,000 increase.

C) $60,000 decrease.

D) $180,000 increase.

A) $30,000 increase.

B) $36,000 increase.

C) $60,000 decrease.

D) $180,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Lantern Corporation has 1,000 obsolete lanterns that are carried in inventory at a manufacturing cost of $20,000.If the lanterns are remachined for $5,000,they could be sold for $9,000.Alternatively,the lanterns could be sold for scrap for $1,000.Which alternative is more desirable and what are the total relevant costs for that alternative?

A) Remachine and $5,000.

B) Remachine and $25,000.

C) Scrap and $1,000.

D) Scrap and $21,000.

A) Remachine and $5,000.

B) Remachine and $25,000.

C) Scrap and $1,000.

D) Scrap and $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

28

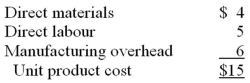

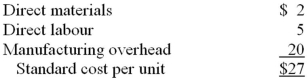

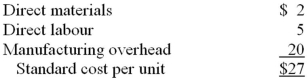

Pitkin Company produces a part used in the manufacture of one of its products.The unit product cost of the part is $33,computed as follows:  An outside supplier has offered to provide the annual requirement of 10,000 of the parts for only $27 each.The company estimates that 30% of the fixed manufacturing overhead costs above will continue if the parts are purchased from the outside supplier.Assume that direct labour is an avoidable cost in this decision.Based on these data,the per unit dollar advantage or disadvantage of purchasing the parts from the outside supplier would be:

An outside supplier has offered to provide the annual requirement of 10,000 of the parts for only $27 each.The company estimates that 30% of the fixed manufacturing overhead costs above will continue if the parts are purchased from the outside supplier.Assume that direct labour is an avoidable cost in this decision.Based on these data,the per unit dollar advantage or disadvantage of purchasing the parts from the outside supplier would be:

A) $1 disadvantage.

B) $1 advantage.

C) $3 advantage.

D) $4 disadvantage.

An outside supplier has offered to provide the annual requirement of 10,000 of the parts for only $27 each.The company estimates that 30% of the fixed manufacturing overhead costs above will continue if the parts are purchased from the outside supplier.Assume that direct labour is an avoidable cost in this decision.Based on these data,the per unit dollar advantage or disadvantage of purchasing the parts from the outside supplier would be:

An outside supplier has offered to provide the annual requirement of 10,000 of the parts for only $27 each.The company estimates that 30% of the fixed manufacturing overhead costs above will continue if the parts are purchased from the outside supplier.Assume that direct labour is an avoidable cost in this decision.Based on these data,the per unit dollar advantage or disadvantage of purchasing the parts from the outside supplier would be:A) $1 disadvantage.

B) $1 advantage.

C) $3 advantage.

D) $4 disadvantage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

29

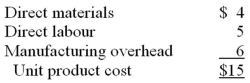

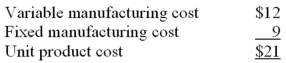

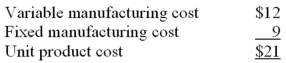

Green Company produces 1,000 parts per year,which are used in the assembly of one of its products.The unit product cost of these parts is:  The part can be purchased from an outside supplier at $20 per unit.If the part is purchased from the outside supplier,two thirds of the fixed manufacturing costs can be eliminated.The annual impact on the company's net operating income as a result of buying the part from the outside supplier would be:

The part can be purchased from an outside supplier at $20 per unit.If the part is purchased from the outside supplier,two thirds of the fixed manufacturing costs can be eliminated.The annual impact on the company's net operating income as a result of buying the part from the outside supplier would be:

A) $1,000 increase.

B) $1,000 decrease.

C) $2,000 decrease.

D) $5,000 increase.

The part can be purchased from an outside supplier at $20 per unit.If the part is purchased from the outside supplier,two thirds of the fixed manufacturing costs can be eliminated.The annual impact on the company's net operating income as a result of buying the part from the outside supplier would be:

The part can be purchased from an outside supplier at $20 per unit.If the part is purchased from the outside supplier,two thirds of the fixed manufacturing costs can be eliminated.The annual impact on the company's net operating income as a result of buying the part from the outside supplier would be:A) $1,000 increase.

B) $1,000 decrease.

C) $2,000 decrease.

D) $5,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

30

A study has been conducted to determine if one of the departments in Parry Company should be discontinued.The contribution margin in the department is $50,000 per year.Fixed expenses charged to the department are $65,000 per year.It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued.These data indicate that if the department is discontinued,the company's overall net operating income would:

A) decrease by $10,000 per year.

B) increase by $10,000 per year.

C) decrease by $25,000 per year.

D) increase by $25,000 per year.

A) decrease by $10,000 per year.

B) increase by $10,000 per year.

C) decrease by $25,000 per year.

D) increase by $25,000 per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

31

Manor Company plans to discontinue a department that has a contribution margin of $25,000 and $50,000 in fixed costs.Of the fixed costs,$21,000 cannot be eliminated.The effect on the profit of Manor Company of discontinuing this department would be:

A) a decrease of $4,000.

B) an increase of $4,000.

C) a decrease of $25,000.

D) an increase of $25,000.

A) a decrease of $4,000.

B) an increase of $4,000.

C) a decrease of $25,000.

D) an increase of $25,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

32

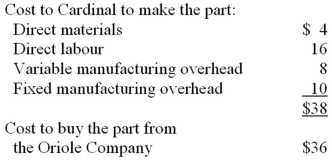

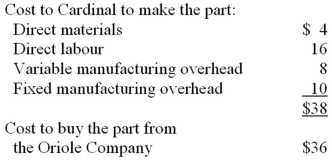

Cardinal Company needs 20,000 units of a certain part to use in one of its products.The following information is available:  Oriole Company has offered to sell this part to Cardinal company for $36 each.If Cardinal buys the part from Oriole instead of making it,Cardinal would not have any use for the released capacity.In addition,60% of the fixed manufacturing overhead costs will continue regardless of what decision is made.Assume that direct labour is an avoidable cost in this decision.In deciding whether to make or buy the part,the total relevant costs to make the part are:

Oriole Company has offered to sell this part to Cardinal company for $36 each.If Cardinal buys the part from Oriole instead of making it,Cardinal would not have any use for the released capacity.In addition,60% of the fixed manufacturing overhead costs will continue regardless of what decision is made.Assume that direct labour is an avoidable cost in this decision.In deciding whether to make or buy the part,the total relevant costs to make the part are:

A) $560,000.

B) $640,000.

C) $720,000.

D) $760,000.

Oriole Company has offered to sell this part to Cardinal company for $36 each.If Cardinal buys the part from Oriole instead of making it,Cardinal would not have any use for the released capacity.In addition,60% of the fixed manufacturing overhead costs will continue regardless of what decision is made.Assume that direct labour is an avoidable cost in this decision.In deciding whether to make or buy the part,the total relevant costs to make the part are:

Oriole Company has offered to sell this part to Cardinal company for $36 each.If Cardinal buys the part from Oriole instead of making it,Cardinal would not have any use for the released capacity.In addition,60% of the fixed manufacturing overhead costs will continue regardless of what decision is made.Assume that direct labour is an avoidable cost in this decision.In deciding whether to make or buy the part,the total relevant costs to make the part are:A) $560,000.

B) $640,000.

C) $720,000.

D) $760,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

33

The following standard costs pertain to a component part manufactured by Ashby Company:  The company can purchase the part from an outside supplier for $25 per unit.The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision.Assume that direct labour is an avoidable cost in this decision.What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?

The company can purchase the part from an outside supplier for $25 per unit.The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision.Assume that direct labour is an avoidable cost in this decision.What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?

A) $2.

$15)

C) $19.

D) $27.

The company can purchase the part from an outside supplier for $25 per unit.The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision.Assume that direct labour is an avoidable cost in this decision.What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?

The company can purchase the part from an outside supplier for $25 per unit.The manufacturing overhead is 60% fixed and this fixed portion would not be affected by this decision.Assume that direct labour is an avoidable cost in this decision.What is the relevant amount of the standard cost per unit to be considered in a decision of whether to make the part internally or buy it from the external supplier?A) $2.

$15)

C) $19.

D) $27.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

34

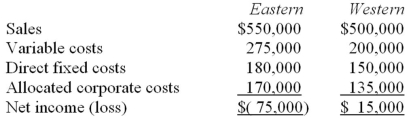

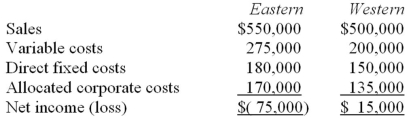

Cook Company has two divisions-Eastern and Western.The divisions have the following revenues and expenses:  The management of Cook is considering the elimination of the Eastern Division.If the Eastern Division were eliminated,the direct fixed costs associated with this division could be avoided.However,corporate costs would still be $305,000 in total.Given these data,the elimination of the Eastern Division would result in an overall company net income (loss)of:

The management of Cook is considering the elimination of the Eastern Division.If the Eastern Division were eliminated,the direct fixed costs associated with this division could be avoided.However,corporate costs would still be $305,000 in total.Given these data,the elimination of the Eastern Division would result in an overall company net income (loss)of:

A) $15,000.

B) ($60,000).

C) ($75,000).

D) ($155,000).

The management of Cook is considering the elimination of the Eastern Division.If the Eastern Division were eliminated,the direct fixed costs associated with this division could be avoided.However,corporate costs would still be $305,000 in total.Given these data,the elimination of the Eastern Division would result in an overall company net income (loss)of:

The management of Cook is considering the elimination of the Eastern Division.If the Eastern Division were eliminated,the direct fixed costs associated with this division could be avoided.However,corporate costs would still be $305,000 in total.Given these data,the elimination of the Eastern Division would result in an overall company net income (loss)of:A) $15,000.

B) ($60,000).

C) ($75,000).

D) ($155,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

35

Lusk Company produces and sells 15,000 units of Product A each month.The selling price of Product A is $20 per unit,and variable expenses are $14 per unit.A study has been made concerning whether Product A should be discontinued.The study shows that $70,000 of the $100,000 in fixed expenses charged to Product A would continue even if the product were discontinued.These data indicate that if Product A is discontinued,the company's overall net operating income would:

A) increase by $10,000 per month.

B) decrease by $20,000 per month.

C) increase by $20,000 per month.

D) decrease by $60,000 per month.

A) increase by $10,000 per month.

B) decrease by $20,000 per month.

C) increase by $20,000 per month.

D) decrease by $60,000 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following is not an effective way of dealing with a production constraint (i.e. ,bottleneck)?

A) Reduce the number of defective units produced at the bottleneck.

B) Pay overtime to workers assigned to the bottleneck in the production process.

C) Pay overtime to workers assigned to work stations located after the bottleneck in the production process.

D) Subcontract work that would otherwise require use of the bottleneck.

A) Reduce the number of defective units produced at the bottleneck.

B) Pay overtime to workers assigned to the bottleneck in the production process.

C) Pay overtime to workers assigned to work stations located after the bottleneck in the production process.

D) Subcontract work that would otherwise require use of the bottleneck.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

37

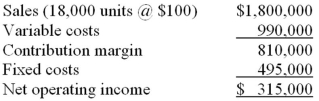

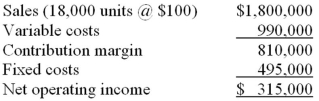

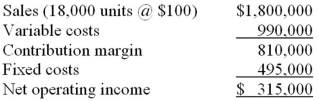

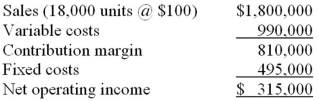

The manufacturing capacity of Jordan Company's facilities is 30,000 units a year.A summary of operating results for last year follows:  A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )

A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )

A) $390,000.

B) $705,000.

C) $840,000.

D) $855,000.

A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )

A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )A) $390,000.

B) $705,000.

C) $840,000.

D) $855,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following is one of the advantages to the target costing approach?

A) In the target costing approach,costs are fully known before the product is actually designed.

B) There is usually a higher level of cost-consciousness in the target costing approach than in the cost plus approach.

C) The target costing approach approach often leads to higher levels of features included that some customers may want.

D) The target costing approach can be completed by marketing department personnel without involving others in the process.

A) In the target costing approach,costs are fully known before the product is actually designed.

B) There is usually a higher level of cost-consciousness in the target costing approach than in the cost plus approach.

C) The target costing approach approach often leads to higher levels of features included that some customers may want.

D) The target costing approach can be completed by marketing department personnel without involving others in the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

39

The opportunity cost of making a component part in a factory with no excess capacity is the:

A) variable manufacturing cost of the component.

B) fixed manufacturing cost of the component.

C) cost of the production given up in order to manufacture the component.

D) net benefit foregone from the best alternative use of the capacity required.

A) variable manufacturing cost of the component.

B) fixed manufacturing cost of the component.

C) cost of the production given up in order to manufacture the component.

D) net benefit foregone from the best alternative use of the capacity required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

40

Manor Company plans to discontinue a department that has a contribution margin of $24,000 and $48,000 in fixed costs.Of the fixed costs,$21,000 cannot be avoided.The effect of this discontinuance on Manor's overall net operating income would be a(an):

A) decrease of $3,000.

B) increase of $3,000.

C) decrease of $24,000.

D) increase of $24,000.

A) decrease of $3,000.

B) increase of $3,000.

C) decrease of $24,000.

D) increase of $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

41

If by dropping a product a firm can avoid more in fixed costs than it loses in contribution margin,then the firm is better off economically if the product is dropped.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

42

Managers should pay little attention to bottleneck operations since they have limited capacity for producing output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

43

Variable costs are always relevant costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

44

An avoidable cost is a cost that can be eliminated (in whole or in part)as a result of choosing one alternative over another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

45

Managers will always seek to eliminate all unprofitable product lines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

46

How much will the company's net operating income be increased or (decreased)if it prices the 1,000 units in the special order at $6 each?

A) ($500)per month.

B) $400 per month.

C) $1,000 per month.

D) $2,500 per month.

A) ($500)per month.

B) $400 per month.

C) $1,000 per month.

D) $2,500 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

47

The cost of a resource that has no alternative use in a make or buy decision problem has an opportunity cost of zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

48

Consider the following production and cost data for two products,L and C:  The company can only perform 65,000 machine set-ups each period due to limited skilled labour and there is unlimited demand for each product.What is the largest possible total contribution margin that can be realized each period?

The company can only perform 65,000 machine set-ups each period due to limited skilled labour and there is unlimited demand for each product.What is the largest possible total contribution margin that can be realized each period?

A) $845,000.

B) $910,000.

C) $975,000.

D) $1,820,000.

The company can only perform 65,000 machine set-ups each period due to limited skilled labour and there is unlimited demand for each product.What is the largest possible total contribution margin that can be realized each period?

The company can only perform 65,000 machine set-ups each period due to limited skilled labour and there is unlimited demand for each product.What is the largest possible total contribution margin that can be realized each period?A) $845,000.

B) $910,000.

C) $975,000.

D) $1,820,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

49

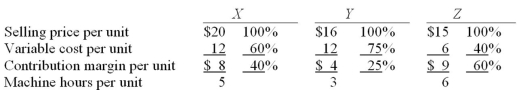

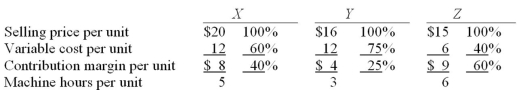

Manico Company produces three products-X,Y,& Z-with the following characteristics:  The company has only 2,000 machine-hours available each month.If demand exceeds the company's capacity,in what sequence should orders be filled if the company wants to maximize its total contribution margin?

The company has only 2,000 machine-hours available each month.If demand exceeds the company's capacity,in what sequence should orders be filled if the company wants to maximize its total contribution margin?

A) Orders for Z first,X second,and Y third.

B) Orders for X first,Z second,and Y third.

C) Orders for Y first,X second,and Z third.

D) Orders for Z first and no orders for X or Y.

The company has only 2,000 machine-hours available each month.If demand exceeds the company's capacity,in what sequence should orders be filled if the company wants to maximize its total contribution margin?

The company has only 2,000 machine-hours available each month.If demand exceeds the company's capacity,in what sequence should orders be filled if the company wants to maximize its total contribution margin?A) Orders for Z first,X second,and Y third.

B) Orders for X first,Z second,and Y third.

C) Orders for Y first,X second,and Z third.

D) Orders for Z first and no orders for X or Y.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

50

One of the dangers of allocating common fixed costs to a product line is that such allocations can make the line appear less profitable than it really is.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

51

A sunk cost is a cost that has already been incurred and that cannot be avoided regardless of what action is chosen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

52

The sunk cost in this situation is:

A) $0.

B) $10,000.

C) $11,200.

D) $26,800.

A) $0.

B) $10,000.

C) $11,200.

D) $26,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

53

The book value of old equipment is not a relevant cost in an equipment replacement decision problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

54

In the target costing approach to pricing,the total cost of a product is first determined and then an expected level of mark-up is added to get the desired selling price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

55

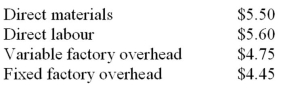

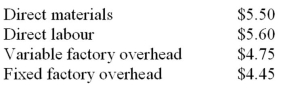

SP Company makes 40,000 motors to be used in the production of its sewing machines.The average cost per motor at this level of activity is:  An outside supplier recently began producing a comparable motor that could be used in the sewing machine.The price offered to SP Company for this motor is $18.If SP Company decides not to make the motors,there would be no other use for the production facilities and total fixed factory overhead costs would not change.If SP Company decides to continue making the motor,how much higher or lower would net income be than if the motors are purchased from the outside suppler? Assume that direct labour is a variable cost in this company.

An outside supplier recently began producing a comparable motor that could be used in the sewing machine.The price offered to SP Company for this motor is $18.If SP Company decides not to make the motors,there would be no other use for the production facilities and total fixed factory overhead costs would not change.If SP Company decides to continue making the motor,how much higher or lower would net income be than if the motors are purchased from the outside suppler? Assume that direct labour is a variable cost in this company.

A) $86,000 higher.

B) $92,000 lower.

C) $178,000 higher.

D) $276,000 higher.

An outside supplier recently began producing a comparable motor that could be used in the sewing machine.The price offered to SP Company for this motor is $18.If SP Company decides not to make the motors,there would be no other use for the production facilities and total fixed factory overhead costs would not change.If SP Company decides to continue making the motor,how much higher or lower would net income be than if the motors are purchased from the outside suppler? Assume that direct labour is a variable cost in this company.

An outside supplier recently began producing a comparable motor that could be used in the sewing machine.The price offered to SP Company for this motor is $18.If SP Company decides not to make the motors,there would be no other use for the production facilities and total fixed factory overhead costs would not change.If SP Company decides to continue making the motor,how much higher or lower would net income be than if the motors are purchased from the outside suppler? Assume that direct labour is a variable cost in this company.A) $86,000 higher.

B) $92,000 lower.

C) $178,000 higher.

D) $276,000 higher.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assume the company has 50 units left over from last year which have small defects and which will have to be sold at a reduced price as scrap.This would have no effect on the company's other sales.What cost is relevant as a guide for setting a minimum price on these defective units?

A) $1.50 per unit.

B) $3.50 per unit.

C) $5.00 per unit.

D) $6.50 per unit.

A) $1.50 per unit.

B) $3.50 per unit.

C) $5.00 per unit.

D) $6.50 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

57

Future costs that do not differ among the alternatives are not relevant in a decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

58

Opportunity costs are recorded in the accounts of an organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

59

Only the variable costs identified with a product are relevant in a decision concerning whether to eliminate,or to accept the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the net advantage or disadvantage to the company from upgrading the calculators?

A) $8,000 disadvantage.

B) $8,800 advantage.

C) $18,000 disadvantage.

D) $20,000 advantage.

A) $8,000 disadvantage.

B) $8,800 advantage.

C) $18,000 disadvantage.

D) $20,000 advantage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

61

Lusk Company produces and sells 15,000 units of Product A each month.The selling price of Product A is $20 per unit,and variable expenses are $14 per unit.A study has been made concerning whether Product A should be discontinued.The study shows that $70,000 of the $100,000 in fixed expenses charged to Product A would continue even if the product were discontinued.These data indicate that if Product A is discontinued,the company's overall net operating income would:

A) increase by $10,000 per month.

B) decrease by $20,000 per month.

C) increase by $20,000 per month.

D) decrease by $60,000 per month.

A) increase by $10,000 per month.

B) decrease by $20,000 per month.

C) increase by $20,000 per month.

D) decrease by $60,000 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

62

The manufacturing capacity of Jordan Company's facilities is 30,000 units a year.A summary of operating results for last year follows:  A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )

A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )

A) $390,000.

B) $705,000.

C) $840,000.

D) $855,000.

A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )

A foreign distributor has offered to buy 15,000 units at $90 per unit next year.Jordan expects its regular sales next year to be 18,000 units.If Jordan accepts this offer and rejects some business from regular customers so as not to exceed capacity,what would be the total net operating income next year? (Assume that the total fixed costs would be the same no matter how many units are produced and sold. )A) $390,000.

B) $705,000.

C) $840,000.

D) $855,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

63

Manor Company plans to discontinue a department that has a contribution margin of $24,000 and $48,000 in fixed costs.Of the fixed costs,$21,000 cannot be avoided.The effect of this discontinuance on Manor's overall net operating income would be a(an):

A) decrease of $3,000.

B) increase of $3,000.

C) decrease of $24,000.

D) increase of $24,000.

A) decrease of $3,000.

B) increase of $3,000.

C) decrease of $24,000.

D) increase of $24,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

64

In deciding the profitability of processing joint products further after the split-off point,all costs should be considered including joint costs incurred prior to the split-off point.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

65

Gata Co.plans to discontinue a department that has a $48,000 contribution margin and $96,000 of fixed costs.Of these fixed costs,$42,000 cannot be avoided.What would be the effect of this discontinuance on Gata's overall net operating income?

A) Increase of $6,000.

B) Decrease of $6,000.

C) Increase of $48,000.

D) Decrease of $48,000.

A) Increase of $6,000.

B) Decrease of $6,000.

C) Increase of $48,000.

D) Decrease of $48,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is not an effective way of dealing with a production constraint (i.e. ,bottleneck)?

A) Reduce the number of defective units produced at the bottleneck.

B) Pay overtime to workers assigned to the bottleneck in the production process.

C) Pay overtime to workers assigned to work stations located after the bottleneck in the production process.

D) Subcontract work that would otherwise require use of the bottleneck.

A) Reduce the number of defective units produced at the bottleneck.

B) Pay overtime to workers assigned to the bottleneck in the production process.

C) Pay overtime to workers assigned to work stations located after the bottleneck in the production process.

D) Subcontract work that would otherwise require use of the bottleneck.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is one of the advantages to the target costing approach?

A) In the target costing approach,costs are fully known before the product is actually designed.

B) There is usually a higher level of cost-consciousness in the target costing approach than in the cost plus approach.

C) The target costing approach approach often leads to higher levels of features included that some customers may want.

D) The target costing approach can be completed by marketing department personnel without involving others in the process.

A) In the target costing approach,costs are fully known before the product is actually designed.

B) There is usually a higher level of cost-consciousness in the target costing approach than in the cost plus approach.

C) The target costing approach approach often leads to higher levels of features included that some customers may want.

D) The target costing approach can be completed by marketing department personnel without involving others in the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

68

Costs that are always relevant in decision-making are:

A) future costs.

B) avoidable costs.

C) sunk costs.

D) fixed costs.

A) future costs.

B) avoidable costs.

C) sunk costs.

D) fixed costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

69

Wagner Company sells product A for $21 per unit.Wagner's unit product cost based on the full capacity of 200,000 units is as follows:  A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:

A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:

A) $14.

B) $15.

C) $16.

D) $18.

A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:

A special order offering to buy 20,000 units has been received from a foreign distributor.The only selling costs that would be incurred on this order would be $3 per unit for shipping.Wagner has sufficient idle capacity to manufacture the additional units.Two-thirds of the manufacturing overhead is fixed and would not be affected by this order.Assume that direct labour is an avoidable cost in this decision.In negotiating a price for the special order,the minimum acceptable selling price per unit should be:A) $14.

B) $15.

C) $16.

D) $18.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

70

The opportunity cost of making a component part in a factory with no excess capacity is the:

A) variable manufacturing cost of the component.

B) fixed manufacturing cost of the component.

C) cost of the production given up in order to manufacture the component.

D) net benefit foregone from the best alternative use of the capacity required.

A) variable manufacturing cost of the component.

B) fixed manufacturing cost of the component.

C) cost of the production given up in order to manufacture the component.

D) net benefit foregone from the best alternative use of the capacity required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

71

A study has been conducted to determine if one of the departments in Parry Company should be discontinued.The contribution margin in the department is $50,000 per year.Fixed expenses charged to the department are $65,000 per year.It is estimated that $40,000 of these fixed expenses could be eliminated if the department is discontinued.These data indicate that if the department is discontinued,the company's overall net operating income would:

A) decrease by $10,000 per year.

B) increase by $10,000 per year.

C) decrease by $25,000 per year.

D) increase by $25,000 per year.

A) decrease by $10,000 per year.

B) increase by $10,000 per year.

C) decrease by $25,000 per year.

D) increase by $25,000 per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

72

A plant operating at capacity would suggest that most likely:

A) every machine and person in the plant is working at the maximum possible rate.

B) only some specific machines or processes are operating at the maximum rate possible.

C) fixed costs will need to change to accommodate increased demand.

D) managers should produce those products with the highest contribution margin in order to deal with the constrained resource.

A) every machine and person in the plant is working at the maximum possible rate.

B) only some specific machines or processes are operating at the maximum rate possible.

C) fixed costs will need to change to accommodate increased demand.

D) managers should produce those products with the highest contribution margin in order to deal with the constrained resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

73

To maximize total contribution margin,a firm faced with a production constraint should:

A) promote those products having the highest unit contribution margins.

B) promote those products having the highest contribution margin ratios.

C) promote those products having the highest contribution margin per unit of constrained resource.

D) promote those products having the highest contribution margins and contribution margin ratios.

A) promote those products having the highest unit contribution margins.

B) promote those products having the highest contribution margin ratios.

C) promote those products having the highest contribution margin per unit of constrained resource.

D) promote those products having the highest contribution margins and contribution margin ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Lantern Corporation has 1,000 obsolete lanterns that are carried in inventory at a manufacturing cost of $20,000.If the lanterns are remachined for $5,000,they could be sold for $9,000.Alternatively,the lanterns could be sold for scrap for $1,000.Which alternative is more desirable and what are the total relevant costs for that alternative?

A) Remachine and $5,000.

B) Remachine and $25,000.

C) Scrap and $1,000.

D) Scrap and $21,000.

A) Remachine and $5,000.

B) Remachine and $25,000.

C) Scrap and $1,000.

D) Scrap and $21,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

75

Assuming all units that are produced can be sold,in deciding which of alternative products to produce in circumstances of constrained resources,managers will always seek to maximize the production of the product with the highest per-unit contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

76

A study has been conducted to determine if Product A should be dropped.Sales of the product total $200,000 per year;variable expenses total $140,000 per year.Fixed expenses charged to the product total $90,000 per year.The company estimates that $40,000 of these fixed expenses will continue even if the product is dropped.These data indicate that if Product A is dropped,the company's overall net operating income would:

A) decrease by $10,000 per year.

B) increase by $20,000 per year.

C) decrease by $20,000 per year.

D) increase by $30,000 per year.

A) decrease by $10,000 per year.

B) increase by $20,000 per year.

C) decrease by $20,000 per year.

D) increase by $30,000 per year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

77

Relay Corporation manufactures batons.Relay can manufacture 300,000 batons a year at a variable cost of $750,000 and a fixed cost of $450,000.Based on Relay's predictions for next year,240,000 batons will be sold at the regular price of $5.00 each.In addition,a special order was placed for 60,000 batons to be sold at a 40% discount off the regular price.Total fixed costs would be unaffected by this order.By what amount would the company's net operating income be increased or decreased as a result of the special order?

A) $30,000 increase.

B) $36,000 increase.

C) $60,000 decrease.

D) $180,000 increase.

A) $30,000 increase.

B) $36,000 increase.

C) $60,000 decrease.

D) $180,000 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

78

Existing fixed manufacturing overhead costs are not relevant in deciding whether to accept a special order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

79

The split-off point is the stage in production of joint products at which the different end products are identified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck

80

Consider a decision facing a firm of either accepting or rejecting a special offer for one of its products.A cost that is not relevant is:

A) direct materials.

B) variable overhead.

C) fixed overhead that will be avoided if the special offer is accepted.

D) common fixed overhead that will continue if the special offer is not accepted.

A) direct materials.

B) variable overhead.

C) fixed overhead that will be avoided if the special offer is accepted.

D) common fixed overhead that will continue if the special offer is not accepted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 145 في هذه المجموعة.

فتح الحزمة

k this deck