Deck 11: Stockholders Equity

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/278

العب

ملء الشاشة (f)

Deck 11: Stockholders Equity

1

The price-earnings ratio reveals information about the stock market's expectations for a company's future growth in earnings.

True

Explanation:The Price/Earnings (P/E)ratio measures how many times more than the current year's earnings investors are willing to pay for a company's common stock.A higher number means investors anticipate an improvement in the company's future results.

Explanation:The Price/Earnings (P/E)ratio measures how many times more than the current year's earnings investors are willing to pay for a company's common stock.A higher number means investors anticipate an improvement in the company's future results.

2

Preferred stock is generally classified as stockholders' equity under both GAAP and IFRS.

True

Explanation:Under GAAP,preferred stock is always included in stockholders' equity.Under IFRS,preferred stock is generally included in stockholders' equity unless the issuing company is contractually obligated to pay dividends or redeem the stock at a future date.In this case,the preferred stock is classified as a liability.

Explanation:Under GAAP,preferred stock is always included in stockholders' equity.Under IFRS,preferred stock is generally included in stockholders' equity unless the issuing company is contractually obligated to pay dividends or redeem the stock at a future date.In this case,the preferred stock is classified as a liability.

3

All other things being equal,the higher the return on equity ratio,the better the financial performance of the company.

True

Explanation:A higher return on equity ratio means that stockholders are likely to enjoy greater returns.

Explanation:A higher return on equity ratio means that stockholders are likely to enjoy greater returns.

4

The par value of stock indicates what the stock is worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

5

Issuing stock to obtain financing is called equity financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

6

Income tax expense would be found on the income statement of a sole proprietorship,but not on the income statement of a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

7

Dividends in arrears are reported as current liabilities on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

8

A stock split increases total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

9

When a company reissues (or sells)shares of its treasury stock at an amount different than its cost,it reports a gain or a loss on the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

10

One reason why a company may choose a stock split over a stock dividend is that the stock split does not reduce Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

11

Corporations are governed by federal law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

12

A company that pays no dividends is always a poor investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

13

Treasury stock is a corporation's own stock that has been issued and subsequently repurchased by the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

14

A liability for dividends is recorded on the declaration date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

15

A corporation's charter establishes the number of shares of stock that will be issued in an initial public offering (IPO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

16

State laws often restrict dividends to the amount of Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

17

Unpaid dividends on cumulative preferred stock are called dividends payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

18

A stock dividend increases the market price of the company's stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

19

A major advantage of debt financing is that interest expense is tax deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

20

A corporation does not have a legal obligation to pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not a characteristic of corporate ownership?

A)Stockholders have no liability for the debts of the corporation.

B)Ownership interests are freely transferable.

C)Shares of stock can be purchased in small increments.

D)Corporate earnings are distributed as interest payments.

A)Stockholders have no liability for the debts of the corporation.

B)Ownership interests are freely transferable.

C)Shares of stock can be purchased in small increments.

D)Corporate earnings are distributed as interest payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

22

The laws governing corporations:

A)require that a company be incorporated in the state in which it does most of its business.

B)require that all companies in Delaware be incorporated.

C)allow a company to be incorporated in a different state from the one in which it operates.

D)require that all companies be incorporated in Delaware.

A)require that a company be incorporated in the state in which it does most of its business.

B)require that all companies in Delaware be incorporated.

C)allow a company to be incorporated in a different state from the one in which it operates.

D)require that all companies be incorporated in Delaware.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

23

Features of common stock usually include all of the following except:

A)voting rights.

B)dividends.

C)primary claim to the company's assets in case of liquidation.

D)preemptive rights.

A)voting rights.

B)dividends.

C)primary claim to the company's assets in case of liquidation.

D)preemptive rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

24

Ownership structure can vary from one company to another,but the most basic form of corporation offers:

A)preferred stock.

B)net income.

C)treasury stock.

D)common stock.

A)preferred stock.

B)net income.

C)treasury stock.

D)common stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

25

Harry owns 1,000 shares of stock in Xit Corporation.What is the effect on Xit Corporation if Harry dies?

A)Xit must reorganize to reflect the change in ownership.

B)Xit will cancel Harry's shares of stock.

C)Xit will have 3 months to resell the stock.

D)A stockholder's death has no effect on a corporation.

A)Xit must reorganize to reflect the change in ownership.

B)Xit will cancel Harry's shares of stock.

C)Xit will have 3 months to resell the stock.

D)A stockholder's death has no effect on a corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

26

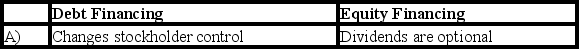

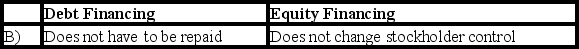

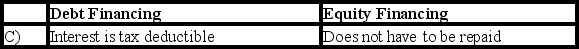

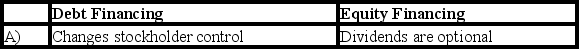

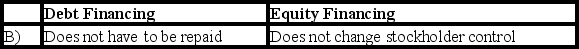

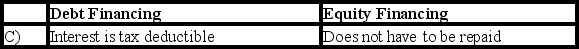

Equity and debt financing both have their advantages and disadvantages.Which of the following pairs of phrases below accurately reflect the advantages of both types of financing?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

27

The rights of current stockholders to purchase additional shares of newly issued stock in order to maintain the same percentage ownership is called:

A)liquidation.

B)preemptive rights.

C)cumulative preference.

D)voting rights.

A)liquidation.

B)preemptive rights.

C)cumulative preference.

D)voting rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

28

A major advantage of the corporate form of ownership is:

A)limited legal liability.

B)unlimited legal liability.

C)ease of formation.

D)that corporate earnings aren't taxed until they are distributed to owners as dividends.

A)limited legal liability.

B)unlimited legal liability.

C)ease of formation.

D)that corporate earnings aren't taxed until they are distributed to owners as dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

29

The creation and oversight of all corporations are regulated by:

A)city councils.

B)state laws.

C)stockholders.

D)corporate officers.

A)city councils.

B)state laws.

C)stockholders.

D)corporate officers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

30

Corporations can raise large amounts of money because:

A)shares of stock in public companies can easily be bought and sold by investors.

B)the unlimited liability feature makes corporate ownership attractive to investors.

C)corporate earnings are not taxed.

D)all investments in corporate stock earn money for investors.

A)shares of stock in public companies can easily be bought and sold by investors.

B)the unlimited liability feature makes corporate ownership attractive to investors.

C)corporate earnings are not taxed.

D)all investments in corporate stock earn money for investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is an advantage of debt financing?

A)It does not have to be repaid.

B)Interest is discretionary.

C)Interest is tax deductible.

D)It reduces stockholder control.

A)It does not have to be repaid.

B)Interest is discretionary.

C)Interest is tax deductible.

D)It reduces stockholder control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statements about the benefits enjoyed by the owners of common stock is not correct?

A)Some classes of common stock can carry more votes than others.

B)Investors in a corporation are called stockholders.

C)Stockholders receive a share of the corporation's profits when distributed as dividends.

D)If the company ceases operations,stockholders share in any assets remaining before creditors have been paid.

A)Some classes of common stock can carry more votes than others.

B)Investors in a corporation are called stockholders.

C)Stockholders receive a share of the corporation's profits when distributed as dividends.

D)If the company ceases operations,stockholders share in any assets remaining before creditors have been paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements about a corporation is not correct?

A)A corporation is a separate legal entity.

B)A corporation has easy transferability of ownership.

C)A corporation may have the ability to raise large amounts of capital.

D)A corporation's owners have unlimited liability.

A)A corporation is a separate legal entity.

B)A corporation has easy transferability of ownership.

C)A corporation may have the ability to raise large amounts of capital.

D)A corporation's owners have unlimited liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

34

Advantages of the corporate form include all of the following except:

A)easy to raise capital.

B)shares can be purchased in small amounts.

C)ownership interests are transferrable.

D)legal liability of its owners is unlimited.

A)easy to raise capital.

B)shares can be purchased in small amounts.

C)ownership interests are transferrable.

D)legal liability of its owners is unlimited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements about equity and debt financing is correct?

A)Equity financing is always better than debt financing.

B)Equity financing requires dividends to be paid.

C)Dividends are tax deductible.

D)Equity financing can change stockholder control.

A)Equity financing is always better than debt financing.

B)Equity financing requires dividends to be paid.

C)Dividends are tax deductible.

D)Equity financing can change stockholder control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

36

At what governmental level are corporate charters issued?

A)State

B)Local

C)Federal

D)International

A)State

B)Local

C)Federal

D)International

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

37

Advantages of debt financing over equity financing are that:

A)repayment of debt principal is optional.

B)interest payments on debt are not tax deductible.

C)control is not diluted.

D)more money is available.

A)repayment of debt principal is optional.

B)interest payments on debt are not tax deductible.

C)control is not diluted.

D)more money is available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

38

Corporations can raise large amounts of money because:

A)shares of stock can be purchased in small amounts,so even small investors can participate.

B)investors always prefer to invest in stock so they can receive dividends.

C)stocks are always a good investment.

D)investing in the stock market is the surest way to get rich quick.

A)shares of stock can be purchased in small amounts,so even small investors can participate.

B)investors always prefer to invest in stock so they can receive dividends.

C)stocks are always a good investment.

D)investing in the stock market is the surest way to get rich quick.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

39

For a business to be considered a corporation:

A)its stock must be sold in very large amounts.

B)it must be organized as a separate legal entity.

C)it must issue both common and preferred stock.

D)it must pay dividends.

A)its stock must be sold in very large amounts.

B)it must be organized as a separate legal entity.

C)it must issue both common and preferred stock.

D)it must pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

40

Holders of common stock receive certain benefits,such as a residual claim,which is the:

A)right of stockholders to be paid back for their investment before anyone else if the company ceases operation.

B)right to oversee management of the company.

C)right to share in any remaining assets after creditors have been paid off,should the company cease operations.

D)continuing right to receive a share of the company's profits in the form of dividends.

A)right of stockholders to be paid back for their investment before anyone else if the company ceases operation.

B)right to oversee management of the company.

C)right to share in any remaining assets after creditors have been paid off,should the company cease operations.

D)continuing right to receive a share of the company's profits in the form of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements about Accumulated Other Comprehensive Income (Loss)is not correct?

A)Accumulated Other Comprehensive Income (Loss)reports unrealized gains and losses,which are temporary changes in the value of certain assets and liabilities the company holds.

B)Accumulated Other Comprehensive Income (Loss)can relate to pensions,foreign currencies,and financial investments.

C)Accumulated Other Comprehensive Income (Loss)is a component of stockholders' equity.

D)Accumulated Other Comprehensive Income (Loss)is reported on the income statement.

A)Accumulated Other Comprehensive Income (Loss)reports unrealized gains and losses,which are temporary changes in the value of certain assets and liabilities the company holds.

B)Accumulated Other Comprehensive Income (Loss)can relate to pensions,foreign currencies,and financial investments.

C)Accumulated Other Comprehensive Income (Loss)is a component of stockholders' equity.

D)Accumulated Other Comprehensive Income (Loss)is reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which number is potentially the largest?

A)The number of shares authorized.

B)The number of shares issued.

C)The number of shares outstanding.

D)The number of shares certified.

A)The number of shares authorized.

B)The number of shares issued.

C)The number of shares outstanding.

D)The number of shares certified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

43

Flint Corporation's contributed capital totals $54,000,Retained Earnings equals $117,000,Treasury Stock equals $32,400,and Common Stock equals $18,000.If the company does not have any accumulated other comprehensive income (loss),stockholders' equity,what is the total amount of stockholders' equity?

A)$203,400

B)$138,600

C)$221,400

D)$156,600

A)$203,400

B)$138,600

C)$221,400

D)$156,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

44

Advantages of equity financing over debt financing include that:

A)dividends are mandatory.

B)equity financing does not require repayment.

C)dividends are tax deductible.

D)stockholders' control will increase.

A)dividends are mandatory.

B)equity financing does not require repayment.

C)dividends are tax deductible.

D)stockholders' control will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following statements about issued and outstanding stock is correct?

A)Outstanding stock includes all stock issued by a corporation.

B)Issued stock equals the sum of outstanding stock and treasury stock.

C)Issued stock is equal to authorized stock.

D)Outstanding stock includes stock in the hands of investors,as well as treasury stock in the hands of the corporation.

A)Outstanding stock includes all stock issued by a corporation.

B)Issued stock equals the sum of outstanding stock and treasury stock.

C)Issued stock is equal to authorized stock.

D)Outstanding stock includes stock in the hands of investors,as well as treasury stock in the hands of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

46

The stockholders' equity section of the balance sheet includes all of the following except:

A)Retained Earnings.

B)Contributed Capital.

C)Treasury Stock.

D)Dividends.

A)Retained Earnings.

B)Contributed Capital.

C)Treasury Stock.

D)Dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

47

When a company issues stock to the public for the first time,the issuance is called a(n):

A)initial public offering (IPO).

B)first time issue (FTI).

C)seasoned new issue (SNI).

D)initial stock offering (ISO).

A)initial public offering (IPO).

B)first time issue (FTI).

C)seasoned new issue (SNI).

D)initial stock offering (ISO).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

48

A corporate charter specifies that the company may issue up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The current number of shares of treasury stock after these transactions have been accounted for is:

A)3 million shares.

B)8 million shares.

C)9 million shares.

D)17 million shares.

A)3 million shares.

B)8 million shares.

C)9 million shares.

D)17 million shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

49

Par value of a stock refers to the:

A)issue price of the stock.

B)value assigned to a share of stock in the corporate charter.

C)market value of the stock.

D)maximum selling price of the stock.

A)issue price of the stock.

B)value assigned to a share of stock in the corporate charter.

C)market value of the stock.

D)maximum selling price of the stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

50

Several years ago,Knox Industries issued 200,000 of its $2 par value stock for a total of $1,600,000.This is the only time that it has sold stock.This year it purchased 2,000 shares of its own stock for $20 a share.As a result of acquiring treasury stock:

A)its stockholders' equity decreases by $40,000.

B)it will recognize a loss of $40,000.

C)its common stock account decreases by $40,000.

D)its retained earnings decrease by $40,000.

A)its stockholders' equity decreases by $40,000.

B)it will recognize a loss of $40,000.

C)its common stock account decreases by $40,000.

D)its retained earnings decrease by $40,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

51

Galleria Company has 280,000 shares authorized,196,000 shares issued and 14,000 shares of treasury stock.How many shares does Galleria Company have outstanding?

A)14,000

B)182,000

C)210,000

D)266,000

A)14,000

B)182,000

C)210,000

D)266,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

52

If you own 200,000 shares of stock in a company with 8 million shares outstanding and the company issues an additional 2 million shares to its employees through a stock purchase plan,your ownership percentage:

A)remains the same because the company now has more assets.

B)falls from 2.5% to 2%.

C)remains the same because the company now has fewer liabilities.

D)increases because the company now has more stock outstanding.

A)remains the same because the company now has more assets.

B)falls from 2.5% to 2%.

C)remains the same because the company now has fewer liabilities.

D)increases because the company now has more stock outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

53

What does the par value of a stock represent?

A)The average market value of a stock for the year to date.

B)It is a legal concept not related to the market value of a stock.

C)The amount that would be paid if a stock was purchased by the issuing company.

D)The current market value of a stock.

A)The average market value of a stock for the year to date.

B)It is a legal concept not related to the market value of a stock.

C)The amount that would be paid if a stock was purchased by the issuing company.

D)The current market value of a stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

54

Advantages of debt financing over equity financing include that:

A)interest payments are optional.

B)debt financing does not require repayments.

C)interest payments are tax not deductible.

D)stockholders' control will not be diluted.

A)interest payments are optional.

B)debt financing does not require repayments.

C)interest payments are tax not deductible.

D)stockholders' control will not be diluted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

55

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company issues 12 million shares to investors and later repurchases 3 million shares.The number of issued shares after these transactions have been accounted for is:

A)12 million shares.

B)11 million shares.

C)9 million shares.

D)5 million shares.

A)12 million shares.

B)11 million shares.

C)9 million shares.

D)5 million shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

56

All of the following are a part of contributed capital except:

A)Common Stock.

B)Additional Paid-in Capital.

C)Preferred Stock.

D)Retained Earnings.

A)Common Stock.

B)Additional Paid-in Capital.

C)Preferred Stock.

D)Retained Earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

57

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The number of authorized shares after these transactions are accounted for is:

A)12 million shares.

B)20 million shares.

C)9 million shares.

D)17 million shares.

A)12 million shares.

B)20 million shares.

C)9 million shares.

D)17 million shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

58

Galveston,Inc.has 308,000 shares authorized,140,000 shares issued,and 14,000 shares of treasury stock.How many shares are outstanding?

A)126,000

B)434,000

C)154,000

D)406,000

A)126,000

B)434,000

C)154,000

D)406,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

59

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The current number of outstanding shares after these transactions have been accounted for is:

A)8 million shares.

B)20 million shares.

C)10 million shares.

D)9 million shares.

A)8 million shares.

B)20 million shares.

C)10 million shares.

D)9 million shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

60

If a company does not have any accumulated other comprehensive income (loss),stockholders' equity is the:

A)amount the company received in exchange for all stock issued plus the amount of Retained Earnings minus the cost of treasury stock.

B)amount the company received for all stock authorized plus the amount of Retained Earnings and treasury stock.

C)par value the company received for all stock issued plus the amount of Retained Earnings minus treasury stock.

D)amount the company received for all stock when issued minus the amount of Retained Earnings and treasury stock.

A)amount the company received in exchange for all stock issued plus the amount of Retained Earnings minus the cost of treasury stock.

B)amount the company received for all stock authorized plus the amount of Retained Earnings and treasury stock.

C)par value the company received for all stock issued plus the amount of Retained Earnings minus treasury stock.

D)amount the company received for all stock when issued minus the amount of Retained Earnings and treasury stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following statements about stock options is not correct?

A)Stock options are intended to give upper management the same goals as stockholders.

B)When stock options are exercised by upper management,existing stockholders lose voting power.

C)Stock options may create an incentive for upper management to overstate net income.

D)An expense is reported by the company when stock options are exercised.

A)Stock options are intended to give upper management the same goals as stockholders.

B)When stock options are exercised by upper management,existing stockholders lose voting power.

C)Stock options may create an incentive for upper management to overstate net income.

D)An expense is reported by the company when stock options are exercised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

62

What effect does the purchase of treasury stock have on the balance sheet?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

63

Buffalo Butter Co.had 40,000 shares of $4 par value common stock outstanding on January 1.On January 20,the company purchased 4,000 of its stock for $16 per share.On July 3,the company reissued 2,000 of the shares at $20 per share.Buffalo Butter uses the cost method to account for its treasury stock. What journal entry will record the purchase of the stock on January 20?

A)Debit Treasury Stock for $16,000,debit Additional Paid-in Capital for $48,000,and credit Cash for $64,000.

B)Debit Treasury Stock and credit Cash for $64,000.

C)Debit Treasury Stock for $16,000,debit Common Stock for $48,000,and credit Cash for $64,000.

D)Debit Common Stock and credit Cash for $64,000.

A)Debit Treasury Stock for $16,000,debit Additional Paid-in Capital for $48,000,and credit Cash for $64,000.

B)Debit Treasury Stock and credit Cash for $64,000.

C)Debit Treasury Stock for $16,000,debit Common Stock for $48,000,and credit Cash for $64,000.

D)Debit Common Stock and credit Cash for $64,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is correct about reissuing treasury stock?

A)If treasury stock is sold at a higher price than the stock's cost when the company reacquired it,a gain will be recognized.

B)If treasury stock is sold at a higher price than the stock's par value,a gain will be recognized.

C)If the treasury stock is sold at a lower price than the amount of the original issuance,a loss will be recognized.

D)A gain or loss on the reissuance of treasury stock is never recognized.

A)If treasury stock is sold at a higher price than the stock's cost when the company reacquired it,a gain will be recognized.

B)If treasury stock is sold at a higher price than the stock's par value,a gain will be recognized.

C)If the treasury stock is sold at a lower price than the amount of the original issuance,a loss will be recognized.

D)A gain or loss on the reissuance of treasury stock is never recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

65

If shares of common stock are issued at a market price greater than par value,the amount in excess of par should be credited to:

A)Common Stock.

B)Treasury Stock.

C)Retained Earnings.

D)Additional Paid-in Capital.

A)Common Stock.

B)Treasury Stock.

C)Retained Earnings.

D)Additional Paid-in Capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

66

An Additional Paid-in Capital account could be used with all of the following transactions except:

A)The issuance of par value stock at a price greater than the par value.

B)The reissuance of treasury stock at a price less than the price paid when the stock was reacquired.

C)The reissuance of treasury stock at a price greater than the price paid when the stock was reacquired.

D)The issuance of no-par stock.

A)The issuance of par value stock at a price greater than the par value.

B)The reissuance of treasury stock at a price less than the price paid when the stock was reacquired.

C)The reissuance of treasury stock at a price greater than the price paid when the stock was reacquired.

D)The issuance of no-par stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

67

Buffalo Butter Co.had 40,000 shares of $4 par value common stock outstanding on January 1.On January 20,the company purchased 4,000 of its stock for $16 per share.On July 3,the company reissued 2,000 of the shares at $20 per share.Buffalo Butter uses the cost method to account for its treasury stock. What journal entry will record the reissuance on July 3?

A)Debit Cash and credit Treasury Stock for $40,000

B)Debit Cash for $40,000,credit Treasury Stock for $32,000,and credit Additional Paid-in Capital for $8,000

C)Debit Cash for $40,000,credit Common Stock for $12,000,and credit Additional Paid-in Capital for $28,000

D)Debit Cash for $40,000,credit Common Stock for $32,000,and credit Gain on Reissuance of Stock for $8,000

A)Debit Cash and credit Treasury Stock for $40,000

B)Debit Cash for $40,000,credit Treasury Stock for $32,000,and credit Additional Paid-in Capital for $8,000

C)Debit Cash for $40,000,credit Common Stock for $12,000,and credit Additional Paid-in Capital for $28,000

D)Debit Cash for $40,000,credit Common Stock for $32,000,and credit Gain on Reissuance of Stock for $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

68

A company issues 1 million shares of common stock with a par value of $0.02 for $15 a share.The entry to record this transaction includes a debit to Cash for:

A)$20,000 and a credit to Common Stock for $20,000.

B)$15,000,000 and a credit to Common Stock for $15,000,000.

C)$15,000,000,a credit to Common Stock for $20,000,and a credit to Additional Paid-in Capital for $14,980,000.

D)$20,000,a debit to Capital Receivable for $14,980,000,a credit to Common Stock for $20,000,and a credit to Additional Paid-in Capital for $14,980,000.

A)$20,000 and a credit to Common Stock for $20,000.

B)$15,000,000 and a credit to Common Stock for $15,000,000.

C)$15,000,000,a credit to Common Stock for $20,000,and a credit to Additional Paid-in Capital for $14,980,000.

D)$20,000,a debit to Capital Receivable for $14,980,000,a credit to Common Stock for $20,000,and a credit to Additional Paid-in Capital for $14,980,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

69

Mountain View Co.buys back 3,000 shares of its $10 par value common stock from investors at $126 per share.This stock repurchase would be recorded with a debit to:

A)Cash and a credit to Treasury Stock for $378,000.

B)Treasury Stock and a credit to Cash for $30,000.

C)Treasury Stock and a credit to Cash for $378,000.

D)Treasury Stock for $30,000,a debit to Additional Paid-in Capital for $348,000,and a credit to Cash for $378,000.

A)Cash and a credit to Treasury Stock for $378,000.

B)Treasury Stock and a credit to Cash for $30,000.

C)Treasury Stock and a credit to Cash for $378,000.

D)Treasury Stock for $30,000,a debit to Additional Paid-in Capital for $348,000,and a credit to Cash for $378,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

70

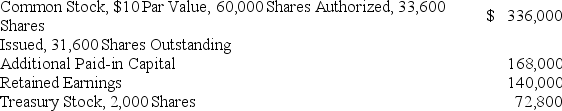

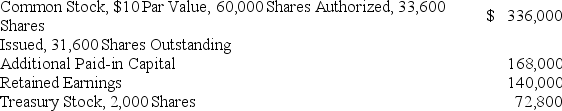

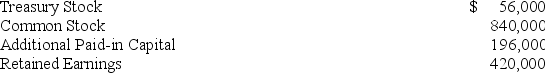

The following data are taken from the stockholders' equity section of the balance sheet of Driftwood Company:  What was the average issue price per share of the common stock?

What was the average issue price per share of the common stock?

A)$36.40

B)$10.00

C)$42.00

D)$50.40

What was the average issue price per share of the common stock?

What was the average issue price per share of the common stock?A)$36.40

B)$10.00

C)$42.00

D)$50.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements about treasury stock is correct?

A)When a company reissues treasury stock for more than it originally paid for the stock,it does not report a gain.

B)When a company purchases treasury stock,it increases total stockholders' equity.

C)Treasury stock is reported as an asset on the balance sheet.

D)Treasury stock is reported as issued and outstanding stock.

A)When a company reissues treasury stock for more than it originally paid for the stock,it does not report a gain.

B)When a company purchases treasury stock,it increases total stockholders' equity.

C)Treasury stock is reported as an asset on the balance sheet.

D)Treasury stock is reported as issued and outstanding stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following statements would not explain why a company may want to repurchase its stock?

A)To demonstrate to investors that it believes its own stock is worth purchasing.

B)To obtain shares to reissue to employees as part of an employee stock plan.

C)To obtain shares that can be reissued as payment for purchase of another company.

D)To increase the number of shares of outstanding stock.

A)To demonstrate to investors that it believes its own stock is worth purchasing.

B)To obtain shares to reissue to employees as part of an employee stock plan.

C)To obtain shares that can be reissued as payment for purchase of another company.

D)To increase the number of shares of outstanding stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

73

Ms.Jessica Duffy purchased 1 share of $10 par value common stock from Ohio Corporation for $50 per share.Ms.Duffy sold that share to Mike Truesdale for $60 per share.As a result of the sale by Duffy to Truesdale sale,Ohio Corporation would:

A)debit Cash and credit Additional Paid-in Capital for $10.

B)debit Cash and credit Common Stock for $10.

C)debit Common Stock and credit Additional Paid-in Capital for $10.

D)not debit or credit any of its accounts.

A)debit Cash and credit Additional Paid-in Capital for $10.

B)debit Cash and credit Common Stock for $10.

C)debit Common Stock and credit Additional Paid-in Capital for $10.

D)not debit or credit any of its accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following statements about the par value of common stock is not correct?

A)The par value is not the same as the market value of the stock.

B)The par value is a nominal amount identified in the corporate charter.

C)The par value is the amount credited to the common stock account when the stock is issued.

D)The par value is the amount credited to common stock when treasury stock is reissued.

A)The par value is not the same as the market value of the stock.

B)The par value is a nominal amount identified in the corporate charter.

C)The par value is the amount credited to the common stock account when the stock is issued.

D)The par value is the amount credited to common stock when treasury stock is reissued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

75

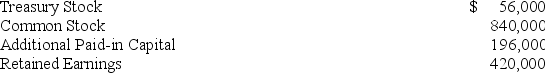

The following information is available from the accounting records of Pecos Company:  What is the amount of stockholders' equity for Pecos Company?

What is the amount of stockholders' equity for Pecos Company?

A)$980,000

B)$1,204,000

C)$1,400,000

D)$1,456,000

What is the amount of stockholders' equity for Pecos Company?

What is the amount of stockholders' equity for Pecos Company?A)$980,000

B)$1,204,000

C)$1,400,000

D)$1,456,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

76

Anthem Inc.issues 200,000 shares of stock with a par value of $0.01 for $150 per share.Three years later,it repurchases these shares for $80 per share.Anthem records the repurchase in which of the following ways?

A)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $29,998,000 and credit Cash for $30 million.

B)Debit Treasury Stock for $16 million and credit Cash for $16 million.

C)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $15,998,000 and credit Cash for $16 million.

D)Debit Stockholders' Equity for $30 million,credit Additional Paid-in Capital for $14 million and credit Cash for $16 million.

A)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $29,998,000 and credit Cash for $30 million.

B)Debit Treasury Stock for $16 million and credit Cash for $16 million.

C)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $15,998,000 and credit Cash for $16 million.

D)Debit Stockholders' Equity for $30 million,credit Additional Paid-in Capital for $14 million and credit Cash for $16 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

77

Treasury stock:

A)does not appear on the balance sheet.

B)is a contra-equity account.

C)is an asset account.

D)is recorded as additional paid-in capital.

A)does not appear on the balance sheet.

B)is a contra-equity account.

C)is an asset account.

D)is recorded as additional paid-in capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company sells 1 million shares of common stock with no par value for $15 a share.In recording the transaction,it would debit:

A)Cash and credit Additional Paid-in Capital for $15 million.

B)Cash and credit Common Stock for $15 million.

C)Common Stock and credit Cash for $15 million.

D)Common Stock and credit Additional Paid-in Capital for $15 million.

A)Cash and credit Additional Paid-in Capital for $15 million.

B)Cash and credit Common Stock for $15 million.

C)Common Stock and credit Cash for $15 million.

D)Common Stock and credit Additional Paid-in Capital for $15 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

79

Galaxy Industries buys back 600,000 shares of its stock from investors at $45 a share.Two years later it reissues this stock for $65 a share.The stock reissue would be recorded with a debit to Cash for:

A)$39 million and a credit to Treasury Stock for $39 million.

B)$27 million,a debit to Additional Paid-in Capital for $12 million,a credit to Treasury Stock for $27 million,and a credit to Stockholders' Equity for $12 million.

C)$39 million,a credit to Treasury Stock for $27 million,and a credit to Additional Paid-in Capital for $12 million.

D)$39 million,a credit to Treasury Stock for $27 million,and a credit to Gain on Sale of Treasury Stock for $12 million.

A)$39 million and a credit to Treasury Stock for $39 million.

B)$27 million,a debit to Additional Paid-in Capital for $12 million,a credit to Treasury Stock for $27 million,and a credit to Stockholders' Equity for $12 million.

C)$39 million,a credit to Treasury Stock for $27 million,and a credit to Additional Paid-in Capital for $12 million.

D)$39 million,a credit to Treasury Stock for $27 million,and a credit to Gain on Sale of Treasury Stock for $12 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck

80

Seville Co.issued 1,680 shares of $50 par value stock for $126,000.What is the total amount of contributed capital?

A)$84,000

B)$42,000

C)$126,000

D)$50

A)$84,000

B)$42,000

C)$126,000

D)$50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 278 في هذه المجموعة.

فتح الحزمة

k this deck