Deck 3: Analyzing Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/131

العب

ملء الشاشة (f)

Deck 3: Analyzing Financial Statements

1

For publicly traded firms, these ratios measure what investors think of the company's future performance and risk.

A) Liquidity ratios

B) Market value ratios

C) Price value ratios

D) Profitability ratios

A) Liquidity ratios

B) Market value ratios

C) Price value ratios

D) Profitability ratios

Market value ratios

2

This measures the number of days that the firm holds accounts payable before it has to extend cash to buy raw materials.

A) Accounts receivable turnover

B) Average collection period

C) Average payment period

D) Accounts payable turnover

A) Accounts receivable turnover

B) Average collection period

C) Average payment period

D) Accounts payable turnover

Average payment period

3

These ratios measure how efficiently a firm uses its assets, as well as how efficiently the firm manages its accounts payable.

A) asset management

B) cash

C) internal-growth

D) quick or acid test

A) asset management

B) cash

C) internal-growth

D) quick or acid test

asset management

4

This measures the number of days accounts receivable are held before the firm collects cash from the sale.

A) Accounts receivable turnover

B) Average collection period

C) Average payment period

D) Accounts payable turnover

A) Accounts receivable turnover

B) Average collection period

C) Average payment period

D) Accounts payable turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

5

This ratio measures the dollars of current assets available to pay each dollar of current liabilities.

A) cross-section

B) current

C) internal-growth

D) quick or acid test

A) cross-section

B) current

C) internal-growth

D) quick or acid test

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

6

These ratios show the combined effects of liquidity, asset management, and debt management on the overall operation results of the firm.

A) Liquidity

B) Coverage

C) Financial

D) Profitability

A) Liquidity

B) Coverage

C) Financial

D) Profitability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of these statements is true?

A) A low inventory turnover ratio or a low days' sales in inventory is a sign of good inventory management.

B) A high inventory turnover ratio or a low days' sales in inventory is a sign of good inventory management.

C) A low inventory turnover ratio or a high days' sales in inventory is a sign of good inventory management.

D) A high inventory turnover ratio or a high days' sales in inventory is a sign of good inventory management.

A) A low inventory turnover ratio or a low days' sales in inventory is a sign of good inventory management.

B) A high inventory turnover ratio or a low days' sales in inventory is a sign of good inventory management.

C) A low inventory turnover ratio or a high days' sales in inventory is a sign of good inventory management.

D) A high inventory turnover ratio or a high days' sales in inventory is a sign of good inventory management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

8

This refers to the amount of debt versus equity a firm has on its balance sheet.

A) capital coverage

B) capital structure

C) debt structure

D) financial structure

A) capital coverage

B) capital structure

C) debt structure

D) financial structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

9

This ratio measures the number of dollars of sales produced per dollar of inventory.

A) asset management

B) cash

C) internal-growth

D) inventory turnover

A) asset management

B) cash

C) internal-growth

D) inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

10

This measures the operating return on the firm's assets, irrespective of financial leverage and taxes.

A) Basic earnings power ratio

B) Profit margin

C) Return on assets

D) Return on equity

A) Basic earnings power ratio

B) Profit margin

C) Return on assets

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

11

These ratios measure the relationship between a firm's liquid (or current) assets and its current liabilities.

A) cross-section

B) internal growth

C) liquidity

D) market value

A) cross-section

B) internal growth

C) liquidity

D) market value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

12

These ratios measure the extent to which the firm uses debt (or financial leverage) versus equity to finance its assets.

A) debt management ratios

B) equity ratios

C) financial ratios

D) liquidity ratios

A) debt management ratios

B) equity ratios

C) financial ratios

D) liquidity ratios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of these statements is true?

A) The age of a firm's cash will affect the current ratio level.

B) The age of a firm's accounts receivable will affect the current ratio level.

C) The age of a firm's fixed assets will affect the fixed asset turnover ratio level.

D) The age of a firm's fixed assets will affect the current ratio level.

A) The age of a firm's cash will affect the current ratio level.

B) The age of a firm's accounts receivable will affect the current ratio level.

C) The age of a firm's fixed assets will affect the fixed asset turnover ratio level.

D) The age of a firm's fixed assets will affect the current ratio level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

14

This ratio measures a firm's ability to pay short-term obligations with its available cash and market securities.

A) cash

B) current

C) internal-growth

D) quick or acid test

A) cash

B) current

C) internal-growth

D) quick or acid test

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

15

This measures the number of dollars of sales produced per dollar of fixed assets.

A) fixed asset to working capital ratio

B) fixed asset turnover ratio

C) fixed asset management ratio

D) sales to working capital ratio

A) fixed asset to working capital ratio

B) fixed asset turnover ratio

C) fixed asset management ratio

D) sales to working capital ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

16

This ratio measures the percentage of total assets financed by debt.

A) debt

B) debt-to-equity

C) equity multiplier

D) liquidity

A) debt

B) debt-to-equity

C) equity multiplier

D) liquidity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of these is NOT considered a coverage ratio?

A) Cash coverage ratio

B) Current ratio

C) Fixed-charge coverage ratio

D) Times Interest Earned

A) Cash coverage ratio

B) Current ratio

C) Fixed-charge coverage ratio

D) Times Interest Earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of these statements is true?

A) In general, the lower the total asset turnover and the lower the capital intensity ratio, the more efficient the overall asset management of the firm will be.

B) In general, the lower the total asset turnover and the higher the capital intensity ratio, the more efficient the overall asset management of the firm will be.

C) In general, the higher the total asset turnover and the lower the capital intensity ratio, the more efficient the overall asset management of the firm will be.

D) In general, the higher the total asset turnover and the higher the capital intensity ratio, the more efficient the overall asset management of the firm will be.

A) In general, the lower the total asset turnover and the lower the capital intensity ratio, the more efficient the overall asset management of the firm will be.

B) In general, the lower the total asset turnover and the higher the capital intensity ratio, the more efficient the overall asset management of the firm will be.

C) In general, the higher the total asset turnover and the lower the capital intensity ratio, the more efficient the overall asset management of the firm will be.

D) In general, the higher the total asset turnover and the higher the capital intensity ratio, the more efficient the overall asset management of the firm will be.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

19

This ratio measures a firm's ability to pay off short-term obligations without relying on inventory sales.

A) cash

B) current

C) internal-growth

D) quick or acid test

A) cash

B) current

C) internal-growth

D) quick or acid test

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which statement is true?

A) The less liquid assets a firm holds, the less likely it is that the firm will experience financial distress.

B) The lower the liquidity ratios, the less liquidity risk a firm has.

C) Liquid assets generate profits for the firm.

D) Extremely high levels of liquidity guard against liquidity crises, but at the cost of lower returns on assets.

A) The less liquid assets a firm holds, the less likely it is that the firm will experience financial distress.

B) The lower the liquidity ratios, the less liquidity risk a firm has.

C) Liquid assets generate profits for the firm.

D) Extremely high levels of liquidity guard against liquidity crises, but at the cost of lower returns on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

21

Asset Management Ratios Rachets R Us Corp. reported sales for 2011 of $200,000. Rachets R Us listed $25,000 of inventory on its balance sheet. Using a 365-day year, how many days did Rachets R Us's inventory stay on the premises? How many times per year did Rachets R Us's inventory turn over?

A) 0.125 days, 8 times, respectively

B) 0.125 days, 5 times, respectively

C) 45.625 days, 8 times, respectively

D) 45.625 days, 5 times respectively

A) 0.125 days, 8 times, respectively

B) 0.125 days, 5 times, respectively

C) 45.625 days, 8 times, respectively

D) 45.625 days, 5 times respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

22

DuPont Analysis If Apex, Inc. has an ROE = 10%, equity multiplier = 3, and profit margin of 5%, what is the total asset turnover ratio?

A) .0600

B) .0667

C) .1667

D) .6667

A) .0600

B) .0667

C) .1667

D) .6667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

23

Debt Management Ratios You are considering a stock investment in one of two firms (LotsofDebt, Inc. and LotsofEquity, Inc.), both of which operate in the same industry. LotsofDebt, Inc. finances its $100 million in assets with $90 million in debt and $10 million in equity. LotsofEquity, Inc. finances its $100 million in assets with $10 million in debt and $90 million in equity. What are the debt ratio, equity multiplier, and debt-to-equity ratio for the two firms?

A) LotsofDebt: 90%, 10 times, 9 times, respectively; and LotsofEquity: 10%, 1.11 times, .1111 times, respectively.

B) LotsofDebt: 10%, 1.11 times, .1111 times, respectively; and LotsofEquity: 90%, 10 times, 9 times, respectively.

C) LotsofDebt: 90%, 1.11 times, .1111 times, respectively; and LotsofEquity: 10%, 10 times, 9 times, respectively.

D) LotsofDebt: 10%, 10 times, 9 times, respectively; and LotsofEquity: 90%, 1.11 times, .1111 times, respectively.

A) LotsofDebt: 90%, 10 times, 9 times, respectively; and LotsofEquity: 10%, 1.11 times, .1111 times, respectively.

B) LotsofDebt: 10%, 1.11 times, .1111 times, respectively; and LotsofEquity: 90%, 10 times, 9 times, respectively.

C) LotsofDebt: 90%, 1.11 times, .1111 times, respectively; and LotsofEquity: 10%, 10 times, 9 times, respectively.

D) LotsofDebt: 10%, 10 times, 9 times, respectively; and LotsofEquity: 90%, 1.11 times, .1111 times, respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

24

To interpret financial ratios, managers, analysts, and investors use the follow type of benchmarks:

A) competitive analysis

B) cross-industry analysis

C) time-industry analysis

D) time series analysis

A) competitive analysis

B) cross-industry analysis

C) time-industry analysis

D) time series analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

25

Market Value Ratios Tina's Track Supply's market-to-book ratio is currently 4.5 times and PE ratio is 10.5 times. If Tina's Track Supply's common stock is currently selling at $100 per share, what is the book value per share and earnings per share?

A) $450, $1050, respectively

B) $1050, $450, respectively

C) $22.2222, $9.5238, respectively

D) $9.5238, $22.2222, respectively

A) $450, $1050, respectively

B) $1050, $450, respectively

C) $22.2222, $9.5238, respectively

D) $9.5238, $22.2222, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

26

Market Value Ratios Bree's Tennis Supply's market-to-book ratio is currently 9.4 times and PE ratio is 20 times. If Bree's Tennis Supply's common stock is currently selling at $20.50 per share, what is the book value per share and earnings per share?

A) $1.025, $2.1809, respectively

B) $2.1809, $1.025, respectively

C) $410.00, $192.70, respectively

D) $192.70, $410.00, respectively

A) $1.025, $2.1809, respectively

B) $2.1809, $1.025, respectively

C) $410.00, $192.70, respectively

D) $192.70, $410.00, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

27

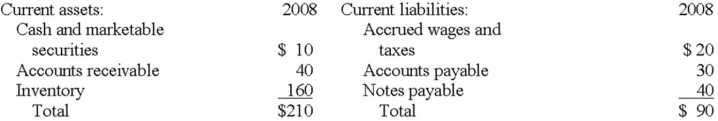

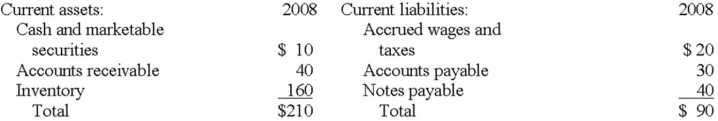

Liquidity Ratios The top part of Mars, Inc.'s 2008 balance sheet is listed below (in millions of dollars).  What are Mars, Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?

What are Mars, Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?

A) 0.1111, 0.5556, 0.2

B) 2.3333, 0.5556, 0.1111

C) 4.2, 1.0, 0.2

D) 10.5, 6.0, 1.0

What are Mars, Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?

What are Mars, Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?A) 0.1111, 0.5556, 0.2

B) 2.3333, 0.5556, 0.1111

C) 4.2, 1.0, 0.2

D) 10.5, 6.0, 1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

28

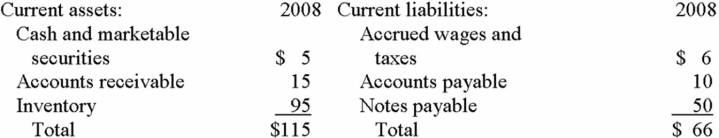

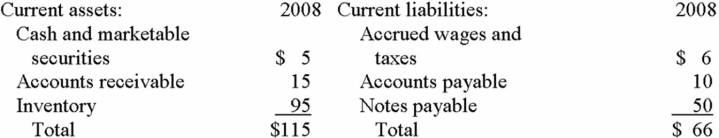

Liquidity Ratios The top part of Rammy's Inc.'s 2008 balance sheet is listed below (in millions of dollars).  What are Rammy's Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?

What are Rammy's Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?

A) 1.74242, 0.30303, 0.07576

B) 7.1875, 1.25, 0.3125

C) 1.43939, 0.30303, 0.07576

D) 19.16667, 3.33333, 0.83333

What are Rammy's Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?

What are Rammy's Inc.'s Current ratio, Quick ratio, and Cash ratio for 2008?A) 1.74242, 0.30303, 0.07576

B) 7.1875, 1.25, 0.3125

C) 1.43939, 0.30303, 0.07576

D) 19.16667, 3.33333, 0.83333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

29

DuPont Analysis Last year Café Creations, Inc. had an ROA of 25%, a profit margin of 12%, and sales of $4 million. What is Café Creations' total assets?

A) $0.12 m

B) $0.48 m

C) $1.00 m

D) $1.92 m

A) $0.12 m

B) $0.48 m

C) $1.00 m

D) $1.92 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

30

These can be used by interested parties to identify changes in corporate performance.

A) common-size financial statements

B) industrialized financial statements

C) sanitized financial statements

D) None of these

A) common-size financial statements

B) industrialized financial statements

C) sanitized financial statements

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

31

DuPont Analysis Last year Mocha Java, Inc. had an ROA of 10%, a profit margin of 5%, and sales of $25 million. What is Mocha Java's total assets?

A) $0.125 m

B) $1.25 m

C) $12.5 m

D) $125 m

A) $0.125 m

B) $1.25 m

C) $12.5 m

D) $125 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which is true? Ratio analysis:

A) can provide useful information on a firm's current position but should never be used to forecast future performance.

B) can provide useful information on a firm's current position and hint at future performance.

C) can provide useful information on a firm's past but not current position.

D) can provide useful information on a firm's past and current position, but should never be used to forecast future performance.

A) can provide useful information on a firm's current position but should never be used to forecast future performance.

B) can provide useful information on a firm's current position and hint at future performance.

C) can provide useful information on a firm's past but not current position.

D) can provide useful information on a firm's past and current position, but should never be used to forecast future performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

33

DuPont Analysis If Epic, Inc. has an ROE = 25%, equity multiplier = 4, a profit margin of 12%, what is the total asset turnover ratio?

A) .0833

B) .192

C) .5208

D) .75

A) .0833

B) .192

C) .5208

D) .75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

34

Internal Growth Rate Last year Umbrellas Unlimited Corporation had an ROA of 10% and a dividend payout ratio of 50%. What is the internal growth rate?

A) 1.00%

B) 2.25%

C) 5.26%

D) 100.00%

A) 1.00%

B) 2.25%

C) 5.26%

D) 100.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

35

Asset Management Ratios Corn Products Corp. ended the year 2011 with an average collection period of 40 days. The firm's credit sales for 2011 were $9 million. What is the approximate year-end 2011 balance in accounts receivable for Corn Products?

A) $225,000

B) $986,300

C) $4,444,400

D) $360,000,000

A) $225,000

B) $986,300

C) $4,444,400

D) $360,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

36

Liquidity Ratios You are evaluating the balance sheet for Blue Jays Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $200,000, Accounts receivable = $800,000, Inventory = $1,000,000, Accrued wages and taxes = $250,000, Accounts payable = $400,000, and Notes payable = $300,000. What are Blue Jays' Current ratio, Quick ratio, and Cash ratio, respectively?

A) 1.05263, 1.05263, 0.21053

B) 2.10526, 1.05263, 0.21053

C) 3.07692, 1.53846, 0.30769

D) 3.07692, 1.05263, 0.30769

A) 1.05263, 1.05263, 0.21053

B) 2.10526, 1.05263, 0.21053

C) 3.07692, 1.53846, 0.30769

D) 3.07692, 1.05263, 0.30769

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

37

Asset Management Ratios Tops N Bottoms Corp. reported sales for 2008 of $50 million. Tops N Bottoms listed $4 million of inventory on its balance sheet. Using a 365-day year, how many days did Tops N Bottoms' inventory stay on the premises? How many times per year did Tops N Bottoms' inventory turn over?

A) 29.2 days, 12.5 times, respectively

B) 12.5 days, 29.2 times, respectively

C) 0.08 days, 12.5 times, respectively

D) 29.2 days, 0.0345 times, respectively

A) 29.2 days, 12.5 times, respectively

B) 12.5 days, 29.2 times, respectively

C) 0.08 days, 12.5 times, respectively

D) 29.2 days, 0.0345 times, respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

38

Debt Management Ratios Trina's Trikes, Inc. reported a debt-to-equity ratio of 2 times at the end of 2011. If the firm's total debt at year-end was $10 million, how much equity does Trina's Trikes have?

A) $2 million

B) $5 million

C) $10 million

D) $20 million

A) $2 million

B) $5 million

C) $10 million

D) $20 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

39

This is the maximum growth rate that can be achieved by financing asset growth with new debt and retained earnings.

A) internal growth rate

B) retained earnings growth rate

C) sustainable growth rate

D) weighted growth rate

A) internal growth rate

B) retained earnings growth rate

C) sustainable growth rate

D) weighted growth rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

40

Debt Management Ratios Will's Wheels, Inc. reported a debt-to-equity ratio of .65 times at the end of 2011. If the firm's total debt at year-end was $5 million, how much equity does Will's Wheels have?

A) $.65 million

B) $3.25 million

C) $5 million

D) $7.69 million

A) $.65 million

B) $3.25 million

C) $5 million

D) $7.69 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

41

Liquidity and Asset Management Ratios Oasis Products, Inc. has current liabilities = $10 million, current ratio = 1.5 times, inventory turnover ratio = 12 times, average collection period = 20 days, and sales = $100 million. What is the value of their cash and marketable securities?

A) $1,187,215

B) $8,333,333

C) $15,000,000

D) $17,146,188

A) $1,187,215

B) $8,333,333

C) $15,000,000

D) $17,146,188

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

42

Liquidity Ratios Ernie's Mufflers has current liabilities of $45 million. Cash makes up 5 percent of the current assets and accounts receivable makes up another 50 percent of current assets. Ernie's current ratio = 1.5 times. What is the value of inventory listed on the firm's balance sheet?

A) $13.75 m

B) $20.25 m

C) $30.375 m

D) $33.75 m

A) $13.75 m

B) $20.25 m

C) $30.375 m

D) $33.75 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

43

Debt Management Ratios Paige's Purses, Inc. reported a debt to equity ratio of 2.4 times at the end of 2011. If the firm's total assets at year-end are $27 million, how much of their assets is financed with equity?

A) $7.94m

B) $11.25m

C) $19.06 m

D) $64.8m

A) $7.94m

B) $11.25m

C) $19.06 m

D) $64.8m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

44

Debt Management Ratios Nicole's Neon Signs, Inc. reported a debt to equity ratio of 1.9 times at the end of 2011. If the firm's total assets at year-end are $100 million, how much of their assets is financed with equity?

A) $34.48m

B) $65.52m

C) $52.63m

D) $100 m

A) $34.48m

B) $65.52m

C) $52.63m

D) $100 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

45

Debt Management Ratios Calculate the times interest earned ratio for Paige's Purses, Inc. using the following information. Sales = $50,000,000, cost of goods sold = $15,000,000, depreciation expense = $2,000,000, addition to retained earnings = $10,000,000, dividends per share = $1.10, tax rate = 30%, and number of shares of common stock outstanding = 10,000,000. Paige's Purses has no preferred stock outstanding.

A) 0.27

B) 3.30

C) 11.00

D) 16.67

A) 0.27

B) 3.30

C) 11.00

D) 16.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

46

Liquidity Ratios You have the following information on Marco's Polo Shop: total liabilities and equity = $205 million, current liabilities = $45 million, inventory = $60 million, and quick ratio = 2.4 times. Using this information, what is the balance for fixed assets on Marco Polo's balance sheet?

A) $37 m

B) $97 m

C) $145 m

D) $157 m

A) $37 m

B) $97 m

C) $145 m

D) $157 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

47

Debt Management Ratios Tierre's Ts, Inc. reported a debt to equity ratio of 3 times at the end of 2011. If the firm's total assets at year-end are $15 million, how much of their assets is financed with equity?

A) $3.75m

B) $5m

C) $11.25m

D) $45m

A) $3.75m

B) $5m

C) $11.25m

D) $45m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

48

Asset Management and Debt Management Ratios Use the following information to calculate current assets: Sales = $12 million, capital intensity ratio = 4 times, debt ratio = 45%, and fixed asset turnover ratio = 2.5 times.

A) $4.8 m

B) $21.6 m

C) $43.2 m

D) $48 m

A) $4.8 m

B) $21.6 m

C) $43.2 m

D) $48 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

49

Asset Management and Profitability Ratios You have the following information on Universe It Ts, Inc.: sales to working capital = 10 times, profit margin = 25%, net income available to common stockholders = $3 million, and current liabilities = $1 million. What is the firm's balance of current assets?

A) $1.075 m

B) $1.2 m

C) $2.2 m

D) $5 m

A) $1.075 m

B) $1.2 m

C) $2.2 m

D) $5 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

50

Debt Management Ratios Calculate the times interest earned ratio for Tierre's Ts, Inc. using the following information. Sales = $200,000, cost of goods sold = $50,000, depreciation expense = $13,000, addition to retained earnings = $70,000, dividends per share = $0.50, tax rate = 30%, and number of shares of common stock outstanding = 1,000. Tierre's Ts has no preferred stock outstanding.

A) 0.1814

B) 0.4854

C) 0.685

D) 3.7756

A) 0.1814

B) 0.4854

C) 0.685

D) 3.7756

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

51

Asset Management and Profitability Ratios You have the following information on Zip's Diner, Inc.: sales to working capital = 8 times, profit margin = 5%, net income available to common stockholders = $20 million, and current liabilities = $4 million. What is the firm's balance of current assets?

A) $4.125 m

B) $6.5 m

C) $46 m

D) $54 m

A) $4.125 m

B) $6.5 m

C) $46 m

D) $54 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

52

Asset Management and Debt Management Ratios Use the following information to calculate current assets: Sales = $100 million, capital intensity ratio = .5 times, debt ratio = 30%, and fixed asset turnover ratio = 5 times.

A) $10m

B) $15m

C) $30m

D) $50m

A) $10m

B) $15m

C) $30m

D) $50m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

53

Internal Growth Rate Last year Poncho Villa Corporation had an ROA of 16% and a dividend payout ratio of 25%. What is the internal growth rate?

A) 1.19%

B) 13.64%

C) 25.40%

D) 33.33%

A) 1.19%

B) 13.64%

C) 25.40%

D) 33.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

54

Internal Growth Rate Last year Rain Repel Corporation had an ROA of 5% and a dividend payout ratio of 90%. What is the internal growth rate?

A) 4.75%

B) 0.50%

C) 50.00%

D) 52.63%

A) 4.75%

B) 0.50%

C) 50.00%

D) 52.63%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

55

Liquidity Ratios You have the following information on Olivia's Bridle Shop: total liabilities and equity = $65 million, current liabilities = $10 million, inventory = $15 million, and quick ratio = 3 times. Using this information, what is the balance for fixed assets on Olivia's balance sheet?

A) $20 m

B) $40 m

C) $45 m

D) $135 m

A) $20 m

B) $40 m

C) $45 m

D) $135 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

56

Liquidity Ratios Burt's TVs has current liabilities of $25 million. Cash makes up 40 percent of the current assets and accounts receivable makes up another 20 percent of current assets. Burt's current ratio = .85 times. What is the value of inventory listed on the firm's balance sheet?

A) $4.25 m

B) $8.5 m

C) $10 m

D) $40 m

A) $4.25 m

B) $8.5 m

C) $10 m

D) $40 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

57

Liquidity and Asset Management Ratios Green Products, Inc. has current liabilities = $40 million, current ratio = 2.4 times, inventory turnover ratio = 8 times, average collection period = 40 days, and sales = $320 million. What is the value of their cash and marketable securities?

A) $20.93m

B) $56.00m

C) $75.07m

D) $96.00m

A) $20.93m

B) $56.00m

C) $75.07m

D) $96.00m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

58

Debt Management Ratios Zoe's Dog Toys, Inc. reported a debt to equity ratio of .5 times at the end of 2011. If the firm's total assets at year-end are $50 million, how much of their assets is financed with equity?

A) $16.67m

B) $25 m

C) $33.33 m

D) $50 m

A) $16.67m

B) $25 m

C) $33.33 m

D) $50 m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

59

Sustainable Growth Rate Last year Rain Repel Corporation had an ROE of 10% and a dividend payout ratio of 80%. What is the sustainable growth rate?

A) 1.11%

B) 2.04%

C) 44.44%

D) 50.00%

A) 1.11%

B) 2.04%

C) 44.44%

D) 50.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

60

Sustainable Growth Rate Last year Umbrellas Unlimited Corporation had an ROE of 16.5% and a dividend payout ratio of 40%. What is the sustainable growth rate?

A) 13.17%

B) 10.99%

C) 27.50%

D) 32.93%

A) 13.17%

B) 10.99%

C) 27.50%

D) 32.93%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

61

Profitability and Asset Management Ratios You are thinking of investing in Tikki's Torches, Inc. You have only the following information on the firm at year-end 2011: net income = $500,000, total debt = $12 million, and debt ratio = 40%. What is Tikki's ROE for 2011?

A) 1.67%

B) 2.78%

C) 4.17%

D) 10.42%

A) 1.67%

B) 2.78%

C) 4.17%

D) 10.42%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

62

DuPont Analysis You are considering investing in Totally Tire Services. You have been able to locate the following information on the firm: total assets = $50 million, accounts receivable = $10 million, ACP = 15 days, net income = $4.5 million, and debt-to-equity ratio = 0.75 times. What is the ROE for the firm?

A) 1.58%

B) 9.00%

C) 15.75%

D) 28.81%

A) 1.58%

B) 9.00%

C) 15.75%

D) 28.81%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

63

Market Value Ratios Lab R Doors' year-end price on its common stock is $40. The firm has a profit margin of 10%, total assets of $30 million, a total asset turnover ratio of 2, no preferred stock, and there are 4 million shares of common stock outstanding. What is the PE ratio for Lab R Doors?

A) 0.375

B) 0.750

C) 6.667

D) 26.667

A) 0.375

B) 0.750

C) 6.667

D) 26.667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

64

DuPont Analysis Last year, DJ's Soda Fountains, Inc. reported an ROE = 27%. The firm's debt ratio was 50%, sales were $9 million, and the capital intensity ratio was 1.5 times. What is the net income for DJ's last year?

A) $1.22m

B) $1.82m

C) $2.43m

D) $2.84m

A) $1.22m

B) $1.82m

C) $2.43m

D) $2.84m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

65

Sustainable Growth Rate You have located the following information on Maize Company: debt ratio = 20%, capital intensity ratio = 1.25 times, profit margin = 12%, and dividend payout ratio = 10%. What is the sustainable growth rate for Maize?

A) 1.20%

B) 10.10%

C) 12.11%

D) 73.26%

A) 1.20%

B) 10.10%

C) 12.11%

D) 73.26%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

66

DuPont Analysis Last year, PJ's Ice Cream Parlors, Inc. reported an ROE = 12%. The firm's debt ratio was 40%, sales were $25 million, and the capital intensity ratio was 0.75 times. What is the net income for PJ's last year?

A) $1.35m

B) $2.40m

C) $3.00m

D) $18.75m

A) $1.35m

B) $2.40m

C) $3.00m

D) $18.75m

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

67

Profitability and Asset Management Ratios You are thinking of investing in Wave Runnerz, Inc. You have only the following information on the firm at year-end 2011: net income = $10 million, total debt = $65 million, and debt ratio = 35%. What is Wave Runnerz's ROE for 2011?

A) 8.28%

B) 15.38%

C) 28.57%

D) 43.96%

A) 8.28%

B) 15.38%

C) 28.57%

D) 43.96%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

68

Market Value Ratios Lab R Doors' year-end price on its common stock is $40. The firm has total assets of $75 million, the debt ratio is 60%, there is no preferred stock, and there are 4 million shares of common stock outstanding. Calculate the market-to-book ratio for Lab R Doors.

A) 2.13

B) 3.20

C) 5.33

D) 10.00

A) 2.13

B) 3.20

C) 5.33

D) 10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

69

DuPont Analysis You are considering investing in Lenny's Lube, Inc. You have been able to locate the following information on the firm: total assets = $20 million, accounts receivable = $6 million, ACP = 20 days, net income = $5 million, and debt-to-equity ratio = 2.5 times. What is the ROE for the firm?

A) 2.5000%

B) 13.9882%

C) 35.0000%

D) 87.50%

A) 2.5000%

B) 13.9882%

C) 35.0000%

D) 87.50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

70

Internal Growth Rate Leash N Collar reported a profit margin of 8%, total asset turnover ratio of 1.5 times, debt-to-equity ratio of 0.75 times, net income of $400,000, and dividends paid to common stockholders of $200,000. The firm has no preferred stock outstanding. What is Leash N Collar's internal growth rate?

A) 5.2632%

B) 7.3333%

C) 8.6956%

D) 6.383%

A) 5.2632%

B) 7.3333%

C) 8.6956%

D) 6.383%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

71

Profitability and Asset Management Ratios You are thinking of investing in Ski Sports, Inc. You have only the following information on the firm at year-end 2011: net income = $50,000, total debt = $1 million, and debt ratio = 70%. What is Ski's ROE for 2011?

A) 2.94%

B) 3.49%

C) 7.14%

D) 11.67%

A) 2.94%

B) 3.49%

C) 7.14%

D) 11.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

72

Sustainable Growth Rate You have located the following information on Greenwich Company: debt ratio = 60%, capital intensity ratio = 0.75 times, profit margin = 13.5%, and dividend payout ratio = 80%. What is the sustainable growth rate for Greenwich?

A) 2.70%

B) 10.80%

C) 25.00%

D) 9.89%

A) 2.70%

B) 10.80%

C) 25.00%

D) 9.89%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

73

Internal Growth Rate Saddle and Bridle reported a profit margin of 12%, total asset turnover ratio of 2 times, debt-to-equity ratio of 1.9 times, net income of $1 million, and dividends paid to common stockholders of $250,000. The firm has no preferred stock outstanding. What is Saddle and Bridle's internal growth rate?

A) 13.64%

B) 18.00%

C) 24.00%

D) 21.95%

A) 13.64%

B) 18.00%

C) 24.00%

D) 21.95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

74

Market Value Ratios Fancy Paws' year-end price on its common stock is $20. The firm has total assets of $40 million, the debt ratio is 40%, there is no preferred stock, and there are 2 million shares of common stock outstanding. Calculate the market-to-book ratio for Fancy Paws.

A) 0.47

B) 1.67

C) 8.00

D) 10.00

A) 0.47

B) 1.67

C) 8.00

D) 10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

75

Sustainable Growth Rate You have located the following information on Tyler Company: debt ratio = 50%, capital intensity ratio = 1.5 times, profit margin = 9%, and dividend payout ratio = 40%. What is the sustainable growth rate for Tyler?

A) 12.00%

B) 7.76%

C) 20.00%

D) 30.00%

A) 12.00%

B) 7.76%

C) 20.00%

D) 30.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

76

Profitability Ratios PJ's Ice Cream Parlor has asked you to help piece together financial information on the firm for the most current year. Managers give you the following information: sales = $50 million, total debt = $20 million, debt ratio = 50%, and ROE = 12%. Using this information, what is PJ's ROA?

A) 4%

B) 6%

C) 10%

D) 12%

A) 4%

B) 6%

C) 10%

D) 12%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following activities will increase a firm's current ratio?

A) Purchase inventory using cash.

B) Buy equipment with a short-term bank loan.

C) Accrued wages and taxes increase.

D) None of these statements will increase a firm's current ratio.

A) Purchase inventory using cash.

B) Buy equipment with a short-term bank loan.

C) Accrued wages and taxes increase.

D) None of these statements will increase a firm's current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

78

Market Value Ratios Fancy Paws' year-end price on its common stock is $20. The firm has a profit margin of 12%, total assets of $20 million, a total asset turnover ratio of 0.5, no preferred stock, and there are 2 million shares of common stock outstanding. What is the PE ratio for Fancy Paws?

A) 3.33

B) 8.33

C) 10.00

D) 33.33

A) 3.33

B) 8.33

C) 10.00

D) 33.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

79

Profitability Ratios DJ's Soda Fountain has asked you to help piece together financial information on the firm for the most current year. Managers give you the following information: sales = $20 million, total debt = $3 million, debt ratio = 75%, ROE = 27%. Using this information, what is DJ's ROA?

A) .0675%

B) 6.75%

C) 25.00%

D) 27.00%

A) .0675%

B) 6.75%

C) 25.00%

D) 27.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck

80

Sustainable Growth Rate You have located the following information on Rock Company: debt ratio = 40%, capital intensity ratio = 2.25 times, profit margin = 8%, and dividend payout ratio = 25%. What is the sustainable growth rate for Rock?

A) 3.56%

B) 6.00%

C) 4.65%

D) 8.00%

A) 3.56%

B) 6.00%

C) 4.65%

D) 8.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 131 في هذه المجموعة.

فتح الحزمة

k this deck