Deck 16: Assessing Long-Term Debt, Equity, and Capital Structure

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/115

العب

ملء الشاشة (f)

Deck 16: Assessing Long-Term Debt, Equity, and Capital Structure

1

In M&M's perfect world, their theorem's two main propositions are referred to as which of the following?

A) active capital structure management

B) passive capital structure management

C) capital structure irrelevance assertion

D) capital structure relevance assertion

A) active capital structure management

B) passive capital structure management

C) capital structure irrelevance assertion

D) capital structure relevance assertion

capital structure irrelevance assertion

2

This is another name for debt in the capital structure.

A) active

B) leverage

C) passive

D) long position

A) active

B) leverage

C) passive

D) long position

leverage

3

This is one of the most extreme examples of firm re-leveraging which occurs when someone uses a firm's debt capacity to buy out the majority of the firm's equity holders.

A) debt buyout

B) equity buyout

C) leveraged buyout

D) separation buyout

A) debt buyout

B) equity buyout

C) leveraged buyout

D) separation buyout

leveraged buyout

4

This is the level of EBIT at which EPS will be equal for two different capital structures.

A) Break-even EBIT

B) Break-even EPS

C) Break-even capital structures

D) Break-even financial structures

A) Break-even EBIT

B) Break-even EPS

C) Break-even capital structures

D) Break-even financial structures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following makes this a true statement? In this slightly more realistic world with corporate taxes, managers can

A) minimize the firm's value by taking on as much debt as possible.

B) maximize the firm's value by taking on as much debt as possible.

C) maximize the firm's value by taking on as much equity as possible.

D) maximize the firm's value by financing only with debt.

A) minimize the firm's value by taking on as much debt as possible.

B) maximize the firm's value by taking on as much debt as possible.

C) maximize the firm's value by taking on as much equity as possible.

D) maximize the firm's value by financing only with debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

6

This type of bankruptcy involves a business liquidating their assets.

A) Chapter 7

B) Chapter 11

C) Chapter 13

D) Chapter 9

A) Chapter 7

B) Chapter 11

C) Chapter 13

D) Chapter 9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is NOT a feature of the "perfect world" in M&M's theorem for optimal capital structure?

A) No taxes

B) No chance of bankruptcy

C) Perfectly efficient markets

D) Assymmetric information sets for all participants

A) No taxes

B) No chance of bankruptcy

C) Perfectly efficient markets

D) Assymmetric information sets for all participants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

8

This type of bankruptcy involves an attempt to allow the firm to reorganize the business under court supervision.

A) Chapter 7

B) Chapter 11

C) Chapter 13

D) Chapter 9

A) Chapter 7

B) Chapter 11

C) Chapter 13

D) Chapter 9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a true statement?

A) A firm's cost of debt increases with the use of equity in the capital structure.

B) A firm's cost of equity increases with the use of equity in the capital structure.

C) A firm's cost of equity increases with the use of debt in the capital structure.

D) A firm's cost of equity decreases with the use of debt in the capital structure.

A) A firm's cost of debt increases with the use of equity in the capital structure.

B) A firm's cost of equity increases with the use of equity in the capital structure.

C) A firm's cost of equity increases with the use of debt in the capital structure.

D) A firm's cost of equity decreases with the use of debt in the capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

10

This is a situation that arises when a firm's equity is close to worthless, and equityholders will prefer to invest in overly risky projects with a small chance of success rather than simply paying debtholders their regularly scheduled payments.

A) leverage problem

B) overinvestment problem

C) underinvestment problem

D) long position

A) leverage problem

B) overinvestment problem

C) underinvestment problem

D) long position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a firm changes their capital structure by waiting until the firm requires additional capital to cover capital budgeting needs and then selling more of the type of claims they wish to increase, they are using this type of capital structure change.

A) active

B) passive

C) separation

D) supportive

A) active

B) passive

C) separation

D) supportive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

12

This is the condition in which a firm is near bankruptcy.

A) passive capital structure

B) active capital structure

C) financial distress

D) call position

A) passive capital structure

B) active capital structure

C) financial distress

D) call position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT a factor for determining whether to use the active or passive approach to capital structure changes?

A) How much the firm faces in flotation costs under the active management approach.

B) How much the firm faces in debt costs under the active management approach.

C) How quickly the firm is growing.

D) How strongly and how quickly they wish to change the capital structure.

A) How much the firm faces in flotation costs under the active management approach.

B) How much the firm faces in debt costs under the active management approach.

C) How quickly the firm is growing.

D) How strongly and how quickly they wish to change the capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

14

How can an investor leverage itself more than the firm?

A) by borrowing money and investing it in stock along with the money they started with

B) by buying the firm's bonds

C) by buying the firm's preferred stock

D) Investors cannot leverage themselves more than the firm.

A) by borrowing money and investing it in stock along with the money they started with

B) by buying the firm's bonds

C) by buying the firm's preferred stock

D) Investors cannot leverage themselves more than the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

15

This is the rule under which claimants are paid in a Chapter 7 bankruptcy.

A) first come, first served

B) absolute priority

C) term structure priority

D) date due priority

A) first come, first served

B) absolute priority

C) term structure priority

D) date due priority

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is a true statement regarding Proposition I?

A) Vu in a world with taxes is going to be more than Vu in a world without taxes.

B) Vu in a world with taxes is going to be less than Vu in a world without taxes.

C) Vu in a world with taxes is going to be equal to Vu in a world without taxes.

D) Vu in a world with taxes cannot be compared to Vu in a world without taxes.

A) Vu in a world with taxes is going to be more than Vu in a world without taxes.

B) Vu in a world with taxes is going to be less than Vu in a world without taxes.

C) Vu in a world with taxes is going to be equal to Vu in a world without taxes.

D) Vu in a world with taxes cannot be compared to Vu in a world without taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a firm changes their capital structure by immediately selling additional claims of one type of capital and using the proceeds to retire another kind of claims, they are using this type of capital structure change.

A) active

B) passive

C) separation

D) supportive

A) active

B) passive

C) separation

D) supportive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

18

This is the mix of debt and equity that a firm uses to finance its operations.

A) capital structure

B) capital management

C) separation structure

D) break even

A) capital structure

B) capital management

C) separation structure

D) break even

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

19

This is the assumption that decisions about which projects to fund are separate from the decisions about how to fund them.

A) break-even principle

B) capital structure principle

C) separation principle

D) long position principle

A) break-even principle

B) capital structure principle

C) separation principle

D) long position principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following allows for two types of bankruptcy for which most businesses can file?

A) Securities Exchange Commission

B) Generally Accepted Accounting Principles

C) The Internal Revenue Service

D) The United States Bankruptcy Code

A) Securities Exchange Commission

B) Generally Accepted Accounting Principles

C) The Internal Revenue Service

D) The United States Bankruptcy Code

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

21

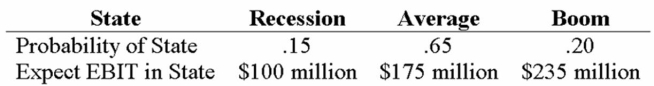

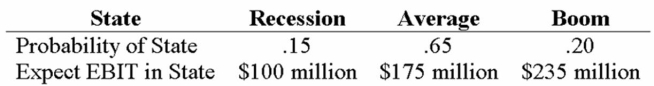

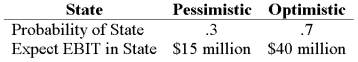

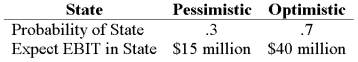

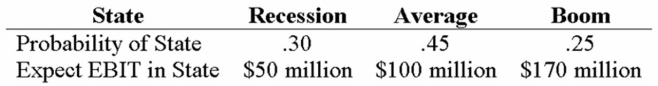

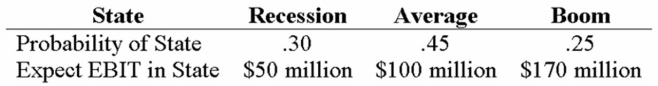

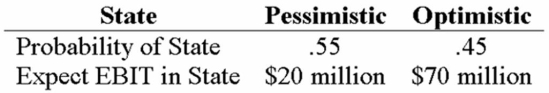

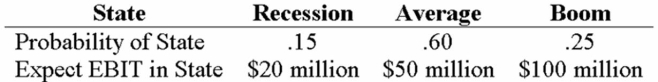

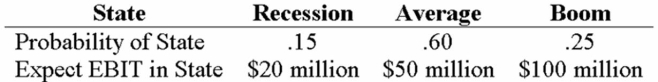

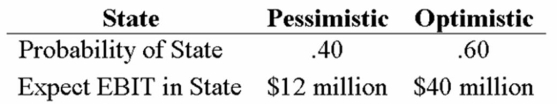

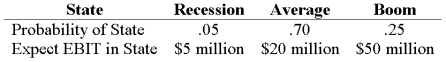

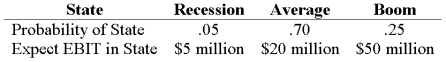

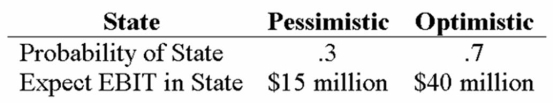

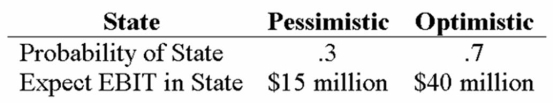

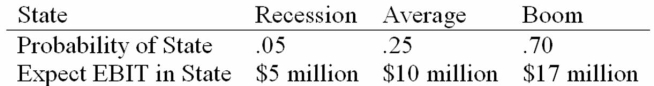

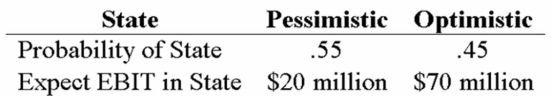

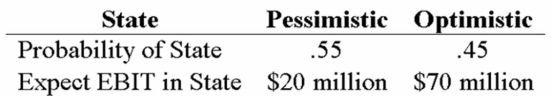

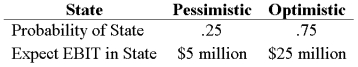

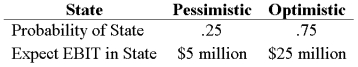

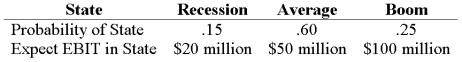

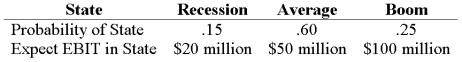

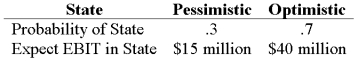

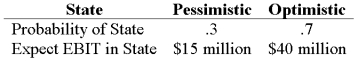

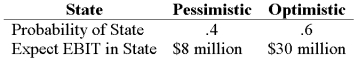

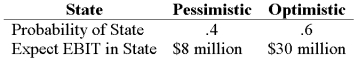

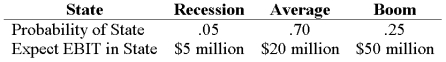

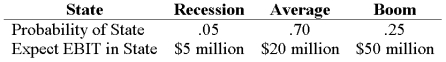

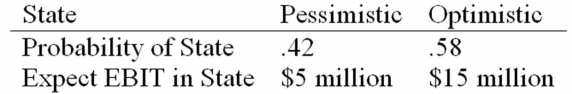

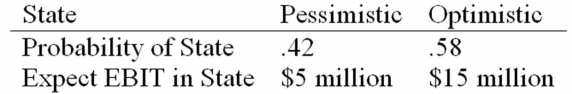

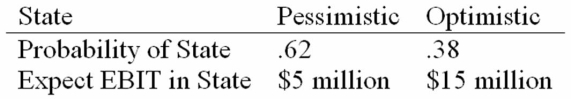

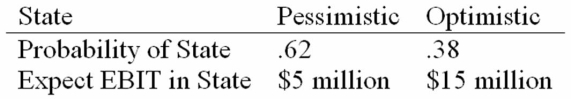

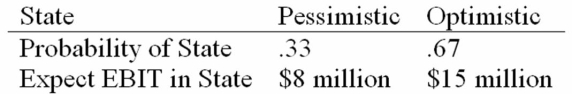

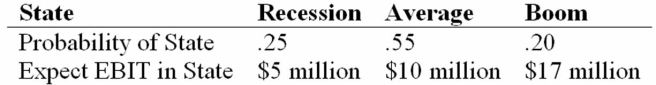

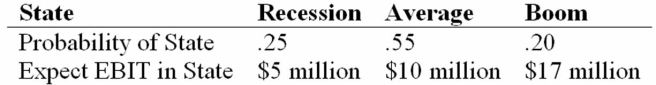

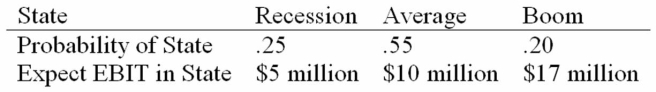

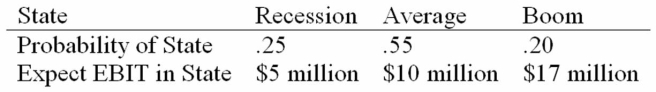

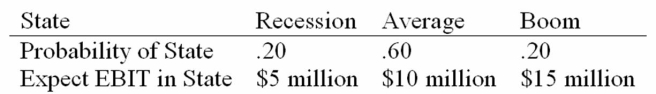

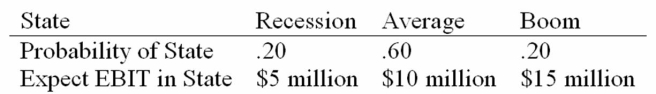

Your company doesn't face any taxes and has $750 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 3.76

B) 9.15

C) 14.17

D) 83.79

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 3.76

B) 9.15

C) 14.17

D) 83.79

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

22

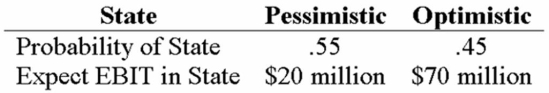

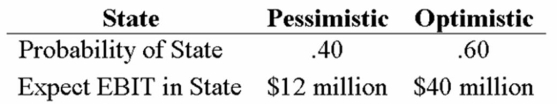

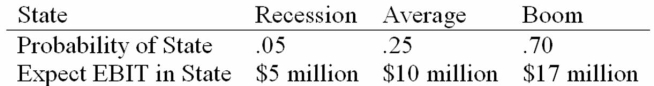

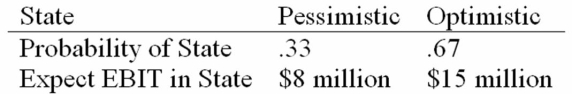

Your company doesn't face any taxes and has $300 million in assets, currently financed entirely with equity. Equity is worth $10 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even EBIT?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even EBIT?

A) $19,000,000

B) $21,200,000

C) $27,000,000

D) $30,000,000

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even EBIT?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even EBIT?A) $19,000,000

B) $21,200,000

C) $27,000,000

D) $30,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

23

Suppose that a company's equity is currently selling for $55 per share and that there are 1 million shares outstanding. If the firm also has 50 thousand bonds outstanding, which are selling at 95 percent of par ($1,000), what are the firm's current capital structure weights for equity and debt respectively?

A) 50%, 50%

B) 53.66%, 46.34%

C) 52.38%, 47.62%

D) 36.67%, 63.33%

A) 50%, 50%

B) 53.66%, 46.34%

C) 52.38%, 47.62%

D) 36.67%, 63.33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose that a company's equity is currently selling for $19 per share and that there are 3 million shares outstanding and 10 thousand bonds outstanding, which are selling at 100 percent of par ($1,000). If the firm was considering an active change to their capital structure so that the firm would have a D/E of 0.5, which type of security (stocks or bonds) would they need to sell to accomplish this, and how much would they have to sell?

A) $12,333,333 in new debt

B) $1,755,400 in new debt

C) $12,328,000 in new equity

D) $1,755,400 in new equity

A) $12,333,333 in new debt

B) $1,755,400 in new debt

C) $12,328,000 in new equity

D) $1,755,400 in new equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

25

This is a situation that arises when a firm's equity is close to worthless, and equityholders will prefer to not invest in safe projects.

A) leverage problem

B) overinvestment problem

C) underinvestment problem

D) long position

A) leverage problem

B) overinvestment problem

C) underinvestment problem

D) long position

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose that a company's equity is currently selling for $45 per share and that there are 1 million shares outstanding. If the firm also has 7 thousand bonds outstanding, which are selling at 97 percent of par ($1,000), what are the firm's current capital structure weights for equity and debt respectively?

A) 50%, 50%

B) 86.89%, 13.11%

C) 12.50%, 87.50%

D) 31.69%, 68.31%

A) 50%, 50%

B) 86.89%, 13.11%

C) 12.50%, 87.50%

D) 31.69%, 68.31%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is a true statement?

A) Sectors of the U.S. economy that tend to have quite variable income streams also carry the highest D/E ratios.

B) Sectors of the U.S. economy that tend to have quite variable income streams also carry the lowest D/E ratios.

C) Conglomerates tend to have high, unstable income streams.

D) Utilities have variable income streams and carry low D/E ratios.

A) Sectors of the U.S. economy that tend to have quite variable income streams also carry the highest D/E ratios.

B) Sectors of the U.S. economy that tend to have quite variable income streams also carry the lowest D/E ratios.

C) Conglomerates tend to have high, unstable income streams.

D) Utilities have variable income streams and carry low D/E ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

28

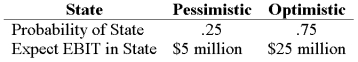

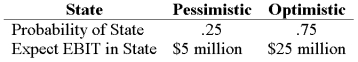

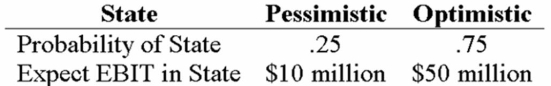

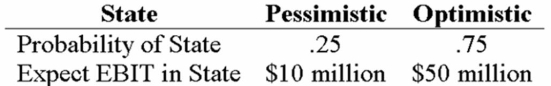

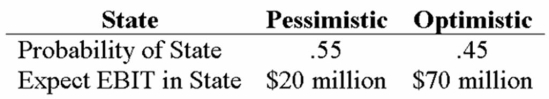

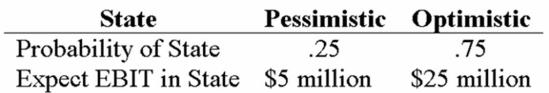

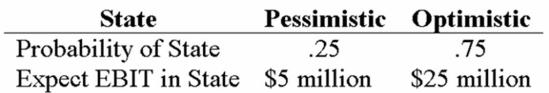

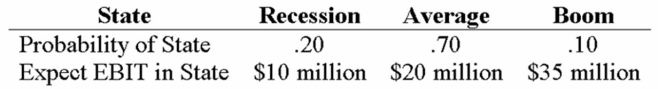

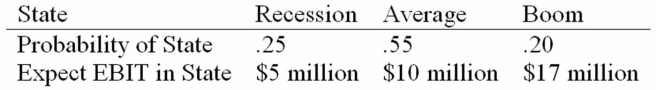

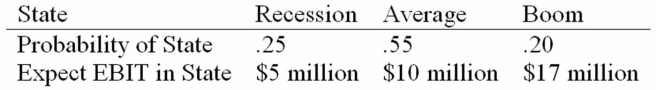

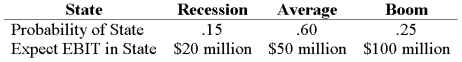

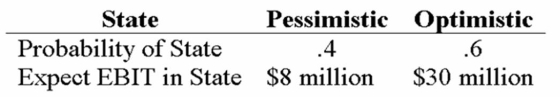

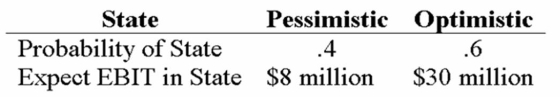

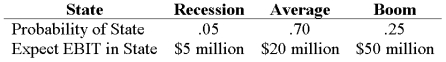

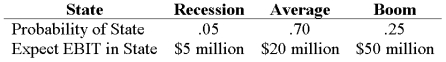

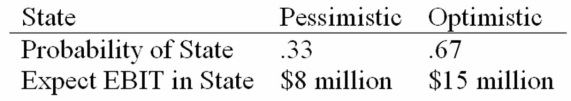

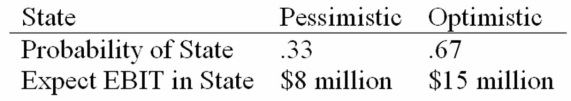

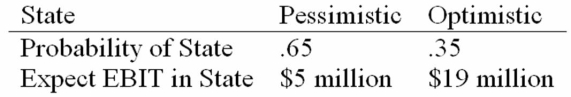

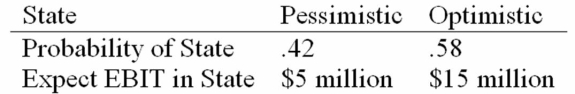

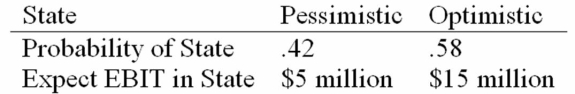

Your company doesn't face any taxes and has $150 million in assets, currently financed entirely with equity. Equity is worth $8 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the break-even EBIT?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the break-even EBIT?

A) $18 million

B) $27.5 million

C) $32.5 million

D) $40 million

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the break-even EBIT?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the break-even EBIT?A) $18 million

B) $27.5 million

C) $32.5 million

D) $40 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

29

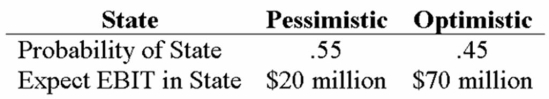

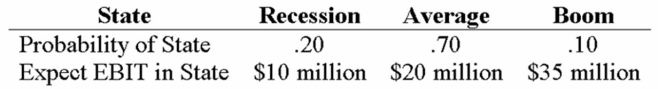

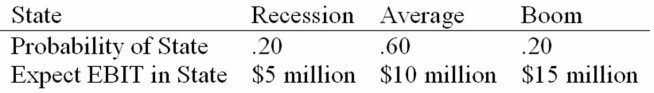

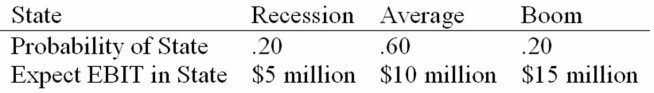

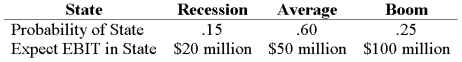

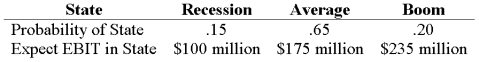

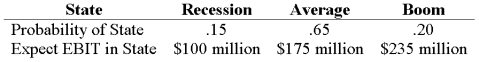

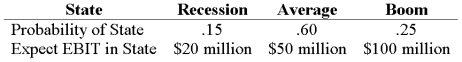

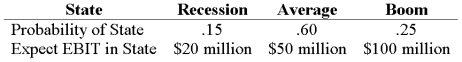

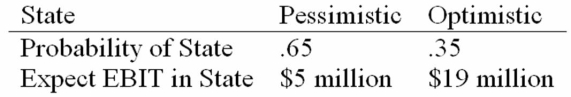

Your company doesn't face any taxes and has $200 million in assets, currently financed entirely with equity. Equity is worth $10 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the break-even EBIT?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the break-even EBIT?

A) $13.6 million

B) $15 million

C) $16 million

D) $20 million

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the break-even EBIT?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the break-even EBIT?A) $13.6 million

B) $15 million

C) $16 million

D) $20 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

30

Suppose that a company's equity is currently selling for $22 per share and that there are 4 million shares outstanding and 30 thousand bonds outstanding, which are selling at 101 percent of par ($1,000). If the firm was considering an active change to their capital structure so that the firm would have a D/E of 0.9, which type of security (stocks or bonds) would they need to sell to accomplish this, and how much would they have to sell?

A) $25,736,842 in new debt

B) $10,434,060 in new debt

C) $10,434,060 in new equity

D) $25,742,080 in new equity

A) $25,736,842 in new debt

B) $10,434,060 in new debt

C) $10,434,060 in new equity

D) $25,742,080 in new equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

31

Your company doesn't face any taxes and has $500 million in assets, currently financed entirely with equity. Equity is worth $40 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 5.07

B) 9.78

C) 25.73

D) 95.68

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 5.07

B) 9.78

C) 25.73

D) 95.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

32

Your company doesn't face any taxes and has $250 million in assets, currently financed entirely with equity. Equity is worth $8 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $1.02

B) $1.42

C) $1.82

D) $2.00

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $1.02

B) $1.42

C) $1.82

D) $2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose that a company's equity is currently selling for $20 per share and that there are 2 million shares outstanding. If the firm also has 8 thousand bonds outstanding, which are selling at 99 percent of par ($1,000), what are the firm's current capital structure weights for equity and debt respectively?

A) 50%, 50%

B) 16.81%, 83.19%

C) 83.47%, 16.53%

D) 83.33%, 16.67%

A) 50%, 50%

B) 16.81%, 83.19%

C) 83.47%, 16.53%

D) 83.33%, 16.67%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

34

Your company doesn't face any taxes and has $750 million in assets, currently financed entirely with equity. Equity is worth $25 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $1.06

B) $1.17

C) $2.27

D) $2.28

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $1.06

B) $1.17

C) $2.27

D) $2.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

35

Your company doesn't face any taxes and has $750 million in assets, currently financed entirely with equity. Equity is worth $25 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

A) $20 million

B) $23.75 million

C) $42.5 million

D) $75 million

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?A) $20 million

B) $23.75 million

C) $42.5 million

D) $75 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

36

Your company doesn't face any taxes and has $800 million in assets, currently financed entirely with equity. Equity is worth $60 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 2.47

B) 5.36

C) 6.12

D) 28.76

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 2.47

B) 5.36

C) 6.12

D) 28.76

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

37

Your company doesn't face any taxes and has $200 million in assets, currently financed entirely with equity. Equity is worth $10 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.75

B) $1.1325

C) $1.1925

D) $1.55

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.75

B) $1.1325

C) $1.1925

D) $1.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

38

Your company doesn't face any taxes and has $300 million in assets, currently financed entirely with equity. Equity is worth $15 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $1.21

B) $1.41

C) $1.55

D) $2.21

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $1.21

B) $1.41

C) $1.55

D) $2.21

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

39

Your company doesn't face any taxes and has $200 million in assets, currently financed entirely with equity. Equity is worth $25 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 7 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 7 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 1.05

B) 1.56

C) 2.67

D) 7.15

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 7 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 7 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 1.05

B) 1.56

C) 2.67

D) 7.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose that a company's equity is currently selling for $30 per share and that there are 5 million shares outstanding. If the firm also has 20 thousand bonds outstanding, which are selling at 98 percent of par ($1,000), what are the firm's current capital structure weights for equity and debt respectively?

A) 50%, 50%

B) 88.44%, 11.56%

C) 99.60%, 0.40%

D) 88.23%, 11.77%

A) 50%, 50%

B) 88.44%, 11.56%

C) 99.60%, 0.40%

D) 88.23%, 11.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

41

Your company has a 25% tax rate and has $600 million in assets, currently financed entirely with equity. Equity is worth $20 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

A) $16,758,621

B) $20,000,000

C) $25,000,000

D) $54,000,000

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?A) $16,758,621

B) $20,000,000

C) $25,000,000

D) $54,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

42

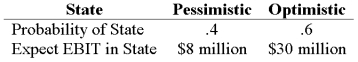

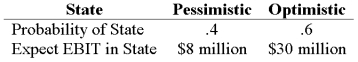

Daddi Mac, Inc., doesn't face any taxes and has $250 million in assets, currently financed entirely with equity. Equity is worth $13 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.13

B) $0.21

C) $0.27

D) $0.16

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.13

B) $0.21

C) $0.27

D) $0.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

43

Your company faces a 34% tax rate and has $150 million in assets, currently financed entirely with equity. Equity is worth $8 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 0.2890

B) 0.5376

C) 0.7983

D) 0.8935

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 0.2890

B) 0.5376

C) 0.7983

D) 0.8935

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

44

Daddi Mac, Inc., doesn't face any taxes and has $250 million in assets, currently financed entirely with equity. Equity is worth $20 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.33

B) $0.21

C) $0.37

D) $0.29

The firm is considering switching to a 30 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.33

B) $0.21

C) $0.37

D) $0.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

45

Daddi Mac, Inc., doesn't face any taxes and has $250 million in assets, currently financed entirely with equity. Equity is worth $13 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.59

B) $0.41

C) $0.27

D) $0.19

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.59

B) $0.41

C) $0.27

D) $0.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

46

Suppose that Lil John Industries' equity is currently selling for $64 per share and that there are 1 million shares outstanding. If the firm also has 20 thousand bonds outstanding, which are selling at 108 percent of par ($1,000), what are the firm's current capital structure weights?

A) Weight of Equity = 25.23%; Weight of Debt = 74.77%

B) Weight of Equity = 84.77%; Weight of Debt = 15.23%

C) Weight of Equity = 74.77%; Weight of Debt = 25.23%

D) Weight of Equity = 32.23%; Weight of Debt = 67.77%

A) Weight of Equity = 25.23%; Weight of Debt = 74.77%

B) Weight of Equity = 84.77%; Weight of Debt = 15.23%

C) Weight of Equity = 74.77%; Weight of Debt = 25.23%

D) Weight of Equity = 32.23%; Weight of Debt = 67.77%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

47

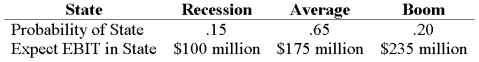

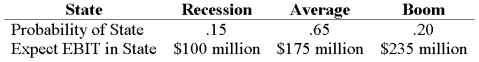

Your company has a 38% tax rate and has $800 million in assets, currently financed entirely with equity. Equity is worth $60 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

A) $26.67 million

B) $50 million

C) $56.67 million

D) $80.1 million

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the break-even level of EBIT?A) $26.67 million

B) $50 million

C) $56.67 million

D) $80.1 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

48

Your company faces a 25% tax rate and has $750 million in assets, currently financed entirely with equity. Equity is worth $25 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 0.6886

B) 0.8298

C) 1.1857

D) 1.4059

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 0.6886

B) 0.8298

C) 1.1857

D) 1.4059

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

49

Suppose that Papa Bell Inc.'s equity is currently selling for $30 per share, with 4 million shares outstanding. If the firm also has 70 thousand bonds outstanding, which are selling at 95 percent of par ($1,000), what are the firm's current capital structure weights?

A) Weight of Equity = 74.11%; Weight of Debt = 25.89%

B) Weight of Equity = 64.34%; Weight of Debt = 35.66%

C) Weight of Equity = 67.80%; Weight of Debt = 32.20%

D) Weight of Equity = 65.19%; Weight of Debt = 34.81%

A) Weight of Equity = 74.11%; Weight of Debt = 25.89%

B) Weight of Equity = 64.34%; Weight of Debt = 35.66%

C) Weight of Equity = 67.80%; Weight of Debt = 32.20%

D) Weight of Equity = 65.19%; Weight of Debt = 34.81%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

50

Your company faces a 30% tax rate and has $300 million in assets, currently financed entirely with equity. Equity is worth $10 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 0.1228

B) 0.2463

C) 0.3562

D) 0.4963

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 0.1228

B) 0.2463

C) 0.3562

D) 0.4963

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

51

Suppose that Papa Bell Inc.'s equity is currently selling for $95 per share, with 4 million shares outstanding. If the firm also has 80 thousand bonds outstanding, which are selling at 91.5 percent of par ($1,000), what are the firm's current capital structure weights?

A) Weight of Equity = 83.85%; Weight of Debt = 16.15%

B) Weight of Equity = 81.29%; Weight of Debt = 18.71%

C) Weight of Equity = 77.80%; Weight of Debt = 12.20%

D) Weight of Equity = 65.19%; Weight of Debt = 34.81%

A) Weight of Equity = 83.85%; Weight of Debt = 16.15%

B) Weight of Equity = 81.29%; Weight of Debt = 18.71%

C) Weight of Equity = 77.80%; Weight of Debt = 12.20%

D) Weight of Equity = 65.19%; Weight of Debt = 34.81%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

52

Your company faces a 34% tax rate and has $200 million in assets, currently financed entirely with equity. Equity is worth $10 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.748

B) $0.7965

C) $0.946

D) $1.023

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay an 8 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.748

B) $0.7965

C) $0.946

D) $1.023

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

53

Your company has a 40% tax rate and has $750 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $8.56

B) $8.84

C) $8.88

D) $25.67

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $8.56

B) $8.84

C) $8.88

D) $25.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

54

Your company has a 38% tax rate and has $800 million in assets, currently financed entirely with equity. Equity is worth $60 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $1.98

B) $2.29

C) $2.36

D) $2.44

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $1.98

B) $2.29

C) $2.36

D) $2.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

55

Your company has a 25% tax rate and has $600 million in assets, currently financed entirely with equity. Equity is worth $20 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 0.46

B) 0.49

C) 0.88

D) 1.16

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 0.46

B) 0.49

C) 0.88

D) 1.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

56

Your company faces a 34% tax rate and has $150 million in assets, currently financed entirely with equity. Equity is worth $8 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.49

B) $1.08

C) $1.31

D) $1.67

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 25-percent debt capital structure, and has determined that they would have to pay a 12 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.49

B) $1.08

C) $1.31

D) $1.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

57

Your company has a 40% tax rate and has $750 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 2.26

B) 5.10

C) 10.05

D) 30.16

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 2.26

B) 5.10

C) 10.05

D) 30.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

58

Your company faces a 30% tax rate and has $300 million in assets, currently financed entirely with equity. Equity is worth $10 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.30

B) $0.365

C) $0.44

D) $0.73

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.30

B) $0.365

C) $0.44

D) $0.73

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

59

Your company has a 38% tax rate and has $800 million in assets, currently financed entirely with equity. Equity is worth $60 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) 1.53

B) 2.35

C) 3.32

D) 11.04

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 20-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt in either event. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) 1.53

B) 2.35

C) 3.32

D) 11.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

60

Your company has a 25% tax rate and has $600 million in assets, currently financed entirely with equity. Equity is worth $20 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $0.32

B) $0.36

C) $0.38

D) $0.95

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 30-percent debt capital structure, and has determined that they would have to pay a 9 percent yield on perpetual debt in either event. What will be the level of expected EPS if they switch to the proposed capital structure?A) $0.32

B) $0.36

C) $0.38

D) $0.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

61

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $7.24

B) $6.94

C) $5.59

D) $5.67

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?A) $7.24

B) $6.94

C) $5.59

D) $5.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

62

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

A) $7.25 million

B) $7 million

C) $10 million

D) $11.2 million

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?

The firm is considering switching to a 40-percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the break-even level of EBIT?A) $7.25 million

B) $7 million

C) $10 million

D) $11.2 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

63

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $3.19

B) $3.94

C) $4.41

D) $5.67

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?A) $3.19

B) $3.94

C) $4.41

D) $5.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

64

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

A) $3.19

B) $4.00

C) $4.72

D) $5.97

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the level of expected EPS if they switch to the proposed capital structure?A) $3.19

B) $4.00

C) $4.72

D) $5.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

65

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?

A) $7.91

B) $7.54

C) $6.59

D) $6.13

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 10 percent yield on perpetual debt. What will be the standard deviation in EPS if they switch to the proposed capital structure?A) $7.91

B) $7.54

C) $6.59

D) $6.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

66

HiLo, Inc., doesn't face any taxes and has $100 million in assets, currently financed entirely with equity. Equity is worth $50 per share, and book value of equity is equal to market value of equity. Also, let's assume that the firm's expected values for EBIT depend upon which state of the economy occurs this year, with the possible values of EBIT and their associated probabilities as shown below:  The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 15 percent yield on perpetual debt. What will be the break-even level of EBIT?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 15 percent yield on perpetual debt. What will be the break-even level of EBIT?

A) $11.2 million

B) $9.5 million

C) $13.0 million

D) $15.0 million

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 15 percent yield on perpetual debt. What will be the break-even level of EBIT?

The firm is considering switching to a 40 percent debt capital structure, and has determined that they would have to pay a 15 percent yield on perpetual debt. What will be the break-even level of EBIT?A) $11.2 million

B) $9.5 million

C) $13.0 million

D) $15.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 115 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is incorrect with respect to leverage buyouts (LBOs)?

A) They originated in the 1960s and were originally known as bootstrap transactions which reflected the general consensus that the firm was, more or less, paying for its own acquisition.

B) The typical LBO uses a ratio of 70% debt to 30% equity but levels of debt can reach much higher.

C) LBOs are an extreme example of releveraging because debt is used to buy out the majority of the equityholders to gain control of the firm.

D) None of these statements is incorrect.