Deck 27: The Theory of Active Portfolio Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/50

العب

ملء الشاشة (f)

Deck 27: The Theory of Active Portfolio Management

1

The tracking error of an optimized portfolio can be expressed in terms of the ____________ of the portfolio and thus reveals ____________.

A)return; portfolio performance

B)total risk; portfolio performance

C)beta; portfolio performance

D)beta; benchmark risk

E)relative return; benchmark risk

A)return; portfolio performance

B)total risk; portfolio performance

C)beta; portfolio performance

D)beta; benchmark risk

E)relative return; benchmark risk

D

Explanation: The tracking error of an optimized portfolio can be expressed in terms of the beta of the portfolio and thus reveals benchmark risk.

Explanation: The tracking error of an optimized portfolio can be expressed in terms of the beta of the portfolio and thus reveals benchmark risk.

2

If a portfolio manager consistently obtains a high Sharpe measure, the manager's forecasting ability

A)is above average.

B)is average.

C)is below average.

D)does not exist.

E)cannot be determined based on the Sharpe measure.

A)is above average.

B)is average.

C)is below average.

D)does not exist.

E)cannot be determined based on the Sharpe measure.

A

Explanation: The manager with the highest Sharpe measure presumably has true forecasting abilities.

Explanation: The manager with the highest Sharpe measure presumably has true forecasting abilities.

3

Active portfolio managers try to construct a risky portfolio with

A)a higher Sharpe measure than a passive strategy.

B)a lower Sharpe measure than a passive strategy.

C)the same Sharpe measure as a passive strategy.

D)very few securities.

A)a higher Sharpe measure than a passive strategy.

B)a lower Sharpe measure than a passive strategy.

C)the same Sharpe measure as a passive strategy.

D)very few securities.

A

Explanation: A higher Sharpe measure than a passive strategy is indicative of the benefits of active management.

Explanation: A higher Sharpe measure than a passive strategy is indicative of the benefits of active management.

4

Passive portfolio management consists of

A)market timing.

B)security analysis.

C)indexing.

D)market timing and security analysis.

E)None of the options

A)market timing.

B)security analysis.

C)indexing.

D)market timing and security analysis.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

5

Benchmark risk

A)is inevitable and is never a significant issue in practice.

B)is inevitable and is always a significant issue in practice.

C)cannot be constrained to keep a Treynor-Black portfolio within reasonable weights.

D)can be constrained to keep a Treynor-Black portfolio within reasonable weights.

A)is inevitable and is never a significant issue in practice.

B)is inevitable and is always a significant issue in practice.

C)cannot be constrained to keep a Treynor-Black portfolio within reasonable weights.

D)can be constrained to keep a Treynor-Black portfolio within reasonable weights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

6

Tracking error is defined as

A)the difference between the returns on the overall risky portfolio versus the benchmark return.

B)the variance of the return of the benchmark portfolio.

C)the variance of the return difference between the portfolio and the benchmark.

D)the variance of the return of the actively managed portfolio.

A)the difference between the returns on the overall risky portfolio versus the benchmark return.

B)the variance of the return of the benchmark portfolio.

C)the variance of the return difference between the portfolio and the benchmark.

D)the variance of the return of the actively managed portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Black-Litterman model is geared toward ____________ while the Treynor-Black model is geared toward ____________.

A)security analysis; security analysis

B)asset allocation; asset allocation

C)security analysis; asset allocation

D)asset allocation; security analysis

E)None of the options

A)security analysis; security analysis

B)asset allocation; asset allocation

C)security analysis; asset allocation

D)asset allocation; security analysis

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

8

The ____________ model allows the private views of the portfolio manager to be incorporated with market data in the optimization procedure.

A)Black-Litterman

B)Treynor-Black

C)Treynor-Mazuy

D)Black-Scholes

A)Black-Litterman

B)Treynor-Black

C)Treynor-Mazuy

D)Black-Scholes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

9

Even low-quality forecasts have proven to be valuable because R-squares of only ____________ in regressions of analysts' forecasts can be used to substantially improve portfolio performance.

A)0.656

B)0.452

C)0.258

D)0.153

E)0.001

A)0.656

B)0.452

C)0.258

D)0.153

E)0.001

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

10

Active portfolio management consists of

A)market timing.

B)security analysis.

C)indexing.

D)market timing and security analysis.

E)None of the options

A)market timing.

B)security analysis.

C)indexing.

D)market timing and security analysis.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Black-Litterman model and Treynor-Black model are

A)nice in theory but practically useless in modern portfolio management.

B)complementary tools that should be used in portfolio management.

C)contradictory models that cannot be used together; therefore, portfolio managers must choose which one suits their needs.

D)not useful due to their complexity.

E)None of the options

A)nice in theory but practically useless in modern portfolio management.

B)complementary tools that should be used in portfolio management.

C)contradictory models that cannot be used together; therefore, portfolio managers must choose which one suits their needs.

D)not useful due to their complexity.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

12

If you begin with a ______ and obtain additional data from an experiment you can form a ______.

A)posterior distribution; prior distribution

B)prior distribution; posterior distribution

C)tight posterior; Bayesian analysis

D)tight prior; Bayesian analysis

E)None of the options

A)posterior distribution; prior distribution

B)prior distribution; posterior distribution

C)tight posterior; Bayesian analysis

D)tight prior; Bayesian analysis

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

13

The Treynor-Black model requires estimates of

A)alpha/beta.

B)alpha/beta/residual variance.

C)beta/residual variance.

D)alpha/residual variance.

A)alpha/beta.

B)alpha/beta/residual variance.

C)beta/residual variance.

D)alpha/residual variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

14

____________ can be used to measure forecast quality and guide in the proper adjustment of forecasts.

A)Regression analysis

B)Exponential smoothing

C)ARIMA

D)Moving average models

E)GAUSS

A)Regression analysis

B)Exponential smoothing

C)ARIMA

D)Moving average models

E)GAUSS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Treynor-Black model is a model that shows how an investment manager can use security analysis and statistics to construct

A)a market portfolio.

B)a passive portfolio.

C)an active portfolio.

D)an index portfolio.

E)a balanced portfolio.

A)a market portfolio.

B)a passive portfolio.

C)an active portfolio.

D)an index portfolio.

E)a balanced portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

16

Absent research, you should assume the alpha of a stock is

A)zero.

B)positive.

C)negative.

D)not zero.

E)zero or positive.

A)zero.

B)positive.

C)negative.

D)not zero.

E)zero or positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

17

Alpha forecasts must be ____________ to account for less-than-perfect forecasting quality.When alpha forecasts are ____________ to account for forecast imprecision, the resulting portfolio position becomes ____________.

A)shrunk; shrunk; far less moderate

B)shrunk; shrunk; far more moderate

C)grossed up; grossed up; far less moderate

D)grossed up; grossed up; far more moderate

E)None of the options

A)shrunk; shrunk; far less moderate

B)shrunk; shrunk; far more moderate

C)grossed up; grossed up; far less moderate

D)grossed up; grossed up; far more moderate

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

18

The critical variable in the determination of the success of the active portfolio is

A)alpha/systematic risk.

B)alpha/nonsystematic risk.

C)gamma/systematic risk.

D)gamma/nonsystematic risk.

A)alpha/systematic risk.

B)alpha/nonsystematic risk.

C)gamma/systematic risk.

D)gamma/nonsystematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the Treynor-Black model

A)portfolio weights are sensitive to large alpha values which can lead to infeasible long or short positions for many portfolio managers.

B)portfolio weights are not sensitive to large alpha values which can lead to infeasible long or short positions for many portfolio managers.

C)portfolio weights are sensitive to large alpha values which can lead to the optimal portfolio for most portfolio managers.

D)portfolio weights are not sensitive to large alpha values which can lead to the optimal portfolio for most portfolio managers.

A)portfolio weights are sensitive to large alpha values which can lead to infeasible long or short positions for many portfolio managers.

B)portfolio weights are not sensitive to large alpha values which can lead to infeasible long or short positions for many portfolio managers.

C)portfolio weights are sensitive to large alpha values which can lead to the optimal portfolio for most portfolio managers.

D)portfolio weights are not sensitive to large alpha values which can lead to the optimal portfolio for most portfolio managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

20

Benchmark risk is defined as

A)the return difference between the portfolio and the benchmark.

B)the standard deviation of the return of the benchmark portfolio.

C)the standard deviation of the return difference between the portfolio and the benchmark.

D)the standard deviation of the return of the actively managed portfolio.

A)the return difference between the portfolio and the benchmark.

B)the standard deviation of the return of the benchmark portfolio.

C)the standard deviation of the return difference between the portfolio and the benchmark.

D)the standard deviation of the return of the actively managed portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

21

Consider the Treynor-Black model.The alpha of an active portfolio is 1%.The expected return on the market index is 16%.The variance of the return on the market portfolio is 4%.The nonsystematic variance of the active portfolio is 1%.The risk-free rate of return is 8%.The beta of the active portfolio is 1.05.The optimal proportion to invest in the active portfolio is

A)48.7%.

B)50.0%.

C)51.3%.

D)100.0%.

A)48.7%.

B)50.0%.

C)51.3%.

D)100.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

22

There appears to be a role for a theory of active portfolio management because

A)some portfolio managers have produced sequences of abnormal returns that are difficult to label as lucky outcomes.

B)the "noise" in the realized returns is enough to prevent the rejection of the hypothesis that some money managers have outperformed a passive strategy by a statistically small, yet economic, margin.

C)some anomalies in realized returns have been persistent enough to suggest that portfolio managers who identified these anomalies in a timely fashion could have outperformed a passive strategy over prolonged periods.

D)some portfolio managers have produced sequences of abnormal returns that are difficult to label as lucky outcomes and the "noise" in the realized returns is enough to prevent the rejection of the hypothesis that some money managers have outperformed a passive strategy by a statistically small, yet economic, margin.

E)All of the options

A)some portfolio managers have produced sequences of abnormal returns that are difficult to label as lucky outcomes.

B)the "noise" in the realized returns is enough to prevent the rejection of the hypothesis that some money managers have outperformed a passive strategy by a statistically small, yet economic, margin.

C)some anomalies in realized returns have been persistent enough to suggest that portfolio managers who identified these anomalies in a timely fashion could have outperformed a passive strategy over prolonged periods.

D)some portfolio managers have produced sequences of abnormal returns that are difficult to label as lucky outcomes and the "noise" in the realized returns is enough to prevent the rejection of the hypothesis that some money managers have outperformed a passive strategy by a statistically small, yet economic, margin.

E)All of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

23

The beta of an active portfolio is 1.20.The standard deviation of the returns on the market index is 20%.The nonsystematic variance of the active portfolio is 1%.The standard deviation of the returns on the active portfolio is

A)3.84%.

B)5.84%.

C)19.60%.

D)24.17%.

E)26.0%.

A)3.84%.

B)5.84%.

C)19.60%.

D)24.17%.

E)26.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

24

Consider the Treynor-Black model.The alpha of an active portfolio is 2%.The expected return on the market index is 16%.The variance of return on the market portfolio is 4%.The nonsystematic variance of the active portfolio is 1%.The risk-free rate of return is 8%.The beta of the active portfolio is 1.The optimal proportion to invest in the active portfolio is

A)0%.

B)25%.

C)50%.

D)100%.

A)0%.

B)25%.

C)50%.

D)100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

25

An active portfolio manager faces a trade-off between I) using the Sharpe measure.

II) using mean-variance analysis.

III) exploiting perceived security mispricings.

IV) holding too much of the risk-free asset.

V) letting a few stocks dominate the portfolio.

A)I and II

B)II and V

C)III and V

D)III and IV

E)II and III

II) using mean-variance analysis.

III) exploiting perceived security mispricings.

IV) holding too much of the risk-free asset.

V) letting a few stocks dominate the portfolio.

A)I and II

B)II and V

C)III and V

D)III and IV

E)II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

26

One property of a risky portfolio that combines an active portfolio of mispriced securities with a market portfolio is that, when optimized, its squared Sharpe measure increases by the square of the active portfolio's

A)Sharpe ratio.

B)information ratio.

C)alpha.

D)Treynor measure.

E)None of the options

A)Sharpe ratio.

B)information ratio.

C)alpha.

D)Treynor measure.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

27

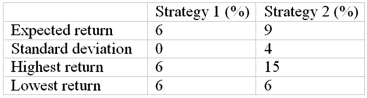

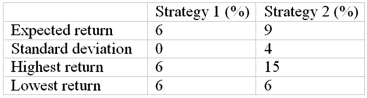

Consider these two investment strategies:  Strategy __________ is the dominant strategy because __________.

Strategy __________ is the dominant strategy because __________.

A)1; it is riskless

B)1; it has the highest reward/risk ratio

C)2; its return is at least equal to Strategy 1 and sometimes greater

D)2; it has the highest reward/risk ratio

E)Both strategies are equally preferred.

Strategy __________ is the dominant strategy because __________.

Strategy __________ is the dominant strategy because __________.A)1; it is riskless

B)1; it has the highest reward/risk ratio

C)2; its return is at least equal to Strategy 1 and sometimes greater

D)2; it has the highest reward/risk ratio

E)Both strategies are equally preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following are not true regarding the Treynor-Black model

A)It considers both macroeconomic and microeconomic risks.

B)It considers security selection only.

C)It is nearly impossible to implement.

D)It considers both macroeconomic and microeconomic risks, and it is nearly impossible to implement.

E)It considers security selection only, and it is nearly impossible to implement.

A)It considers both macroeconomic and microeconomic risks.

B)It considers security selection only.

C)It is nearly impossible to implement.

D)It considers both macroeconomic and microeconomic risks, and it is nearly impossible to implement.

E)It considers security selection only, and it is nearly impossible to implement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

29

According to the Treynor-Black model, the weight of a security in the active portfolio depends on the ratio of __________ to __________.

A)the degree of mispricing; the nonsystematic risk of the security

B)the degree of mispricing; the systematic risk of the security

C)the market sensitivity of the security; the nonsystematic risk of the security

D)the nonsystematic risk of the security; the systematic risk of the security

E)the total return on the security; the nonsystematic risk of the security

A)the degree of mispricing; the nonsystematic risk of the security

B)the degree of mispricing; the systematic risk of the security

C)the market sensitivity of the security; the nonsystematic risk of the security

D)the nonsystematic risk of the security; the systematic risk of the security

E)the total return on the security; the nonsystematic risk of the security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Treynor-Black model

A)considers both macroeconomic and microeconomic risks.

B)considers security selection only.

C)is nearly impossible to implement.

D)considers both macroeconomic and microeconomic risks and is nearly impossible to implement.

E)considers security selection only and is nearly impossible to implement.

A)considers both macroeconomic and microeconomic risks.

B)considers security selection only.

C)is nearly impossible to implement.

D)considers both macroeconomic and microeconomic risks and is nearly impossible to implement.

E)considers security selection only and is nearly impossible to implement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

31

The beta of an active portfolio is 1.36.The standard deviation of the returns on the market index is 22%.The nonsystematic variance of the active portfolio is 1.2%.The standard deviation of the returns on the active portfolio is

A)3.19%.

B)31.86%.

C)42.00%.

D)27.57%.

E)2.86%.

A)3.19%.

B)31.86%.

C)42.00%.

D)27.57%.

E)2.86%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

32

Ideally, clients would like to invest with the portfolio manager who has

A)a moderate personal risk-aversion coefficient.

B)a low personal risk-aversion coefficient.

C)the highest Sharpe measure.

D)the highest record of realized returns.

E)the lowest record of standard deviations.

A)a moderate personal risk-aversion coefficient.

B)a low personal risk-aversion coefficient.

C)the highest Sharpe measure.

D)the highest record of realized returns.

E)the lowest record of standard deviations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

33

A purely passive strategy

A)uses only index funds.

B)uses weights that change in response to market conditions.

C)uses only risk-free assets.

D)is best if there is "noise" in realized returns.

E)is useless if abnormal returns are available.

A)uses only index funds.

B)uses weights that change in response to market conditions.

C)uses only risk-free assets.

D)is best if there is "noise" in realized returns.

E)is useless if abnormal returns are available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Treynor-Black model does not assume that

A)the objective of security analysis is to form an active portfolio of a limited number of mispriced securities.

B)the cost of less than full diversification comes from the nonsystematic risk of the mispriced stock.

C)the optimal weight of a mispriced security in the active portfolio is a function of the degree of mispricing, the market sensitivity of the security, and its degree of nonsystematic risk.

D)indexing is always optimal.

A)the objective of security analysis is to form an active portfolio of a limited number of mispriced securities.

B)the cost of less than full diversification comes from the nonsystematic risk of the mispriced stock.

C)the optimal weight of a mispriced security in the active portfolio is a function of the degree of mispricing, the market sensitivity of the security, and its degree of nonsystematic risk.

D)indexing is always optimal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

35

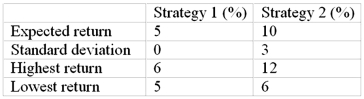

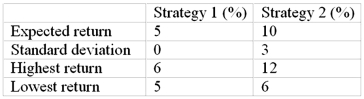

Consider these two investment strategies:  Strategy __________ is the dominant strategy because __________.

Strategy __________ is the dominant strategy because __________.

A)1; it is riskless

B)1; it has the highest reward/risk ratio

C)2; its return is at least equal to Strategy 1 and sometimes greater

D)2; it has the highest reward/risk ratio

E)Both strategies are equally preferred.

Strategy __________ is the dominant strategy because __________.

Strategy __________ is the dominant strategy because __________.A)1; it is riskless

B)1; it has the highest reward/risk ratio

C)2; its return is at least equal to Strategy 1 and sometimes greater

D)2; it has the highest reward/risk ratio

E)Both strategies are equally preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

36

To improve future analyst forecasts using the statistical properties of past forecasts, a regression model can be fitted to past forecasts.The intercept of the regression is a __________ coefficient, and the regression beta represents a __________ coefficient.

A)bias; precision

B)bias; bias

C)precision; precision

D)precision; bias

A)bias; precision

B)bias; bias

C)precision; precision

D)precision; bias

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

37

A purely passive strategy is defined as

A)one that uses only index funds.

B)one that allocates assets in fixed proportions that do not vary with market conditions.

C)one that is mean-variance efficient.

D)one that uses only index funds and allocates assets in fixed proportions that do not vary with market conditions.

E)All of the options

A)one that uses only index funds.

B)one that allocates assets in fixed proportions that do not vary with market conditions.

C)one that is mean-variance efficient.

D)one that uses only index funds and allocates assets in fixed proportions that do not vary with market conditions.

E)All of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

38

Consider the Treynor-Black model.The alpha of an active portfolio is 3%.The expected return on the market index is 18%.The standard deviation of the return on the market portfolio is 25%.The nonsystematic standard deviation of the active portfolio is 15%.The risk-free rate of return is 6%.The beta of the active portfolio is 1.2.The optimal proportion to invest in the active portfolio is

A)50.0%.

B)69.4%.

C)72.3%.

D)80.6%.

E)100.0%.

A)50.0%.

B)69.4%.

C)72.3%.

D)80.6%.

E)100.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Treynor-Black model assumes that

A)the objective of security analysis is to form an active portfolio of a limited number of mispriced securities.

B)the cost of less than full diversification comes from the nonsystematic risk of the mispriced stock.

C)the optimal weight of a mispriced security in the active portfolio is a function of the degree of mispricing, the market sensitivity of the security, and its degree of nonsystematic risk.

D)All of the options

E)None of the options

A)the objective of security analysis is to form an active portfolio of a limited number of mispriced securities.

B)the cost of less than full diversification comes from the nonsystematic risk of the mispriced stock.

C)the optimal weight of a mispriced security in the active portfolio is a function of the degree of mispricing, the market sensitivity of the security, and its degree of nonsystematic risk.

D)All of the options

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

40

A manager who uses the mean-variance theory to construct an optimal portfolio will satisfy

A)investors with low risk-aversion coefficients.

B)investors with high risk-aversion coefficients.

C)investors with moderate risk-aversion coefficients.

D)all investors, regardless of their level of risk aversion.

E)only clients with whom she has established long-term relationships, because she knows their personal preferences.

A)investors with low risk-aversion coefficients.

B)investors with high risk-aversion coefficients.

C)investors with moderate risk-aversion coefficients.

D)all investors, regardless of their level of risk aversion.

E)only clients with whom she has established long-term relationships, because she knows their personal preferences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

41

Discuss the Treynor-Black model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

42

Consider the Treynor-Black model.The alpha of an active portfolio is 1%.The expected return on the market index is 11%.The variance of return on the market portfolio is 6%.The nonsystematic variance of the active portfolio is 2%.The risk-free rate of return is 4%.The beta of the active portfolio is 1.1.The optimal proportion to invest in the active portfolio is

A)45%.

B)25%.

C)50%.

D)100%.

A)45%.

B)25%.

C)50%.

D)100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

43

Kane, Marcus, and Trippi (1999) show that the annualized fee that investors should be willing to pay for active management, over and above the fee charged by a passive index fund, does not depend on I) the investor's coefficient of risk aversion.

II) the value of at-the-money call option on the market portfolio.

III) the value of out-of-the-money call option on the market portfolio.

IV) the precision of the security analyst.

V) the distribution of the squared information ratio of in the universe of securities.

A)I, II, and IV

B)II, III, and V

C)II and III

D)I, IV, and V

E)II, IV, and V

II) the value of at-the-money call option on the market portfolio.

III) the value of out-of-the-money call option on the market portfolio.

IV) the precision of the security analyst.

V) the distribution of the squared information ratio of in the universe of securities.

A)I, II, and IV

B)II, III, and V

C)II and III

D)I, IV, and V

E)II, IV, and V

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

44

The beta of an active portfolio is 1.45.The standard deviation of the returns on the market index is 22%.The nonsystematic variance of the active portfolio is 3%.The standard deviation of the returns on the active portfolio is

A)36.30%.

B)5.84%.

C)19.60%.

D)24.17%.

E)26.0%.

A)36.30%.

B)5.84%.

C)19.60%.

D)24.17%.

E)26.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

45

Perfect timing ability is equivalent to having __________ on the market portfolio.

A)a call option

B)a futures contract

C)a put option

D)a commodities contract

A)a call option

B)a futures contract

C)a put option

D)a commodities contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider the Treynor-Black model.The alpha of an active portfolio is 2%.The expected return on the market index is 12%.The variance of the return on the market portfolio is 4%.The nonsystematic variance of the active portfolio is 2%.The risk-free rate of return is 3%.The beta of the active portfolio is 1.15.The optimal proportion to invest in the active portfolio is

A)48.7%.

B)98.3%.

C)47.6%.

D)100.0%.

A)48.7%.

B)98.3%.

C)47.6%.

D)100.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

47

You have a record of an analyst's past forecasts of alpha.Describe how you would use this information within the context of the Treynor-Black model to determine the forecasting ability of the analyst.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

48

To determine the optimal risky portfolio in the Treynor-Black model, macroeconomic forecasts are used for the _________ and composite forecasts are used for the __________.

A)passive index portfolio; active portfolio

B)active portfolio, passive index portfolio

C)expected return; standard deviation

D)expected return ; beta coefficient

E)alpha coefficient; beta coefficient

A)passive index portfolio; active portfolio

B)active portfolio, passive index portfolio

C)expected return; standard deviation

D)expected return ; beta coefficient

E)alpha coefficient; beta coefficient

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

49

Consider the Treynor-Black model.The alpha of an active portfolio is 3%.The expected return on the market index is 10%.The variance of the return on the market portfolio is 4%.The nonsystematic variance of the active portfolio is 2%.The risk-free rate of return is 3%.The beta of the active portfolio is 1.15.The optimal proportion to invest in the active portfolio is

A)48.7%.

B)98.4%.

C)51.3%.

D)100.0%.

A)48.7%.

B)98.4%.

C)51.3%.

D)100.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck

50

Kane, Marcus, and Trippi (1999) show that the annualized fee that investors should be willing to pay for active management, over and above the fee charged by a passive index fund, depends on I) the investor's coefficient of risk aversion.

II) the value of at-the-money call option on the market portfolio.

III) the value of out-of-the-money call option on the market portfolio.

IV) the precision of the security analyst.

V) the distribution of the squared information ratio of in the universe of securities.

A)I, II, and IV

B)I, III, and V

C)II, IV, and V

D)I, IV, and V

E)II, III, and V

II) the value of at-the-money call option on the market portfolio.

III) the value of out-of-the-money call option on the market portfolio.

IV) the precision of the security analyst.

V) the distribution of the squared information ratio of in the universe of securities.

A)I, II, and IV

B)I, III, and V

C)II, IV, and V

D)I, IV, and V

E)II, III, and V

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 50 في هذه المجموعة.

فتح الحزمة

k this deck