Deck 20: Options Markets: Introduction

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/108

العب

ملء الشاشة (f)

Deck 20: Options Markets: Introduction

1

The price that the buyer of a call option pays for the underlying asset if she executes her option is called the

A)strike price.

B)exercise price.

C)execution price.

D)strike price or execution price.

E)strike price or exercise price.

A)strike price.

B)exercise price.

C)execution price.

D)strike price or execution price.

E)strike price or exercise price.

E

Explanation: The price that the buyer of a call option pays for the underlying asset if she executes her option is strike price or exercise price.

Explanation: The price that the buyer of a call option pays for the underlying asset if she executes her option is strike price or exercise price.

2

An American call option allows the buyer to

A)sell the underlying asset at the exercise price on or before the expiration date.

B)buy the underlying asset at the exercise price on or before the expiration date.

C)sell the option in the open market prior to expiration.

D)sell the underlying asset at the exercise price on or before the expiration date and sell the option in the open market prior to expiration.

E)buy the underlying asset at the exercise price on or before the expiration date and sell the option in the open market prior to expiration.

A)sell the underlying asset at the exercise price on or before the expiration date.

B)buy the underlying asset at the exercise price on or before the expiration date.

C)sell the option in the open market prior to expiration.

D)sell the underlying asset at the exercise price on or before the expiration date and sell the option in the open market prior to expiration.

E)buy the underlying asset at the exercise price on or before the expiration date and sell the option in the open market prior to expiration.

E

Explanation: An American call option may be exercised (allowing the holder to buy the underlying asset) on or before expiration; the option contract also may be sold prior to expiration.

Explanation: An American call option may be exercised (allowing the holder to buy the underlying asset) on or before expiration; the option contract also may be sold prior to expiration.

3

A European put option can be exercised

A)any time in the future.

B)only on the expiration date.

C)if the price of the underlying asset declines below the exercise price.

D)immediately after dividends are paid.

A)any time in the future.

B)only on the expiration date.

C)if the price of the underlying asset declines below the exercise price.

D)immediately after dividends are paid.

B

Explanation: European options can be exercised at expiration only.

Explanation: European options can be exercised at expiration only.

4

The price that the buyer of a put option receives for the underlying asset if she executes her option is called the

A)strike price.

B)exercise price.

C)execution price.

D)strike price or execution price.

E)strike price or exercise price.

A)strike price.

B)exercise price.

C)execution price.

D)strike price or execution price.

E)strike price or exercise price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

5

A European put option allows the holder to

A)buy the underlying asset at the striking price on or before the expiration date.

B)sell the underlying asset at the striking price on or before the expiration date.

C)potentially benefit from a stock price increase.

D)sell the underlying asset at the striking price on the expiration date.

E)potentially benefit from a stock price increase and sell the underlying asset at the striking price on the expiration date.

A)buy the underlying asset at the striking price on or before the expiration date.

B)sell the underlying asset at the striking price on or before the expiration date.

C)potentially benefit from a stock price increase.

D)sell the underlying asset at the striking price on the expiration date.

E)potentially benefit from a stock price increase and sell the underlying asset at the striking price on the expiration date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

6

All else equal, call option values are higher

A)in the month of May.

B)for low dividend payout policies.

C)for high dividend payout policies.

D)in the month of May and for low dividend payout policies.

E)in the month of May and for high dividend payout policies.

A)in the month of May.

B)for low dividend payout policies.

C)for high dividend payout policies.

D)in the month of May and for low dividend payout policies.

E)in the month of May and for high dividend payout policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

7

The price that the writer of a call option receives to sell the option is called the

A)strike price.

B)exercise price.

C)execution price.

D)acquisition price.

E)premium.

A)strike price.

B)exercise price.

C)execution price.

D)acquisition price.

E)premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

8

A European call option allows the buyer to

A)sell the underlying asset at the exercise price on the expiration date.

B)buy the underlying asset at the exercise price on or before the expiration date.

C)sell the option in the open market prior to expiration.

D)buy the underlying asset at the exercise price on the expiration date.

E)sell the option in the open market prior to expiration and buy the underlying asset at the exercise price on the expiration date.

A)sell the underlying asset at the exercise price on the expiration date.

B)buy the underlying asset at the exercise price on or before the expiration date.

C)sell the option in the open market prior to expiration.

D)buy the underlying asset at the exercise price on the expiration date.

E)sell the option in the open market prior to expiration and buy the underlying asset at the exercise price on the expiration date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

9

To adjust for stock splits

A)the exercise price of the option is reduced by the factor of the split and the number of options held is increased by that factor.

B)the exercise price of the option is increased by the factor of the split and the number of options held is reduced by that factor.

C)the exercise price of the option is reduced by the factor of the split and the number of options held is reduced by that factor.

D)the exercise price of the option is increased by the factor of the split and the number of options held is increased by that factor.

A)the exercise price of the option is reduced by the factor of the split and the number of options held is increased by that factor.

B)the exercise price of the option is increased by the factor of the split and the number of options held is reduced by that factor.

C)the exercise price of the option is reduced by the factor of the split and the number of options held is reduced by that factor.

D)the exercise price of the option is increased by the factor of the split and the number of options held is increased by that factor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

10

The current market price of a share of AT&T stock is $50.If a call option on this stock has a strike price of $45, the call

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of AT&T stock is $40.

D)is out of the money and sells for a higher price than if the market price of AT&T stock is $40.

E)is in the money and sells for a higher price than if the market price of AT&T stock is $40.

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of AT&T stock is $40.

D)is out of the money and sells for a higher price than if the market price of AT&T stock is $40.

E)is in the money and sells for a higher price than if the market price of AT&T stock is $40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

11

The price that the writer of a put option receives for the underlying asset if the option is exercised is called the

A)strike price.

B)exercise price.

C)execution price.

D)strike price or exercise price.

E)None of the options

A)strike price.

B)exercise price.

C)execution price.

D)strike price or exercise price.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

12

All else equal, call option values are lower

A)in the month of May.

B)for low dividend payout policies.

C)for high dividend payout policies.

D)in the month of May and for low dividend payout policies.

E)in the month of May and for high dividend payout policies.

A)in the month of May.

B)for low dividend payout policies.

C)for high dividend payout policies.

D)in the month of May and for low dividend payout policies.

E)in the month of May and for high dividend payout policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

13

The price that the writer of a call option receives for the underlying asset if the buyer executes her option is called the

A)strike price.

B)exercise price.

C)execution price.

D)strike price or exercise price.

E)strike price or execution price.

A)strike price.

B)exercise price.

C)execution price.

D)strike price or exercise price.

E)strike price or execution price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

14

The price that the buyer of a put option pays to acquire the option is called the

A)strike price.

B)exercise price.

C)execution price.

D)acquisition price.

E)premium.

A)strike price.

B)exercise price.

C)execution price.

D)acquisition price.

E)premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

15

An American put option allows the holder to

A)buy the underlying asset at the striking price on or before the expiration date.

B)sell the underlying asset at the striking price on or before the expiration date.

C)potentially benefit from a stock price increase.

D)sell the underlying asset at the striking price on or before the expiration date and potentially benefit from a stock price increase.

E)buy the underlying asset at the striking price on or before the expiration date and potentially benefit from a stock price increase.

A)buy the underlying asset at the striking price on or before the expiration date.

B)sell the underlying asset at the striking price on or before the expiration date.

C)potentially benefit from a stock price increase.

D)sell the underlying asset at the striking price on or before the expiration date and potentially benefit from a stock price increase.

E)buy the underlying asset at the striking price on or before the expiration date and potentially benefit from a stock price increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

16

The price that the writer of a put option receives to sell the option is called the

A)premium.

B)exercise price.

C)execution price.

D)acquisition price.

E)strike price.

A)premium.

B)exercise price.

C)execution price.

D)acquisition price.

E)strike price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

17

An American put option can be exercised

A)any time on or before the expiration date.

B)only on the expiration date.

C)any time in the indefinite future.

D)only after dividends are paid.

E)None of the options

A)any time on or before the expiration date.

B)only on the expiration date.

C)any time in the indefinite future.

D)only after dividends are paid.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

18

A European call option can be exercised

A)any time in the future.

B)only on the expiration date.

C)if the price of the underlying asset declines below the exercise price.

D)immediately after dividends are paid.

A)any time in the future.

B)only on the expiration date.

C)if the price of the underlying asset declines below the exercise price.

D)immediately after dividends are paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

19

The price that the buyer of a call option pays to acquire the option is called the

A)strike price.

B)exercise price.

C)execution price.

D)acquisition price.

E)premium.

A)strike price.

B)exercise price.

C)execution price.

D)acquisition price.

E)premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

20

An American call option can be exercised

A)any time on or before the expiration date.

B)only on the expiration date.

C)any time in the indefinite future.

D)only after dividends are paid.

E)None of the options

A)any time on or before the expiration date.

B)only on the expiration date.

C)any time in the indefinite future.

D)only after dividends are paid.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

21

A put option on a stock is said to be in the money if

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

22

The current market price of a share of CSCO stock is $22.If a call option on this stock has a strike price of $20, the call

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of CSCO stock is $21.

D)is out of the money and sells for a higher price than if the market price of CSCO stock is $21.

E)is in the money and sells for a higher price than if the market price of CSCO stock is $21.

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of CSCO stock is $21.

D)is out of the money and sells for a higher price than if the market price of CSCO stock is $21.

E)is in the money and sells for a higher price than if the market price of CSCO stock is $21.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

23

The current market price of a share of MOT stock is $24.If a call option on this stock has a strike price of $24, the call

A)is out of the money.

B)is in the money.

C)is at the money.

D)None of the options

A)is out of the money.

B)is in the money.

C)is at the money.

D)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

24

A call option on a stock is said to be at the money if

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

25

The current market price of a share of IBM stock is $195.If a call option on this stock has a strike price of $195, the call

A)is out of the money.

B)is in the money.

C)is at the money.

D)None of the options

A)is out of the money.

B)is in the money.

C)is at the money.

D)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

26

A call option on a stock is said to be in the money if

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

27

The current market price of a share of a stock is $20.If a put option on this stock has a strike price of $18, the put

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the strike price of the put option was $23.

D)is out of the money and sells for a higher price than if the strike price of the put option was $23.

E)is in the money and sells for a higher price than if the strike price of the put option was $23.

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the strike price of the put option was $23.

D)is out of the money and sells for a higher price than if the strike price of the put option was $23.

E)is in the money and sells for a higher price than if the strike price of the put option was $23.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

28

The current market price of a share of CSCO stock is $22.If a put option on this stock has a strike price of $20, the put

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the strike price of the put option was $25.

D)is out of the money and sells for a higher price than if the strike price of the put option was $25.

E)is in the money and sells for a higher price than if the strike price of the put option was $25.

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the strike price of the put option was $25.

D)is out of the money and sells for a higher price than if the strike price of the put option was $25.

E)is in the money and sells for a higher price than if the strike price of the put option was $25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

29

The current market price of a share of a stock is $80.If a put option on this stock has a strike price of $75, the put

A)is in the money.

B)is out of the money.

C)sells for a lower price than if the market price of the stock is $75.

D)is in the money and sells for a lower price than if the market price of the stock is $75.

E)is out of the money and sells for a lower price than if the market price of the stock is $75.

A)is in the money.

B)is out of the money.

C)sells for a lower price than if the market price of the stock is $75.

D)is in the money and sells for a lower price than if the market price of the stock is $75.

E)is out of the money and sells for a lower price than if the market price of the stock is $75.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

30

The current market price of a share of AT&T stock is $50.If a put option on this stock has a strike price of $45, the put

A)is out of the money.

B)is in the money.

C)sells for a lower price than if the market price of AT&T stock is $40.

D)is out of the money and sells for a lower price than if the market price of AT&T stock is $40.

E)is in the money and sells for a lower price than if the market price of AT&T stock is $40.

A)is out of the money.

B)is in the money.

C)sells for a lower price than if the market price of AT&T stock is $40.

D)is out of the money and sells for a lower price than if the market price of AT&T stock is $40.

E)is in the money and sells for a lower price than if the market price of AT&T stock is $40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

31

The current market price of a share of Boeing stock is $75.If a call option on this stock has a strike price of $70, the call

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of Boeing stock is $70.

D)is out of the money and sells for a higher price than if the market price of Boeing stock is $70.

E)is in the money and sells for a higher price than if the market price of Boeing stock is $70.

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of Boeing stock is $70.

D)is out of the money and sells for a higher price than if the market price of Boeing stock is $70.

E)is in the money and sells for a higher price than if the market price of Boeing stock is $70.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

32

The current market price of a share of MOT stock is $15.If a put option on this stock has a strike price of $20, the put

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

33

The current market price of a share of JNJ stock is $60.If a put option on this stock has a strike price of $55, the put

A)is in the money.

B)is out of the money.

C)sells for a lower price than if the market price of JNJ stock is $50.

D)is in the money and sells for a lower price than if the market price of JNJ stock is $50.

E)is out of the money and sells for a lower price than if the market price of JNJ stock is $50.

A)is in the money.

B)is out of the money.

C)sells for a lower price than if the market price of JNJ stock is $50.

D)is in the money and sells for a lower price than if the market price of JNJ stock is $50.

E)is out of the money and sells for a lower price than if the market price of JNJ stock is $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

34

The current market price of a share of CAT stock is $76.If a call option on this stock has a strike price of $76, the call

A)is out of the money.

B)is in the money.

C)is at the money.

D)None of the options

A)is out of the money.

B)is in the money.

C)is at the money.

D)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

35

A put option on a stock is said to be out of the money if

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

36

A call option on a stock is said to be out of the money if

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

37

A put option on a stock is said to be at the money if

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

A)the exercise price is higher than the stock price.

B)the exercise price is less than the stock price.

C)the exercise price is equal to the stock price.

D)the price of the put is higher than the price of the call.

E)the price of the call is higher than the price of the put.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

38

The current market price of a share of TSCO stock is $75.If a put option on this stock has a strike price of $79, the put

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

39

The current market price of a share of Disney stock is $60.If a call option on this stock has a strike price of $65, the call

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

40

The current market price of a share of Boeing stock is $75.If a put option on this stock has a strike price of $70, the put

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of Boeing stock is $70.

D)is out of the money and sells for a higher price than if the market price of Boeing stock is $70.

E)is in the money and sells for a higher price than if the market price of Boeing stock is $70.

A)is out of the money.

B)is in the money.

C)sells for a higher price than if the market price of Boeing stock is $70.

D)is out of the money and sells for a higher price than if the market price of Boeing stock is $70.

E)is in the money and sells for a higher price than if the market price of Boeing stock is $70.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

41

A covered call position is

A)the simultaneous purchase of the call and the underlying asset.

B)the purchase of a share of stock with a simultaneous sale of a put on that stock.

C)the short sale of a share of stock with a simultaneous sale of a call on that stock.

D)the purchase of a share of stock with a simultaneous sale of a call on that stock.

E)the simultaneous purchase of a call and sale of a put on the same stock.

A)the simultaneous purchase of the call and the underlying asset.

B)the purchase of a share of stock with a simultaneous sale of a put on that stock.

C)the short sale of a share of stock with a simultaneous sale of a call on that stock.

D)the purchase of a share of stock with a simultaneous sale of a call on that stock.

E)the simultaneous purchase of a call and sale of a put on the same stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

42

The maximum loss a buyer of a stock call option can suffer is equal to

A)the striking price minus the stock price.

B)the stock price minus the value of the call.

C)the call premium.

D)the stock price.

E)None of the options

A)the striking price minus the stock price.

B)the stock price minus the value of the call.

C)the call premium.

D)the stock price.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

43

Buyers of put options anticipate the value of the underlying asset will __________ and sellers of call options anticipate the value of the underlying asset will ________.

A)increase; increase

B)decrease; increase

C)increase; decrease

D)decrease; decrease

E)Cannot tell without further information

A)increase; increase

B)decrease; increase

C)increase; decrease

D)decrease; decrease

E)Cannot tell without further information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

44

According to the put-call parity theorem, the value of a European put option on a nondividend paying stock is equal to

A)the call value plus the present value of the exercise price plus the stock price.

B)the call value plus the present value of the exercise price minus the stock price.

C)the present value of the stock price minus the exercise price minus the call price.

D)the present value of the stock price plus the exercise price minus the call price.

E)None of the options

A)the call value plus the present value of the exercise price plus the stock price.

B)the call value plus the present value of the exercise price minus the stock price.

C)the present value of the stock price minus the exercise price minus the call price.

D)the present value of the stock price plus the exercise price minus the call price.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

45

The potential loss for a writer of a naked call option on a stock is

A)limited.

B)unlimited.

C)larger the lower the stock price.

D)equal to the call premium.

E)None of the options

A)limited.

B)unlimited.

C)larger the lower the stock price.

D)equal to the call premium.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

46

You purchase one JNJ 75 call option for a premium of $3.Ignoring transaction costs, the break-even price of the position is

A)$75.

B)$72.

C)$3.

D)$78.

A)$75.

B)$72.

C)$3.

D)$78.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

47

You write one AT&T February 50 put for a premium of $5.Ignoring transactions costs, what is the break-even price of this position

A)$50

B)$55

C)$45

D)$40

A)$50

B)$55

C)$45

D)$40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

48

The current market price of a share of Disney stock is $60.If a put option on this stock has a strike price of $65, the put

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

49

Binary options

A)are based on two possible outcomes-yes or no.

B)may make a payoff of a fixed amount if a specified event happens.

C)may make a payoff of a fixed amount if a specified event does not happen.

D)may make a payoff of a fixed amount if a specified event happens and are based on two possible outcomes-yes or no.

E)All of the options

A)are based on two possible outcomes-yes or no.

B)may make a payoff of a fixed amount if a specified event happens.

C)may make a payoff of a fixed amount if a specified event does not happen.

D)may make a payoff of a fixed amount if a specified event happens and are based on two possible outcomes-yes or no.

E)All of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

50

Barrier options have payoffs that

A)have payoffs that only depend on the minimum price of the underlying asset during the life of the option.

B)depend both on the asset's price at expiration and on whether the underlying asset's price has crossed through some barrier.

C)are known in advance.

D)have payoffs that only depend on the maximum price of the underlying asset during the life of the option.

A)have payoffs that only depend on the minimum price of the underlying asset during the life of the option.

B)depend both on the asset's price at expiration and on whether the underlying asset's price has crossed through some barrier.

C)are known in advance.

D)have payoffs that only depend on the maximum price of the underlying asset during the life of the option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

51

You purchase one IBM 200 call option for a premium of $6.Ignoring transaction costs, the break-even price of the position is

A)$194.

B)$228.

C)$206.

D)$211.

A)$194.

B)$228.

C)$206.

D)$211.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

52

The current market price of a share of CAT stock is $76.If a put option on this stock has a strike price of $80, the put

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

A)is out of the money.

B)is in the money.

C)can be exercised profitably.

D)is out of the money and can be exercised profitably.

E)is in the money and can be exercised profitably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

53

Call options on IBM listed stock options are

A)issued by IBM Corporation.

B)created by investors.

C)traded on various exchanges.

D)issued by IBM Corporation and traded on various exchanges.

E)created by investors and traded on various exchanges.

A)issued by IBM Corporation.

B)created by investors.

C)traded on various exchanges.

D)issued by IBM Corporation and traded on various exchanges.

E)created by investors and traded on various exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

54

Currency-translated options have

A)only asset prices denoted in a foreign currency.

B)only exercise prices denoted in a foreign currency.

C)payoffs that only depend on the maximum price of the underlying asset during the life of the option.

D)either asset or exercise prices denoted in a foreign currency.

A)only asset prices denoted in a foreign currency.

B)only exercise prices denoted in a foreign currency.

C)payoffs that only depend on the maximum price of the underlying asset during the life of the option.

D)either asset or exercise prices denoted in a foreign currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

55

Lookback options have payoffs that

A)depend in part on the minimum or maximum price of the underlying asset during the life of the option.

B)only depend on the minimum price of the underlying asset during the life of the option.

C)only depend on the maximum price of the underlying asset during the life of the option.

D)are known in advance.

A)depend in part on the minimum or maximum price of the underlying asset during the life of the option.

B)only depend on the minimum price of the underlying asset during the life of the option.

C)only depend on the maximum price of the underlying asset during the life of the option.

D)are known in advance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

56

You write one JNJ February 70 put for a premium of $5.Ignoring transactions costs, what is the break-even price of this position

A)$65

B)$75

C)$5

D)$70

A)$65

B)$75

C)$5

D)$70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Option Clearing Corporation is owned by

A)the Federal Reserve System.

B)the exchanges on which stock options are traded.

C)the major U.S.banks.

D)the Federal Deposit Insurance Corporation.

A)the Federal Reserve System.

B)the exchanges on which stock options are traded.

C)the major U.S.banks.

D)the Federal Deposit Insurance Corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

58

Buyers of call options __________ required to post margin deposits and sellers of put options __________ required to post margin deposits.

A)are; are not

B)are; are

C)are not; are

D)are not; are not

E)are always; are sometimes

A)are; are not

B)are; are

C)are not; are

D)are not; are not

E)are always; are sometimes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

59

The maximum loss a buyer of a stock put option can suffer is equal to

A)the striking price minus the stock price.

B)the stock price minus the value of the call.

C)the put premium.

D)the stock price.

E)None of the options

A)the striking price minus the stock price.

B)the stock price minus the value of the call.

C)the put premium.

D)the stock price.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

60

The lower bound on the market price of a convertible bond is

A)its straight bond value.

B)its crooked bond value.

C)its conversion value.

D)its straight bond value and its conversion value.

E)None of the options

A)its straight bond value.

B)its crooked bond value.

C)its conversion value.

D)its straight bond value and its conversion value.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

61

Suppose you purchase one WFM May 100 call contract at $5 and write one WFM May 105 call contract at $2. The maximum loss you could suffer from your strategy is

A)$200.

B)$300.

C)zero.

D)$500.

A)$200.

B)$300.

C)zero.

D)$500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

62

Before expiration, the time value of a call option is equal to

A)zero.

B)the actual call price minus the intrinsic value of the call.

C)the intrinsic value of the call.

D)the actual call price plus the intrinsic value of the call.

A)zero.

B)the actual call price minus the intrinsic value of the call.

C)the intrinsic value of the call.

D)the actual call price plus the intrinsic value of the call.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

63

Suppose you purchase one WFM May 100 call contract at $5 and write one WFM May 105 call contract at $2. If, at expiration, the price of a share of WFM stock is $103, your profit would be

A)$500.

B)$300.

C)zero.

D)$200.

A)$500.

B)$300.

C)zero.

D)$200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

64

A protective put strategy is

A)a long put plus a long position in the underlying asset.

B)a long put plus a long call on the same underlying asset.

C)a long call plus a short put on the same underlying asset.

D)a long put plus a short call on the same underlying asset.

E)None of the options

A)a long put plus a long position in the underlying asset.

B)a long put plus a long call on the same underlying asset.

C)a long call plus a short put on the same underlying asset.

D)a long put plus a short call on the same underlying asset.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

65

You purchased one AT&T March 50 put and sold one AT&T April 50 put.Your strategy is known as

A)a vertical spread.

B)a straddle.

C)a time spread.

D)a collar.

A)a vertical spread.

B)a straddle.

C)a time spread.

D)a collar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

66

The value of a stock put option is positively related to the following factors except

A)the time to expiration.

B)the striking price.

C)the stock price.

D)All of the options

E)None of the options

A)the time to expiration.

B)the striking price.

C)the stock price.

D)All of the options

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

67

Suppose the price of a share of IBM stock is $200.An April call option on IBM stock has a premium of $5 and an exercise price of $200.Ignoring commissions, the holder of the call option will earn a profit if the price of the share

A)increases to $204.

B)decreases to $190.

C)increases to $206.

D)decreases to $196.

E)None of the options

A)increases to $204.

B)decreases to $190.

C)increases to $206.

D)decreases to $196.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

68

You purchase one June 70 put contract for a put premium of $4.What is the maximum profit that you could gain from this strategy

A)$7,000

B)$400

C)$7,400

D)$6,600

E)None of the options

A)$7,000

B)$400

C)$7,400

D)$6,600

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

69

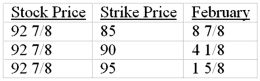

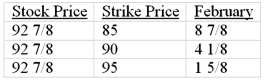

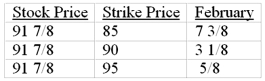

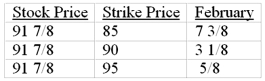

The following price quotations on WFM were taken from the Wall Street Journal.  The premium on one WFM February 90 call contract is

The premium on one WFM February 90 call contract is

A)$4.1250.

B)$418.00.

C)$412.50.

D)$158.00.

The premium on one WFM February 90 call contract is

The premium on one WFM February 90 call contract isA)$4.1250.

B)$418.00.

C)$412.50.

D)$158.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

70

Suppose you purchase one WFM May 100 call contract at $5 and write one WFM May 105 call contract at $2. What is the lowest stock price at which you can break even

A)$101

B)$102

C)$103

D)$104

E)None of the options

A)$101

B)$102

C)$103

D)$104

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

71

The following price quotations on WFM were taken from the Wall Street Journal.  The premium on one WFM February 85 call contract is

The premium on one WFM February 85 call contract is

A)$8.875.

B)$887.50.

C)$412.50.

D)$158.00.

The premium on one WFM February 85 call contract is

The premium on one WFM February 85 call contract isA)$8.875.

B)$887.50.

C)$412.50.

D)$158.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

72

You purchase one IBM March 200 put contract for a put premium of $6.What is the maximum profit that you could gain from this strategy

A)$20,000

B)$20,600

C)$19,400

D)$19,000

A)$20,000

B)$20,600

C)$19,400

D)$19,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

73

All of the following factors affect the price of a stock option except

A)the risk-free rate.

B)the riskiness of the stock.

C)the time to expiration.

D)the expected rate of return on the stock.

E)None of the options

A)the risk-free rate.

B)the riskiness of the stock.

C)the time to expiration.

D)the expected rate of return on the stock.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following factors affect the price of a stock option

A)The risk-free rate

B)The riskiness of the stock

C)The time to expiration

D)The expected rate of return on the stock

E)The risk-free rate, riskiness of the stock, and time to expiration

A)The risk-free rate

B)The riskiness of the stock

C)The time to expiration

D)The expected rate of return on the stock

E)The risk-free rate, riskiness of the stock, and time to expiration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

75

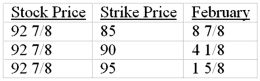

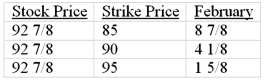

The following price quotations were taken from the Wall Street Journal.  The premium on one February 90 call contract is

The premium on one February 90 call contract is

A)$3.1250.

B)$318.00.

C)$312.50.

D)$58.00.

The premium on one February 90 call contract is

The premium on one February 90 call contract isA)$3.1250.

B)$318.00.

C)$312.50.

D)$58.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

76

Suppose the price of a share of Google stock is $500.An April call option on Google stock has a premium of $5 and an exercise price of $500.Ignoring commissions, the holder of the call option will earn a profit if the price of the share

A)increases to $504.

B)decreases to $490.

C)increases to $506.

D)decreases to $496.

E)None of the options

A)increases to $504.

B)decreases to $490.

C)increases to $506.

D)decreases to $496.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

77

You purchase one September 50 put contract for a put premium of $2.What is the maximum profit that you could gain from this strategy

A)$4,800

B)$200

C)$5,000

D)$5,200

E)None of the options

A)$4,800

B)$200

C)$5,000

D)$5,200

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

78

The value of a stock put option is positively related to

A)the time to expiration.

B)the striking price.

C)the stock price.

D)All of the options

E)the time to expiration and the striking price.

A)the time to expiration.

B)the striking price.

C)the stock price.

D)All of the options

E)the time to expiration and the striking price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

79

You purchased one AT&T March 50 call and sold one AT&T March 55 call.Your strategy is known as

A)a long straddle.

B)a horizontal spread.

C)a money spread.

D)a short straddle.

E)None of the options

A)a long straddle.

B)a horizontal spread.

C)a money spread.

D)a short straddle.

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

80

Suppose you purchase one WFM May 100 call contract at $5 and write one WFM May 105 call contract at $2. The maximum potential profit of your strategy is ________ if both options are exercised.

A)$600

B)$500

C)$200

D)$300

E)$100

A)$600

B)$500

C)$200

D)$300

E)$100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck