Deck 16: Efficiency Vsequality: The Big Trade-Off

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/79

العب

ملء الشاشة (f)

Deck 16: Efficiency Vsequality: The Big Trade-Off

1

Growth in spending by all levels of government in the United States over the past half-century:

A)has kept pace with neither tax revenues nor real GDP.

B)has kept pace, except for an occasional wartime surge, with both tax revenues and real GDP.

C)has kept pace, except for an occasional wartime surge, with both tax revenues and nominal GDP.

D)has surged at a rate that has significantly exceeded the rate of growth of nominal GDP.

E)has surged at a rate that has significantly exceeded the rate of growth of tax receipts.

A)has kept pace with neither tax revenues nor real GDP.

B)has kept pace, except for an occasional wartime surge, with both tax revenues and real GDP.

C)has kept pace, except for an occasional wartime surge, with both tax revenues and nominal GDP.

D)has surged at a rate that has significantly exceeded the rate of growth of nominal GDP.

E)has surged at a rate that has significantly exceeded the rate of growth of tax receipts.

has kept pace, except for an occasional wartime surge, with both tax revenues and nominal GDP.

2

Which of the following are the main areas of international issues for the economy?

A)Reducing trade barriers.

B)Conducting assistance programs.

C)Coordinating macroeconomic policies.

D)Protecting the global environment.

E)All of the above.

A)Reducing trade barriers.

B)Conducting assistance programs.

C)Coordinating macroeconomic policies.

D)Protecting the global environment.

E)All of the above.

All of the above.

3

Which of the following is an appropriate economic goal for government in a mixed economy?

A)Improving economic efficiency.

B)Reducing economic inequality.

C)Stabilizing the economy through macroeconomic policies.

D)Conducting international economic policy.

E)All of the above.

A)Improving economic efficiency.

B)Reducing economic inequality.

C)Stabilizing the economy through macroeconomic policies.

D)Conducting international economic policy.

E)All of the above.

All of the above.

4

Broadly defined, public choice theory is the branch of economics that studies:

A)monetary policies pursued by the Federal Reserve.

B)the way that governments make decisions.

C)the consumer decision-making process.

D)the effect of externalities on public welfare.

E)the ways that statistics can be used to analyze economic data.

A)monetary policies pursued by the Federal Reserve.

B)the way that governments make decisions.

C)the consumer decision-making process.

D)the effect of externalities on public welfare.

E)the ways that statistics can be used to analyze economic data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

5

If government use of resources becomes more efficient, then:

A)a rational society will necessarily spend more resources on the public sector.

B)a rational society will necessarily spend fewer resources on the public sector.

C)society necessarily moves from inside the production possibility frontier out toward that frontier.

D)a rational society necessarily chooses more of both public and private goods.

E)none of the above.

A)a rational society will necessarily spend more resources on the public sector.

B)a rational society will necessarily spend fewer resources on the public sector.

C)society necessarily moves from inside the production possibility frontier out toward that frontier.

D)a rational society necessarily chooses more of both public and private goods.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

6

By 2007, the combined cost of all levels of government in the United States had risen from approximately 11% of GDP in 1930 to:

A)50% of GDP.

B)33% of GDP.

C)25% of GDP.

D)15% of GDP.

E)10% of GDP.

A)50% of GDP.

B)33% of GDP.

C)25% of GDP.

D)15% of GDP.

E)10% of GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

7

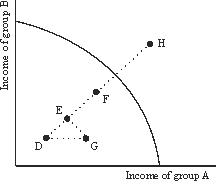

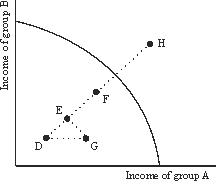

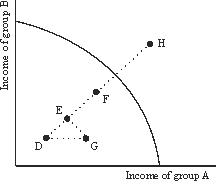

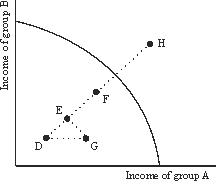

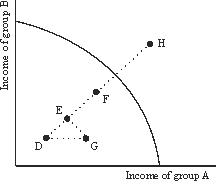

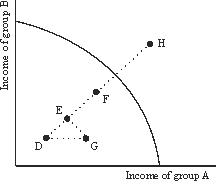

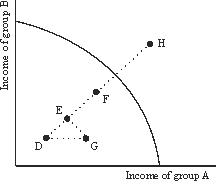

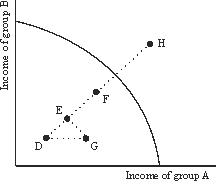

Use the following to answer questions :

Figure 16-1

Which point in Figure 16-1 could represent an income distribution under a laissez-faire economy?

A)E

B)F

C)G

D)D

E)All of the above.

Figure 16-1

Which point in Figure 16-1 could represent an income distribution under a laissez-faire economy?

A)E

B)F

C)G

D)D

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

8

Because the United States is organized around a "one person, one vote" rule, the impact of the political structure on economic performance and decision making is:

A)an essential and growing field of scholarly research.

B)difficult to determine, in general, but nonetheless susceptible to productive research.

C)based in part on the question of whether or not that structure is capable of doing what ought to be done, however that is defined.

D)producing results that suggest that some objectives and some political structures are incompatible.

E)all of the above.

A)an essential and growing field of scholarly research.

B)difficult to determine, in general, but nonetheless susceptible to productive research.

C)based in part on the question of whether or not that structure is capable of doing what ought to be done, however that is defined.

D)producing results that suggest that some objectives and some political structures are incompatible.

E)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

9

Use the following to answer questions :

Figure 16-1

What type of event could move the economy from point E to G in Figure 16-1?

A)A tax which redistributes income from rich to poor.

B)Massive highway construction

C)Tax on rich which subsidizes income support programs.

D)A and B

E)A and C

Figure 16-1

What type of event could move the economy from point E to G in Figure 16-1?

A)A tax which redistributes income from rich to poor.

B)Massive highway construction

C)Tax on rich which subsidizes income support programs.

D)A and B

E)A and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

10

Laissez-faire policies in the United States gave way to some regulatory activity in part in response to problems with:

A)hazards in the workplace.

B)hazards facing consumers.

C)information that kept buyers from knowing completely the value of their purchases.

D)discrimination in the workplace.

E)all of the above.

A)hazards in the workplace.

B)hazards facing consumers.

C)information that kept buyers from knowing completely the value of their purchases.

D)discrimination in the workplace.

E)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

11

On average over the past half-century, tax receipts in the United States have:

A)grown at a rate that was significantly slower than expenditure.

B)grown at a rate that was nearly the same as expenditure.

C)grown at a rate that matched the rate of growth of real GDP.

D)grown at a rate that matched the rate of growth of nominal GDP.

E)held remarkably stable despite taxpayer protests to the contrary.

A)grown at a rate that was significantly slower than expenditure.

B)grown at a rate that was nearly the same as expenditure.

C)grown at a rate that matched the rate of growth of real GDP.

D)grown at a rate that matched the rate of growth of nominal GDP.

E)held remarkably stable despite taxpayer protests to the contrary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

12

Governments are playing an increasing role in representing their countries internationally.This is because:

A)the importance of international trade and finance have increased as communications and transportation have improved.

B)rich nations refuse to send aid to poor countries.

C)countries are trying increasingly to shelter their own domestic fiscal and monetary policies from the rest of the world.

D)environmental concerns have encouraged consumers to buy only goods produced domestically.

E)none of the above.

A)the importance of international trade and finance have increased as communications and transportation have improved.

B)rich nations refuse to send aid to poor countries.

C)countries are trying increasingly to shelter their own domestic fiscal and monetary policies from the rest of the world.

D)environmental concerns have encouraged consumers to buy only goods produced domestically.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following are conditions that bind the invisible hand?

A)All goods must be produced efficiently by perfectly competitive firms.

B)All goods must be private goods.

C)No externalities like pollution.

D)Consumers and firms must be fully informed about the prices and goods they buy and sell.

E)All of the above.

A)All goods must be produced efficiently by perfectly competitive firms.

B)All goods must be private goods.

C)No externalities like pollution.

D)Consumers and firms must be fully informed about the prices and goods they buy and sell.

E)All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

14

Government transfer payments are basically defined as:

A)those which require service on the part of the recipient.

B)those for which the recipient gives no concurrent service in return.

C)receipts which do not increase the total purchasing power of all recipients.

D)intergovernmental flows that do not affect individuals directly.

E)that part of government expenditures on goods and services not financed by taxes.

A)those which require service on the part of the recipient.

B)those for which the recipient gives no concurrent service in return.

C)receipts which do not increase the total purchasing power of all recipients.

D)intergovernmental flows that do not affect individuals directly.

E)that part of government expenditures on goods and services not financed by taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

15

Use the following to answer questions :

Figure 16-1

What type of event could move the economy from E to D in Figure 16-1?

A)Inefficient dictator takes over government.

B)Nuclear war.

C)New income taxes on A.

D)A and B

E)None of the above.

Figure 16-1

What type of event could move the economy from E to D in Figure 16-1?

A)Inefficient dictator takes over government.

B)Nuclear war.

C)New income taxes on A.

D)A and B

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

16

In recent years, the Federal Trade Commission has investigated the airline industry on charges of price fixing.This involves the government in:

A)protecting the consumer against external costs of production.

B)providing a public good for society.

C)smoothing the effects of the business cycle over time.

D)protecting the consumer against unfair monopoly practices.

E)protecting the supplier against consumer misinformation about pricing policies.

A)protecting the consumer against external costs of production.

B)providing a public good for society.

C)smoothing the effects of the business cycle over time.

D)protecting the consumer against unfair monopoly practices.

E)protecting the supplier against consumer misinformation about pricing policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following can be used by the government to influence the private economy?

A)Taxes on goods and services.

B)Expenditures on certain goods and services.

C)Regulations that direct people to perform or refrain from certain activities.

D)All of the above.

E)None of the above.

A)Taxes on goods and services.

B)Expenditures on certain goods and services.

C)Regulations that direct people to perform or refrain from certain activities.

D)All of the above.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

18

Use the following to answer questions :

Figure 16-1

What type of government activity would move the economy from E to F in Figure 16-1?

A)Nuclear war.

B)High taxes.

C)Public health spending.

D)Building of highways.

E)C and D.

Figure 16-1

What type of government activity would move the economy from E to F in Figure 16-1?

A)Nuclear war.

B)High taxes.

C)Public health spending.

D)Building of highways.

E)C and D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

19

Regulation in the United States began to be imposed as it became clear that laissez-faire policies were being undermined by:

A)pockets of poverty that were exploited by the more advantaged.

B)wide swings in the business cycle marked by frequent banking crises.

C)widespread discrimination on the basis of sex, race, and other factors.

D)flagrant abuse of the environment.

E)all of the above.

A)pockets of poverty that were exploited by the more advantaged.

B)wide swings in the business cycle marked by frequent banking crises.

C)widespread discrimination on the basis of sex, race, and other factors.

D)flagrant abuse of the environment.

E)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

20

Regulatory activity in the United States:

A)started almost immediately after the passage of a Constitutional amendment empowering the government to secure the public interest.

B)started in 1913 with the advent of the regulatory arm of the Federal Reserve System.

C)started in 1887 with the control of the banking system by the Federal Reserve.

D)started in 1887 with the creation of the Interstate Commerce Commission.

E)peaked during the Reagan administration after declining somewhat under President Carter.

A)started almost immediately after the passage of a Constitutional amendment empowering the government to secure the public interest.

B)started in 1913 with the advent of the regulatory arm of the Federal Reserve System.

C)started in 1887 with the control of the banking system by the Federal Reserve.

D)started in 1887 with the creation of the Interstate Commerce Commission.

E)peaked during the Reagan administration after declining somewhat under President Carter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

21

The largest item of expenditure by the federal government is:

A)aid to families with dependent children.

B)foreign aid.

C)social security.

D)revenue sharing.

E)national defense.

A)aid to families with dependent children.

B)foreign aid.

C)social security.

D)revenue sharing.

E)national defense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

22

An example of a transfer payment is:

A)a check to a hospital for payment of a bill owed by a senior citizen covered by Medicare.

B)a mail carrier's wages.

C)payment to Boeing Aircraft for an intercontinental bomber.

D)the lunch provided for a cleaning person.

E)none of the above.

A)a check to a hospital for payment of a bill owed by a senior citizen covered by Medicare.

B)a mail carrier's wages.

C)payment to Boeing Aircraft for an intercontinental bomber.

D)the lunch provided for a cleaning person.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following taxes, as structured in the United States, is the best example of ability-to-pay taxation?

A)The federal excise tax on cigarettes.

B)The federal corporate income tax.

C)A state imposed highway user tax.

D)A proportional state sales tax.

E)The federal personal income tax.

A)The federal excise tax on cigarettes.

B)The federal corporate income tax.

C)A state imposed highway user tax.

D)A proportional state sales tax.

E)The federal personal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

24

As people's incomes rise, a progressive tax is best described as taking:

A)an increasing amount of tax.

B)the same amount of tax.

C)the same percent of income as tax

D)an increasing percent of income as tax.

E)a decreasing percent of income as tax.

A)an increasing amount of tax.

B)the same amount of tax.

C)the same percent of income as tax

D)an increasing percent of income as tax.

E)a decreasing percent of income as tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

25

The largest single source of total tax receipts of the federal government is:

A)personal income taxation

B)death and gift taxation.

C)corporation income taxation.

D)sales taxation.

E)social security taxation.

A)personal income taxation

B)death and gift taxation.

C)corporation income taxation.

D)sales taxation.

E)social security taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

26

State and local taxes in the United States tend to be:

A)regressive, on the whole.

B)proportional, on the whole.

C)progressive, on the whole.

D)based almost exclusively on ability to pay.

E)based almost exclusively on individual benefit.

A)regressive, on the whole.

B)proportional, on the whole.

C)progressive, on the whole.

D)based almost exclusively on ability to pay.

E)based almost exclusively on individual benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is an example of a direct tax?

A)Excise taxes.

B)General sales taxes.

C)Inheritance taxes.

D)Tariffs.

E)None of the above.

A)Excise taxes.

B)General sales taxes.

C)Inheritance taxes.

D)Tariffs.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

28

Tax incidence is the analysis of:

A)how progressive a tax is.

B)how distorting a tax is.

C)who ultimately pays the tax.

D)how a tax is collected.

E)tax expenditures.

A)how progressive a tax is.

B)how distorting a tax is.

C)who ultimately pays the tax.

D)how a tax is collected.

E)tax expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would be considered indirect taxes?

A)Gasoline tax.

B)Social security.

C)Federal income tax.

D)State income tax.

E)Gift tax.

A)Gasoline tax.

B)Social security.

C)Federal income tax.

D)State income tax.

E)Gift tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

30

The two biggest items in the federal budget are:

A)Congress and the judiciary.

B)national defense and agriculture.

C)agriculture and conservation.

D)national defense and social security.

E)none of the above.

A)Congress and the judiciary.

B)national defense and agriculture.

C)agriculture and conservation.

D)national defense and social security.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

31

The principal source of local government revenue is:

A)property taxation.

B)sales taxation.

C)income and payroll taxation.

D)aid from the federal government.

E)none of the above.

A)property taxation.

B)sales taxation.

C)income and payroll taxation.

D)aid from the federal government.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

32

Value-added taxes are:

A)collected only at the sale of the final product.

B)income taxes.

C)corporate taxes.

D)based upon an ability-to-pay principle.

E)collected at each stage of the production process.

A)collected only at the sale of the final product.

B)income taxes.

C)corporate taxes.

D)based upon an ability-to-pay principle.

E)collected at each stage of the production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

33

An example of a government transfer payment is

A)the cost of a submarine purchased by the government.

B)a mail carrier's wage.

C)payments to General Electric to develop nuclear energy.

D)the salary of a Department of State employee.

E)unemployment insurance compensation.

A)the cost of a submarine purchased by the government.

B)a mail carrier's wage.

C)payments to General Electric to develop nuclear energy.

D)the salary of a Department of State employee.

E)unemployment insurance compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

34

Double-taxation in the U.S.tax system generally refers to:

A)the fact that both employers and employees pay a payroll tax.

B)the taxation as regular income of dividends paid to stockholders out of profits upon which taxes have already been paid.

C)the occasional imposition of a tax surcharge on the personal income tax paid by Americans to their federal government.

D)the doubling of the corporate profits tax rate as corporations' incomes climb above $100,000.

E)none of the above.

A)the fact that both employers and employees pay a payroll tax.

B)the taxation as regular income of dividends paid to stockholders out of profits upon which taxes have already been paid.

C)the occasional imposition of a tax surcharge on the personal income tax paid by Americans to their federal government.

D)the doubling of the corporate profits tax rate as corporations' incomes climb above $100,000.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

35

An example of a regressive tax is:

A)the personal income tax.

B)a general sales tax.

C)the graduated corporation income tax.

D)the inheritance tax.

E)none of the above.

A)the personal income tax.

B)a general sales tax.

C)the graduated corporation income tax.

D)the inheritance tax.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

36

When we speak of the incidence of a tax, we are:

A)referring to the group upon whom it is directly levied.

B)asking whether that tax is progressive or regressive in nature.

C)measuring the extent to which the tax tends to reduce incentives in the group that pays it.

D)referring to the group that receives the burden of the tax bill, regardless of whether or not it actually makes the money payment to the government.

E)measuring the extent to which the tax brings in a steady amount of money to the government in both prosperity and depression.

A)referring to the group upon whom it is directly levied.

B)asking whether that tax is progressive or regressive in nature.

C)measuring the extent to which the tax tends to reduce incentives in the group that pays it.

D)referring to the group that receives the burden of the tax bill, regardless of whether or not it actually makes the money payment to the government.

E)measuring the extent to which the tax brings in a steady amount of money to the government in both prosperity and depression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

37

The best technical description of a progressive tax is a:

A)tax which takes more money from the rich than from the poor.

B)tax likely to discourage incentive.

C)more equitable tax than a regressive one.

D)tax which takes a higher proportion of extra dollars received as income rises.

E)tax which falls directly on those in the high income brackets.

A)tax which takes more money from the rich than from the poor.

B)tax likely to discourage incentive.

C)more equitable tax than a regressive one.

D)tax which takes a higher proportion of extra dollars received as income rises.

E)tax which falls directly on those in the high income brackets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

38

Many people disagree about the degree of equity built into the current tax system.This is because of the problem of evaluating:

A)tax expenditures.

B)tax shifting or incidence.

C)benefit taxes.

D)withholding practices.

E)the distributional effects of government spending.

A)tax expenditures.

B)tax shifting or incidence.

C)benefit taxes.

D)withholding practices.

E)the distributional effects of government spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

39

A general sales tax is:

A)a progressive tax because it applies to luxuries as well as necessities

B)a progressive tax because wealthy people spend more than poor people.

C)a regressive tax because wealthy people spend a smaller percentage of their total income on taxed commodities.

D)a regressive tax because more money is collected from a poor person than from a rich one.

E)a proportional tax because everybody pays the same tax percentage on each purchase.

A)a progressive tax because it applies to luxuries as well as necessities

B)a progressive tax because wealthy people spend more than poor people.

C)a regressive tax because wealthy people spend a smaller percentage of their total income on taxed commodities.

D)a regressive tax because more money is collected from a poor person than from a rich one.

E)a proportional tax because everybody pays the same tax percentage on each purchase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

40

The largest item in local government budgets in the aggregate is:

A)police and fire protection.

B)welfare expenditures.

C)education.

D)roads and highways.

E)none of the above.

A)police and fire protection.

B)welfare expenditures.

C)education.

D)roads and highways.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

41

Before World War I, the combined federal, state, and local government expenditures or taxation amounted to little more than one-tenth of the entire US national income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Invisible Hand has several limitations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

43

A shift from progressive direct taxes to a federal sales or value-added tax would probably encourage investment more than consumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

44

Government expenditure in the United States measured as a percentage of GDP is larger than it is in France.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

45

Prior to World War I, aggregate local government expenditures were larger than federal government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

46

The efficiency function of government is motivated primarily by a concern that the what and how questions are being incorrectly answered by the marketplace.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

47

When monopolies or oligopolies collude to fix prices, government can apply anti-trust policies or regulation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

48

The efficiency concern of government is motivated primarily as an attempt to help the market answer the for whom question of allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

49

Statistical studies show that the incidence of our income-tax structure is regressive at low levels of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

50

Government intervention is necessary to control breakdowns in the market mechanism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

51

Early capitalism was prone to financial panics and bouts of inflation and depression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

52

Before the twentieth century, local government was by far the most important of the three levels of government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

53

Laissez-faire policies lapsed in response, at least in part, to exaggerated business cycle swings in the aggregate economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

54

Some redistribution of income is accomplished by the way in which the government allocates the burden of the taxes it levies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

55

Income redistribution is usually accomplished through taxation and spending policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

56

The cost of government at all levels has grown in the United States since 1913.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

57

Governments can function to reallocate resources more equitably, but are powerless to effect greater efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

58

"Fiscal policy" is the economist's name for tax and expenditure policies in general.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

59

The cost of all levels of government in the United States has grown more than 400-fold since 1913.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

60

Welfare payments are an example of a redistributional government policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

61

Of the three levels of government, state government has generally been the least important in terms of total expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

62

Increased public services always entail the shift of resources from the private to the public sector.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

63

It always pays to get more income, even it this shifts you to a higher tax bracket, in the sense that you will definitely have more after-tax income than before.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

64

Any tax whose burden depends on the outcome of an economic decision can be expected to create an economic distortion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

65

Fiscal policy is another name for the government's attempt to balance the budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

66

A sales tax on a consumer good on which the wealthy spend a higher proportion of their income than the poor would be progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

67

Analysis of the incidence of a tax is really an analysis of its progressivity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

68

Progressive income taxes tend, through redistribution of income, to expand purchasing power.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

69

A major criticism of the general property tax is that it violates principles of horizontal equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

70

Excise taxes are, in general, regarded as regressive, and one levied on fur coats would be no exception.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

71

Education is the biggest single item in the budget of local government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

72

The U.S.Social Security tax is designed to be progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

73

Transfer payments hardly ever create inefficiencies because they simply transfer money from the hands of one set of people and deliver into the hands of another set of people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

74

The U.S.federal income tax is designed to be progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

75

A general sales tax would probably be regressive if it were applied proportionately to all expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

76

The corporate income tax is a classic example of benefit taxation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

77

Inefficient government can cause an economy to operate below its production possibility frontier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

78

State and local governments spend more each year on public education than they do for police and fire protection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck

79

The working poor are regressively taxed, but since more expenditure goes to them, the net tax burden after transfers may actually be progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 79 في هذه المجموعة.

فتح الحزمة

k this deck