Deck 11: Diversification and Risky Asset Allocation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/88

العب

ملء الشاشة (f)

Deck 11: Diversification and Risky Asset Allocation

1

An efficient portfolio is a portfolio that does which one of the following?

A) offers the highest return for the lowest possible cost

B) provides an evenly weighted portfolio of diverse assets

C) eliminates all risk while providing an expected positive rate of return

D) lies on the vertical axis when graphing expected returns against standard deviation

E) offers the highest return for a given level of risk

A) offers the highest return for the lowest possible cost

B) provides an evenly weighted portfolio of diverse assets

C) eliminates all risk while providing an expected positive rate of return

D) lies on the vertical axis when graphing expected returns against standard deviation

E) offers the highest return for a given level of risk

E

2

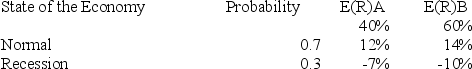

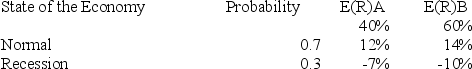

Which of the following are affected by the probability of a state of the economy occurring?

I)expected return of an individual security

II)expected return of a portfolio

III)standard deviation of an individual security

IV)standard deviation of a portfolio

A) I and III only

B) I and II only

C) II and IV only

D) III and IV only

E) I, II, III, and IV

I)expected return of an individual security

II)expected return of a portfolio

III)standard deviation of an individual security

IV)standard deviation of a portfolio

A) I and III only

B) I and II only

C) II and IV only

D) III and IV only

E) I, II, III, and IV

E

3

If the future return on a security is known with absolute certainty,then the risk premium on that security should be equal to:

A) zero.

B) the risk-free rate.

C) the market rate.

D) the market rate minus the risk-free rate.

E) the risk-free rate plus one-half the market rate.

A) zero.

B) the risk-free rate.

C) the market rate.

D) the market rate minus the risk-free rate.

E) the risk-free rate plus one-half the market rate.

A

4

Which one of the following is the set of portfolios that provides the maximum return for a given standard deviation?

A) minimum variance portfolio

B) Markowitz efficient frontier

C) correlated market frontier

D) asset allocation relationship

E) diversified portfolio line

A) minimum variance portfolio

B) Markowitz efficient frontier

C) correlated market frontier

D) asset allocation relationship

E) diversified portfolio line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

5

What is the extra compensation paid to an investor who invests in a risky asset rather than in a risk-free asset called?

A) efficient return

B) correlated value

C) risk premium

D) expected return

E) realized return

A) efficient return

B) correlated value

C) risk premium

D) expected return

E) realized return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

6

You own a portfolio of 5 stocks and have 3 expected states of the economy.You have twice as much invested in Stock A as you do in Stock E.How will the weights be determined when you compute the rate of return for each economic state?

A) The weights will be the probability of occurrence for each economic state.

B) Each stock will have a weight of 20 percent for a total of 100 percent.

C) The weights will decline steadily from Stock A to Stock E.

D) The weights will be based on the amount invested in each stock as a percentage of the total amount invested.

E) The weights will be based on a combination of the dollar amounts invested as well as the economic probabilities.

A) The weights will be the probability of occurrence for each economic state.

B) Each stock will have a weight of 20 percent for a total of 100 percent.

C) The weights will decline steadily from Stock A to Stock E.

D) The weights will be based on the amount invested in each stock as a percentage of the total amount invested.

E) The weights will be based on a combination of the dollar amounts invested as well as the economic probabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following returns is the average return you expect to earn in the future on a risky asset?

A) realized return

B) expected return

C) market return

D) real return

E) adjusted return

A) realized return

B) expected return

C) market return

D) real return

E) adjusted return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

8

The value of an individual security divided by the total value of the portfolio is referred to as the portfolio:

A) beta.

B) standard deviation.

C) balance.

D) weight.

E) variance.

A) beta.

B) standard deviation.

C) balance.

D) weight.

E) variance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which one of the following is a collection of possible risk-return combinations available from portfolios consisting of individual assets?

A) minimum variance set

B) financial frontier

C) efficient portfolio

D) allocated set

E) investment opportunity set

A) minimum variance set

B) financial frontier

C) efficient portfolio

D) allocated set

E) investment opportunity set

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following will increase the expected risk premium for a security,all else constant?

I)an increase in the security's expected return

II)a decrease in the security's expected return

III)an increase in the risk-free rate

IV)a decrease in the risk-free rate

A) I only

B) III only

C) IV only

D) I and IV only

E) II and III only

I)an increase in the security's expected return

II)a decrease in the security's expected return

III)an increase in the risk-free rate

IV)a decrease in the risk-free rate

A) I only

B) III only

C) IV only

D) I and IV only

E) II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which one of the following statements must be true?

A) All securities are projected to have higher rates of return when the economy booms versus when it is normal.

B) Considering the possible states of the economy emphasizes the fact that multiple outcomes can be realized from an investment.

C) The highest probability of occurrence must be placed on a normal economy versus either a boom or a recession.

D) The total of the probabilities of the economic states can vary between zero and 100 percent.

E) Various economic states affect a portfolio's expected return but not the expected level of risk.

A) All securities are projected to have higher rates of return when the economy booms versus when it is normal.

B) Considering the possible states of the economy emphasizes the fact that multiple outcomes can be realized from an investment.

C) The highest probability of occurrence must be placed on a normal economy versus either a boom or a recession.

D) The total of the probabilities of the economic states can vary between zero and 100 percent.

E) Various economic states affect a portfolio's expected return but not the expected level of risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

12

Correlation is the:

A) squared measure of a security's total risk.

B) extent to which the returns on two assets move together.

C) measurement of the systematic risk contained in an asset.

D) daily return on an asset compared to its previous daily return.

E) spreading of an investment across a number of assets.

A) squared measure of a security's total risk.

B) extent to which the returns on two assets move together.

C) measurement of the systematic risk contained in an asset.

D) daily return on an asset compared to its previous daily return.

E) spreading of an investment across a number of assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

13

Diversification is investing in a variety of assets with which one of the following as the primary goal?

A) increasing returns

B) minimizing taxes

C) reducing some risks

D) eliminating all risks

E) increasing the variance

A) increasing returns

B) minimizing taxes

C) reducing some risks

D) eliminating all risks

E) increasing the variance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

14

You own three securities.Security A has an expected return of 11 percent as compared to 14 percent for Security B and 9 percent for Security C.The expected inflation rate is 4 percent and the nominal risk-free rate is 5 percent.Which one of the following statements is correct?

A) There is no risk premium on Security C.

B) The risk premium on Security A exceeds that of Security B.

C) Security B has a risk premium that is 50 percent greater than Security A's risk premium.

D) The risk premium on Security C is 5 percent.

E) All three securities have the same expected risk premium.

A) There is no risk premium on Security C.

B) The risk premium on Security A exceeds that of Security B.

C) Security B has a risk premium that is 50 percent greater than Security A's risk premium.

D) The risk premium on Security C is 5 percent.

E) All three securities have the same expected risk premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

15

You own a stock that will produce varying rates of return based upon the state of the economy.Which one of the following will measure the risk associated with owning that stock?

A) weighted average return given the multiple states of the economy

B) rate of return for a given economic state

C) variance of the returns given the multiple states of the economy

D) correlation between the returns give the various states of the economy

E) correlation of the weighted average return as compared to the market

A) weighted average return given the multiple states of the economy

B) rate of return for a given economic state

C) variance of the returns given the multiple states of the economy

D) correlation between the returns give the various states of the economy

E) correlation of the weighted average return as compared to the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

16

A group of stocks and bonds held by an investor is called which one of the following?

A) weights

B) grouping

C) basket

D) portfolio

E) bundle

A) weights

B) grouping

C) basket

D) portfolio

E) bundle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

17

Terry has a portfolio comprised of two individual securities.Which one of the following computations that he might do is NOT a weighted average?

A) correlation between the securities

B) individual security expected return

C) portfolio expected return

D) portfolio variance

E) portfolio beta

A) correlation between the securities

B) individual security expected return

C) portfolio expected return

D) portfolio variance

E) portfolio beta

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

18

The division of a portfolio's dollars among various types of assets is referred to as:

A) the minimum variance portfolio.

B) the efficient frontier.

C) correlation.

D) asset allocation.

E) setting the investment opportunities.

A) the minimum variance portfolio.

B) the efficient frontier.

C) correlation.

D) asset allocation.

E) setting the investment opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

19

You own a stock which is expected to return 14 percent in a booming economy and 9 percent in a normal economy.If the probability of a booming economy decreases,your expected return will:

A) decrease.

B) either remain constant or decrease.

C) remain constant.

D) increase.

E) either remain constant or increase.

A) decrease.

B) either remain constant or decrease.

C) remain constant.

D) increase.

E) either remain constant or increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following affect the expected rate of return for a portfolio?

I)weight of each security held in the portfolio

II)the probability of various economic states occurring

III)the variance of each individual security

IV)the expected rate of return of each security given each economic state

A) I and IV only

B) II and IV only

C) II, III, and IV only

D) I, II, and IV only

E) I, II, III, and IV

I)weight of each security held in the portfolio

II)the probability of various economic states occurring

III)the variance of each individual security

IV)the expected rate of return of each security given each economic state

A) I and IV only

B) II and IV only

C) II, III, and IV only

D) I, II, and IV only

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which one of the following statements is correct concerning asset allocation?

A) Because there is an ideal mix, all investors should use the same asset allocation for their portfolios.

B) The minimum variance portfolio will have a 50/50 asset allocation between stocks and bonds.

C) Asset allocation affects the expected return but not the risk level of a portfolio.

D) There is an ideal asset allocation between stocks and bonds given a specified level of risk.

E) Asset allocation should play a minor role in portfolio construction.

A) Because there is an ideal mix, all investors should use the same asset allocation for their portfolios.

B) The minimum variance portfolio will have a 50/50 asset allocation between stocks and bonds.

C) Asset allocation affects the expected return but not the risk level of a portfolio.

D) There is an ideal asset allocation between stocks and bonds given a specified level of risk.

E) Asset allocation should play a minor role in portfolio construction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which one of the following correlation coefficients must apply to two assets if the equally weighted portfolio of those assets creates a minimum variance portfolio that has a standard deviation of zero?

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which one of the following distinguishes a minimum variance portfolio?

A) lowest risk portfolio of any possible portfolio given the same securities but in differing proportions

B) lowest risk portfolio possible given any specified expected rate of return

C) the zero risk portfolio created by maximizing the asset allocation mix

D) any portfolio with an expected standard deviation of 9 percent or less

E) any portfolio created with securities that are evenly weighted in respect to the asset allocation mix

A) lowest risk portfolio of any possible portfolio given the same securities but in differing proportions

B) lowest risk portfolio possible given any specified expected rate of return

C) the zero risk portfolio created by maximizing the asset allocation mix

D) any portfolio with an expected standard deviation of 9 percent or less

E) any portfolio created with securities that are evenly weighted in respect to the asset allocation mix

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

24

If two assets have a zero correlation,their returns will:

A) always move in the same direction by the same amount.

B) always move in the same direction but not necessarily by the same amount.

C) move randomly and independently of each other.

D) always move in opposite directions but not necessarily by the same amount.

E) always move in opposite directions by the same amount.

A) always move in the same direction by the same amount.

B) always move in the same direction but not necessarily by the same amount.

C) move randomly and independently of each other.

D) always move in opposite directions but not necessarily by the same amount.

E) always move in opposite directions by the same amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

25

You own a portfolio comprised of 4 stocks and the economy has 3 possible states.Assume you invest your portfolio in a manner that results in an expected rate of return of 7.5 percent,regardless of the economic state.Given this,what must be value of the portfolio's variance be?

A) negative, but not -1

B) -1.0

C) 0.0

D) 1.0

E) positive, but not +1

A) negative, but not -1

B) -1.0

C) 0.0

D) 1.0

E) positive, but not +1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which one of the following statements is correct?

A) A portfolio variance is a weighted average of the variances of the individual securities which comprise the portfolio.

B) A portfolio variance is dependent upon the portfolio's asset allocation.

C) A portfolio variance is unaffected by the correlations between the individual securities held in the portfolio.

D) The portfolio variance must be greater than the lowest variance of any of the securities held in the portfolio.

E) The portfolio variance must be less than the lowest variance of any of the securities held in the portfolio.

A) A portfolio variance is a weighted average of the variances of the individual securities which comprise the portfolio.

B) A portfolio variance is dependent upon the portfolio's asset allocation.

C) A portfolio variance is unaffected by the correlations between the individual securities held in the portfolio.

D) The portfolio variance must be greater than the lowest variance of any of the securities held in the portfolio.

E) The portfolio variance must be less than the lowest variance of any of the securities held in the portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following correlation relationships has the potential to completely eliminate risk?

A) perfectly positive

B) positive

C) negative

D) perfectly negative

E) uncorrelated

A) perfectly positive

B) positive

C) negative

D) perfectly negative

E) uncorrelated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

28

You are graphing the portfolio expected return against the portfolio standard deviation for a portfolio consisting of two securities.Which one of the following statements is correct regarding this graph?

A) Risk-taking investors should select the minimum variance portfolio.

B) Risk-averse investors should select the portfolio with the lowest rate of return.

C) Some portfolios will be efficient while others will not.

D) The minimum variance portfolio will have the lowest portfolio expected return of any of the possible portfolios.

E) All possible portfolios will graph as efficient portfolios.

A) Risk-taking investors should select the minimum variance portfolio.

B) Risk-averse investors should select the portfolio with the lowest rate of return.

C) Some portfolios will be efficient while others will not.

D) The minimum variance portfolio will have the lowest portfolio expected return of any of the possible portfolios.

E) All possible portfolios will graph as efficient portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which one of the following is eliminated,or at least greatly reduced,by increasing the number of individual securities held in a portfolio?

A) number of economic states

B) various expected returns caused by changing economic states

C) market risk

D) diversifiable risk

E) non-diversifiable risk

A) number of economic states

B) various expected returns caused by changing economic states

C) market risk

D) diversifiable risk

E) non-diversifiable risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which one of the following correlation coefficients can provide the greatest diversification benefit?

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

31

Non-diversifiable risk:

A) can be cut almost in half by simply investing in 10 stocks provided each stock is in a different industry.

B) can almost be eliminated by investing in 35 diverse securities.

C) remains constant regardless of the number of securities held in a portfolio.

D) has little, if any, impact on the actual realized returns for a diversified portfolio.

E) should be ignored by investors.

A) can be cut almost in half by simply investing in 10 stocks provided each stock is in a different industry.

B) can almost be eliminated by investing in 35 diverse securities.

C) remains constant regardless of the number of securities held in a portfolio.

D) has little, if any, impact on the actual realized returns for a diversified portfolio.

E) should be ignored by investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

32

A portfolio comprised of which one of the following is most apt to be the minimum variance portfolio?

A) 100 percent stocks

B) 100 percent bonds

C) 50/50 mix of stocks and bonds

D) 30 percent stocks and 70 percent bonds

E) 30 percent bonds and 70 percent stocks

A) 100 percent stocks

B) 100 percent bonds

C) 50/50 mix of stocks and bonds

D) 30 percent stocks and 70 percent bonds

E) 30 percent bonds and 70 percent stocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which one of the following statements about efficient portfolios is correct?

A) Any efficient portfolio will lie below the minimum variance portfolio when the expected portfolio return is plotted against the portfolio standard deviation.

B) An efficient portfolio will have the lowest standard deviation of any portfolio consisting of the same two securities.

C) There are multiple efficient portfolios that can be constructed using the same two securities.

D) Any portfolio mix consisting of only two securities will be an efficient portfolio.

E) There is only one efficient portfolio that can be constructed using two securities.

A) Any efficient portfolio will lie below the minimum variance portfolio when the expected portfolio return is plotted against the portfolio standard deviation.

B) An efficient portfolio will have the lowest standard deviation of any portfolio consisting of the same two securities.

C) There are multiple efficient portfolios that can be constructed using the same two securities.

D) Any portfolio mix consisting of only two securities will be an efficient portfolio.

E) There is only one efficient portfolio that can be constructed using two securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

34

Where does the minimum variance portfolio lie in respect to the investment opportunity set?

A) lowest point

B) highest point

C) most leftward point

D) most rightward point

E) exact center

A) lowest point

B) highest point

C) most leftward point

D) most rightward point

E) exact center

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

35

To reduce risk as much as possible,you should combine assets which have one of the following correlation relationships?

A) strong positive

B) slightly positive

C) slightly negative

D) strongly negative

E) zero

A) strong positive

B) slightly positive

C) slightly negative

D) strongly negative

E) zero

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

36

How will the returns on two assets react if those returns have a perfect positive correlation?

I)move in the same direction

II)move in opposite directions

III)move by the same amount

IV)move by either equal or unequal amounts

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

E) III only

I)move in the same direction

II)move in opposite directions

III)move by the same amount

IV)move by either equal or unequal amounts

A) I and III only

B) I and IV only

C) II and III only

D) II and IV only

E) III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

37

Assume the returns on Stock X were positive in January,February,April,July,and November.The other months the returns on Stock X were negative.The returns on Stock Y were positive in January,April,May,July,August,and October and negative the remaining months.Which one of the following correlation coefficients best describes the relationship between Stock X and Stock Y?

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

A) -1.0

B) -0.5

C) 0.0

D) 0.5

E) 1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

38

You currently have a portfolio comprised of 70 percent stocks and 30 percent bonds.Which one of the following must be true if you change the asset allocation?

A) The expected return will remain constant.

B) The revised portfolio will be perfectly negatively correlated with the initial portfolio.

C) The two portfolios could have significantly different standard deviations.

D) The portfolio variance will be unaffected.

E) The portfolio variance will most likely decrease in value.

A) The expected return will remain constant.

B) The revised portfolio will be perfectly negatively correlated with the initial portfolio.

C) The two portfolios could have significantly different standard deviations.

D) The portfolio variance will be unaffected.

E) The portfolio variance will most likely decrease in value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

39

As the number of individual stocks in a portfolio increases,the portfolio standard deviation:

A) increases at a constant rate.

B) remains unchanged.

C) decreases at a constant rate.

D) decreases at a diminishing rate.

E) decreases at an increasing rate.

A) increases at a constant rate.

B) remains unchanged.

C) decreases at a constant rate.

D) decreases at a diminishing rate.

E) decreases at an increasing rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is the correlation coefficient of two assets that are uncorrelated?

A) -100

B) -1

C) 0

D) 1

E) 100

A) -100

B) -1

C) 0

D) 1

E) 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

41

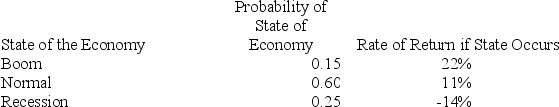

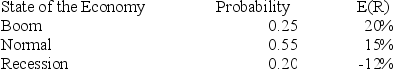

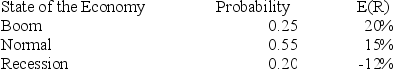

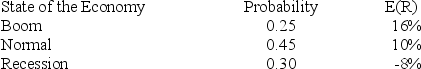

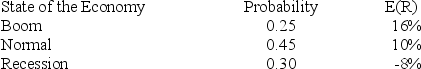

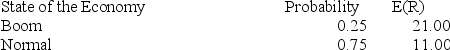

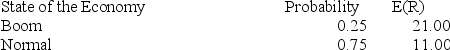

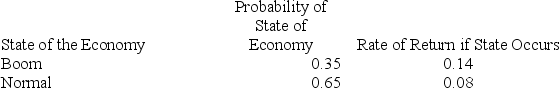

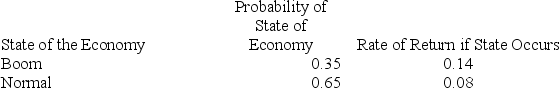

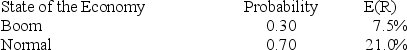

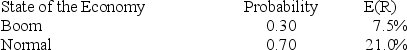

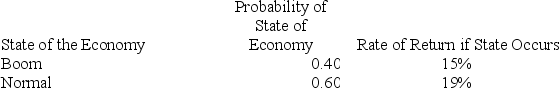

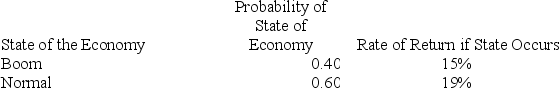

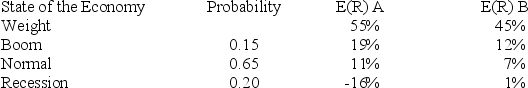

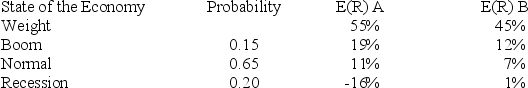

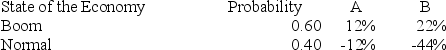

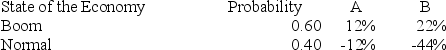

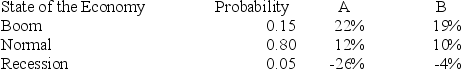

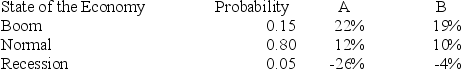

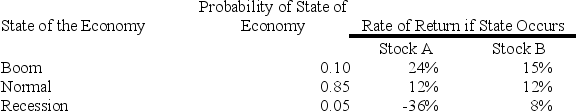

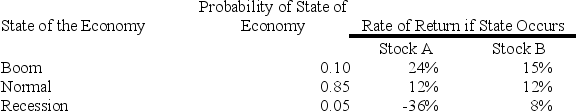

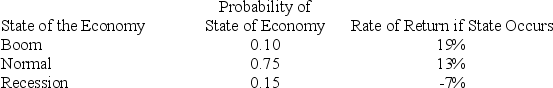

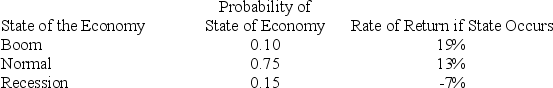

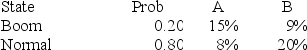

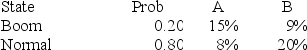

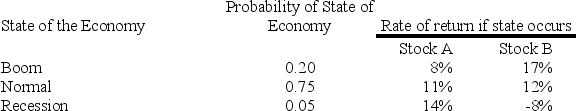

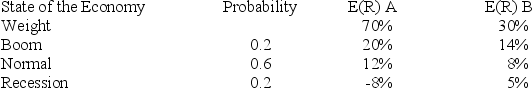

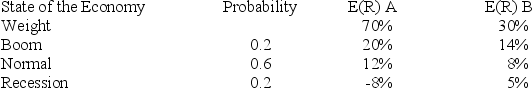

What is the expected return on this stock given the following information?

A) 6.40 percent

B) 6.57 percent

C) 8.99 percent

D) 13.40 percent

E) 14.25 percent

A) 6.40 percent

B) 6.57 percent

C) 8.99 percent

D) 13.40 percent

E) 14.25 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

42

Tall Stand Timber stock has an expected return of 16.8 percent.What is the risk-free rate if the risk premium on the stock is 12.1 percent?

A) 4.70 percent

B) 5.30 percent

C) 5.67 percent

D) 6.55 percent

E) 7.17 percent

A) 4.70 percent

B) 5.30 percent

C) 5.67 percent

D) 6.55 percent

E) 7.17 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

43

You are graphing the investment opportunity set for a portfolio of two securities with the expected return on the vertical axis and the standard deviation on the horizontal axis.If the correlation coefficient of the two securities is +1,the opportunity set will appear as which one of the following shapes?

A) conical shape

B) linear with an upward slope

C) combination of two straight lines

D) hyperbole

E) horizontal line

A) conical shape

B) linear with an upward slope

C) combination of two straight lines

D) hyperbole

E) horizontal line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

44

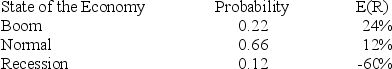

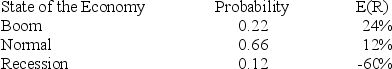

What is the expected return on this stock given the following information?

A) -8.07 percent

B) -7.69 percent

C) -6.80 percent

D) -5.70 percent

E) -5.20 percent

A) -8.07 percent

B) -7.69 percent

C) -6.80 percent

D) -5.70 percent

E) -5.20 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the expected return on this stock given the following information?

A) 9.36 percent

B) 9.74 percent

C) 10.85 percent

D) 11.78 percent

E) 12.05 percent

A) 9.36 percent

B) 9.74 percent

C) 10.85 percent

D) 11.78 percent

E) 12.05 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

46

What is the expected return on this stock given the following information?

A) -2.05 percent

B) -1.08 percent

C) 0.47 percent

D) 1.22 percent

E) 1.43 percent

A) -2.05 percent

B) -1.08 percent

C) 0.47 percent

D) 1.22 percent

E) 1.43 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

47

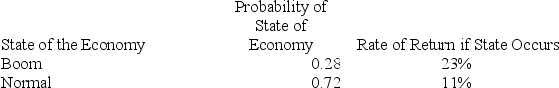

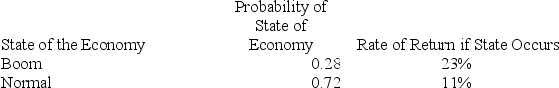

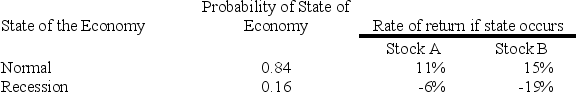

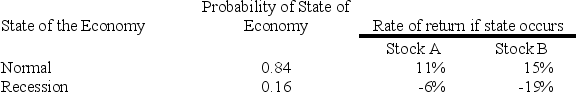

What is the variance of the returns on a security given the following information?

A) 48.18

B) 56.23

C) 64.38

D) 72.87

E) 91.35

A) 48.18

B) 56.23

C) 64.38

D) 72.87

E) 91.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

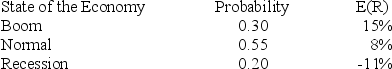

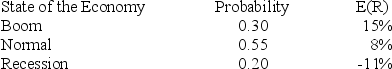

48

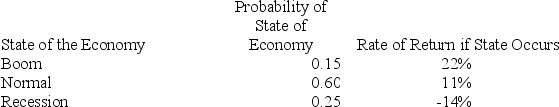

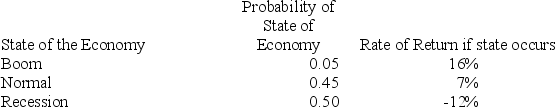

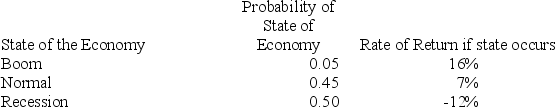

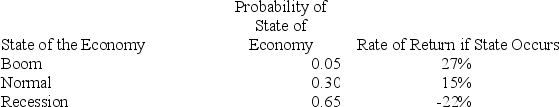

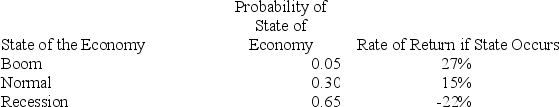

The risk-free rate is 3.5 percent.What is the expected risk premium on this security given the following information?

A) 2.09 percent

B) 3.01 percent

C) 3.20 percent

D) 3.87 percent

E) 4.15 percent

A) 2.09 percent

B) 3.01 percent

C) 3.20 percent

D) 3.87 percent

E) 4.15 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

49

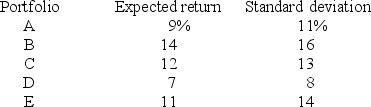

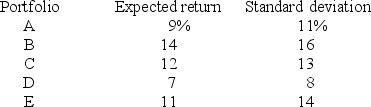

You combine a set of assets using different weights such that you produce the following results.  Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

A) A

B) B

C) C

D) D

E) E

Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

Which one of these portfolios CANNOT be a Markowitz efficient portfolio?A) A

B) B

C) C

D) D

E) E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the variance of the expected returns on this stock?

A) 18.75

B) 35.49

C) 61.53

D) 78.97

E) 80.03

A) 18.75

B) 35.49

C) 61.53

D) 78.97

E) 80.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

51

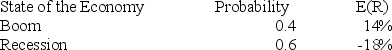

The risk-free rate is 4.15 percent.What is the expected risk premium on this stock given the following information?

A) 5.88 percent

B) 5.95 percent

C) 6.10 percent

D) 6.23 percent

E) 6.27 percent

A) 5.88 percent

B) 5.95 percent

C) 6.10 percent

D) 6.23 percent

E) 6.27 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

52

There is a 35 percent probability that a particular stock will earn a 16 percent return and a 65 percent probability that it will earn 10 percent.What is the risk-free rate if the risk premium on the stock is 7.5 percent?

A) 4.20 percent

B) 4.60 percent

C) 5.20 percent

D) 5.40 percent

E) 5.80 percent

A) 4.20 percent

B) 4.60 percent

C) 5.20 percent

D) 5.40 percent

E) 5.80 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

53

What is the variance of the returns on a security given the following information?

A) 239.77

B) 284.05

C) 321.16

D) 347.15

E) 362.98

A) 239.77

B) 284.05

C) 321.16

D) 347.15

E) 362.98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

54

What is the standard deviation of the returns on this stock?

A) 3.33 percent

B) 4.62 percent

C) 5.01 percent

D) 5.77 percent

E) 6.19 percent

A) 3.33 percent

B) 4.62 percent

C) 5.01 percent

D) 5.77 percent

E) 6.19 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

55

What is the standard deviation of the returns on this stock?

A) 223.94 percent

B) 24.08 percent

C) 24.17 percent

D) 25.72 percent

E) 26.90 percent

A) 223.94 percent

B) 24.08 percent

C) 24.17 percent

D) 25.72 percent

E) 26.90 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is the variance of the expected returns on this stock?

A) 1.21

B) 1.42

C) 1.56

D) 3.84

E) 4.03

A) 1.21

B) 1.42

C) 1.56

D) 3.84

E) 4.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

57

A portfolio that belongs to the Markowitz efficient set of portfolios will have which one of the following characteristics? Assume the portfolios are comprised of five individual securities.

A) the lowest return for any given level of risk

B) the largest number of potential portfolios that can achieve a specific rate of return

C) the largest number of potential portfolios that can achieve a specific level of risk

D) a positive rate of return and a zero standard deviation

E) the lowest risk for any given rate of return

A) the lowest return for any given level of risk

B) the largest number of potential portfolios that can achieve a specific rate of return

C) the largest number of potential portfolios that can achieve a specific level of risk

D) a positive rate of return and a zero standard deviation

E) the lowest risk for any given rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

58

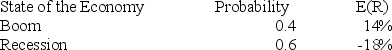

The risk-free rate is 4.20 percent.What is the expected risk premium on this stock given the following information?

A) 5.85 percent

B) 6.59 percent

C) 8.22 percent

D) 10.16 percent

E) 11.21 percent

A) 5.85 percent

B) 6.59 percent

C) 8.22 percent

D) 10.16 percent

E) 11.21 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

59

Rosita owns a stock with an overall expected return of 14.40 percent.The economy is expected to either boom or be normal.There is a 52 percent chance the economy will boom.If the economy booms,this stock is expected to return 15 percent.What is the expected return on the stock if the economy is normal?

A) 12.00 percent

B) 12.83 percent

C) 13.15 percent

D) 13.75 percent

E) 14.40 percent

A) 12.00 percent

B) 12.83 percent

C) 13.15 percent

D) 13.75 percent

E) 14.40 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

60

An investor owns a security that is expected to return 10 percent in a booming economy and 3 percent in a normal economy.The overall expected return on the security is 5.45 percent.Given there are only two states of the economy,what is the probability that the economy will boom?

A) 28 percent

B) 33 percent

C) 35 percent

D) 41 percent

E) 45 percent

A) 28 percent

B) 33 percent

C) 35 percent

D) 41 percent

E) 45 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

61

Alicia has a portfolio consisting of two stocks,X and Y,which is valued at $95,300.Stock X is worth $65,700.What is the portfolio weight of stock Y?

A) 0.351

B) 0.390

C) 0.408

D) 0.610

E) 0.649

A) 0.351

B) 0.390

C) 0.408

D) 0.610

E) 0.649

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

62

A stock fund has a standard deviation of 18 percent and a bond fund has a standard deviation of 10 percent.The correlation of the two funds is .15.What is the approximate weight of the stock fund in the minimum variance portfolio?

A) 11 percent

B) 15 percent

C) 20 percent

D) 24 percent

E) 27 percent

A) 11 percent

B) 15 percent

C) 20 percent

D) 24 percent

E) 27 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

63

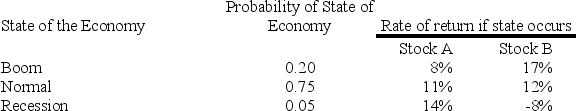

You have a portfolio which is comprised of 55 percent of stock A and 45 percent of stock B.What is the expected return on this portfolio?

A) 5.45 percent

B) 6.69 percent

C) 7.14 percent

D) 7.60 percent

E) 8.22 percent

A) 5.45 percent

B) 6.69 percent

C) 7.14 percent

D) 7.60 percent

E) 8.22 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

64

Stock X has a standard deviation of 21 percent per year and stock Y has a standard deviation of 6 percent per year.The correlation between stock A and stock B is 0.38.You have a portfolio of these two stocks wherein stock X has a portfolio weight of 42 percent.What is your portfolio standard deviation?

A) 8.89 percent

B) 9.85 percent

C) 10.64 percent

D) 11.84 percent

E) 12.92 percent

A) 8.89 percent

B) 9.85 percent

C) 10.64 percent

D) 11.84 percent

E) 12.92 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

65

Stock A has a standard deviation of 15 percent per year and stock B has a standard deviation of 21 percent per year.The correlation between stock A and stock B is 0.30.You have a portfolio of these two stocks wherein stock B has a portfolio weight of 60 percent.What is your portfolio standard deviation?

A) 14.87 percent

B) 15.50 percent

C) 16.91 percent

D) 17.45 percent

E) 18.03 percent

A) 14.87 percent

B) 15.50 percent

C) 16.91 percent

D) 17.45 percent

E) 18.03 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

66

Travis has a portfolio consisting of two stocks,A and B,which is valued at $53,800.Stock A is worth $23,900.What is the portfolio weight of stock B?

A) 0.528

B) 0.543

C) 0.549

D) 0.551

E) 0.556

A) 0.528

B) 0.543

C) 0.549

D) 0.551

E) 0.556

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

67

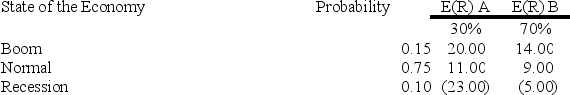

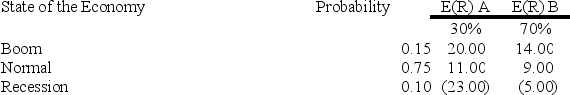

You have a portfolio which is comprised of 72 percent of stock A and 28 percent of stock B.What is the variance of this portfolio?

A) 190.9

B) 203.8

C) 268.1

D) 290.9

E) 306.9

A) 190.9

B) 203.8

C) 268.1

D) 290.9

E) 306.9

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

68

You have a portfolio which is comprised of 35 percent of stock A and 65 percent of stock B.What is the standard deviation of this portfolio?

A) 4.39 percent

B) 5.68 percent

C) 6.41 percent

D) 7.14 percent

E) 9.08 percent

A) 4.39 percent

B) 5.68 percent

C) 6.41 percent

D) 7.14 percent

E) 9.08 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

69

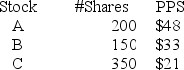

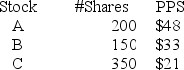

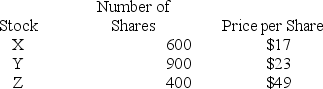

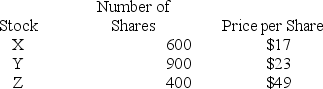

A portfolio consists of the following securities.What is the portfolio weight of stock C?

A) 0.336

B) 0.389

C) 0.445

D) 0.451

E) 0.557

A) 0.336

B) 0.389

C) 0.445

D) 0.451

E) 0.557

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

70

You have a portfolio which is comprised of 75 percent of stock A and 25 percent of stock B.What is the expected rate of return on this portfolio?

A) 10.70 percent

B) 10.87 percent

C) 11.13 percent

D) 12.11 percent

E) 12.80 percent

A) 10.70 percent

B) 10.87 percent

C) 11.13 percent

D) 12.11 percent

E) 12.80 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

71

Roger has a portfolio comprised of $8,000 of stock A and $12,000 of stock B.What is the standard deviation of this portfolio?

A) 4.67 percent

B) 9.97 percent

C) 7.23 percent

D) 8.83 percent

E) 10.42 percent

A) 4.67 percent

B) 9.97 percent

C) 7.23 percent

D) 8.83 percent

E) 10.42 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

72

Stock A has a standard deviation of 20 percent per year and stock B has a standard deviation of 15 percent per year.The correlation between stock A and stock B is .35.You have a portfolio of these two stocks wherein stock B has a portfolio weight of 40 percent.What is your portfolio variance?

A) 0.02022

B) 0.02156

C) 0.02239

D) 0.02247

E) 0.02304

A) 0.02022

B) 0.02156

C) 0.02239

D) 0.02247

E) 0.02304

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

73

You have a portfolio which is comprised of 40 percent of stock A and 60 percent of stock B.What is the variance of the portfolio?

A) 57.86

B) 62.13

C) 66.84

D) 70.15

E) 75.93

A) 57.86

B) 62.13

C) 66.84

D) 70.15

E) 75.93

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

74

What is the standard deviation of a security which has the following expected returns?

A) 7.48 percent

B) 7.61 percent

C) 7.67 percent

D) 7.82 percent

E) 7.91 percent

A) 7.48 percent

B) 7.61 percent

C) 7.67 percent

D) 7.82 percent

E) 7.91 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

75

You have a portfolio which is comprised of 60 percent of stock A and 40 percent of stock B.What is the expected rate of return on this portfolio?

A) 12.76 percent

B) 12.88 percent

C) 13.44 percent

D) 13.56 percent

E) 13.85 percent

A) 12.76 percent

B) 12.88 percent

C) 13.44 percent

D) 13.56 percent

E) 13.85 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

76

A portfolio consists of the following securities.What is the portfolio weight of stock X?

A) 0.183

B) 0.202

C) 0.219

D) 0.246

E) 0.285

A) 0.183

B) 0.202

C) 0.219

D) 0.246

E) 0.285

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

77

You have a portfolio which is comprised of 48 percent of stock A and 52 percent of stock B.What is the standard deviation of this portfolio?

A) 1.98 percent

B) 2.06 percent

C) 2.13 percent

D) 2.27 percent

E) 2.30 percent

A) 1.98 percent

B) 2.06 percent

C) 2.13 percent

D) 2.27 percent

E) 2.30 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

78

You have a portfolio which is comprised of 30 percent of stock A and 70 percent of stock B.What is the portfolio standard deviation?

A) 4.00 percent

B) 5.56 percent

C) 6.06 percent

D) 6.82 percent

E) 7.47 percent

A) 4.00 percent

B) 5.56 percent

C) 6.06 percent

D) 6.82 percent

E) 7.47 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

79

You have a portfolio which is comprised of 70 percent of stock A and 30 percent of stock B.What is the ex return on this portfolio?

A) 9.30 percent

B) 9.58 percent

C) 10.03 percent

D) 11.79 percent

E) 12.40 percent

A) 9.30 percent

B) 9.58 percent

C) 10.03 percent

D) 11.79 percent

E) 12.40 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck

80

Stock A has a standard deviation of 15 percent per year and stock B has a standard deviation of 8 percent per year.The correlation between stock A and stock B is .40.You have a portfolio of these two stocks wherein stock B has a portfolio weight of 40 percent.What is your portfolio variance?

A) 0.01143

B) 0.01214

C) 0.01329

D) 0.01437

E) 0.01470

A) 0.01143

B) 0.01214

C) 0.01329

D) 0.01437

E) 0.01470

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 88 في هذه المجموعة.

فتح الحزمة

k this deck