Deck 4: Completing the Accounting Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 4: Completing the Accounting Cycle

1

In accrual basis accounting, when are expenses usually recognized?

A) When cash is paid

B) When assets are purchased

C) When incurred

D) When assets are ordered

A) When cash is paid

B) When assets are purchased

C) When incurred

D) When assets are ordered

C

2

Each adjusting entry will always affect

A) Only balance sheet accounts

B) At least one income statement account and one retained earnings statement account

C) At least one balance sheet account and one income statement account

D) Only income statement accounts

A) Only balance sheet accounts

B) At least one income statement account and one retained earnings statement account

C) At least one balance sheet account and one income statement account

D) Only income statement accounts

C

3

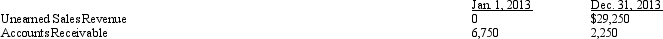

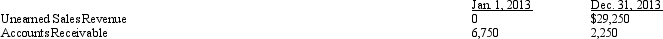

The 2013 accrual-basis income statement for Razorri Corporation reports sales revenue of $81,000. The related balance sheet accounts for the beginning and end of the year were  Based on this information, the amount of cash collected during 2013 from Razorri's customers was

Based on this information, the amount of cash collected during 2013 from Razorri's customers was

A) $81,000

B) $119,250

C) $114,750

D) $99,000

Based on this information, the amount of cash collected during 2013 from Razorri's customers was

Based on this information, the amount of cash collected during 2013 from Razorri's customers wasA) $81,000

B) $119,250

C) $114,750

D) $99,000

C

4

A system of accounting in which revenues and expenses are recorded only when cash is received or paid, is called

A) Revenue recognition accounting

B) Accrual-basis accounting

C) Realization accounting

D) Cash-basis accounting

A) Revenue recognition accounting

B) Accrual-basis accounting

C) Realization accounting

D) Cash-basis accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

A system of accounting in which revenues and expenses are recorded as they are earned and incurred, is called

A) Revenue recognition accounting

B) Accrual-basis accounting

C) Realization accounting

D) Cash-basis accounting

A) Revenue recognition accounting

B) Accrual-basis accounting

C) Realization accounting

D) Cash-basis accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

The idea that a company's life can be divided into distinct time periods so that accounting information can be reported on a timely basis is the

A) Accrual basis accounting

B) Time period concept

C) Fiscal year concept

D) Revenue recognition concept

A) Accrual basis accounting

B) Time period concept

C) Fiscal year concept

D) Revenue recognition concept

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

In analyzing accounts to determine which adjusting entries are necessary, accountants should determine

A) Whether the amounts recorded for all assets and liabilities are correct

B) What revenue or expense adjustment is required

C) What accounts need debits or credits

D) All of these are correct

A) Whether the amounts recorded for all assets and liabilities are correct

B) What revenue or expense adjustment is required

C) What accounts need debits or credits

D) All of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under accrual-basis accounting, expenses are recognized

A) When they are incurred, whether or not cash is paid

B) When they are incurred and paid at the same time

C) If they are paid before they are incurred

D) If they are paid after they are incurred

A) When they are incurred, whether or not cash is paid

B) When they are incurred and paid at the same time

C) If they are paid before they are incurred

D) If they are paid after they are incurred

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

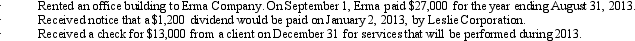

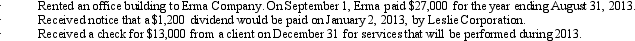

Nona Corporation, a calendar-year company, had the following transactions during 2012:  Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

A) $21,000

B) $27,000

C) $40,000

D) $41,200

Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?

Assuming cash-basis accounting for Nona Corporation, how much income should be reported on its 2012 income statement?A) $21,000

B) $27,000

C) $40,000

D) $41,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

A twelve-month accounting period ending on December 31 is known as a

A) Calendar year

B) Reporting period

C) Fiscal year

D) All of these are correct

A) Calendar year

B) Reporting period

C) Fiscal year

D) All of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under accrual-basis accounting, revenues are always recognized when

A) Earned

B) Cash is received

C) The manufacture of the product to be sold is completed

D) The selling price is firmly established

A) Earned

B) Cash is received

C) The manufacture of the product to be sold is completed

D) The selling price is firmly established

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following are usually NOT directly affected by adjusting entries?

A) Asset accounts

B) Liability accounts

C) Revenue accounts

D) Capital stock accounts

A) Asset accounts

B) Liability accounts

C) Revenue accounts

D) Capital stock accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is true about accrual-basis accounting?

A) Income is generally larger with accrual-basis accounting.

B) Accrual-basis accounting provides a better measure of performance.

C) Accrual-basis accounting is not required by GAAP.

D) Accrual-basis accounting and cash-basis accounting always produce the same results.

A) Income is generally larger with accrual-basis accounting.

B) Accrual-basis accounting provides a better measure of performance.

C) Accrual-basis accounting is not required by GAAP.

D) Accrual-basis accounting and cash-basis accounting always produce the same results.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following types of accounts will always be debited to adjust for an unrecorded receivable?

A) Liabilities

B) Revenues

C) Receivables

D) Expenses

A) Liabilities

B) Revenues

C) Receivables

D) Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

Under accrual-basis accounting, revenue is recognized

A) When cash is received without regard to when the services are rendered

B) When the services are rendered without regard to when cash is received

C) When cash is received before the time services are rendered

D) If cash is received after the services are rendered

A) When cash is received without regard to when the services are rendered

B) When the services are rendered without regard to when cash is received

C) When cash is received before the time services are rendered

D) If cash is received after the services are rendered

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

During 2013, Rumbo Corporation had cash and credit sales of $21,760 and $15,225, respectively. The company also collected accounts receivable of $9,765 and incurred operating expenses of $27,700, 80 percent of which were paid during the year. In addition, Rumbo paid $4,500 for an 18-month advertising campaign that began on September 30. Rumbo's accrual-basis net income (loss) for 2009 was

A) $9,285

B) $8,535

C) $14,075

D) $(775)

A) $9,285

B) $8,535

C) $14,075

D) $(775)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

The idea that all expenses incurred in generating revenues should be recognized in the same period as those revenues is called the

A) Time period concept

B) Realization concept

C) Matching principle

D) Revenue recognition principle

A) Time period concept

B) Realization concept

C) Matching principle

D) Revenue recognition principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

The matching principle requires that

A) Cash outflows be matched with cash inflows

B) Expenses incurred be matched with revenues earned

C) Assets be matched with liabilities

D) Assets be matched with owners' equity

A) Cash outflows be matched with cash inflows

B) Expenses incurred be matched with revenues earned

C) Assets be matched with liabilities

D) Assets be matched with owners' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following statements about adjusting entries is NOT true?

A) They are recorded on a daily basis as transactions occur.

B) They are posted at the end of an accounting period.

C) They do not affect the cash account.

D) They are not based on transactions.

A) They are recorded on a daily basis as transactions occur.

B) They are posted at the end of an accounting period.

C) They do not affect the cash account.

D) They are not based on transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

Adjusting entries are

A) Recorded on a daily basis as transactions occur

B) Not posted to the general ledger

C) Made at the end of an accounting period

D) Not required under accrual-basis accounting

A) Recorded on a daily basis as transactions occur

B) Not posted to the general ledger

C) Made at the end of an accounting period

D) Not required under accrual-basis accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following will occur if an adjusting entry to record an unrecorded receivable is NOT made?

A) Both revenues and assets will be understated.

B) Both revenues and assets will be overstated.

C) Revenues will be understated, but assets will be overstated.

D) Assets will be understated, but revenues will be overstated.

A) Both revenues and assets will be understated.

B) Both revenues and assets will be overstated.

C) Revenues will be understated, but assets will be overstated.

D) Assets will be understated, but revenues will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

On October 1, Mathis Company entered into a six-month contract with Lewis Company to provide custodial services on a daily basis. The terms of the contract state that the cost will be $3,000 per month and Mathis will bill Lewis at the end of every two months. If Mathis is a calendar year company, what is the appropriate adjusting entry at December 31?

A)

\begin{array}{l}\text { Cash }&3,000\ \\\quad \text { Service Revenue }&3,000\\end{array}

B)

C)

Service Revenue

Accounts Receivable

D)

A)

\begin{array}{l}\text { Cash }&3,000\ \\\quad \text { Service Revenue }&3,000\\end{array}

B)

C)

Service Revenue

Accounts Receivable

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

Bay Graphics pays its employees each Friday for a five-day total workweek. The payroll is $9,000 per week. If the end of the accounting period occurs on a Wednesday, what is the adjusting entry to record wages payable?

A)

B)

Salary Expense

Salaries Payable

C)

D)

Salaries Payable

Salary Expense

A)

B)

Salary Expense

Salaries Payable

C)

D)

Salaries Payable

Salary Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

An adjusting entry to record the expired portion of a prepaid expense that was originally debited to a prepaid expense account always includes

A) A debit to an asset

B) A credit to cash

C) A debit to an expense

D) A credit to an expense

A) A debit to an asset

B) A credit to cash

C) A debit to an expense

D) A credit to an expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following types of accounts will always be debited to adjust for an unrecorded liability?

A) Liabilities

B) Revenues

C) Receivables

D) Expenses

A) Liabilities

B) Revenues

C) Receivables

D) Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

For which of the following types of adjusting entries is there no original entry?

A) Prepaid expenses

B) Unearned revenues

C) Unrecorded liabilities

D) None of these are correct

A) Prepaid expenses

B) Unearned revenues

C) Unrecorded liabilities

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

If rent revenue of $5,000 is earned in 2012 but will NOT be received until 2013, what is the appropriate adjusting entry at December 31, 2013?

A)

B)

Cash

Rent Revenue

C)

D)

A)

B)

Cash

Rent Revenue

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

Prepaid expense accounts are usually classified as

A) Assets

B) Liabilities

C) Expenses

D) Revenues

A) Assets

B) Liabilities

C) Expenses

D) Revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following types of accounts will always be credited when a prepaid expense account is adjusted?

A) Assets

B) Liabilities

C) Revenues

D) Expenses

A) Assets

B) Liabilities

C) Revenues

D) Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

Revenue items that are earned but have NOT been collected or recognized are called

A) Unearned receivables

B) Deferred revenues

C) Unrecorded receivables

D) Prepaid revenues

A) Unearned receivables

B) Deferred revenues

C) Unrecorded receivables

D) Prepaid revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

An expired asset is called a(n)

A) Revenue

B) Expense

C) Retained earning

D) Cost

A) Revenue

B) Expense

C) Retained earning

D) Cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following will occur if an adjusting entry to record an accrued but unrecorded liability is NOT made?

A) Both expenses and liabilities will be understated.

B) Both expenses and liabilities will be overstated.

C) Expenses will be understated, but liabilities will be overstated.

D) Liabilities will be understated, but expenses will be overstated.

A) Both expenses and liabilities will be understated.

B) Both expenses and liabilities will be overstated.

C) Expenses will be understated, but liabilities will be overstated.

D) Liabilities will be understated, but expenses will be overstated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

On October 1, Doe Hunting Supplies, a calendar-year company, sold inventory that cost $60,000 for $100,000. The customer signed a six-month, 10 percent note in payment. On December 31, Woods should

A) Debit Interest Receivable for $2,500

B) Debit Interest Revenue for $2,500

C) Credit Interest Revenue for $10,000

D) Debit Interest Receivable for $10,000

A) Debit Interest Receivable for $2,500

B) Debit Interest Revenue for $2,500

C) Credit Interest Revenue for $10,000

D) Debit Interest Receivable for $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

What is the effect on account balances when an adjusting entry to record an unrecorded receivable is made?

A) Both revenues and assets will be increased.

B) Both revenues and assets will be decreased.

C) Revenues will be increased, but assets will be decreased.

D) Assets will be increased, but revenues will be decreased.

A) Both revenues and assets will be increased.

B) Both revenues and assets will be decreased.

C) Revenues will be increased, but assets will be decreased.

D) Assets will be increased, but revenues will be decreased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

An adjusting entry to record an unrecorded liability usually includes a credit to

A) A liability account

B) An asset account

C) A revenue account

D) An expense account

A) A liability account

B) An asset account

C) A revenue account

D) An expense account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

If on December 31, 2012, interest expense of $600 is owed on a bank note that will NOT be paid until July 2013, what is the appropriate adjusting entry at the end of 2012?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

Bay Graphics pays its employees each Friday for a five-day total workweek. The payroll is $9,000 per week. If the end of the accounting period occurs on a Wednesday, the adjusting entry to record wages payable would include a

A) Debit to Salary Expense of $3,600

B) Debit to Salary Expense of $5,400

C) Credit to Cash of $5,400

D) Credit to Salaries Payable of $3,600

A) Debit to Salary Expense of $3,600

B) Debit to Salary Expense of $5,400

C) Credit to Cash of $5,400

D) Credit to Salaries Payable of $3,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

The failure to adjust a prepaid expense that has partially expired and was originally recorded by debiting a prepaid expense for the entire amount will usually result in an

A) Understatement of assets and an understatement of expenses

B) Overstatement of assets and an overstatement of expenses

C) Understatement of assets and an overstatement of expenses

D) Overstatement of assets and an understatement of expenses

A) Understatement of assets and an understatement of expenses

B) Overstatement of assets and an overstatement of expenses

C) Understatement of assets and an overstatement of expenses

D) Overstatement of assets and an understatement of expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

Boudin Corporation, a calendar-year company, obtained a $15,000, one-year, 10 percent bank loan on October 31 of the current year. Interest is payable at the end of the loan term. The adjusting entry needed on December 31 is

A) A debit to Interest Expense of $1,500 and a credit to Interest Payable of $1,500

B) A debit to Interest Payable of $1,500 and a credit to Interest Expense of 1,500

C) A debit to Interest Expense of $250 and a credit to Interest Payable of $250

D) A debit to Interest Expense of $250 and a credit to Cash of $250

A) A debit to Interest Expense of $1,500 and a credit to Interest Payable of $1,500

B) A debit to Interest Payable of $1,500 and a credit to Interest Expense of 1,500

C) A debit to Interest Expense of $250 and a credit to Interest Payable of $250

D) A debit to Interest Expense of $250 and a credit to Cash of $250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

Unrecognized interest expense on a note is an example of a(n)

A) Unrecorded receivable

B) Unearned revenue

C) Unrecorded liability

D) Prepaid expense

A) Unrecorded receivable

B) Unearned revenue

C) Unrecorded liability

D) Prepaid expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

Kim Company purchased a two-year insurance policy on October 1, 2012, for $6,000. The policy covers its buildings for the next two years. If Kim debited Prepaid Insurance to record the purchase of the policy, the adjusting entry on December 31, 2012 (year-end) would include a credit to

A) Insurance Expense of $750

B) Insurance Expense of $3,000

C) Prepaid Insurance of $750

D) Prepaid Insurance of $3,000

A) Insurance Expense of $750

B) Insurance Expense of $3,000

C) Prepaid Insurance of $750

D) Prepaid Insurance of $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

Garcia Company has received advance payment for services yet to be performed. This prepayment is an example of a(n)

A) Unrecorded liability

B) Unrecorded receivable

C) Prepaid expense

D) Unearned revenue

A) Unrecorded liability

B) Unrecorded receivable

C) Prepaid expense

D) Unearned revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

An unearned revenue account is usually considered to be a(n)

A) Liability

B) Asset

C) Revenue

D) Expense

A) Liability

B) Asset

C) Revenue

D) Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

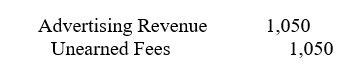

On June 1, 2013, Marino Corporation received $1,800 as advance payment for 12 months' advertising. The receipt was recorded as a credit to Unearned Fees. What adjusting entry is required at December 31, 2013?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

Amounts received before they are earned are called

A) Unrecorded receivables

B) Unrecorded liabilities

C) Prepaid expenses

D) Unearned revenues

A) Unrecorded receivables

B) Unrecorded liabilities

C) Prepaid expenses

D) Unearned revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

At the beginning of the period, Hann Corporation had $4,000 of supplies on hand. During the period, it purchased $1,300 of supplies and debited supplies for the same amount. At the end of the period, Hann Corporation determined that only $1,000 of supplies were still on hand. What adjusting entry should Hann Corporation make at the end of the period?

A)

Supplies

Supplies Expense

B)

Supplies

Supplies Expense

C)

Supplies Expense

Supplies

D)

A)

Supplies

Supplies Expense

B)

Supplies

Supplies Expense

C)

Supplies Expense

Supplies

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

The original entry to record a prepaid expense will usually include

A) A debit to an asset account and a credit to another asset account

B) A debit to an asset account and a credit to an expense account

C) A debit to an expense account and a credit to an asset account

D) None of these are correct

A) A debit to an asset account and a credit to another asset account

B) A debit to an asset account and a credit to an expense account

C) A debit to an expense account and a credit to an asset account

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

On December 16, 2012, Keen Company received $5,400 from Smith Company for rent on an office building owned by Keen. The $1,800 covers the period December 16, 2012, through February 15, 2013. If Keen Company credited Unearned Rent to record the $5,400 rent collected on December 16, the adjusting entry needed on December 31, 2012, would include

A) A credit to Rent Revenue of $1,350

B) A credit to Unearned Rent of $1,350

C) A debit to Rent Revenue of $2,700

D) A debit to Unearned Rent Revenue of $2,700

A) A credit to Rent Revenue of $1,350

B) A credit to Unearned Rent of $1,350

C) A debit to Rent Revenue of $2,700

D) A debit to Unearned Rent Revenue of $2,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

An adjusting entry to record the portion of unearned revenue that was earned in the current period usually includes a debit to

A) A liability account

B) An asset account

C) An expense account

D) A revenue account

A) A liability account

B) An asset account

C) An expense account

D) A revenue account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

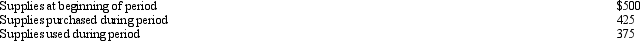

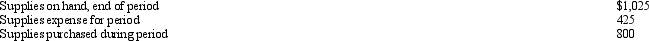

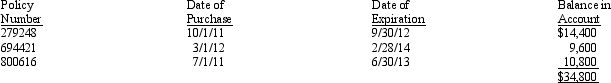

Given the following data, what is the amount in the supplies account to be shown as an asset on the balance sheet at the end of the period?

A) $350

B) $550

C) $375

D) $425

A) $350

B) $550

C) $375

D) $425

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

On June 30, 2012, Sinise Co. purchased a three-year fire insurance policy at a cost of $27,000 and debited Prepaid Insurance for the entire amount. The policy covers the period July 1, 2012, to June 30, 2015. The adjusting entry needed on December 31, 2012, includes a credit to

A) Insurance Expense for $9,000

B) Insurance Expense for $4,500

C) Prepaid Insurance for $4,500

D) Prepaid Insurance for $9,000

A) Insurance Expense for $9,000

B) Insurance Expense for $4,500

C) Prepaid Insurance for $4,500

D) Prepaid Insurance for $9,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

On April 1, Ciaunna Company paid $48,000 for two years rent and recorded the entire amount as a debit to Prepaid Rent. The adjusting entry on December 31 of that year would include a

A) Credit to Rent Expense of $18,000

B) Credit to Prepaid Rent of $24,000

C) Debit to Rent Expense of $24,000

D) Debit to Rent Expense of $18,000

A) Credit to Rent Expense of $18,000

B) Credit to Prepaid Rent of $24,000

C) Debit to Rent Expense of $24,000

D) Debit to Rent Expense of $18,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

From the following data, determine the amount of supplies on hand at the beginning of the period.

A) $650

B) $600

C) $1,450

D) $375

A) $650

B) $600

C) $1,450

D) $375

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

The failure to adjust an unearned revenue that has been partially earned and was originally recorded as a credit to Unearned Revenue will usually result in an

A) Overstatement of revenues and an overstatement of liabilities

B) Overstatement of revenues and an understatement of liabilities

C) Understatement of revenues and an understatement of liabilities

D) Understatement of revenues and an overstatement of liabilities

A) Overstatement of revenues and an overstatement of liabilities

B) Overstatement of revenues and an understatement of liabilities

C) Understatement of revenues and an understatement of liabilities

D) Understatement of revenues and an overstatement of liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

Scully Corporation purchased a three-year insurance policy on November 1 for $3,600. Assuming that Scully Corporation recorded the original transaction by debiting Prepaid Insurance, the adjusting entry on December 31 will include a

A) Debit to Insurance Expense for $200

B) Credit to Prepaid Insurance for $100

C) Debit to Prepaid Insurance for $100

D) Credit to Cash for $200

A) Debit to Insurance Expense for $200

B) Credit to Prepaid Insurance for $100

C) Debit to Prepaid Insurance for $100

D) Credit to Cash for $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

If a company receives rent for January 2013 from a tenant in December 2012, that rent would be

A) A revenue in 2012

B) An asset in 2012

C) An expense in 2012

D) A liability in 2012

A) A revenue in 2012

B) An asset in 2012

C) An expense in 2012

D) A liability in 2012

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

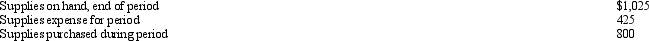

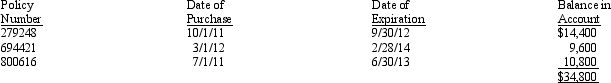

Montana Inc.'s fiscal year ended on December 31, 2012. The balance in the prepaid insurance account as of December 31, 2012, was $34,800 (before adjustment) and consisted of the following policies:  The adjusting entry required on December 31, 2012, would be

The adjusting entry required on December 31, 2012, would be

A)

B)

Insurance Expense

Prepaid Insurance

C)

D)

The adjusting entry required on December 31, 2012, would be

The adjusting entry required on December 31, 2012, would beA)

B)

Insurance Expense

Prepaid Insurance

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

On August 1, 2012, Base Line Realty purchased a two-year insurance policy for $15,000. On that date, the company debited Prepaid Insurance for $15,000. The adjusting entry on December 31, 2012, would include a debit to

A) Prepaid Insurance for $2,500

B) Prepaid Insurance for $3,125

C) Insurance Expense for $3,125

D) Insurance Expense for $2,500

A) Prepaid Insurance for $2,500

B) Prepaid Insurance for $3,125

C) Insurance Expense for $3,125

D) Insurance Expense for $2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

Brooklynne Company paid $25,400 in insurance premiums during 2012. Brooklynne showed $6,800 in prepaid insurance on its December 31, 2012, balance sheet and $4,600 on December 31, 2013. The insurance expense on the income statement for 2013 was

A) $18,600

B) $27,600

C) $23,200

D) $30,000

A) $18,600

B) $27,600

C) $23,200

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

On September 1, 2012, Carter's Construction Company received a $5,400 deposit towards the construction of a new house. The house will not be finished until February 28, 2013. The deposit was originally recorded as Unearned construction revenue. What adjusting entry is required at December 31, 2012?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

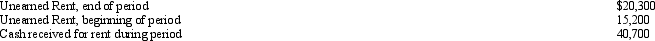

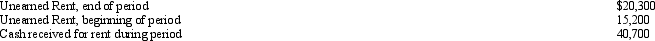

From the following data, determine the amount of rent revenue earned during the period.

A) $20,400

B) $35,600

C) $30,400

D) $55,900

A) $20,400

B) $35,600

C) $30,400

D) $55,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

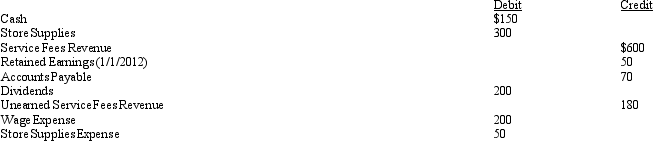

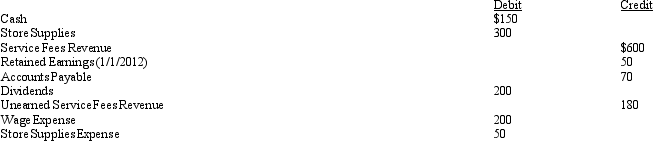

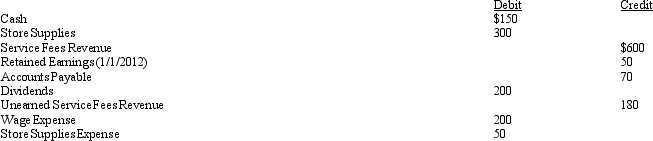

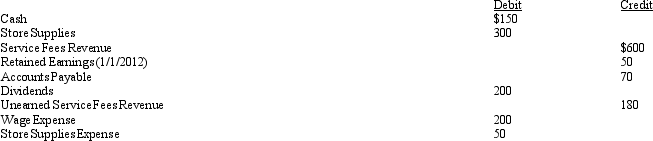

Exhibit 4-1 The following are a selection of account balances taken from the Adjusted Trial Balance of Cajon Corporation for December 31, 2012:

Refer to Exhibit 4-1. Given the information above, Cajon Corporation had net income in 2012 of

Refer to Exhibit 4-1. Given the information above, Cajon Corporation had net income in 2012 of

A) $150

B) $530

C) $330

D) $350

Refer to Exhibit 4-1. Given the information above, Cajon Corporation had net income in 2012 of

Refer to Exhibit 4-1. Given the information above, Cajon Corporation had net income in 2012 ofA) $150

B) $530

C) $330

D) $350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following accounts is NOT a real account?

A) Dividends

B) Cash

C) Accounts Payable

D) Retained Earnings

A) Dividends

B) Cash

C) Accounts Payable

D) Retained Earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

The purpose of financial statement analysis is to

A) Use the past performance to predict future performance.

B) Evaluate the current performance in order to identify problem areas.

C) Both use the past performance to predict future performance and evaluate the current performance in order to identify problem areas.

D) Neither use the past performance to predict future performance nor evaluate the current performance in order to identify problem areas.

A) Use the past performance to predict future performance.

B) Evaluate the current performance in order to identify problem areas.

C) Both use the past performance to predict future performance and evaluate the current performance in order to identify problem areas.

D) Neither use the past performance to predict future performance nor evaluate the current performance in order to identify problem areas.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

On December 31, the trial balance of Fife Company included the following account with a credit balance: Unearned advertising revenue If it is determined that the amount of advertising revenue applicable to future periods is $10,400, the correct adjusting entry would be:

A) Debit Unearned Advertising Revenue $10,400; credit Advertising Revenue $10,400

B) Debit Advertising Revenue $10,400; credit Unearned Advertising Revenue $10,400

C) Debit Unearned Advertising Revenue $5,800; credit Advertising Revenue $5,800

D) Debit Advertising Revenue $5,800; credit Unearned Advertising Revenue $5,800

A) Debit Unearned Advertising Revenue $10,400; credit Advertising Revenue $10,400

B) Debit Advertising Revenue $10,400; credit Unearned Advertising Revenue $10,400

C) Debit Unearned Advertising Revenue $5,800; credit Advertising Revenue $5,800

D) Debit Advertising Revenue $5,800; credit Unearned Advertising Revenue $5,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

The audit procedures conducted by the external auditor include all of the following, EXCEPT

A) Review of adjustments

B) Review of accounting systems

C) Sample of financial ratios

D) Sample of selected accounts

A) Review of adjustments

B) Review of accounting systems

C) Sample of financial ratios

D) Sample of selected accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

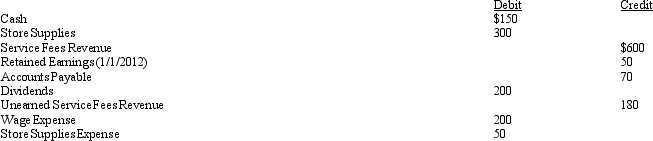

Exhibit 4-1 The following are a selection of account balances taken from the Adjusted Trial Balance of Cajon Corporation for December 31, 2012:

Refer to Exhibit 4-1. Given the information above, what is the amount of total assets on Cajon Corporation's balance sheet in 2012?

Refer to Exhibit 4-1. Given the information above, what is the amount of total assets on Cajon Corporation's balance sheet in 2012?

A) $150

B) $300

C) $450

D) $650

Refer to Exhibit 4-1. Given the information above, what is the amount of total assets on Cajon Corporation's balance sheet in 2012?

Refer to Exhibit 4-1. Given the information above, what is the amount of total assets on Cajon Corporation's balance sheet in 2012?A) $150

B) $300

C) $450

D) $650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

Nominal accounts are temporary subcategories of which account?

A) Sales revenue

B) Inventory

C) Retained earnings

D) Capital stock

A) Sales revenue

B) Inventory

C) Retained earnings

D) Capital stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

Nominal accounts are NOT found on which of the following financial statements?

A) Balance sheet

B) Income statement

C) Statement of cash flows

D) Retained earnings statement

A) Balance sheet

B) Income statement

C) Statement of cash flows

D) Retained earnings statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

Closing entries are

A) Required to bring all real accounts to a zero balance at the end of the accounting period

B) Not required to be posted

C) Required to bring all nominal accounts to a zero balance prior to starting a new accounting cycle

D) Generally taken from the financial statements rather than from the work sheet or the accounts themselves

A) Required to bring all real accounts to a zero balance at the end of the accounting period

B) Not required to be posted

C) Required to bring all nominal accounts to a zero balance prior to starting a new accounting cycle

D) Generally taken from the financial statements rather than from the work sheet or the accounts themselves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

When conducting an audit of a company's financial statements, auditors will usually be more concerned about which of the following?

A) Assets and liabilities are not overstated

B) Assets and liabilities are not understated

C) Assets are not understated and liabilities are not overstated

D) Assets are not overstated and liabilities are not understated

A) Assets and liabilities are not overstated

B) Assets and liabilities are not understated

C) Assets are not understated and liabilities are not overstated

D) Assets are not overstated and liabilities are not understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is a true statement about an auditor's evaluation of an accounting system?

A) If a company has a haphazard accounting system then the auditor has greater confidence that the financial statements are reliable.

B) If a company has an efficient and orderly accounting system then the auditor has greater confidence that the financial statements are reliable.

C) If a company has an efficient and orderly accounting system then the auditor must do more detailed work to verify that the financial statements are reliable.

D) None of these are correct.

A) If a company has a haphazard accounting system then the auditor has greater confidence that the financial statements are reliable.

B) If a company has an efficient and orderly accounting system then the auditor has greater confidence that the financial statements are reliable.

C) If a company has an efficient and orderly accounting system then the auditor must do more detailed work to verify that the financial statements are reliable.

D) None of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

The notes to the financial statements tell all of the following EXCEPT

A) Details about specific items

B) Assumptions used by the company

C) Accounting methods used by the company

D) Financial analysis

A) Details about specific items

B) Assumptions used by the company

C) Accounting methods used by the company

D) Financial analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is true of a work sheet?

A) It is prepared for distribution to outsiders.

B) It facilitates the preparation of financial statements.

C) It is the next to last step in the accounting cycle.

D) It is a required step in the accounting cycle.

A) It is prepared for distribution to outsiders.

B) It facilitates the preparation of financial statements.

C) It is the next to last step in the accounting cycle.

D) It is a required step in the accounting cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following describes the correct order of how financial statements are prepared from the information taken from the trial balance?

A) Compute net income, Identify all revenues and expenses, Compute the ending retained earnings balance, Prepare a balance sheet

B) Identify all revenues and expenses, Prepare a balance sheet, Compute the ending retained earnings balance, Compute net income

C) Compute the ending retained earnings balance, Compute net income, Prepare a balance sheet, Identify all revenues and expenses.

D) Identify all revenues and expenses, Compute net income, Compute the ending retained earnings balance, Prepare a balance sheet.

A) Compute net income, Identify all revenues and expenses, Compute the ending retained earnings balance, Prepare a balance sheet

B) Identify all revenues and expenses, Prepare a balance sheet, Compute the ending retained earnings balance, Compute net income

C) Compute the ending retained earnings balance, Compute net income, Prepare a balance sheet, Identify all revenues and expenses.

D) Identify all revenues and expenses, Compute net income, Compute the ending retained earnings balance, Prepare a balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

The closing entry involving a net loss will include a

A) Credit to sales revenue

B) Debit to retained earnings

C) Credit to dividends

D) Debit to salaries expense

A) Credit to sales revenue

B) Debit to retained earnings

C) Credit to dividends

D) Debit to salaries expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

When preparing its financial statements, a company is more concerned about which of the following?

A) Assets and liabilities are not overstated

B) Assets and liabilities are not understated

C) Assets are not understated and liabilities are not overstated

D) Assets are not overstated and liabilities are not understated

A) Assets and liabilities are not overstated

B) Assets and liabilities are not understated

C) Assets are not understated and liabilities are not overstated

D) Assets are not overstated and liabilities are not understated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

Prior to making any adjusting entries, Terra Corporation had net income of $155,100. The following adjusting entries were made: salaries payable, $1,574; interest earned on short-term investments but not yet recorded or collected, $7,268; adjustment to prepaid insurance for $5,538 for an insurance policy that expired during the period; and fees of $586 collected in advance that have now been earned. After recording these adjustments, net income would be

A) $170,084

B) 158,008

C) 155,842

D) 155,836

A) $170,084

B) 158,008

C) 155,842

D) 155,836

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

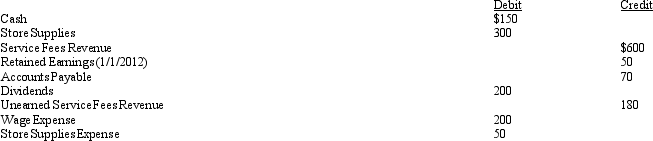

Exhibit 4-1 The following are a selection of account balances taken from the Adjusted Trial Balance of Cajon Corporation for December 31, 2012:

Refer to Exhibit 4-1. Given the information above, what is the amount of total liabilities and owner's equity on Cajon Corporation's balance sheet in 2012?

Refer to Exhibit 4-1. Given the information above, what is the amount of total liabilities and owner's equity on Cajon Corporation's balance sheet in 2012?

A) $100

B) $300

C) $250

D) $450

Refer to Exhibit 4-1. Given the information above, what is the amount of total liabilities and owner's equity on Cajon Corporation's balance sheet in 2012?

Refer to Exhibit 4-1. Given the information above, what is the amount of total liabilities and owner's equity on Cajon Corporation's balance sheet in 2012?A) $100

B) $300

C) $250

D) $450

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following sources provides the raw material to prepare the financial statements?

A) Income statement from previous year

B) Balance sheet from previous year

C) Adjusted trial balance

D) Unadjusted trial balance

A) Income statement from previous year

B) Balance sheet from previous year

C) Adjusted trial balance

D) Unadjusted trial balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck