Deck 14: Analyzing Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

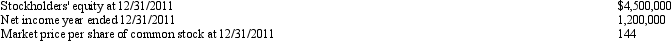

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/91

العب

ملء الشاشة (f)

Deck 14: Analyzing Financial Statements

1

Which of the following ratios represents an indication of investors' expectations concerning a firm's growth potential?

A) Earnings per share

B) Return on equity

C) Price-earnings ratio

D) Asset turnover

A) Earnings per share

B) Return on equity

C) Price-earnings ratio

D) Asset turnover

C

2

Which of the following ratios is a comparison of a financial statement number to a market value number?

A) Price-earnings ratio

B) Return on equity

C) Return on sales

D) Debt ratio

A) Price-earnings ratio

B) Return on equity

C) Return on sales

D) Debt ratio

A

3

Management uses financial statement analysis for

A) Operating, investing, and financing decisions

B) Investing decisions

C) Operating and financing decisions

D) Financing decisions

A) Operating, investing, and financing decisions

B) Investing decisions

C) Operating and financing decisions

D) Financing decisions

A

4

Which of the following is one of the purposes of financial statement analysis?

A) Diagnosis

B) Prognosis

C) Both diagnosis and prognosis

D) Neither diagnosis nor prognosis

A) Diagnosis

B) Prognosis

C) Both diagnosis and prognosis

D) Neither diagnosis nor prognosis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

5

When analyzing financial statements, diagnosis is

A) The prediction of how a business will perform in the future

B) The identification of the trends in past numbers

C) The prediction of how many employees will lose their jobs in the coming year

D) The identification of where a business has problems

A) The prediction of how a business will perform in the future

B) The identification of the trends in past numbers

C) The prediction of how many employees will lose their jobs in the coming year

D) The identification of where a business has problems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

6

The ability a company has to pay its debts in the short run is its

A) Leverage

B) Liquidity

C) Efficiency

D) Profitability

A) Leverage

B) Liquidity

C) Efficiency

D) Profitability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

7

When analyzing financial statements, prognosis is

A) The prediction of how a business will perform in the future

B) The identification of the trends in past numbers

C) The prediction of how many employees will lose their jobs in the coming year

D) The identification of where a business has problems

A) The prediction of how a business will perform in the future

B) The identification of the trends in past numbers

C) The prediction of how many employees will lose their jobs in the coming year

D) The identification of where a business has problems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following ratios is used to measure the profit earned on each dollar of sales in a firm?

A) Current ratio

B) Asset turnover

C) Return on sales

D) Return on equity

A) Current ratio

B) Asset turnover

C) Return on sales

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

9

What ratio is used to measure a firm's liquidity?

A) Debt ratio

B) Asset turnover

C) Current ratio

D) Return on equity

A) Debt ratio

B) Asset turnover

C) Current ratio

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following ratios is used to measure a firm's efficiency at using its assets?

A) Current ratio

B) Asset turnover

C) Return on sales

D) Return on equity

A) Current ratio

B) Asset turnover

C) Return on sales

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following ratios is the fundamental measure of overall company performance?

A) Return on equity

B) Current ratio

C) Asset turnover

D) Return on sales

A) Return on equity

B) Current ratio

C) Asset turnover

D) Return on sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following ratios is used to measure a firm's leverage?

A) Debt ratio

B) Current ratio

C) Asset turnover

D) Return on equity

A) Debt ratio

B) Current ratio

C) Asset turnover

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following ratios is used to measure the profit earned on each dollar invested in a firm?

A) Current ratio

B) Asset turnover

C) Return on sales

D) Return on equity

A) Current ratio

B) Asset turnover

C) Return on sales

D) Return on equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following ratios represents the proportion of borrowed funds used to acquire the company's assets?

A) Return on assets

B) Return on sales

C) Debt ratio

D) Current ratio

A) Return on assets

B) Return on sales

C) Debt ratio

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

15

External users of financial statements use financial statement analysis for

A) Operating, investing, and financing decisions

B) Investing decisions

C) Operating and financing decisions

D) Financing decisions

A) Operating, investing, and financing decisions

B) Investing decisions

C) Operating and financing decisions

D) Financing decisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

16

Financial statement analysis is greatly enhanced when financial ratios are compared with

A) Past values

B) Future values

C) Values for other firms in the same industry

D) Both past values and values for other firms in the same industry

A) Past values

B) Future values

C) Values for other firms in the same industry

D) Both past values and values for other firms in the same industry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is a measure of the liquid position of a corporation?

A) Price earnings ratio

B) Debt ratio

C) Current ratio

D) Asset turnover

A) Price earnings ratio

B) Debt ratio

C) Current ratio

D) Asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following ratios is calculated using only balance sheet numbers?

A) Price earnings ratio

B) Return on sales

C) Asset turnover

D) Current ratio

A) Price earnings ratio

B) Return on sales

C) Asset turnover

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following statements best describes financial statement analysis?

A) Financial statement analysis involves relationships and trends.

B) Financial statement analysis evaluates future performance.

C) Measurements for a specific company should be compared only with the past.

D) All of these are correct.

A) Financial statement analysis involves relationships and trends.

B) Financial statement analysis evaluates future performance.

C) Measurements for a specific company should be compared only with the past.

D) All of these are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

20

Relationships between financial statement amounts are called

A) Financial statement analyses

B) Financial ratios

C) Liquidity ratios

D) DuPont ratios

A) Financial statement analyses

B) Financial ratios

C) Liquidity ratios

D) DuPont ratios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

21

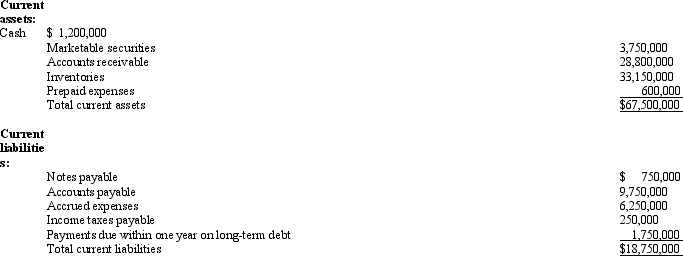

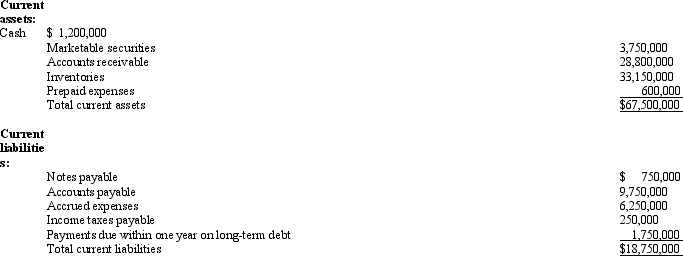

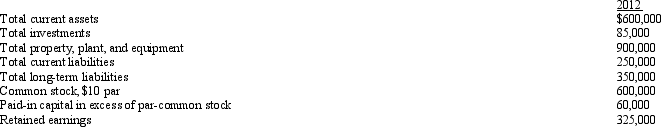

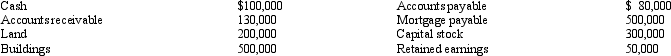

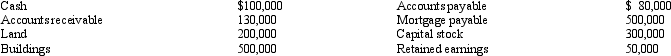

Partial information from Blain Company's balance sheet is as follows:  What is Blain's current ratio?

What is Blain's current ratio?

A) 0.26

B) 0.30

C) 1.80

D) 3.60

What is Blain's current ratio?

What is Blain's current ratio?A) 0.26

B) 0.30

C) 1.80

D) 3.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following ratios is calculated using only income statement numbers?

A) Debt ratio

B) Return on sales

C) Return on equity

D) Current ratio

A) Debt ratio

B) Return on sales

C) Return on equity

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following ratios is calculated using numbers from both the income statement and the balance sheet?

A) Current ratio

B) Price-earnings ratio

C) Return on equity

D) Return on sales

A) Current ratio

B) Price-earnings ratio

C) Return on equity

D) Return on sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is NOT included in the DuPont framework of the return on equity ratio?

A) Return on sales

B) Current ratio

C) Asset turnover

D) Asset-to-equity ratio

A) Return on sales

B) Current ratio

C) Asset turnover

D) Asset-to-equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

25

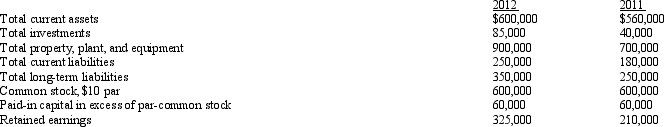

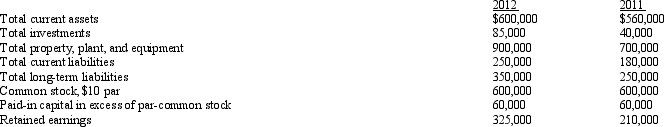

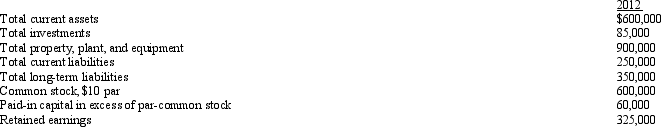

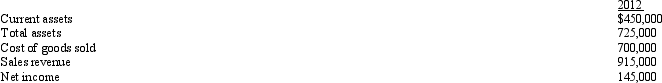

The balance sheet at the end of the current year of operations indicates the following:  If net income is $115,000 for 2012, what is the return on equity for 2012 (round percent to one decimal point)?

If net income is $115,000 for 2012, what is the return on equity for 2012 (round percent to one decimal point)?

A) 10.6%

B) 11.7%

C) 12.4%

D) 15.6%

If net income is $115,000 for 2012, what is the return on equity for 2012 (round percent to one decimal point)?

If net income is $115,000 for 2012, what is the return on equity for 2012 (round percent to one decimal point)?A) 10.6%

B) 11.7%

C) 12.4%

D) 15.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following below generally is the most useful in analyzing companies of different sizes?

A) Comparative statements

B) Common-sized financial statements

C) Price-level accounting

D) Audit report

A) Comparative statements

B) Common-sized financial statements

C) Price-level accounting

D) Audit report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

27

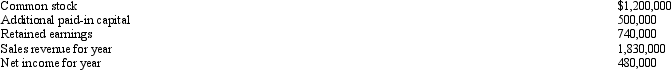

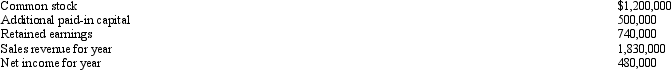

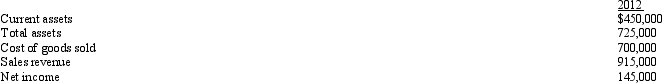

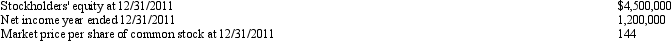

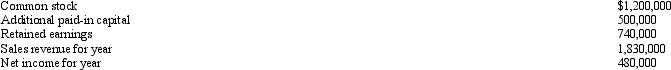

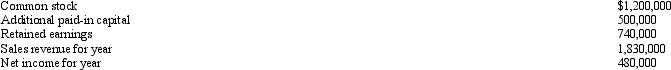

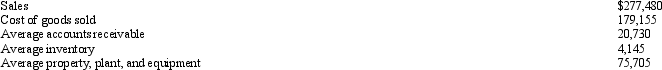

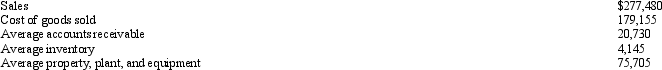

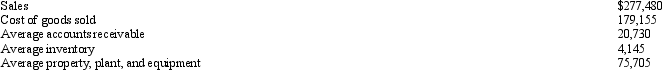

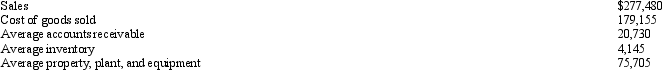

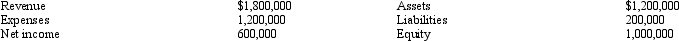

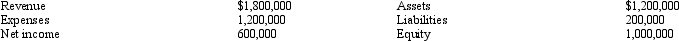

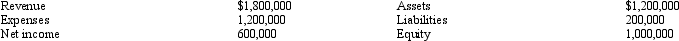

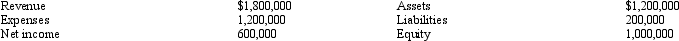

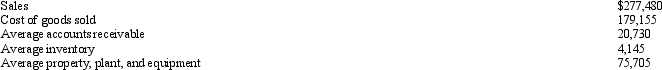

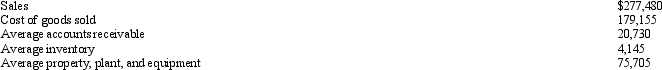

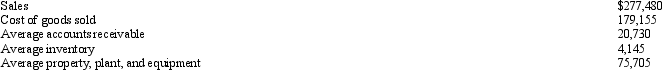

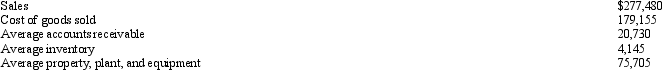

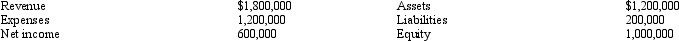

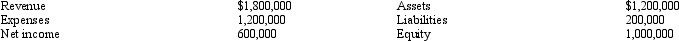

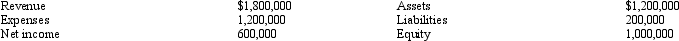

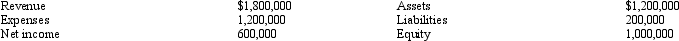

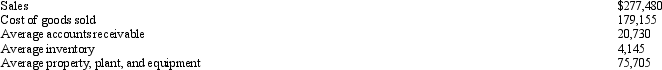

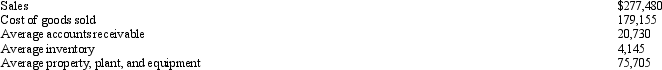

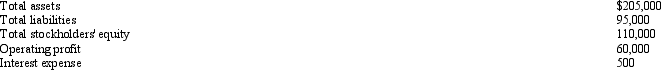

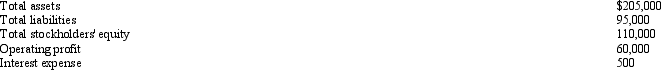

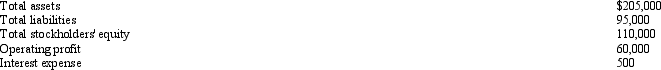

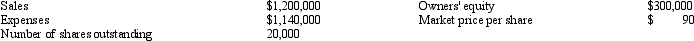

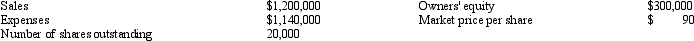

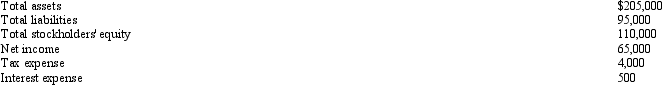

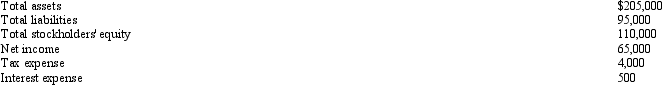

Exhibit 14-1 Selected information for Isaac Company is as follows:

Refer to Exhibit 14-1. Isaac's return on sales, rounded to the nearest percentage point, is

Refer to Exhibit 14-1. Isaac's return on sales, rounded to the nearest percentage point, is

A) 20 percent.

B) 21 percent.

C) 26 percent.

D) 40 percent.

Refer to Exhibit 14-1. Isaac's return on sales, rounded to the nearest percentage point, is

Refer to Exhibit 14-1. Isaac's return on sales, rounded to the nearest percentage point, isA) 20 percent.

B) 21 percent.

C) 26 percent.

D) 40 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a common-size income statement, each item on the statement is expressed as a percentage of

A) Revenue

B) Expenses

C) Net income

D) Gross profit

A) Revenue

B) Expenses

C) Net income

D) Gross profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

29

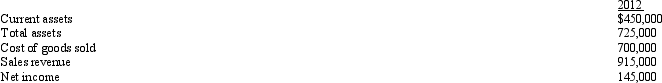

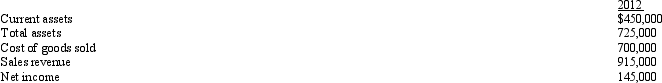

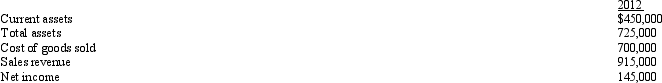

Exhibit 14-3 Selected information for Alastair Company is as follows:

Refer to Exhibit 14-3. What is the percentage that would be given to current assets on a common-size balance sheet (round to the nearest percent)?

Refer to Exhibit 14-3. What is the percentage that would be given to current assets on a common-size balance sheet (round to the nearest percent)?

A) 20 percent.

B) 49 percent

C) 77 percent

D) 100 percent

Refer to Exhibit 14-3. What is the percentage that would be given to current assets on a common-size balance sheet (round to the nearest percent)?

Refer to Exhibit 14-3. What is the percentage that would be given to current assets on a common-size balance sheet (round to the nearest percent)?A) 20 percent.

B) 49 percent

C) 77 percent

D) 100 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

30

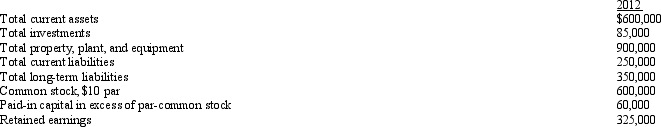

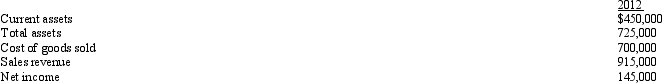

Exhibit 14-2 The balance sheet at the end of the first year of operations indicates the following:

Refer to Exhibit 14-2. If sales revenue for 2012 is $950,000, what is the asset turnover for 2012 (round to two decimal places)?

Refer to Exhibit 14-2. If sales revenue for 2012 is $950,000, what is the asset turnover for 2012 (round to two decimal places)?

A) 2.64

B) 1.58

C) 0.96

D) 0.60

Refer to Exhibit 14-2. If sales revenue for 2012 is $950,000, what is the asset turnover for 2012 (round to two decimal places)?

Refer to Exhibit 14-2. If sales revenue for 2012 is $950,000, what is the asset turnover for 2012 (round to two decimal places)?A) 2.64

B) 1.58

C) 0.96

D) 0.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following transactions could increase a firm's current ratio?

A) Purchase of inventory for cash

B) Payment of accounts payable

C) Collection of accounts receivable

D) Purchase of temporary investments for cash

A) Purchase of inventory for cash

B) Payment of accounts payable

C) Collection of accounts receivable

D) Purchase of temporary investments for cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

32

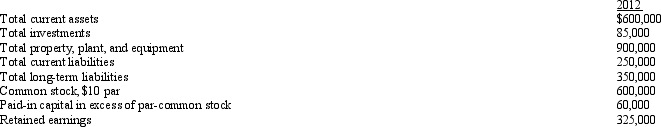

Exhibit 14-2 The balance sheet at the end of the first year of operations indicates the following:

Refer to Exhibit 14-2. What is the debt ratio for 2012 (rounded to one decimal places)?

Refer to Exhibit 14-2. What is the debt ratio for 2012 (rounded to one decimal places)?

A) 37.9%

B) 40.0%

C) 22.1%

D) 41.7%

Refer to Exhibit 14-2. What is the debt ratio for 2012 (rounded to one decimal places)?

Refer to Exhibit 14-2. What is the debt ratio for 2012 (rounded to one decimal places)?A) 37.9%

B) 40.0%

C) 22.1%

D) 41.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

33

Exhibit 14-3 Selected information for Alastair Company is as follows:

Refer to Exhibit 14-3. What is the percentage that would be given to cost of goods sold on a common-size income statement (round to the nearest percent)?

Refer to Exhibit 14-3. What is the percentage that would be given to cost of goods sold on a common-size income statement (round to the nearest percent)?

A) 20 percent.

B) 49 percent

C) 77 percent

D) 100 percent

Refer to Exhibit 14-3. What is the percentage that would be given to cost of goods sold on a common-size income statement (round to the nearest percent)?

Refer to Exhibit 14-3. What is the percentage that would be given to cost of goods sold on a common-size income statement (round to the nearest percent)?A) 20 percent.

B) 49 percent

C) 77 percent

D) 100 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

34

A useful tool in financial statement analysis is the common-size financial statement. What does this tool enable the financial analyst to do?

A) Evaluate financial statements of companies within a given industry of approximately the same value.

B) Determine which companies in the same industry are at approximately the same stage of development.

C) Ascertain the relative potential of companies of similar size in different industries.

D) Compare the mix of revenue, and expenses, and determine efficient use of resources within a company over time or between companies within a given industry without respect to relative size.

A) Evaluate financial statements of companies within a given industry of approximately the same value.

B) Determine which companies in the same industry are at approximately the same stage of development.

C) Ascertain the relative potential of companies of similar size in different industries.

D) Compare the mix of revenue, and expenses, and determine efficient use of resources within a company over time or between companies within a given industry without respect to relative size.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

35

In a common-size balance sheet, each item on the balance sheet is typically expressed as a percentage of

A) Assets

B) Net income

C) Equity

D) Sales revenue

A) Assets

B) Net income

C) Equity

D) Sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

36

The return on equity ratio under the DuPont framework is computed as

A) Net income/Revenue

B) Revenue/Assets

C) Assets/Equity

D) Net income/Equity

A) Net income/Revenue

B) Revenue/Assets

C) Assets/Equity

D) Net income/Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

37

Exhibit 14-3 Selected information for Alastair Company is as follows:

Refer to Exhibit 14-3. What is the percentage that would be given to sales revenue on a common-size income statement (round to the nearest percent)?

Refer to Exhibit 14-3. What is the percentage that would be given to sales revenue on a common-size income statement (round to the nearest percent)?

A) 20 percent.

B) 49 percent

C) 77 percent

D) 100 percent

Refer to Exhibit 14-3. What is the percentage that would be given to sales revenue on a common-size income statement (round to the nearest percent)?

Refer to Exhibit 14-3. What is the percentage that would be given to sales revenue on a common-size income statement (round to the nearest percent)?A) 20 percent.

B) 49 percent

C) 77 percent

D) 100 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

38

On December 31, 2010 and 2011, Taft Corporation had 100,000 shares of common stock issued and outstanding. Additional information is as follows:  The price-earnings ratio on common stock at December 31, 2011, was

The price-earnings ratio on common stock at December 31, 2011, was

A) 10

B) 12

C) 14

D) 16

The price-earnings ratio on common stock at December 31, 2011, was

The price-earnings ratio on common stock at December 31, 2011, wasA) 10

B) 12

C) 14

D) 16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

39

Exhibit 14-1 Selected information for Isaac Company is as follows:

Refer to Exhibit 14-1. Isaac's return on equity, rounded to the nearest percentage point, is

Refer to Exhibit 14-1. Isaac's return on equity, rounded to the nearest percentage point, is

A) 20 percent.

B) 21 percent.

C) 28 percent.

D) 40 percent.

Refer to Exhibit 14-1. Isaac's return on equity, rounded to the nearest percentage point, is

Refer to Exhibit 14-1. Isaac's return on equity, rounded to the nearest percentage point, isA) 20 percent.

B) 21 percent.

C) 28 percent.

D) 40 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

40

When using common-size statements

A) Data may be selected for the same business as of different dates, or for two or more businesses as of the same date

B) Relationships should be stated in terms of ratios

C) Dollar changes are reported over a period of at least three years

D) All of these are correct

A) Data may be selected for the same business as of different dates, or for two or more businesses as of the same date

B) Relationships should be stated in terms of ratios

C) Dollar changes are reported over a period of at least three years

D) All of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

41

Exhibit 14-5 Selected financial statement numbers for Frederick Company are given below:

Refer to Exhibit 14-5. Using the information above, calculate Frederick's accounts receivable turnover (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's accounts receivable turnover (round to two decimal places).

A) 13.39 times

B) 66.94 times

C) 3.67 times

D) 8.64 times

Refer to Exhibit 14-5. Using the information above, calculate Frederick's accounts receivable turnover (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's accounts receivable turnover (round to two decimal places).A) 13.39 times

B) 66.94 times

C) 3.67 times

D) 8.64 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

42

Exhibit 14-5 Selected financial statement numbers for Frederick Company are given below:

Refer to Exhibit 14-5. Using the information above, calculate Frederick's inventory turnover (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's inventory turnover (round to two decimal places).

A) 2.37 times

B) 66.94 times

C) 43.22 times

D) 8.64 times

Refer to Exhibit 14-5. Using the information above, calculate Frederick's inventory turnover (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's inventory turnover (round to two decimal places).A) 2.37 times

B) 66.94 times

C) 43.22 times

D) 8.64 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following ratios is decomposed using the DuPont framework?

A) Return on equity

B) Asset turnover

C) Assets-to-equity ratio

D) Return on sales

A) Return on equity

B) Asset turnover

C) Assets-to-equity ratio

D) Return on sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

44

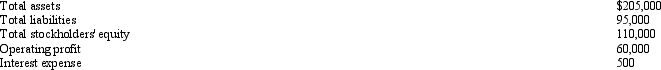

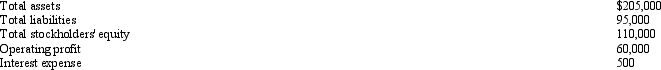

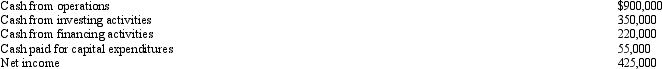

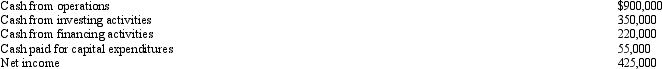

Exhibit 14-4 The following data came from the financial statements of the Cheviot Company:

Refer to Exhibit 14-4. Compute the return on equity.

Refer to Exhibit 14-4. Compute the return on equity.

A) 40%

B) 50%

C) 30%

D) 60%

Refer to Exhibit 14-4. Compute the return on equity.

Refer to Exhibit 14-4. Compute the return on equity.A) 40%

B) 50%

C) 30%

D) 60%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following ratios is used to measure a firm's leverage?

A) Net income ¸ Equity

B) Sales ¸ Assets

C) Assets ¸ Equity

D) Net income ¸ Sales

A) Net income ¸ Equity

B) Sales ¸ Assets

C) Assets ¸ Equity

D) Net income ¸ Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which ratio represents how a company is managing its property, plant, and equipment?

A) Average collection period for accounts receivable

B) Accounts receivable turnover

C) Inventory turnover

D) Property, plant, and equipment turnover

A) Average collection period for accounts receivable

B) Accounts receivable turnover

C) Inventory turnover

D) Property, plant, and equipment turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

47

Exhibit 14-4 The following data came from the financial statements of the Cheviot Company:

Refer to Exhibit 14-4. Compute the return on sales.

Refer to Exhibit 14-4. Compute the return on sales.

A) 25%

B) 33%

C) 40%

D) 50%

Refer to Exhibit 14-4. Compute the return on sales.

Refer to Exhibit 14-4. Compute the return on sales.A) 25%

B) 33%

C) 40%

D) 50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which ratio represents how many times during the year a company is collecting its receivables?

A) Average collection period for accounts receivable

B) Accounts receivable turnover

C) Inventory turnover

D) Fixed asset turnover

A) Average collection period for accounts receivable

B) Accounts receivable turnover

C) Inventory turnover

D) Fixed asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

49

The ratio that reflects the mix of sources of financing for a company is the

A) Current ratio

B) Debt-to-equity ratio

C) Price-earnings ratio

D) Times interest earned ratio

A) Current ratio

B) Debt-to-equity ratio

C) Price-earnings ratio

D) Times interest earned ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

50

Exhibit 14-5 Selected financial statement numbers for Frederick Company are given below:

Refer to Exhibit 14-5. Using the information above, calculate Frederick's average collection period (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's average collection period (round to two decimal places).

A) 99.46 days

B) 27.26 days

C) 42.25 days

D) 5.45 days

Refer to Exhibit 14-5. Using the information above, calculate Frederick's average collection period (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's average collection period (round to two decimal places).A) 99.46 days

B) 27.26 days

C) 42.25 days

D) 5.45 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following ratios is used to measure a firm's efficiency?

A) Net income ¸ Equity

B) Sales ¸ Assets

C) Assets ¸ Equity

D) Net income ¸ Sales

A) Net income ¸ Equity

B) Sales ¸ Assets

C) Assets ¸ Equity

D) Net income ¸ Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which ratio represents how many times a company replenishes its inventory during the year?

A) Average collection period for accounts receivable

B) Accounts receivable turnover

C) Inventory turnover

D) Fixed asset turnover

A) Average collection period for accounts receivable

B) Accounts receivable turnover

C) Inventory turnover

D) Fixed asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

53

Borrowing that allows a company to purchase more assets than its stockholders are able to pay for is

A) Leverage

B) Profitability

C) Efficiency

D) Liquidity

A) Leverage

B) Profitability

C) Efficiency

D) Liquidity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following ratios is NOT an efficiency ratio?

A) Fixed asset turnover

B) Inventory turnover

C) Debt-to-equity

D) Days' sales in inventory

A) Fixed asset turnover

B) Inventory turnover

C) Debt-to-equity

D) Days' sales in inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

55

Exhibit 14-5 Selected financial statement numbers for Frederick Company are given below:

Refer to Exhibit 14-5. Using the information above, calculate Frederick's number of days' sales in inventory (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's number of days' sales in inventory (round to two decimal places).

A) 154.01 days

B) 8.45 days

C) 42.25 days

D) 27.26 days

Refer to Exhibit 14-5. Using the information above, calculate Frederick's number of days' sales in inventory (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's number of days' sales in inventory (round to two decimal places).A) 154.01 days

B) 8.45 days

C) 42.25 days

D) 27.26 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

56

Exhibit 14-4 The following data came from the financial statements of the Cheviot Company:

Refer to Exhibit 14-4. Compute the asset-to-equity ratio (round to two decimal places).

Refer to Exhibit 14-4. Compute the asset-to-equity ratio (round to two decimal places).

A) 1.20

B) 1.40

C) 1.25

D) 1.15

Refer to Exhibit 14-4. Compute the asset-to-equity ratio (round to two decimal places).

Refer to Exhibit 14-4. Compute the asset-to-equity ratio (round to two decimal places).A) 1.20

B) 1.40

C) 1.25

D) 1.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

57

Exhibit 14-4 The following data came from the financial statements of the Cheviot Company:

Refer to Exhibit 14-4. Compute the asset turnover (round to two decimal places).

Refer to Exhibit 14-4. Compute the asset turnover (round to two decimal places).

A) 1.25

B) 1.40

C) 1.50

D) 1.60

Refer to Exhibit 14-4. Compute the asset turnover (round to two decimal places).

Refer to Exhibit 14-4. Compute the asset turnover (round to two decimal places).A) 1.25

B) 1.40

C) 1.50

D) 1.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following ratios is used to measure a firm's profitability?

A) Liabilities ¸ Equity

B) Sales ¸ Assets

C) Assets ¸ Equity

D) Net income ¸ Sales

A) Liabilities ¸ Equity

B) Sales ¸ Assets

C) Assets ¸ Equity

D) Net income ¸ Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

59

Exhibit 14-5 Selected financial statement numbers for Frederick Company are given below:

Refer to Exhibit 14-5. Using the information above, calculate Frederick's fixed asset turnover (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's fixed asset turnover (round to two decimal places).

A) 3.67 times

B) 13.39 times

C) 66.94 times

D) 2.39 times

Refer to Exhibit 14-5. Using the information above, calculate Frederick's fixed asset turnover (round to two decimal places).

Refer to Exhibit 14-5. Using the information above, calculate Frederick's fixed asset turnover (round to two decimal places).A) 3.67 times

B) 13.39 times

C) 66.94 times

D) 2.39 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is NOT included in the DuPont framework?

A) A measure of profitability

B) A measure of efficiency

C) A measure of market share

D) A measure of leverage

A) A measure of profitability

B) A measure of efficiency

C) A measure of market share

D) A measure of leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

61

Exhibit 14-6 The following data came from the financial statements of Petrini Company:

Refer to Exhibit 14-6. Given the information above, compute the assets-to-equity ratio (rounded to two decimal places) for Petrini Company.

Refer to Exhibit 14-6. Given the information above, compute the assets-to-equity ratio (rounded to two decimal places) for Petrini Company.

A) 0.46

B) 0.54

C) 0.86

D) 1.86

Refer to Exhibit 14-6. Given the information above, compute the assets-to-equity ratio (rounded to two decimal places) for Petrini Company.

Refer to Exhibit 14-6. Given the information above, compute the assets-to-equity ratio (rounded to two decimal places) for Petrini Company.A) 0.46

B) 0.54

C) 0.86

D) 1.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

62

In general, most companies have significant noncash expenses that reduce net income and also cause the cash flow-to-net income ratio to be

A) Greater than 1

B) Equal to 1

C) Less than 1

D) None of these are correct

A) Greater than 1

B) Equal to 1

C) Less than 1

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which cash flow ratio reflects a company's ability to finance its capital expansion through cash from operations?

A) Cash flow-to-operating profit

B) Cash flow-to-net income

C) Cash flow frequency

D) Cash flow adequacy

A) Cash flow-to-operating profit

B) Cash flow-to-net income

C) Cash flow frequency

D) Cash flow adequacy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

64

Exhibit 14-6 The following data came from the financial statements of Petrini Company:

Refer to Exhibit 14-6. Given the information above, compute the debt-to-equity ratio (rounded to two decimal places) for Petrini Company.

Refer to Exhibit 14-6. Given the information above, compute the debt-to-equity ratio (rounded to two decimal places) for Petrini Company.

A) 0.86

B) 1.86

C) 1.16

D) 0.54

Refer to Exhibit 14-6. Given the information above, compute the debt-to-equity ratio (rounded to two decimal places) for Petrini Company.

Refer to Exhibit 14-6. Given the information above, compute the debt-to-equity ratio (rounded to two decimal places) for Petrini Company.A) 0.86

B) 1.86

C) 1.16

D) 0.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

65

The particular analytical measures chosen to analyze a company may be influenced by all BUT which one of the following?

A) Industry type

B) Capital structure

C) Diversity of business operations

D) Product quality or service effectiveness

A) Industry type

B) Capital structure

C) Diversity of business operations

D) Product quality or service effectiveness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

66

Exhibit 14-7 The following data came from the financial statements of the Green Company:

Refer to Exhibit 14-7. Compute the cash flow adequacy ratio.

Refer to Exhibit 14-7. Compute the cash flow adequacy ratio.

A) 2.57

B) 4.09

C) 16.36

D) 2.12

Refer to Exhibit 14-7. Compute the cash flow adequacy ratio.

Refer to Exhibit 14-7. Compute the cash flow adequacy ratio.A) 2.57

B) 4.09

C) 16.36

D) 2.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

67

When analyzing a company's debt ratio, if the ratio has a value that is equal to one, then the company has

A) No debt

B) More debt than equity

C) Equal amounts of debt and equity

D) No stockholders' equity

A) No debt

B) More debt than equity

C) Equal amounts of debt and equity

D) No stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which one of these is NOT one of the benchmarking problems that arises when analyzing financial statements?

A) Reported financial statement numbers may actually be a measurement of different things

B) Companies that are being compared may be conglomerates

C) Not all companies use the same accounting practices

D) All of these are benchmarking problems

A) Reported financial statement numbers may actually be a measurement of different things

B) Companies that are being compared may be conglomerates

C) Not all companies use the same accounting practices

D) All of these are benchmarking problems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

69

When analyzing a company's debt-to-equity ratio, if the ratio has a value that is greater then one, then the company has

A) Less debt than equity

B) More debt than equity

C) Equal amounts of debt and equity

D) None of these are correct

A) Less debt than equity

B) More debt than equity

C) Equal amounts of debt and equity

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

70

Exhibit 14-6 The following data came from the financial statements of Petrini Company:

Refer to Exhibit 14-6. Given the information above, compute the debt ratio (rounded to two decimal places) for Petrini Company.

Refer to Exhibit 14-6. Given the information above, compute the debt ratio (rounded to two decimal places) for Petrini Company.

A) 0.46

B) 2.15

C) 0.86

D) 1.86

Refer to Exhibit 14-6. Given the information above, compute the debt ratio (rounded to two decimal places) for Petrini Company.

Refer to Exhibit 14-6. Given the information above, compute the debt ratio (rounded to two decimal places) for Petrini Company.A) 0.46

B) 2.15

C) 0.86

D) 1.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

71

The ratio that indicates if a borrowing company will be able to meet its required interest payments is the

A) Current ratio

B) Debt-to-equity ratio

C) Price-earnings ratio

D) Times interest earned ratio

A) Current ratio

B) Debt-to-equity ratio

C) Price-earnings ratio

D) Times interest earned ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

72

The financial statements for Kobe Corporation revealed that sales revenue was $1,581,000 and that the following were the ending account balances:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

73

The cash flow adequacy ratio is computed as

A) Cash from operations ¸ Cash from investing activities

B) Cash from operations ¸ Cash from financing activities

C) Cash from operations ¸ Cash paid for capital expenditures

D) Cash from investing activities ¸ Cash from operations

A) Cash from operations ¸ Cash from investing activities

B) Cash from operations ¸ Cash from financing activities

C) Cash from operations ¸ Cash paid for capital expenditures

D) Cash from investing activities ¸ Cash from operations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

74

Amherst, Inc.'s financial statements contained the following information:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is NOT a situation when it would be important to analyze cash flow information because net income is NOT giving an accurate portrayal of the economic performance of the company?

A) When a company is growing rapidly

B) When a company is striving to present a stellar financial record

C) When a company has a negative operating cash flow

D) When a company has several large noncash expenses

A) When a company is growing rapidly

B) When a company is striving to present a stellar financial record

C) When a company has a negative operating cash flow

D) When a company has several large noncash expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

76

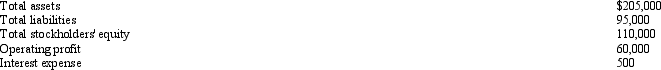

The following data came from the financial statements of Petrini Company:  Compute the times interest earned ratio (rounded to two decimal places) for Petrini Company.

Compute the times interest earned ratio (rounded to two decimal places) for Petrini Company.

A) 130 times

B) 129 times

C) 122 times

D) 139 times

Compute the times interest earned ratio (rounded to two decimal places) for Petrini Company.

Compute the times interest earned ratio (rounded to two decimal places) for Petrini Company.A) 130 times

B) 129 times

C) 122 times

D) 139 times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

77

When analyzing a company's debt-to-equity ratio, if the ratio has a value that is equal to one, then the company has

A) Less debt than equity

B) More debt than equity

C) Equal amounts of debt and equity

D) None of these are correct

A) Less debt than equity

B) More debt than equity

C) Equal amounts of debt and equity

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

78

Exhibit 14-7 The following data came from the financial statements of the Green Company:

Refer to Exhibit 14-7. Compute the cash flow-to-net income ratio.

Refer to Exhibit 14-7. Compute the cash flow-to-net income ratio.

A) 2.57

B) 4.09

C) 16.36

D) 2.12

Refer to Exhibit 14-7. Compute the cash flow-to-net income ratio.

Refer to Exhibit 14-7. Compute the cash flow-to-net income ratio.A) 2.57

B) 4.09

C) 16.36

D) 2.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

79

When analyzing a company's assets-to-equity ratio, if the ratio has a value that is equal to one, then the company has

A) No debt

B) More debt than equity

C) Equal amounts of debt and equity

D) No stockholders' equity

A) No debt

B) More debt than equity

C) Equal amounts of debt and equity

D) No stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which cash flow ratio reflects the extent to which accrual accounting adjustments and assumptions have been included in net income?

A) Cash flow-to-operating profit

B) Cash flow-to-net income

C) Cash flow frequency

D) Cash flow adequacy

A) Cash flow-to-operating profit

B) Cash flow-to-net income

C) Cash flow frequency

D) Cash flow adequacy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck