Deck 13: Statement of Cash Flows

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

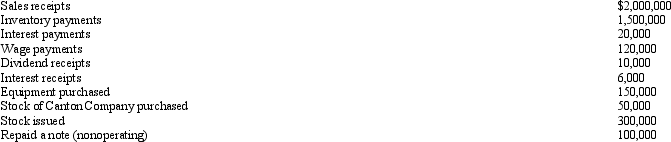

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

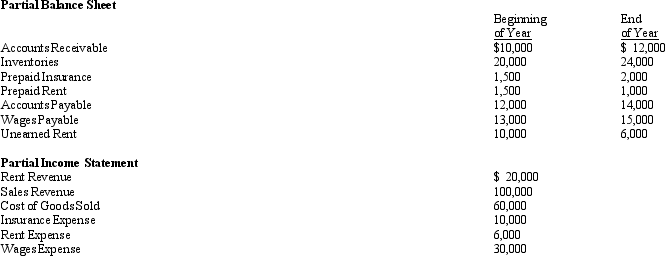

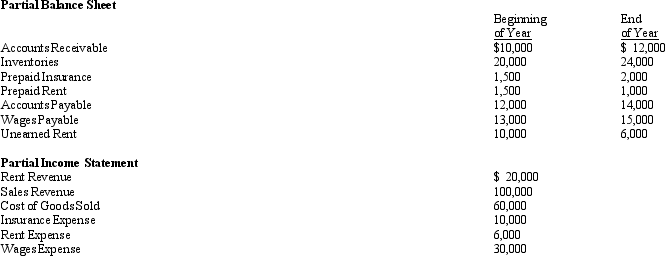

سؤال

سؤال

سؤال

سؤال

سؤال

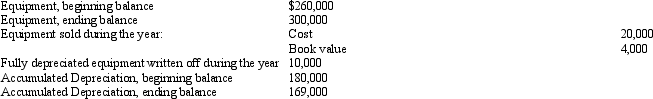

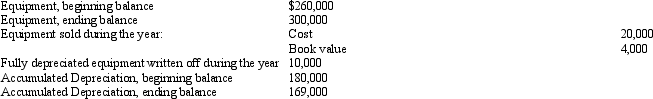

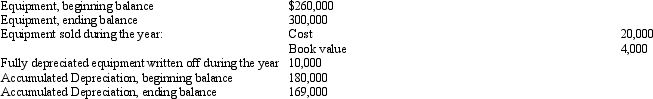

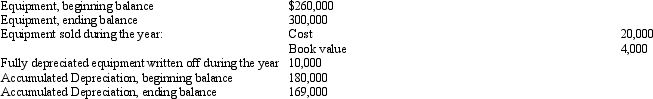

سؤال

سؤال

سؤال

سؤال

سؤال

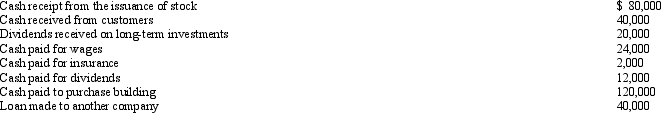

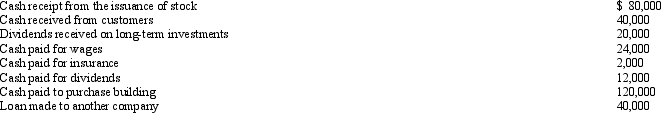

سؤال

سؤال

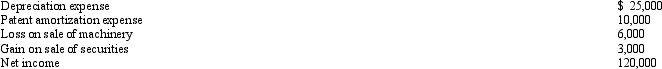

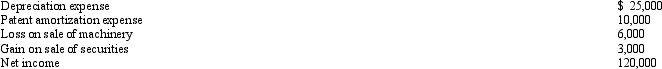

سؤال

سؤال

سؤال

سؤال

سؤال

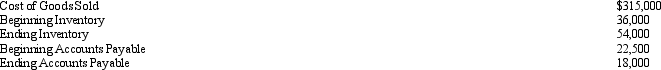

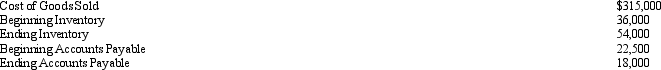

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/97

العب

ملء الشاشة (f)

Deck 13: Statement of Cash Flows

1

Which of the following is the typical sequencing of activities on the statement of cash flows?

A) Operating, investing, and financing

B) Operating, financing, and investing

C) Investing, operating, and financing

D) Investing, financing, and operating

A) Operating, investing, and financing

B) Operating, financing, and investing

C) Investing, operating, and financing

D) Investing, financing, and operating

A

2

Which of the following would NOT be reported as an investing activity on a statement of cash flows?

A) Collection of a long-term note receivable

B) Amounts borrowed

C) Extending loans to other entities

D) Sale of a building

A) Collection of a long-term note receivable

B) Amounts borrowed

C) Extending loans to other entities

D) Sale of a building

B

3

Which of the following would be reported as a financing activity on a statement of cash flows?

A) Receipt of a dividend

B) Purchase of treasury stock

C) Proceeds from the sale of land

D) Payment of interest

A) Receipt of a dividend

B) Purchase of treasury stock

C) Proceeds from the sale of land

D) Payment of interest

B

4

The repayment of the principal on a loan used to finance the purchase of equipment should be classified as a(n)

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

5

The statement of cash flows replaces the

A) Balance sheet

B) Statement of financial position

C) Income statement

D) None of these

A) Balance sheet

B) Statement of financial position

C) Income statement

D) None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

6

A statement of cash flows will help investors understand all the following EXCEPT

A) How a new building was financed

B) Why inventory increased

C) How much long-term debt was retired

D) Whether or not a company paid cash dividends

A) How a new building was financed

B) Why inventory increased

C) How much long-term debt was retired

D) Whether or not a company paid cash dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following would be reported as a cash flow from financing activities?

A) Cash receipts from the sale of equipment

B) Cash receipts from interest on notes receivable

C) Cash receipts from dividends on long-term investments

D) Cash receipts from the issuance of long-term debt

A) Cash receipts from the sale of equipment

B) Cash receipts from interest on notes receivable

C) Cash receipts from dividends on long-term investments

D) Cash receipts from the issuance of long-term debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following would NOT be included in the operating activities section of the statement of cash flows?

A) Interest received

B) Interest paid

C) Dividends received

D) Dividends paid

A) Interest received

B) Interest paid

C) Dividends received

D) Dividends paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is NOT a purpose of the statement of cash flows?

A) It provides information about an entity's cash receipts and payments over a period of time.

B) It provides investors with information about the investing and financing activities of an entity.

C) It highlights changes in managerial strategy regarding investments and finances.

D) It measures the profitability of an entity.

A) It provides information about an entity's cash receipts and payments over a period of time.

B) It provides investors with information about the investing and financing activities of an entity.

C) It highlights changes in managerial strategy regarding investments and finances.

D) It measures the profitability of an entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following would be reported as an operating activity on a statement of cash flows?

A) Payment of taxes

B) Payment of dividends

C) Repayment of a loan

D) Purchase of a building

A) Payment of taxes

B) Payment of dividends

C) Repayment of a loan

D) Purchase of a building

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

11

Those transactions and events that enter into the determination of net income are reported under which section of the statement of cash flows?

A) Significant noncash investing and financing activities

B) Financing activities

C) Investing activities

D) Operating activities

A) Significant noncash investing and financing activities

B) Financing activities

C) Investing activities

D) Operating activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would be classified as an investing activity on a statement of cash flows?

A) Cash received from dividends

B) Cash paid for interest

C) Cash received from the sale of a land

D) Cash used to repay principal amounts borrowed

A) Cash received from dividends

B) Cash paid for interest

C) Cash received from the sale of a land

D) Cash used to repay principal amounts borrowed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following would NOT be considered cash or cash equivalents for purposes of preparing a statement of cash flows?

A) Money market funds

B) Checking accounts

C) Treasury bills

D) Notes receivable

A) Money market funds

B) Checking accounts

C) Treasury bills

D) Notes receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

14

In addition to the three primary financial statements, which of the following is also required under GAAP?

A) Statement of financial position

B) Statement of cash flows

C) Statement of changes in working capital

D) Statement of cash equivalents

A) Statement of financial position

B) Statement of cash flows

C) Statement of changes in working capital

D) Statement of cash equivalents

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

15

Significant noncash financing and investing transactions are

A) Listed in the body of a statement of cash flows

B) Reported in a narrative or in a separate schedule

C) Reported under the financing and investing activities sections

D) Converted to cash equivalents

A) Listed in the body of a statement of cash flows

B) Reported in a narrative or in a separate schedule

C) Reported under the financing and investing activities sections

D) Converted to cash equivalents

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following statements is NOT true?

A) The statement of cash flows provides details as to how the cash account changed during a period.

B) The statement of cash flows does not replace the income statement.

C) The statement of cash flows includes transactions that are not already reflected in the balance sheet and income statement.

D) The statement of cash flows sheds some light on a company's ability to generate income in the future.

A) The statement of cash flows provides details as to how the cash account changed during a period.

B) The statement of cash flows does not replace the income statement.

C) The statement of cash flows includes transactions that are not already reflected in the balance sheet and income statement.

D) The statement of cash flows sheds some light on a company's ability to generate income in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

17

The statement of cash flows

A) Is a required statement only for those companies using cash-basis accounting

B) Provides a connecting link between two consecutive income statements

C) Is intended primarily to provide necessary information for assessing the profitability of an entity

D) Summarizes all cash inflows and outflows of an entity for a given period of time

A) Is a required statement only for those companies using cash-basis accounting

B) Provides a connecting link between two consecutive income statements

C) Is intended primarily to provide necessary information for assessing the profitability of an entity

D) Summarizes all cash inflows and outflows of an entity for a given period of time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

18

Significant noncash financing transactions

A) Are included parenthetically on a statement of cash flows

B) Should not be disclosed at all since they are irrelevant to actual performance

C) Should not be disclosed in the body of a statement of cash flows but should appear elsewhere

D) Are deducted from net income to determine cash provided by operating activities on a statement of cash flows

A) Are included parenthetically on a statement of cash flows

B) Should not be disclosed at all since they are irrelevant to actual performance

C) Should not be disclosed in the body of a statement of cash flows but should appear elsewhere

D) Are deducted from net income to determine cash provided by operating activities on a statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following would be classified as an operating activity on a statement of cash flows?

A) Cash received from selling equity securities

B) Cash received as dividends on investments

C) Cash dividends paid to stockholders

D) Cash paid to purchase treasury stock

A) Cash received from selling equity securities

B) Cash received as dividends on investments

C) Cash dividends paid to stockholders

D) Cash paid to purchase treasury stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

20

The exchange of debt for equipment would

A) Be shown on a statement of cash flows as an operating activity

B) Be shown on a statement of cash flows as an investing activity

C) Be shown on a statement of cash flows as a financing activity

D) Be shown as a supplementary disclosure

A) Be shown on a statement of cash flows as an operating activity

B) Be shown on a statement of cash flows as an investing activity

C) Be shown on a statement of cash flows as a financing activity

D) Be shown as a supplementary disclosure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following would be added to net income on a statement of cash flows prepared using the indirect method?

A) A gain from the sale of equipment

B) A decrease in accounts receivable

C) A decrease in accounts payable

D) Dividends received

A) A gain from the sale of equipment

B) A decrease in accounts receivable

C) A decrease in accounts payable

D) Dividends received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

22

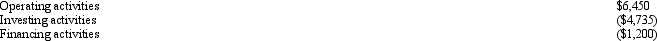

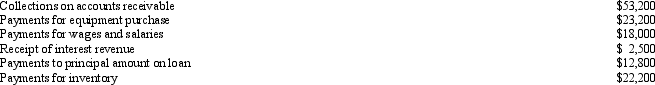

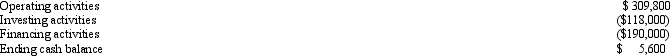

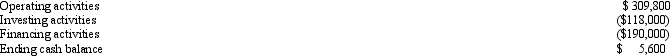

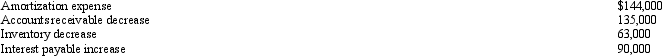

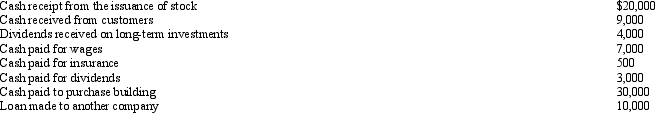

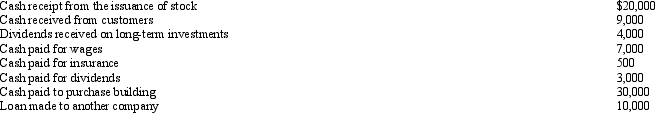

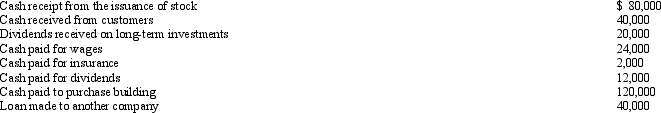

Yuka Company had a beginning cash balance of $1,875. In addition, Yuka Company reported the following items from its cash flow statement:  Given this information, Yuka Company's ending cash balance is

Given this information, Yuka Company's ending cash balance is

A) $515

B) $2,390

C) $2,480

D) $3,590

Given this information, Yuka Company's ending cash balance is

Given this information, Yuka Company's ending cash balance isA) $515

B) $2,390

C) $2,480

D) $3,590

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

23

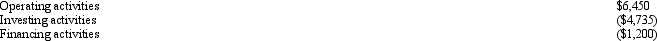

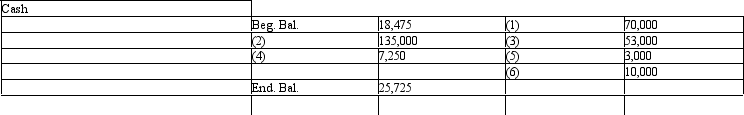

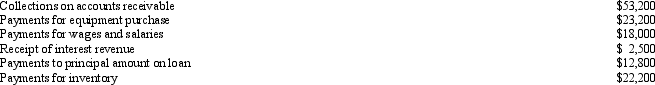

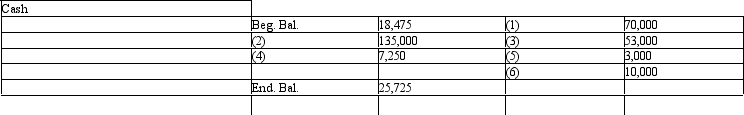

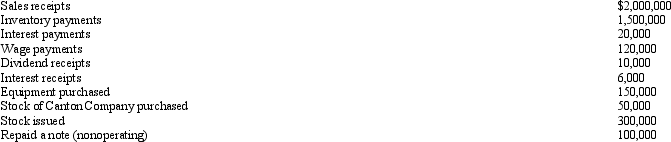

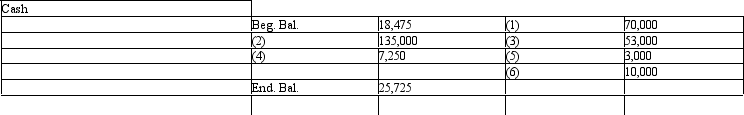

Exhibit 13-1 On December 31, 2012, Lodger Company's ledger had the following information in its cash account:

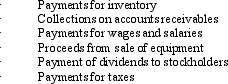

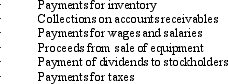

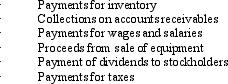

The transactions that are represented in Lodger's cash account are as follows:

The transactions that are represented in Lodger's cash account are as follows:

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) operating activities.

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) operating activities.

A) ($3,000)

B) $7,250

C) ($2,000)

D) $2,000

The transactions that are represented in Lodger's cash account are as follows:

The transactions that are represented in Lodger's cash account are as follows: Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) operating activities.

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) operating activities.A) ($3,000)

B) $7,250

C) ($2,000)

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

24

Simpson purchased money market funds with cash during the current year. This transaction will result in a decrease in cash from

A) Operating activities

B) Financing activities

C) Investing activities

D) No change in cash will occur

A) Operating activities

B) Financing activities

C) Investing activities

D) No change in cash will occur

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

25

The method that begins with net income or net loss and adjusts that number for items that did not affect cash is called the

A) Direct method

B) Operating method

C) Indirect method

D) Cash-equivalent method

A) Direct method

B) Operating method

C) Indirect method

D) Cash-equivalent method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following would be deducted from net income on a statement of cash flows prepared using the indirect method?

A) A gain from the sale of equipment

B) A decrease in accounts receivable

C) An increase in accounts payable

D) Dividends paid

A) A gain from the sale of equipment

B) A decrease in accounts receivable

C) An increase in accounts payable

D) Dividends paid

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

27

Dahbi Corporation has the following financial information available:  Given this information, what is the amount of cash provided by (used in) Dahbi's investing activities?

Given this information, what is the amount of cash provided by (used in) Dahbi's investing activities?

A) $17,750

B) ($24,850)

C) ($13,550)

D) $13,550

Given this information, what is the amount of cash provided by (used in) Dahbi's investing activities?

Given this information, what is the amount of cash provided by (used in) Dahbi's investing activities?A) $17,750

B) ($24,850)

C) ($13,550)

D) $13,550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

28

Hee Jung Company had the following information available:  Using this information, compute Hee Jung's cash provided by (paid for) operating activities.

Using this information, compute Hee Jung's cash provided by (paid for) operating activities.

A) $15,500

B) $14,500

C) $13,000

D) $12,000

Using this information, compute Hee Jung's cash provided by (paid for) operating activities.

Using this information, compute Hee Jung's cash provided by (paid for) operating activities.A) $15,500

B) $14,500

C) $13,000

D) $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

29

The purchase of inventory on account would increase

A) Cash from operating activities

B) Cash from financing activities

C) Working capital

D) None of these are correct

A) Cash from operating activities

B) Cash from financing activities

C) Working capital

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

30

Durning Company loaned $1,000,000 at 8 percent interest to Silva Company. Durning Company would classify the loan as a(n)

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

31

Exhibit 13-1 On December 31, 2012, Lodger Company's ledger had the following information in its cash account:

The transactions that are represented in Lodger's cash account are as follows:

The transactions that are represented in Lodger's cash account are as follows:

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) financing activities.

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) financing activities.

A) ($3,000)

B) $7,250

C) ($2,000)

D) $2,000

The transactions that are represented in Lodger's cash account are as follows:

The transactions that are represented in Lodger's cash account are as follows: Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) financing activities.

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) financing activities.A) ($3,000)

B) $7,250

C) ($2,000)

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

32

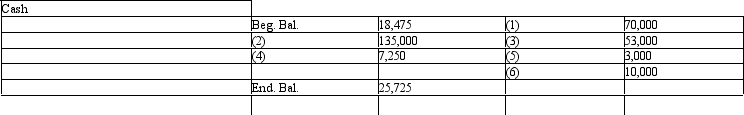

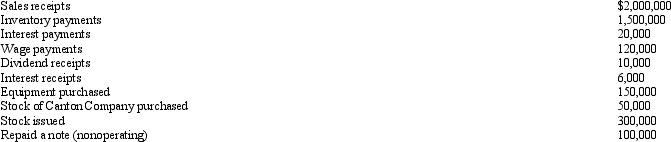

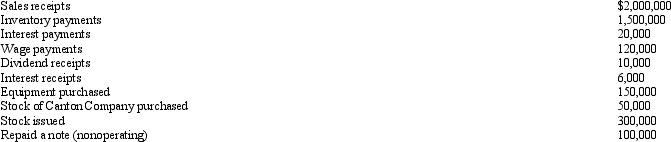

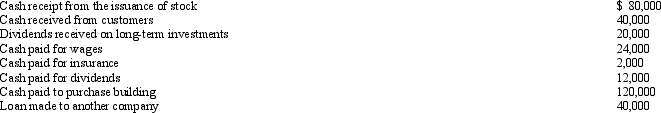

Exhibit 13-2 Avondale Inc. had the following cash transactions during 2012:

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) financing activities?

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) financing activities?

A) $200,000

B) $300,000

C) $100,000

D) $150,000

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) financing activities?

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) financing activities?A) $200,000

B) $300,000

C) $100,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

33

Exhibit 13-2 Avondale Inc. had the following cash transactions during 2012:

Refer to Exhibit 13-2. What was Avondale's net increase in cash for the year?

Refer to Exhibit 13-2. What was Avondale's net increase in cash for the year?

A) $306,000

B) $266,000

C) $376,000

D) $576,000

Refer to Exhibit 13-2. What was Avondale's net increase in cash for the year?

Refer to Exhibit 13-2. What was Avondale's net increase in cash for the year?A) $306,000

B) $266,000

C) $376,000

D) $576,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

34

Exhibit 13-2 Avondale Inc. had the following cash transactions during 2012:

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) operating activities?

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) operating activities?

A) $2,016,000

B) $360,000

C) $516,000

D) $376,000

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) operating activities?

Refer to Exhibit 13-2. What was Avondale's net cash provided by (used in) operating activities?A) $2,016,000

B) $360,000

C) $516,000

D) $376,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

35

Durning Company loaned $1,000,000 at 8 percent interest to Silva Company. The interest revenue would be classified as a(n)

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

36

Exhibit 13-1 On December 31, 2012, Lodger Company's ledger had the following information in its cash account:

The transactions that are represented in Lodger's cash account are as follows:

The transactions that are represented in Lodger's cash account are as follows:

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) investing activities.

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) investing activities.

A) ($3,000)

B) $7,250

C) ($2,000)

D) $2,000

The transactions that are represented in Lodger's cash account are as follows:

The transactions that are represented in Lodger's cash account are as follows: Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) investing activities.

Refer to Exhibit 13-1. Using the information above, compute the amount of cash provided by (used in) investing activities.A) ($3,000)

B) $7,250

C) ($2,000)

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

37

Durning Company loaned $1,000,000 at 8 percent interest to Silva Company. Silva Company would classify the loan as a(n)

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

A) Operating activity

B) Investing activity

C) Financing activity

D) Noncash transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

38

A simple statement of cash flows can be prepared by using

A) The cash t-account

B) The beginning trial balance

C) The ending trial balance

D) The income statement

A) The cash t-account

B) The beginning trial balance

C) The ending trial balance

D) The income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following transactions is LEAST likely to be a separate item on a statement of cash flows prepared using the indirect method?

A) The collection of accounts receivable

B) The sale of equipment

C) The issuance of stock

D) The payment of dividends

A) The collection of accounts receivable

B) The sale of equipment

C) The issuance of stock

D) The payment of dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

40

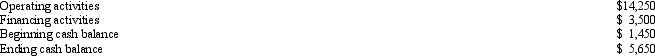

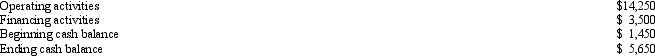

The following financial information is available for the year 2012:  Given this information, what is the beginning cash balance?

Given this information, what is the beginning cash balance?

A) $1,800

B) $3,800

C) $72,600

D) $112,400

Given this information, what is the beginning cash balance?

Given this information, what is the beginning cash balance?A) $1,800

B) $3,800

C) $72,600

D) $112,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

41

The method by which cash flows are presented on a statement of cash flows as operating cash receipts and payments is the

A) All financial resources method

B) Direct method

C) Indirect method

D) Working capital method

A) All financial resources method

B) Direct method

C) Indirect method

D) Working capital method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

42

The direct and indirect methods will usually show different amounts of cash flows from

A) Operating activities

B) Financing activities

C) Investing activities

D) None of these are correct

A) Operating activities

B) Financing activities

C) Investing activities

D) None of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

43

The indirect method of preparing a statement of cash flows

A) Results in the same net cash flow from operating activities as the direct method

B) Is the method most often used in practice

C) Involves adjusting the net income figure for any noncash expenses

D) Does all of these items

A) Results in the same net cash flow from operating activities as the direct method

B) Is the method most often used in practice

C) Involves adjusting the net income figure for any noncash expenses

D) Does all of these items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would be subtracted from net income on a statement of cash flows prepared by the indirect method?

A) An increase in accounts payable

B) A decrease in accounts receivable

C) A gain from the sale of equipment

D) Depreciation expense

A) An increase in accounts payable

B) A decrease in accounts receivable

C) A gain from the sale of equipment

D) Depreciation expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

45

If cost of goods sold is $80,000 and the beginning and ending Accounts Payable balances are $10,000 and $15,000, respectively, cash paid to suppliers is

A) $75,000

B) $80,000

C) $85,000

D) Not determinable from the information given

A) $75,000

B) $80,000

C) $85,000

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

46

If depreciation expense is $20,000 and the beginning and ending Accumulated Depreciation balances are $100,000 and $110,000, respectively, cash paid for depreciation is

A) $0

B) $10,000

C) $20,000

D) $100,000

A) $0

B) $10,000

C) $20,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

47

The direct method of presenting a statement of cash flows

A) Classifies activities differently from the indirect method

B) Involves reconciling accrual net income to net cash flows from operating activities

C) Shows the major classes of operating cash receipts and payments

D) Includes noncash financing transactions

A) Classifies activities differently from the indirect method

B) Involves reconciling accrual net income to net cash flows from operating activities

C) Shows the major classes of operating cash receipts and payments

D) Includes noncash financing transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

48

Sales revenue for the period is $500,000 and the beginning and ending Accounts Receivable balances are $50,000 and $37,500, respectively. How much cash is collected from customers?

A) $500,000

B) $512,500

C) $487,500

D) $587,500

A) $500,000

B) $512,500

C) $487,500

D) $587,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

49

If cost of goods sold is $100,000 and the beginning and ending Inventory balances are $20,000 and $16,000, respectively, net purchases are

A) $96,000

B) $100,000

C) $104,000

D) $136,000

A) $96,000

B) $100,000

C) $104,000

D) $136,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

50

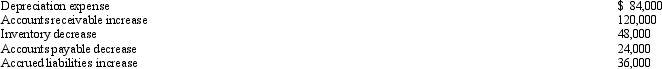

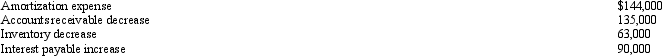

Chaffee Company's financial statements show a net loss of $180,000. The following items also appear on Chaffee's balance sheet:  What is Chaffee's net cash flow from operating activities?

What is Chaffee's net cash flow from operating activities?

A) $84,000

B) ($156,000)

C) $348,000

D) ($180,000)

What is Chaffee's net cash flow from operating activities?

What is Chaffee's net cash flow from operating activities?A) $84,000

B) ($156,000)

C) $348,000

D) ($180,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

51

A loss from the sale of a building would be reported on an indirect method statement of cash flows as

A) An addition to net income

B) A deduction from net income

C) A cash inflow from financing activities

D) A cash outflow from investing activities

A) An addition to net income

B) A deduction from net income

C) A cash inflow from financing activities

D) A cash outflow from investing activities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

52

If net purchases are $252,000 and the beginning and ending Accounts Payable balances are $32,000 and $12,000, respectively, cash paid to suppliers is

A) $272,000

B) $232,000

C) $252,000

D) Not determinable from the information given

A) $272,000

B) $232,000

C) $252,000

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

53

If interest revenue for the period is $13,200 and the beginning and ending Interest Receivable balances are $1,650 and $6,600, respectively, cash received from interest is

A) $19,800

B) $21,450

C) $18,150

D) $8,250

A) $19,800

B) $21,450

C) $18,150

D) $8,250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

54

If wages expense is $100,000 and the beginning and ending Wages Payable balances are $10,000 and $20,000, respectively, cash paid to employees is

A) $90,000

B) $100,000

C) $110,000

D) Not determinable from the information given

A) $90,000

B) $100,000

C) $110,000

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

55

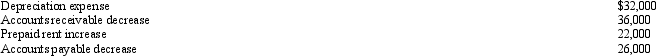

Chen Company's financial statements show a net income of $184,000. The following items also appear on Chen's balance sheet:  What is Chen's net cash flow from operating activities?

What is Chen's net cash flow from operating activities?

A) $216,000

B) $136,000

C) $232,000

D) $272,000

What is Chen's net cash flow from operating activities?

What is Chen's net cash flow from operating activities?A) $216,000

B) $136,000

C) $232,000

D) $272,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

56

If insurance expense is $5,000 and the beginning and ending Prepaid Insurance balances are $1,000 and $1,500, respectively, cash paid for insurance is

A) $4,500

B) $5,000

C) $5,500

D) Not determinable from the information given

A) $4,500

B) $5,000

C) $5,500

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following would be subtracted from net income on a statement of cash flows prepared by the indirect method?

A) An increase in accounts payable

B) An decrease in dividends payable

C) Depreciation expense

D) A decrease in accounts receivable

A) An increase in accounts payable

B) An decrease in dividends payable

C) Depreciation expense

D) A decrease in accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

58

The approach to preparing a statement of cash flows that adjusts net income to cash flows from operations is the

A) All financial resources method

B) Direct method

C) Indirect method

D) Worksheet method

A) All financial resources method

B) Direct method

C) Indirect method

D) Worksheet method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following items would be reported on a statement of cash flows prepared by the indirect method but NOT by the direct method?

A) Depreciation expense

B) Cash received from the sale of a building

C) Cash received from issuance of stock

D) Cash paid for dividends

A) Depreciation expense

B) Cash received from the sale of a building

C) Cash received from issuance of stock

D) Cash paid for dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

60

A gain on the sale of machinery in the ordinary course of business should be presented in a statement of cash flows (indirect method) as

A) A deduction from net income

B) An addition to net income

C) An inflow and outflow of cash

D) An outflow of cash

A) A deduction from net income

B) An addition to net income

C) An inflow and outflow of cash

D) An outflow of cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

61

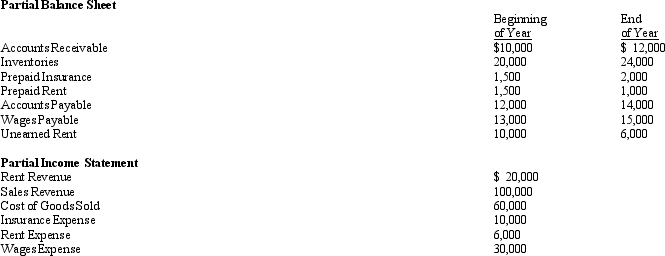

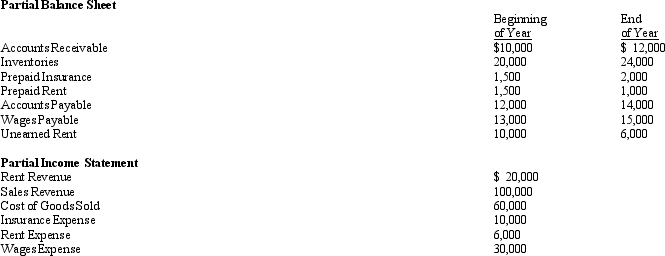

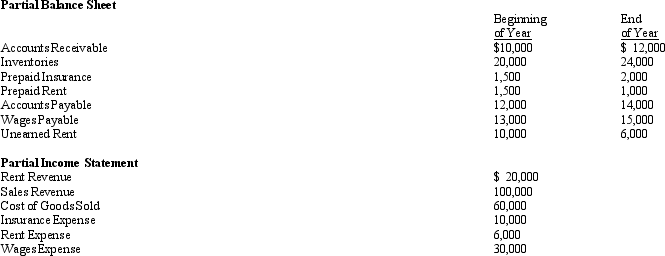

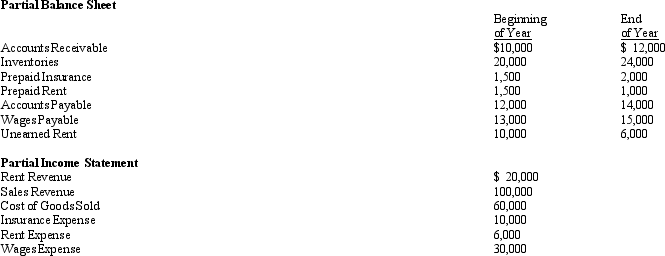

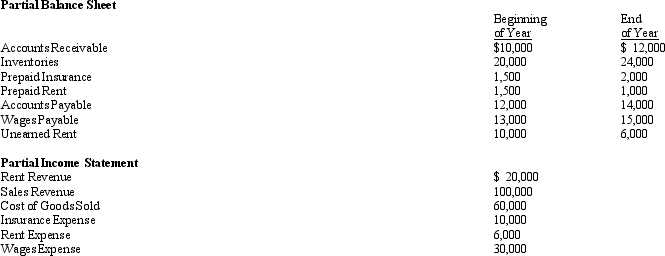

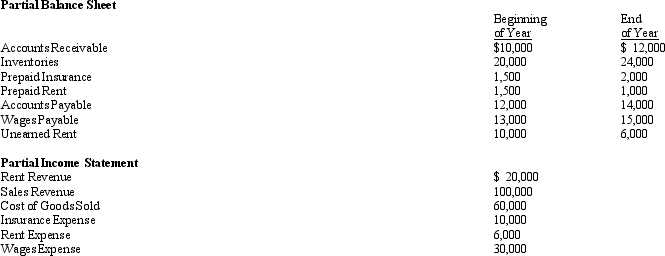

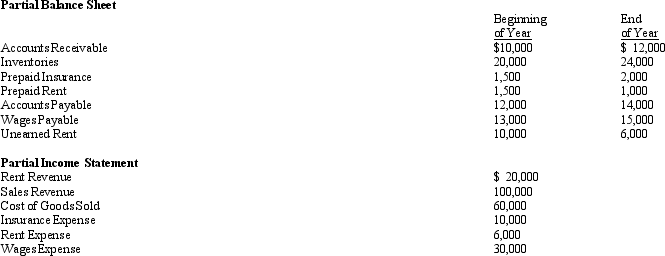

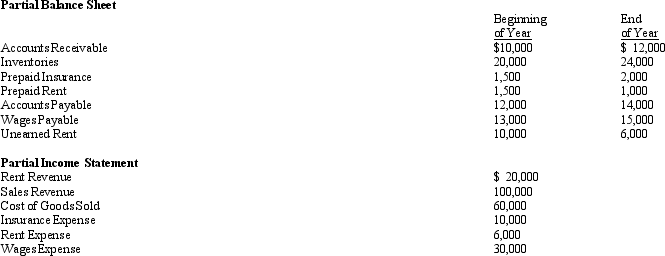

Exhibit 13-4 Selected balance sheet and income statement data for Fowler Inc. are presented below. The company uses the direct method in preparing its statement of cash flows.

Refer to Exhibit 13-4. Given the information above, cash paid for rent is

Refer to Exhibit 13-4. Given the information above, cash paid for rent is

A) $5,500

B) $6,000

C) $6,500

D) Not determinable from the information given

Refer to Exhibit 13-4. Given the information above, cash paid for rent is

Refer to Exhibit 13-4. Given the information above, cash paid for rent isA) $5,500

B) $6,000

C) $6,500

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

62

Ozark Corporation's Retained Earnings balance increased by $100,000 during the year. Ozark also paid $30,000 in cash dividends that had been declared last year and declared dividends of $40,000 for the current year (but has not paid them at year-end). Ozark's net income for the current year must be

A) $60,000

B) $140,000

C) $130,000

D) $100,000

A) $60,000

B) $140,000

C) $130,000

D) $100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

63

Exhibit 13-4 Selected balance sheet and income statement data for Fowler Inc. are presented below. The company uses the direct method in preparing its statement of cash flows.

Refer to Exhibit 13-4. Given the information above, cash paid for insurance is

Refer to Exhibit 13-4. Given the information above, cash paid for insurance is

A) $9,500

B) $10,000

C) $10,500

D) Not determinable from the information given

Refer to Exhibit 13-4. Given the information above, cash paid for insurance is

Refer to Exhibit 13-4. Given the information above, cash paid for insurance isA) $9,500

B) $10,000

C) $10,500

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

64

Exhibit 13-4 Selected balance sheet and income statement data for Fowler Inc. are presented below. The company uses the direct method in preparing its statement of cash flows.

Refer to Exhibit 13-4. Given the information above, cash paid for wages is

Refer to Exhibit 13-4. Given the information above, cash paid for wages is

A) $28,000

B) $30,000

C) $32,000

D) Not determinable from the information given

Refer to Exhibit 13-4. Given the information above, cash paid for wages is

Refer to Exhibit 13-4. Given the information above, cash paid for wages isA) $28,000

B) $30,000

C) $32,000

D) Not determinable from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

65

Exhibit 13-3 The following information relates to Equipment and related accounts of De Soto Corporation:

Refer to Exhibit 13-3. Assuming that all of De Soto's equipment purchases are for cash, how much cash was used to purchase equipment during the year?

Refer to Exhibit 13-3. Assuming that all of De Soto's equipment purchases are for cash, how much cash was used to purchase equipment during the year?

A) $42,000

B) $50,000

C) $70,000

D) $78,000

Refer to Exhibit 13-3. Assuming that all of De Soto's equipment purchases are for cash, how much cash was used to purchase equipment during the year?

Refer to Exhibit 13-3. Assuming that all of De Soto's equipment purchases are for cash, how much cash was used to purchase equipment during the year?A) $42,000

B) $50,000

C) $70,000

D) $78,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

66

In 2011, Franco Manufacturing had sales of $975,000, beginning Accounts Receivable of $84,500, and ending Accounts Receivable of $110,500. Cash collected from customers for the year totaled

A) $975,000

B) $1,001,000

C) $1,059,500

D) $949,000

A) $975,000

B) $1,001,000

C) $1,059,500

D) $949,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

67

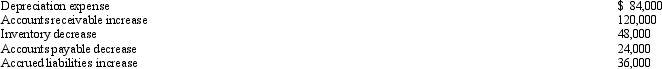

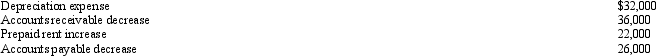

Worthy Company's financial statements show a net income of $540,000. The following items also appear on Worthy's balance sheet:  What is Worthy's net cash flow from operating activities?

What is Worthy's net cash flow from operating activities?

A) $276,000

B) $666,000

C) $846,000

D) $972,000

What is Worthy's net cash flow from operating activities?

What is Worthy's net cash flow from operating activities?A) $276,000

B) $666,000

C) $846,000

D) $972,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

68

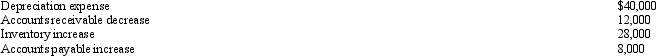

Booth Company's financial statements show a net income of $143,000. The following items also appear on Booth's balance sheet:  What is Booth's net cash flow from operating activities?

What is Booth's net cash flow from operating activities?

A) $121,000

B) $163,000

C) $177,000

D) $157,000

What is Booth's net cash flow from operating activities?

What is Booth's net cash flow from operating activities?A) $121,000

B) $163,000

C) $177,000

D) $157,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

69

Exhibit 13-4 Selected balance sheet and income statement data for Fowler Inc. are presented below. The company uses the direct method in preparing its statement of cash flows.

Refer to Exhibit 13-4. Given the information above, cash collected for rent is

Refer to Exhibit 13-4. Given the information above, cash collected for rent is

A) $16,000

B) $20,000

C) $24,000

D) $24,500

Refer to Exhibit 13-4. Given the information above, cash collected for rent is

Refer to Exhibit 13-4. Given the information above, cash collected for rent isA) $16,000

B) $20,000

C) $24,000

D) $24,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

70

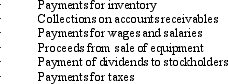

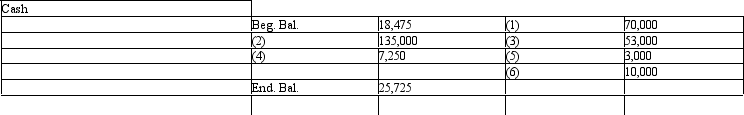

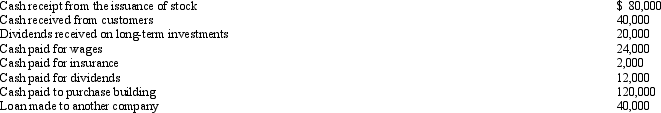

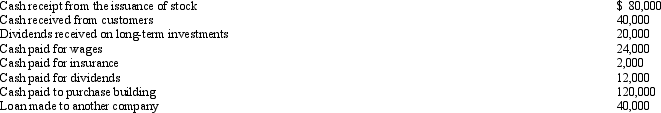

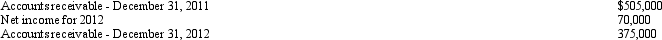

Exhibit 13-5 Chen Corporation had the following cash flows during 2012. The company uses the direct method of preparing a statement of cash flows.

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from ALL activities is

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from ALL activities is

A) $22,000

B) $40,000

C) ($58,000)

D) ($98,000)

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from ALL activities is

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from ALL activities isA) $22,000

B) $40,000

C) ($58,000)

D) ($98,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

71

Exhibit 13-5 Chen Corporation had the following cash flows during 2012. The company uses the direct method of preparing a statement of cash flows.

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from investing activities is

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from investing activities is

A) ($40,000)

B) ($120,000)

C) ($160,000)

D) ($172,000)

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from investing activities is

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from investing activities isA) ($40,000)

B) ($120,000)

C) ($160,000)

D) ($172,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

72

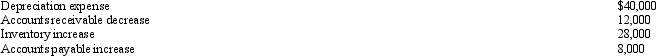

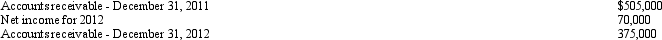

The following information appeared on the 2012 income statement of Kane Company:  Based on this information, what is Kane's net cash provided by operations?

Based on this information, what is Kane's net cash provided by operations?

A) $164,000

B) $158,000

C) $120,000

D) $82,000

Based on this information, what is Kane's net cash provided by operations?

Based on this information, what is Kane's net cash provided by operations?A) $164,000

B) $158,000

C) $120,000

D) $82,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

73

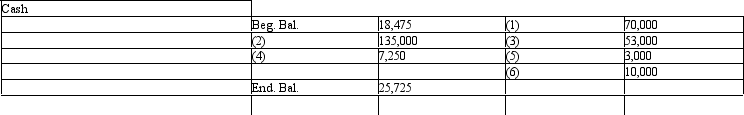

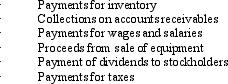

Ojeda Corporation had the following cash flows during 2012. The company uses the direct method of preparing a statement of cash flows.  Given this information, net cash inflow (outflow) from operating activities is

Given this information, net cash inflow (outflow) from operating activities is

A) $8,500

B) $5,500

C) $3,500

D) $15,000

Given this information, net cash inflow (outflow) from operating activities is

Given this information, net cash inflow (outflow) from operating activities isA) $8,500

B) $5,500

C) $3,500

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

74

Exhibit 13-4 Selected balance sheet and income statement data for Fowler Inc. are presented below. The company uses the direct method in preparing its statement of cash flows.

Refer to Exhibit 13-4. Given the information above, cash collected from customers is

Refer to Exhibit 13-4. Given the information above, cash collected from customers is

A) $98,000

B) $100,000

C) $102,000

D) $122,000

Refer to Exhibit 13-4. Given the information above, cash collected from customers is

Refer to Exhibit 13-4. Given the information above, cash collected from customers isA) $98,000

B) $100,000

C) $102,000

D) $122,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

75

Exhibit 13-5 Chen Corporation had the following cash flows during 2012. The company uses the direct method of preparing a statement of cash flows.

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from financing activities is

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from financing activities is

A) $80,000

B) $68,000

C) ($12,000)

D) ($52,000)

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from financing activities is

Refer to Exhibit 13-5. Given the information above, net cash inflow (outflow) from financing activities isA) $80,000

B) $68,000

C) ($12,000)

D) ($52,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

76

In its accrual-basis income statement for the year ended December 31, 2012, Nelson Company reported revenue of $1,750,000. Additional information is as follows:  Nelson should report cash collected from customers in its 2012 statement of cash flows (direct method) in the amount of

Nelson should report cash collected from customers in its 2012 statement of cash flows (direct method) in the amount of

A) $1,620,000

B) $1,550,000

C) $1,690,000

D) $1,880,000

Nelson should report cash collected from customers in its 2012 statement of cash flows (direct method) in the amount of

Nelson should report cash collected from customers in its 2012 statement of cash flows (direct method) in the amount ofA) $1,620,000

B) $1,550,000

C) $1,690,000

D) $1,880,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

77

The following data were taken from the 2012 financial statements of Magelby Corporation:  How much cash did Sigma pay for inventory in 2012?

How much cash did Sigma pay for inventory in 2012?

A) $301,500

B) $292,500

C) $337,500

D) $328,500

How much cash did Sigma pay for inventory in 2012?

How much cash did Sigma pay for inventory in 2012?A) $301,500

B) $292,500

C) $337,500

D) $328,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

78

Exhibit 13-4 Selected balance sheet and income statement data for Fowler Inc. are presented below. The company uses the direct method in preparing its statement of cash flows.

Refer to Exhibit 13-4. Given the information above, cash paid for inventory is

Refer to Exhibit 13-4. Given the information above, cash paid for inventory is

A) $58,000

B) $60,000

C) $62,000

D) $64,000

Refer to Exhibit 13-4. Given the information above, cash paid for inventory is

Refer to Exhibit 13-4. Given the information above, cash paid for inventory isA) $58,000

B) $60,000

C) $62,000

D) $64,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

79

In 2012, Kahoka Company paid $10,000 to satisfy its 2011 tax liability, $64,000 for its 2012 tax liability, and still owed taxes payable of $16,000 at year-end. How much should Kahoka report as a cash outflow for tax payments on the 2012 statement of cash flows?

A) $74,000

B) $54,000

C) $80,000

D) $90,000

A) $74,000

B) $54,000

C) $80,000

D) $90,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

80

Exhibit 13-3 The following information relates to Equipment and related accounts of De Soto Corporation:

Refer to Exhibit 13-3. Assuming De Soto uses the indirect method, the depreciation expense that would be added to net income in computing cash flows from operations would be

Refer to Exhibit 13-3. Assuming De Soto uses the indirect method, the depreciation expense that would be added to net income in computing cash flows from operations would be

A) $9,000

B) $15,000

C) $21,000

D) $23,000

Refer to Exhibit 13-3. Assuming De Soto uses the indirect method, the depreciation expense that would be added to net income in computing cash flows from operations would be

Refer to Exhibit 13-3. Assuming De Soto uses the indirect method, the depreciation expense that would be added to net income in computing cash flows from operations would beA) $9,000

B) $15,000

C) $21,000

D) $23,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck