Deck 15: Leasing and Other Equipment Finance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/49

العب

ملء الشاشة (f)

Deck 15: Leasing and Other Equipment Finance

1

Which lease can be best defined as a cancellable lease which is written for a period considerably less than the useful life of the leased asset?

A)Finance lease.

B)Operating lease.

C)Cross-border lease.

D)Leveraged lease.

A)Finance lease.

B)Operating lease.

C)Cross-border lease.

D)Leveraged lease.

Operating lease.

2

Which of the following statements with regards to taxation and leases is the most accurate?

A)Both lease rentals and depreciation on the leased asset are deductible for tax purposes by the lessor.

B)Both lease rentals and depreciation on the leased asset are deductible for tax purposes by the lessee.

C)Lease rentals and depreciation on the leased asset are not deductible for tax purposes by the lessee.

D)If lease rentals are deductible for tax purposes by the lessee then depreciation on the leased asset can be deductible for tax purposes only by the lessor.

A)Both lease rentals and depreciation on the leased asset are deductible for tax purposes by the lessor.

B)Both lease rentals and depreciation on the leased asset are deductible for tax purposes by the lessee.

C)Lease rentals and depreciation on the leased asset are not deductible for tax purposes by the lessee.

D)If lease rentals are deductible for tax purposes by the lessee then depreciation on the leased asset can be deductible for tax purposes only by the lessor.

If lease rentals are deductible for tax purposes by the lessee then depreciation on the leased asset can be deductible for tax purposes only by the lessor.

3

Which of the following statements with regards to operating leases is false?

A)They are essentially rental agreements.

B)They are cancellable by the lessor at little cost.

C)They are often over a short duration.

D)The lessee is usually able to return the asset at short notice.

A)They are essentially rental agreements.

B)They are cancellable by the lessor at little cost.

C)They are often over a short duration.

D)The lessee is usually able to return the asset at short notice.

They are cancellable by the lessor at little cost.

4

Calculate the present value to XYZ Ltd of cash flows from the ownership of equipment that it intends to lease to another company for five years.The equipment costs $500 000 and can be depreciated straight-line over three years for tax purposes.Assume the cost of capital is 10% p.a. ,the residual value is 20 per cent of cost and the tax rate is 30 per cent.

A)$167 807

B)$176 935

C)$157 188

D)$124 343

A)$167 807

B)$176 935

C)$157 188

D)$124 343

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following statements best describes sale and lease-back agreements?

A)The lessee relinquishes the title to the property in return for cash and agrees to make periodic lease payments.

B)The lessor relinquishes the title to the property and the lessee agrees to make periodic lease payments.

C)The lessee obtains effective control of the asset.

D)They normally involve leasing such assets as computers and motor vehicles.

A)The lessee relinquishes the title to the property in return for cash and agrees to make periodic lease payments.

B)The lessor relinquishes the title to the property and the lessee agrees to make periodic lease payments.

C)The lessee obtains effective control of the asset.

D)They normally involve leasing such assets as computers and motor vehicles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

6

According the estimate of the Australian Equipment Lessors Association,leasing and other equipment finance accounts for around what percentage of all capital expenditure on equipment in Australia?

A)45 per cent.

B)40 per cent.

C)35 per cent.

D)30 per cent.

A)45 per cent.

B)40 per cent.

C)35 per cent.

D)30 per cent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements with regards to leases is false?

A)The lessor has legal ownership of the leased asset.

B)The lessee obtains the right to use the asset in return for periodic payments.

C)The lessee ultimately obtains legal ownership of the leased asset.

D)Leasing allows a lessee to obtain the use of an asset without also obtaining ownership of the asset.

A)The lessor has legal ownership of the leased asset.

B)The lessee obtains the right to use the asset in return for periodic payments.

C)The lessee ultimately obtains legal ownership of the leased asset.

D)Leasing allows a lessee to obtain the use of an asset without also obtaining ownership of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

8

A tax deduction may be permitted for lease rentals provided that:

A)the lease is classified as an instalment purchase agreement.

B)the lease agreement does not give the lessee an option to purchase the leased asset at the end of the lease term.

C)the leased asset is used to generate revenue.

D)the lease is an operating lease.

A)the lease is classified as an instalment purchase agreement.

B)the lease agreement does not give the lessee an option to purchase the leased asset at the end of the lease term.

C)the leased asset is used to generate revenue.

D)the lease is an operating lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements best describes leveraged lease agreements?

A)Typically,the lessor is responsible for repayment if the loan is a non-recourse loan.

B)They are similar to an operating lease in that the lessor maintains ownership of the asset upon completion of the lease term.

C)They are a type of finance lease.

D)They are a type of operating lease.

A)Typically,the lessor is responsible for repayment if the loan is a non-recourse loan.

B)They are similar to an operating lease in that the lessor maintains ownership of the asset upon completion of the lease term.

C)They are a type of finance lease.

D)They are a type of operating lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

10

The lessor in a leveraged lease is usually:

A)the lending party.

B)a partnership of debt participants.

C)a partnership of two or more equity participants.

D)a life insurance company or superannuation fund.

A)the lending party.

B)a partnership of debt participants.

C)a partnership of two or more equity participants.

D)a life insurance company or superannuation fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

11

A loan secured by a mortgage over movable property is known as a:

A)hire-purchase agreement.

B)chattel mortgage.

C)leveraged lease.

D)sale and lease-back agreement.

A)hire-purchase agreement.

B)chattel mortgage.

C)leveraged lease.

D)sale and lease-back agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under the provisions of Taxation Ruling IT2051,the debt participants are expected to contribute no more than:

A)80 per cent of the cost of the asset.

B)70 per cent of the cost of the asset.

C)60 per cent of the cost of the asset.

D)90 per cent of the cost of the asset.

A)80 per cent of the cost of the asset.

B)70 per cent of the cost of the asset.

C)60 per cent of the cost of the asset.

D)90 per cent of the cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following criteria is essential for a lease to be recognised as a finance lease?

A)It must be cancellable.

B)The lease term is for 75 per cent or more of the useful life of the asset.

C)The present value of the lease payments equals or exceeds 90 per cent of the fair value of the leased asset to the lessor.

D)Substantially all the risks and benefits of the asset are effectively transferred from the lessor to the lessee.

A)It must be cancellable.

B)The lease term is for 75 per cent or more of the useful life of the asset.

C)The present value of the lease payments equals or exceeds 90 per cent of the fair value of the leased asset to the lessor.

D)Substantially all the risks and benefits of the asset are effectively transferred from the lessor to the lessee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

14

The Australian Equipment Lessors Association reports that for the 2007-08 financial year motor vehicles accounted for:

A)85 per cent of the total equipment finance.

B)37 per cent of the total equipment finance.

C)8 per cent of the total equipment finance.

D)41 per cent of the total equipment finance.

A)85 per cent of the total equipment finance.

B)37 per cent of the total equipment finance.

C)8 per cent of the total equipment finance.

D)41 per cent of the total equipment finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

15

XYZ Ltd intends to lease to another company for a duration of five years equipment which costs $500 000 and can be depreciated straight-line over three years for tax purposes.Assume the cost of capital is 10% p.a. ,the residual value is 20 per cent of cost and the tax rate is 30 per cent.Calculate the required present value of the lease payments.

A)$375 657

B)$342 812

C)$323 065

D)$332 193

A)$375 657

B)$342 812

C)$323 065

D)$332 193

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which lease is essentially a rental agreement?

A)Finance lease.

B)Cross-border lease.

C)Operating lease.

D)Leveraged lease.

A)Finance lease.

B)Cross-border lease.

C)Operating lease.

D)Leveraged lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which lease can be best defined as a finance lease where the lessor borrows most of the funds to acquire the asset?

A)Finance lease.

B)Operating lease.

C)Cross-border lease.

D)Leveraged lease.

A)Finance lease.

B)Operating lease.

C)Cross-border lease.

D)Leveraged lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

18

An essential characteristic of operating leases is that:

A)the lessor is able to use the asset without directly incurring the risks of ownership.

B)the lessor is responsible for insuring the asset and maintaining it.

C)they are usually short term.

D)the lessee is able to use the asset without directly incurring the risks of ownership.

A)the lessor is able to use the asset without directly incurring the risks of ownership.

B)the lessor is responsible for insuring the asset and maintaining it.

C)they are usually short term.

D)the lessee is able to use the asset without directly incurring the risks of ownership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which Accounting Standard states that the accounting treatment of a lease depends on whether it is classified as an operating lease or a finance lease?

A)AASB 171.

B)AASB 107.

C)AASB 117.

D)AASB 177.

A)AASB 171.

B)AASB 107.

C)AASB 117.

D)AASB 177.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which feature of a lease ensures that lease payments are tax deductible to the lessee?

A)It must be a finance lease.

B)The lease must be non-cancellable.

C)The lease agreement cannot explicitly provide the lessee with an option to purchase the asset.

D)The lease agreement must provide that the lessee must guarantee that the lessor receives a specified residual value from the sale of the asset at the end of the lease term.

A)It must be a finance lease.

B)The lease must be non-cancellable.

C)The lease agreement cannot explicitly provide the lessee with an option to purchase the asset.

D)The lease agreement must provide that the lessee must guarantee that the lessor receives a specified residual value from the sale of the asset at the end of the lease term.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following statements represents a potential advantage to leasing?

A)The lessee has an advantage not available to the lessor.

B)A tax advantage exists when the lessee and/or lessor are taxed at the same rate.

C)A tax advantage exists if the lessee is unable to fully utilise depreciation deductions if the asset is purchased.

D)A tax advantage exists if the lessee is taxed at a higher tax rate than the lessor.

A)The lessee has an advantage not available to the lessor.

B)A tax advantage exists when the lessee and/or lessor are taxed at the same rate.

C)A tax advantage exists if the lessee is unable to fully utilise depreciation deductions if the asset is purchased.

D)A tax advantage exists if the lessee is taxed at a higher tax rate than the lessor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

22

Company-specific assets are more likely to be:

A)purchased rather than leased,because such assets are less highly valued within the company than in their best alternative use.

B)purchased rather than leased,because such assets are more highly valued within the company than in their best alternative use.

C)leased rather than purchased,because such assets are less highly valued within the company than in their best alternative use.

D)leased rather than purchased,because such assets are more highly valued within the company than in their best alternative use.

A)purchased rather than leased,because such assets are less highly valued within the company than in their best alternative use.

B)purchased rather than leased,because such assets are more highly valued within the company than in their best alternative use.

C)leased rather than purchased,because such assets are less highly valued within the company than in their best alternative use.

D)leased rather than purchased,because such assets are more highly valued within the company than in their best alternative use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

23

An argument forwarded as justification for leasing is that it allows a company to conserve its capital.Which of the following statements offers criticism of this argument?

A)If lease rentals are payable in advance,the finance effectively provided by leasing can be much less than the purchase price of the asset.

B)Security provided to the lessor is restricted to ownership of the asset.

C)A lessee can borrow 100 per cent of the purchase price of an asset compared with perhaps 80 per cent in the case of a secured loan.

D)Leasing has the potential to offer 'off balance sheet financing'.

A)If lease rentals are payable in advance,the finance effectively provided by leasing can be much less than the purchase price of the asset.

B)Security provided to the lessor is restricted to ownership of the asset.

C)A lessee can borrow 100 per cent of the purchase price of an asset compared with perhaps 80 per cent in the case of a secured loan.

D)Leasing has the potential to offer 'off balance sheet financing'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

24

Shine Ltd is considering purchasing or leasing new equipment.If it purchases the equipment it will cost $500 000 and if it leases the equipment it will be required to pay six rentals of $115 000 each.The equipment can be depreciated over three years on a straight-line basis for tax purposes.The residual value is expected to be zero and the tax rate is 30 per cent.What is the incremental cash flow in Year 3 for leasing the equipment rather than buying it for Year 3? Assume that rental payments are paid at the beginning of each period.

A)($80 500)

B)($130 500)

C)($115 000)

D)($99 500)

A)($80 500)

B)($130 500)

C)($115 000)

D)($99 500)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements is not a reason identified by Smith and Wakeman (1985)to explain leasing policy?

A)There is an incentive to buy,rather than lease,specialised assets.

B)Manufacturers who accept used assets as trade-ins offer the same comparative advantages to asset buyers.

C)Leasing company-specific assets involves negotiation costs and other agency costs that can be significant because of the conflict between the lessor and lessee about the division between them in that part of the value of the asset which exceeds its value in alternative uses.

D)None of the given options.

A)There is an incentive to buy,rather than lease,specialised assets.

B)Manufacturers who accept used assets as trade-ins offer the same comparative advantages to asset buyers.

C)Leasing company-specific assets involves negotiation costs and other agency costs that can be significant because of the conflict between the lessor and lessee about the division between them in that part of the value of the asset which exceeds its value in alternative uses.

D)None of the given options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

26

One of the main reasons for firms entering into an operating lease as the lessee is:

A)it is an equivalent alternative to buying the asset.

B)they can claim tax deductions for depreciation.

C)they can claim tax deductions for rental payments.

D)uncertainty about the length of time for which the asset is required.

A)it is an equivalent alternative to buying the asset.

B)they can claim tax deductions for depreciation.

C)they can claim tax deductions for rental payments.

D)uncertainty about the length of time for which the asset is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

27

XYZ Ltd intends to lease to another company for a duration of five years equipment which costs $500 000 and can be depreciated straight-line over three years for tax purposes.Assume the cost of capital is 10% p.a. ,the residual value is 20 per cent of cost,the tax rate is 30 per cent and that annual lease payments are payable in advance.Calculate the minimum after-tax lease payments if it desires a rate of return at 10 per cent after tax.

A)$77 476

B)$98 316

C)$96 652

D)$107 735

A)$77 476

B)$98 316

C)$96 652

D)$107 735

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

28

XYZ Ltd intends to lease to another company for a duration of five years equipment which costs $500 000 and can be depreciated straight-line over three years for tax purposes.Assume the cost of capital is 10% p.a. ,the residual value is 20 per cent of cost,the tax rate is 30 per cent and that annual lease payments are payable in advance.Calculate the minimum before-tax lease payments that XYZ Ltd should quote if it desires a rate of return of 10 per cent after tax.

A)$153 907

B)$140 451

C)$110 680

D)$132 360

A)$153 907

B)$140 451

C)$110 680

D)$132 360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

29

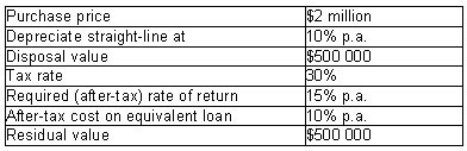

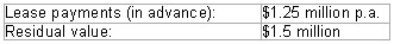

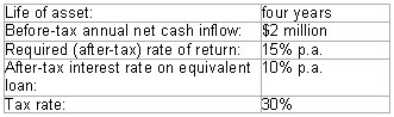

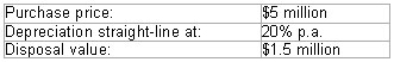

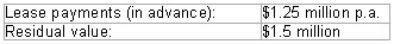

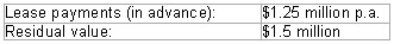

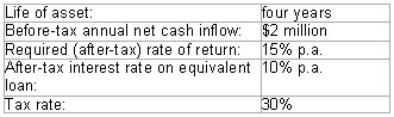

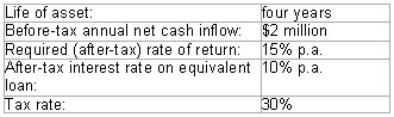

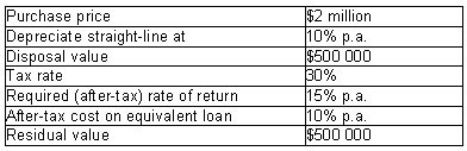

Aviation Ltd requires an aircraft for six years and is evaluating the following information:

What annual lease payments (made in advance)would make Aviation Ltd indifferent between buying and leasing the asset? Assume that the tax treatment associated with disposal is as risky as the lease cash flows.

A)$523 772

B)$419 151

C)$498 229

D)$449 449

What annual lease payments (made in advance)would make Aviation Ltd indifferent between buying and leasing the asset? Assume that the tax treatment associated with disposal is as risky as the lease cash flows.

A)$523 772

B)$419 151

C)$498 229

D)$449 449

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

30

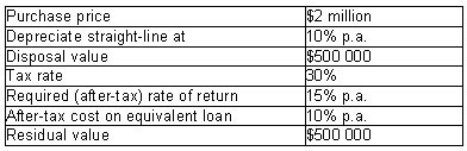

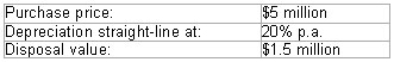

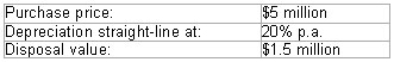

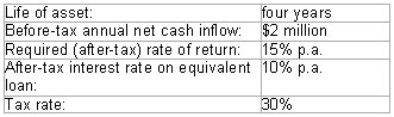

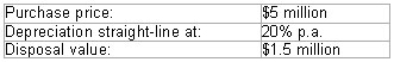

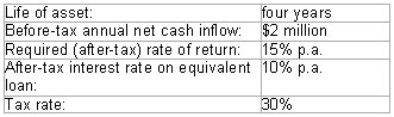

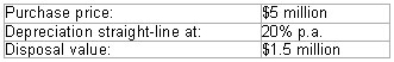

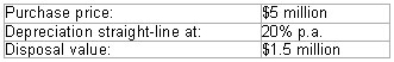

Tow Ltd plans to expand its fleet of train engines.It is considering the following alternatives:

• Purchase

• Lease

Further information is as follows:

Calculate the NPV of a lease versus purchasing decision.Assume that the tax treatment associated with disposal is riskier than the lease cash flows.

A)$77 394

B)$59 288

C)$75 977

D)$112 238

• Purchase

• Lease

Further information is as follows:

Calculate the NPV of a lease versus purchasing decision.Assume that the tax treatment associated with disposal is riskier than the lease cash flows.

A)$77 394

B)$59 288

C)$75 977

D)$112 238

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

31

An __________ lease separates the risks of ownership from the use of the asset,and provides advantages such as convenience and flexibility,insurance against obsolescence and lower transaction costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

32

Cancellable short-term operating leases are an attractive option to a lessee because:

A)the degree of uncertainty with respect to the selling price of the leased asset is great.

B)the asset becomes obsolete owing to technological change.

C)a company requires the asset for a period significantly less than its economic life.

D)the asset is part of a project that may be discontinued.

A)the degree of uncertainty with respect to the selling price of the leased asset is great.

B)the asset becomes obsolete owing to technological change.

C)a company requires the asset for a period significantly less than its economic life.

D)the asset is part of a project that may be discontinued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

33

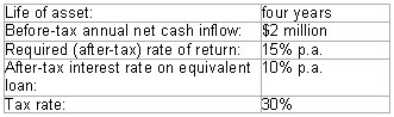

Tow Ltd plans to expand its fleet of train engines.It is considering the following alternatives:

Purchase

Lease

Further information is as follows:

Calculate the NPV of the project if Tow Ltd decides to purchase the train engine.

A)$775 531

B)$1 310 839

C)$231 163

D)$625 330

Purchase

Lease

Further information is as follows:

Calculate the NPV of the project if Tow Ltd decides to purchase the train engine.

A)$775 531

B)$1 310 839

C)$231 163

D)$625 330

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

34

In the lease contract,the party that owns the asset is called the _________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

35

Tow Ltd plans to expand its fleet of train engines.It is considering the following alternatives:

• Purchase

• Lease

Further information is as follows:

What is the maximum operating licence fee that Tow Ltd would be willing to pay?

A)$684 618

B)$0

C)$851 508

D)$834 819

• Purchase

• Lease

Further information is as follows:

What is the maximum operating licence fee that Tow Ltd would be willing to pay?

A)$684 618

B)$0

C)$851 508

D)$834 819

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

36

What is the rationale for analysing a finance lease by comparing it with debt?

A)An operating lease will use some of the lessee'slessee's debt capacity.

B)A finance lease will use some of the lessee'slessee's debt capacity.

C)A finance lease will use some of the lessor'slessor's debt capacity.

D)The lessor is able to extend its debt capacity.

A)An operating lease will use some of the lessee'slessee's debt capacity.

B)A finance lease will use some of the lessee'slessee's debt capacity.

C)A finance lease will use some of the lessor'slessor's debt capacity.

D)The lessor is able to extend its debt capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following statements is not a reason for disposing of an asset earlier than expected?

A)The efficiency of the asset deteriorates faster than expected.

B)The asset becomes obsolete owing to technological change.

C)The asset's service potential is greater than the entity's requirements.

D)None of the given options.

A)The efficiency of the asset deteriorates faster than expected.

B)The asset becomes obsolete owing to technological change.

C)The asset's service potential is greater than the entity's requirements.

D)None of the given options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

38

An essential feature of a commercial hire-purchase agreement is that:

A)it is basically a rental agreement with no option for the user to ultimately purchase the asset.

B)it gives the user the option to purchase the asset,as does a finance lease.

C)it does not give the user the option to purchase the asset,as does an operating lease.

D)it either commits the user to buy the asset or gives them the option to buy it.

A)it is basically a rental agreement with no option for the user to ultimately purchase the asset.

B)it gives the user the option to purchase the asset,as does a finance lease.

C)it does not give the user the option to purchase the asset,as does an operating lease.

D)it either commits the user to buy the asset or gives them the option to buy it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

39

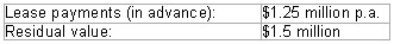

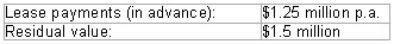

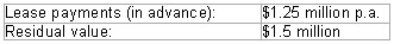

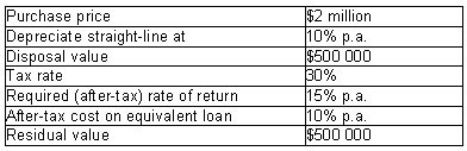

Aviation Ltd requires an aircraft for 6 years and is evaluating the following information:

What annual lease payments (made in advance)would make Aviation indifferent between buying and leasing the asset? Assume that the tax treatment associated with disposal is riskier than the lease cash flows.

A)$422 698

B)$419 151

C)$432 910

D)$416 564

What annual lease payments (made in advance)would make Aviation indifferent between buying and leasing the asset? Assume that the tax treatment associated with disposal is riskier than the lease cash flows.

A)$422 698

B)$419 151

C)$432 910

D)$416 564

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

40

Shine Ltd is considering purchasing or leasing new equipment.If it purchases the equipment it will cost $500 000 and if it leases the equipment it will be required to pay six rentals of $115 000 each.The equipment can be depreciated over three years on a straight-line basis for tax purposes.The residual value is expected to be zero and the tax rate is 30 per cent.Assume that rental payments are paid at the beginning of each period.Assume the cost of capital after tax is 10 per cent.Calculate the NPV (approx. )of the lease relative to an equivalent loan.

A)$23 317

B)($91 880)

C)($10 001)

D)($125 198)

A)$23 317

B)($91 880)

C)($10 001)

D)($125 198)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

41

The default costs of a lease agreement are often significantly higher than the default costs of other forms of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

42

Chattel mortgages are treated in the same way as other loans in that they are classed as a financial supply and as such no GST is payable on the provision of the loan or loan repayment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

43

In a perfect capital market,investors are _____________ between leasing and buying an asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

44

Companies may seek to take advantage of differences between tax regulations of different countries through a ___________________ lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

45

Myers,Dill and Bautista (1976)evaluated finance leases in the context of its effect on the lessee's ______________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

46

A finance lease is considered an alternative to other forms of debt finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

47

A finance lease is a short-term,cancellable lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

48

The conservation of capital is not considered a potential advantage of leasing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck

49

A leveraged lease differs from an ordinary finance lease in that it involves at least ________ parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 49 في هذه المجموعة.

فتح الحزمة

k this deck