Deck 8: Absorption and Variable Costing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

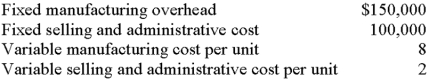

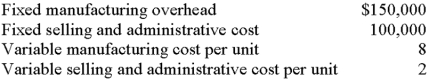

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

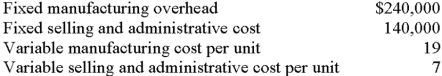

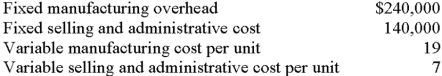

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 8: Absorption and Variable Costing

1

All of the following are inventoried under absorption costing except:

A)direct labor.

B)raw materials used in production.

C)utilities cost consumed in manufacturing.

D)sales commissions.

E)machine lubricant used in production.

A)direct labor.

B)raw materials used in production.

C)utilities cost consumed in manufacturing.

D)sales commissions.

E)machine lubricant used in production.

D

2

Under variable costing,fixed manufacturing overhead is:

A)expensed immediately when incurred.

B)never expensed.

C)applied directly to Finished-Goods Inventory.

D)applied directly to Work-in-Process Inventory.

E)treated in the same manner as variable manufacturing overhead.

A)expensed immediately when incurred.

B)never expensed.

C)applied directly to Finished-Goods Inventory.

D)applied directly to Work-in-Process Inventory.

E)treated in the same manner as variable manufacturing overhead.

A

3

When units sold exceed units produced,absorption-costing income will be lower than variable-costing income.

True

4

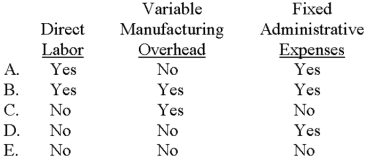

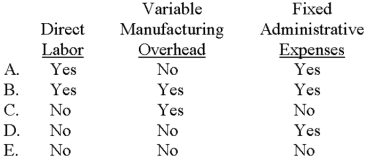

Which of the following costs would be treated differently under absorption costing and variable costing?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

The underlying difference between absorption costing and variable costing lies in the treatment of:

A)direct labor.

B)variable manufacturing overhead.

C)fixed manufacturing overhead.

D)variable selling and administrative expenses.

E)fixed selling and administrative expenses.

A)direct labor.

B)variable manufacturing overhead.

C)fixed manufacturing overhead.

D)variable selling and administrative expenses.

E)fixed selling and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Variable manufacturing overhead becomes part of a unit's cost when variable costing is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

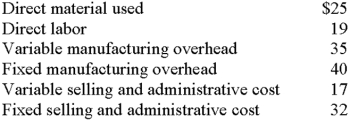

7

Under variable costing,each unit of the company's inventory would be carried at:

A)$35.

B)$55.

C)$65.

D)$84.

E)some other amount.

A)$35.

B)$55.

C)$65.

D)$84.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under absorption costing,each unit of the company's inventory would be carried at:

A)$35.

B)$55.

C)$65.

D)$84.

E)some other amount.

A)$35.

B)$55.

C)$65.

D)$84.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

All of the following are expensed under variable costing except:

A)variable manufacturing overhead.

B)fixed manufacturing overhead.

C)variable selling and administrative costs.

D)fixed selling and administrative costs.

E)items "C" and "D" abovE.

A)variable manufacturing overhead.

B)fixed manufacturing overhead.

C)variable selling and administrative costs.

D)fixed selling and administrative costs.

E)items "C" and "D" abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

Absorption costing is required for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fixed manufacturing overhead is not inventoried under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

For external-reporting purposes,generally accepted accounting principles require that net income be based on variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

All of the following costs are inventoried under absorption costing except:

A)direct materials.

B)direct labor.

C)variable manufacturing overhead.

D)fixed manufacturing overheaD.

E)fixed administrative salaries.

A)direct materials.

B)direct labor.

C)variable manufacturing overhead.

D)fixed manufacturing overheaD.

E)fixed administrative salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

Indiana's per-unit inventoriable cost under variable costing is:

A)$9.50.

B)$25.00.

C)$28.00.

D)$33.00.

E)$40.50.

A)$9.50.

B)$25.00.

C)$28.00.

D)$33.00.

E)$40.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

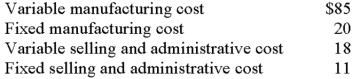

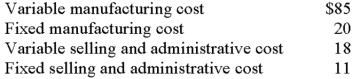

Delaware has computed the following unit costs for the year just ended:

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

A)Variable,$85;absorption,$105.

B)Variable,$85;absorption,$116.

C)Variable,$103;absorption,$105.

D)Variable,$103;absorption,$116.

E)Some other combination of figures not listed abovE.

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

A)Variable,$85;absorption,$105.

B)Variable,$85;absorption,$116.

C)Variable,$103;absorption,$105.

D)Variable,$103;absorption,$116.

E)Some other combination of figures not listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

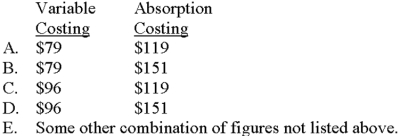

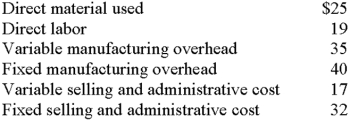

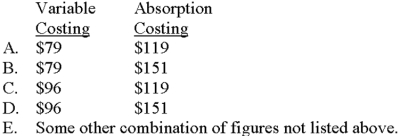

16

Santa Fe Corporation has computed the following unit costs for the year just ended:

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

Which of the following choices correctly depicts the per-unit cost of inventory under variable costing and absorption costing?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

If Indiana uses variable costing,the total inventoriable costs for the year would be:

A)$400,000.

B)$460,000.

C)$560,000.

D)$620,000.

E)$660,000.

A)$400,000.

B)$460,000.

C)$560,000.

D)$620,000.

E)$660,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

Under absorption costing,each unit of the company's inventory would be carried at:

A)$49.

B)$54.

C)$72.

D)$104.

E)some other amount.

A)$49.

B)$54.

C)$72.

D)$104.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under variable costing,each unit of the company's inventory would be carried at:

A)$49.

B)$54.

C)$72.

D)$104.

E)some other amount.

A)$49.

B)$54.

C)$72.

D)$104.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

All of the following are inventoried under variable costing except:

A)direct materials.

B)direct labor.

C)variable manufacturing overhead.

D)fixed manufacturing overheaD.

E)items "C" and "D" abovE.

A)direct materials.

B)direct labor.

C)variable manufacturing overhead.

D)fixed manufacturing overheaD.

E)items "C" and "D" abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

The contribution margin that the company would disclose on a variable-costing income statement is:

A)$0.

B)$120,000.

C)$166,500.

D)$342,000.

E)some other amount.

A)$0.

B)$120,000.

C)$166,500.

D)$342,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

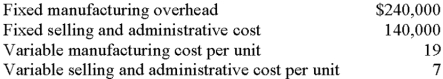

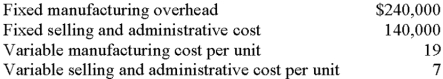

Chino began business at the start of the current year.The company planned to produce 25,000 units,and actual production conformed to expectations.Sales totaled 22,000 units at $30 each.Costs incurred were:

If there were no variances,the company's absorption-costing income would be:

A)$190,000.

B)$202,000.

C)$208,000.

D)$220,000.

E)some other amount.

If there were no variances,the company's absorption-costing income would be:

A)$190,000.

B)$202,000.

C)$208,000.

D)$220,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following product-costing systems is/are required for tax purposes?

A)Absorption costing.

B)Variable costing.

C)Throughput costing.

D)Either absorption or variable costing.

E)Either absorption,variable costing,or throughput costing.

A)Absorption costing.

B)Variable costing.

C)Throughput costing.

D)Either absorption or variable costing.

E)Either absorption,variable costing,or throughput costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Consider the following comments about absorption- and variable-costing income statements:

I)A variable-costing income statement discloses a firm's gross margin.

II)Cost of goods sold on an absorption-costing income statement includes fixed costs.

III)The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)I and II.

D)II and III.

E)I,II,and III.

I)A variable-costing income statement discloses a firm's gross margin.

II)Cost of goods sold on an absorption-costing income statement includes fixed costs.

III)The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)I and II.

D)II and III.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

Springstein began business at the start of the current year.The company planned to produce 40,000 units,and actual production conformed to expectations.Sales totaled 37,000 units at $42 each.Costs incurred were:

If there were no variances,the company's variable-costing income would be:

A)$155,000.

B)$212,000.

C)$240,500.

D)$592,000.

E)some other amount.

If there were no variances,the company's variable-costing income would be:

A)$155,000.

B)$212,000.

C)$240,500.

D)$592,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Income reported under absorption costing and variable costing is:

A)always the same.

B)typically different.

C)always higher under absorption costing.

D)always higher under variable costing.

E)always the same or higher under absorption costing.

A)always the same.

B)typically different.

C)always higher under absorption costing.

D)always higher under variable costing.

E)always the same or higher under absorption costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

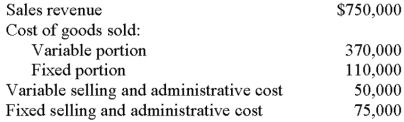

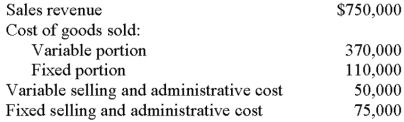

The following data relate to Lebeaux Corporation for the year just ended:

Which of the following statements is correct?

A)Lebeaux 's variable-costing income statement would reveal a gross margin of $270,000.

B)Lebeaux 's variable costing income statement would reveal a contribution margin of $330,000.

C)Lebeaux 's absorption-costing income statement would reveal a contribution margin of $330,000.

D)Lebeaux 's absorption costing income statement would reveal a gross margin of $330,000.

E)Lebeaux 's absorption-costing income statement would reveal a gross margin of $145,000.

Which of the following statements is correct?

A)Lebeaux 's variable-costing income statement would reveal a gross margin of $270,000.

B)Lebeaux 's variable costing income statement would reveal a contribution margin of $330,000.

C)Lebeaux 's absorption-costing income statement would reveal a contribution margin of $330,000.

D)Lebeaux 's absorption costing income statement would reveal a gross margin of $330,000.

E)Lebeaux 's absorption-costing income statement would reveal a gross margin of $145,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

The income (loss)under absorption costing is:

A)$(7,500).

B)$9,000.

C)$15,000.

D)$18,000.

E)some other amount.

A)$(7,500).

B)$9,000.

C)$15,000.

D)$18,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following statements pertain to both variable costing and absorption costing?

A)The income statement discloses the amount of gross margin generated during the reporting period.

B)Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.

C)Both variable and absorption costing can be used for external financial reporting.

D)Variable selling costs are written-off as expenses of the accounting perioD.

E)Fixed manufacturing overhead is attached to each unit produced.

A)The income statement discloses the amount of gross margin generated during the reporting period.

B)Fixed selling and administrative expenses are treated in the same manner as fixed manufacturing overhead.

C)Both variable and absorption costing can be used for external financial reporting.

D)Variable selling costs are written-off as expenses of the accounting perioD.

E)Fixed manufacturing overhead is attached to each unit produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements pertain to variable costing?

A)This method must be used for external financial reporting.

B)Fixed manufacturing overhead is attached to each unit produced.

C)The income statement discloses a company's contribution margin.

D)Variable manufacturing overhead becomes part of a unit's cost.

E)Statements "C" and "D" both pertain to variable costing.

A)This method must be used for external financial reporting.

B)Fixed manufacturing overhead is attached to each unit produced.

C)The income statement discloses a company's contribution margin.

D)Variable manufacturing overhead becomes part of a unit's cost.

E)Statements "C" and "D" both pertain to variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

The gross margin that the company would disclose on an absorption-costing income statement is:

A)$0.

B)$133,000.

C)$166,500.

D)$342,000.

E)some other amount.

Original answer is wrong ($120,000).Should be $133,000.

A)$0.

B)$133,000.

C)$166,500.

D)$342,000.

E)some other amount.

Original answer is wrong ($120,000).Should be $133,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Indiana's per-unit inventoriable cost under absorption costing is:

A)$9.50.

B)$25.00.

C)$28.00.

D)$33.00.

E)$40.50.

A)$9.50.

B)$25.00.

C)$28.00.

D)$33.00.

E)$40.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

If Indiana uses absorption costing,the total inventoriable costs for the year would be:

A)$400,000.

B)$460,000.

C)$560,000.

D)$620,000.

E)$660,000.

A)$400,000.

B)$460,000.

C)$560,000.

D)$620,000.

E)$660,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

The gross margin that the company would disclose on an absorption-costing income statement is:

A)$97,500.

B)$147,000.

C)$166,500.

D)$370,000.

E)some other amount.

A)$97,500.

B)$147,000.

C)$166,500.

D)$370,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

Consider the following comments about absorption- and variable-costing income statements:

I)A variable-costing income statement discloses a firm's contribution margin.

II)Cost of goods sold on an absorption-costing income statement includes fixed costs.

III)The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)I and II.

D)II and III.

E)I,II,and III.

I)A variable-costing income statement discloses a firm's contribution margin.

II)Cost of goods sold on an absorption-costing income statement includes fixed costs.

III)The amount of variable selling and administrative cost is the same on absorption- and variable-costing income statements.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)I and II.

D)II and III.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

Springer began business at the start of the current year.The company planned to produce 40,000 units,and actual production conformed to expectations.Sales totaled 37,000 units at $42 each.Costs incurred were:

If there were no variances,the company's absorption-costing income would be:

A)$155,000.

B)$230,000.

C)$240,500.

D)$592,000.

E)some other amount.

If there were no variances,the company's absorption-costing income would be:

A)$155,000.

B)$230,000.

C)$240,500.

D)$592,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

The contribution margin that the company would disclose on a variable-costing income statement is:

A)$97,500.

B)$147,000.

C)$166,500.

D)$370,000.

E)some other amount.

A)$97,500.

B)$147,000.

C)$166,500.

D)$370,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

Variable costing of inventory and absorption costing of inventory is relevant for which of the following types of businesses:

A)Manufacturing firms.

B)Not-for-profit companies.

C)Governmental units.

D)Service firms.

E)All of thesE.

This question is vague as originally worded."Choice" to use variable costing or absorption costing for what purpose - financial statements,decision making? I think I know what you are getting at,and changed it to read as abovE.

A)Manufacturing firms.

B)Not-for-profit companies.

C)Governmental units.

D)Service firms.

E)All of thesE.

This question is vague as originally worded."Choice" to use variable costing or absorption costing for what purpose - financial statements,decision making? I think I know what you are getting at,and changed it to read as abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

The income (loss)under variable costing is:

A)$(7,500).

B)$9,000.

C)$15,000.

D)$18,000.

E)some other amount.

A)$(7,500).

B)$9,000.

C)$15,000.

D)$18,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

Garcia's inventory increased during the year.On the basis of this information,income reported under absorption costing:

A)will be the same as that reported under variable costing.

B)will be higher than that reported under variable costing.

C)will be lower than that reported under variable costing.

D)will differ from that reported under variable costing,the direction of which cannot be determined from the information given.

E)will be less than that reported in the previous period.

A)will be the same as that reported under variable costing.

B)will be higher than that reported under variable costing.

C)will be lower than that reported under variable costing.

D)will differ from that reported under variable costing,the direction of which cannot be determined from the information given.

E)will be less than that reported in the previous period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following conditions would cause absorption-costing income to be higher than variable-costing income?

A)Units sold exceeded units produced.

B)Units sold equaled units produced.

C)Units sold were less than units produced.

D)Sales prices decreaseD.

E)Selling expenses increased.

A)Units sold exceeded units produced.

B)Units sold equaled units produced.

C)Units sold were less than units produced.

D)Sales prices decreaseD.

E)Selling expenses increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Absorption and variable costing are two different methods of measuring income and costing inventory.

Required:

A.Product costs are defined as costs associated with the manufacturing process.How does the operational definition of product cost differ between absorption costing and variable costing?

A.The sole difference between the two methods is that fixed manufacturing overhead costs are defined as a product cost under absorption costing and as a period cost under variable costing.

B.An absorption-costing income statement will report gross profit or gross margin whereas a variable-costing income statement will report contribution margin.What is the difference between these terms?

B.Gross profit (gross margin)is the difference between sales and cost of goods solD.Cost of goods sold includes variable and fixed manufacturing costs.Contribution margin,on the other hand,is the difference between sales and variable expenses,namely,variable cost of goods sold and variable operating expenses.Fixed costs are ignored when calculating the contribution margin.

Required:

A.Product costs are defined as costs associated with the manufacturing process.How does the operational definition of product cost differ between absorption costing and variable costing?

A.The sole difference between the two methods is that fixed manufacturing overhead costs are defined as a product cost under absorption costing and as a period cost under variable costing.

B.An absorption-costing income statement will report gross profit or gross margin whereas a variable-costing income statement will report contribution margin.What is the difference between these terms?

B.Gross profit (gross margin)is the difference between sales and cost of goods solD.Cost of goods sold includes variable and fixed manufacturing costs.Contribution margin,on the other hand,is the difference between sales and variable expenses,namely,variable cost of goods sold and variable operating expenses.Fixed costs are ignored when calculating the contribution margin.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

Moneka reported $65,000 of income for the year by using absorption costing.The company had no beginning inventory,planned and actual production of 20,000 units,and sales of 18,000 units.Standard variable manufacturing costs were $20 per unit,and total budgeted fixed manufacturing overhead was $100,000.If there were no variances,income under variable costing would be:

A)$15,000.

B)$55,000.

C)$65,000.

D)$75,000.

E)$115,000.

A)$15,000.

B)$55,000.

C)$65,000.

D)$75,000.

E)$115,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

For external-reporting purposes,generally accepted accounting principles require that net income be based on:

A)absorption costing.

B)variable costing.

C)direct costing.

D)semivariable costing.

E)activity-based costing.

A)absorption costing.

B)variable costing.

C)direct costing.

D)semivariable costing.

E)activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

Under throughput costing,the cost of a unit typically includes:

A)selling costs.

B)fixed manufacturing overhead.

C)the direct costs incurred whenever a unit is manufactured.

D)administrative costs.

E)all of thesE.

A)selling costs.

B)fixed manufacturing overhead.

C)the direct costs incurred whenever a unit is manufactured.

D)administrative costs.

E)all of thesE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following situations would cause variable-costing income to be higher than absorption-costing income?

A)Units sold equaled 39,000 and units produced equaled 42,000.

B)Units sold and units produced were both 42,000.

C)Units sold equaled 55,000 and units produced equaled 49,000.

D)Sales prices decreased by $7 per unit during the accounting perioD.

E)Selling expenses increased by 10% during the accounting period.

A)Units sold equaled 39,000 and units produced equaled 42,000.

B)Units sold and units produced were both 42,000.

C)Units sold equaled 55,000 and units produced equaled 49,000.

D)Sales prices decreased by $7 per unit during the accounting perioD.

E)Selling expenses increased by 10% during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Consider the following statements about absorption costing and variable costing:

I)Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II)Absorption costing must be used for external financial reporting.

III)A number of companies use both absorption costing and variable costing.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)I,II,and III.

I)Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II)Absorption costing must be used for external financial reporting.

III)A number of companies use both absorption costing and variable costing.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

Consider the following statements about absorption costing and variable costing:

I)Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II)Variable costing must be used for external financial reporting.

III)A number of companies use both absorption costing and variable costing.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)I and III.

I)Variable costing is consistent with contribution reporting and cost-volume-profit analysis.

II)Variable costing must be used for external financial reporting.

III)A number of companies use both absorption costing and variable costing.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)I and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following conditions would cause absorption-costing income to be lower than variable-costing income?

A)Units sold exceeded units produced.

B)Units sold equaled units produced.

C)Units sold were less than units produced.

D)Sales prices decreaseD.

E)Selling expenses increased.

A)Units sold exceeded units produced.

B)Units sold equaled units produced.

C)Units sold were less than units produced.

D)Sales prices decreaseD.

E)Selling expenses increased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

The table that follows denotes selected characteristics of absorption costing and/or variable costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

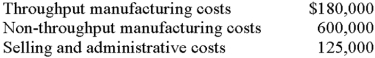

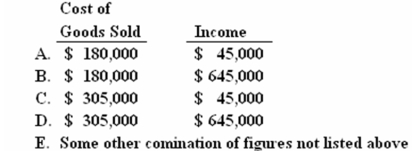

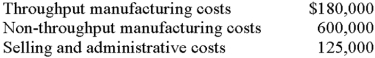

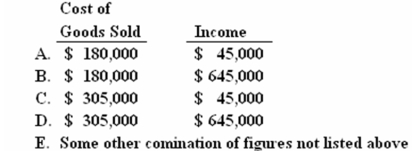

Highway Company reported the following costs for the year just ended:

If Highway uses throughput costing and had sales revenues for the period of $950,000,which of the following choices correctly depicts the company's cost of goods sold and income?

(delete "Net",below;just say "Income.")

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

If Highway uses throughput costing and had sales revenues for the period of $950,000,which of the following choices correctly depicts the company's cost of goods sold and income?

(delete "Net",below;just say "Income.")

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following methods defines product cost as the unit-level cost incurred each time a unit is manufactured?

A)Throughput costing.

B)Indirect costing.

C)Process costing.

D)Absorption costing.

E)Back-flush costing.

A)Throughput costing.

B)Indirect costing.

C)Process costing.

D)Absorption costing.

E)Back-flush costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

Consider the following statements about absorption- and variable-costing income:

I)Yearly income reported under absorption costing will differ from income reported under variable costing if production and sales volumes differ.

II)In the long-run,total income reported under absorption costing will often be close to that reported under variable costing.

III)Differences in income under absorption and variable costing can often be reconciled by multiplying the change in inventory (in units)by the variable manufacturing overhead cost per unit.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)II and III.

I)Yearly income reported under absorption costing will differ from income reported under variable costing if production and sales volumes differ.

II)In the long-run,total income reported under absorption costing will often be close to that reported under variable costing.

III)Differences in income under absorption and variable costing can often be reconciled by multiplying the change in inventory (in units)by the variable manufacturing overhead cost per unit.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)II and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following situations would cause variable-costing income to be lower than absorption-costing income?

A)Units sold equaled 39,000 and units produced equaled 42,000.

B)Units sold and units produced were both 42,000.

C)Units sold equaled 55,000 and units produced equaled 49,000.

D)Sales prices decreased by $7 per unit during the accounting perioD.

E)Selling expenses increased by 10% during the accounting period.

A)Units sold equaled 39,000 and units produced equaled 42,000.

B)Units sold and units produced were both 42,000.

C)Units sold equaled 55,000 and units produced equaled 49,000.

D)Sales prices decreased by $7 per unit during the accounting perioD.

E)Selling expenses increased by 10% during the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

Carter reported $106,000 of income for the year by using variable costing.The company had no beginning inventory,planned and actual production of 50,000 units,and sales of 47,000 units.Standard variable manufacturing costs were $15 per unit,and total budgeted fixed manufacturing overhead was $150,000.If there were no variances,income under absorption costing would be:

A)$52,000.

B)$97,000.

C)$106,000.

D)$115,000.

E)$160,000.

A)$52,000.

B)$97,000.

C)$106,000.

D)$115,000.

E)$160,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

Ortego's management recently committed to incurring direct labor and all manufacturing overhead charges regardless of the number of units produced.Under throughput costing,the company's cost of goods sold would include charges for:

A)selling and administrative costs.

B)direct materials.

C)direct labor and manufacturing overhead.

D)direct materials,direct labor,and manufacturing overheaD.

E)direct materials,direct labor,manufacturing overhead,and selling and administrative costs.

A)selling and administrative costs.

B)direct materials.

C)direct labor and manufacturing overhead.

D)direct materials,direct labor,and manufacturing overheaD.

E)direct materials,direct labor,manufacturing overhead,and selling and administrative costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

The difference in income between absorption and variable costing can be explained by the change in finished-goods inventory (in units)multiplied by the standard fixed manufacturing overhead rate.

Required:

Explain why this calculation accounts for the difference noted.

Required:

Explain why this calculation accounts for the difference noted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following formulas can often reconcile the difference between absorption- and variable-costing income?

A)Change in inventory units *predetermined variable-overhead rate per unit.

B)Change in inventory units / predetermined variable-overhead rate per unit.

C)Change in inventory units *predetermined fixed-overhead rate per unit.

D)Change in inventory units /predetermined fixed-overhead rate per unit.

E)(Absorption-costing income - variable-costing income)* fixed-overhead rate per unit.

A)Change in inventory units *predetermined variable-overhead rate per unit.

B)Change in inventory units / predetermined variable-overhead rate per unit.

C)Change in inventory units *predetermined fixed-overhead rate per unit.

D)Change in inventory units /predetermined fixed-overhead rate per unit.

E)(Absorption-costing income - variable-costing income)* fixed-overhead rate per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck