Deck 5: Activity-Based Costing and Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/102

العب

ملء الشاشة (f)

Deck 5: Activity-Based Costing and Management

1

Activity-based costing systems have a tendency to distort product costs.

False

2

In an activity-based costing system,direct materials used would typically be classified as a unit-level cost.

True

3

Generally speaking,companies prefer doing business with customers who order small quantities rather than large quantities.

False

4

An example of a customer-value-added activity is final painting and polishing of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is least likely to be classified as a facility-level activity in an activity-based costing system?

A)Plant maintenance.

B)Property taxes.

C)Machine processing cost.

D)Plant depreciation.

E)Plant management salaries.

A)Plant maintenance.

B)Property taxes.

C)Machine processing cost.

D)Plant depreciation.

E)Plant management salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following tasks is not normally associated with an activity-based costing system?

A)Calculation of pool rates.

B)Identification of cost pools.

C)Preparation of allocation matrices.

D)Identification of cost drivers.

E)Assignment of cost to products.

A)Calculation of pool rates.

B)Identification of cost pools.

C)Preparation of allocation matrices.

D)Identification of cost drivers.

E)Assignment of cost to products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

7

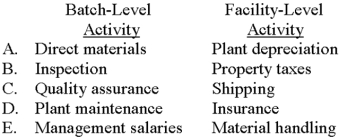

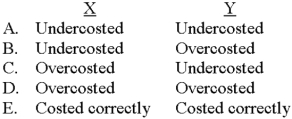

Which of the following choices correctly depicts a cost that arises from a batch-level activity and one that arises from a facility-level activity?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

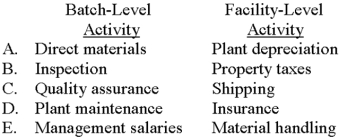

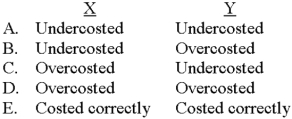

8

Which of the following choices correctly depicts the proper classification of direct materials used and management salaries?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

9

In an activity-based costing system,materials receiving would typically be classified as a:

A)unit-level activity.

B)batch-level activity.

C)product-sustaining activity.

D)facility-level activity.

E)period-level activity.

A)unit-level activity.

B)batch-level activity.

C)product-sustaining activity.

D)facility-level activity.

E)period-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

10

The salaries of a manufacturing plant's management are said to arise from:

A)unit-level activities.

B)batch-level activities.

C)product-sustaining activities.

D)facility-level activities.

E)direct-cost activities.

A)unit-level activities.

B)batch-level activities.

C)product-sustaining activities.

D)facility-level activities.

E)direct-cost activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

11

Consider the following statements regarding product-sustaining activities:

I)They must be performed for each batch of product that is made.

II)They must be performed for each unit of product that is made.

III)They are needed to support an entire product line.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)II and III.

I)They must be performed for each batch of product that is made.

II)They must be performed for each unit of product that is made.

III)They are needed to support an entire product line.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and II.

E)II and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following is the proper sequence of events in an activity-based costing system?

A)Identification of cost drivers,identification of cost pools,calculation of pool rates,assignment of cost to products.

B)Identification of cost pools,identification of cost drivers,calculation of pool rates,assignment of cost to products.

C)Assignment of cost to products,identification of cost pools,identification of cost drivers,calculation of pool rates.

D)Calculation of pool rates,identification of cost drivers,identification of cost pools,assignment of cost to products.

E)Some other sequence of the four activities listed abovE.

A)Identification of cost drivers,identification of cost pools,calculation of pool rates,assignment of cost to products.

B)Identification of cost pools,identification of cost drivers,calculation of pool rates,assignment of cost to products.

C)Assignment of cost to products,identification of cost pools,identification of cost drivers,calculation of pool rates.

D)Calculation of pool rates,identification of cost drivers,identification of cost pools,assignment of cost to products.

E)Some other sequence of the four activities listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

13

Consumption ratios are useful in determining the existence of product-line diversity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

14

Many traditional costing systems:

A)trace manufacturing overhead to individual activities and require the development of numerous activity-costing rates.

B)write off manufacturing overhead as an expense of the current period.

C)combine widely varying elements of overhead into a single cost pool.

D)use a host of different cost drivers (e.g. ,number of production setups,inspection hours,orders processed)to improve the accuracy of product costing.

E)produce results far superior to those achieved with activity-based costing.

A)trace manufacturing overhead to individual activities and require the development of numerous activity-costing rates.

B)write off manufacturing overhead as an expense of the current period.

C)combine widely varying elements of overhead into a single cost pool.

D)use a host of different cost drivers (e.g. ,number of production setups,inspection hours,orders processed)to improve the accuracy of product costing.

E)produce results far superior to those achieved with activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

15

In an activity-based costing system,direct materials used would typically be classified as a:

A)unit-level cost.

B)batch-level cost.

C)product-sustaining cost.

D)facility-level cost.

E)matrix-level cost.

A)unit-level cost.

B)batch-level cost.

C)product-sustaining cost.

D)facility-level cost.

E)matrix-level cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

16

Feinstein,Inc. ,an appliance manufacturer,is developing a new line of ovens that uses controlled-laser technology.The research and testing costs associated with the new ovens is said to arise from a:

A)unit-level activity.

B)batch-level activity.

C)product-sustaining activity.

D)facility-level activity.

E)competitive-level activity.

A)unit-level activity.

B)batch-level activity.

C)product-sustaining activity.

D)facility-level activity.

E)competitive-level activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

17

The following tasks are associated with an activity-based costing system:

1- Assignment of cost to products

2- Calculation of pool rates

3- Identification of cost drivers

4- Identification of cost pools

Which of the following choices correctly expresses the proper order of the preceding tasks?

A)1,2,3,4.

B)2,4,1,3.

C)3,4,2,1.

D)4,2,1,3.

4,3,2,1.

1- Assignment of cost to products

2- Calculation of pool rates

3- Identification of cost drivers

4- Identification of cost pools

Which of the following choices correctly expresses the proper order of the preceding tasks?

A)1,2,3,4.

B)2,4,1,3.

C)3,4,2,1.

D)4,2,1,3.

4,3,2,1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

18

Consider the following statements regarding traditional costing systems:

I)Overhead costs are applied to products on the basis of volume-related measures.

II)All manufacturing costs are easily traceable to the goods produced.

III)Traditional costing systems tend to distort unit manufacturing costs when numerous goods are made that have widely varying production requirements.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and III.

E)II and III.

I)Overhead costs are applied to products on the basis of volume-related measures.

II)All manufacturing costs are easily traceable to the goods produced.

III)Traditional costing systems tend to distort unit manufacturing costs when numerous goods are made that have widely varying production requirements.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)III only.

D)I and III.

E)II and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is not a broad,cost classification category typically used in activity-based costing?

A)Unit-level.

B)Batch-level.

C)Product-sustaining level.

D)Facility-level.

E)Management-level.

A)Unit-level.

B)Batch-level.

C)Product-sustaining level.

D)Facility-level.

E)Management-level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is least likely to be classified as a batch-level activity in an activity-based costing system?

A)Shipping.

B)Receiving and inspection.

C)Production setup.

D)Property taxes.

E)Quality assurancE.

A)Shipping.

B)Receiving and inspection.

C)Production setup.

D)Property taxes.

E)Quality assurancE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is HiTech's pool rate for the material-handling activity?

A)$1.00 per part.

B)$2.25 per part.

C)$6.62 per labor hour.

D)$13.23 per part.

E)A rate other than those listed abovE.

A)$1.00 per part.

B)$2.25 per part.

C)$6.62 per labor hour.

D)$13.23 per part.

E)A rate other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

22

What is HiTech's pool rate for the finishing activity?

A)$5.00 per labor hour.

B)$5.00 per machine hour.

C)$5.00 per unit.

D)$7.50 per unit.

E)A rate other than those listed abovE.

A)$5.00 per labor hour.

B)$5.00 per machine hour.

C)$5.00 per unit.

D)$7.50 per unit.

E)A rate other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is HiTech's pool rate for the automated machinery activity?

A)$24.00 per machine hour.

B)$24.50 per labor hour.

C)$49.42 per unit.

D)$50.00 per machine hour.

E)A rate other than those listed abovE.

A)$24.00 per machine hour.

B)$24.50 per labor hour.

C)$49.42 per unit.

D)$50.00 per machine hour.

E)A rate other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

24

The overhead cost allocated to Beta by using activity-based costing procedures would be:

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

25

The division of activities into unit-level,batch-level,product-sustaining level,and facility-level categories is commonly known as a cost:

A)object.

B)application method.

C)hierarchy.

D)estimation methoD.

E)classification scheme that is useful in traditional,volume-based systems.

A)object.

B)application method.

C)hierarchy.

D)estimation methoD.

E)classification scheme that is useful in traditional,volume-based systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

26

The overhead cost allocated to Zeta by using activity-based costing procedures would be:

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

27

Assume that HiTech is using a volume-based costing system,and the preceding overhead costs are applied to all products on the basis of direct labor hours.The overhead cost that would be assigned to the Deluxe product line is closest to:

A)$456,471.

B)$646,471.

C)$961,176.

D)$1,141,176.

E)An amount other than those listed abovE.

A)$456,471.

B)$646,471.

C)$961,176.

D)$1,141,176.

E)An amount other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

28

Assume that HiTech is using a volume-based costing system,and the preceding overhead costs are applied to all products on the basis of direct labor hours.The overhead cost that would be assigned to the Standard product line is closest to:

A)$456,471.

B)$646,471.

C)$961,176.

D)$1,141,176.

E)An amount other than those listed abovE.

A)$456,471.

B)$646,471.

C)$961,176.

D)$1,141,176.

E)An amount other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

29

Aladin's customer service department follows up on customer complaints by telephone inquiry.During a recent period,the department initiated 7,000 calls and incurred costs of $203,000.If 2,940 of these calls were for the company's wholesale operation (the remainder were for the retail division),costs allocated to the wholesale operation should amount to:

A)$0.

B)$29.

C)$85,260.

D)$117,740.

E)$203,000.

A)$0.

B)$29.

C)$85,260.

D)$117,740.

E)$203,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

30

The cost of wages and salaries and other overhead that would be charged to each delivery is closest to:

A)$19.63.

B)$20.31.

C)$26.75.

D)$40.63.

E)some other amount.

A)$19.63.

B)$20.31.

C)$26.75.

D)$40.63.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

31

The cost of wages and salaries and other overhead that would be charged to each bouquet made is:

A)$7.15.

B)$8.75.

C)$12.50.

D)$13.75.

E)some other amount.

A)$7.15.

B)$8.75.

C)$12.50.

D)$13.75.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

32

Astro's customer service department follows up on customer complaints by telephone inquiry.During a recent period,the department initiated 10,000 calls and incurred costs of $312,000.Of these calls,3,800 were for the company's wholesale operation;the remainder were for the retail division.Costs allocated to the retail division are:

A)$0.

B)$31,200.

C)$118,560.

D)$193,440.

E)$203,000.

A)$0.

B)$31,200.

C)$118,560.

D)$193,440.

E)$203,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

33

Alamo's customer service department follows up on customer complaints by telephone inquiry.During a recent period,the department initiated 7,000 calls and incurred costs of $203,000.If 2,940 of these calls were for the company's wholesale operation (the remainder were for the retail division),costs allocated to the retail division should amount to:

A)$0.

B)$29.

C)$85,260.

D)$117,740.

E)$203,000.

A)$0.

B)$29.

C)$85,260.

D)$117,740.

E)$203,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

34

The overhead cost allocated to Zeta by using traditional costing procedures would be:

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

35

What is HiTech's pool rate for the packaging activity?

A)$4.86 per machine hour.

B)$5.00 per labor hour.

C)$10.00 per unit.

D)$100.00 per order shippeD.

E)A rate other than those listed abovE.

A)$4.86 per machine hour.

B)$5.00 per labor hour.

C)$10.00 per unit.

D)$100.00 per order shippeD.

E)A rate other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

36

Under an activity-based costing system,what is the per-unit overhead cost of Deluxe?

A)$272.

B)$282.

C)$320.

D)$440.

E)An amount other than those listed abovE.

A)$272.

B)$282.

C)$320.

D)$440.

E)An amount other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

37

Under an activity-based costing system,what is the per-unit overhead cost of Economy?

A)$141.

B)$164.

C)$225.

D)$228.

E)An amount other than those listed abovE.

A)$141.

B)$164.

C)$225.

D)$228.

E)An amount other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

38

Under an activity-based costing system,what is the per-unit overhead cost of Standard?

A)$164.

B)$228.

C)$272.

D)$282.

E)An amount other than those listed abovE.

A)$164.

B)$228.

C)$272.

D)$282.

E)An amount other than those listed abovE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

39

The overhead cost allocated to Beta by using traditional costing procedures would be:

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

A)$240,000.

B)$356,000.

C)$444,000.

D)$560,000.

E)some other amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

40

Alaina's customer service department follows up on customer complaints by telephone inquiry.During a recent period,the department initiated 10,000 calls and incurred costs of $312,000.Of these calls,3,800 were for the company's wholesale operation;the remainder were for the retail division.Costs allocated to the wholesale operation are:

A)$0.

B)$31,200.

C)$118,560.

D)$193,440.

E)$203,000.

A)$0.

B)$31,200.

C)$118,560.

D)$193,440.

E)$203,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

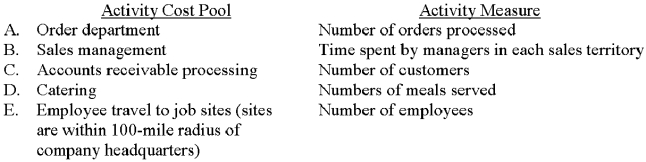

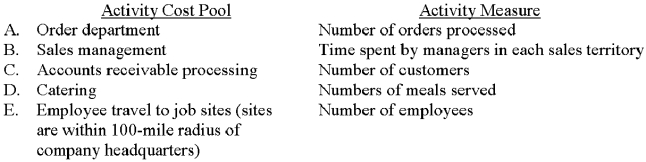

41

Which of the following activity cost pools and activity measures likely has the lowest degree of correlation?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

42

Dreyson Manufacturing sells a number of goods whose selling price is heavily influenced by cost.A recent study of product no.519 revealed a traditionally-derived total cost of $1,019,a selling price of $1,850 based on that figure,and a newly computed activity-based total cost of $1,215.Which of the following statements is true?

A)All other things being equal,the company should consider a drop in its sales price.

B)The company may have been extremely competitive in the marketplace from a price perspective.

C)Product no.519 could be labeled as being overcosted by the firm's traditional costing procedures.

D)If product no.519 is undercosted by traditional accounting procedures,then all of the company's other products must be undercosted as well.

E)Generally speaking,the activity-based cost figure is "less accurate" than the traditionally-derived cost figurE.

A)All other things being equal,the company should consider a drop in its sales price.

B)The company may have been extremely competitive in the marketplace from a price perspective.

C)Product no.519 could be labeled as being overcosted by the firm's traditional costing procedures.

D)If product no.519 is undercosted by traditional accounting procedures,then all of the company's other products must be undercosted as well.

E)Generally speaking,the activity-based cost figure is "less accurate" than the traditionally-derived cost figurE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assuming the use of activity-based costing,the proper percentage to use in allocating staff support costs to tax planning services is:

A)20%.

B)60%.

C)65%.

D)75%.

E)80%.

A)20%.

B)60%.

C)65%.

D)75%.

E)80%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

44

Consumption ratios are useful in determining:

A)the existence of product-line diversity.

B)overhead that is incurred at the unit level.

C)if overhead-producing activities are being utilized effectively.

D)if overhead costs are being applied to products.

E)if overhead-producing activities are being utilized efficiently.

A)the existence of product-line diversity.

B)overhead that is incurred at the unit level.

C)if overhead-producing activities are being utilized effectively.

D)if overhead costs are being applied to products.

E)if overhead-producing activities are being utilized efficiently.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

45

Widely varying consumption ratios:

A)are reflective of product-line diversity.

B)indicate an out-of-control production environment.

C)dictate a need for traditional costing systems.

D)work against the implementation of activity-based costing.

E)create an unsolvable product-costing problem.

A)are reflective of product-line diversity.

B)indicate an out-of-control production environment.

C)dictate a need for traditional costing systems.

D)work against the implementation of activity-based costing.

E)create an unsolvable product-costing problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

46

If Kelly and Logan switched from its current accounting method to an activity-based costing system,the amount of administrative cost chargeable to consulting services would:

A)decrease by $23,500.

B)increase by $23,500.

C)decrease by $32,500.

D)change by an amount other than those listed above.

E)change,but the amount cannot be determined based on the information presented.

A)decrease by $23,500.

B)increase by $23,500.

C)decrease by $32,500.

D)change by an amount other than those listed above.

E)change,but the amount cannot be determined based on the information presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

47

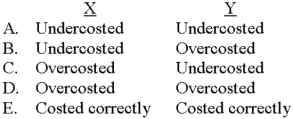

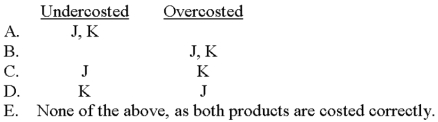

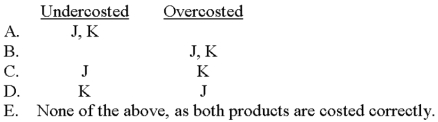

Jackson manufactures products X and Y,applying overhead on the basis of labor hours.X,a low-volume product,requires a variety of complex manufacturing procedures.Y,on the other hand,is both a high-volume product and relatively simplistic in nature.What would an activity-based costing system likely disclose about products X and Y as a result of Jackson's current accounting procedures?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

48

Storch Corporation takes eight hours to complete the setup process for a certain electrical component,with the setup cost averaging $150 per hour.If the company's competitor can accomplish the same process in six hours,Stanley's non-value-added cost would be:

A)$0.

B)$150.

C)$300.

D)$900.

E)$1,200.

A)$0.

B)$150.

C)$300.

D)$900.

E)$1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

49

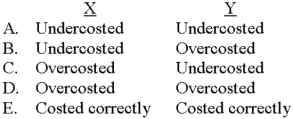

Johnson manufactures products X and Y,applying overhead on the basis of labor hours.X is a high-volume product and relatively simplistic in nature.Y is both a low-volume product and requires a variety of complex manufacturing procedures.What would an activity-based costing system likely disclose about products X and Y as a result of Johnson's current accounting procedures?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

50

Activity-based costing systems:

A)use a single,volume-based cost driver.

B)assign overhead to products based on the products' relative usage of direct labor.

C)often reveal products that were under- or over-costed by traditional costing systems.

D)typically use fewer cost drivers than more traditional costing systems.

E)have a tendency to distort product costs.

A)use a single,volume-based cost driver.

B)assign overhead to products based on the products' relative usage of direct labor.

C)often reveal products that were under- or over-costed by traditional costing systems.

D)typically use fewer cost drivers than more traditional costing systems.

E)have a tendency to distort product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

51

Successful adoptions of activity-based costing typically occur when companies rely heavily on:

A)finance personnel.

B)accounting personnel.

C)manufacturing personnel.

D)office personnel.

E)multidisciplinary project teams.

A)finance personnel.

B)accounting personnel.

C)manufacturing personnel.

D)office personnel.

E)multidisciplinary project teams.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

52

Vanguilder combines all manufacturing overhead into a single cost pool and allocates this overhead to products by using machine hours.Activity-based costing would likely show that with Vanguard's current procedures

A)all of the company's products are undercosted.

B)the company's high-volume products are undercosted.

C)all of the company's products are overcosted.

D)the company's high-volume products are overcosteD.

E)the company's low-volume products are overcosted.

A)all of the company's products are undercosted.

B)the company's high-volume products are undercosted.

C)all of the company's products are overcosted.

D)the company's high-volume products are overcosteD.

E)the company's low-volume products are overcosted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

53

Koski manufactures products J and K,applying overhead on the basis of labor hours.J,a low-volume product,requires a variety of complex manufacturing procedures.K,on the other hand,is both a high-volume product and relatively simplistic in nature.What would an activity-based costing system likely disclose about products J and K as a result of Koski's current accounting procedures?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

54

Consider the following factors:

I)The degree of correlation between consumption of an activity and consumption of a particular cost driver.

II)The likelihood that a particular cost driver will induce a desired behavioral effect.

III)The likelihood that a particular cost driver will cause an increase in the cost of measurement.

Which of these factors should be considered in the selection of a cost driver?

A)I only.

B)I and II.

C)I and III.

D)II and III.

E)I,II,and III.

I)The degree of correlation between consumption of an activity and consumption of a particular cost driver.

II)The likelihood that a particular cost driver will induce a desired behavioral effect.

III)The likelihood that a particular cost driver will cause an increase in the cost of measurement.

Which of these factors should be considered in the selection of a cost driver?

A)I only.

B)I and II.

C)I and III.

D)II and III.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

55

During a recent accounting period,Marty's shipping department processed 26 orders.Each order typically takes four hours to complete;however,the average time increased to five hours because of various departmental inefficiencies.If shipping labor is paid $14 per hour,the company's non-value-added cost would be:

A)$0.

B)$56.

C)$364.

D)$1,456.

E)$1,820.

A)$0.

B)$56.

C)$364.

D)$1,456.

E)$1,820.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

56

Consider the following statements:

I)Product diversity creates costing problems because diverse products tend to utilize manufacturing activities in different ways.

II)Overhead costs that are not incurred at the unit level create costing problems because such costs do not vary with traditional application bases such as direct labor hours or machine hours.

III)Product diversity typically exists when a single product (e.g. ,a ballpoint pen)is made in different colors.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)I and II.

D)I and III.

E)II and III.

I)Product diversity creates costing problems because diverse products tend to utilize manufacturing activities in different ways.

II)Overhead costs that are not incurred at the unit level create costing problems because such costs do not vary with traditional application bases such as direct labor hours or machine hours.

III)Product diversity typically exists when a single product (e.g. ,a ballpoint pen)is made in different colors.

Which of the above statements is (are)true?

A)I only.

B)II only.

C)I and II.

D)I and III.

E)II and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

57

Drake Manufacturing sells a number of goods whose selling price is heavily influenced by cost.A recent study of product no.520 revealed a traditionally-derived total cost of $1,623 and a selling price of $1,850 based on that figure.A newly computed activity-based total cost is $1,215.Which of the following statements is true?

A)All other things being equal,Drake should consider increasing its sales price.

B)Drake should increase the product's selling price to maintain the same markup percentage.

C)Product no.520 could be labeled as being overcosted by Drake's traditional costing procedures.

D)If product no.520 is undercosted by traditional accounting procedures,then all of Drake's other products must be undercosted as well.

E)Generally speaking,the activity-based cost figure is "less accurate" than the traditionally-derived cost figurE.

A)All other things being equal,Drake should consider increasing its sales price.

B)Drake should increase the product's selling price to maintain the same markup percentage.

C)Product no.520 could be labeled as being overcosted by Drake's traditional costing procedures.

D)If product no.520 is undercosted by traditional accounting procedures,then all of Drake's other products must be undercosted as well.

E)Generally speaking,the activity-based cost figure is "less accurate" than the traditionally-derived cost figurE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

58

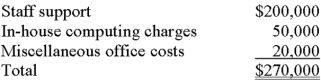

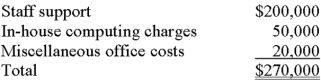

Martin and Beasley,an accounting firm,provides consulting and tax planning services.For many years,the firm's total administrative cost (currently $270,000)has been allocated to services on this basis of billable hours to clients.A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services,while 45% resulted from consulting services.

The firm,contemplating a change to activity-based costing,has identified three components of administrative cost,as follows:

A recent analysis of staff support found a strong correlation with the number of clients served.In contrast,in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions,respectively.Consulting clients served totaled 35% of the total client base,consumed 30% of the firm's computer hours,and accounted for 20% of the total client transactions.

If Martin and Beasley switched from its current accounting method to an activity-based costing system,the amount of administrative cost chargeable to consulting services would:

A)decrease by $32,500.

B)increase by $32,500.

C)decrease by $59,500.

D)change by an amount other than those listed above.

E)change,but the amount cannot be determined based on the information presented.

The firm,contemplating a change to activity-based costing,has identified three components of administrative cost,as follows:

A recent analysis of staff support found a strong correlation with the number of clients served.In contrast,in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions,respectively.Consulting clients served totaled 35% of the total client base,consumed 30% of the firm's computer hours,and accounted for 20% of the total client transactions.

If Martin and Beasley switched from its current accounting method to an activity-based costing system,the amount of administrative cost chargeable to consulting services would:

A)decrease by $32,500.

B)increase by $32,500.

C)decrease by $59,500.

D)change by an amount other than those listed above.

E)change,but the amount cannot be determined based on the information presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

59

Grist Enterprises is converting to an activity-based costing system and needs to depict the various activities in its manufacturing process along with the activities' relationships.Which of the following is a possible tool that the company can use to accomplish this task?

A)Storyboards.

B)Activity relationship charts (ARCs).

C)Decision trees.

D)Simulation games.

E)Process organizers.

A)Storyboards.

B)Activity relationship charts (ARCs).

C)Decision trees.

D)Simulation games.

E)Process organizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements is (are)true about non-value-added activities?

I)Non-value-added activities are often unnecessary and dispensable.

II)Non-value-added activities may be necessary but are being performed in an inefficient and improvable manner.

III)Non-value-added activities can be eliminated without deterioration of product quality,performance,or perceived value.

A)I only

B)II only.

C)III only.

D)I and II.

E)I,II,and III.

I)Non-value-added activities are often unnecessary and dispensable.

II)Non-value-added activities may be necessary but are being performed in an inefficient and improvable manner.

III)Non-value-added activities can be eliminated without deterioration of product quality,performance,or perceived value.

A)I only

B)II only.

C)III only.

D)I and II.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following can have a negative impact on a sale's profitability?

A)Number of required sales contacts (phone calls,visits,etc. ).

B)Special shipping instructions.

C)Accounts receivable collection time.

D)Purchase-order changes.

E)All of thesE.

A)Number of required sales contacts (phone calls,visits,etc. ).

B)Special shipping instructions.

C)Accounts receivable collection time.

D)Purchase-order changes.

E)All of thesE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

62

Factory Oak produces various wooden bookcases,tables,storage units,and chairs.Which of the following would be included in a listing of the company's non-value-added activities?

A)Assembly of tables.

B)Staining of storage units.

C)Transfer of chairs from the assembly line to the staining facility.

D)Storage of completed bookcases in inventory.

E)Both "C" and "D."

A)Assembly of tables.

B)Staining of storage units.

C)Transfer of chairs from the assembly line to the staining facility.

D)Storage of completed bookcases in inventory.

E)Both "C" and "D."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

63

Customer profitability analysis is tied closely to:

A)just-in-time systems.

B)activity-based costing.

C)job costing.

D)process costing.

E)operation costing.

A)just-in-time systems.

B)activity-based costing.

C)job costing.

D)process costing.

E)operation costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

64

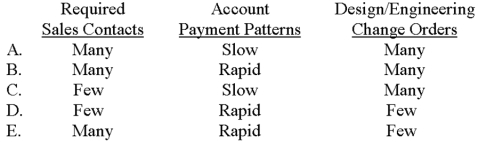

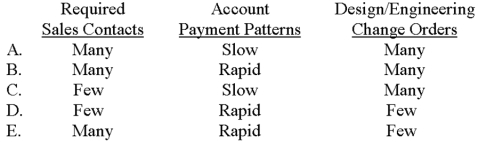

Hilton Corporation's customers differ greatly with respect to number of required sales contacts (e.g. ,phone calls and sales visits),account payment patterns,and design/engineering change orders.Which of the following choices likely denotes an ideal customer from Hilton's perspective?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following statements regarding quality is (are)true for a company that has implemented a JIT system?

I)JIT requires quality production facilities,methods,and employees.

II)JIT requires the acquisition of quality raw materials.

III)JIT requires that long-term contracts be negotiated with quality suppliers.

A)II only.

B)I and II.

C)I and III.

D)II and III.

E)I,II,and III.

I)JIT requires quality production facilities,methods,and employees.

II)JIT requires the acquisition of quality raw materials.

III)JIT requires that long-term contracts be negotiated with quality suppliers.

A)II only.

B)I and II.

C)I and III.

D)II and III.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

66

A hospital administrator is in the process of implementing an activity-based-costing system.Which of the following tasks would not be part of this process?

A)Identification of cost pools.

B)Calculation of pool rates.

C)Assignment of cost to services provided.

D)Identification of cost drivers.

E)None of these,as all these tasks would be part of the process.

A)Identification of cost pools.

B)Calculation of pool rates.

C)Assignment of cost to services provided.

D)Identification of cost drivers.

E)None of these,as all these tasks would be part of the process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

67

A company that adopts a just-in-time production system would attempt to reduce and/or eliminate:

A)raw-material inventory.

B)raw-material inventory and work-in-process inventory.

C)raw-material inventory,work-in-process inventory,and finished-goods inventory.

D)work-in-process inventory.

E)finished-goods inventory.

A)raw-material inventory.

B)raw-material inventory and work-in-process inventory.

C)raw-material inventory,work-in-process inventory,and finished-goods inventory.

D)work-in-process inventory.

E)finished-goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

68

The adoption of a 24-7 employee hotline for workplace complaints is an example of a:

A)business-value-added activity.

B)customer-value-added activity.

C)nonvalue-added activity.

D)batch-related activity.

E)product-sustaining activity.

A)business-value-added activity.

B)customer-value-added activity.

C)nonvalue-added activity.

D)batch-related activity.

E)product-sustaining activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

69

When determining customer profitability,activity-based costing can be used to analyze:

A)orders processed.

B)sales visits.

C)special packaging and handling.

D)billing and collections.

E)All of thesE.

A)orders processed.

B)sales visits.

C)special packaging and handling.

D)billing and collections.

E)All of thesE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

70

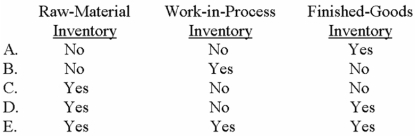

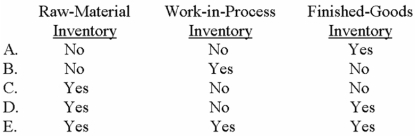

Which of the following inventories would a company try to reduce and/or eliminate under a just-in-time system?

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

A)Choice A

B)Choice B

C)Choice C

D)Choice D

E)Choice E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which of the following statements regarding the pull method is (are)true?

I)Goods are produced in each manufacturing stage only as they are needed at the next stage.

II)The pull method greatly reduces work-in-process inventory.

III)The pull method reduces waiting time and the associated non-value-added cost.

A)II only.

B)I and II.

C)I and III.

D)II and III.

E)I,II,and III.

I)Goods are produced in each manufacturing stage only as they are needed at the next stage.

II)The pull method greatly reduces work-in-process inventory.

III)The pull method reduces waiting time and the associated non-value-added cost.

A)II only.

B)I and II.

C)I and III.

D)II and III.

E)I,II,and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

72

A Kanban:

A)is used in conjunction with activity-based costing.

B)facilitates quick and inexpensive setups of machines.

C)helps train workers to do a variety of assignments.

D)initiates production in a particular work center.

E)measures the correlation between a cost driver and a cost pool.

A)is used in conjunction with activity-based costing.

B)facilitates quick and inexpensive setups of machines.

C)helps train workers to do a variety of assignments.

D)initiates production in a particular work center.

E)measures the correlation between a cost driver and a cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

73

Airstream builds recreational motor homes.All of the following activities add value to the finished product except:

A)installation of carpet.

B)assembly of the frame to the chassis.

C)storage of the vehicle in the sales area.

D)addition of exterior lights.

E)final painting and polishing.

A)installation of carpet.

B)assembly of the frame to the chassis.

C)storage of the vehicle in the sales area.

D)addition of exterior lights.

E)final painting and polishing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

74

Generally speaking,companies prefer doing business with customers who:

A)order small quantities rather than large quantities.

B)often change their orders.

C)require special packaging or handling.

D)request normal delivery times.

E)need specialized engineering design changes.

A)order small quantities rather than large quantities.

B)often change their orders.

C)require special packaging or handling.

D)request normal delivery times.

E)need specialized engineering design changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is not a key feature of a JIT system?

A)Purchases of materials in relatively large amounts (i.e. ,lot sizes).

B)A smooth,uniform production rate.

C)Total quality control.

D)Multiskilled workers and flexible production facilities.

E)A pull approach to coordinating steps in the production process.

A)Purchases of materials in relatively large amounts (i.e. ,lot sizes).

B)A smooth,uniform production rate.

C)Total quality control.

D)Multiskilled workers and flexible production facilities.

E)A pull approach to coordinating steps in the production process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following is not an example of a business-value-added activity?

A)Adopting bar-code technology in the receiving department.

B)Installation of a computerized human resource management module.

C)Shortening the customers' billing cycle.

D)Addition of an employee hotline for workplace complaints.

E)Final painting and polishing of the product.

A)Adopting bar-code technology in the receiving department.

B)Installation of a computerized human resource management module.

C)Shortening the customers' billing cycle.

D)Addition of an employee hotline for workplace complaints.

E)Final painting and polishing of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

77

An example of a customer-value-added activity is:

A)final painting and polishing of the product.

B)installation of a computerized human resource management module.

C)shortening the customers' billing cycle.

D)addition of an employee hotline for workplace complaints.

E)maintenance of an adequate safety stock.

A)final painting and polishing of the product.

B)installation of a computerized human resource management module.

C)shortening the customers' billing cycle.

D)addition of an employee hotline for workplace complaints.

E)maintenance of an adequate safety stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

78

Marion Corporation,which produces unique office furniture,recently installed a just-in-time production system.The various steps in the company's manufacturing process are coordinated by using a philosophy known as:

A)supply pull.

B)demand pull.

C)supply push.

D)demand push.

E)None of thesE.

A)supply pull.

B)demand pull.

C)supply push.

D)demand push.

E)None of thesE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

79

Of the following organizations,activity-based costing (ABC)cannot be used by:

A)manufacturers.

B)financial-services firms.

C)book publishers.

D)hotels.

E)None of these are correct,as all these organizations can use ABC.

A)manufacturers.

B)financial-services firms.

C)book publishers.

D)hotels.

E)None of these are correct,as all these organizations can use ABC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

80

The adoption of a 24-7 customer service help line is an example of a:

A)business-value-added activity.

B)customer-value-added activity.

C)nonvalue-added activity.

D)batch-related activity.

E)product-sustaining activity.

A)business-value-added activity.

B)customer-value-added activity.

C)nonvalue-added activity.

D)batch-related activity.

E)product-sustaining activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck