Deck 6: Payroll Register, employees Earning Records, and Accounting System Entries

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/70

العب

ملء الشاشة (f)

Deck 6: Payroll Register, employees Earning Records, and Accounting System Entries

1

Which of the following best describes the purpose of the payroll register?

A) It is a list of all persons and companies that the company pays money during a period.

B) It is a report that becomes published with other financial reports.

C) It is a worksheet that accountants use to ensure payroll accuracy.

D) It is an individual register maintained for each employee,listing of all the payroll information.

A) It is a list of all persons and companies that the company pays money during a period.

B) It is a report that becomes published with other financial reports.

C) It is a worksheet that accountants use to ensure payroll accuracy.

D) It is an individual register maintained for each employee,listing of all the payroll information.

C

2

How does a payroll accountant keep track of employee's year-to-date earnings for wage bases on taxes like FICA,FUTA,and SUTA?

A) Form W-4

B) Form W-2

C) Payroll register

D) Employee earnings record

A) Form W-4

B) Form W-2

C) Payroll register

D) Employee earnings record

D

3

A debit always decreases the balance of an account.

False

4

Employee earnings records form the link between accounting and the human resources department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

5

Columns included in the payroll register to compute net pay may include which of the following (select all that apply)?

A) Medicare tax

B) Employee address

C) Employee signature

D) Garnishments

A) Medicare tax

B) Employee address

C) Employee signature

D) Garnishments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

6

How does the payroll register connect with the employees' earnings records?

A) Both documents contain information about the employee's address and job title

B) Both documents contain details of employee earnings,deductions,and disbursement for a pay period

C) Both documents contain year-to-date totals of taxes

D) Both documents contain information from multiple pay periods

A) Both documents contain information about the employee's address and job title

B) Both documents contain details of employee earnings,deductions,and disbursement for a pay period

C) Both documents contain year-to-date totals of taxes

D) Both documents contain information from multiple pay periods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is true about the fundamental accounting equation?

A) It must remain in balance at all times.

B) It is always expressed as assets = liabilities - owners' equity.

C) One side of the equation must equal zero.

D) It may be expressed as assets + liabilities = owners' equity.

A) It must remain in balance at all times.

B) It is always expressed as assets = liabilities - owners' equity.

C) One side of the equation must equal zero.

D) It may be expressed as assets + liabilities = owners' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following reports links the accounting and the human resources departments?

A) Form 941

B) Payroll register

C) Employee earnings record

D) Labor reports

A) Form 941

B) Payroll register

C) Employee earnings record

D) Labor reports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

9

Two complete payroll-related General Journal entries are recorded each pay period: one for the employees' payroll,one for the employer's share of the taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

10

The information in the payroll register forms the basis for entries in the Employee Earnings Records and the General Journal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

11

The purpose of the net pay and check number columns in the payroll register is to verify accurate disbursal of payroll.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

12

Payroll accruals reflect the amount of payroll paid but not earned at the end of the financial period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

13

Besides containing the supporting data for periodic tax reports,the employee earnings record serves as a backup in the event of computer failure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

14

The General Journal contains records of a firm's financial transactions,which appear chronologically.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is an example of an asset account?

A) Revenue

B) Salaries Payable

C) Cash

D) Payroll Tax Expense

A) Revenue

B) Salaries Payable

C) Cash

D) Payroll Tax Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

16

Why is it important to have columns on the payroll register title "Earnings subject to Federal Withholding" and "Earnings subject to FICA"?

A) It adds complexity to the payroll register.

B) Both columns contain information about the employer's tax matching responsibilities.

C) It facilitates accuracy in employee payroll tax computations.

D) It allows payroll employees to divert funds into faux accounts.

A) It adds complexity to the payroll register.

B) Both columns contain information about the employer's tax matching responsibilities.

C) It facilitates accuracy in employee payroll tax computations.

D) It allows payroll employees to divert funds into faux accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which columns might an employer include to facilitate employer-share payroll tax General Journal entries (select all that apply)?

A) Worker's Compensation

B) FUTA

C) SUTA

D) Employer's Federal Income tax

A) Worker's Compensation

B) FUTA

C) SUTA

D) Employer's Federal Income tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

18

The payroll register is identical for each company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the General Ledger,the debit column reflects the balance of the account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

20

To which items is information from the payroll register transferred (select all that apply)?

A) Employee earnings record

B) General Journal

C) Labor reports

D) Company website

A) Employee earnings record

B) General Journal

C) Labor reports

D) Company website

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

21

What are the General Journal entries that should appear on each pay date?

A) Employee pay accrual and employee pay disbursement

B) Employee pay remittance and voluntary deduction remittance

C) Employee pay recording and employer share payroll taxes recording

D) Employee pay disbursement and voluntary deduction remittance

A) Employee pay accrual and employee pay disbursement

B) Employee pay remittance and voluntary deduction remittance

C) Employee pay recording and employer share payroll taxes recording

D) Employee pay disbursement and voluntary deduction remittance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

22

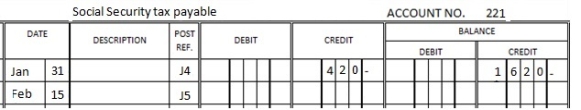

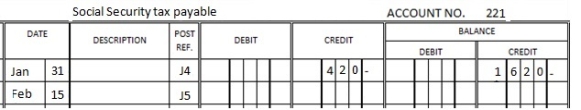

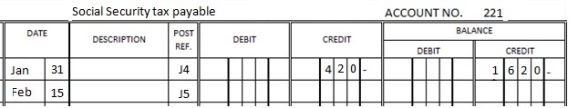

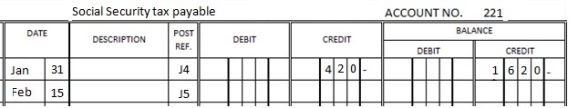

Rushing River Boats has the following data in its Social Security tax payable General Ledger account:

It is a monthly schedule depositor.What entry should appear in the General Ledger to reflect the tax remittance on February 15?

A) Credit $420

B) Debit $420

C) Credit $1,620

D) Debit $1,620

It is a monthly schedule depositor.What entry should appear in the General Ledger to reflect the tax remittance on February 15?

A) Credit $420

B) Debit $420

C) Credit $1,620

D) Debit $1,620

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

23

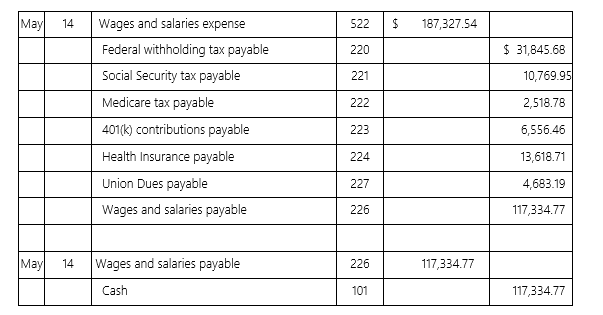

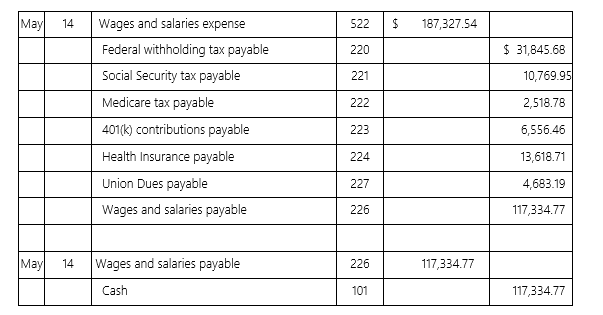

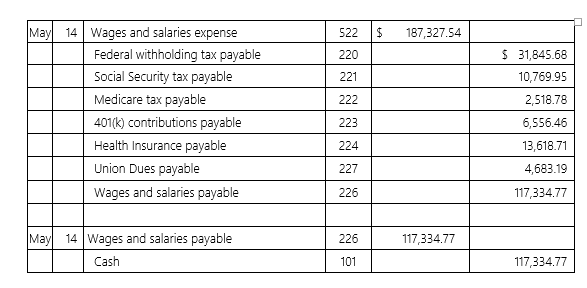

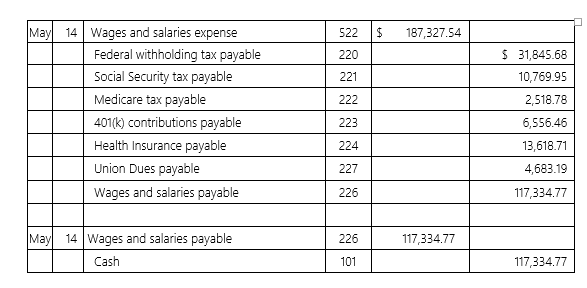

Supermeg Dry Cleaners had the following payroll data for its May 14 pay date:

When the firm remits its health insurance premium for this pay date,what is the General Journal entry?

When the firm remits its health insurance premium for this pay date,what is the General Journal entry?

A) Debit Cash $13,618.71;Credit Health Insurance Payable $13,618.71

B) Debit Cash $27,237.42;Credit Health Insurance Payable $27,237.42

C) Debit Health Insurance Payable $13,618.71;Credit Cash $13,618.71

D) Debit Health Insurance Payable $27,237.42;Credit Cash $27,237.42

When the firm remits its health insurance premium for this pay date,what is the General Journal entry?

When the firm remits its health insurance premium for this pay date,what is the General Journal entry?A) Debit Cash $13,618.71;Credit Health Insurance Payable $13,618.71

B) Debit Cash $27,237.42;Credit Health Insurance Payable $27,237.42

C) Debit Health Insurance Payable $13,618.71;Credit Cash $13,618.71

D) Debit Health Insurance Payable $27,237.42;Credit Cash $27,237.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

24

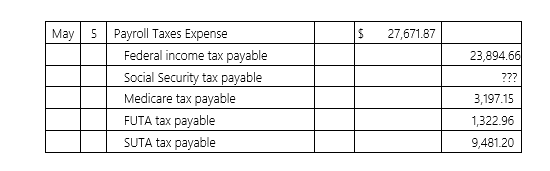

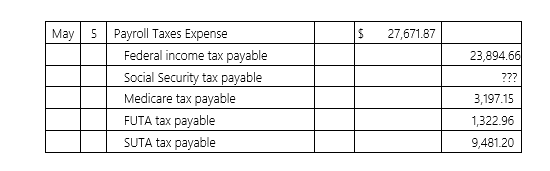

Didier and Sons had the following employer's share payroll tax general journal entry for the May 5 pay date:

What is the amount of the Social Security tax payable?

What is the amount of the Social Security tax payable?

A) $2,572.59

B) $1,875.98

C) $1,582.39

D) $1,715.66

What is the amount of the Social Security tax payable?

What is the amount of the Social Security tax payable?A) $2,572.59

B) $1,875.98

C) $1,582.39

D) $1,715.66

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

25

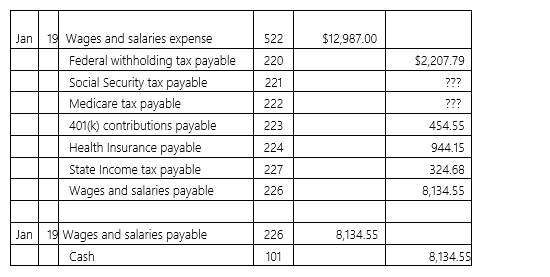

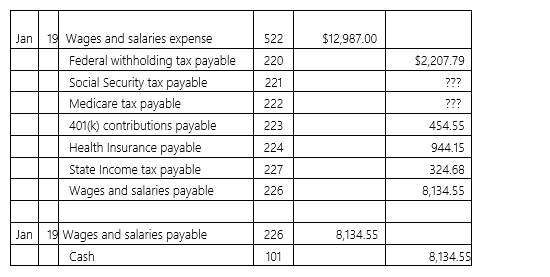

The following data is for the January 19 pay date for Waryzbok Inc.:

Which of the following represents the missing Social Security and Medicare taxes?

Which of the following represents the missing Social Security and Medicare taxes?

A) Social Security tax,$746.66;Medicare tax,$174.62

B) Social Security tax,$188.31;Medicare tax,$805.19

C) Social Security tax,$204.15: Medicare tax,$792.35

D) Social Security tax,$792.35;Medicare tax,$204.15

Which of the following represents the missing Social Security and Medicare taxes?

Which of the following represents the missing Social Security and Medicare taxes?A) Social Security tax,$746.66;Medicare tax,$174.62

B) Social Security tax,$188.31;Medicare tax,$805.19

C) Social Security tax,$204.15: Medicare tax,$792.35

D) Social Security tax,$792.35;Medicare tax,$204.15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of these accounts is increased by a debit (select all that apply?

A) Expenses

B) Revenue

C) Assets

D) Owners' Capital

A) Expenses

B) Revenue

C) Assets

D) Owners' Capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

27

In which order are transactions listed in the General Journal?

A) Alphabetically

B) Order of importance

C) Numerically

D) Chronologically

A) Alphabetically

B) Order of importance

C) Numerically

D) Chronologically

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is an example of a liability account?

A) Cash

B) Owners' Capital

C) Salaries Payable

D) Wages Expense

A) Cash

B) Owners' Capital

C) Salaries Payable

D) Wages Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

29

What is the term for transferring data from the General Journal to the General Ledger?

A) Cross-referencing

B) Ledgering

C) Posting

D) Transcribing

A) Cross-referencing

B) Ledgering

C) Posting

D) Transcribing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

30

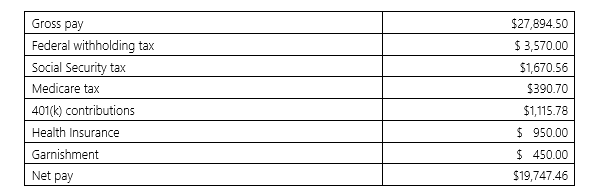

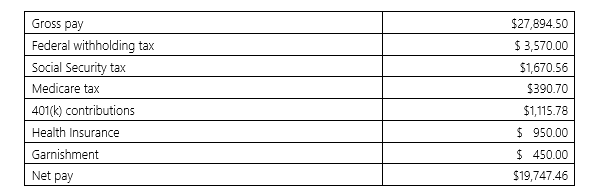

Zipperle Company has the following payroll information for the pay period ending September 18,20XX:

Which items would be debited in the General Journal entry to record the employees' share of the payroll?

Which items would be debited in the General Journal entry to record the employees' share of the payroll?

A) 401(k)contributions

B) Garnishment

C) Gross pay

D) Net pay

Which items would be debited in the General Journal entry to record the employees' share of the payroll?

Which items would be debited in the General Journal entry to record the employees' share of the payroll?A) 401(k)contributions

B) Garnishment

C) Gross pay

D) Net pay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is an example of a liability account?

A) Cash

B) Payroll Taxes Expense

C) Salaries and Wages Expense

D) FUTA Payable

A) Cash

B) Payroll Taxes Expense

C) Salaries and Wages Expense

D) FUTA Payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

32

Supermeg Dry Cleaners had the following payroll data for its May 14 pay date:

When the firm remits the union dues for this pay period,what is the correct General Journal entry?

When the firm remits the union dues for this pay period,what is the correct General Journal entry?

A) Debit Cash $6,556.46;Credit Union Dues Payable $4,683.19

B) Debit Union Dues Payable $4,683.19;Credit Cash $4,683.19

C) Debit Cash $4,683.19;Credit Union Dues Payable $4,683.19

D) Debit Union Dues Payable $4,683.19;Credit Cash $6,556.46

When the firm remits the union dues for this pay period,what is the correct General Journal entry?

When the firm remits the union dues for this pay period,what is the correct General Journal entry?A) Debit Cash $6,556.46;Credit Union Dues Payable $4,683.19

B) Debit Union Dues Payable $4,683.19;Credit Cash $4,683.19

C) Debit Cash $4,683.19;Credit Union Dues Payable $4,683.19

D) Debit Union Dues Payable $4,683.19;Credit Cash $6,556.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a firm accrues the payroll due but not paid at the end of a financial period,what should it do on the first day of the next financial period?

A) It should create a reversing entry in the General Journal.

B) It should disburse the accrued pay to the employees.

C) It should create a reminder about the accrual to ensure accuracy of computations on the next pay date.

D) It should make a note to create the reversing entry at the end of the next financial period.

A) It should create a reversing entry in the General Journal.

B) It should disburse the accrued pay to the employees.

C) It should create a reminder about the accrual to ensure accuracy of computations on the next pay date.

D) It should make a note to create the reversing entry at the end of the next financial period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

34

When a firm has wages earned but not yet paid at the end of a financial reporting period,what must it do to recognize the liabilities and expenses?

A) It must credit the asset accounts for the appropriate payroll amounts.

B) It must pay its employees for the wages earned as of that date.

C) It must wait until the next financial period to record the payroll data.

D) It must create an adjusting entry to recognize the payroll accrual.

A) It must credit the asset accounts for the appropriate payroll amounts.

B) It must pay its employees for the wages earned as of that date.

C) It must wait until the next financial period to record the payroll data.

D) It must create an adjusting entry to recognize the payroll accrual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

35

On December 1,20XX,Riley Sanders invested $250,000 to open Sanders Enterprises.What is the General Journal entry to record this transaction?

A) Debit R.Sanders Capital,$250,000;Credit Cash,$250,000

B) Debit Revenue,$250,000;Credit Cash,$250,000

C) Debit Cash,$250,000;Credit Revenue,$250,000

D) Debit Cash,$250,000;Credit R.Sanders Capital,$250,000

A) Debit R.Sanders Capital,$250,000;Credit Cash,$250,000

B) Debit Revenue,$250,000;Credit Cash,$250,000

C) Debit Cash,$250,000;Credit Revenue,$250,000

D) Debit Cash,$250,000;Credit R.Sanders Capital,$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

36

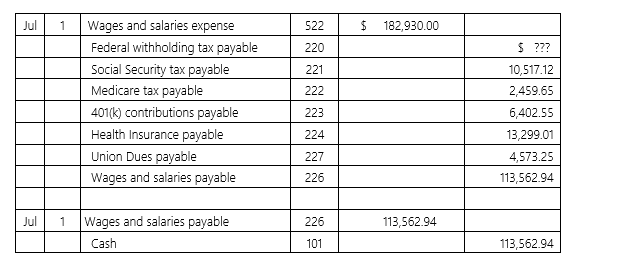

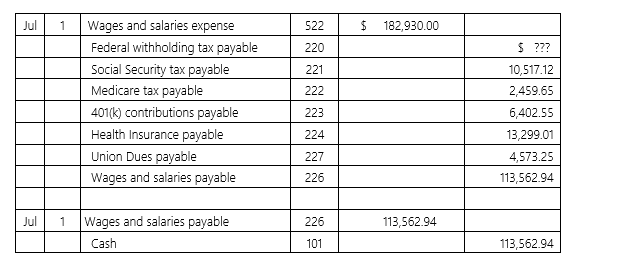

Dooley Publishing has the following payroll data for its July 1 pay date:

How much Federal withholding tax was deducted from employees' pay?

How much Federal withholding tax was deducted from employees' pay?

A) $15,203.14

B) $42,083.87

C) $32,115.48

D) $29,391.98

How much Federal withholding tax was deducted from employees' pay?

How much Federal withholding tax was deducted from employees' pay?A) $15,203.14

B) $42,083.87

C) $32,115.48

D) $29,391.98

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

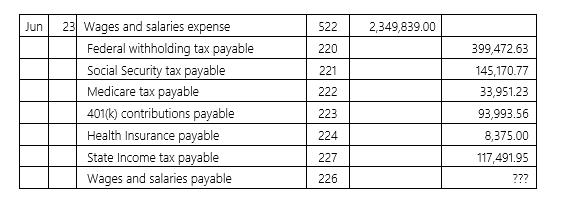

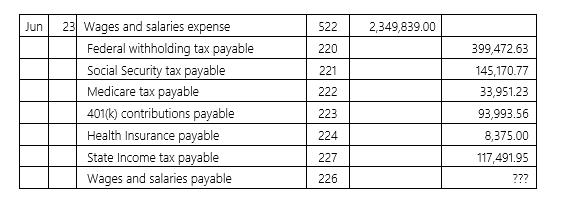

37

In the following payroll transaction,what is the amount of the net pay?

A) $399,472.63

B) $2,349,839.00

C) $93,993.56

D) $1,551,383.86

A) $399,472.63

B) $2,349,839.00

C) $93,993.56

D) $1,551,383.86

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

38

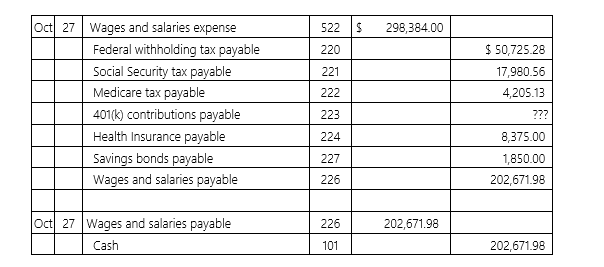

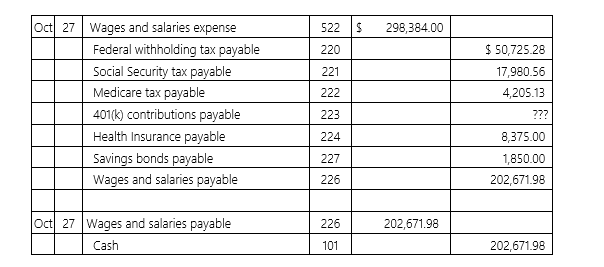

McHale Enterprises has the following incomplete General Journal entry for the most recent pay date:

What is the amount of the 401(k)contributions for the pay date?

What is the amount of the 401(k)contributions for the pay date?

A) $2,253.00

B) $15,298.22

C) $12,576.05

D) $9,215.38

What is the amount of the 401(k)contributions for the pay date?

What is the amount of the 401(k)contributions for the pay date?A) $2,253.00

B) $15,298.22

C) $12,576.05

D) $9,215.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of these accounts is increased by a credit (select all that apply)?

A) Owners' capital

B) Revenue

C) Assets

D) Expenses

A) Owners' capital

B) Revenue

C) Assets

D) Expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

40

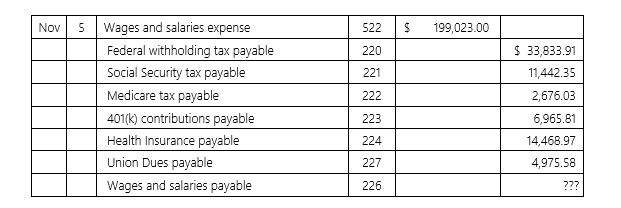

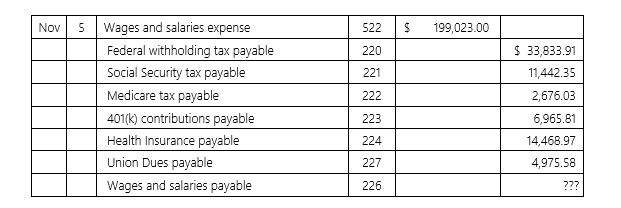

Kierofree Air Tours has the following payroll data for its November 5 pay date:

How much is the net pay?

How much is the net pay?

A) $199,023.00

B) $185,216.26

C) $142,578.94

D) $124,660.35

How much is the net pay?

How much is the net pay?A) $199,023.00

B) $185,216.26

C) $142,578.94

D) $124,660.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the primary purpose of a labor report?

A) It depicts the ideal distribution of labor in a firm.

B) It designates where labor is used in a firm.

C) It communicates departmental profitability.

D) It is a report designed to be read by parties external to the firm.

A) It depicts the ideal distribution of labor in a firm.

B) It designates where labor is used in a firm.

C) It communicates departmental profitability.

D) It is a report designed to be read by parties external to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

42

On which financial report will employer-paid portions of health insurance premiums be listed?

A) The statement of owners' equity

B) The income statement

C) The balance sheet

D) The labor report

A) The statement of owners' equity

B) The income statement

C) The balance sheet

D) The labor report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

43

As of the June 11 pay date,the General Ledger account for Burling Mills has a balance of $14,289 in its Federal withholding tax payable account.A credit of $16,250 is recorded on the June 25 pay date.What is the balance in the account?

A) Debit $1,961

B) Debit $30,539

C) Credit $1,961

D) Credit $30,539

A) Debit $1,961

B) Debit $30,539

C) Credit $1,961

D) Credit $30,539

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which report contains employer share tax expenses for a period?

A) The income statement

B) The statement of owners' equity

C) The balance sheet

D) The labor report

A) The income statement

B) The statement of owners' equity

C) The balance sheet

D) The labor report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

45

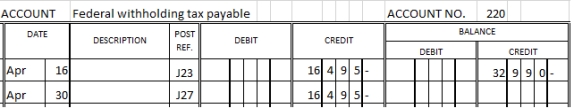

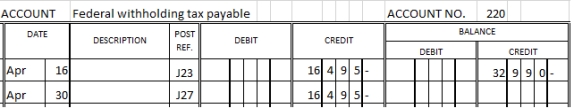

Enchanted Creations has the following data in its Federal withholding tax payable General Ledger account:

What is the balance of the account as of April 30?

A) Credit $16,495

B) Debit $16,495

C) Debit $49,485

D) Credit $49,485

What is the balance of the account as of April 30?

A) Credit $16,495

B) Debit $16,495

C) Debit $49,485

D) Credit $49,485

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

46

On October 15,Eco Brewers had a balance of $4,390 in its Social Security tax payable account.It posted an additional $4,390 on its October 31 pay date.Since Eco Brewers is a monthly schedule depositor,what entry should appear on November 15 for the remittance of the month's Social Security taxes?

A) Credit $8,780

B) Debit $8,780

C) Credit $4,390

D) Debit $4,390

A) Credit $8,780

B) Debit $8,780

C) Credit $4,390

D) Debit $4,390

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

47

How do accrued,but not paid,wages appear on the balance sheet?

A) As expenses

B) As assets

C) As equity

D) As liabilities

A) As expenses

B) As assets

C) As equity

D) As liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is a financial report that is reflects the effects of debit and credit General Journal entries used in payroll accounting? (Select all that apply)

A) Income Statement

B) Trial Balance

C) Balance Sheet

D) Labor Distribution Report

A) Income Statement

B) Trial Balance

C) Balance Sheet

D) Labor Distribution Report

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

49

What effect do payroll entries have on a firm's accounting system?

A) They increase the firm's assets.

B) They reduce the firm's liabilities.

C) They increase the owners' equity.

D) They increase the firm's expenses.

A) They increase the firm's assets.

B) They reduce the firm's liabilities.

C) They increase the owners' equity.

D) They increase the firm's expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

50

Frellies Gym has a credit balance of $31,485.27 in its Wages and Salaries Payable General Ledger account as of August 16.If the pay date is August 16,what transaction should appear in the Wages and Salaries Payable General Ledger account on that date?

A) Debit $31,485.27

B) Credit $31,485.27

C) Debit $62,970.54

D) Credit $62,970.54

A) Debit $31,485.27

B) Credit $31,485.27

C) Debit $62,970.54

D) Credit $62,970.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

51

What is a use of a firm's labor trend reports (select all that apply)?

A) It allows managers to determine the effect of employee labor on departmental profits.

B) It allows managers to predict future labor costs.

C) It is a report designed for external stakeholders.

D) It highlights issues and results of seasonal labor.

A) It allows managers to determine the effect of employee labor on departmental profits.

B) It allows managers to predict future labor costs.

C) It is a report designed for external stakeholders.

D) It highlights issues and results of seasonal labor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

52

What does the term "billable time" mean as it pertains to payroll accounting?

A) It is employee labor that may be billed to customers.

B) It is employee labor that does not pertain to labor on customer jobs.

C) It is non-employee labor that the company must pay.

D) It is non-traceable labor that a company must absorb as overhead.

A) It is employee labor that may be billed to customers.

B) It is employee labor that does not pertain to labor on customer jobs.

C) It is non-employee labor that the company must pay.

D) It is non-traceable labor that a company must absorb as overhead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

53

Why do decreases in company profitability decrease in direct proportion to the payroll expenses?

A) Because payroll represents a liability and an expense of the business.The higher payroll expenses are,the lower the profitability will be.

B) Because payroll represents an asset and an income of the business.The higher payroll income are,the higher the profitability will be.

C) Because payroll represents a liability and an expense of the business.The lower payroll expenses are,the lower the profitability will be.

D) Because payroll represents an asset and an income of the business.The lower the payroll expenses are,the higher the profitability will be.

A) Because payroll represents a liability and an expense of the business.The higher payroll expenses are,the lower the profitability will be.

B) Because payroll represents an asset and an income of the business.The higher payroll income are,the higher the profitability will be.

C) Because payroll represents a liability and an expense of the business.The lower payroll expenses are,the lower the profitability will be.

D) Because payroll represents an asset and an income of the business.The lower the payroll expenses are,the higher the profitability will be.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following payroll items is not reflected on the income statement?

A) Federal withholding tax payable

B) Health insurance expense

C) Salaries and wages expense

D) Payroll taxes expense

A) Federal withholding tax payable

B) Health insurance expense

C) Salaries and wages expense

D) Payroll taxes expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

55

How does a debit balance in the wages and salaries expense account affect a firm's income statement?

A) A debit balance will increase the expenses of the firm's income statement.This will increase the total expenses of the firm and decrease the net income of the firm.

B) A debit balance will decrease the expenses of the firm's income statement.This will increase the total incomes of the firm and decrease the net income of the firm.

C) A debit balance will increase the expenses of the firm's income statement.This will decrease the total expenses of the firm and increase the net income of the firm.

D) A debit balance will increase the income of the firm's income statement.This will increase the total expenses of the firm and increase the net income of the firm.

A) A debit balance will increase the expenses of the firm's income statement.This will increase the total expenses of the firm and decrease the net income of the firm.

B) A debit balance will decrease the expenses of the firm's income statement.This will increase the total incomes of the firm and decrease the net income of the firm.

C) A debit balance will increase the expenses of the firm's income statement.This will decrease the total expenses of the firm and increase the net income of the firm.

D) A debit balance will increase the income of the firm's income statement.This will increase the total expenses of the firm and increase the net income of the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

56

In what order are accounts presented on the trial balance?

A) By dollar amount

B) Alphabetically

C) The same as the chart of accounts

D) By order of importance

A) By dollar amount

B) Alphabetically

C) The same as the chart of accounts

D) By order of importance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

57

Rushing River Boats has the following data in its Social Security tax payable General Ledger account:

For the entry on January 31,what does the J4 signify?

A) It is the fourth entry in the General Journal on that date.

B) The transaction appears on page four of the General Journal.

C) It is the fourth repetition of the same entry.

D) The account appears fourth in the list of liability accounts.

For the entry on January 31,what does the J4 signify?

A) It is the fourth entry in the General Journal on that date.

B) The transaction appears on page four of the General Journal.

C) It is the fourth repetition of the same entry.

D) The account appears fourth in the list of liability accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

58

In general,how are the expenses associated with the payroll accountant's labor allocated in a firm?

A) They are billed directly to a customer.

B) They are allocated to one department.

C) They are reported as part of the firm's overhead.

D) They are billed directly to each department manager.

A) They are billed directly to a customer.

B) They are allocated to one department.

C) They are reported as part of the firm's overhead.

D) They are billed directly to each department manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following payroll items is included on the Balance Sheet?

A) Health insurance expense

B) Salaries and wages expense

C) Federal withholding tax payable

D) Payroll taxes expense

A) Health insurance expense

B) Salaries and wages expense

C) Federal withholding tax payable

D) Payroll taxes expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is true about the trial balance?

A) It contains a detailed listing of every transaction during a period.

B) It may contain whatever accounts the accountant wishes to include.

C) Payroll accounts do not appear on it because of their changeable nature.

D) The total of the debits must equal the total of the credits.

A) It contains a detailed listing of every transaction during a period.

B) It may contain whatever accounts the accountant wishes to include.

C) Payroll accounts do not appear on it because of their changeable nature.

D) The total of the debits must equal the total of the credits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

61

Besides payroll information,the payroll register contains _________________________________.

A) information about the firm's liabilities

B) tax remittance information

C) proof of payroll deposits

D) the firm's payroll checking account information

A) information about the firm's liabilities

B) tax remittance information

C) proof of payroll deposits

D) the firm's payroll checking account information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

62

The purpose of the ________________________ is to record all the financial transactions of a firm.

A) General Ledger

B) T-account

C) Payroll register

D) General Journal

A) General Ledger

B) T-account

C) Payroll register

D) General Journal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

63

___________ is the transferring of information from the General Journal to the General Ledger.

A) Annotating

B) Accruing

C) Posting

D) Computing

A) Annotating

B) Accruing

C) Posting

D) Computing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

64

The _________________ reflects all unpaid payroll liabilities at any point in the financial period.

A) Income statement

B) Statement of Owners' Equity

C) Payroll register

D) Balance sheet

A) Income statement

B) Statement of Owners' Equity

C) Payroll register

D) Balance sheet

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

65

The _______ is the master document that contains an employee's marital status,deductions,and year-to-date earnings.

A) Payroll register

B) Form W-4

C) Employee earnings record

D) Personnel file

A) Payroll register

B) Form W-4

C) Employee earnings record

D) Personnel file

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

66

When journalizing the employees' pay accrual,the _______________ is/are the debit(s),and the _____________ is one of the credits.

A) Net pay;gross pay

B) Payroll tax liabilities;gross pay

C) Gross pay;net pay

D) Cash account;net pay

A) Net pay;gross pay

B) Payroll tax liabilities;gross pay

C) Gross pay;net pay

D) Cash account;net pay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

67

The payroll register contains ______________________________________.

A) the employee's name,social security number,and address

B) the name of the firm and the payroll accountant

C) the beginning and ending dates of the pay period.

D) the total gross pay,deductions,and net pay during the period

A) the employee's name,social security number,and address

B) the name of the firm and the payroll accountant

C) the beginning and ending dates of the pay period.

D) the total gross pay,deductions,and net pay during the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

68

A(n)________________ is a collection of cash and other items that are used in the operation of the business.

A) Liability

B) Asset

C) Revenue

D) Equity

A) Liability

B) Asset

C) Revenue

D) Equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

69

It is important that the payroll accountant understand the flow of the payroll transactions,especially when working with ______________.

A) The payroll register

B) The employee earnings record

C) Accounting software packages

D) Payroll tax reports

A) The payroll register

B) The employee earnings record

C) Accounting software packages

D) Payroll tax reports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

70

At the end of the financial period,the payroll accountant records the _____________ of the employee's pay that is earned but not yet paid;in the next financial period,this entry is _______________.

A) Amount;deleted

B) Accrual;reversed

C) Total;carried forward

D) Reversal;accrued

A) Amount;deleted

B) Accrual;reversed

C) Total;carried forward

D) Reversal;accrued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck