Deck 8: Risk and Return

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

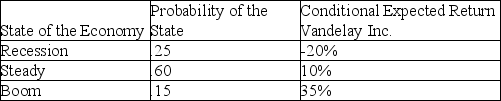

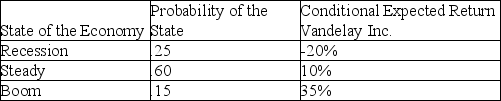

سؤال

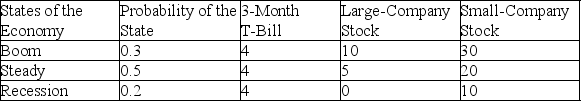

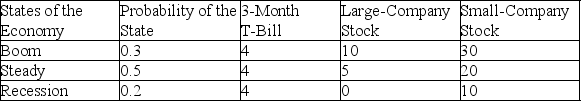

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

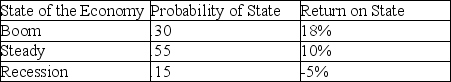

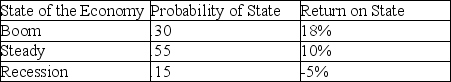

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

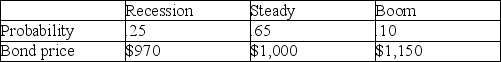

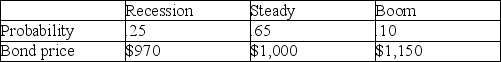

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/119

العب

ملء الشاشة (f)

Deck 8: Risk and Return

1

Jarvis bought a share of stock for $15.75 that paid a dividend of $.45 and sold three months later for $18.65. What was his dollar profit or loss and holding period return?

A) $2.90, 18.41%

B) $3.35, 21.27%

C) -$2.90, -18.41%

D) $.45, 2.86%

A) $2.90, 18.41%

B) $3.35, 21.27%

C) -$2.90, -18.41%

D) $.45, 2.86%

B

2

Your investment advisor informs you that you do not need to pay a fee for his services. Instead, he invests your money for one month and keeps all of the proceeds before investing it for you. If your advisor makes and keeps a 2% return on your investment, what is his EAR if the earnings rate could be extrapolated for one year?

A) 2.00%

B) 24.00%

C) 26.82%

D) 126.82%

A) 2.00%

B) 24.00%

C) 26.82%

D) 126.82%

C

3

Travis bought a share of stock for $31.50 that paid a dividend of $.85 and sold six months later for $27.65. What was his dollar profit or loss and holding period return?

A) -$3.00, -9.52%

B) -$3.85, -12.22%

C) -$.85, -2.70%

D) -$3.85, -9.52%

A) -$3.00, -9.52%

B) -$3.85, -12.22%

C) -$.85, -2.70%

D) -$3.85, -9.52%

A

4

The textbook provides a history of returns from 1950 through 1999 for four classifications of securities in the United States. Rank the average returns from the highest to lowest over this time period.

A) Large-company stocks, small-company stocks, 3-month U.S. Treasury bills, long-term government bonds

B) Long-term government bonds, 3-month U.S. Treasury bills, small-company stocks, large-company stocks

C) Small-company stocks, large-company stocks, long-term government bonds, 3-month U.S. Treasury bills

D) Large-company stocks, long-term government bonds, small-company stocks, 3-month U.S. Treasury bills

A) Large-company stocks, small-company stocks, 3-month U.S. Treasury bills, long-term government bonds

B) Long-term government bonds, 3-month U.S. Treasury bills, small-company stocks, large-company stocks

C) Small-company stocks, large-company stocks, long-term government bonds, 3-month U.S. Treasury bills

D) Large-company stocks, long-term government bonds, small-company stocks, 3-month U.S. Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

5

Finance functions in a two-parameter world of risk and return. Define risk and return in a financial sense and discuss how these two concepts are "joined at the hip."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

6

Simple interest is akin to the effective annual rate (EAR) and compound interest is akin to the annual percentage rate (APR).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

7

Robert invested in stock and received a positive return over a 9-month period. Which of the following types of returns will be greater?

A) Holding period return (HPR)

B) Effective annual return

C) Annual percentage rate

D) There is not enough information to make a definitive choice.

A) Holding period return (HPR)

B) Effective annual return

C) Annual percentage rate

D) There is not enough information to make a definitive choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

8

Alice purchased Hampton Industries Inc. stock for $14.65 and sold it 6 months later for $17.38 after receiving a $0.25 dividend. What was Alice's holding period return (HPR), Annual Percentage Rate (APR), and Effective Annual Rate (EAR)?

A) 20.34%, 40.68%, 9.70%

B) 18.63%, 37.27%, 40.74%

C) 17.15%, 34.29%, 37.23%

D) 20.34%, 40.68%, 44.82%

A) 20.34%, 40.68%, 9.70%

B) 18.63%, 37.27%, 40.74%

C) 17.15%, 34.29%, 37.23%

D) 20.34%, 40.68%, 44.82%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the statements below is TRUE?

A) Investors want to maximize return and maximize risk.

B) Investors want to maximize return and minimize risk.

C) Investors want to minimize return and maximize risk.

D) Investors want to minimize return and minimize risk.

A) Investors want to maximize return and maximize risk.

B) Investors want to maximize return and minimize risk.

C) Investors want to minimize return and maximize risk.

D) Investors want to minimize return and minimize risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

10

One definition of return is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

11

________ may be defined as a measure of uncertainty in a set of potential outcomes for an event in which there is a chance for some loss.

A) Diversification

B) Risk

C) Uncertainty

D) Collaboration

A) Diversification

B) Risk

C) Uncertainty

D) Collaboration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

12

The practice of not putting all of your eggs in one basket is an illustration of ________.

A) variance

B) diversification

C) portion control

D) expected return

A) variance

B) diversification

C) portion control

D) expected return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

13

Even if there is certainty of future payoffs, there can still be risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

14

Joe bought a share of stock for $47.50 that paid a dividend of $.72 and sold one year later for $51.38. What was Joe's dollar profit or loss and holding period return?

A) $0.72, 7.55%

B) $3.88, 8.95%

C) $4.60, 9.68%

D) $3.88, 9.68%

A) $0.72, 7.55%

B) $3.88, 8.95%

C) $4.60, 9.68%

D) $3.88, 9.68%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

15

The textbook provides a history of returns from 1950 through 1999 for four classifications of securities in the United States. Rank the average standard deviation ( measure of risk) from the highest to lowest over this time period.

A) Large-company stocks, small-company stocks, 3-month U.S. Treasury bills, long-term government bonds

B) Long-term government bonds, 3-month U.S. Treasury bills, small-company stocks, large-company stocks

C) Small-company stocks, large-company stocks, long-term government bonds, 3-month U.S. Treasury bills

D) Large-company stocks, long-term government bonds, small-company stocks, 3-month U.S. Treasury bills

A) Large-company stocks, small-company stocks, 3-month U.S. Treasury bills, long-term government bonds

B) Long-term government bonds, 3-month U.S. Treasury bills, small-company stocks, large-company stocks

C) Small-company stocks, large-company stocks, long-term government bonds, 3-month U.S. Treasury bills

D) Large-company stocks, long-term government bonds, small-company stocks, 3-month U.S. Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following investments is considered to be default risk-free?

A) Currency options

B) AAA rated corporate bonds

C) Common stock

D) Treasury bills

A) Currency options

B) AAA rated corporate bonds

C) Common stock

D) Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

17

________ is the absence of knowledge of the outcome of an event before it happens.

A) Return

B) Diversification

C) Uncertainty

D) Certainty

A) Return

B) Diversification

C) Uncertainty

D) Certainty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

18

The holding period return (HPR) is the return measured from the initial purchase to the final sale of the investment without regard to the length of time the investment is held.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

19

Amy bought a share of stock for $64.50 that paid a dividend of $.50 and sold nine months later for $64.00. What was her dollar profit or loss and holding period return?

A) $0.50, 0.78%

B) -$0.50, -0.78%

C) $0.00, 0.00%

D) There is no correct solution to this question.

A) $0.50, 0.78%

B) -$0.50, -0.78%

C) $0.00, 0.00%

D) There is no correct solution to this question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

20

Define risk. Give an example of a risk-free investment and explain why you claim it has no risk. Give an example of a risky investment and explain why you claim the investment to be risky.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following classifications of securities had NO negative one-year returns over the period 1950-1999?

A) Long-term government bonds

B) Large-company stocks

C) 3-month U.S. Treasury bills

D) Each of the classification of securities listed experienced at least one negative one-year return over the listed time period.

A) Long-term government bonds

B) Large-company stocks

C) 3-month U.S. Treasury bills

D) Each of the classification of securities listed experienced at least one negative one-year return over the listed time period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following classifications of securities had the smallest one-year return over the period 1950-1999?

A) Long-term government bonds

B) 3-month U.S. Treasury bills

C) Small-company stocks

D) Large-company stocks

A) Long-term government bonds

B) 3-month U.S. Treasury bills

C) Small-company stocks

D) Large-company stocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

23

Historically, the ________ risk an investor is willing to accept the ________ the potential return for the investment

A) more, lesser

B) less, greater

C) more, greater

D) Historically, the risk/return tradeoff has not played out in any particular manner.

A) more, lesser

B) less, greater

C) more, greater

D) Historically, the risk/return tradeoff has not played out in any particular manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following classifications of securities had the smallest range of annual returns over the period 1950-1999?

A) Large-company stocks

B) Long-term government bonds

C) Small-company stocks

D) 3-month U.S. Treasury bills

A) Large-company stocks

B) Long-term government bonds

C) Small-company stocks

D) 3-month U.S. Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following classifications of securities had the largest range of annual returns over the period 1950-1999?

A) Large-company stocks

B) Long-term government bonds

C) Small-company stocks

D) 3-month U.S. Treasury bills

A) Large-company stocks

B) Long-term government bonds

C) Small-company stocks

D) 3-month U.S. Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

26

The chart below gives information for four classes of U.S. securities over the 50-year time period from 1950 - 1999. Order the securities from highest average annual return to lowest for this time period. Now rank the securities from highest to lowest based on risk. Is the information consistent with what financial theory tells us? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

27

Over the 50-year period from 1950 to 1999, 3-month Treasury bills earned a positive average annual rate of return in each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

28

Over the 50-year period from 1950 to 1999, 3-month Treasury bills earned a higher average annual rate of return than long-term government bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

29

If you were required to estimate the average return for one category of securities for the coming year, history tells us that you should have the greatest degree of confidence estimating which of the following?

A) Long-term government bonds

B) 3-month U.S. Treasury bills

C) Small-company stocks

D) Large-company stocks

A) Long-term government bonds

B) 3-month U.S. Treasury bills

C) Small-company stocks

D) Large-company stocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

30

Stocks A, B, C, and D have standard deviations, respectively, of 20%, 5%, 10%, and 15%. Which one is the riskiest?

A) Stock A

B) Stock B

C) Stock C

D) Stock D

A) Stock A

B) Stock B

C) Stock C

D) Stock D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following classifications of securities had the largest one-year return over the period 1950-1999?

A) Small-company stocks

B) Long-term government bonds

C) 3-month U.S. Treasury bills

D) Large-company stocks

A) Small-company stocks

B) Long-term government bonds

C) 3-month U.S. Treasury bills

D) Large-company stocks

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

32

Stocks A, B, C, and D have returns of 10%, 20%, 30%, and 40%, respectively. What is their variance?

A) 66.67%

B) 166.67%

C) 4.08%

D) 2.15%

A) 66.67%

B) 166.67%

C) 4.08%

D) 2.15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

33

The larger the variance, the smaller the dispersion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

34

Stocks A, B, C, and D have returns of 5%, 15%, 30%, and 110%, respectively. What is their standard deviation?

A) 64.25%

B) 56.75%

C) 47.78%

D) 32.05%

A) 64.25%

B) 56.75%

C) 47.78%

D) 32.05%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following ranges of annual returns best describes the variability for small-company stocks in the United States for the period 1950-1999?

A) 0% to 15%

B) -10% to 40%

C) -30% to 55%

D) -40% to 100%

A) 0% to 15%

B) -10% to 40%

C) -30% to 55%

D) -40% to 100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following statements is true about variance?

A) Variance describes how spread out a set of numbers or values is around its mean or average.

B) Variance is essentially the variability from the average.

C) The larger the variance, the greater the dispersion.

D) All of the above statements are true.

A) Variance describes how spread out a set of numbers or values is around its mean or average.

B) Variance is essentially the variability from the average.

C) The larger the variance, the greater the dispersion.

D) All of the above statements are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

37

Find the variance for a security that has three one-year returns of -5%, 15%, and 20%.

A) 175.00%

B) 75.00%

C) 58.33%

D) 25.00%

A) 175.00%

B) 75.00%

C) 58.33%

D) 25.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

38

A more risky stock has a higher ________.

A) expected return

B) standard deviation

C) variance

D) B and C

A) expected return

B) standard deviation

C) variance

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

39

Find the variance for a security that has three one-year returns of 5%, 10%, and 15%.

A) 10.00%

B) 16.67%

C) 25.00%

D) 30.00%

A) 10.00%

B) 16.67%

C) 25.00%

D) 30.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

40

Over the 50-year period from 1950 to 1999, the portfolio of large U.S. stocks has had a greater variance than the portfolio of small U.S. stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

41

You are considering buying a share of stock in a firm that has the following two possible payoffs with the corresponding probability of occurring. The stock has a purchase price of $15.00. You forecast that there is a 30% chance that the stock will sell for $30.00 at the end of one year. The alternative expectation is that there is a 70% chance that the stock will sell for $10.00 at the end of one year. What is the expected percentage return on this stock, and what is the return variance?

A) 6.67%, 9.17%

B) 1.00%, 93.50%

C) 6.67%, 37.33%

D) 84.00%, $9.67

A) 6.67%, 9.17%

B) 1.00%, 93.50%

C) 6.67%, 37.33%

D) 84.00%, $9.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

42

Explain how the statistical concepts of mean and standard deviation apply to the financial ideas of risk and return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements about probabilities is INCORRECT?

A) The sum of all probabilities of a particular event must sum to 100%.

B) Each possible outcome must have a non-negative probability.

C) Probability is a statistical tool for estimating future outcomes.

D) Probability is associated with an ex-post view.

A) The sum of all probabilities of a particular event must sum to 100%.

B) Each possible outcome must have a non-negative probability.

C) Probability is a statistical tool for estimating future outcomes.

D) Probability is associated with an ex-post view.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

44

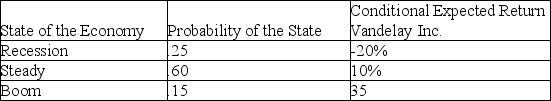

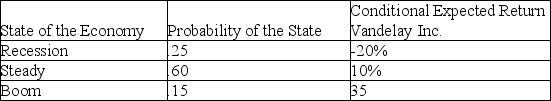

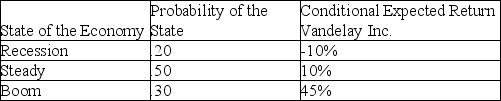

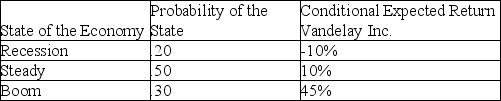

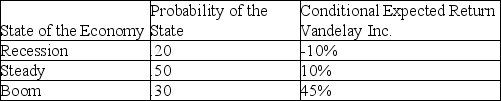

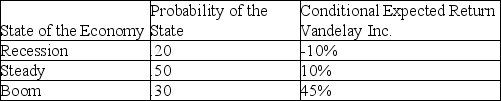

George is considering an investment in Vandelay Inc. and has gathered the information in the following table. What is the expected standard deviation for a share of the firm's stock?

A) 17.46%

B) 22.48

C) 27.54%

D) 31.62%

A) 17.46%

B) 22.48

C) 27.54%

D) 31.62%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

45

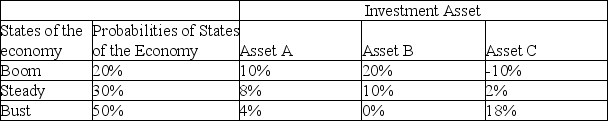

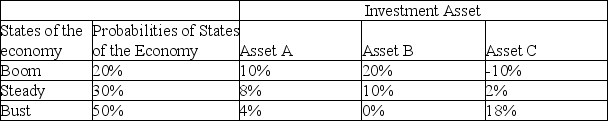

Use the information in the table to calculate the expected return and standard deviation of an equally-weighted portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

46

You are considering buying a share of stock in a firm that has the following two possible payoffs with the corresponding probability of occurring. The stock has a purchase price of $50.00. You forecast that there is a 40% chance that the stock will sell for $70.00 at the end of one year. The alternative expectation is that there is a 60% chance that the stock will sell for $30.00 at the end of one year. What is the expected percentage return on this stock, and what is the return variance?

A) -8.00%, 15.36%

B) 4.00%, 30.72%

C) 8.00%, 15.36%

D) -4.00%, -30.72%

A) -8.00%, 15.36%

B) 4.00%, 30.72%

C) 8.00%, 15.36%

D) -4.00%, -30.72%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

47

Andre is considering an investment in Pollard's Inc. and has gathered the following information. What is the expected return for a share of the firm's stock?

A) 45.00%

B) 65.00%

C) 16.50%

D) 15.00%

A) 45.00%

B) 65.00%

C) 16.50%

D) 15.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

48

When looking at the history of returns, we are taking an "ex-ante" review and when we are looking at the future of returns we are taking an "ex-post" view.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

49

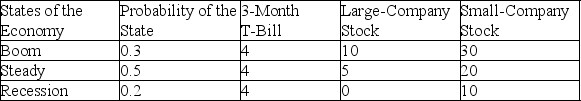

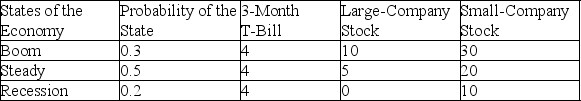

Use the following table:  What is the difference between the standard deviation of a small-company stock and a 3-month T-bill?

What is the difference between the standard deviation of a small-company stock and a 3-month T-bill?

A) 7.0%

B) 5.5%

C) 4.0%

D) 3.5%

What is the difference between the standard deviation of a small-company stock and a 3-month T-bill?

What is the difference between the standard deviation of a small-company stock and a 3-month T-bill?A) 7.0%

B) 5.5%

C) 4.0%

D) 3.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

50

Andre is considering an investment in Pollard's Inc. and has gathered the following information. What is the expected standard deviation for a share of the firm's stock?

A) 17.48%

B) 122.63%

C) 20.13%

D) 5.14%

A) 17.48%

B) 122.63%

C) 20.13%

D) 5.14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

51

Most stock analysts would agree that more variance is an indicator of less risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

52

Given the expected returns and probabilities of various states of the world in this table, what is the expected return for Carbide Company? Carbide Company

A) 10.15%

B) 5.40%

C) 5.50%

D) -0.75%

A) 10.15%

B) 5.40%

C) 5.50%

D) -0.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

53

Stock A B C D Expected Return 5% 5% 7% 6%

Standard Deviation 10% 12% 12% 11%

Which of the following statements is true?

A) A is a better investment than B.

B) B is a better investment than C.

C) C is a better investment than D.

D) D is a better investment than C.

Standard Deviation 10% 12% 12% 11%

Which of the following statements is true?

A) A is a better investment than B.

B) B is a better investment than C.

C) C is a better investment than D.

D) D is a better investment than C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the following table:  What is the difference between the variances for large- and small-company stocks?

What is the difference between the variances for large- and small-company stocks?

A) 40.25%

B) 36.75%

C) 27.30%

D) 14.90%

What is the difference between the variances for large- and small-company stocks?

What is the difference between the variances for large- and small-company stocks?A) 40.25%

B) 36.75%

C) 27.30%

D) 14.90%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

55

Evidence from the 50-year period from 1950 to 1999 indicates that returns and risk (as measured by the standard deviation of returns) are positively related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the statements below is NOT correct?

A) If two investments have the same expected return, the investment with the lower risk is preferred.

B) If two investments have the same expected return, the investment with the greater risk is preferred.

C) If two investments have the same expected risk, the investment with the higher expected return is preferred.

D) If one investment has a higher expected return and a greater level of risk than another, it is not clear which investment is the preferred choice.

A) If two investments have the same expected return, the investment with the lower risk is preferred.

B) If two investments have the same expected return, the investment with the greater risk is preferred.

C) If two investments have the same expected risk, the investment with the higher expected return is preferred.

D) If one investment has a higher expected return and a greater level of risk than another, it is not clear which investment is the preferred choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

57

Ronnie estimates that there are three possible return outcomes for a stock he is considering for purchase. He thinks that there is a 45% chance the economy will boom and his stock will return 25%, a 50% chance the economy will continue at its current pace and the stock will return 8%, and finally, that there is a 5% chance that the economy will falter and the expected return on his stock will be -10%. Given these probabilities and conditional expected returns, what is Ronnie's expected return on the stock he is considering for purchase?

A) 8.00%

B) 9.00%

C) 10.25%

D) 15.25%

A) 8.00%

B) 9.00%

C) 10.25%

D) 15.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

58

Your investment banking firm has estimated what your new issue of bonds is likely to sell for under several different economic conditions. What is the expected (average) selling price of each bond?

A) $1,000.00

B) $1,007.50

C) $1,040.00

D) $1,100.33

A) $1,000.00

B) $1,007.50

C) $1,040.00

D) $1,100.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

59

If stock A has a greater standard deviation than stock B then it must also have a greater return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

60

George is considering an investment in Vandelay Inc. and has gathered the following information. What is the expected return for a share of the firm's stock?

A) 5.00%

B) 6.25%

C) 8.33%

D) 10.00%

A) 5.00%

B) 6.25%

C) 8.33%

D) 10.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

61

________ is risk that cannot be diversified away.

A) Unsystematic risk

B) Systematic risk

C) Firm-specific risk

D) Diversifiable risk

A) Unsystematic risk

B) Systematic risk

C) Firm-specific risk

D) Diversifiable risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

62

The correlation coefficient, a measurement of the comovement between two variables, has what range?

A) From 0.0 to +10.0

B) From 0.0 to +1.0

C) From -1.0 to +10.0

D) From =1.0 to -1.0

A) From 0.0 to +10.0

B) From 0.0 to +1.0

C) From -1.0 to +10.0

D) From =1.0 to -1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

63

The primary benefit of diversification is:

A) an increase in expected return.

B) an equal reduction in risk and return.

C) a reduction in risk.

D) diversification has no real benefit; it is a shell game promoted by investment advisors who are the only real winners.

A) an increase in expected return.

B) an equal reduction in risk and return.

C) a reduction in risk.

D) diversification has no real benefit; it is a shell game promoted by investment advisors who are the only real winners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

64

For purposes of maximum portfolio diversification, which for the following would provide the greatest diversification?

A) Security A with a correlation coefficient of -0.0

B) Security B with a correlation coefficient of 0.0

C) Security C with a correlation coefficient of -0.50

D) Security D with a correlation coefficient of 0.50

A) Security A with a correlation coefficient of -0.0

B) Security B with a correlation coefficient of 0.0

C) Security C with a correlation coefficient of -0.50

D) Security D with a correlation coefficient of 0.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following statements is FALSE?

A) The maximum benefits to diversification between securities occurs when they are perfectly positively correlated.

B) The maximum benefits to diversification between securities occurs when they are perfectly negatively correlated.

C) There is some benefit to diversification when the correlation between securities is 0.0.

D) There is some benefit to diversification when the correlation between securities is greater than 0.0 but less than 1.0.

A) The maximum benefits to diversification between securities occurs when they are perfectly positively correlated.

B) The maximum benefits to diversification between securities occurs when they are perfectly negatively correlated.

C) There is some benefit to diversification when the correlation between securities is 0.0.

D) There is some benefit to diversification when the correlation between securities is greater than 0.0 but less than 1.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

66

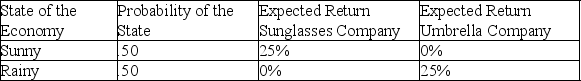

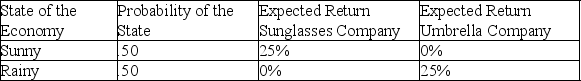

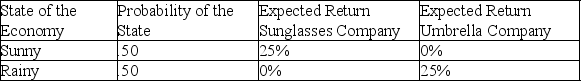

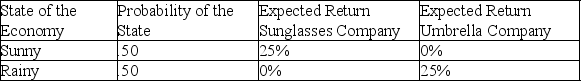

Denard has two investment opportunities. He can invest in The Sunglasses Company or The Umbrella Company. What is the expected return and standard deviation of each company?

A) The expected return for each company is 12.50% and the standard deviation for each company is 0.00%.

B) The expected return for each company is 12.50% and the standard deviation for each company is 12.50%.

C) The expected return for each company is 12.50% and the standard deviation for each company is 156.25%.

D) The expected return for each company is 12.50% and the standard deviation for each company is 25.00%.

A) The expected return for each company is 12.50% and the standard deviation for each company is 0.00%.

B) The expected return for each company is 12.50% and the standard deviation for each company is 12.50%.

C) The expected return for each company is 12.50% and the standard deviation for each company is 156.25%.

D) The expected return for each company is 12.50% and the standard deviation for each company is 25.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

67

Unsystematic risk

A) is also known as nondiversifiable risk.

B) can be diversified away.

C) is system-wide risk.

D) is equal to 2 times the systematic risk.

A) is also known as nondiversifiable risk.

B) can be diversified away.

C) is system-wide risk.

D) is equal to 2 times the systematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

68

If two investments have the same expected return, a rational investor will choose the the investment with the greater risk in an effort to get a much larger return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

69

Denard has two investment opportunities. He can invest in The Sunglasses Company or The Umbrella Company. If he diversifies his investment by putting 50% of his money into each company, what is the expected return and standard deviation of his portfolio?

A) The expected return for the portfolio is 12.50% and the standard deviation 0.00%.

B) The expected return for the portfolio is 25.00% and the standard deviation 0.00%.

C) The expected return for the portfolio is 12.50% and the standard deviation 12.50%.

D) The expected return for the portfolio is 25.00% and the standard deviation 25.00%.

A) The expected return for the portfolio is 12.50% and the standard deviation 0.00%.

B) The expected return for the portfolio is 25.00% and the standard deviation 0.00%.

C) The expected return for the portfolio is 12.50% and the standard deviation 12.50%.

D) The expected return for the portfolio is 25.00% and the standard deviation 25.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following securities could NOT have any benefits for diversification with your investment portfolio?

A) Treasury bills with a correlation coefficient of 0.0 with your portfolio

B) Alpha Company stock that has a correlation coefficient of -0.25 with your portfolio

C) Beta Company stock that has a correlation coefficient of 0.50 with your portfolio

D) All of these choices would reduce risk for your portfolio and therefore show at least some benefit to diversification.

A) Treasury bills with a correlation coefficient of 0.0 with your portfolio

B) Alpha Company stock that has a correlation coefficient of -0.25 with your portfolio

C) Beta Company stock that has a correlation coefficient of 0.50 with your portfolio

D) All of these choices would reduce risk for your portfolio and therefore show at least some benefit to diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

71

What are the two investment rules identified in the text? Evaluate the validity of the following statement and justify your reasoning. "Investors do not like risk and will always choose the investment with the least risk."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

72

You wish to diversify your single-security portfolio in a way that will maximize your reduction in risk. Which of the following securities should you add to your portfolio?

A) Treasury bills that have a correlation coefficient of 0.0 with your current security

B) Alpha Company stock that has a correlation coefficient of -0.25 with your current security

C) Beta Company stock that has a correlation coefficient of 0.50 with your current security

D) Delta Company bonds that have a correlation coefficient of 0.36 with your current security

A) Treasury bills that have a correlation coefficient of 0.0 with your current security

B) Alpha Company stock that has a correlation coefficient of -0.25 with your current security

C) Beta Company stock that has a correlation coefficient of 0.50 with your current security

D) Delta Company bonds that have a correlation coefficient of 0.36 with your current security

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

73

Diversification is

A) not putting all of your eggs in one basket.

B) spreading wealth over a variety of investment opportunities.

C) a common investment strategy.

D) All of the above

A) not putting all of your eggs in one basket.

B) spreading wealth over a variety of investment opportunities.

C) a common investment strategy.

D) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

74

The type of risk that can be diversified away is called ________.

A) unsystematic risk

B) systematic risk

C) nondiversifiable risk

D) system-wide risk

A) unsystematic risk

B) systematic risk

C) nondiversifiable risk

D) system-wide risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

75

Assuming that stocks represent most industries, the number of stocks necessary to eliminate nearly all unsystematic risk varies from ________.

A) 5 to 10

B) 10 to 20

C) 20 to 30

D) 30 to 50

A) 5 to 10

B) 10 to 20

C) 20 to 30

D) 30 to 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

76

When considering expected returns, what is true about the states of the world?

A) They must have probabilities that sum to 100%.

B) They represent all possible outcomes.

C) They are sometimes simplified into outcomes such as boom, bust, and normal.

D) Statements A through C are all true.

A) They must have probabilities that sum to 100%.

B) They represent all possible outcomes.

C) They are sometimes simplified into outcomes such as boom, bust, and normal.

D) Statements A through C are all true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

77

For most stocks, the correlation coefficient with other stocks is ________.

A) positive

B) negative

C) zero

D) The distribution of correlation coefficients between stocks is uniform from -1.0 to +1.0.

A) positive

B) negative

C) zero

D) The distribution of correlation coefficients between stocks is uniform from -1.0 to +1.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

78

An investor's total investment set may be referred to as ________.

A) the stock market

B) diversification

C) a financial portfolio

D) None of the above

A) the stock market

B) diversification

C) a financial portfolio

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

79

If two investments have the same level of risk, a rational investor will choose the investment with the higher expected rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck

80

Correlation, a standardized measure of how stocks perform relative to one another in different states of the economy, has a range from ________.

A) 0.0 to +10.0

B) 0.0 to +1.0

C) -1.0 to +1.0

D) There is no range; correlation is a calculated number that can take on any value.

A) 0.0 to +10.0

B) 0.0 to +1.0

C) -1.0 to +1.0

D) There is no range; correlation is a calculated number that can take on any value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 119 في هذه المجموعة.

فتح الحزمة

k this deck