Deck 15: Capital Structure: Limits to the Use of Debt

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 15: Capital Structure: Limits to the Use of Debt

1

Which one of the following statements is correct concerning a Chapter 7 bankruptcy?

A)A firm in Chapter 7 bankruptcy is reorganizing its operations such that is can return to being a viable concern.

B)Under a Chapter 7 bankruptcy, a trustee will assume control of the firm's assets until those assets can be liquidated.

C)Chapter 7 bankruptcies are always involuntary on the part of the firm.

D)Under a Chapter 7 bankruptcy, the claims of creditors are paid prior to the administrative costs of the bankruptcy.

E)Chapter 7 bankruptcy allows a firm to restructure its equity position such that new shares of stock are generally issued prior to the firm coming out of bankruptcy.

A)A firm in Chapter 7 bankruptcy is reorganizing its operations such that is can return to being a viable concern.

B)Under a Chapter 7 bankruptcy, a trustee will assume control of the firm's assets until those assets can be liquidated.

C)Chapter 7 bankruptcies are always involuntary on the part of the firm.

D)Under a Chapter 7 bankruptcy, the claims of creditors are paid prior to the administrative costs of the bankruptcy.

E)Chapter 7 bankruptcy allows a firm to restructure its equity position such that new shares of stock are generally issued prior to the firm coming out of bankruptcy.

Under a Chapter 7 bankruptcy, a trustee will assume control of the firm's assets until those assets can be liquidated.

2

The costs of avoiding a bankruptcy filing by a financially distressed firm are classified as _____ costs.

A)capital structure

B)direct bankruptcy

C)financial solvency

D)indirect bankruptcy

E)flotation

A)capital structure

B)direct bankruptcy

C)financial solvency

D)indirect bankruptcy

E)flotation

indirect bankruptcy

3

The optimal capital structure will tend to include more debt for firms with:

A)less taxable income.

B)lower probability of financial distress.

C)substantial tax shields from other sources.

D)the lowest marginal tax rate.

E)the highest depreciation deductions.

A)less taxable income.

B)lower probability of financial distress.

C)substantial tax shields from other sources.

D)the lowest marginal tax rate.

E)the highest depreciation deductions.

lower probability of financial distress.

4

The legal proceeding for liquidating or reorganizing a firm operating in default is called a:

A)tender offer.

B)bankruptcy.

C)merger.

D)takeover.

E)proxy fight.

A)tender offer.

B)bankruptcy.

C)merger.

D)takeover.

E)proxy fight.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

In general,the capital structures used by U.S.firms:

A)vary significantly across industries.

B)are easily explained in terms of earnings volatility.

C)are easily explained by analyzing the types of assets owned by the various firms.

D)tend to be those which maximize the use of the firm's available tax shelters.

E)tend to overweight debt in relation to equity.

A)vary significantly across industries.

B)are easily explained in terms of earnings volatility.

C)are easily explained by analyzing the types of assets owned by the various firms.

D)tend to be those which maximize the use of the firm's available tax shelters.

E)tend to overweight debt in relation to equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

A firm is technically insolvent when:

A)the value of its stock declines by more than 50%.

B)the value of the firm's assets is less than the value of the firm's liabilities.

C)it files the legal forms petitioning for bankruptcy protection.

D)it is unable to meet its financial obligations.

E)it has a negative net worth on its balance sheet.

A)the value of its stock declines by more than 50%.

B)the value of the firm's assets is less than the value of the firm's liabilities.

C)it files the legal forms petitioning for bankruptcy protection.

D)it is unable to meet its financial obligations.

E)it has a negative net worth on its balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

Indirect bankruptcy costs:

A)effectively limit the amount of equity a firm issues.

B)serve as an incentive to increase the financial leverage of a firm.

C)include the costs incurred by a firm as it tries to avoid seeking bankruptcy protection.

D)tend to increase as the debt-equity ratio decreases.

E)include direct costs such as legal and accounting fees.

A)effectively limit the amount of equity a firm issues.

B)serve as an incentive to increase the financial leverage of a firm.

C)include the costs incurred by a firm as it tries to avoid seeking bankruptcy protection.

D)tend to increase as the debt-equity ratio decreases.

E)include direct costs such as legal and accounting fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

In a world with taxes and financial distress,when a firm is operating with the optimal capital structure:

I.the debt-equity ratio will also be optimal.

II.the weighted average cost of capital will be at its minimal point.

III.the required return on assets will be at its maximum point.

IV.the increased benefit from additional debt is equal to the increased bankruptcy costs of that debt.

A)I and IV only

B)II and III only

C)I and II only

D)II, III, and IV only

E)I, II, and IV only

I.the debt-equity ratio will also be optimal.

II.the weighted average cost of capital will be at its minimal point.

III.the required return on assets will be at its maximum point.

IV.the increased benefit from additional debt is equal to the increased bankruptcy costs of that debt.

A)I and IV only

B)II and III only

C)I and II only

D)II, III, and IV only

E)I, II, and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

Corporations in the U.S.tend to:

A)have extremely high debt-equity ratios.

B)rely less on equity financing than they should.

C)underutilize debt.

D)maximize taxes.

E)rely more heavily on bonds than stocks as the major source of financing.

A)have extremely high debt-equity ratios.

B)rely less on equity financing than they should.

C)underutilize debt.

D)maximize taxes.

E)rely more heavily on bonds than stocks as the major source of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

The optimal capital structure has been achieved when the:

A)weight of equity is equal to the weight of debt.

B)debt-equity ratio is equal to 1.

C)debt-equity ratio selected results in the lowest possible weighted average cost of capital.

D)debt-equity ratio is such that the cost of debt exceeds the cost of equity.

E)cost of equity is maximized given a pre-tax cost of debt.

A)weight of equity is equal to the weight of debt.

B)debt-equity ratio is equal to 1.

C)debt-equity ratio selected results in the lowest possible weighted average cost of capital.

D)debt-equity ratio is such that the cost of debt exceeds the cost of equity.

E)cost of equity is maximized given a pre-tax cost of debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

An attempt to financially restructure a failing firm so that it can continue operating as a going concern is called a:

A)merger.

B)reorganization.

C)liquidation.

D)repurchase program.

E)divestiture.

A)merger.

B)reorganization.

C)liquidation.

D)repurchase program.

E)divestiture.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

The complete termination of a firm as a going business concern is called a:

A)liquidation.

B)repurchase program.

C)merger.

D)divestiture.

E)reorganization.

A)liquidation.

B)repurchase program.

C)merger.

D)divestiture.

E)reorganization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following statements concerning bankruptcy is correct?

A)An indirect cost of bankruptcy is the loss of key employees.

B)Bondholders have a greater incentive than stockholders to keep a firm from filing for bankruptcy.

C)Bankruptcy is sometimes used as a means to increase payroll costs.

D)The assets of a firm tend to increase in value when a firm is in financial distress.

E)The administrative costs incurred in a bankruptcy are considered indirect bankruptcy costs.

A)An indirect cost of bankruptcy is the loss of key employees.

B)Bondholders have a greater incentive than stockholders to keep a firm from filing for bankruptcy.

C)Bankruptcy is sometimes used as a means to increase payroll costs.

D)The assets of a firm tend to increase in value when a firm is in financial distress.

E)The administrative costs incurred in a bankruptcy are considered indirect bankruptcy costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

The explicit costs,such as the legal expenses,associated with corporate default are classified as _____ costs.

A)unlevered

B)direct bankruptcy

C)beta conversion

D)indirect bankruptcy

E)flotation

A)unlevered

B)direct bankruptcy

C)beta conversion

D)indirect bankruptcy

E)flotation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

The optimal capital structure:

A)of a firm will vary over time as taxes and market conditions change.

B)is unaffected by changes in the financial markets.

C)will be the same for all firms in the same industry.

D)places more emphasis on the operations of a firm rather than the financing of a firm.

E)will remain constant over time unless the firm makes an acquisition.

A)of a firm will vary over time as taxes and market conditions change.

B)is unaffected by changes in the financial markets.

C)will be the same for all firms in the same industry.

D)places more emphasis on the operations of a firm rather than the financing of a firm.

E)will remain constant over time unless the firm makes an acquisition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

The value of a firm is maximized when the:

A)weighted average cost of capital is minimized.

B)levered cost of capital is maximized.

C)tax rate is zero.

D)cost of equity is maximized.

E)debt-equity ratio is minimized.

A)weighted average cost of capital is minimized.

B)levered cost of capital is maximized.

C)tax rate is zero.

D)cost of equity is maximized.

E)debt-equity ratio is minimized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

The optimal capital structure of a firm _____ the marketed claims and _____ the nonmarketed claims against the cash flows of the firm.

A)minimizes; minimizes

B)maximizes; minimizes

C)minimizes; maximizes

D)maximizes; maximizes

E)equates; (leave blank)

A)minimizes; minimizes

B)maximizes; minimizes

C)minimizes; maximizes

D)maximizes; maximizes

E)equates; (leave blank)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

The basic lesson of MM theory is that the value of a firm is dependent upon the:

A)capital structure of the firm.

B)total cash flows of the firm.

C)percentage of a firm to which the bondholders have a claim.

D)tax claim placed on the firm by the government.

E)size of the stockholders claims on the firm.

A)capital structure of the firm.

B)total cash flows of the firm.

C)percentage of a firm to which the bondholders have a claim.

D)tax claim placed on the firm by the government.

E)size of the stockholders claims on the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

A firm that has a negative net worth is said to be:

A)experiencing a business failure.

B)in legal bankruptcy.

C)experiencing technical insolvency.

D)experiencing accounting insolvency.

E)in Chapter 11 bankruptcy reorganization.

A)experiencing a business failure.

B)in legal bankruptcy.

C)experiencing technical insolvency.

D)experiencing accounting insolvency.

E)in Chapter 11 bankruptcy reorganization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

The explicit and implicit costs associated with corporate default are referred to as the _____ costs of a firm.

A)flotation

B)default beta

C)direct bankruptcy

D)indirect bankruptcy

E)financial distress

A)flotation

B)default beta

C)direct bankruptcy

D)indirect bankruptcy

E)financial distress

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

Given realistic estimates of the probability and cost of bankruptcy,the future costs of a possible bankruptcy are borne by:

A)all investors in the firm.

B)debtholders only because if default occurs interest and principal payments are not made.

C)shareholders because debtholders will pay less for the debt providing less cash for the shareholders.

D)management because if the firm defaults they will lose their jobs.

E)None of the above.

A)all investors in the firm.

B)debtholders only because if default occurs interest and principal payments are not made.

C)shareholders because debtholders will pay less for the debt providing less cash for the shareholders.

D)management because if the firm defaults they will lose their jobs.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

What three factors are important to consider in determining a target debt to equity ratio?

A)Taxes, asset types, and pecking order and financial slack

B)Asset types, uncertainty of operating income, and pecking order and financial slack

C)Taxes, financial slack and pecking order, and uncertainty of operating income

D)Taxes, asset types, and uncertainty of operating income

E)None of the above.

A)Taxes, asset types, and pecking order and financial slack

B)Asset types, uncertainty of operating income, and pecking order and financial slack

C)Taxes, financial slack and pecking order, and uncertainty of operating income

D)Taxes, asset types, and uncertainty of operating income

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

When graphing firm value against debt levels,the debt level that maximizes the value of the firm is the level where:

A)the increase in the present value of distress costs from an additional dollar of debt is greater than the increase in the present value of the debt tax shield.

B)the increase in the present value of distress costs from an additional dollar of debt is equal to the increase in the present value of the debt tax shield.

C)the increase in the present value of distress costs from an additional dollar of debt is less than the increase of the present value of the debt tax shield.

D)distress costs as well as debt tax shields are zero.

E)distress costs as well as debt tax shields are maximized.

A)the increase in the present value of distress costs from an additional dollar of debt is greater than the increase in the present value of the debt tax shield.

B)the increase in the present value of distress costs from an additional dollar of debt is equal to the increase in the present value of the debt tax shield.

C)the increase in the present value of distress costs from an additional dollar of debt is less than the increase of the present value of the debt tax shield.

D)distress costs as well as debt tax shields are zero.

E)distress costs as well as debt tax shields are maximized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

The possibility of bankruptcy has a negative effect on the value of the firm because:

A)increased bankruptcy risk always lowers value.

B)reorganization is costless but risk is not.

C)a bankruptcy has real costs associated with it.

D)value enhancing strategies are no longer available.

E)None of the above.

A)increased bankruptcy risk always lowers value.

B)reorganization is costless but risk is not.

C)a bankruptcy has real costs associated with it.

D)value enhancing strategies are no longer available.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

Conflicts of interest between stockholders and bondholders are known as:

A)trustee costs.

B)financial distress costs.

C)dealer costs.

D)agency costs.

E)underwriting costs.

A)trustee costs.

B)financial distress costs.

C)dealer costs.

D)agency costs.

E)underwriting costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Indirect costs of bankruptcy are born principally by:

A)stockholders.

B)bondholders.

C)managers.

D)the firm's suppliers.

E)the federal government.

A)stockholders.

B)bondholders.

C)managers.

D)the firm's suppliers.

E)the federal government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

The MM theory with taxes implies that firms should issue maximum debt.In practice,this is not true because:

A)debt is more risky than equity.

B)bankruptcy is a disadvantage to debt.

C)firms will incur large agency costs of short term debt by issuing long term debt.

D)Both A and B.

E)Both B and C

A)debt is more risky than equity.

B)bankruptcy is a disadvantage to debt.

C)firms will incur large agency costs of short term debt by issuing long term debt.

D)Both A and B.

E)Both B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not empirically true when formulating capital structure policy?

A)Most corporations have low debt-asset ratios.

B)Some firms use no debt.

C)Debt levels across industries vary widely.

D)There are no differences in capital structure across different industries.

E)Debt ratios in all countries are considerably less than 100%.

A)Most corporations have low debt-asset ratios.

B)Some firms use no debt.

C)Debt levels across industries vary widely.

D)There are no differences in capital structure across different industries.

E)Debt ratios in all countries are considerably less than 100%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

A firm may file for Chapter 11 bankruptcy:

I.in an attempt to gain a competitive advantage.

II.using a prepack.

III.while allowing the current management to continue running the firm.

IV.even though it is not insolvent.

A)I and III only

B)I, II, and IV only

C)I and II only

D)III and IV only

E)I, II, III, and IV

I.in an attempt to gain a competitive advantage.

II.using a prepack.

III.while allowing the current management to continue running the firm.

IV.even though it is not insolvent.

A)I and III only

B)I, II, and IV only

C)I and II only

D)III and IV only

E)I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

Although the use of debt provides tax benefits to the firm,debt also puts pressure on the firms to:

A)meet interest and principal payments which, if not met, can put the company into financial distress.

B)make dividend payments which, if not met, can put the company into financial distress.

C)meet both interest and dividend payments which, when met, increase the firm's cash flow.

D)meet increased tax payments thereby increasing firm value.

E)None of the above.

A)meet interest and principal payments which, if not met, can put the company into financial distress.

B)make dividend payments which, if not met, can put the company into financial distress.

C)meet both interest and dividend payments which, when met, increase the firm's cash flow.

D)meet increased tax payments thereby increasing firm value.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

The value of a firm in financial distress is diminished only if the firm:

A)is declared bankrupt and proceeds to be liquidated.

B)is declared insolvent and undergoes financial reorganization.

C)hires lawyers and accountants to receive and make all payments.

D)Both A and C.

E)Both A and B.

A)is declared bankrupt and proceeds to be liquidated.

B)is declared insolvent and undergoes financial reorganization.

C)hires lawyers and accountants to receive and make all payments.

D)Both A and C.

E)Both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

One of the indirect costs of bankruptcy is the incentive toward underinvestment.Following this strategy may result in:

A)the firm always choosing projects with the positive NPVs.

B)the firm turning down positive NPV projects that it would clearly accept in an all equity firm.

C)stockholders contributing the full amount of the investment,but both stockholders and bondholders sharing in the benefits of the project.

D)Both A and C.

E)Both B and C.

A)the firm always choosing projects with the positive NPVs.

B)the firm turning down positive NPV projects that it would clearly accept in an all equity firm.

C)stockholders contributing the full amount of the investment,but both stockholders and bondholders sharing in the benefits of the project.

D)Both A and C.

E)Both B and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

When shareholders pursue selfish strategies such as taking large risks or paying excessive dividends,these will result in:

A)undertaking scale enhancing projects.

B)investments of the same risk class that the firm is in.

C)positive agency costs, as bondholders impose various restrictions and covenants, which will diminish firm value.

D)no action by debtholders since these are equity holder concerns.

E)lower agency costs, as shareholders have more control over the firm's assets.

A)undertaking scale enhancing projects.

B)investments of the same risk class that the firm is in.

C)positive agency costs, as bondholders impose various restrictions and covenants, which will diminish firm value.

D)no action by debtholders since these are equity holder concerns.

E)lower agency costs, as shareholders have more control over the firm's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under a Chapter 7 bankruptcy,which one of the following is generally considered to be the highest priority claim?

A)Consumer claim

B)Payment of employee wages

C)Payment to an unsecured creditor

D)Company contribution to the employees' retirement account

E)Dividend payment to preferred shareholder

A)Consumer claim

B)Payment of employee wages

C)Payment to an unsecured creditor

D)Company contribution to the employees' retirement account

E)Dividend payment to preferred shareholder

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is true?

A)A firm with low anticipated profit will likely take on a high level of debt.

B)Investors will generally view an increase in debt as a positive sign for the firm's value.

C)Rational investors are likely to infer a higher firm value from a zero debt level.

D)Rational firms raise debt levels when profits are expected to decline.

E)A successful firm will probably take on zero debt.

A)A firm with low anticipated profit will likely take on a high level of debt.

B)Investors will generally view an increase in debt as a positive sign for the firm's value.

C)Rational investors are likely to infer a higher firm value from a zero debt level.

D)Rational firms raise debt levels when profits are expected to decline.

E)A successful firm will probably take on zero debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

If a firm issues debt but writes protective and restrictive covenants into the loan contract,then the firm's debt may be issued at a _____ interest rate compared with otherwise similar debt.

A)significantly higher

B)slightly higher

C)equal

D)lower

E)Either A or B.

A)significantly higher

B)slightly higher

C)equal

D)lower

E)Either A or B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

An exchange offer may:

A)allow customers a 30 day money-back guarantee on the firm's product.

B)allow customers a 90 day warranty on the firm's product from defects.

C)allow bondholders to exchange some debt for stock.

D)allow stockholders to exchange some of their stock for debt.

E)Both C and D.

A)allow customers a 30 day money-back guarantee on the firm's product.

B)allow customers a 90 day warranty on the firm's product from defects.

C)allow bondholders to exchange some debt for stock.

D)allow stockholders to exchange some of their stock for debt.

E)Both C and D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

One of the indirect costs of bankruptcy is the incentive for managers to take large risks.When following this strategy:

A)the firm will rank all projects and take the project which results in the highest expected value of the firm.

B)stockholders expropriate value from bondholders by selecting high risk projects.

C)stockholders expropriate value from stockholders by selecting high risk projects.

D)the firm will always take the low risk project.

E)Both A and B.

A)the firm will rank all projects and take the project which results in the highest expected value of the firm.

B)stockholders expropriate value from bondholders by selecting high risk projects.

C)stockholders expropriate value from stockholders by selecting high risk projects.

D)the firm will always take the low risk project.

E)Both A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

Studies have found that firms with high proportions of intangible assets are likely to use ___________ debt compared with firms with low proportions of intangible assets.

A)more

B)the same amount of

C)less

D)either more or the same amount of

A)more

B)the same amount of

C)less

D)either more or the same amount of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

Covenants restricting the use of leasing and additional borrowings primarily protect:

A)the equityholders from added risk of default.

B)the debtholders from the transfer of assets.

C)the debtholders from added risk of dilution of their claims.

D)the management from having to pay agency costs.

E)None of the above.

A)the equityholders from added risk of default.

B)the debtholders from the transfer of assets.

C)the debtholders from added risk of dilution of their claims.

D)the management from having to pay agency costs.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

Windsor Company's debtholders are promised payments of $45 if the firm does well,but will receive only $20 if the firm does poorly.Bondholders are willing to pay $35.The promised return to the bondholders is approximately

A)2.9%

B)14.3%

C)15.0%

D)22.1%

E)28.6%

A)2.9%

B)14.3%

C)15.0%

D)22.1%

E)28.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

Given the following information,leverage will add how much value to the unlevered firm per dollar of debt?

Corporate tax rate:

34%

Personal tax rate on income from bonds:

50%

Personal tax rate on income from stocks:

12%

A)$-0.050

B)$-0.162

C)$0.188

D)$0.633

E)None of the above.

Corporate tax rate:

34%

Personal tax rate on income from bonds:

50%

Personal tax rate on income from stocks:

12%

A)$-0.050

B)$-0.162

C)$0.188

D)$0.633

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

Given the following information,leverage will add how much value to the unlevered firm per dollar of debt?

Corporate tax rate:

34%

Personal tax rate on income from bonds:

30%

Personal tax rate on income from stocks:

30%

A)$-0.050

B)$0.006

C)$0.246

D)$0.340

E)$0.660

Corporate tax rate:

34%

Personal tax rate on income from bonds:

30%

Personal tax rate on income from stocks:

30%

A)$-0.050

B)$0.006

C)$0.246

D)$0.340

E)$0.660

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Growth opportunities _______ the _____ of debt financing.

A)increase; advantage

B)decrease; advantage

C)decrease; disadvantage

D)Both A and C.

E)None of the above.

A)increase; advantage

B)decrease; advantage

C)decrease; disadvantage

D)Both A and C.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Loveland Enterprises will earn $70 in one year if it does well.The debtholders are promised payments of $40 in one year if the firm does well.If the firm does poorly,expected earnings in one year will be $35 and the repayment will be $25 because of the dead weight cost of bankruptcy.The probability of the firm performing poorly or well is 50%.If bondholders are fully aware of these costs what will they pay for the debt? The interest rate on the bonds is 9%.

A)$23.50

B)$25.00

C)$27.50

D)$29.82

E)$35.00

A)$23.50

B)$25.00

C)$27.50

D)$29.82

E)$35.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

Issuing debt instead of new equity in a closely held firm more likely:

A)causes the owner-manager to work less hard and shirk their duties as they have less capital at risk.

B)causes the owner-manager to consume more perquisites because the cost is passed to the debtholders.

C)causes both more shirking and perquisite consumption since the government provides a tax shield on debt.

D)causes agency costs to fall as owner-managers do not need to worry about other shareholders.

E)causes the owner-manager to reduce shirking and perquisite consumption as the excess cash flow must be used to meet debt payments.

A)causes the owner-manager to work less hard and shirk their duties as they have less capital at risk.

B)causes the owner-manager to consume more perquisites because the cost is passed to the debtholders.

C)causes both more shirking and perquisite consumption since the government provides a tax shield on debt.

D)causes agency costs to fall as owner-managers do not need to worry about other shareholders.

E)causes the owner-manager to reduce shirking and perquisite consumption as the excess cash flow must be used to meet debt payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

The free cash flow hypothesis states:

A)that firms with greater free cash flow will pay more in dividends,reducing the risk of financial distress.

B)that firms with greater free cash flow should issue new equity to force managers to minimize wasting resources and to work harder.

C)that issuing debt requires interest and principal payments reducing the potential of management to waste resources.

D)Both A and C.

E)Both B and C.

A)that firms with greater free cash flow will pay more in dividends,reducing the risk of financial distress.

B)that firms with greater free cash flow should issue new equity to force managers to minimize wasting resources and to work harder.

C)that issuing debt requires interest and principal payments reducing the potential of management to waste resources.

D)Both A and C.

E)Both B and C.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

What are the advantages of a prepackaged bankruptcy for a firm?

What are the disadvantages?

What are the disadvantages?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

The pecking order states how financing should be raised.In order to avoid asymmetric information problems and misinterpretation of whether management is sending a signal on security overvaluation the firm's first rule is to:

A)issue new equity first.

B)always issue debt then the market won't know when management thinks the security is overvalued.

C)finance with internally generated funds.

D)issue debt first.

E)None of the above.

A)issue new equity first.

B)always issue debt then the market won't know when management thinks the security is overvalued.

C)finance with internally generated funds.

D)issue debt first.

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

The TrunkLine Company will earn $60 in one year if it does well.The debtholders are promised payments of $35 in one year if the firm does well.If the firm does poorly,expected earnings in one year will be $30 and the repayment will be $20 because of the dead weight cost of bankruptcy.The probability of the firm performing poorly or well is 50%.If bondholders are fully aware of these costs what will they pay for the debt? The interest rate on the bonds is 10%.

A)$25.00

B)$27.50

C)$29.55

D)$32.50

E)$35.00

A)$25.00

B)$27.50

C)$29.55

D)$32.50

E)$35.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

Given the following information,leverage will add how much value to the unlevered firm per dollar of debt?

Corporate tax rate:

34%

Personal tax rate on income from bonds:

20%

Personal tax rate on income from stocks:

0%

A)$0.175

B)$0.472

C)$0.528

D)$0.825

E)None of the above.

Corporate tax rate:

34%

Personal tax rate on income from bonds:

20%

Personal tax rate on income from stocks:

0%

A)$0.175

B)$0.472

C)$0.528

D)$0.825

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

An investment is available that pays a tax-free 5%.Ignoring risk,what is the pre-tax return on taxable bonds? The corporate tax rate is 30%.

A)4.20%

B)6.00%

C)7.14%

D)8.57%

E)None of the above.

A)4.20%

B)6.00%

C)7.14%

D)8.57%

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

When firms issue more debt,the tax shield on debt ____,the agency costs on debt (i.e.,costs of financial distress)____,and the agency costs on equity ____.

A)increases; increase; increase

B)decreases; decrease; decrease

C)increases; increase; decrease

D)decreases; decrease; increase

E)increases; decrease; decrease

A)increases; increase; increase

B)decreases; decrease; decrease

C)increases; increase; decrease

D)decreases; decrease; increase

E)increases; decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

Given the following information,leverage will add how much value to the unlevered firm per dollar of debt?

Corporate tax rate:

34%

Personal tax rate on income from bonds:

10%

Personal tax rate on income from stocks:

40%

A)$-0.050

B)$-0.188

C)$0.367

D)$0.560

E)None of the above.

Corporate tax rate:

34%

Personal tax rate on income from bonds:

10%

Personal tax rate on income from stocks:

40%

A)$-0.050

B)$-0.188

C)$0.367

D)$0.560

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following industries would tend to have the highest leverage?

A)Paper

B)Electronics

C)Drugs

D)Computer

E)Biological products

A)Paper

B)Electronics

C)Drugs

D)Computer

E)Biological products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

Your firm has a debt-equity ratio of .40.Your cost of equity is 12% and your after-tax cost of debt is 6%.What will your cost of equity be if the target capital structure becomes a 50/50 mix of debt and equity?

A)11.45%

B)12.00%

C)13.50%

D)13.67%

E)14.56%

A)11.45%

B)12.00%

C)13.50%

D)13.67%

E)14.56%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

The Aggie Company has EBIT of $50,000 and market value debt of $100,000 outstanding with a 9% coupon rate.The cost of equity for an all equity firm would be 14%.Aggie has a 35% corporate tax rate.Investors face a 20% tax rate on debt receipts and a 15% rate on equity.Determine the value of Aggie.

A)$120,000

B)$162,948

C)$258,537

D)$263,080

E)$332,143

A)$120,000

B)$162,948

C)$258,537

D)$263,080

E)$332,143

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

Your firm has a debt-equity ratio of .60.Your cost of equity is 11% and your after-tax cost of debt is 7%.What will your cost of equity be if the target capital structure becomes a 50/50 mix of debt and equity?

A)9.50%

B)10.50%

C)11.00%

D)11.25%

E)12.00%

A)9.50%

B)10.50%

C)11.00%

D)11.25%

E)12.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

An investment is available that pays a tax-free 6%.Ignoring risk,what is the pre-tax return on taxable bonds? The corporate tax rate is 35%.

A)3.50%

B)6.00%

C)7.14%

D)9.23%

E)None of the above.

A)3.50%

B)6.00%

C)7.14%

D)9.23%

E)None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

The TrunkLine Company's debtholders are promised payments of $30 if the firm does well,but will receive only $20 if the firm does poorly.Bondholders are willing to pay $25.The promised return to the bondholders is approximately

A)2.9%

B)20.0%

C)27.3%

D)40.0%

E)100%

A)2.9%

B)20.0%

C)27.3%

D)40.0%

E)100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

The All-Mine Corporation is deciding whether to invest in a new project.The project would have to be financed by equity.The cost is $2,000 and will return $2,500 in one year.The discount rate for both bonds and stock is 15% and the tax rate is zero.The predicted cash flows without the project are $4,500 in a good economy,$3,000 in an average,economy and $1,000 in a poor economy.Each economic outcome is equally likely and the promised debt repayment is $3,000 with or without the project.Should the company take the project?

What is the value of the firm and its debt and equity components before and after the project addition?

What is the value of the firm and its debt and equity components before and after the project addition?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

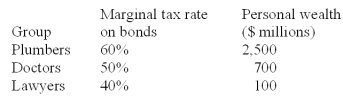

Consider an economy in which there are three groups of investors and no others.  There are no personal taxes on income from stocks.An investment is available that pays a tax-free 4%.The tax rate is 50%.Total corporate income before earnings and taxes (EBIT)is $224 million forever.What is the maximum debt-to-equity ratio for the economy as a whole?

There are no personal taxes on income from stocks.An investment is available that pays a tax-free 4%.The tax rate is 50%.Total corporate income before earnings and taxes (EBIT)is $224 million forever.What is the maximum debt-to-equity ratio for the economy as a whole?

There are no personal taxes on income from stocks.An investment is available that pays a tax-free 4%.The tax rate is 50%.Total corporate income before earnings and taxes (EBIT)is $224 million forever.What is the maximum debt-to-equity ratio for the economy as a whole?

There are no personal taxes on income from stocks.An investment is available that pays a tax-free 4%.The tax rate is 50%.Total corporate income before earnings and taxes (EBIT)is $224 million forever.What is the maximum debt-to-equity ratio for the economy as a whole?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Describe some of the sources of business risk and financial risk.Do financial decision makers have the ability to "trade off" one type of risk for the other?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

Assume that all earnings are paid out as dividends.Now consider the fact that Louis must pay personal tax on the firm's cash flow.Louis pays taxes on interest at a rate of 33%,but pays taxes on dividends at a rate of 28%.Calculate the total cash flow to Louis after he pays personal taxes.(Challenge problem; covered in text problems 9 and 10)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

The Do-All-Right Marketing Research firm has promised payments to its bondholders that total $100.The company believes that there is an 85% chance that the cash flow will be sufficient to meet these claims.However,there is a 15% chance that cash flows will fall short,in which case total earnings are expected to be $65.If the bonds sell in the market for $84,what is an estimate of the bankruptcy costs for Do-All-Right?

Assume a cost of debt of 10%.

Assume a cost of debt of 10%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Explain the difference between direct and indirect bankruptcy costs.Give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

Is there an easily identifiable debt-equity ratio that will maximize the value of a firm?

Why or why not?

Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

Establishing a capital structure for a firm is not simple.Although financial theory guides the process,there is no simple formula.List and explain four main items that one should consider in determining the capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

If the firm were to convert $4 million of equity into debt at a cost of 10%,what would be the total cash flow to Louis if he holds all the debt?

Compare this to Louis' total cash flow if the firm remains unlevered.

Compare this to Louis' total cash flow if the firm remains unlevered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck