Deck 12: Accounting for Hospitals and Other Health Care Providers

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 12: Accounting for Hospitals and Other Health Care Providers

1

Both public and private sector health care organizations measure transactions and events similarly,but use different equity accounts.

True

2

Because they are engaged in business-type activities,governmental health care organizations typically use the accrual basis and economic resources measurement focus.

True

3

Private for-profit health care organizations follow FASB standards excluding those written specifically for not-for-profits.

True

4

For accounting purposes,health care organizations include HMOs and individual medical practitioners,as well as hospitals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

Like charities and private colleges,private not-for-profit health care organizations follow FASB standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

Not-for-profit business-oriented organizations use modified accrual accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

The AICPA Audit and Accounting Guide:

Health Care Organizations applies equally to private not-for-profit and investor-owned but not governmentally owned health care organizations.

Health Care Organizations applies equally to private not-for-profit and investor-owned but not governmentally owned health care organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

Government-owned health care organizations do not report depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

The AICPA Health Care Guide applies to investor-owned,private not-for-profit,and government-owned hospitals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

As both the FASB and the GASB approved the AICPA Health Care Guide,its requirements constitute Category A GAAP and must be followed by all health care organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

The AICPA Health Care Guide provides additional guidance regarding accounting and reporting requirements for voluntary health and welfare organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a health care organization is owned or controlled by a government,it is typically considered a special-purpose entity engaged only in business-type activities and would use governmental fund accounting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

Both governmental owned and private health care providers use the accrual basis of accounting and the economic resources measurement focus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

Private-sector health care organizations use the three-category FASB format for the Statement of Cash flows,while public sector organizations use the four-category GASB format

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

Both commercial and not-for-profit hospitals in the private sector follow FASB standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

The AICPA Health Care Guide provides accounting and reporting requirements that override GASB and FASB standards,but apply only to health care providers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

Government owned hospitals follow FASB Statements 116 and 117.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

Private health care organizations,both not-for-profit and for-profit,follow FASB standards while government healthcare organizations follow GASB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

Government hospitals are typically considered special purpose entities engaged in business-type activities under GASB Statement 34.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Both commercial and private sector not-for-profit hospitals and health care providers follow FASB Statements 116 and 117.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

The level of charity care should be disclosed in the notes to financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

For hospitals,contractual adjustments to 3rd party payers,such as insurance companies,are recorded with a debit to Contractual Adjustment expense and a credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

According to The AICPA Health Care Guide,Transfers among affiliated organizations should not be included in the determination of a performance indicator for a health care organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Differences between actual and estimated contractual adjustments require restatement of prior periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

Charity care is reported as both revenue and expense (bad debt)in the Statement of Operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

Patient Service Revenue of hospitals is to be presented net of contractual adjustments in the Statement of Operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

Health care organizations that are privately owned and operated to provide a return to investors follow FASB standards excluding those standards specifically for not-for-profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

With respect to health care organizations,expenses must be reported using their natural classifications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

The AICPA Health Care Guide requires a performance indicator in the financial statements of private sector not-for-profit health care providers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

The AICPA Health Care Guide prescribes a separate Statement of Operations and Statement of Changes in Net Assets rather than a Statement of Activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

The cash flow statements of private health care organizations,both not-for-profit and for-profit,may use the direct or indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

Health care organizations that are privately owned and operated to provide a return to investors report the same net asset classifications as private not-for-profit health care organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

Patient service revenue for a hospital does not include charges for charity care.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

Voluntary health and welfare organizations raise a significant amount or nearly all of their resources from contributions and grants,and are subject to the rules of the AICPA Not-for-Profit Guide.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

According to The AICPA Health Care Guide,Transfers among affiliated organizations should not be included in the determination of a performance indicator for a health care organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

For hospitals,contractual adjustments to 3rd party payers,such as insurance companies,are recorded with a debit to Contractual Adjustments (a contra-revenue account)and a credit to an allowance for contractual adjustments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

Contractual adjustments from insurance companies are reported as expenses in the Statement of Operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

The AICPA Audit and Accounting Guide:

Health Care Organizations applies equally to private not-for-profit,governmentally owned,and investor-owned health care organizations.

Health Care Organizations applies equally to private not-for-profit,governmentally owned,and investor-owned health care organizations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

Health care organizations that are privately owned and operated to provide a return to investors follow GASB standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

With respect to health care organizations,private sector not-for-profit health care entities must disclose expenses by functional classifications.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

The equity section of the Statement of Net Assets of a private not-for-profit hospital may contain which of the following descriptions?

A) Fiduciary, Proprietary, and General.

B) Nonspendable, Committed, Restricted and Assigned.

C) Permanently Restricted, Temporarily Restricted, and Unrestricted.

D) Invested in Capital Assets Net of Related Debt, Restricted, and Unrestricted.

A) Fiduciary, Proprietary, and General.

B) Nonspendable, Committed, Restricted and Assigned.

C) Permanently Restricted, Temporarily Restricted, and Unrestricted.

D) Invested in Capital Assets Net of Related Debt, Restricted, and Unrestricted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

The equity section of the Statement of Net Assets of a government-owned hospital may contain which of the following descriptions?

A) Fiduciary, Proprietary, and General.

B) Nonspendable, Committed, Restricted and Assigned.

C) Permanently Restricted, Temporarily Restricted, and Unrestricted.

D) Net Assets Invested in Capital Assets Net of Related Debt, Restricted, and Unrestricted.

A) Fiduciary, Proprietary, and General.

B) Nonspendable, Committed, Restricted and Assigned.

C) Permanently Restricted, Temporarily Restricted, and Unrestricted.

D) Net Assets Invested in Capital Assets Net of Related Debt, Restricted, and Unrestricted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is true regarding the financial statements of a private sector not-for-profit hospital?

A) Revenues are measured using the accrual basis of accounting.

B) Changes in net assets must be shown by net asset classification.

C) The Statement of Cash Flows uses a three-category format.

D) All of the above are true.

A) Revenues are measured using the accrual basis of accounting.

B) Changes in net assets must be shown by net asset classification.

C) The Statement of Cash Flows uses a three-category format.

D) All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is true regarding revenue recognition for health care organizations?

A) Patient service revenue is reported net of contractual adjustments.

B) Patient service revenue includes an imputed charge for charity care.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Patient service revenue is reported net of contractual adjustments.

B) Patient service revenue includes an imputed charge for charity care.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

The statement reflecting revenues,expenses,and other changes in unrestricted net assets for a private sector,not-for-profit hospital is called the:

A) Statement of Changes in Unrestricted Net Assets.

B) Statement of Operations.

C) Statement of Activities.

D) Income Statement.

A) Statement of Changes in Unrestricted Net Assets.

B) Statement of Operations.

C) Statement of Activities.

D) Income Statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

Private sector,not-for-profit health care organizations have a category of assets called "Assets Whose Use is Limited." That category refers to:

A) Assets that have been restricted by donor action.

B) Unrestricted assets that have been limited by individuals or entities other than contributors (such as by bond covenants).

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Assets that have been restricted by donor action.

B) Unrestricted assets that have been limited by individuals or entities other than contributors (such as by bond covenants).

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is not a required statement of a private not-for-profit hospital?

A) Statement of Financial Position.

B) Statement of Functional Expense.

C) Statement of Cash Flows.

D) Statement of Operations.

A) Statement of Financial Position.

B) Statement of Functional Expense.

C) Statement of Cash Flows.

D) Statement of Operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is not true regarding financial reporting of health care entities?

A) It is important to distinguish operating revenues and expenses from nonoperating.

B) It is important to distinguish between current and noncurrent assets and liabilities.

C) Private sector organizations use a three-category format for the Statement of Cash Flows, and public sector organizations us a four-category format.

D) Private sector organizations use accrual accounting, while public sector organizations use modified accrual.

A) It is important to distinguish operating revenues and expenses from nonoperating.

B) It is important to distinguish between current and noncurrent assets and liabilities.

C) Private sector organizations use a three-category format for the Statement of Cash Flows, and public sector organizations us a four-category format.

D) Private sector organizations use accrual accounting, while public sector organizations use modified accrual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

The AICPA Audit and Accounting Guide: Health Care Organizations applies to:

A) Private sector, not-for-profit hospitals.

B) Public sector, government-owned hospitals.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Private sector, not-for-profit hospitals.

B) Public sector, government-owned hospitals.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

The cash flow statements of health care organizations,both private and government-owned,may use the direct or indirect method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

The equity section of governmentally-owned hospitals includes nonspendable,restricted,committed and assigned fund balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

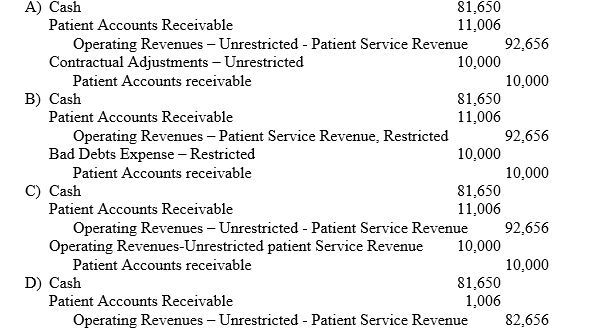

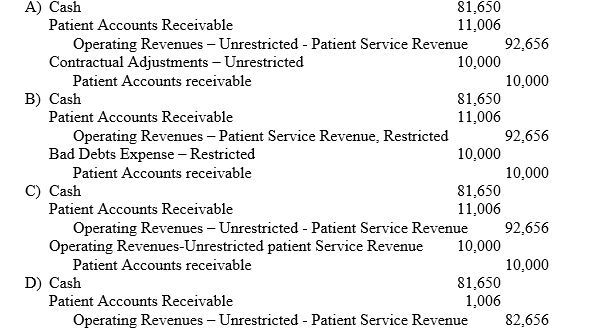

St.David's is a not-for-profit business-oriented hospital.What is the journal entry for the following transaction: During the month,gross patient service revenue amounted to $92,656 of which $81,650 was received in cash.Contractual adjustments to third-party payers amounted to $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

The AICPA Audit and Accounting Guide: Health Care Organizations provides reporting requirements for all of the following organizations except:

A) The University of Virginia Hospital, a government-owned hospital.

B) a psychiatrist operating as a limited liability corporation.

C) a nursing home operated by the Lutheran Church.

D) voluntary health and welfare organizations

A) The University of Virginia Hospital, a government-owned hospital.

B) a psychiatrist operating as a limited liability corporation.

C) a nursing home operated by the Lutheran Church.

D) voluntary health and welfare organizations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

Health care organizations that are privately owned and operated to provide a return to investors follow which standards:

A) GASB.

B) FASB, excluding standards specifically for not-for-profits.

C) FASB, including standards specifically for not-for-profits.

D) None of the above.

A) GASB.

B) FASB, excluding standards specifically for not-for-profits.

C) FASB, including standards specifically for not-for-profits.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is correct with respect to the recording of charity care for health care organizations?

A) Revenues are not recorded for the value of charity care services provided, but related expenses are included with other expenses on the Statement of Operations

B) Charity care is recorded as revenue and an adjustment is recorded for the difference between the value of the revenue and expenses incurred in providing health care services.

C) The value of foregone charity care revenue is deducted as a charitable contribution expense in the Statement of Operations

D) Management's policy for providing charity care and the level of charity care provided is an optional disclosure

A) Revenues are not recorded for the value of charity care services provided, but related expenses are included with other expenses on the Statement of Operations

B) Charity care is recorded as revenue and an adjustment is recorded for the difference between the value of the revenue and expenses incurred in providing health care services.

C) The value of foregone charity care revenue is deducted as a charitable contribution expense in the Statement of Operations

D) Management's policy for providing charity care and the level of charity care provided is an optional disclosure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

Private not-for-profit health care organizations follow standards set by:

A) GASB.

B) FASB.

C) SEC.

D) All of the above.

A) GASB.

B) FASB.

C) SEC.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following is not correct with respect to reporting of patient service revenue for health care organizations?

A) Patient service revenue must be reported net of estimated adjustments for contractual adjustments

B) Changes to estimates of contractual adjustments related to prior periods must be reported as a prior period adjustment if material

C) Patient service revenue does not include amounts representing charity care

D) Unrestricted bequests and investment income for current unrestricted purposes may be reported as either operating or nonoperatiang revenue, depending on the policy of the entity

A) Patient service revenue must be reported net of estimated adjustments for contractual adjustments

B) Changes to estimates of contractual adjustments related to prior periods must be reported as a prior period adjustment if material

C) Patient service revenue does not include amounts representing charity care

D) Unrestricted bequests and investment income for current unrestricted purposes may be reported as either operating or nonoperatiang revenue, depending on the policy of the entity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

A private sector not-for-profit hospital received a gift of $250,000 cash on the first day of 2014 with a donor restriction that the resources be used to purchase certain equipment.The equipment was purchased on the same day and is expected to last five years with no salvage value.The Statement of Financial Position as of December 31,2014 would reflect as net assets of:

A) $200,000 unrestricted and $0 temporarily restricted.

B) $0 unrestricted and $200,000 temporarily restricted.

C) Either (a) or (b), depending on the policy of the hospital.

D) None of the above.

A) $200,000 unrestricted and $0 temporarily restricted.

B) $0 unrestricted and $200,000 temporarily restricted.

C) Either (a) or (b), depending on the policy of the hospital.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

The AICPA Audit and Accounting Guide: Health Care Organizations applies to:

A) Private not-for-profit health care organizations.

B) Governmentally owned health care organizations.

C) Investor-owned health care organizations.

D) All of the above.

A) Private not-for-profit health care organizations.

B) Governmentally owned health care organizations.

C) Investor-owned health care organizations.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

A private sector,not-for-profit hospital received a pledge of $100,000 in 2013,with no purpose restriction.The pledge card indicated that the funds were to be used in 2014.Cash was turned over to the hospital in 2014.The not-for-profit hospital would recognize contribution revenue in:

A) 2013.

B) 2014.

C) When the funds are expended.

D) Either 2013 or 2014, depending on the policy of the hospital.

A) 2013.

B) 2014.

C) When the funds are expended.

D) Either 2013 or 2014, depending on the policy of the hospital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is true regarding the reporting of expenses by private sector,not-for-profit hospitals?

A) All expenses are considered reductions in unrestricted net assets.

B) Expenses must be reported by natural (i.e. salaries, supplies, etc.) classification in the statements.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) All expenses are considered reductions in unrestricted net assets.

B) Expenses must be reported by natural (i.e. salaries, supplies, etc.) classification in the statements.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

The difference between the financial statements of private not-for-profit hospitals and private not-for-profit voluntary health and welfare organizations is:

A) Hospitals do not have to prepare a Statement of Functional Expense.

B) Voluntary health and welfare organizations do not have to prepare a Statement of Cash Flows.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Hospitals do not have to prepare a Statement of Functional Expense.

B) Voluntary health and welfare organizations do not have to prepare a Statement of Cash Flows.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

The difference between accounting for private not-for-profit hospitals and government- owned hospitals is:

A) Government owned hospitals do not have to prepare a Statement of Cash Flows.

B) Government owned hospitals do not have to record depreciation.

C) The equity accounts have different titles and definitions.

D) All of the above.

A) Government owned hospitals do not have to prepare a Statement of Cash Flows.

B) Government owned hospitals do not have to record depreciation.

C) The equity accounts have different titles and definitions.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following is not true regarding accounting and financial reporting for private not-for-profit hospitals?

A) Expenses may be unrestricted or temporarily restricted depending on donor intent.

B) Fund accounting is not required.

C) The Statement of Cash Flows may use either the direct or indirect method.

D) Net assets are classified as Unrestricted, Temporarily Restricted or Permanently Restricted.

A) Expenses may be unrestricted or temporarily restricted depending on donor intent.

B) Fund accounting is not required.

C) The Statement of Cash Flows may use either the direct or indirect method.

D) Net assets are classified as Unrestricted, Temporarily Restricted or Permanently Restricted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

Private not-for-profit health care organizations include what categories in the equity section of the Statement of Net Assets?

A) Unrestricted, temporarily restricted, and permanently restricted.

B) Paid in capital and retained earnings.

C) Invested in capital net of related debt, restricted, and unrestricted.

D) Operating, investing, financing.

A) Unrestricted, temporarily restricted, and permanently restricted.

B) Paid in capital and retained earnings.

C) Invested in capital net of related debt, restricted, and unrestricted.

D) Operating, investing, financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sam Smith died,leaving a will that provided that $1,000,000 be transferred to a not-for-profit hospital.The hospital is to invest the funds for 10 years and give $40,000 each year to the granddaughter.At the end of the 10 years,the $1,000,000 can be used for any purpose desired by the hospital.Which of the following is true?

A) The hospital would record revenue in the amount of $1,000,000, increasing temporarily restricted net assets.

B) The hospital would record revenue in an amount equal to the present value of the 10 payments to the granddaughter.

C) The hospital would record revenue in an amount equal to the $1,000,000 less the present value of the 10 payments to the granddaughter.

D) The hospital would not record revenue for 10 years; then a revenue would be recorded, increasing unrestricted net assets.

A) The hospital would record revenue in the amount of $1,000,000, increasing temporarily restricted net assets.

B) The hospital would record revenue in an amount equal to the present value of the 10 payments to the granddaughter.

C) The hospital would record revenue in an amount equal to the $1,000,000 less the present value of the 10 payments to the granddaughter.

D) The hospital would not record revenue for 10 years; then a revenue would be recorded, increasing unrestricted net assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following is true regarding accounting and financial reporting for not-for-profit health care organizations?

A) Charity care is reported as operating revenue at the normal and customary rate and bad debt expense is reported for an equal amount.

B) Contractual adjustments with insurance companies are reported as a reduction in patient service revenue.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Charity care is reported as operating revenue at the normal and customary rate and bad debt expense is reported for an equal amount.

B) Contractual adjustments with insurance companies are reported as a reduction in patient service revenue.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following could be recognized as contributed services revenue by a not-for-profit hospital?

A) An architect developed building plans for a new outpatient clinic.

B) A high school student class volunteered to answer the telephone during the Friday night midnight shift.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) An architect developed building plans for a new outpatient clinic.

B) A high school student class volunteered to answer the telephone during the Friday night midnight shift.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

A "performance indicator" is required in the Statement of Operations for health care entities.Which of the following must be reported below that performance indicator?

A) Other revenue, such as parking lot or cafeteria revenue.

B) Net assets released from restrictions for operating purposes.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Other revenue, such as parking lot or cafeteria revenue.

B) Net assets released from restrictions for operating purposes.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following health care organizations must follow standards established by the Governmental Accounting Standards Board?

A) Private not-for-profit hospitals.

B) Government owed hospitals.

C) Both (a) and (b) above.

D) Neither (a) nor (b)above.

A) Private not-for-profit hospitals.

B) Government owed hospitals.

C) Both (a) and (b) above.

D) Neither (a) nor (b)above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

A private not-for-profit entity estimated its Allowance for Contractual Adjustment.During the next year,the hospital found that the actual total of contractual adjustments applied to receivables on hand at the end of the previous year was $ 5,000 higher than the estimate.How should the difference be reported?

A) The hospital should reduce current period net patient service revenues for the $5,000.

B) The hospital should make a prior period adjustment to retained earnings for $5,000.

C) The hospital should record a current period expense for the $5,000.

D) The hospital should record a "cumulative effect of a change in accounting principle" for the $5,000.

A) The hospital should reduce current period net patient service revenues for the $5,000.

B) The hospital should make a prior period adjustment to retained earnings for $5,000.

C) The hospital should record a current period expense for the $5,000.

D) The hospital should record a "cumulative effect of a change in accounting principle" for the $5,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is true regarding revenue recognition for health care organizations?

A) Patient service revenues are reported net of contractual adjustments.

B) Revenues do not include charity care.

C) Revenues may include fees for parking, cafeteria sales, and gift shops.

D) All of the above are true.

A) Patient service revenues are reported net of contractual adjustments.

B) Revenues do not include charity care.

C) Revenues may include fees for parking, cafeteria sales, and gift shops.

D) All of the above are true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

A hospital reported the following uncollectible amounts:

$ 10,000 for services rendered to homeless individuals with no intention of collection.

$ 30,000 for services rendered with the expectation of collection,but which proved to be uncollectible.

What amount should be reported in revenues and bad debt expense for these items?

A) Revenues: $ 40,000; Bad Debt Expense: 40,000.

B) Revenues: $ 40,000; Bad Debt Expense: 30,000.

C) Revenues: $ 30,000; Bad Debt Expense: 30,000.

D) Revenues: $ 0; Bad Debt Expense: 0.

$ 10,000 for services rendered to homeless individuals with no intention of collection.

$ 30,000 for services rendered with the expectation of collection,but which proved to be uncollectible.

What amount should be reported in revenues and bad debt expense for these items?

A) Revenues: $ 40,000; Bad Debt Expense: 40,000.

B) Revenues: $ 40,000; Bad Debt Expense: 30,000.

C) Revenues: $ 30,000; Bad Debt Expense: 30,000.

D) Revenues: $ 0; Bad Debt Expense: 0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

A private sector,not-for-profit hospital received a pledge of $150,000 in 2013 to be used for a building to be constructed in 2014 but contingent on the hospital being able to raise an equivalent amount from other donors.As of the end of 2013,half the amount had been raised from other donors.In 2014,the hospital raised the amount from other donors.The donor gave the $150,000 to the hospital in 2014 and the building was completed in 2014.In which year should the hospital recognize the $150,000 from the pledge?

A) 2013.

B) 2014.

C) 2015.

D) $75,000 should be recognized in 2013 and $75,000 in 2014.

A) 2013.

B) 2014.

C) 2015.

D) $75,000 should be recognized in 2013 and $75,000 in 2014.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

A donor pledged $500,000 to a not-for-profit hospital in 2013 to conduct medical research,conditional on the hospital raising $500,000 from other donors.The other donors met the condition in 2014.The donor transferred the funds to the hospital in 2014.In which year would the revenue be recognized?

A) 2013.

B) 2014.

C) Half in 2013 and half in 2014.

D) None of the above; the hospital would only recognize revenue when the amounts had been expended according to the donor's wishes.

A) 2013.

B) 2014.

C) Half in 2013 and half in 2014.

D) None of the above; the hospital would only recognize revenue when the amounts had been expended according to the donor's wishes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Private health care organizations follow _____ standards while governmentally owned health care organizations follow _____ standards.

A) GASB; FASB.

B) FASB; GASB.

C) FASB; FASAB.

D) GASB; FASAB.

A) GASB; FASB.

B) FASB; GASB.

C) FASB; FASAB.

D) GASB; FASAB.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

Not-for-profit health care entities are distinguished from voluntary health and welfare organizations in the following manner:

A) Health care organizations provide health care services while voluntary health and welfare organizations do not.

B) Health care organizations use accrual accounting whereas voluntary health and welfare organizations do not.

C) Health care organizations do not provide services to individuals who are unable to pay.

D) Health care organizations are considered to be primarily business-oriented whereas voluntary health and welfare organizations raise a significant portion of their money from voluntary contributions.

A) Health care organizations provide health care services while voluntary health and welfare organizations do not.

B) Health care organizations use accrual accounting whereas voluntary health and welfare organizations do not.

C) Health care organizations do not provide services to individuals who are unable to pay.

D) Health care organizations are considered to be primarily business-oriented whereas voluntary health and welfare organizations raise a significant portion of their money from voluntary contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following health care organizations have " Category B" GAAP established by the AICPA's Audit and Accounting Guide: Health Care Organizations?

A) Cook County Hospital, a department of Cook County.

B) Kishwaukee Hospital, a nongovernmental, not-for-profit hospital.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) Cook County Hospital, a department of Cook County.

B) Kishwaukee Hospital, a nongovernmental, not-for-profit hospital.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

Which of the following is a required statement for a governmental hospital?

A) Statement of Changes in Fund Balance.

B) Statement of Revenues and Expenditures.

C) Statement of Functional Expense.

D) Statement of Cash Flows.

A) Statement of Changes in Fund Balance.

B) Statement of Revenues and Expenditures.

C) Statement of Functional Expense.

D) Statement of Cash Flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

A donor contributed $1,000,000 to a not-for-profit hospital with the restriction that the funds be invested indefinitely and the income be used for cancer research.Which of the following would be true?

A) The gift would be recorded as an increase in permanently restricted net assets.

B) The income from the endowment would be recorded as an increase in temporarily restricted net assets.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

A) The gift would be recorded as an increase in permanently restricted net assets.

B) The income from the endowment would be recorded as an increase in temporarily restricted net assets.

C) Both (a) and (b) above.

D) Neither (a) nor (b) above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck