Deck 7: Cost Allocation: Departments, Joint Products, and By-Products

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

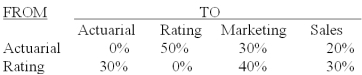

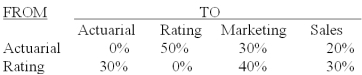

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

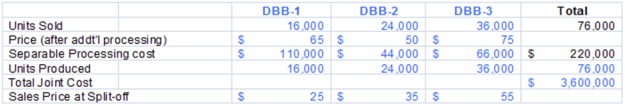

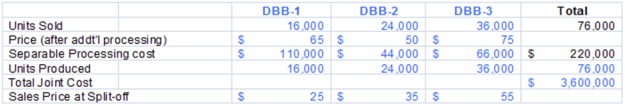

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/85

العب

ملء الشاشة (f)

Deck 7: Cost Allocation: Departments, Joint Products, and By-Products

1

An alternative concept of fairness in cost allocation,absent the cause-and-effect basis,include(s):

A)Ability-to-bear.

B)Efficiency.

C)Different costs for different purposes.

D)Consistency.

A)Ability-to-bear.

B)Efficiency.

C)Different costs for different purposes.

D)Consistency.

A

2

Dual allocation is a cost allocation approach that separates direct and indirect costs,tracing the direct costs directly to the department that:

A)Can bear the cost.

B)Relates best to the cost.

C)Is first identified with the cost.

D)Caused the cost.

E)Is most impacted by the cost.

A)Can bear the cost.

B)Relates best to the cost.

C)Is first identified with the cost.

D)Caused the cost.

E)Is most impacted by the cost.

D

3

The most effective basis for cost allocation exists when which one of the following can be determined?

A)Cost shifting.

B)Benefit received.

C)Equity share.

D)Cause and effect relationship.

E)Ability to bear.

A)Cost shifting.

B)Benefit received.

C)Equity share.

D)Cause and effect relationship.

E)Ability to bear.

D

4

Cost allocation provides a services firm a basis for evaluating the:

A)Cost and profitability of its services.

B)Cost of its services only.

C)Profitability of its services only.

D)Manufacturing costs for the company.

E)Profitability of its customers.

A)Cost and profitability of its services.

B)Cost of its services only.

C)Profitability of its services only.

D)Manufacturing costs for the company.

E)Profitability of its customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

5

The objectives of cost allocation are to:

A)Motivate,provide incentives,and determine fair awards.

B)Accurately define,divide and spread direct costs.

C)Value,measure,and interpret cost data.

D)Connect,communicate,and discern information.

E)Define,refine,and re-define indirect costs.

A)Motivate,provide incentives,and determine fair awards.

B)Accurately define,divide and spread direct costs.

C)Value,measure,and interpret cost data.

D)Connect,communicate,and discern information.

E)Define,refine,and re-define indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following methods considers all reciprocal flows between service departments through simultaneous equations?

A)Dual method.

B)Step method.

C)Reciprocal method.

D)Direct method.

E)The net realizable value method.

A)Dual method.

B)Step method.

C)Reciprocal method.

D)Direct method.

E)The net realizable value method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following methods uses units of output to allocate joint costs to joint products?

A)Net realizable value method.

B)Physical units method.

C)Net sales value method.

D)Sales value at split-off method.

E)Activity-based costing.

A)Net realizable value method.

B)Physical units method.

C)Net sales value method.

D)Sales value at split-off method.

E)Activity-based costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

8

The mathematical technique that underlies the reciprocal cost allocation method is:

A)Regression analysis.

B)Simultaneous equations.

C)Analysis of variances.

D)Complex algebraic functions.

E)Multiple correlation.

A)Regression analysis.

B)Simultaneous equations.

C)Analysis of variances.

D)Complex algebraic functions.

E)Multiple correlation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a budgeted activity base is used as the base in cost allocation,each department's cost allocation will be predictable,and not influenced by the:

A)Actual total cost.

B)Change in activity.

C)Variations from budget.

D)Errors in calculations.

E)Actual usage in other departments.

A)Actual total cost.

B)Change in activity.

C)Variations from budget.

D)Errors in calculations.

E)Actual usage in other departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

10

A key ethical issue in cost allocation involves costing in an international context,because the choice of a cost allocation method can affect:

A)Management reward systems.

B)Management fraud.

C)Taxes in domestic and foreign countries.

D)The firm's financial statements.

E)The fair share of cost by a governmental unit.

A)Management reward systems.

B)Management fraud.

C)Taxes in domestic and foreign countries.

D)The firm's financial statements.

E)The fair share of cost by a governmental unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

11

The concepts of cost allocation that are used in manufacturing can also apply in:

A)Service and not-for-profit industries.

B)Service industries only.

C)Not-for-profit industries only.

D)Limited instances outside of manufacturing.

E)The concepts apply only in manufacturing.

A)Service and not-for-profit industries.

B)Service industries only.

C)Not-for-profit industries only.

D)Limited instances outside of manufacturing.

E)The concepts apply only in manufacturing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

12

Allocation of service department costs to producing departments is the most complex of the allocation phase of departmental cost allocation because of the likely presence of:

A)Manager bias.

B)Formula distracters.

C)Repetitive steps.

D)Reciprocal flows.

E)Non-value adding activities.

A)Manager bias.

B)Formula distracters.

C)Repetitive steps.

D)Reciprocal flows.

E)Non-value adding activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

13

An overhead cost that can be traced directly to either a service or production department:

A)Is called a "flow through" cost.

B)Requires less allocation effort.

C)Is charged directly to that department.

D)Must be variable.

E)Must be fixed.

A)Is called a "flow through" cost.

B)Requires less allocation effort.

C)Is charged directly to that department.

D)Must be variable.

E)Must be fixed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cost allocation of shared facilities cost is intended to remind managers of:

A)The cost of using a shared resource.

B)Both the cost and value of using shared resources.

C)How much capacity a firm has.

D)Why the firm invests in these facilities.

E)How dependent the managers are for these facilities.

A)The cost of using a shared resource.

B)Both the cost and value of using shared resources.

C)How much capacity a firm has.

D)Why the firm invests in these facilities.

E)How dependent the managers are for these facilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

15

The direct method of departmental cost allocation ignores:

A)The managers' bias.

B)Accrual accounting.

C)Tax implications

D)Long-term implications.

E)Reciprocal flows.

A)The managers' bias.

B)Accrual accounting.

C)Tax implications

D)Long-term implications.

E)Reciprocal flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

16

The most important reason cost allocation is an important strategic issue for U.S.manufacturing firms with foreign subsidiaries:

A)The tax implications.

B)Quality concerns.

C)Import restrictions.

D)Cultural differences.

E)The company's desire to grow.

A)The tax implications.

B)Quality concerns.

C)Import restrictions.

D)Cultural differences.

E)The company's desire to grow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

17

The reciprocal method of departmental cost allocation is preferred over the step method because it takes into account all the reciprocal flows between:

A)The service departments.

B)The producing departments.

C)Multiple products.

D)Competing departments.

E)Similar,but separate,products.

A)The service departments.

B)The producing departments.

C)Multiple products.

D)Competing departments.

E)Similar,but separate,products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

18

The reciprocal method can be solved using the Excel function:

A)Goal Seek

B)Regression

C)Solver

D)Scenarios

E)Pivot Tables

A)Goal Seek

B)Regression

C)Solver

D)Scenarios

E)Pivot Tables

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

19

In making decisions about whether to sell or further process joint products,allocation of common or joint costs is:

A)Essential.

B)Useful.

C)C)Irrelevant.

D)Is useful depending on the method chosen.

E)Is the only way to get the true total product cost.

A)Essential.

B)Useful.

C)C)Irrelevant.

D)Is useful depending on the method chosen.

E)Is the only way to get the true total product cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

20

By-product costing that uses the asset recognition method(s)creates:

A)Expense recognition in the current period.

B)A distortion of net income.

C)An adjustment on the income statement.

D)An inventory value in the period in which the by products are produced.

E)A result that is not compatible with GAAP.

A)Expense recognition in the current period.

B)A distortion of net income.

C)An adjustment on the income statement.

D)An inventory value in the period in which the by products are produced.

E)A result that is not compatible with GAAP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which one of the following methods of allocating joint costs allocates joint costs to joint products on the basis of estimated sales values at the split-off point?

A)Net realizable value method.

B)Physical measure method.

C)Average cost method.

D)Net sales value method.

E)Sales value at split-off method.

A)Net realizable value method.

B)Physical measure method.

C)Average cost method.

D)Net sales value method.

E)Sales value at split-off method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

22

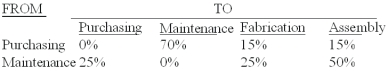

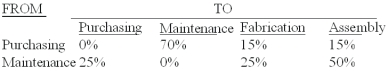

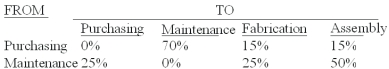

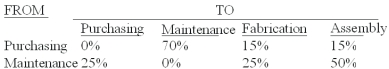

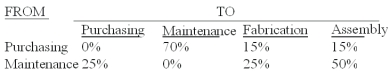

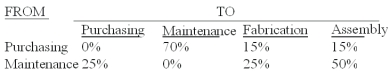

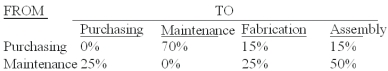

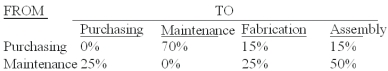

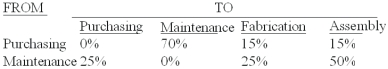

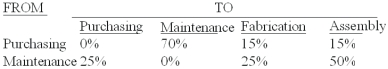

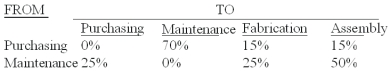

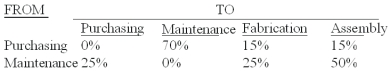

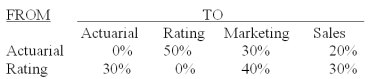

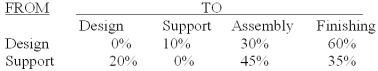

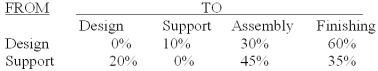

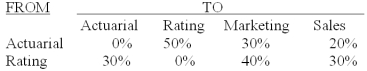

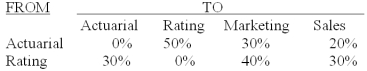

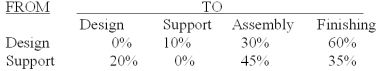

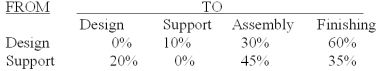

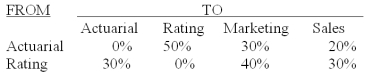

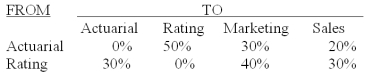

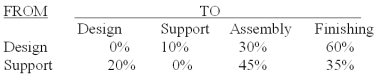

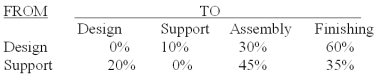

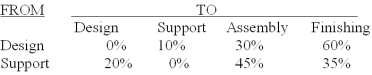

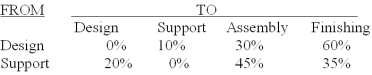

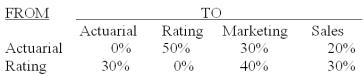

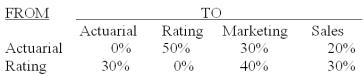

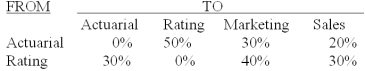

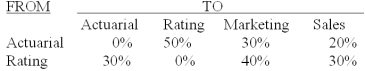

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows:

Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the fabrication department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$117,909.

C)$116,091.

D)$108,000.

E)$119,200.

The direct operating costs of the departments (including both variable and fixed costs)were as follows:

Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the fabrication department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$117,909.

C)$116,091.

D)$108,000.

E)$119,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

23

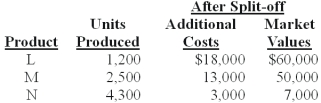

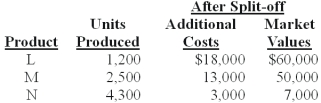

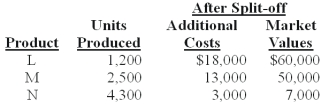

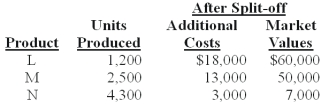

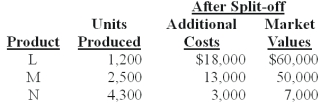

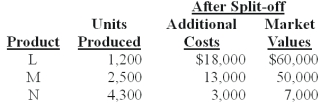

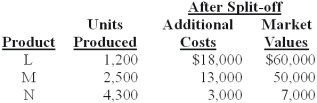

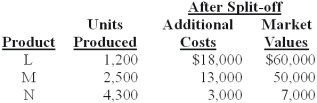

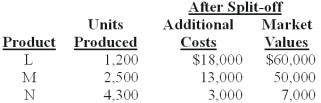

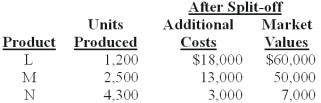

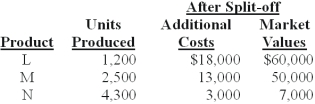

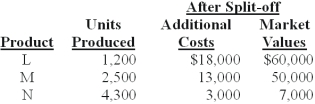

Hatchett Inc.produces joint products L,M,and N from a joint process.Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product N using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$3,614.

B)$11,250.

C)$40,312.

D)$33,434.

E)$37,952.

The amount of joint costs allocated to product N using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$3,614.

B)$11,250.

C)$40,312.

D)$33,434.

E)$37,952.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

24

Hatchett Inc.produces joint products L,M,and N from a joint process.Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product L using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$23,438.

B)$33,434.

C)$40,313.

D)$27,109.

E)$11,250.

The amount of joint costs allocated to product L using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$23,438.

B)$33,434.

C)$40,313.

D)$27,109.

E)$11,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

25

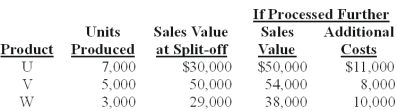

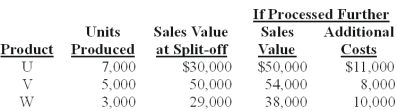

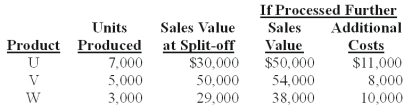

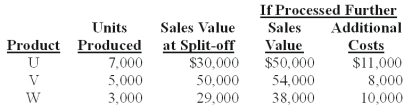

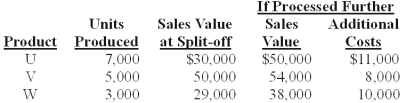

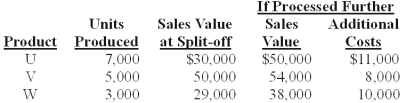

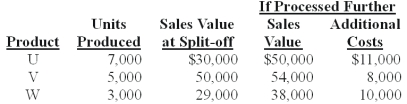

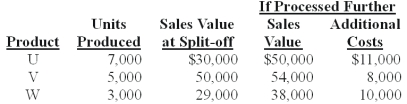

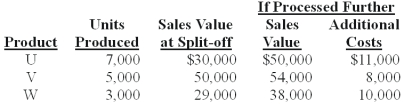

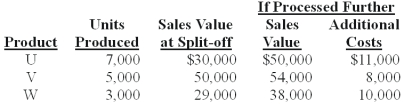

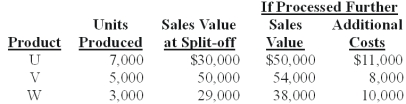

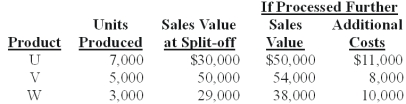

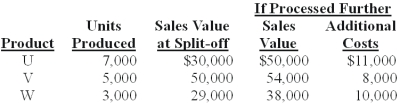

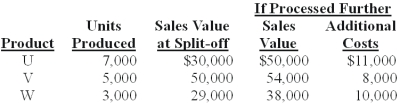

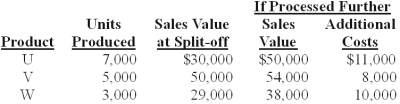

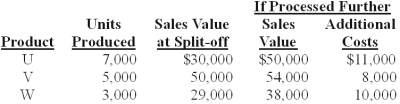

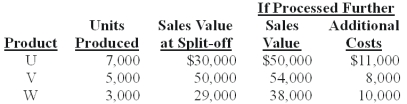

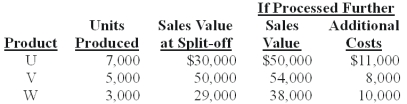

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product V using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$23,333.

D)$14,000.

E)$32,667.

The amount of joint costs allocated to product V using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$23,333.

D)$14,000.

E)$32,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the fabrication department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the fabrication department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

28

Hatchett Inc.produces joint products L,M,and N from a joint process.Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product M using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$23,438.

B)$33,434.

C)$40,313.

D)$27,109.

E)$11,250.

The amount of joint costs allocated to product M using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$23,438.

B)$33,434.

C)$40,313.

D)$27,109.

E)$11,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

29

Hatchett Inc.produces joint products L,M,and N from a joint process.Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product M using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$3,614.

B)$11,250.

C)$40,312.

D)$33,434.

E)$37,952.

The amount of joint costs allocated to product M using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$3,614.

B)$11,250.

C)$40,312.

D)$33,434.

E)$37,952.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which one of the following methods of allocating joint costs uses a measure of weight,size or number of units to allocate joint costs to joint products?

A)Net realizable value method.

B)Physical measure method.

C)Product measure method.

D)Cost measure method.

E)Sales value at split-off method.

A)Net realizable value method.

B)Physical measure method.

C)Product measure method.

D)Cost measure method.

E)Sales value at split-off method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

31

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product W using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$23,333.

D)$14,000.

E)$32,667.

The amount of joint costs allocated to product W using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$23,333.

D)$14,000.

E)$32,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

32

Hatchett Inc.produces joint products L,M,and N from a joint process.Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product L using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$3,614.

B)$11,250.

C)$40,312.

D)$33,434.

E)$37,952.

The amount of joint costs allocated to product L using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$3,614.

B)$11,250.

C)$40,312.

D)$33,434.

E)$37,952.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the sales department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$117,909.

C)$116,091.

D)$108,000.

E)$119,200.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the sales department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$117,909.

C)$116,091.

D)$108,000.

E)$119,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

34

A concept which is commonly employed with allocation bases related to size is:

A)Cost shifting.

B)Benefit received.

C)Equity share.

D)Cause and effect relationship.

E)Ability to bear.

A)Cost shifting.

B)Benefit received.

C)Equity share.

D)Cause and effect relationship.

E)Ability to bear.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

35

Hatchett Inc.produces joint products L,M,and N from a joint process.Information concerning a batch produced in May at a joint cost of $75,000 was as follows:

The amount of joint costs allocated to product N using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$23,438.

B)$33,434.

C)$40,313.

D)$27,109.

E)$11,250.

The amount of joint costs allocated to product N using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$23,438.

B)$33,434.

C)$40,313.

D)$27,109.

E)$11,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000 Assembly 48,000.The total cost accumulated in the fabrication department using the step method is (assume the purchasing department goes first).Calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar.

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000 Assembly 48,000.The total cost accumulated in the fabrication department using the step method is (assume the purchasing department goes first).Calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar.

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which one of the following methods of cost allocation is completed by taking the service flows to production departments only and determining each production department's share of that service?

A)Direct method.

B)Indirect method.

C)Step method.

D)Reciprocal method.

E)Cross-functional method.

A)Direct method.

B)Indirect method.

C)Step method.

D)Reciprocal method.

E)Cross-functional method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

38

Revenue methods of by-product cost allocation are justified on financial accounting concepts of:

A)Revenue realization and materiality.

B)Revenue realization,materiality and cost-benefit.

C)Materiality and cost-benefit.

D)Materiality and stable dollar.

E)Cost-benefit and stable dollar.

A)Revenue realization and materiality.

B)Revenue realization,materiality and cost-benefit.

C)Materiality and cost-benefit.

D)Materiality and stable dollar.

E)Cost-benefit and stable dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Sakicki Manufacturing Company has two service departments - purchasing and maintenance,and two production departments - fabrication and assembly.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Purchasing $96,000.Maintenance 18,000.Fabrication 72,000.Assembly 48,000.The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$114,800.

B)$119,200.

C)$117,000.

D)$108,000.

E)$126,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

40

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product U using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$23,333.

D)$14,000.

E)$32,667.

The amount of joint costs allocated to product U using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$23,333.

D)$14,000.

E)$32,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements best describes a by-product?

A)A product that is produced from material that would otherwise be scrap.

B)A product that has a similar unit selling price than the main product.

C)A product created along with the main product whose sales value does not cover its cost of production.

D)A product that usually produces a small amount of revenue when compared to the main product's revenue.

E)A product that has a lower unit selling price than the main unit.

A)A product that is produced from material that would otherwise be scrap.

B)A product that has a similar unit selling price than the main product.

C)A product created along with the main product whose sales value does not cover its cost of production.

D)A product that usually produces a small amount of revenue when compared to the main product's revenue.

E)A product that has a lower unit selling price than the main unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

42

The cost allocation method most widely used because of its accuracy and ability to provide a detailed level of analysis is:

A)Departmental approach.

B)Activity-based approach.

C)Direct approach.

D)Accounting approach.

E)Joint product costing.

A)Departmental approach.

B)Activity-based approach.

C)Direct approach.

D)Accounting approach.

E)Joint product costing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

43

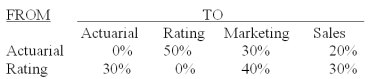

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$52,857.

B)$60,000.

C)$112,857.

D)$130,000.

E)$142,857.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$52,857.

B)$60,000.

C)$112,857.

D)$130,000.

E)$142,857.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is an example of a physical measure used in the physical measure method?

A)Pounds.

B)Minutes.

C)Seconds.

D)Dollars.

E)Volume.

A)Pounds.

B)Minutes.

C)Seconds.

D)Dollars.

E)Volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

45

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product V using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$24,159.

B)$28,496.

C)$18,624.

D)$17,345.

E)$32,110.

The amount of joint costs allocated to product V using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$24,159.

B)$28,496.

C)$18,624.

D)$17,345.

E)$32,110.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

46

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product W using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$18,624.

D)$28,496.

E)$17,345.

The amount of joint costs allocated to product W using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$18,624.

D)$28,496.

E)$17,345.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which is not a common method used to allocate costs under the departmental approach?

A)Dual method.

B)Step method.

C)Reciprocal method.

D)Direct method.

A)Dual method.

B)Step method.

C)Reciprocal method.

D)Direct method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

48

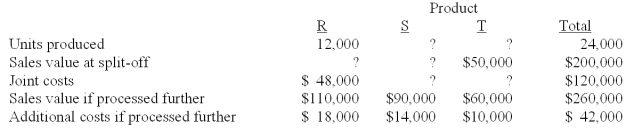

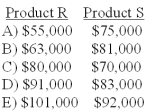

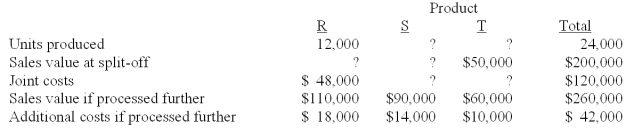

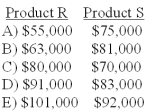

Johns Company manufactures products R,S,and T from a joint process.The following information is available:

Assuming that joint product costs are allocated using the relative-sales-value at split-off approach,what was the sales value at split-off for products R and S?

A)A

B)B

C)C

D)D

E)E

Assuming that joint product costs are allocated using the relative-sales-value at split-off approach,what was the sales value at split-off for products R and S?

A)A

B)B

C)C

D)D

E)E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

49

Place the following phases of the departmental approach in the correct order.

1)Allocate the production department costs to products.

2)Allocate service costs to the overhead costs.

3)Allocate the service department costs to the production department.

4)Trace all direct costs and allocate overhead costs to both the service and production departments.

A)3,4,1,2.

B)4,3,2,1.

C)4,3,1.

D)3,2,1.

E)1,3,2.

1)Allocate the production department costs to products.

2)Allocate service costs to the overhead costs.

3)Allocate the service department costs to the production department.

4)Trace all direct costs and allocate overhead costs to both the service and production departments.

A)3,4,1,2.

B)4,3,2,1.

C)4,3,1.

D)3,2,1.

E)1,3,2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

50

The departmental approach of cost allocation recognizes that the typical manufacturing operation involves which type(s)of departments?

A)Service departments and product departments.

B)Production departments and assembly departments.

C)Joint product departments and separable departments.

D)Cost pools and cost objects.

E)Support departments and other service departments.

A)Service departments and product departments.

B)Production departments and assembly departments.

C)Joint product departments and separable departments.

D)Cost pools and cost objects.

E)Support departments and other service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

51

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product W using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$24,159.

B)$28,496.

C)$18,624.

D)$17,345.

E)$32,110.

The amount of joint costs allocated to product W using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$24,159.

B)$28,496.

C)$18,624.

D)$17,345.

E)$32,110.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

52

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product V using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$18,624.

D)$28,496.

E)$17,345.

The amount of joint costs allocated to product V using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$18,624.

D)$28,496.

E)$17,345.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

53

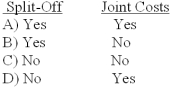

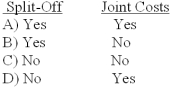

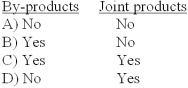

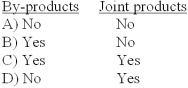

Relative sales value at split-off is used to allocate: Cost Beyond

A)A

B)B

C)C

D)D

A)A

B)B

C)C

D)D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

54

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product U using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$18,624.

D)$28,496.

E)$17,345.

The amount of joint costs allocated to product U using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$19,266.

B)$32,110.

C)$18,624.

D)$28,496.

E)$17,345.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

55

By-product costing approaches include:

A)Activity-based approach.

B)Cost approach.

C)Asset recognition approach.

D)Resource consumption approach.

E)Sales value at split off approach.

A)Activity-based approach.

B)Cost approach.

C)Asset recognition approach.

D)Resource consumption approach.

E)Sales value at split off approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

56

For the purposes of cost accumulation,which of the following are identifiable as different individual products before the split-off point?

A)A

B)B

C)C

D)D

A)A

B)B

C)C

D)D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

57

Net Realizable Value (NRV)of a product is:

A)Split-off cost - profit margin - additional processing and selling cost.

B)Profit at split-off + additional processing and selling cost.

C)Ultimate sales value - additional processing and selling cost.

D)Ultimate sales value + additional processing and selling cost.

E)Cost allocation plus separable cost.

A)Split-off cost - profit margin - additional processing and selling cost.

B)Profit at split-off + additional processing and selling cost.

C)Ultimate sales value - additional processing and selling cost.

D)Ultimate sales value + additional processing and selling cost.

E)Cost allocation plus separable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

58

A key disincentive effect of departmental cost allocation can occur when:

A)Allocated costs are less than external purchase costs

B)Managers do not understand the incentives in the allocation base

C)The allocation base is actual usage

D)The allocation base is budgeted usage

E)The allocation base is greater than usage

A)Allocated costs are less than external purchase costs

B)Managers do not understand the incentives in the allocation base

C)The allocation base is actual usage

D)The allocation base is budgeted usage

E)The allocation base is greater than usage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

59

Russell Co.produces three products - U,V,and W - from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Last year all three products were processed beyond split-off.Joint production costs for the year were $70,000.Sales values and costs needed to evaluate Russell's production policy follow.

The amount of joint costs allocated to product U using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$24,159.

B)$28,496.

C)$18,624.

D)$17,345.

E)$32,110.

The amount of joint costs allocated to product U using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$24,159.

B)$28,496.

C)$18,624.

D)$17,345.

E)$32,110.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is not one of the objectives of cost allocation?

A)Motivate managers to exert a high-level of effort.

B)Provide useful departmental and product costs.

C)Identify production constraints.

D)Provide the right incentive for managers to make decisions.

E)Provide an appropriate basis for performance evaluation.

A)Motivate managers to exert a high-level of effort.

B)Provide useful departmental and product costs.

C)Identify production constraints.

D)Provide the right incentive for managers to make decisions.

E)Provide an appropriate basis for performance evaluation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

61

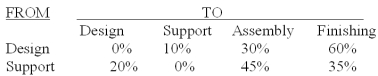

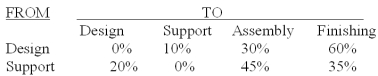

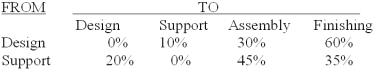

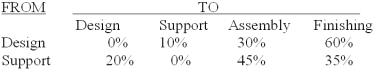

Hartwicke Manufacturing Company has two service departments - product design and engineering support,and two production departments - assembly and finishing.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the finishing department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,890,000.

B)$827,143.

C)$837,750.

D)$1,062,857.

E)$1,033,450.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the finishing department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,890,000.

B)$827,143.

C)$837,750.

D)$1,062,857.

E)$1,033,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

62

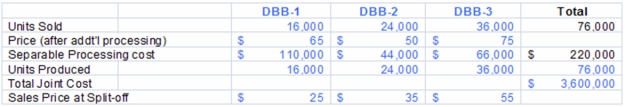

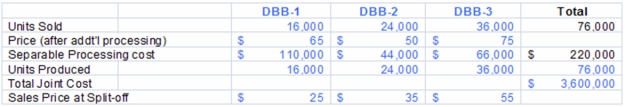

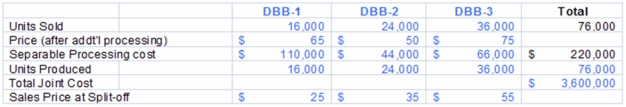

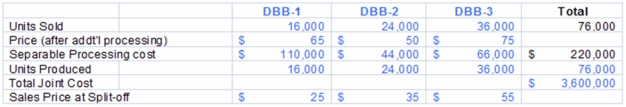

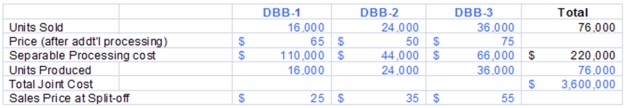

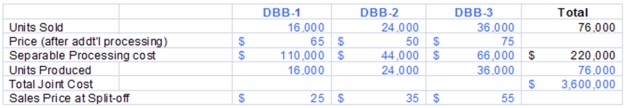

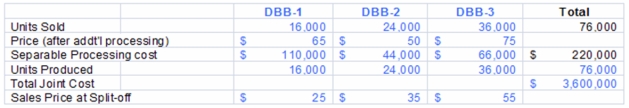

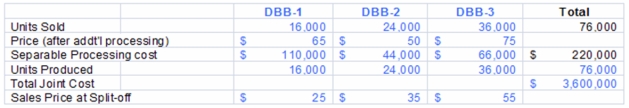

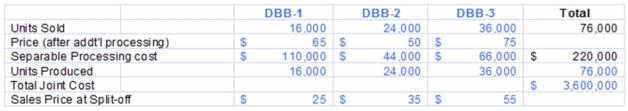

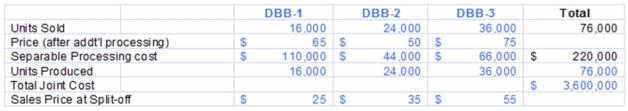

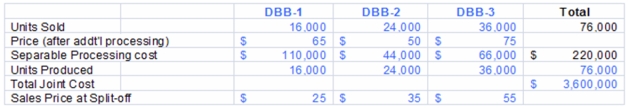

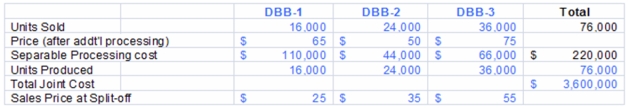

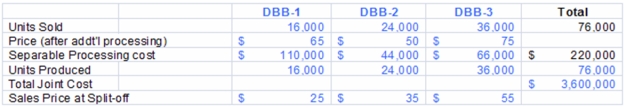

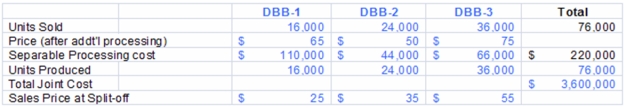

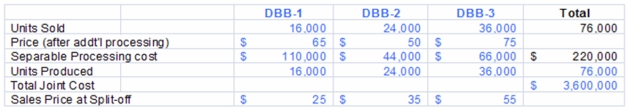

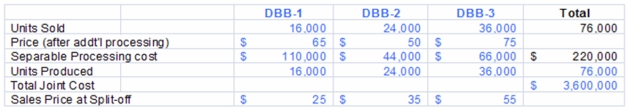

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-2 using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$54,243.

B)$757,895.

C)$1,705,263.

D)$49,202.

E)$1,136,842.

The amount of joint costs allocated to product DBB-2 using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$54,243.

B)$757,895.

C)$1,705,263.

D)$49,202.

E)$1,136,842.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

63

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$37,143.

B)$52,143.

C)$60,000.

D)$97,143.

E)$112,143.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$37,143.

B)$52,143.

C)$60,000.

D)$97,143.

E)$112,143.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

64

Hartwicke Manufacturing Company has two service departments - product design and engineering support,and two production departments - assembly and finishing.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$367,550.

B)$1,890,000.

C)$1,052,250.

D)$995,800.

E)$837,750.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the assembly department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$367,550.

B)$1,890,000.

C)$1,052,250.

D)$995,800.

E)$837,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

65

Hartwicke Manufacturing Company has two service departments - product design and engineering support,and two production departments - assembly and finishing.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the assembly department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,890,000.

B)$827,143.

C)$837,750.

D)$1,062,857.

E)$1,033,450.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the assembly department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,890,000.

B)$827,143.

C)$837,750.

D)$1,062,857.

E)$1,033,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

66

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-1 using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$2,008,983.

B)$286,496.

C)$881,695.

D)$667,345.

E)$709,322.

The amount of joint costs allocated to product DBB-1 using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$2,008,983.

B)$286,496.

C)$881,695.

D)$667,345.

E)$709,322.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the sales department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$14,588.

B)$84,588.

C)$107,529.

D)$160,000.

E)$177,529.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the sales department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$14,588.

B)$84,588.

C)$107,529.

D)$160,000.

E)$177,529.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

68

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-3 using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$54,243.

B)$757,895.

C)$1,705,263.

D)$49,202.

E)$1,136,842.

The amount of joint costs allocated to product DBB-3 using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$54,243.

B)$757,895.

C)$1,705,263.

D)$49,202.

E)$1,136,842.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

69

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-1 using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$939,130.

B)$216,870.

C)$447,205.

D)$420,335.

E)$2,213,665.

The amount of joint costs allocated to product DBB-1 using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$939,130.

B)$216,870.

C)$447,205.

D)$420,335.

E)$2,213,665.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

70

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$112,471.

B)$122,471.

C)$130,000.

D)$142,471.

E)$150,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the marketing department using the reciprocal method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$112,471.

B)$122,471.

C)$130,000.

D)$142,471.

E)$150,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

71

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-3 using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$939,130.

B)$216,870.

C)$447,205.

D)$420,335.

E)$2,213,665.

The amount of joint costs allocated to product DBB-3 using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$939,130.

B)$216,870.

C)$447,205.

D)$420,335.

E)$2,213,665.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

72

Hartwicke Manufacturing Company has two service departments - product design and engineering support,and two production departments - assembly and finishing.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,055,000.

B)$1,890,000.

C)$835,000.

D)$645,000.

E)$723,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the assembly department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,055,000.

B)$1,890,000.

C)$835,000.

D)$645,000.

E)$723,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

73

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-1 using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$54,243.

B)$757,895.

C)$1,705,263.

D)$49,202.

E)$1,136,842.

The amount of joint costs allocated to product DBB-1 using the physical measure method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$54,243.

B)$757,895.

C)$1,705,263.

D)$49,202.

E)$1,136,842.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

74

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$939,130.

B)$216,870.

C)$447,205.

D)$420,335.

E)$2,213,665.

The amount of joint costs allocated to product DBB-2 using the sales value at split-off method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$939,130.

B)$216,870.

C)$447,205.

D)$420,335.

E)$2,213,665.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

75

Hartwicke Manufacturing Company has two service departments - product design and engineering support,and two production departments - assembly and finishing.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000;Engineering Support $240,000;Assembly $660,000;Finishing $870,000.The total cost accumulated in the finishing department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$367,550.

B)$1,890,000.

C)$1,052,250.

D)$995,800.

E)$837,750.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000;Engineering Support $240,000;Assembly $660,000;Finishing $870,000.The total cost accumulated in the finishing department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$367,550.

B)$1,890,000.

C)$1,052,250.

D)$995,800.

E)$837,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

76

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-2 using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$2,008,983.

B)$286,496.

C)$881,695.

D)$667,345.

E)$709,322.

The amount of joint costs allocated to product DBB-2 using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$2,008,983.

B)$286,496.

C)$881,695.

D)$667,345.

E)$709,322.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

77

Marin Products produces three products - DBB-1,DBB-2,and DBB-3 from a joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Key information about Marin's production,sales,and costs follows.

The amount of joint costs allocated to product DBB-3 using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$2,008,983.

B)$286,496.

C)$881,695.

D)$667,345.

E)$709,322.

The amount of joint costs allocated to product DBB-3 using the net realizable value method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$2,008,983.

B)$286,496.

C)$881,695.

D)$667,345.

E)$709,322.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

78

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the sales department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$37,143.

B)$70,000.

C)$100,000.

D)$107,143.

E)$137,143.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the sales department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$37,143.

B)$70,000.

C)$100,000.

D)$107,143.

E)$137,143.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

79

The Insurance Plus Company has two service departments - actuarial and premium rating,and two production departments - marketing and sales.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the sales department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$70,000.

B)$107,857.

C)$127,857.

D)$137,857.

E)$140,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Actuarial $50,000.Premium Rating $40,000.Marketing $60,000.Sales $70,000.The total cost accumulated in the sales department using the step method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$70,000.

B)$107,857.

C)$127,857.

D)$137,857.

E)$140,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

80

Hartwicke Manufacturing Company has two service departments - product design and engineering support,and two production departments - assembly and finishing.The distribution of each service department's efforts to the other departments is shown below:

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the finishing department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,055,000.

B)$1,890,000.

C)$835,000.

D)$645,000.

E)$723,000.

The direct operating costs of the departments (including both variable and fixed costs)were as follows: Design $120,000.Engineering Support $240,000.Assembly $660,000.Finishing $870,000.The total cost accumulated in the finishing department using the direct method is (calculate all ratios and percentages to 4 decimal places,for example 33.3333%,and round all dollar amounts to the nearest whole dollar):

A)$1,055,000.

B)$1,890,000.

C)$835,000.

D)$645,000.

E)$723,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck