Deck 23: Managing Risk Off the Balance Sheet With Derivative Securities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 23: Managing Risk Off the Balance Sheet With Derivative Securities

1

The buyer of an American-style bond call option has the right,but not the obligation,to sell the bond at a set price until the option expires.

False

2

An FI with DA < kDL may choose to enter into a long-term swap in which it pays a fixed rate of interest and receives a variable rate in order to effectively reduce the duration gap.

False

3

A spot contract is an immediate delivery versus payment contract.

True

4

Gains and losses on a futures contract must be recognized daily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

5

Swaps and forwards are subject to contingent risk; exchange-traded futures and options are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

A bank with a negative repricing gap could enter into a swap to pay a fixed rate of interest and receive a variable rate of interest to effectively reduce its repricing gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

Buying a cap is similar to buying a call option on bond prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

As interest rates fall,bond prices and call option potential profits increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

Futures contracts are not subject to capital requirements for banks,but many forward contracts are.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

10

A U.S. corporation has a yen-denominated loan it must repay in six months. A long position in yen futures could help offset the corporation's foreign exchange risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

Swaps are usually the best hedging tool to use to hedge long-term risks of four or five years or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

A bank has a positive repricing gap and wishes to protect its profits from an unfavorable interest rate move. Purchasing a cap will help limit this bank's interest rate risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

The writer of an American-style bond call option has the right,but not the obligation,to buy the bond at a preset price until the option expires.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

Writing a call option on a bond pays off if interest rates rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

The lack of perfect correlation between spot and futures prices implies that most hedges will have some basis risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

A fixed-floating interest rate swap is called a plain vanilla swap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

17

A purchaser of a bond call option gains if interest rates fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

The maximum gain (ignoring commissions and taxes)from buying an at-the-money bond put option is the bond price at time of option purchase less the put premium. The maximum loss is the put premium.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

19

Basis risk is the risk that the prices or value of the underlying spot and the derivatives instrument used to hedge do not move predictably relative to one another.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

20

A macrohedge is a hedge of a particular asset or liability exposure to a change in a macroeconomic variable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following requires daily cash flow settlements between the parties?

A)Forward contract

B)Futures contract

C)Purchased options contract

D)Swap contract

E)Collars

A)Forward contract

B)Futures contract

C)Purchased options contract

D)Swap contract

E)Collars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

An FI has long-term fixed-rate assets funded by short-term variable-rate liabilities. To protect the equity value,the FI may engage in a swap to pay a _____ rate and receive a _____ interest.

A)fixed; variable

B)variable; variable

C)variable; fixed

D)fixed; fixed

A)fixed; variable

B)variable; variable

C)variable; fixed

D)fixed; fixed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

An FI with DA > kDL could do which of the following to reduce the duration gap?

A)Engage in a swap and pay a variable rate and receive a fixed rate of interest

B)Sell bond futures contracts

C)Buy bonds forward

D)Buy bond call options

E)None of the options

A)Engage in a swap and pay a variable rate and receive a fixed rate of interest

B)Sell bond futures contracts

C)Buy bonds forward

D)Buy bond call options

E)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

The largest two categories of swaps are

A)credit risk and interest rate swaps.

B)currency and commodity swaps.

C)interest rate and currency swaps.

D)equity and interest rate swaps.

E)none of the options.

A)credit risk and interest rate swaps.

B)currency and commodity swaps.

C)interest rate and currency swaps.

D)equity and interest rate swaps.

E)none of the options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

A bondholder owns 15-year government bonds with a $5 million face value and a 6 percent coupon that is paid annually. The bonds are currently priced at $550,018.73 with a yield of 5.034 percent. The bonds have a duration of 10.53 years. If interest rates are projected to increase by 50 basis points,how much will the bondholder gain or lose?

A)$27,571

B)$25,063

C)-$27,571

D)-$25,063

E)$5,313

A)$27,571

B)$25,063

C)-$27,571

D)-$25,063

E)$5,313

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following are potentially subject to risk-based capital requirements?

A)Swaps and futures

B)Swaps and forwards

C)Forwards and futures

D)Purchased option positions and futures

E)Purchased option positions and swaps

A)Swaps and futures

B)Swaps and forwards

C)Forwards and futures

D)Purchased option positions and futures

E)Purchased option positions and swaps

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

A forward contract

A)is marked to market.

B)has significant default risk.

C)is standardized.

D)is traded over the counter.

E)is highly liquid.

A)is marked to market.

B)has significant default risk.

C)is standardized.

D)is traded over the counter.

E)is highly liquid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

A bond portfolio manager has a $25 million market value bond portfolio with a six-year duration. The manager believes interest rates may increase 50 basis points. Which of the following could be used to help limit his risk?

I) Sell the bonds forward.

II) Buy bond futures contracts.

III) Buy call options on the bonds.

IV) Buy put options on the bonds.

A)I only

B)II only

C)I and III only

D)I and IV only

E)II and III only

I) Sell the bonds forward.

II) Buy bond futures contracts.

III) Buy call options on the bonds.

IV) Buy put options on the bonds.

A)I only

B)II only

C)I and III only

D)I and IV only

E)II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following bond option positions increase in value when interest rates increase?

A)Long call; written put

B)Long put; written call

C)Long put; long call

D)Written put; written call

A)Long call; written put

B)Long put; written call

C)Long put; long call

D)Written put; written call

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

Plain vanilla interest rate swaps are exchanges of

A)principal only.

B)interest only.

C)principal and interest.

D)principal and currency.

E)interest rate and currency.

A)principal only.

B)interest only.

C)principal and interest.

D)principal and currency.

E)interest rate and currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

A macrohedge is a

A)hedge of a particular asset or liability.

B)hedge of an entire balance sheet.

C)hedge using options.

D)hedge without basis risk.

E)hedge using futures on macroeconomic variables.

A)hedge of a particular asset or liability.

B)hedge of an entire balance sheet.

C)hedge using options.

D)hedge without basis risk.

E)hedge using futures on macroeconomic variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

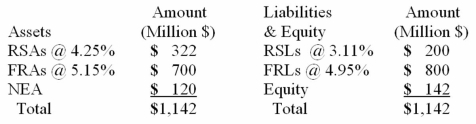

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL)and fixed-rate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given:  If we were to design a macrohedge,which of the following positions would help reduce the bank's interest rate risk?

If we were to design a macrohedge,which of the following positions would help reduce the bank's interest rate risk?

I) Long position in bond futures contracts

II) Buying put options on bonds

III) Purchasing an interest rate cap

A)I only

B)II only

C)III only

D)I and III only

E)II and III only

If we were to design a macrohedge,which of the following positions would help reduce the bank's interest rate risk?

If we were to design a macrohedge,which of the following positions would help reduce the bank's interest rate risk?I) Long position in bond futures contracts

II) Buying put options on bonds

III) Purchasing an interest rate cap

A)I only

B)II only

C)III only

D)I and III only

E)II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

A microhedge is a

A)hedge of a particular asset or liability.

B)hedge against a change in a particular macro variable.

C)hedge of an entire balance sheet.

D)hedge using options.

E)hedge without basis risk.

A)hedge of a particular asset or liability.

B)hedge against a change in a particular macro variable.

C)hedge of an entire balance sheet.

D)hedge using options.

E)hedge without basis risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

The price of a bond rises from 98 to par. Even if you do nothing,this would still result in an immediately recognized loss on a _____________ on a bond,and a paper gain on a bond ______________.

A)long forward contract; call option

B)short futures contract; call option

C)call option; put option

D)short futures contract; put option

E)short forward contract; call option

A)long forward contract; call option

B)short futures contract; call option

C)call option; put option

D)short futures contract; put option

E)short forward contract; call option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

The profits on a derivatives position are fixed when a bond's price falls below a certain point,but above that point the profits fall when the bond price rises. This profit profile fits which of the following positions?

A)Purchased call option

B)Written call option

C)Purchased put option

D)Written put option

A)Purchased call option

B)Written call option

C)Purchased put option

D)Written put option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

The safest way to hedge a bond liability with options is to

A)purchase a call option on the bond.

B)write a call option on the bond.

C)purchase a put option on the bond.

D)write a put option on the bond.

A)purchase a call option on the bond.

B)write a call option on the bond.

C)purchase a put option on the bond.

D)write a put option on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

For a bond put option,the _____ the exercise price,the greater the cost of the put,and for a bond call option,the _____ the exercise price,the higher the cost of the call option.

A)higher; higher

B)lower; lower

C)higher; lower

D)lower; higher

A)higher; higher

B)lower; lower

C)higher; lower

D)lower; higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

A _____ position in T-bond futures should be used to hedge falling interest rates and a _____ position in T-bond futures should be used to hedge falling bond prices.

A)long; short

B)long; long

C)short; long

D)short; short

A)long; short

B)long; long

C)short; long

D)short; short

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

Basis risk occurs because it is generally impossible to

A)hedge unanticipated rate changes.

B)exactly predict interest rate changes.

C)exactly match the terms of the hedging instrument with the terms of the asset or liability at risk.

D)find negatively correlated asset prices.

E)All of the options.

A)hedge unanticipated rate changes.

B)exactly predict interest rate changes.

C)exactly match the terms of the hedging instrument with the terms of the asset or liability at risk.

D)find negatively correlated asset prices.

E)All of the options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

The safest way to hedge a bond asset with options is to

A)purchase a call option on the bond.

B)write a call option on the bond.

C)purchase a put option on the bond.

D)write a put option on the bond.

A)purchase a call option on the bond.

B)write a call option on the bond.

C)purchase a put option on the bond.

D)write a put option on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

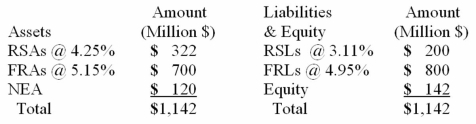

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL)and fixed-rate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given:  If the bank wishes to set up a swap to totally hedge the interest rate risk,the bank should

If the bank wishes to set up a swap to totally hedge the interest rate risk,the bank should

A)pay a variable rate of interest and receive a fixed rate of interest.

B)pay a fixed rate of interest and receive a variable rate of interest.

C)pay a variable rate of interest and receive a variable rate of interest.

D)pay a fixed rate of interest and receive a fixed rate of interest.

If the bank wishes to set up a swap to totally hedge the interest rate risk,the bank should

If the bank wishes to set up a swap to totally hedge the interest rate risk,the bank shouldA)pay a variable rate of interest and receive a fixed rate of interest.

B)pay a fixed rate of interest and receive a variable rate of interest.

C)pay a variable rate of interest and receive a variable rate of interest.

D)pay a fixed rate of interest and receive a fixed rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

In terms of direct costs,are futures or options likely to be a more expensive form of hedging?

Why?

In terms of opportunity costs,which is more expensive?

Why?

Why?

In terms of opportunity costs,which is more expensive?

Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

A U.S. bank has deposit liabilities denominated in euros that must be repaid in two years. The deposits pay a fixed interest rate of 4 percent. The bank took the money raised and converted it to dollars,whereupon it lent the dollars to a corporate customer that will repay the bank over the next two years in dollars at a variable rate of interest equal to LIBOR +3 percent. The interest rate earned may change every six months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

A U.S. firm is earning British pounds from its foreign subsidiary. A UK firm is earning dollars from its U.S. subsidiary. Neither firm can borrow at a cost-effective rate outside of its home country/currency. What kind of swap could be used to limit the FX risk of both firms and explain the payment flows involved?

(Be specific.)

(Be specific.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

Is it safer to hedge a contingent liability with options,futures,forwards,or swaps?

Explain.

Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

A bank wishes to hedge its $25 million face value bond portfolio (currently priced at 106 percent of par). The bond portfolio has a duration of five years. It will hedge with put options that have a delta of 0.67. The bond underlying the option contract has a market value of $112,000 and a duration of eight years. How many put options are needed?

Assume that there is no basis risk on the hedge.

Assume that there is no basis risk on the hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

An FI has DA = 2.45 years and kDL = 0.97 years. The FI has total assets equal to $375 million. The FI wishes to effectively reduce the duration gap to one year by hedging with T-bond futures that have a market value of $115,000 and a DFut = 8 years. How many contracts are needed and should the FI buy or sell them?

(D = Duration)

(D = Duration)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

A naïve hedge is one

A)in which the hedger is not fully informed.

B)in which the hedger attempts to eliminate all of the risk of the underlying spot position.

C)in which the hedger uses microhedges rather than macrohedges to limit risk.

D)in which the hedger unwittingly increases the risk of the FI's position.

E)that does not have to be reported on the FI's financial statements.

A)in which the hedger is not fully informed.

B)in which the hedger attempts to eliminate all of the risk of the underlying spot position.

C)in which the hedger uses microhedges rather than macrohedges to limit risk.

D)in which the hedger unwittingly increases the risk of the FI's position.

E)that does not have to be reported on the FI's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

A regional bank negotiates the purchase of a one-year interest rate cap with a cap rate of 5.45 percent with a large bank. The option has a notional principle of $2 million and costs $3,400. In one year,interest rates are 6.33 percent. The regional bank's net profit,ignoring commissions and taxes,was

A)$105,600.

B)$18,400.

C)$17,600.

D)$14,200.

E)$11,500.

A)$105,600.

B)$18,400.

C)$17,600.

D)$14,200.

E)$11,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

The primary federal banks' regulators have established guidelines for derivatives usage at banks that includes the following:

I) Banks must establish internal guidelines regarding hedging activity.

II) Banks must establish trading limits.

III) Banks are prohibited from using derivatives to speculate.

IV) Banks must disclose large derivatives positions that may materially affect stakeholders in their financial statements.

A)I and II only

B)I,III,and IV only

C)I,II,and IV only

D)II,III,and IV only

E)I,II,III,and IV

I) Banks must establish internal guidelines regarding hedging activity.

II) Banks must establish trading limits.

III) Banks are prohibited from using derivatives to speculate.

IV) Banks must disclose large derivatives positions that may materially affect stakeholders in their financial statements.

A)I and II only

B)I,III,and IV only

C)I,II,and IV only

D)II,III,and IV only

E)I,II,III,and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

A U.S. corporation is bidding on a revenue-generating contract in England. If the corporation gets the bid,it will be paid in pounds. (A)If the managers are risk averse,can hedging increase the likelihood that the U.S. firm gets the bid?

Explain. (B)In this situation,should the corporation hedge with options,futures,or forwards?

Explain.

Explain. (B)In this situation,should the corporation hedge with options,futures,or forwards?

Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

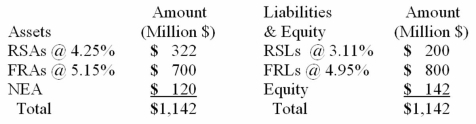

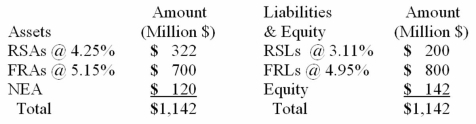

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL)and fixed-rate assets and liabilities (FRAs and FRLs); the rate of return and cost rates on the accounts are also given:  Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

A)$202,600

B)-$202,600

C)$300,000

D)-$195,200

E)$195,200

Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?A)$202,600

B)-$202,600

C)$300,000

D)-$195,200

E)$195,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

In 2013,only about _____ of the largest banks actively used derivatives.

A)750

B)830

C)940

D)990

E)1,400

A)750

B)830

C)940

D)990

E)1,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

A thrift purchases a one-year interest rate floor with a floor rate of 4.23 percent from a large bank. The option has a notional principal of $1 million and costs $2,000. If in one year,interest rates are 3 percent,the thrift's net profit,ignoring commissions and taxes,was _____ ; and if in one year,interest rates were 2 percent,the thrift's net profit was _____.

A)$0; $7,500

B)$8,800; -$2,000

C)$8,800; $0

D)$29,500; -$2,000

E)$29,500; $0

A)$0; $7,500

B)$8,800; -$2,000

C)$8,800; $0

D)$29,500; -$2,000

E)$29,500; $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

Why is the credit risk on a plain vanilla interest rate swap generally less than the credit risk of a loan with an equivalent (notional)principal amount?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

A bank wishes to hedge its $30 million face value bond portfolio (currently priced at 99 percent of par). The bond portfolio has a duration of 9.75 years. It will hedge with T-bond futures ($100,000 face)priced at 98 percent of par. The duration of the T-bonds to be delivered is nine years. How many contracts are needed to hedge?

Should the contracts be bought or sold?

Ignore basis risk.

Should the contracts be bought or sold?

Ignore basis risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

Draw a graph of the gains and losses from owning a bond and simultaneously buying a put on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

What are the advantages and disadvantages of forwards versus futures contracts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

A U.S. bank has deposit liabilities denominated in euros that must be repaid in two years. The deposits pay a fixed interest rate of 4 percent. The bank took the money raised and converted it to dollars,whereupon it lent the dollars to a corporate customer that will repay the bank over the next two years in dollars at a variable rate of interest equal to LIBOR +3 percent. The interest rate earned may change every six months.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

Your firm has sold long-term government bonds short on a when-issued basis; your firm must purchase the bonds and deliver them when they are issued in six months. To hedge this risk,you could I. buy at-the-money put options on bonds.

II) sell bond futures contracts.

III) write at-the-money call options on bonds.

A)I only

B)II only

C)I and III only

D)II and III only

E)None of these choices would hedge the risk

II) sell bond futures contracts.

III) write at-the-money call options on bonds.

A)I only

B)II only

C)I and III only

D)II and III only

E)None of these choices would hedge the risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

A $995 million bank has a negative repricing gap equal to 6 percent of assets. The bank is currently paying 4.5 percent on its rate-sensitive liabilities. These rates will vary as interest rates move. The managers wish to reduce the effective repricing gap to zero with an interest rate cap or floor. A one-year cap is available with a 5 percent cap rate and a one-year floor is available at a floor rate of 4 percent.

(a)Suggest a position using either the cap or the floor (but not both)that will limit the bank's interest rate risk. Explain.

(b)Suppose that interest rates are volatile this year and the cap costs $275,000 and the floor costs $195,000. Suggest a collar that helps limit the bank's cost of hedging. How does the collar affect the bank's risk?

(a)Suggest a position using either the cap or the floor (but not both)that will limit the bank's interest rate risk. Explain.

(b)Suppose that interest rates are volatile this year and the cap costs $275,000 and the floor costs $195,000. Suggest a collar that helps limit the bank's cost of hedging. How does the collar affect the bank's risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

A bank wishes to reduce its duration gap from 1.2 years to zero by using put options. The bank has $800 million in assets. The underlying bonds on the puts are valued at $115,000 and have a duration of four years. The put options have a delta of 0.58. How many put options are needed?

Assume that there is no basis risk on the hedge.

Assume that there is no basis risk on the hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck