Deck 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/93

العب

ملء الشاشة (f)

Deck 7: Foreign Currency Transactions and Hedging Foreign Exchange Risk

1

The forward rate may be defined as

A)The price a foreign currency can be purchased or sold today.

B)The price today at which a foreign currency can be purchased or sold in the future.

C)The forecasted future value of a foreign currency.

D)The U.S. dollar value of a foreign currency.

E)The Euro value of a foreign currency.

A)The price a foreign currency can be purchased or sold today.

B)The price today at which a foreign currency can be purchased or sold in the future.

C)The forecasted future value of a foreign currency.

D)The U.S. dollar value of a foreign currency.

E)The Euro value of a foreign currency.

B

2

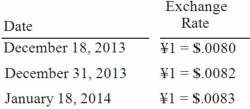

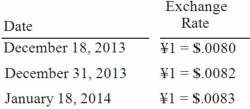

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2013, with payment of 10 million Korean won to be received on January 15, 2014. The following exchange rates applied: Assuming a forward contract was entered into, the foreign currency was originally sold in the foreign currency market on December 16, 2013 at a

A)forward contract discount $600.

B)forward contract premium $600.

C)forward contract discount $980.

D)forward discount premium $980.

E)There is no premium or discount because the fair value of the contract is zero.

A)forward contract discount $600.

B)forward contract premium $600.

C)forward contract discount $980.

D)forward discount premium $980.

E)There is no premium or discount because the fair value of the contract is zero.

forward contract premium $600.

3

A spot rate may be defined as

A)The price a foreign currency can be purchased or sold today.

B)The price today at which a foreign currency can be purchased or sold in the future.

C)The forecasted future value of a foreign currency.

D)The U.S. dollar value of a foreign currency.

E)The Euro value of a foreign currency.

A)The price a foreign currency can be purchased or sold today.

B)The price today at which a foreign currency can be purchased or sold in the future.

C)The forecasted future value of a foreign currency.

D)The U.S. dollar value of a foreign currency.

E)The Euro value of a foreign currency.

A

4

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2013, with payment of 10 million Korean won to be received on January 15, 2014. The following exchange rates applied: Assuming a forward contract was not entered into, what would be the net impact on Car Corp.'s 2013 income statement related to this transaction?

A)$500 (gain).

B)$500 (loss).

C)$200 (gain).

D)$200 (loss).

E)$- 0 -

A)$500 (gain).

B)$500 (loss).

C)$200 (gain).

D)$200 (loss).

E)$- 0 -

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

5

Brisco Bricks purchases raw material from its foreign supplier, Bolivian Clay, on May 8. Payment of 2,000,000 foreign currency units (FC) is due in 30 days. May 31 is Brisco's fiscal year-end. The pertinent exchange rates were as follows: How much U.S. $ will it cost Brisco to finally pay the payable on June 7?

A)$1,666,667.

B)$2,440,000.

C)$2,520,000.

D)$2,500,000.

E)$2,400,000.

A)$1,666,667.

B)$2,440,000.

C)$2,520,000.

D)$2,500,000.

E)$2,400,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

6

Meisner Co. ordered parts costing §100,000 for a foreign supplier on May 12 when the spot rate was $.24 per stickle. A one-month forward contract was signed on that date to purchase §100,000 at a forward rate of $.25 per stickle. On June 12, when the parts were received and payment was made, the spot rate was $.28 per stickle. At what amount should inventory be reported?

A)$0.

B)$28,000.

C)$24,000.

D)$25,000.

E)$2,000.

A)$0.

B)$28,000.

C)$24,000.

D)$25,000.

E)$2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

7

Norton Co., a U.S. corporation, sold inventory on December 1, 2013, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: What amount of foreign exchange gain or loss should be recorded on January 30?

A)$1,516 gain.

B)$1,516 loss.

C)$575 loss.

D)$500 loss.

E)$500 gain.

A)$1,516 gain.

B)$1,516 loss.

C)$575 loss.

D)$500 loss.

E)$500 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which statement is true regarding a foreign currency option?

A)A foreign currency option gives the holder the obligation to buy or sell foreign currency in the future.

B)A foreign currency option gives the holder the obligation only sell foreign currency in the future.

C)A foreign currency option gives the holder the obligation to only buy foreign currency in the future.

D)A foreign currency option gives the holder the right but not the obligation to buy or sell foreign currency in the future.

E)A foreign currency option gives the holder the obligation to buy or sell foreign currency in the future at the spot rate on the future date.

A)A foreign currency option gives the holder the obligation to buy or sell foreign currency in the future.

B)A foreign currency option gives the holder the obligation only sell foreign currency in the future.

C)A foreign currency option gives the holder the obligation to only buy foreign currency in the future.

D)A foreign currency option gives the holder the right but not the obligation to buy or sell foreign currency in the future.

E)A foreign currency option gives the holder the obligation to buy or sell foreign currency in the future at the spot rate on the future date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

9

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2013, with payment of 10 million Korean won to be received on January 15, 2014. The following exchange rates applied: Assuming a forward contract was entered into, what would be the net impact on Car Corp.'s 2013 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

A)$700 (gain).

B)$700 (loss).

C)$300 (gain).

D)$300 (loss).

E)$297 (gain).

A)$700 (gain).

B)$700 (loss).

C)$300 (gain).

D)$300 (loss).

E)$297 (gain).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

10

Brisco Bricks purchases raw material from its foreign supplier, Bolivian Clay, on May 8. Payment of 2,000,000 foreign currency units (FC) is due in 30 days. May 31 is Brisco's fiscal year-end. The pertinent exchange rates were as follows: How much Foreign Exchange Gain or Loss should Brisco record on May 31?

A)$2,520,000 gain.

B)$20,000 gain.

C)$20,000 loss.

D)$80,000 gain.

E)$80,000 loss.

A)$2,520,000 gain.

B)$20,000 gain.

C)$20,000 loss.

D)$80,000 gain.

E)$80,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

11

Belsen purchased inventory on December 1, 2012. Payment of 200,000 stickles was to be made in sixty days. Also on December 1, Belsen signed a contract to purchase §200,000 in sixty days. The spot rate was §1 = .35714, and the 60-day forward rate was §1 = $.38462. On December 31, the spot rate was §1 = .34483 and the 30-day forward rate was §1 = .38168. Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901. In the journal entry to record the establishment of a forward exchange contract, at what amount should the Forward Contract account be recorded on December 1?

A)$71,428.

B)$76,924.

C)$588.

D)$582.

E)$0, since there is no cost, there is no value for the contract at this date.

A)$71,428.

B)$76,924.

C)$588.

D)$582.

E)$0, since there is no cost, there is no value for the contract at this date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

12

Brisco Bricks purchases raw material from its foreign supplier, Bolivian Clay, on May 8. Payment of 2,000,000 foreign currency units (FC) is due in 30 days. May 31 is Brisco's fiscal year-end. The pertinent exchange rates were as follows: For what amount should Brisco's Accounts Payable be credited on May 8?

A)$2,500,000.

B)$2,440,000.

C)$1,600,000.

D)$1,639,344.

E)$1,666,667.

A)$2,500,000.

B)$2,440,000.

C)$1,600,000.

D)$1,639,344.

E)$1,666,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

13

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2013, with payment of 10 million Korean won to be received on January 15, 2014. The following exchange rates applied: Assuming a forward contract was entered into on December 16, what would be the net impact on Car Corp.'s 2014 income statement related to this transaction?

A)$500 (gain).

B)$303 (gain).

C)$300 (gain).

D)$300 (loss).

E)$0.

A)$500 (gain).

B)$303 (gain).

C)$300 (gain).

D)$300 (loss).

E)$0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

14

Mills Inc. had a receivable from a foreign customer that is due in the local currency of the customer (stickles). On December 31, 2012, this receivable for §200,000 was correctly included in Mills' balance sheet at $132,000. When the receivable was collected on February 15, 2013, the U.S. dollar equivalent was $144,000. In Mills' 2013 consolidated income statement, how much should have been reported as a foreign exchange gain?

A)$0.

B)$36,000.

C)$48,000.

D)$10,000.

E)$12,000.

A)$0.

B)$36,000.

C)$48,000.

D)$10,000.

E)$12,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

15

On June 1, CamCo received a signed agreement to sell inventory for ×500,000. The sale would take place in 90 days. CamCo immediately signed a 90-day forward contract to sell the yen as soon as they are received. The spot rate on June 1 was ×1 = $.004167, and the 90-day forward rate was ×1 = $.00427. At what amount would CamCo record the Forward Contract on June 1?

A)$2,083.

B)$0.

C)$2,110.

D)$2,532.

E)$2,135.

A)$2,083.

B)$0.

C)$2,110.

D)$2,532.

E)$2,135.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

16

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2013, with payment of 10 million Korean won to be received on January 15, 2014. The following exchange rates applied: Assuming a forward contract was entered into, at what amount should the forward contract be recorded at December 31, 2013? Assume an annual interest rate of 12% and a fair value hedge. The present value for one month at 12% is .9901.

A)$200.

B)$295.

C)$495.

D)$500.

E)$9,300.

A)$200.

B)$295.

C)$495.

D)$500.

E)$9,300.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

17

Norton Co., a U.S. corporation, sold inventory on December 1, 2013, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: For what amount should Sales be credited on December 1?

A)$5,500.

B)$16,949.

C)$18,182.

D)$17,241.

E)$16,667.

A)$5,500.

B)$16,949.

C)$18,182.

D)$17,241.

E)$16,667.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

18

Pigskin Co., a U.S. corporation, sold inventory on credit to a British company on April 8, 2013. Pigskin received payment of 35,000 British pounds on May 8, 2013. The exchange rate was ≤1 = $1.54 on April 8 and ≤1 = 1.43 on May 8. What amount of foreign exchange gain or loss should be recognized? (round to the nearest dollar)

A)$10,500 loss

B)$10,500 gain

C)$1,750 loss

D)$3,850 loss

E)No gain or loss should be recognized.

A)$10,500 loss

B)$10,500 gain

C)$1,750 loss

D)$3,850 loss

E)No gain or loss should be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

19

Norton Co., a U.S. corporation, sold inventory on December 1, 2013, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows: What amount of foreign exchange gain or loss should be recorded on December 31?

A)$300 gain.

B)$300 loss.

C)$0.

D)$941 loss.

E)$941 gain.

A)$300 gain.

B)$300 loss.

C)$0.

D)$941 loss.

E)$941 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

20

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2013, with payment of 10 million Korean won to be received on January 15, 2014. The following exchange rates applied: Assuming a forward contract was entered into, how would the forward contract be reflected on Car's December 31, 2013 balance sheet?

A)Forward contract (asset).

B)Forward contract (liability).

C)Foreign currency (asset).

D)Foreign currency (liability).

E)Foreign exchange (liability).

A)Forward contract (asset).

B)Forward contract (liability).

C)Foreign currency (asset).

D)Foreign currency (liability).

E)Foreign exchange (liability).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

21

A U.S. company buys merchandise from a foreign company denominated in U.S. dollars. Which of the following statements is true?

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange gain will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)Any gain or loss will be included in comprehensive income.

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange gain will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)Any gain or loss will be included in comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

22

On December 1, 2013, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2014. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2013. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow: Compute the U.S. dollars received on February 1, 2014.

A)$138,000.

B)$136,500.

C)$145,500.

D)$141,000.

E)$142,500.

A)$138,000.

B)$136,500.

C)$145,500.

D)$141,000.

E)$142,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

23

A company has a discount on a forward contract for a foreign currency denominated asset. How is the discount recognized over the life of the contract under fair value hedge accounting?

A)As a debit to discount expense.

B)As a debit to amortization expense.

C)As a debit to accumulated other comprehensive income.

D)As a debit impact on net income, as a result of the hedge.

E)As a decreases to sales.

A)As a debit to discount expense.

B)As a debit to amortization expense.

C)As a debit to accumulated other comprehensive income.

D)As a debit impact on net income, as a result of the hedge.

E)As a decreases to sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

24

On December 1, 2013, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2014. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2013. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow: Compute the fair value of the foreign currency option at February 1, 2014.

A)$6,000.

B)$4,500.

C)$3,000.

D)$7,500.

E)$1,500.

A)$6,000.

B)$4,500.

C)$3,000.

D)$7,500.

E)$1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following statements is true concerning hedge accounting?

A)Hedges of foreign currency firm commitments are used for future sales only.

B)Hedges of foreign currency firm commitments are used for future purchases only.

C)Hedges of foreign currency firm commitments are used for current sales or purchases.

D)Hedges of foreign currency firm commitments are used for future sales or purchases.

E)Hedges of foreign currency firm commitments are speculative in nature.

A)Hedges of foreign currency firm commitments are used for future sales only.

B)Hedges of foreign currency firm commitments are used for future purchases only.

C)Hedges of foreign currency firm commitments are used for current sales or purchases.

D)Hedges of foreign currency firm commitments are used for future sales or purchases.

E)Hedges of foreign currency firm commitments are speculative in nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

26

All of the following data may be needed to determine the fair value of a forward contract at any point in time except

A)The forward rate when the forward contract was entered into.

B)The current forward rate for a contract that matures on the same date as the forward contract entered into.

C)The future spot rate.

D)A discount rate.

E)The company's incremental borrowing rate.

A)The forward rate when the forward contract was entered into.

B)The current forward rate for a contract that matures on the same date as the forward contract entered into.

C)The future spot rate.

D)A discount rate.

E)The company's incremental borrowing rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

27

All of the following hedges are used for future purchase/sale transactions except

A)Forward contracts used as a fair value hedge of a firm commitment.

B)Options used as a fair value hedge of a firm commitment.

C)Option contract cash flow hedge of a forecasted transaction.

D)Forward contract cash flow hedges of a forecasted transaction.

E)Forward contracts used to hedge a foreign currency denominated liability.

A)Forward contracts used as a fair value hedge of a firm commitment.

B)Options used as a fair value hedge of a firm commitment.

C)Option contract cash flow hedge of a forecasted transaction.

D)Forward contract cash flow hedges of a forecasted transaction.

E)Forward contracts used to hedge a foreign currency denominated liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

28

A U.S. company buys merchandise from a foreign company denominated in the foreign currency. Which of the following statements is true?

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange loss will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)Any gain or loss will be included in comprehensive income.

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange loss will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)Any gain or loss will be included in comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a U.S. company purchases parts from a foreign company, which of the following will result in zero foreign exchange gain or loss?

A)The transaction is denominated in U.S. dollars.

B)The option strike price to sell foreign currency is less than the spot rate of the currency.

C)The option strike price to buy foreign currency is less than the spot rate of the currency.

D)The foreign currency appreciated in value relative to the U.S. dollar.

E)The foreign currency depreciated in value relative to the U.S. dollar.

A)The transaction is denominated in U.S. dollars.

B)The option strike price to sell foreign currency is less than the spot rate of the currency.

C)The option strike price to buy foreign currency is less than the spot rate of the currency.

D)The foreign currency appreciated in value relative to the U.S. dollar.

E)The foreign currency depreciated in value relative to the U.S. dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

30

U.S. GAAP provides guidance for hedges of all the following sources of foreign exchange risk except

A)Recognized foreign currency denominated assets and liabilities.

B)Unrecognized foreign currency firm commitments.

C)Forecasted foreign currency denominated transactions.

D)Net investment in foreign operations.

E)Deferred foreign currency gains and losses.

A)Recognized foreign currency denominated assets and liabilities.

B)Unrecognized foreign currency firm commitments.

C)Forecasted foreign currency denominated transactions.

D)Net investment in foreign operations.

E)Deferred foreign currency gains and losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

31

On December 1, 2013, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2014. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2013. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow: Compute the fair value of the foreign currency option at December 1, 2013.

A)$6,000.

B)$4,500.

C)$3,000.

D)$7,500.

E)$1,500.

A)$6,000.

B)$4,500.

C)$3,000.

D)$7,500.

E)$1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

32

On April 1, 2012, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2013. The dollar value of the loan was as follows: Angela Inc., a U.S. company, had a euro receivable from exports to Spain and a British pound payable resulting from imports from England. Angela recorded foreign exchange gain related to both its euro receivable and pound payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

33

On April 1, 2012, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2013. The dollar value of the loan was as follows: How much foreign exchange gain or loss should be included in Shannon's 2013 income statement?

A)$1,000 gain.

B)$1,000 loss.

C)$2,000 gain.

D)$2,000 loss.

E)$8,000 loss.

A)$1,000 gain.

B)$1,000 loss.

C)$2,000 gain.

D)$2,000 loss.

E)$8,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

34

A U.S. company sells merchandise to a foreign company denominated in the foreign currency. Which of the following statements is true?

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange gain will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)Any gain or loss will be included in comprehensive income.

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange gain will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)Any gain or loss will be included in comprehensive income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

35

A forward contract may be used for which of the following?

1) A fair value hedge of an asset.

2) A cash flow hedge of an asset.

3) A fair value hedge of a liability.

4) A cash flow hedge of a liability.

A)1 and 3

B)2 and 4

C)1 and 2

D)1, 3, and 4

E)1, 2, 3, and 4

1) A fair value hedge of an asset.

2) A cash flow hedge of an asset.

3) A fair value hedge of a liability.

4) A cash flow hedge of a liability.

A)1 and 3

B)2 and 4

C)1 and 2

D)1, 3, and 4

E)1, 2, 3, and 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

36

A U.S. company sells merchandise to a foreign company denominated in U.S. dollars. Which of the following statements is true?

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange gain will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)If the foreign currency depreciates, a foreign exchange loss will result.

A)If the foreign currency appreciates, a foreign exchange gain will result.

B)If the foreign currency depreciates, a foreign exchange gain will result.

C)No foreign exchange gain or loss will result.

D)If the foreign currency appreciates, a foreign exchange loss will result.

E)If the foreign currency depreciates, a foreign exchange loss will result.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

37

On April 1, 2012, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2013. The dollar value of the loan was as follows: How much foreign exchange gain or loss should be included in Shannon's 2012 income statement?

A)$3,000 gain.

B)$3,000 loss.

C)$6,000 gain.

D)$6,000 loss.

E)$7,000 gain.

A)$3,000 gain.

B)$3,000 loss.

C)$6,000 gain.

D)$6,000 loss.

E)$7,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

38

Alpha Inc., a U.S. company, had a receivable from a customer that was denominated in Mexican pesos. On December 31, 2012, this receivable for 75,000 pesos was correctly included in Alpha's balance sheet at $8,000. The receivable was collected on March 2, 2013, when the U.S. equivalent was $6,900. How much foreign exchange gain or loss will Alpha record on the income statement for the year ended December 31, 2013?

A)$1,100 loss.

B)$1,100 gain.

C)$6,900 loss.

D)$6,900 gain.

E)$8,000 gain.

A)$1,100 loss.

B)$1,100 gain.

C)$6,900 loss.

D)$6,900 gain.

E)$8,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

39

On December 1, 2013, Keenan Company, a U.S. firm, sold merchandise to Velez Company of Canada for 150,000 Canadian dollars (CAD). Collection of the receivable is due on February 1, 2014. Keenan purchased a foreign currency put option with a strike price of $.97 (U.S.) on December 1, 2013. This foreign currency option is designated as a cash flow hedge. Relevant exchange rates follow: Compute the fair value of the foreign currency option at December 31, 2013.

A)$6,000.

B)$4,500.

C)$3,000.

D)$7,500.

E)$1,500.

A)$6,000.

B)$4,500.

C)$3,000.

D)$7,500.

E)$1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following approaches is used in the United States in accounting for foreign currency transactions?

A)One-transaction perspective; defer foreign exchange gains and losses.

B)Two-transaction perspective; accrue foreign exchange gains and losses.

C)Three-transaction perspective; defer foreign exchange gains and losses.

D)One-transaction perspective; accrue foreign exchange gains and losses.

E)Two-transaction perspective; defer foreign exchange gains and losses.

A)One-transaction perspective; defer foreign exchange gains and losses.

B)Two-transaction perspective; accrue foreign exchange gains and losses.

C)Three-transaction perspective; defer foreign exchange gains and losses.

D)One-transaction perspective; accrue foreign exchange gains and losses.

E)Two-transaction perspective; defer foreign exchange gains and losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

41

On March 1, 2013, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2014. On March 1, 2013, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2014 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2013. The following spot exchange rates apply: Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2013 income as a result of this fair value hedge of a firm commitment?

A)$1,800.00 decrease.

B)$1,760.60 decrease.

C)$2,240.40 decrease.

D)$1,660.40 increase.

E)$2,240.60 increase.

A)$1,800.00 decrease.

B)$1,760.60 decrease.

C)$2,240.40 decrease.

D)$1,660.40 increase.

E)$2,240.60 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

42

Parker Corp., a U.S. company, had the following foreign currency transactions during 2013: (1) Purchased merchandise from a foreign supplier on July 5, 2013 for the U.S. dollar equivalent of $80,000 and paid the invoice on August 3, 2013 at the U.S. dollar equivalent of $82,000.

(2) On October 1, 2013 borrowed the U.S. dollar equivalent of $872,000 evidenced by a non-interest-bearing note payable in euros on October 1, 2013. The U.S. dollar equivalent of the note amount was $860,000 on December 31, 2013, and $881,000 on October 1, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2013?

A)$2,000 loss.

B)$2,000 gain.

C)$10,000 gain.

D)$14,000 loss.

E)$14,000 gain.

(2) On October 1, 2013 borrowed the U.S. dollar equivalent of $872,000 evidenced by a non-interest-bearing note payable in euros on October 1, 2013. The U.S. dollar equivalent of the note amount was $860,000 on December 31, 2013, and $881,000 on October 1, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2013?

A)$2,000 loss.

B)$2,000 gain.

C)$10,000 gain.

D)$14,000 loss.

E)$14,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

43

Atherton Inc., a U.S. company, expects to order goods from a foreign supplier at a price of 100,000 lira, with delivery and payment to be made on April 17. On January 17, Atherton purchased a three-month call option on 100,000 lira and designated this option as a cash flow hedge of a forecasted foreign currency transaction. The following exchange rates apply: What amount will Atherton include as an option expense in net income for the period January 17 to April 17?

A)$4,000

B)$4,260

C)$4,340

D)$5,000

E)$5,260

A)$4,000

B)$4,260

C)$4,340

D)$5,000

E)$5,260

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

44

On March 1, 2013, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2014. On March 1, 2013, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2014 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2013. The following spot exchange rates apply: Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net increase or decrease in cash flow from having purchased the foreign currency option to hedge this exposure to foreign exchange risk?

A)$0

B)$10,000 increase.

C)$10,000 decrease.

D)$20,000 increase.

E)$20,000 decrease.

A)$0

B)$10,000 increase.

C)$10,000 decrease.

D)$20,000 increase.

E)$20,000 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

45

On March 1, 2013, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2014. On March 1, 2013, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2014 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2013. The following spot exchange rates apply: Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2014 income as a result of this fair value hedge of a firm commitment?

A)$379,760.60 decrease.

B)$8,360.60 increase.

C)$8,360.60 decrease.

D)$4,390.40 decrease.

E)$379,760.60 increase.

A)$379,760.60 decrease.

B)$8,360.60 increase.

C)$8,360.60 decrease.

D)$4,390.40 decrease.

E)$379,760.60 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

46

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply: What amount will Woolsey include as an option expense in net income for the period July 24 to October 24?

A)$4,000.

B)$5,000.

C)$10,000.

D)$12,000.

E)$14,000.

A)$4,000.

B)$5,000.

C)$10,000.

D)$12,000.

E)$14,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

47

Winston Corp., a U.S. company, had the following foreign currency transactions during 2013: (1) Purchased merchandise from a foreign supplier on July 16, 2013 for the U.S. dollar equivalent of $47,000 and paid the invoice on August 3, 2013 at the U.S. dollar equivalent of $54,000.

(2) On October 15, 2013 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2013. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2013, and $299,000 on October 15, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2014?

A)$1,000 loss.

B)$1,000 gain.

C)$2,000 loss.

D)$4,000 gain.

E)$4,000 loss.

(2) On October 15, 2013 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2013. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2013, and $299,000 on October 15, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2014?

A)$1,000 loss.

B)$1,000 gain.

C)$2,000 loss.

D)$4,000 gain.

E)$4,000 loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

48

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply: What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

A)$6,000 positive.

B)$6,000 negative.

C)$10,000 positive.

D)$10,000 negative.

E)$14,000 positive.

A)$6,000 positive.

B)$6,000 negative.

C)$10,000 positive.

D)$10,000 negative.

E)$14,000 positive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

49

Larson Company, a U.S. company, has an India rupee account receivable resulting from an export sale on September 7 to a customer in India. Larson signed a forward contract on September 7 to sell rupees and designated it as a cash flow hedge of a recognized receivable. The spot rate was $.023, and the forward rate was $.021. Which of the following did the U.S. exporter report in net income?

A)Discount revenue.

B)Premium revenue.

C)Discount expense.

D)Premium expense.

E)Both discount revenue and premium expense.

A)Discount revenue.

B)Premium revenue.

C)Discount expense.

D)Premium expense.

E)Both discount revenue and premium expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

50

Parker Corp., a U.S. company, had the following foreign currency transactions during 2013: (1) Purchased merchandise from a foreign supplier on July 5, 2013 for the U.S. dollar equivalent of $80,000 and paid the invoice on August 3, 2013 at the U.S. dollar equivalent of $82,000.

(2) On October 1, 2013 borrowed the U.S. dollar equivalent of $872,000 evidenced by a non-interest-bearing note payable in euros on October 1, 2013. The U.S. dollar equivalent of the note amount was $860,000 on December 31, 2013, and $881,000 on October 1, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2014?

A)$9,000 loss.

B)$9,000 gain.

C)$11,000 loss.

D)$21,000 loss.

E)$21,000 gain.

(2) On October 1, 2013 borrowed the U.S. dollar equivalent of $872,000 evidenced by a non-interest-bearing note payable in euros on October 1, 2013. The U.S. dollar equivalent of the note amount was $860,000 on December 31, 2013, and $881,000 on October 1, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2014?

A)$9,000 loss.

B)$9,000 gain.

C)$11,000 loss.

D)$21,000 loss.

E)$21,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

51

Lawrence Company, a U.S. company, ordered parts costing 1,000,000 Thailand bahts from a foreign supplier on July 7 when the spot rate was $.025 per baht. A one-month forward contract was signed on that date to purchase 1,000,000 bahts at a rate of $.027. The forward contract is properly designated as a fair value hedge of the 1,000,000 baht firm commitment. On August 7, when the parts are received, the spot rate is $.028. What is the amount of accounts payable that will be paid at this date?

A)$20,000.

B)$20,100.

C)$25,000.

D)$27,000.

E)$28,000.

A)$20,000.

B)$20,100.

C)$25,000.

D)$27,000.

E)$28,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

52

On December 1, 2013, Joseph Company, a U.S. company, entered into a three-month forward contract to purchase 50,000 pesos on March 1, 2014, as a fair value hedge of a foreign currency denominated account payable. The following U.S. dollar per peso exchange rates apply: Joseph's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent is .9803. Which of the following is included in Joseph's December 31, 2013 balance sheet for the forward contract?

A)$5,146.58 asset.

B)$5,146.58 liability.

C)$500.00 liability.

D)$490.15 asset.

E)$490.15 liability.

A)$5,146.58 asset.

B)$5,146.58 liability.

C)$500.00 liability.

D)$490.15 asset.

E)$490.15 liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

53

On May 1, 2013, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2014. On May 1, 2013, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2014 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2013. The following spot exchange rates apply: Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2013 net income as a result of this fair value hedge of a firm commitment?

A)$1,760.60 decrease.

B)$1,960.60 decrease.

C)$1,000.00 decrease.

D)$1,760.60 increase.

E)$1,960.60 increase.

A)$1,760.60 decrease.

B)$1,960.60 decrease.

C)$1,000.00 decrease.

D)$1,760.60 increase.

E)$1,960.60 increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

54

Frankfurter Company, a U.S. company, had a ruble receivable from exports to Russia and a euro payable resulting from imports from Italy. Frankfurter recorded foreign exchange loss related to both its ruble receivable and euro payable. Did the foreign currencies increase or decrease in dollar value from the date of the transaction to the settlement date?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

55

On May 1, 2013, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2014. On May 1, 2013, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2014 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2013. The following spot exchange rates apply: Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

A)$0

B)$9,000 net loss on the option.

C)$9,000 net gain on the option.

D)$2,000 net gain on the option.

E)$2,000 net loss.

A)$0

B)$9,000 net loss on the option.

C)$9,000 net gain on the option.

D)$2,000 net gain on the option.

E)$2,000 net loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

56

On May 1, 2013, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2014. On May 1, 2013, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2014 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2013. The following spot exchange rates apply: Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2014 net income as a result of this fair value hedge of a firm commitment?

A)$1,800.00 decrease.

B)$2,500.00 increase.

C)$2,500.00 decrease.

D)$188,760.60 increase.

E)$188,760.60 decrease.

A)$1,800.00 decrease.

B)$2,500.00 increase.

C)$2,500.00 decrease.

D)$188,760.60 increase.

E)$188,760.60 decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

57

Williams Inc., a U.S. company, has a Japanese yen account receivable resulting from an export sale on March 1 to a customer in Japan. The exporter signed a forward contract on March 1 to sell yen and designated it as a cash flow hedge of a recognized receivable. The spot rate was $.0094, and the forward rate was $.0095. Which of the following did the U.S. exporter report in net income?

A)Discount revenue.

B)Premium revenue.

C)Discount expense.

D)Premium expense.

E)Both discount revenue and premium expense.

A)Discount revenue.

B)Premium revenue.

C)Discount expense.

D)Premium expense.

E)Both discount revenue and premium expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

58

On April 1, Quality Corporation, a U.S. company, expects to sell merchandise to a French customer in three months, denominating the transaction in euros. On April 1, the spot rate is $1.41 per euro, and Quality enters into a three-month forward contract cash flow hedge to sell 400,000 euros at a rate of $1.36. At the end of three months, the spot rate is $1.37 per euro, and Quality delivers the merchandise, collecting 400,000 euros. What are the effects on net income from these transactions?

A)$16,000 Discount Expense plus a $12,000 positive Adjustment to Net Income when the merchandise is delivered.

B)$16,000 Discount Expense plus a $12,000 negative Adjustment to Net Income when the merchandise is delivered.

C)$16,000 Discount Expense plus a $20,000 negative Adjustment to Net Income when the merchandise is delivered.

D)$16,000 Discount Expense plus a $20,000 positive Adjustment to Net Income when the merchandise is delivered.

E)$16,000 Discount Expense plus an $16,000 positive Adjustment to Net Income when the merchandise is delivered.

A)$16,000 Discount Expense plus a $12,000 positive Adjustment to Net Income when the merchandise is delivered.

B)$16,000 Discount Expense plus a $12,000 negative Adjustment to Net Income when the merchandise is delivered.

C)$16,000 Discount Expense plus a $20,000 negative Adjustment to Net Income when the merchandise is delivered.

D)$16,000 Discount Expense plus a $20,000 positive Adjustment to Net Income when the merchandise is delivered.

E)$16,000 Discount Expense plus an $16,000 positive Adjustment to Net Income when the merchandise is delivered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

59

Primo Inc., a U.S. company, ordered parts costing 100,000 rupee from a foreign supplier on July 7 when the spot rate was $.025 per rupee. A one-month forward contract was signed on that date to purchase 100,000 rupee at a rate of $.027. The forward contract is properly designated as a fair value hedge of the 100,000 rupee firm commitment. On August 7, when the parts are received, the spot rate is $.028. At what amount should the parts inventory be carried on Primo's books?

A)$2,000.

B)$2,100.

C)$2,500.

D)$2,700.

E)$2,800.

A)$2,000.

B)$2,100.

C)$2,500.

D)$2,700.

E)$2,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

60

Winston Corp., a U.S. company, had the following foreign currency transactions during 2013: (1) Purchased merchandise from a foreign supplier on July 16, 2013 for the U.S. dollar equivalent of $47,000 and paid the invoice on August 3, 2013 at the U.S. dollar equivalent of $54,000.

(2) On October 15, 2013 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2013. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2013, and $299,000 on October 15, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2013?

A)$9,000 loss.

B)$9,000 gain.

C)$11,000 loss.

D)$13,000 gain.

E)$14,000 gain.

(2) On October 15, 2013 borrowed the U.S. dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15, 2013. The U.S. dollar equivalent of the note amount was $295,000 on December 31, 2013, and $299,000 on October 15, 2014.

What amount should be included as a foreign exchange gain or loss from the two transactions for 2013?

A)$9,000 loss.

B)$9,000 gain.

C)$11,000 loss.

D)$13,000 gain.

E)$14,000 gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

61

What happens when a U.S. company sells goods denominated in a foreign currency and the foreign currency depreciates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

62

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply: What journal entry should Eagle prepare on October 1, 2013?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

63

What factors create a foreign exchange gain?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

64

Where can you find exchange rates between the U.S. dollar and most foreign currencies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

65

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply: What is the amount of Adjustment to Accumulated Other Comprehensive Income for 2014 from these transactions?

A)$1,000.

B)$1,600.

C)$1,800.

D)$2,000.

E)$2,600.

A)$1,000.

B)$1,600.

C)$1,800.

D)$2,000.

E)$2,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the major assumption underlying the one-transaction perspective?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

67

What happens when a U.S. company purchases goods denominated in a foreign currency and the foreign currency depreciates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

68

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply: What journal entry should Eagle prepare on December 31, 2013?

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

A)Option A

B)Option B

C)Option C

D)Option D

E)Option E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

69

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply: What is the 2014 effect on net income as a result of these transactions?

A)$195,000

B)$201,600

C)$201,000

D)$202,600

E)$203,000

A)$195,000

B)$201,600

C)$201,000

D)$202,600

E)$203,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

70

What happens when a U.S. company sells goods denominated in a foreign currency and the foreign currency appreciates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

71

How is the fair value of a Forward Contract determined by U.S. GAAP?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

72

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply: What is the amount of Cost of Goods Sold for 2014 as a result of these transactions?

A)$200,000.

B)$195,000.

C)$201,000.

D)$202,600.

E)$203,000.

A)$200,000.

B)$195,000.

C)$201,000.

D)$202,600.

E)$203,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

73

What is the purpose of a hedge of foreign exchange risk?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

74

Gaw Produce Company purchased inventory from a Japanese company on December 18, 2013. Payment of 4,000,000 yen (×) was due on January 18, 2014. Exchange rates between the dollar and the yen were as follows:  Required:

Required:

Prepare all journal entries for Gaw Produce Co. in connection with the purchase and payment.

Required:

Required:Prepare all journal entries for Gaw Produce Co. in connection with the purchase and payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is meant by the spot rate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

76

On October 1, 2013, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2014, at a price of 100,000 British pounds. On October 1, 2013, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2013, the option has a fair value of $1,600. The following spot exchange rates apply: What is the amount of option expense for 2014 from these transactions?

A)$1,000.

B)$1,600.

C)$2,500.

D)$2,600.

E)$0.

A)$1,000.

B)$1,600.

C)$2,500.

D)$2,600.

E)$0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

77

How does a foreign currency forward contract differ from a foreign currency option?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

78

What happens when a U.S. company purchases goods denominated in a foreign currency and the foreign currency appreciates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

79

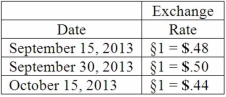

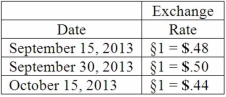

Old Colonial Corp. (a U.S. company) made a sale to a foreign customer on September 15, 2013, for 100,000 stickles. Payment was received on October 15, 2013. The following exchange rates applied:  Required:

Required:

Prepare all journal entries for Old Colonial Corp. in connection with this sale assuming that the company closes its books on September 30 to prepare interim financial statements.

Required:

Required:Prepare all journal entries for Old Colonial Corp. in connection with this sale assuming that the company closes its books on September 30 to prepare interim financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

80

Yelton Co. just sold inventory for 80,000 euros, which Yelton will collect in sixty days. Briefly describe a hedging transaction Yelton could engage in to reduce its risk of unfavorable exchange rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck