Deck 18: International Aspects of Financial Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/91

العب

ملء الشاشة (f)

Deck 18: International Aspects of Financial Management

1

The market where euros, pesos, dollars, and pounds are traded is referred to as which one of the following?

A) ADR market

B) LIBOR market

C) Gilt market

D) Euromarket

E) Foreign exchange market

A) ADR market

B) LIBOR market

C) Gilt market

D) Euromarket

E) Foreign exchange market

Foreign exchange market

2

An agreement to exchange currencies some time in the future is referred to as which one of the following?

A) Forward trade

B) Hedge

C) Gilt

D) Forward exchange rate

E) Spot trade

A) Forward trade

B) Hedge

C) Gilt

D) Forward exchange rate

E) Spot trade

Forward trade

3

Eurobonds are best defined as international bonds issued in _____ and denominated in _____.

A) a single country; multiple currencies

B) a single country; a single currency

C) multiple countries; multiple currencies

D) multiple countries; a single currency

E) euroland; euros

A) a single country; multiple currencies

B) a single country; a single currency

C) multiple countries; multiple currencies

D) multiple countries; a single currency

E) euroland; euros

multiple countries; a single currency

4

Which one of the following is the best universal definition of an exchange rate?

A) Price of one country's currency expressed in terms of another country's currency

B) Number of foreign dollars that can be purchased for every one U.S. dollar paid

C) Price of a country's currency expressed in terms of that country's currency unit

D) Number of units of a currency that were originally required to obtain one euro when a country adopted the euro as its official currency

E) Price which must be paid to obtain a good or service from another country

A) Price of one country's currency expressed in terms of another country's currency

B) Number of foreign dollars that can be purchased for every one U.S. dollar paid

C) Price of a country's currency expressed in terms of that country's currency unit

D) Number of units of a currency that were originally required to obtain one euro when a country adopted the euro as its official currency

E) Price which must be paid to obtain a good or service from another country

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

5

A trader in Switzerland just agreed to trade Swiss francs for British pounds based on today's exchange rate. The trade is expected to settle tomorrow. What term best describes this exchange?

A) Arbitrage transaction

B) Forward trade

C) Spot trade

D) Purchasing power parity

E) Interest rate parity

A) Arbitrage transaction

B) Forward trade

C) Spot trade

D) Purchasing power parity

E) Interest rate parity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which one of the following is the best definition of Eurocurrency?

A) Any paper money used by a country that has adopted the euro as its common currency

B) Money deposited in a financial institution outside of the country whose currency is involved

C) Both paper and coins officially adopted under the euro system of coinage

D) U.S. dollars owned by any country which has adopted the euro as its currency

E) Any exchange of funds between two countries that have adopted the euro as their official currency

A) Any paper money used by a country that has adopted the euro as its common currency

B) Money deposited in a financial institution outside of the country whose currency is involved

C) Both paper and coins officially adopted under the euro system of coinage

D) U.S. dollars owned by any country which has adopted the euro as its currency

E) Any exchange of funds between two countries that have adopted the euro as their official currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following is the agreed-upon exchange rate that is to be used when currencies are exchanged at some point in the future based on an agreement made today?

A) Spot rate

B) ADR rate

C) London Interbank Offer Rate

D) Forward exchange rate

E) Cross rate

A) Spot rate

B) ADR rate

C) London Interbank Offer Rate

D) Forward exchange rate

E) Cross rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

8

The spot exchange rate is the exchange rate that applies to a(n):

A) LIBOR transaction.

B) ADR transaction.

C) Spot trade.

D) Forward trade.

E) Future transaction.

A) LIBOR transaction.

B) ADR transaction.

C) Spot trade.

D) Forward trade.

E) Future transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

9

You are given the exchange rate between the U.S. dollar and the Canadian dollar. You are also given the exchange rate between the U.S. dollar and the Mexican peso. What is the name given to the Canadian dollar per Mexican peso exchange rate derived from the information that was provided?

A) Swap rate

B) Depositary rate

C) Forward rate

D) London Interbank rate

E) Cross-rate

A) Swap rate

B) Depositary rate

C) Forward rate

D) London Interbank rate

E) Cross-rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which one of the following is the risk arising from changes in value caused by political actions?

A) Exchange rate risk

B) Political risk

C) Translation risk

D) LIBOR risk

E) Cross rate risk

A) Exchange rate risk

B) Political risk

C) Translation risk

D) LIBOR risk

E) Cross rate risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which one of the following terms is used to describe international bonds issued in a single country and generally denominated in that country's currency?

A) Eurobonds

B) American Depositary Receipts

C) Foreign bonds

D) Swaps

E) Gilts

A) Eurobonds

B) American Depositary Receipts

C) Foreign bonds

D) Swaps

E) Gilts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

12

An American Depositary Receipt is defined as a security:

A) that has been deposited in an interest-bearing account at a U.S. bank.

B) issued outside of the U.S. that represents shares of a U.S. stock.

C) issued in the U.S. which represents shares of a foreign stock.

D) that has a guarantee of payment from a U.S. bank.

E) issued in multiple countries but denominated in U.S. currency.

A) that has been deposited in an interest-bearing account at a U.S. bank.

B) issued outside of the U.S. that represents shares of a U.S. stock.

C) issued in the U.S. which represents shares of a foreign stock.

D) that has a guarantee of payment from a U.S. bank.

E) issued in multiple countries but denominated in U.S. currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following terms is used to identify the concept that exchange rates vary to keep purchasing power constant among currencies?

A) Exchange rate equilibrium

B) Exchange rate parity

C) Universal parity

D) Market equilibrium

E) Purchasing power parity

A) Exchange rate equilibrium

B) Exchange rate parity

C) Universal parity

D) Market equilibrium

E) Purchasing power parity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which one of the following correctly matches a country with its currency?

A) Canada - pound

B) China - yuan

C) Mexico - real

D) Japan - lira

E) United Kingdom - euro

A) Canada - pound

B) China - yuan

C) Mexico - real

D) Japan - lira

E) United Kingdom - euro

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which one of the following is defined as an agreement to exchange two securities or two currencies?

A) Hedge

B) Swap

C) SWIFT

D) Gilt

E) Arbitrage

A) Hedge

B) Swap

C) SWIFT

D) Gilt

E) Arbitrage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

16

Rembrandt, Samurai, Yankee, and Bulldog are all names associated with which one of the following?

A) Eurobonds

B) Currencies

C) Cross rate

D) Foreign bonds

E) Foreign interest rates

A) Eurobonds

B) Currencies

C) Cross rate

D) Foreign bonds

E) Foreign interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

17

You live in the U.S. and want to invest in a Chinese company, which will be referred to as "CC", because you believe its stock is uniquely positioned to be unusually profitable over the next five years. However, you do not have direct access to the Chinese financial markets. You may be able to indirectly invest in CC by purchasing which one of the following?

A) Swap

B) ADR

C) Gilt

D) Bulldog bond

E) Samurai bond

A) Swap

B) ADR

C) Gilt

D) Bulldog bond

E) Samurai bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which one of the following terms is defined as having international operations in a world where relative currency values change?

A) Political risk

B) Relative purchasing power parity

C) Interest rate parity

D) Absolute purchasing power parity

E) Exchange rate risk

A) Political risk

B) Relative purchasing power parity

C) Interest rate parity

D) Absolute purchasing power parity

E) Exchange rate risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which one of the following is the rate that most international banks charge when they loan Eurodollars to other banks?

A) ADR

B) LIBOR

C) Cross rate

D) Gilt rate

E) Swap rate

A) ADR

B) LIBOR

C) Cross rate

D) Gilt rate

E) Swap rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which one of the following states that the difference in interest rates between two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate?

A) Arbitrage equilibrium

B) Relative purchasing power parity

C) Absolute purchasing power parity

D) Interest rate parity

E) Cross rate parity

A) Arbitrage equilibrium

B) Relative purchasing power parity

C) Absolute purchasing power parity

D) Interest rate parity

E) Cross rate parity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

21

Assume you can exchange $1 for either £1.0 or €0.50 in the U.S. In the London market, you can exchange £1 for €0.52. This situation creates an opportunity to profit immediately from which one of the following?

A) Futures arbitrage

B) Currency hedge

C) Interest rate swap

D) Absolute purchasing power parity

E) Triangle arbitrage

A) Futures arbitrage

B) Currency hedge

C) Interest rate swap

D) Absolute purchasing power parity

E) Triangle arbitrage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

22

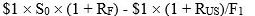

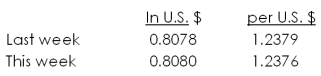

35. Which one of the following formulas illustrates the mechanics of covered interest arbitrage? Assume the  is borrowed and

is borrowed and  = spot rate;

= spot rate;  = one-year forward rate;

= one-year forward rate;  = foreign country risk-free rate; and

= foreign country risk-free rate; and  risk-free rate.

risk-free rate.

A)

B)

C)

D)

E)

is borrowed and

is borrowed and  = spot rate;

= spot rate;  = one-year forward rate;

= one-year forward rate;  = foreign country risk-free rate; and

= foreign country risk-free rate; and  risk-free rate.

risk-free rate.A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

23

You have just agreed to a forward trade that will be settled six months from now. When will the exchange rate for this transaction be determined?

A) Today

B) Three months from today because that is the half-way point

C) Anytime you prefer within the next 6 months

D) Whenever the spot rate six months from today is known

E) Six months from now

A) Today

B) Three months from today because that is the half-way point

C) Anytime you prefer within the next 6 months

D) Whenever the spot rate six months from today is known

E) Six months from now

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which one of the following is an example of long-run exposure to exchange rate risk? Ignore all fees and transaction costs.

A) A U.S. firm owns land in Mexico valued at three million pesos. That value has remained constant in Mexican pesos for the past year. However, the firm's financial statement reflects a three percent decrease in the value of that land for last year.

B) A U.S. firm sells $250,000 worth of goods to Peru. However, when the payment for those goods arrives and the U.S. firm exchanges the foreign currency, it only receives $248,700.

C) A U.S. firms purchases $120,000 worth of goods from Canada. However, by the time the goods arrive and the invoice is payable, the cost of those goods has increased to $120,400.

D) A few years ago, a U.S. firm built a factory in Asia to take advantage of the lower labor costs. Today, the Asian labor costs have increased such that the Asian factory no longer provides a cost advantage over a U.S. factory.

E) A. U.S. traveler withdrew an extra $2,000 in cash from her savings account to take with her as emergency funds when she traveled to Mexico. Before leaving on her trip, she exchanged this money into Mexican pesos. She never used any of this money during her vacation, so exchanged all of it back into U.S. dollars on her return and received $1,960.

A) A U.S. firm owns land in Mexico valued at three million pesos. That value has remained constant in Mexican pesos for the past year. However, the firm's financial statement reflects a three percent decrease in the value of that land for last year.

B) A U.S. firm sells $250,000 worth of goods to Peru. However, when the payment for those goods arrives and the U.S. firm exchanges the foreign currency, it only receives $248,700.

C) A U.S. firms purchases $120,000 worth of goods from Canada. However, by the time the goods arrive and the invoice is payable, the cost of those goods has increased to $120,400.

D) A few years ago, a U.S. firm built a factory in Asia to take advantage of the lower labor costs. Today, the Asian labor costs have increased such that the Asian factory no longer provides a cost advantage over a U.S. factory.

E) A. U.S. traveler withdrew an extra $2,000 in cash from her savings account to take with her as emergency funds when she traveled to Mexico. Before leaving on her trip, she exchanged this money into Mexican pesos. She never used any of this money during her vacation, so exchanged all of it back into U.S. dollars on her return and received $1,960.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which one of the following must be significantly eliminated if interest rate parity is to exist?

A) Absolute purchasing power parity

B) Short-run exposure to exchange rate risk

C) Covered interest arbitrage opportunities

D) Relative purchasing power parity

E) Translation exposure

A) Absolute purchasing power parity

B) Short-run exposure to exchange rate risk

C) Covered interest arbitrage opportunities

D) Relative purchasing power parity

E) Translation exposure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose you could buy 1,320 South Korea won or 78 Pakistan rupees last year for $1. Today, $1 will buy you 1,318 won or 80 rupees. Which one of the following occurred over the past year?

A) The dollar appreciated against the won.

B) The dollar depreciated against the rupee.

C) The dollar appreciated against both the won and the rupee.

D) The won depreciated against the dollar.

E) The rupee depreciated against the dollar.

A) The dollar appreciated against the won.

B) The dollar depreciated against the rupee.

C) The dollar appreciated against both the won and the rupee.

D) The won depreciated against the dollar.

E) The rupee depreciated against the dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which one of the following best describes an agreement you make today to exchange U.S. dollars for British pounds three months from now?

A) Forward trade

B) Spot trade

C) Arbitrage transaction

D) Cross-rate exchange

E) Eurocurrency transaction

A) Forward trade

B) Spot trade

C) Arbitrage transaction

D) Cross-rate exchange

E) Eurocurrency transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

28

Later this week, you are traveling from the U.S. to Canada for a week's vacation. This morning, you exchanged some U.S. dollars for Canadian dollars in preparation for that trip. Which one of the following best describes this exchange?

A) Forward trade

B) Spot trade

C) Arbitrage transaction

D) Cross-rate exchange

E) Eurocurrency transaction

A) Forward trade

B) Spot trade

C) Arbitrage transaction

D) Cross-rate exchange

E) Eurocurrency transaction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which one of the following statements is correct?

A) Exchange rates are adjusted each morning and held constant until the next morning.

B) The four most common currencies traded in the foreign exchange market are the U.S. dollar, franc, euro, and peso.

C) All of South America uses the peso as their currency.

D) New Zealand uses the same currency as Australia and that is the A$.

E) The foreign exchange market is the largest financial market in the world.

A) Exchange rates are adjusted each morning and held constant until the next morning.

B) The four most common currencies traded in the foreign exchange market are the U.S. dollar, franc, euro, and peso.

C) All of South America uses the peso as their currency.

D) New Zealand uses the same currency as Australia and that is the A$.

E) The foreign exchange market is the largest financial market in the world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following are participants in the foreign exchange market? I. U.S. importers

II) U.S. exporters

III) U.S. travelers to Europe

IV) U.S. portfolio manager who purchases foreign securities

A) I and III only

B) II and IV only

C) I, III, and IV only

D) II, III, and IV only

E) I, II, III, and IV

II) U.S. exporters

III) U.S. travelers to Europe

IV) U.S. portfolio manager who purchases foreign securities

A) I and III only

B) II and IV only

C) I, III, and IV only

D) II, III, and IV only

E) I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

31

Short-run exposure to exchange rate risk is best illustrated by which one of the following?

A) Change in book value when the market value of an asset remains constant

B) Daily fluctuations in the spot rate

C) Increases in the forward rate as the time to settlement increases

D) Changes in relative economic conditions between two countries

E) Unrealized foreign exchange gains

A) Change in book value when the market value of an asset remains constant

B) Daily fluctuations in the spot rate

C) Increases in the forward rate as the time to settlement increases

D) Changes in relative economic conditions between two countries

E) Unrealized foreign exchange gains

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

32

Assume a canned soft drink costs $1 in the U.S. and $1.30 in Canada. At the same time, the currency per U.S. dollar is C$1.30. Which one of the following conditions exists in this situation?

A) Absolute purchasing power parity

B) Interest rate parity

C) Relative purchasing power parity

D) Translation exposure

E) Equal spot and forward rates

A) Absolute purchasing power parity

B) Interest rate parity

C) Relative purchasing power parity

D) Translation exposure

E) Equal spot and forward rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

33

Interest rate parity defines the relationships among which of the following?

A) Spot exchange rates, future exchange rates, interest rates, and inflation rates

B) Real and nominal interest rates across countries

C) Real interest and inflation rates

D) Forward exchange rates, relative interest rates, and spot exchange rates

E) Spot exchange rates, forward exchange rates, nominal interest rates, and real interest rates

A) Spot exchange rates, future exchange rates, interest rates, and inflation rates

B) Real and nominal interest rates across countries

C) Real interest and inflation rates

D) Forward exchange rates, relative interest rates, and spot exchange rates

E) Spot exchange rates, forward exchange rates, nominal interest rates, and real interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

34

Assume you can currently exchange one U.S. dollar for one hundred Japanese yen. Also assume the inflation rate will be 2.5 percent annually in the U.S. and 2 percent in Japan. Given these assumptions, how many yen should you expect in exchange for one U.S. dollar next year?

A) More than 100

B) Either 100 or more than 100

C) Exactly 100

D) Either 100 or less than 100

E) Less than 100

A) More than 100

B) Either 100 or more than 100

C) Exactly 100

D) Either 100 or less than 100

E) Less than 100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

35

Assume that  is the euro price of a product,

is the euro price of a product,  is the U.S. price of the identical

is the U.S. price of the identical

product, and is the spot exchange rate, quoted as the amount of foreign currency per dollar.

is the spot exchange rate, quoted as the amount of foreign currency per dollar.

Given this, which one of the following correctly expresses absolute purchasing power parity?

A)

B)

C)

D)

E)

is the euro price of a product,

is the euro price of a product,  is the U.S. price of the identical

is the U.S. price of the identicalproduct, and

is the spot exchange rate, quoted as the amount of foreign currency per dollar.

is the spot exchange rate, quoted as the amount of foreign currency per dollar.Given this, which one of the following correctly expresses absolute purchasing power parity?

A)

B)

C)

D)

E)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which one of the following occurs when interest rate parity exists between countries A and B?

A) Country A investors are indifferent between risk-free investments in countries A and B

B) Forward exchange rates for countries A and B must be equal for all time periods

C) Risk-free interest rates in countries A and B must be equal

D) Spot and forward exchange rates between the currencies of the two countries must be equal

E) Significant covered interest arbitrage opportunities between currencies A and B must exist

A) Country A investors are indifferent between risk-free investments in countries A and B

B) Forward exchange rates for countries A and B must be equal for all time periods

C) Risk-free interest rates in countries A and B must be equal

D) Spot and forward exchange rates between the currencies of the two countries must be equal

E) Significant covered interest arbitrage opportunities between currencies A and B must exist

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

37

Currently, you can exchange $1 for Sf1.14. Assume that the average inflation rate in the U.S. over the next two years will be 2.5 percent annually as compared to 3 percent in Switzerland. Based on this information and relative purchasing power parity, which one of the following assumptions can you make regarding the next two years?

A) The Swiss franc will appreciate against all currencies.

B) The Swiss franc will appreciate against the U.S. dollar.

C) The U.S. dollar will appreciate against all currencies.

D) The U.S. dollar will appreciate against the Swiss franc.

E) Both the U.S. dollar and the Swiss franc will appreciate against all other currencies.

A) The Swiss franc will appreciate against all currencies.

B) The Swiss franc will appreciate against the U.S. dollar.

C) The U.S. dollar will appreciate against all currencies.

D) The U.S. dollar will appreciate against the Swiss franc.

E) Both the U.S. dollar and the Swiss franc will appreciate against all other currencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

38

Relative purchasing power parity is based on the principle that the expected percentage change in the exchange rate between two countries is equal to which one of the following?

A) difference in the risk-free interest rates in the two countries

B) average interest rate in the two countries

C) average inflation rate of the two countries

D) difference in the inflation rates of the two countries

E) difference between the two countries' average inflation and interest rates

A) difference in the risk-free interest rates in the two countries

B) average interest rate in the two countries

C) average inflation rate of the two countries

D) difference in the inflation rates of the two countries

E) difference between the two countries' average inflation and interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

39

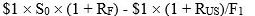

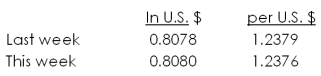

You are given the following exchange rates for the Canadian dollar versus the U.S. dollar:  Which one of the following statements is correct given this information?

Which one of the following statements is correct given this information?

A) Last week, it took C$0.8078 to purchase US$1.

B) This week you can exchange one Canadian dollar for $1.2376 American.

C) It is cheaper for an American to travel in Canada this week as compared to last week.

D) The Canadian dollar depreciated from last week to this week.

E) You would have made a profit if you invested U.S. $100 in Canadian dollars last week and then converted your money back to U.S. dollars this week. Ignore any interest earnings.

Which one of the following statements is correct given this information?

Which one of the following statements is correct given this information?A) Last week, it took C$0.8078 to purchase US$1.

B) This week you can exchange one Canadian dollar for $1.2376 American.

C) It is cheaper for an American to travel in Canada this week as compared to last week.

D) The Canadian dollar depreciated from last week to this week.

E) You would have made a profit if you invested U.S. $100 in Canadian dollars last week and then converted your money back to U.S. dollars this week. Ignore any interest earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

40

The U.S. dollar equivalent is 0.4502 for the Brazilian real and 1.4729 for the U.K. pound. Which one of the following statements is correct given this information?

A) One U.S. dollar will buy 0.4502 Brazilian reals.

B) If you have 0.4502 Brazilian reals, they are worth 1.4729 U.K. pounds.

C) One U.K. pound will buy 1.4729 U.S. dollars.

D) One Brazilian real will buy 1.4729 U.K. pounds.

E) One U.S. dollar will buy 1.4729 U.K. pounds.

A) One U.S. dollar will buy 0.4502 Brazilian reals.

B) If you have 0.4502 Brazilian reals, they are worth 1.4729 U.K. pounds.

C) One U.K. pound will buy 1.4729 U.S. dollars.

D) One Brazilian real will buy 1.4729 U.K. pounds.

E) One U.S. dollar will buy 1.4729 U.K. pounds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

41

You are planning a trip to the U.K. and plan on spending 3,600 pounds. How many dollars will this trip cost you if the currency per U.S. dollar is 0.6789 pounds?

A) $2,444.04

B) $3,892.16

C) $5,302.70

D) $5,890.01

E) $6,044.04

A) $2,444.04

B) $3,892.16

C) $5,302.70

D) $5,890.01

E) $6,044.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which one of the following is the suggested method of handling exchange rate risk for a large, multinational firm headquartered in the U.S.? Assume the operations in each country represent a different division of the firm.

A) At the division level

B) At a level which combines all divisions representing a separate geographical continent

C) At a level which combines divisions based on the currency used by each division

D) By segregating U.S. operations and foreign operations

E) On a centralized basis for all divisions

A) At the division level

B) At a level which combines all divisions representing a separate geographical continent

C) At a level which combines divisions based on the currency used by each division

D) By segregating U.S. operations and foreign operations

E) On a centralized basis for all divisions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

43

Currently, you can exchange $1 for 100.37 yen or €0.7538 in New York. In Tokyo, the exchange rate is ¥1 = €0.0077. If you have $1,000, how much profit can you earn using triangle arbitrage?

A) $18.08

B) $25.27

C) $27.91

D) $32.50

E) $33.14

A) $18.08

B) $25.27

C) $27.91

D) $32.50

E) $33.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

44

In New York, you can exchange $1 for €0.7538 or £0.6789. In Berlin, £1 costs €1.1087. How much profit can you earn on $5,000 using triangle arbitrage?

A) $5.45

B) $5.87

C) $7.33

D) $7.92

E) $8.48

A) $5.45

B) $5.87

C) $7.33

D) $7.92

E) $8.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which one of the following is an example of the political risks associated with foreign operations?

A) Technological changes

B) Exchange rate fluctuations

C) Translation exposure to exchange rate risk

D) Changes in foreign tax laws

E) Changes in relative wage rates between the home country and the foreign country

A) Technological changes

B) Exchange rate fluctuations

C) Translation exposure to exchange rate risk

D) Changes in foreign tax laws

E) Changes in relative wage rates between the home country and the foreign country

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

46

Your German friend has decided to come and visit you in the U.S. You estimate the cost of her trip at $2,200. What is the cost to her in euros if the U.S. dollar equivalent of the euro is 1.3266?

A) €1,566.67

B) €1,658.37

C) €1,908.50

D) €2,716.34

E) €2,918.52

A) €1,566.67

B) €1,658.37

C) €1,908.50

D) €2,716.34

E) €2,918.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

47

The spot rate for the pound is £0.6789 = $1 and for the Canadian dollar is C$1.2381 = $1. What is the £/C$ cross rate?

A) £0.5483/€1

B) £0.6627/€1

C) £1.0333/€1

D) £1.5090/€1

E) £01.8238/€1

A) £0.5483/€1

B) £0.6627/€1

C) £1.0333/€1

D) £1.5090/€1

E) £01.8238/€1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

48

You can exchange $1 for either C$1.2381 or ¥100.37. What is the cross rate between the Canadian dollar and the Japanese yen?

A) C$.012335/¥1

B) C$.013723/¥1

C) C$.014582/¥1

D) CS124.2681/¥1

E) C$131.0818/¥1

A) C$.012335/¥1

B) C$.013723/¥1

C) C$.014582/¥1

D) CS124.2681/¥1

E) C$131.0818/¥1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

49

A good steak dinner in the U.S. costs $49 while the exact meal costs 660 pesos across the border in Mexico. Based on purchasing power parity, what is the implied Peso/$ exchange rate?

A) Ps12.97/$1

B) Ps13.47/$1

C) Ps14.42/$1

D) Ps14.67/$1

E) Ps15.08/$1

A) Ps12.97/$1

B) Ps13.47/$1

C) Ps14.42/$1

D) Ps14.67/$1

E) Ps15.08/$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

50

You are debating between spending a week in Brazil or a week in Chile. You've estimated the cost of the Brazilian trip at 56,300 reals and the Chilean trip at 13.6 million pesos. The currency per U.S. dollar is 2.2212 reals and 581.73 pesos. If you prefer the less expensive trip, as measured in U.S. dollars, you should travel to _____ because you can save _____.

A) Brazil; you can save $1,460.45

B) Brazil; you can save $1,518.74

C) Chile; you can save $984.29

D) Chile; you can save $1,613.33

E) Chile; you can save $1,968.12

A) Brazil; you can save $1,460.45

B) Brazil; you can save $1,518.74

C) Chile; you can save $984.29

D) Chile; you can save $1,613.33

E) Chile; you can save $1,968.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

51

Your favorite running shoes cost $89 in the U.S. while the identical shoes cost C$114.50 in Canada. According to purchasing power parity, what is the C$/$ exchange rate?

A) C$0.7773/$1

B) C$0.8426/$1

C) C$0.9108/$1

D) C$1.2865/$1

E) C$1.3305/$1

A) C$0.7773/$1

B) C$0.8426/$1

C) C$0.9108/$1

D) C$1.2865/$1

E) C$1.3305/$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

52

The exchange rates in New York for $1 are C$1.2381 and £0.6789. In Toronto, C$1 will buy £0.5487. How much profit can you earn on $10,000 using triangle arbitrage?

A) $6.56

B) $6.88

C) $6.97

D) $7.03

E) $7.11

A) $6.56

B) $6.88

C) $6.97

D) $7.03

E) $7.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

53

The foreign subsidiary of a U.S. firm is profitable when profits are measured in the foreign currency but those profits become losses when measured in U.S. dollars. This is an example of which one of the following?

A) Interest rate disparities

B) Short-run exposure to exchange rate risk

C) Long-run exposure to exchange rate risk

D) Political risk associated with the foreign operations

E) Translation exposure to exchange rate risk

A) Interest rate disparities

B) Short-run exposure to exchange rate risk

C) Long-run exposure to exchange rate risk

D) Political risk associated with the foreign operations

E) Translation exposure to exchange rate risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

54

You are planning an extended trip to Hong Kong. You have located some housing that you can lease for 10,500 Hong Kong dollars per month. What is the cost per month in U.S. dollars if the exchange rate is HK$1 = $0.1290?

A) $1,208.15

B) $1,354.50

C) $78,311.27

D) $81,395.35

E) $84,206.19

A) $1,208.15

B) $1,354.50

C) $78,311.27

D) $81,395.35

E) $84,206.19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

55

Suppose a U.S. firm builds a factory in China, staffs it with Chinese workers, uses materials supplied by Chinese companies, and finances the entire operation with a loan from a Chinese bank located in the same town as the factory. This firm is most likely trying to greatly reduce, or eliminate, which one of the following?

A) Interest rate disparities

B) Short-run exposure to exchange rate risk

C) Long-run exposure to exchange rate risk

D) Political risk associated with the foreign operations

E) Translation exposure to exchange rate risk

A) Interest rate disparities

B) Short-run exposure to exchange rate risk

C) Long-run exposure to exchange rate risk

D) Political risk associated with the foreign operations

E) Translation exposure to exchange rate risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

56

You just returned from a trip to Venezuela and have 1,516 bolivares fuertes in your pocket. How many dollars will you receive when you exchange this money if the U.S. dollar equivalent of the bolivares fuertes is 0.465701?

A) $629.08

B) $706.00

C) $811.40

D) $2,897.18

E) $3,255.31

A) $629.08

B) $706.00

C) $811.40

D) $2,897.18

E) $3,255.31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which one of the following most likely represents the greatest political risk for a U.S.-based firm?

A) A product assembly plant located in a foreign country

B) A foreign sales office

C) Accounting office which handles all payroll functions and is located in a foreign country

D) Natural ore mine in a foreign country

E) Sub-assembly plant in a foreign country that uses U.S. made components

A) A product assembly plant located in a foreign country

B) A foreign sales office

C) Accounting office which handles all payroll functions and is located in a foreign country

D) Natural ore mine in a foreign country

E) Sub-assembly plant in a foreign country that uses U.S. made components

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

58

Currently, you can purchase either 124 Canadian dollars or 10,037 Japanese yen for $100. What is the ¥/C$ cross rate?

A) ¥78.87/C$1

B) ¥80.94/C$1

C) ¥81.23/C$1

D) ¥86.27/C$1

E) ¥87.08/C$1

A) ¥78.87/C$1

B) ¥80.94/C$1

C) ¥81.23/C$1

D) ¥86.27/C$1

E) ¥87.08/C$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

59

The exchange rate is 1.14 Swiss francs per U.S. dollar. How many U.S. dollars are needed to purchase 2,500 Swiss francs?

A) $2,021.21

B) $2,192.98

C) $2,646.64

D) $2,850.00

E) $2,918.46

A) $2,021.21

B) $2,192.98

C) $2,646.64

D) $2,850.00

E) $2,918.46

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

60

You can exchange $1 for either 0.7538 euros or 0.6789 British pounds. What is the cross rate between the pound and the euro?

A) £0.7519/€1

B) £0.8756/€1

C) £0.9006/€1

D) £1.0852/€1

E) £1.1103/€1

A) £0.7519/€1

B) £0.8756/€1

C) £0.9006/€1

D) £1.0852/€1

E) £1.1103/€1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

61

The current spot rate between the U.K. and the U.S. is £0.6764 per $1. The expected inflation rate in the U.S. is 1.8 percent. The expected inflation rate in the U.K. is 3.4 percent. If relative purchasing power parity exists, what will the exchange rate be 2 years from now?

A) £0.6549/$1

B) £.0.6656/$1

C) £.0.6872/$1

D) £0.6982/$1

E) £.5331/$1

A) £0.6549/$1

B) £.0.6656/$1

C) £.0.6872/$1

D) £0.6982/$1

E) £.5331/$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

62

Currently, you can exchange €100 for $132.66. The inflation rate in Euroland is expected to be 3.1 percent as compared to 3.6 percent in the U.S. Assuming that relative purchasing power parity exists, what should the exchange rate be 5 years from now?

A) €.7298/$1

B) €.7351/$1

C) €.7367/$1

D) €.7405/$1

E) €.7423/$1

A) €.7298/$1

B) €.7351/$1

C) €.7367/$1

D) €.7405/$1

E) €.7423/$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

63

Identify four parties that have a demand for U.S. dollars and explain why they wish to obtain those dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is LIBOR and what role does it play in international finance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

65

The spot rate on the Hong Kong dollar is 7.75. Interest rates in Hong Kong are expected to be 6 percent while they are anticipated to be 2.8 percent in the U.S. What is the expected exchange rate two years from now?

A) HK$8.0000

B) HK$8.1808

C) HK$8.2539

D) HK$8.3778

E) HK$8.4141

A) HK$8.0000

B) HK$8.1808

C) HK$8.2539

D) HK$8.3778

E) HK$8.4141

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

66

The spot rate is SF1.1426 = $1. A hotel room in a resort area of Switzerland costs SF385. Based on absolute purchasing power parity, what should an identical room in the U.S. cost?

A) $354.24

B) $336.95

C) $387.05

D) $425.48

E) $439.90

A) $354.24

B) $336.95

C) $387.05

D) $425.48

E) $439.90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

67

The 1-year forward rate between the U.S. and Japan is ¥122.47 = $1. A 1-year risk-free security in Japan is yielding 5.3 percent while it is 4.6 percent in the U.S. Assume interest rate parity exists. What is the spot rate between the U.S. and Japan?

A) ¥120.41

B) ¥121.08

C) ¥121.66

D) ¥121.94

E) ¥122.03

A) ¥120.41

B) ¥121.08

C) ¥121.66

D) ¥121.94

E) ¥122.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

68

The spot rate between the U.K. and the U.S. is £0.6789 = $1, while the 1-year forward rate is £0.6782 = $1. The risk-free rate in the U.K. is 3.1 percent. The risk-free rate in the U.S. is 2.9 percent. How much profit can you earn on a loan of $2,000 by utilizing covered interest arbitrage?

A) -$4.09

B) -$2.78

C) $3.15

D) $6.13

E) $8.55

A) -$4.09

B) -$2.78

C) $3.15

D) $6.13

E) $8.55

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

69

The spot rate on the Norwegian kroner is 6.689. The exchange rate one year from now is expected to be 6.745 assuming that relative interest rate parity exists. Interest rates in Norway are 3.7 percent. What is the interest rate in the U.S.?

A) 2.86 percent

B) 3.02 percent

C) 3.59 percent

D) 4.54 percent

E) 4.68 percent

A) 2.86 percent

B) 3.02 percent

C) 3.59 percent

D) 4.54 percent

E) 4.68 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

70

A U.S. firm has total assets valued at £890,000 located in London. This valuation did not change from last year. Last year, the exchange rate was £0.62 = $1. Today, the exchange rate is £0.68 = $1. By what amount did these assets change in value on the firm's U.S. financial statements?

A) -$126,660.34

B) $-113,511.03

C) $-87,248.91

D) $113,511.03

E) $126,660.34

A) -$126,660.34

B) $-113,511.03

C) $-87,248.91

D) $113,511.03

E) $126,660.34

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

71

A particular set of golf clubs in the U.S. costs $990. According to absolute purchasing power parity, what should the identical set of clubs cost in the U.K. when the spot rate is £0.6703 = $1?

A) £1,476.95

B) £1,428.08

C) £633.80

D) £647.50

E) £663.60

A) £1,476.95

B) £1,428.08

C) £633.80

D) £647.50

E) £663.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

72

The 1-year forward rate for the Swiss franc is Sf1.1375 = $1. The spot rate is Sf1.1426 = $1. The interest rate on a risk-free asset in Switzerland is 3.3 percent. If interest rate parity exists, a 1 year risk-free security in the U.S. is yielding _____ percent.

A) 2.28 percent

B) 2.51 percent

C) 2.98 percent

D) 3.40 percent

E) 3.76 percent

A) 2.28 percent

B) 2.51 percent

C) 2.98 percent

D) 3.40 percent

E) 3.76 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

73

The spot rate between Canada and the U.S. is C$1.2381 = $1, while the 1-year forward rate is C$1.2379 = $1. The risk-free rate in Canada is 2.8 percent. The risk-free rate in the U.S. is 3.6 percent. How much profit can you earn on a loan of $10,000 by utilizing covered interest arbitrage?

A) -$81.42

B) -$78.34

C) -$53.60

D) $34.91

E) $65.07

A) -$81.42

B) -$78.34

C) -$53.60

D) $34.91

E) $65.07

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

74

The spot rate on the Canadian dollar is 1.23. Interest rates in Canada are expected to average 4.2 percent while they are anticipated to be 3.3 percent in the U.S. What is the expected exchange rate three years from now?

A) C$1.2760

B) C$1.2635

C) C$1.2483

D) C$1.2108

E) C$1.1971

A) C$1.2760

B) C$1.2635

C) C$1.2483

D) C$1.2108

E) C$1.1971

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

75

Currently, you can exchange $100 for €75.42. The inflation rate in Euroland is expected to be 3.8 percent as compared to 2.1 percent in the U.S. Assuming that relative purchasing power parity exists, what should the exchange rate be 4 years from now?

A) €0.7042/$1

B) €0.7414/$1

C) €0.7670/$1

D) €0.7778/$1

E) €0.8068/$1

A) €0.7042/$1

B) €0.7414/$1

C) €0.7670/$1

D) €0.7778/$1

E) €0.8068/$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

76

Currently, you can exchange €100 for $133. The inflation rate in Euroland is expected to be 2.5 percent. In one year, it is expected that €100 can be exchanged for $136. Assume relative purchasing power parity exists. What is the expected inflation rate in the U.S.?

A) 3.84 percent

B) 4.26 percent

C) 4.71 percent

D) 5.21 percent

E) 5.68 percent

A) 3.84 percent

B) 4.26 percent

C) 4.71 percent

D) 5.21 percent

E) 5.68 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

77

The spot rate between Japan and the U.S. is ¥100.37 = $1, while the 1-year forward rate is ¥99.97 = $1. A 1-year risk-free security in the U.S. is yielding 3.8 percent. What is the rate of return on a 1-year risk-free security in Japan assuming that interest rate parity exists?

A) 3.32 percent

B) 3.39 percent

C) 3.44 percent

D) 3.49 percent

E) 3.56 percent

A) 3.32 percent

B) 3.39 percent

C) 3.44 percent

D) 3.49 percent

E) 3.56 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

78

The 1-year forward rate for the British pound is £0.6781 = $1. The spot rate is £0.6789 = $1. The interest rate on a risk-free asset in the U.K. is 4.6 percent. If interest rate parity exists, what is the 1 year risk-free rate in the U.S.?

A) 4.68 percent

B) 4.72 percent

C) 4.77 percent

D) 4.83 percent

E) 4.87 percent

A) 4.68 percent

B) 4.72 percent

C) 4.77 percent

D) 4.83 percent

E) 4.87 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

79

A U.S. firm has total assets valued at €687,000 located in Germany. This valuation did not change from last year. Last year, the exchange rate was €0.94 = $1. Today, the exchange rate is €.0.75 = $1. By what amount did these assets change in value on the firm's U.S. financial statements?

A) -$185,148.94

B) -$162,311.19

C) $162,311.19

D) $185,148.94

E) $0

A) -$185,148.94

B) -$162,311.19

C) $162,311.19

D) $185,148.94

E) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck

80

The current spot rate between the U.K. and the U.S. is £0.6789 per $1. The expected inflation rate in the U.S. is 2.1 percent. The expected inflation rate in the U.K. is 2.6 percent. If relative purchasing power parity exists, what will the exchange rate be next year?

A) £0.6755/$1

B) £0.6410/$1

C) £0.6823/$1

D) £0.7023/$1

E) £0.7110/$1

A) £0.6755/$1

B) £0.6410/$1

C) £0.6823/$1

D) £0.7023/$1

E) £0.7110/$1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 91 في هذه المجموعة.

فتح الحزمة

k this deck