Deck 6: Making Investment Decisions With the Net Present Value Rule

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/76

العب

ملء الشاشة (f)

Deck 6: Making Investment Decisions With the Net Present Value Rule

1

Money that a firm has already spent,or committed to spend regardless of whether a project is taken,is called:

A)fixed cost.

B)opportunity cost.

C)sunk cost.

D)incremental cost.

A)fixed cost.

B)opportunity cost.

C)sunk cost.

D)incremental cost.

sunk cost.

2

A firm owns a building with a book value of $150,000 and a market value of $250,000.If the firm uses the building for a project,then its opportunity cost,ignoring taxes,is:

A)$100,000.

B)$150,000.

C)$250,000.

D)$400,000.

A)$100,000.

B)$150,000.

C)$250,000.

D)$400,000.

$250,000.

3

A reduction in the sales of existing products caused by the introduction of a new product is an example of:

A)incidental effects.

B)opportunity costs.

C)sunk costs.

D)allocated overhead costs.

A)incidental effects.

B)opportunity costs.

C)sunk costs.

D)allocated overhead costs.

incidental effects.

4

For the case of an electric car project,the following costs should be treated as incremental costs when deciding whether to go ahead with the project EXCEPT:

A)the consequent reduction in sales of the company's existing gasoline models (i.e.,incidental effects).

B)interest payments on debt incurred to finance the project.

C)the value of tools that will be transferred to the project from the company's existing plants instead of being sold.

D)the expenditure on new plants and equipment.

A)the consequent reduction in sales of the company's existing gasoline models (i.e.,incidental effects).

B)interest payments on debt incurred to finance the project.

C)the value of tools that will be transferred to the project from the company's existing plants instead of being sold.

D)the expenditure on new plants and equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a firm has the opportunity to add a project that will utilize excess factory capacity (that is currently not being used),which costs should be used to help determine if the added project should be undertaken?

A)allocated overhead costs

B)sunk costs

C)incremental costs

D)average costs

A)allocated overhead costs

B)sunk costs

C)incremental costs

D)average costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

6

Net working capital is best represented as:

I.short-term assets;

II.short-term liabilities;

III.long-term assets;

IV.long-term liabilities

A)I only

B)(I - II)

C)(III - I)

D)(III - IV)

I.short-term assets;

II.short-term liabilities;

III.long-term assets;

IV.long-term liabilities

A)I only

B)(I - II)

C)(III - I)

D)(III - IV)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

7

Investment in inventories includes investment in:

i.raw material; II)work-in-progress; III)finished goods

A)I only

B)I and II only

C)I,II,and III

D)III only

i.raw material; II)work-in-progress; III)finished goods

A)I only

B)I and II only

C)I,II,and III

D)III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

8

The current market value of a previously purchased machine proposed for use in a project is an example of a:

A)sunk cost.

B)opportunity cost.

C)fixed cost.

D)inventoriable cost.

A)sunk cost.

B)opportunity cost.

C)fixed cost.

D)inventoriable cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the discount rate is stated in real terms then-in order to calculate the NPV in a consistent manner-the project requires that:

A)cash flows be estimated in nominal terms.

B)cash flows be estimated in real terms.

C)accounting income be used.

D)cash flows be estimated including future inflation.

A)cash flows be estimated in nominal terms.

B)cash flows be estimated in real terms.

C)accounting income be used.

D)cash flows be estimated including future inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

10

The principal short-term assets are:

i.cash; II)accounts receivable; III)inventories; and IV)accounts payable

A)I only

B)I and IV only

C)I,II,and III

D)IV only

i.cash; II)accounts receivable; III)inventories; and IV)accounts payable

A)I only

B)I and IV only

C)I,II,and III

D)IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

11

Important points to remember while estimating the cash flows of a project are:

I.Only cash flow is relevant.

II.Always estimate cash flows on an incremental basis.

III.Be consistent in the treatment of inflation.

A)I only

B)I and II only

C)II and III only

D)I,II,and III

I.Only cash flow is relevant.

II.Always estimate cash flows on an incremental basis.

III.Be consistent in the treatment of inflation.

A)I only

B)I and II only

C)II and III only

D)I,II,and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

12

Preferably,a financial analyst estimates cash flows for a project as:

A)cash flows before taxes.

B)cash flows after taxes.

C)accounting profits before taxes.

D)accounting profits after taxes.

A)cash flows before taxes.

B)cash flows after taxes.

C)accounting profits before taxes.

D)accounting profits after taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

13

An analyst wishes to determine the value of resources used by a proposed project.Which values should the analyst use to approximate opportunity costs?

A)book values

B)market values

C)historical values

D)Accounting values plus an inflation adjustment

A)book values

B)market values

C)historical values

D)Accounting values plus an inflation adjustment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

14

For the case of an electric car project,which of the following costs or cash flows should be categorized as incremental when analyzing whether to invest in the project?

A)The cost of research and development undertaken for developing the electric car during the past three years

B)The annual depreciation charge

C)Tax savings resulting from the depreciation charges

D)Dividend payments

A)The cost of research and development undertaken for developing the electric car during the past three years

B)The annual depreciation charge

C)Tax savings resulting from the depreciation charges

D)Dividend payments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the discount rate is stated in nominal terms then-in order to calculate the NPV in a consistent manner-the project requires that:

A)cash flows be estimated in nominal terms.

B)cash flows be estimated in real terms.

C)accounting income be used.

D)cash flows be estimated ignoring inflation.

A)cash flows be estimated in nominal terms.

B)cash flows be estimated in real terms.

C)accounting income be used.

D)cash flows be estimated ignoring inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

16

Costs incurred as a result of past,irrevocable decisions and irrelevant to future decisions are called:

A)opportunity costs.

B)sunk costs.

C)incremental costs.

D)marginal costs.

A)opportunity costs.

B)sunk costs.

C)incremental costs.

D)marginal costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

17

When Honda develops a new engine the incidental effects might include the following:

I.demand for replacement parts;

II.profits from the sale of repair services;

III.offer modified or improved versions of the new engine for other uses

A)I only

B)I and II only

C)I,II,and III

D)I and III only

I.demand for replacement parts;

II.profits from the sale of repair services;

III.offer modified or improved versions of the new engine for other uses

A)I only

B)I and II only

C)I,II,and III

D)I and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

18

One should consider net working capital (NWC)in project cash flows because:

A)typically,firms must invest cash in short-term assets to produce finished goods.

B)NWC represents sunk costs.

C)firms need positive NPV projects for investment.

D)inclusion of NWC typically increases calculated NPV.

A)typically,firms must invest cash in short-term assets to produce finished goods.

B)NWC represents sunk costs.

C)firms need positive NPV projects for investment.

D)inclusion of NWC typically increases calculated NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

19

The cost of a resource that may be relevant to an investment decision even when no cash changes hand is called a(an):

A)sunk cost.

B)opportunity cost.

C)depreciation cost.

D)average cost.

A)sunk cost.

B)opportunity cost.

C)depreciation cost.

D)average cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

20

Accountants do not depreciate investment in net working capital because:

A)it is not a cash flow.

B)it is recovered during-or at the end of-the project,thus is not a depreciating asset.

C)it is a sunk cost.

D)working capital appears on the balance sheet,not the income statement.

A)it is not a cash flow.

B)it is recovered during-or at the end of-the project,thus is not a depreciating asset.

C)it is a sunk cost.

D)working capital appears on the balance sheet,not the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

21

The real rate of interest is 3% and inflation is 4%.What is the nominal rate of interest?

A)3%

B)1.00%

C)7.12%

D)-1.00%

A)3%

B)1.00%

C)7.12%

D)-1.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

22

Capital equipment costing $250,000 today has 50,000 salvage value at the end of five years.If the straight-line depreciation method is used,what is the book value of the equipment at the end of two years?

A)$200,000

B)$170,000

C)$140,000

D)$150,000

A)$200,000

B)$170,000

C)$140,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

23

Proper treatment of inflation in NPV calculations involves:

I.discounting nominal cash flows by the nominal discount rate;

II.discounting real cash flows by the real discount rate;

III.discounting nominal cash flows by the real discount rate

A)I only

B)II only

C)III only

D)I and II only

I.discounting nominal cash flows by the nominal discount rate;

II.discounting real cash flows by the real discount rate;

III.discounting nominal cash flows by the real discount rate

A)I only

B)II only

C)III only

D)I and II only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

24

If the nominal interest rate is 7.5% and the inflation rate is 4.0%,what is the real interest rate?

A)4.0%

B)9.5%

C)3.4%

D)11.5%

A)4.0%

B)9.5%

C)3.4%

D)11.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

25

The real interest rate is 3.0% and the inflation rate is 5.0%.What is the nominal interest rate?

A)3.00%

B)5.00%

C)8.15%

D)2.00%

A)3.00%

B)5.00%

C)8.15%

D)2.00%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

26

A project requires an initial investment of $200,000 and expects to produce a cash flow before taxes of 120,000 per year for two years .The corporate tax rate is 30%.The assets will depreciate using the MACRS - 3-year schedule: (t = 1,33%); (t = 2: 45%); (t = 3: 15%); (t = 4: 7%).The company's tax situation is such that it can use all applicable tax shields.The opportunity cost of capital is 12%.Assume that the asset can sell for book value at the end of the project.Calculate the NPV of the project (approximately):

A)$22,463.

B)$19,315.

C)$16,244.

D)$5,721

A)$22,463.

B)$19,315.

C)$16,244.

D)$5,721

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

27

The NPV value obtained by discounting nominal cash flows using the nominal discount rate is the same as the NPV value obtained by discounting:

I.real cash flows using the real discount rate;

II.real cash flows using the nominal discount rate;

III.nominal cash flows using the real discount rate

A)I only

B)II only

C)III only

D)II and III only

I.real cash flows using the real discount rate;

II.real cash flows using the nominal discount rate;

III.nominal cash flows using the real discount rate

A)I only

B)II only

C)III only

D)II and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

28

Suppose that a project has a depreciable investment of $600,000 and falls under the following MACRS year 5 class depreciation schedule:

Year 1: 20%; year 2: 32%; year 3: 19.2%; year 4: 11.5%; year 5: 11.5%; and year 6: 5.8%.

Calculate depreciation for year 2.

A)$120,000

B)$192,000

C)$96,000

D)$115,200

Year 1: 20%; year 2: 32%; year 3: 19.2%; year 4: 11.5%; year 5: 11.5%; and year 6: 5.8%.

Calculate depreciation for year 2.

A)$120,000

B)$192,000

C)$96,000

D)$115,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

29

A piece of capital equipment costing $400,000 today has no (zero)salvage value at the end of five years.If straight-line depreciation is used,what is the book value of the equipment at the end of three years?

A)$120,000

B)$80,000

C)$160,000

D)$240,000

A)$120,000

B)$80,000

C)$160,000

D)$240,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

30

Working capital is a frequent source of errors in estimating project cash flows.These errors include:

I.forgetting about working capital entirely;

II.forgetting that working capital may change during the life of the project;

III.forgetting that working capital is recovered at the end of the project;

IV.forgetting to depreciate working capital

A)I and II only

B)I,II,and III only

C)II,III,and IV only

D)I,II,and IV only

I.forgetting about working capital entirely;

II.forgetting that working capital may change during the life of the project;

III.forgetting that working capital is recovered at the end of the project;

IV.forgetting to depreciate working capital

A)I and II only

B)I,II,and III only

C)II,III,and IV only

D)I,II,and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

31

For project Z,year 5 inventories increase by $6,000,accounts receivable by $4,000,and accounts payable by $3,000.Calculate the increase or decrease in working capital for year 5.

A)increases by $5,000

B)decreases by $1,000

C)increases by $7,000

D)decreases by $7,000

A)increases by $5,000

B)decreases by $1,000

C)increases by $7,000

D)decreases by $7,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

32

Given the following data for Project M:

A)$25.85.

B)$17.77.

C)$22.65.

D)$35.00.

A)$25.85.

B)$17.77.

C)$22.65.

D)$35.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

33

If depreciation is $100,000 and the marginal tax rate is 35%,then the tax shield due to depreciation is:

A)$35,000

B)$100,000

C)$65,000

D)cannot be determined from the information given

A)$35,000

B)$100,000

C)$65,000

D)cannot be determined from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

34

Your firm expects to receive a cash flow in two years of $10,816 in nominal terms.If the real rate of interest is 2% and the inflation rate is 4%,what is the real cash flow for year 2?

A)$11,236

B)$10,816

C)$10,000

D)$9,246

A)$11,236

B)$10,816

C)$10,000

D)$9,246

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

35

For project A in year 2,inventories increase by $12,000 and accounts payable increases by $2,000.Accounts receivable remain the same.Calculate the increase or decrease in net working capital for year 2.

A)decreases by $14,000

B)increases by $14,000

C)decreases by $10,000

D)increases by $10,000

A)decreases by $14,000

B)increases by $14,000

C)decreases by $10,000

D)increases by $10,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

36

The real cash flow occurring in year 2 is $60,000.If the inflation rate is 5% per year and the real rate of interest is 2% per year,calculate the nominal cash flow for year 2.

A)$60,000

B)$62,424

C)$66,150

D)$63,654

A)$60,000

B)$62,424

C)$66,150

D)$63,654

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

37

Given the following data for Project M:

A)$51.70.

B)$35.54.

C)$45.21.

D)$70.00.

A)$51.70.

B)$35.54.

C)$45.21.

D)$70.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

38

A firm has a general-purpose machine,which has a book value of $300,000 and is worth $500,000 in the market.If the tax rate is 35%,what is the opportunity cost of using the machine in a project?

A)$500,000

B)$430,000

C)$300,000

D)$200,000

A)$500,000

B)$430,000

C)$300,000

D)$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose that a project has a depreciable investment of $1,000,000 and falls under the following MACRS year 5 class depreciation schedule:

Year 1: 20%; year 2: 32%; year 3: 19.2%; year 4: 11.5%; year 5: 11.5%; and year 6: 5.8%.

Calculate the depreciation tax shield for year 2 using a tax rate of 30%:

A)$224,000.

B)$60,000.

C)$96,000.

D)$300,000.

Year 1: 20%; year 2: 32%; year 3: 19.2%; year 4: 11.5%; year 5: 11.5%; and year 6: 5.8%.

Calculate the depreciation tax shield for year 2 using a tax rate of 30%:

A)$224,000.

B)$60,000.

C)$96,000.

D)$300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

40

If depreciation is $600,000 and the marginal tax rate is 35%,then the tax shield due to depreciation is:

A)$210,000.

B)$600,000.

C)$390,000.

D)cannot be determined from the information given.

A)$210,000.

B)$600,000.

C)$390,000.

D)cannot be determined from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

41

You are considering the purchase of one of two machines required in your production process.Machine A has a life of two years.Machine A costs $50 initially and then $70 per year in maintenance.Machine B has an initial cost of $90.It requires $40 in maintenance for each year of its three-year life.Either machine must be replaced at the end of its life.Which is the better machine for the firm? The discount rate is 15% and the tax rate is zero.

A)Machine A as EAC for machine A is $100.76

B)Machine B as EAC for machine B is $79.42

C)Machine A as PV of costs for machine A is $163.80

D)Machine B as PV of costs for machine B is $181.33Machine A: Annuity factor = (1/.15)× (1 - (1/(1.15^2)))= 1.6257.Machine B: Annuity factor = (1/.15)(1 - (1/(1.15^3)))= 2.2832.Costs:PV(A)= 50 + 70 (1.6257)= 163.80; EAC = 163.80/(1.6257)= 100.76;

A)Machine A as EAC for machine A is $100.76

B)Machine B as EAC for machine B is $79.42

C)Machine A as PV of costs for machine A is $163.80

D)Machine B as PV of costs for machine B is $181.33Machine A: Annuity factor = (1/.15)× (1 - (1/(1.15^2)))= 1.6257.Machine B: Annuity factor = (1/.15)(1 - (1/(1.15^3)))= 2.2832.Costs:PV(A)= 50 + 70 (1.6257)= 163.80; EAC = 163.80/(1.6257)= 100.76;

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

42

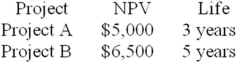

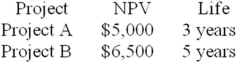

Two mutually exclusive projects have the following positive NPVs and project lives.

If the cost of capital were 15%,which project would you accept?

A)Project A because it has higher EAC

B)Project B because it has higher EAC

C)Project A because its NPV can be earned more quickly

D)Project B beca

If the cost of capital were 15%,which project would you accept?

A)Project A because it has higher EAC

B)Project B because it has higher EAC

C)Project A because its NPV can be earned more quickly

D)Project B beca

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

43

A financial analyst should include interest and dividend payments when calculating a project's cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following countries allows firms to keep two separate sets of books,one for the stockholders and one for the tax authorities like the Internal Revenue Service?

i.U)S.; II)Japan; III)France

A)I only

B)I and II only

C)I,II,and III only

D)None of the options

i.U)S.; II)Japan; III)France

A)I only

B)I and II only

C)I,II,and III only

D)None of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

45

Germany allows firms to choose the following depreciation methods:

i.straight-line method; II)declining-balance method

A)I only

B)II only

C)I and II only

D)Germany allows a very different system

i.straight-line method; II)declining-balance method

A)I only

B)II only

C)I and II only

D)Germany allows a very different system

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

46

By undertaking an analysis in real terms,the financial manager avoids having to forecast inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

47

When calculating cash flows,one should consider them on an incremental basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

48

Opportunity costs should not be included in project analysis,as they are missed opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

49

Working capital is needed for additional investment within a project and should be included within cash-flow estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

50

A project requires an initial investment of $200,000 and expects to produce a cash flow before taxes of 120,000 per year for two years .The corporate tax rate is 30%.The assets will depreciate using the MACRS year 3 schedule: (t = 1: 33%); (t = 2: 45%); (t = 3: 15%); (t = 4: 7%).The company's tax situation is such that it can use all applicable tax shields.The opportunity cost of capital is 11%.Assume that the asset can sell for book value at the end of the project.Calculate the approximate IRR for the project.

A)12.00%

B)11.00%

C)17.73%

D)14.06%

A)12.00%

B)11.00%

C)17.73%

D)14.06%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

51

Your boss asked you to evaluate a project with an infinite life.Sales and costs project to $1,000 and $500 per year,respectively.(Assume sales and costs occur at the end of the year,i.e.,profit of $500 at the end of year one.)There is no depreciation and the tax rate is 30%.The real required rate of return is 10%.The inflation rate is 4% and is expected to be 4% forever.Sales and costs will increase at the rate of inflation.If the project costs $3,000,what is the NPV?

A)$500.00

B)$1629.62

C)$365.38

D)$472.22

A)$500.00

B)$1629.62

C)$365.38

D)$472.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

52

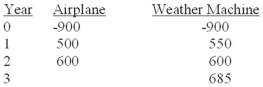

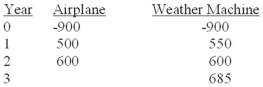

RainMan Inc.is in the business of producing rain upon request.They must decide between two investment projects: a new airplane for seeding rain clouds or a new weather control machine built by Dr.Nutzbaum.The discount rate for the new airplane is 9%,while the discount rate for the weather machine is 39% (it happens to have higher market risk).Which investment should the company select and why? (Assume a 0% inflation rate and that projected costs do not change over time.)

A)Airplane because it has a higher NPV

B)Weather machine because it has a higher NPV

C)Airplane because it has a higher equivalent annual cash flow

D)Weather machine beca

A)Airplane because it has a higher NPV

B)Weather machine because it has a higher NPV

C)Airplane because it has a higher equivalent annual cash flow

D)Weather machine beca

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

53

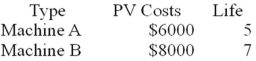

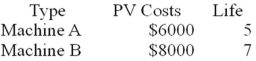

Two machines,A and B,which perform the same functions,have the following costs and lives.

Which machine would you choose? The two machines are mutually exclusive and the cost of capital is 15%.

A)Machine A because the EAC is $1789.89

B)Machine B because the EAC is $1922.88

C)Machine A because it has lower PV costs

D)Machine B beca

Which machine would you choose? The two machines are mutually exclusive and the cost of capital is 15%.

A)Machine A because the EAC is $1789.89

B)Machine B because the EAC is $1922.88

C)Machine A because it has lower PV costs

D)Machine B beca

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

54

OM Construction Company must choose between two types of cranes.Crane A costs $600,000,will last for five years,and will require $60,000 in maintenance each year.Crane B costs $750,000,will last for seven years,and will require $30,000 in maintenance each year.Maintenance costs for cranes A and B occur at the end of each year.The appropriate discount rate is 12% per year.Which machine should OM Construction purchase?

A)Crane A as EAC is $226,444

B)Crane B as EAC is $194,336

C)Crane A because its PV is $816,286,i.e.,less than the PV of Project B

D)Cannot be calculated as the revenues for the project are not givenCrane A: Annuity factor = (1/.12)× (1 - (1/(1.12^5)))= 3.6048.Crane B: Annuity factor = (1/.12)× (1 - (1/(1.12^7)))= 4.5638.Costs:PV (A)= 600,000 + 60,000 (3.6048)= 816,286;EAC = 816,286/(3.6048)= $226,444;PV(B)= 750,000 + 30,000 (4.5638)= 886,913;

A)Crane A as EAC is $226,444

B)Crane B as EAC is $194,336

C)Crane A because its PV is $816,286,i.e.,less than the PV of Project B

D)Cannot be calculated as the revenues for the project are not givenCrane A: Annuity factor = (1/.12)× (1 - (1/(1.12^5)))= 3.6048.Crane B: Annuity factor = (1/.12)× (1 - (1/(1.12^7)))= 4.5638.Costs:PV (A)= 600,000 + 60,000 (3.6048)= 816,286;EAC = 816,286/(3.6048)= $226,444;PV(B)= 750,000 + 30,000 (4.5638)= 886,913;

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

55

Working capital is one of the most common sources of mistakes in estimating project cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

56

When calculating cash flows,one should consider all incidental effects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

57

Depreciation expense acts as a tax shield in reducing taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

58

Sunk costs are bygones,i.e.,they are unaffected by the decision to accept or reject a project.They should therefore be ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

59

Using the technique of equivalent annual cash flows and a discount rate of 7%,what is the value of the following project?

A)3.06

B)3.61

C)10.25

D)12.23

A)3.06

B)3.61

C)10.25

D)12.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

60

A project requires an investment of $900 today.It can generate sales of $1,100 per year forever.Costs are $600 for the first year and will increase by 20% per year.(Assume all sales and costs occur at year-end,i.e.,costs are $600 @ t = 1.)Ignore taxes and calculate the NPV of the project at a 12% discount rate.

A)$65.00

B)$57.51

C)$100.00

D)Cannot be calculated as g > rNPV = -900 + (1,100 - 600)/1.12 + (1,100 - (600 × 1.2))/(1.12^2)+ (1,100 - 600 (1.2^2))/(1.12)^3 + (1,100 - 600 (1.2^3))/(1.12^4)= $57.51).

A)$65.00

B)$57.51

C)$100.00

D)Cannot be calculated as g > rNPV = -900 + (1,100 - 600)/1.12 + (1,100 - (600 × 1.2))/(1.12^2)+ (1,100 - 600 (1.2^2))/(1.12)^3 + (1,100 - 600 (1.2^3))/(1.12^4)= $57.51).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

61

Most large U.S.corporations keep two separate sets of books,one for stockholders and one for the Internal Revenue Service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

62

Briefly explain how the decision to replace an existing machine is made?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

63

What are some of the important points to remember while estimating the cash flows of a project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

64

Briefly explain how the cost of excess capacity is taken into consideration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

65

When evaluating projects with positive NPV but different life spans,the proper technique to employ is the equivalent annual cash-flow approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

66

Within the MACRS system of depreciation,most industrial equipment falls into the ten- and fifteen-year classes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

67

Briefly discuss how tax reporting to governments vs.shareholders is treated in countries like Japan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

68

You should replace a machine when the EAC of continuing to operate it exceeds the EAC of the new machine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

69

Define the term cash flow for a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

70

What are some of the additional factors that an analyst should consider while estimating cash flows in foreign countries and currencies?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

71

How do you compare projects with different lives?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

72

The rule for comparing machines with different lives is to select the machine with the greatest equivalent annual cost (EAC).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

73

The equivalent annual cash-flow technique is primarily used whenever the lives of two different projects are the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

74

Briefly explain the acronym MACRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

75

Briefly explain how inflation is treated consistently while estimating a project's NPV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck

76

A financial analyst can use the equivalent annual cash-flow approach to determine the year in which an existing machine can be profitably replaced with a new machine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 76 في هذه المجموعة.

فتح الحزمة

k this deck