Deck 12: Return, Risk, and the Security Market Line

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/84

العب

ملء الشاشة (f)

Deck 12: Return, Risk, and the Security Market Line

1

Which one of the following betas represents the greatest level of systematic risk?

A).05

B).68

C)1.00

D)1.19

E)1.27

A).05

B).68

C)1.00

D)1.19

E)1.27

E

2

Which one of the following is the theory which states that the value of a security is dependent upon the pure time value of money,the reward for bearing systematic risk,and the amount of systematic risk?

A)reward-to-risk theory

B)capital asset pricing model

C)risk premium proposal

D)market slope hypothesis

E)security market line proposition

A)reward-to-risk theory

B)capital asset pricing model

C)risk premium proposal

D)market slope hypothesis

E)security market line proposition

B

3

Which one of the following is the best example of systematic risk?

A)there is a shortage of nurses

B)a fire destroys a warehouse

C)gas prices rise sharply

D)the cost of sugar increases

E)two firms merge their operations

A)there is a shortage of nurses

B)a fire destroys a warehouse

C)gas prices rise sharply

D)the cost of sugar increases

E)two firms merge their operations

C

4

A stock with which one of the following betas has an expected return that most resembles the overall market expected rate of return?

A).33

B).74

C).99

D)1.06

E)1.22

A).33

B).74

C).99

D)1.06

E)1.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

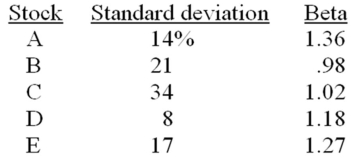

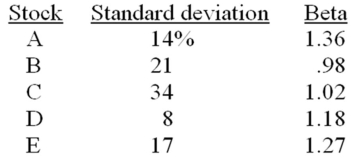

5

Which one of the following stocks has the highest expected risk premium?

A)A

B)B

C)C

D)D

E)E

A)A

B)B

C)C

D)D

E)E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which one of the following is the type of risk that affects a large number of assets?

A)unique

B)systematic

C)asset-specific

D)unsystematic

E)firm-specific

A)unique

B)systematic

C)asset-specific

D)unsystematic

E)firm-specific

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which one of the following measures systematic risk?

A)beta

B)alpha

C)variance

D)standard deviation

E)correlation coefficient

A)beta

B)alpha

C)variance

D)standard deviation

E)correlation coefficient

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

8

Retail Specialties just announced that its Chief Operating Officer is retiring at the end of this month.This announcement will cause the firm's stock price to:

A)increase.

B)either increase or remain constant.

C)remain constant.

D)decrease.

E)either increase, decrease, or remain constant.

A)increase.

B)either increase or remain constant.

C)remain constant.

D)decrease.

E)either increase, decrease, or remain constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which one of the following qualifies as diversifiable risk?

A)market risk

B)systematic risk associated with an individual security

C)market crash

D)the systematic portion of an expected return

E)the unsystematic portion of an unexpected return

A)market risk

B)systematic risk associated with an individual security

C)market crash

D)the systematic portion of an expected return

E)the unsystematic portion of an unexpected return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which one of the following is the best example of unsystematic risk?

A)decrease in company sales

B)increase in market interest rates

C)change in corporate tax rates

D)increase in inflation

E)This risk is related to expected portfolio returns

A)decrease in company sales

B)increase in market interest rates

C)change in corporate tax rates

D)increase in inflation

E)This risk is related to expected portfolio returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which one of the following terms is the measure of the tendency of two things to move or vary together?

A)variance

B)squared deviation

C)standard deviation

D)alpha

E)covariance

A)variance

B)squared deviation

C)standard deviation

D)alpha

E)covariance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of the following statements applies to unsystematic risk?

A)It can be eliminated through portfolio diversification.

B)It is also called market risk.

C)It is a type of risk that applies to most, if not all, securities.

D)Investors receive a risk premium as compensation for accepting this risk.

E)This risk is related to expected returns.

A)It can be eliminated through portfolio diversification.

B)It is also called market risk.

C)It is a type of risk that applies to most, if not all, securities.

D)Investors receive a risk premium as compensation for accepting this risk.

E)This risk is related to expected returns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which one of the following is expressed as "E(RM)- Rf"?

A)market risk premium

B)individual security risk premium

C)real rate of return

D)total expected rate of return

E)market rate of return

A)market risk premium

B)individual security risk premium

C)real rate of return

D)total expected rate of return

E)market rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the beta of a risk-free security?

A).00

B).50

C)1.00

D)1.50

E)2.00

A).00

B).50

C)1.00

D)1.50

E)2.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which one of the following is the type of risk that only affects either a single firm or just a small number of firms?

A)unexpected

B)market

C)systematic

D)unsystematic

E)expected

A)unexpected

B)market

C)systematic

D)unsystematic

E)expected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

16

The security market line depicts the graphical relationship between which two of the following?

I)expected return

II)surprise return

III)systematic risk

IV)unsystematic risk

A)I and III

B)I and IV

C)II and III

D)II and IV

E)none of these

I)expected return

II)surprise return

III)systematic risk

IV)unsystematic risk

A)I and III

B)I and IV

C)II and III

D)II and IV

E)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which one of the following announcements is most apt to cause the price of a firm's stock to increase?

A)The firm met its quarterly earnings forecast.

B)An unpopular CEO unexpectedly announced he is resigning effective immediately.

C)A firm officially confirmed the rumors that it is merging with a competitor.

D)The firm just lowered its projected earnings per share for next year.

E)Analysts are expected to lower the firm's credit rating on its debt.

A)The firm met its quarterly earnings forecast.

B)An unpopular CEO unexpectedly announced he is resigning effective immediately.

C)A firm officially confirmed the rumors that it is merging with a competitor.

D)The firm just lowered its projected earnings per share for next year.

E)Analysts are expected to lower the firm's credit rating on its debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

18

According to the systematic risk principle,the reward for bearing risk is based on which one of the following types of risk?

A)unsystematic

B)firm specific

C)expected

D)systematic

E)diversifiable

A)unsystematic

B)firm specific

C)expected

D)systematic

E)diversifiable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which one of the following terms is another name for systematic risk?

A)unique risk

B)firm risk

C)market risk

D)asset-specific risk

E)diversifiable risk

A)unique risk

B)firm risk

C)market risk

D)asset-specific risk

E)diversifiable risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which one of the following is the best example of a risk associated with stock ownership?

A)The stock paid a regular quarterly dividend.

B)The firm's net income decreased by 4 percent for the quarter, as had been expected.

C)One of the firm's patent applications was unexpectedly rejected.

D)The firm's cost of debt increased as the result of an expected tax cut.

E)The firm's production costs increased in line with previous years.

A)The stock paid a regular quarterly dividend.

B)The firm's net income decreased by 4 percent for the quarter, as had been expected.

C)One of the firm's patent applications was unexpectedly rejected.

D)The firm's cost of debt increased as the result of an expected tax cut.

E)The firm's production costs increased in line with previous years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following are needed to compute the beta of an individual security?

I)average return on the market for the period

II)standard deviation of the security and the market

III)returns on the security and the market for multiple time periods

IV)correlation of the security to the market

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

E)I, II, and III only

I)average return on the market for the period

II)standard deviation of the security and the market

III)returns on the security and the market for multiple time periods

IV)correlation of the security to the market

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

E)I, II, and III only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

22

Where will a security plot in relation to the security market line (SML)if it has a beta of 1.1 and is overvalued?

A)to the right of the overall market and above the SML

B)to the right of the overall market and below the SML

C)to the left of the overall market and above the SML

D)to the left of the overall market and below the SML

E)on the SML

A)to the right of the overall market and above the SML

B)to the right of the overall market and below the SML

C)to the left of the overall market and above the SML

D)to the left of the overall market and below the SML

E)on the SML

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which two of the following determine how sensitive a security is relative to movements in the overall market?

I)the standard deviation of the security

II)correlation between the security's return and the market return

III)the volatility of the security relative to the market

IV)the amount of unsystematic risk inherent in the security

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

E)III and IV only

I)the standard deviation of the security

II)correlation between the security's return and the market return

III)the volatility of the security relative to the market

IV)the amount of unsystematic risk inherent in the security

A)I and III only

B)I and IV only

C)II and III only

D)II and IV only

E)III and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

24

A portfolio beta is computed as which one of the following?

A)weighted average

B)arithmetic average

C)geometric average

D)correlated value

E)covariance value

A)weighted average

B)arithmetic average

C)geometric average

D)correlated value

E)covariance value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which one of the following must be equal for two individual securities with differing betas if those securities are correctly priced according to the capital asset pricing model?

A)standard deviation

B)rate of return

C)beta

D)risk premium

E)reward-to-risk ratio

A)standard deviation

B)rate of return

C)beta

D)risk premium

E)reward-to-risk ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is the beta of an average asset?

A)0

B)> 0 but < 1

C)< 1

D)1

E)> 1

A)0

B)> 0 but < 1

C)< 1

D)1

E)> 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

27

Stocks D,E,and F have actual reward-to-risk ratios of 7.1,6.8,and 7.4,respectively.Given this,you know for certain that:

A) stock E is preferable to stock F.

B) stock D has a higher beta than stock F.

C) the market risk premium is greater than 6.8 and less than 7.4.

D) stock F is riskier than stock D.

E) at least two of the securities are mispriced.

A) stock E is preferable to stock F.

B) stock D has a higher beta than stock F.

C) the market risk premium is greater than 6.8 and less than 7.4.

D) stock F is riskier than stock D.

E) at least two of the securities are mispriced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

28

According to the capital asset pricing model,which of the following will increase the expected rate of return on a security that has a beta that is less than that of the market? Assume the market rate of return is greater than the risk-free rate and both rates are positive.

I)increase in the risk-free rate

II)decrease in the risk-free rate

III)increase in the market risk premium

IV)decrease in the market rate of return

A)I and III only

B)II and III only

C)I and IV only

D)II and IV only

E)II, III, and IV only

I)increase in the risk-free rate

II)decrease in the risk-free rate

III)increase in the market risk premium

IV)decrease in the market rate of return

A)I and III only

B)II and III only

C)I and IV only

D)II and IV only

E)II, III, and IV only

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following will affect the beta value of an individual security?

I)interval of time frequency used for the data sample

II)length of the time period used for the data sample

III)particular time period selected for the sampling

IV)choice of index used as the measure of the market

A)I and II only

B)I and III only

C)II and IV only

D)II, III, and IV only

E)I, II, III, and IV

I)interval of time frequency used for the data sample

II)length of the time period used for the data sample

III)particular time period selected for the sampling

IV)choice of index used as the measure of the market

A)I and II only

B)I and III only

C)II and IV only

D)II, III, and IV only

E)I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

30

A portfolio of securities has a beta of 1.14.Given this,you know that:

A)adding another security to the portfolio must lower the portfolio beta.

B)the portfolio has more risk than a risk-free asset but less risk than the market.

C)each of the securities in the portfolio has more risk than an average security.

D)the portfolio has 14 percent more risk than a risk-free security.

E)the expected return on the portfolio is greater than the expected market return.

A)adding another security to the portfolio must lower the portfolio beta.

B)the portfolio has more risk than a risk-free asset but less risk than the market.

C)each of the securities in the portfolio has more risk than an average security.

D)the portfolio has 14 percent more risk than a risk-free security.

E)the expected return on the portfolio is greater than the expected market return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

31

The amount of risk premium allocated to Security A is dependent upon which one of the following?

A)unsystematic risk associated only with Security A

B)total risk associated with Security A's classification

C)total surprise associated with Security A

D)the difference between the expected return and the actual return on Security A

E)systematic risk associated with Security A

A)unsystematic risk associated only with Security A

B)total risk associated with Security A's classification

C)total surprise associated with Security A

D)the difference between the expected return and the actual return on Security A

E)systematic risk associated with Security A

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

32

You own three stocks which have betas of 1.16,1.34,and 1.02.You would like to add a fourth security such that your portfolio beta will match that of the market.Given this situation,the new security:

A)must have a beta of 1.0.

B)must have a beta of zero.

C)could be a U.S. Treasury bill.

D)could have any beta greater than 1.0.

E)must have a portfolio weight of 50 percent or more.

A)must have a beta of 1.0.

B)must have a beta of zero.

C)could be a U.S. Treasury bill.

D)could have any beta greater than 1.0.

E)must have a portfolio weight of 50 percent or more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

33

A security has a zero covariance with the market.This means that:

A)the return on the security is always equal to that of the market.

B)the return on the security moves in the same direction as the market return.

C)the security is a risk-free security.

D)there is no identifiable relationship between the return on the security and that of the market.

E)the return on the security must vary more than that of the market.

A)the return on the security is always equal to that of the market.

B)the return on the security moves in the same direction as the market return.

C)the security is a risk-free security.

D)there is no identifiable relationship between the return on the security and that of the market.

E)the return on the security must vary more than that of the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which one of the following will increase the slope of the security market line? Assume all else constant.

A)increasing the beta of an efficiently-priced portfolio

B)increasing the risk-free rate

C)increasing the market risk premium

D)decreasing the market rate of return

E)replacing a low-beta stock with a high-beta stock within a portfolio

A)increasing the beta of an efficiently-priced portfolio

B)increasing the risk-free rate

C)increasing the market risk premium

D)decreasing the market rate of return

E)replacing a low-beta stock with a high-beta stock within a portfolio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

35

Of the following,Stock _____ has the greatest level of total risk and Stock _____ has the highest risk premium.

A)A; B

B)B; E

C)C; D

D)D; C

E)C; E

A)A; B

B)B; E

C)C; D

D)D; C

E)C; E

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

36

Where will a security plot in relation to the security market line (SML)if it is considered to be a good purchase because it is underpriced?

A)above the SML

B)either on or above the SML

C)on the SML

D)on or below the SML

E)below the SML

A)above the SML

B)either on or above the SML

C)on the SML

D)on or below the SML

E)below the SML

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

37

All else held constant,which of the following will increase the expected return on a security based on CAPM? Assume the market return exceeds the risk-free rate and both values are positive.Also assume the beta exceeds 1.0.

I)decrease in the security beta

II)increase in the market risk premium

III)decrease in the risk-free rate

IV)increase in the market rate of return

A)I and III only

B)II and IV only

C)I, II, and IV only

D)II, III, and IV only

E)I, II, III, and IV

I)decrease in the security beta

II)increase in the market risk premium

III)decrease in the risk-free rate

IV)increase in the market rate of return

A)I and III only

B)II and IV only

C)I, II, and IV only

D)II, III, and IV only

E)I, II, III, and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

38

You own a portfolio which is invested equally in two stocks and a risk-free security.The stock betas are .89 for Stock A and 1.26 for Stock B.Which one of the following will increase the portfolio beta,all else constant?

A) increasing the amount invested in the risk-free security

B) decreasing the weight of Stock B and increasing the weight of Stock A

C) replacing Stock A with a security that has a beta of .77

D) increasing the weight of Stock A and decreasing the weight of the risk-free security

E) replacing Stock B with Stock C,which has a beta equal to that of the market

A) increasing the amount invested in the risk-free security

B) decreasing the weight of Stock B and increasing the weight of Stock A

C) replacing Stock A with a security that has a beta of .77

D) increasing the weight of Stock A and decreasing the weight of the risk-free security

E) replacing Stock B with Stock C,which has a beta equal to that of the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which one of the following has the highest expected risk premium?

A)stock portfolio with a beta of 1.06

B)U.S. Treasury bill

C)individual stock with a beta of 1.46

D)a stock mutual fund with a beta of .89

E)individual stock with a beta of .94

A)stock portfolio with a beta of 1.06

B)U.S. Treasury bill

C)individual stock with a beta of 1.46

D)a stock mutual fund with a beta of .89

E)individual stock with a beta of .94

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

40

The slope of the security market line is equal to the:

A)market risk premium.

B)risk-free rate of return.

C)market rate of return.

D)market rate of return multiplied by any security's beta, given an inefficient market.

E)market rate of return multiplied by the risk-free rate.

A)market risk premium.

B)risk-free rate of return.

C)market rate of return.

D)market rate of return multiplied by any security's beta, given an inefficient market.

E)market rate of return multiplied by the risk-free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

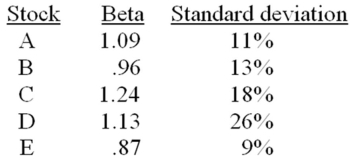

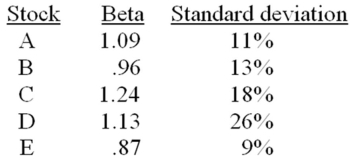

41

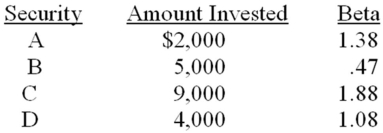

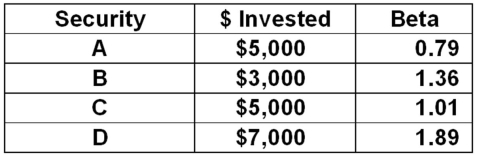

What is the beta of a portfolio which consists of the following?

A)1.18

B)1.22

C)1.23

D)1.32

E)1.37

A)1.18

B)1.22

C)1.23

D)1.32

E)1.37

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

42

A portfolio consists of two stocks and has a beta of 1.07.The first stock has a beta of 1.48 and comprises 38 percent of the portfolio.What is the beta of the second stock?

A).41

B).66

C).82

D)1.28

E)1.35

A).41

B).66

C).82

D)1.28

E)1.35

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

43

Phil realized a total return of 13.2 percent which is less than his expected return of 14.4 percent.What is the amount of his unexpected return?

A)-1.2 percent

B)-0.6 percent

C)0.6 percent

D)1.2 percent

E)1.3 percent

A)-1.2 percent

B)-0.6 percent

C)0.6 percent

D)1.2 percent

E)1.3 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

44

A risky asset has a beta of .90 and an expected return of 7.4 percent.What is the reward-to-risk ratio if the risk-free rate is 2.69 percent?

A)4.04 percent

B)5.23 percent

C)6.51 percent

D)8.41 percent

E)11.59 percent

A)4.04 percent

B)5.23 percent

C)6.51 percent

D)8.41 percent

E)11.59 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

45

Laura has one risk-free asset and one risky stock in her portfolio.The risk-free asset has an expected return of 3.2 percent.The risky asset has a beta of 1.3 and an expected return of 14.9 percent.What is the expected return on the portfolio if the portfolio beta is .975?

A)7.65 percent

B)9.83 percent

C)10.73 percent

D)11.98 percent

E)12.37 percent

A)7.65 percent

B)9.83 percent

C)10.73 percent

D)11.98 percent

E)12.37 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

46

The risk-free rate is 3.4 percent and the expected return on the market is 10.8 percent.Stock A has a beta of 1.18.For a given year,stock A returned 13.6 percent while the market returned 11.8 percent.The systematic portion of the unexpected return was _____ percent and the unsystematic portion was _____ percent.

A)1.045; 0.207

B)1.145; 0.126

C)1.180; 0.288

D)1.344; 1.443

E)1.500; 1.449

A)1.045; 0.207

B)1.145; 0.126

C)1.180; 0.288

D)1.344; 1.443

E)1.500; 1.449

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

47

Reed Plastics just announced the earnings per share for the quarter just ended were $.45 a share.Analysts were expecting $.51.What is the amount of the surprise portion of the announcement?

A)-$.12

B)-$.06

C)$.06

D)$.00

E)$.03

A)-$.12

B)-$.06

C)$.06

D)$.00

E)$.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

48

A risky asset has a beta of 1.40 and an expected return of 17.6 percent.What is the risk-free rate if the risk-to-reward ratio is 8.4 percent?

A)2.74 percent

B)4.03 percent

C)4.33 percent

D)5.32 percent

E)5.84 percent

A)2.74 percent

B)4.03 percent

C)4.33 percent

D)5.32 percent

E)5.84 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

49

The risk-free rate is 3.0 percent and the expected return on the market is 9 percent.Stock A has a beta of 1.20.For a given year,Stock A returned 12.5 percent while the market returned 9.75 percent.The systematic portion of Stock A's unexpected return was _____ percent and the unsystematic portion was _____ percent.

A)0.80; 1.30

B)0.90; 1.40

C)1.11; 2.30

D)1.40; 0.90

E)4.62; 1.41

A)0.80; 1.30

B)0.90; 1.40

C)1.11; 2.30

D)1.40; 0.90

E)4.62; 1.41

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which one of the following is most commonly used as the measure of the overall market rate of return?

A)DJIA

B)S&P 500

C)NASDAQ 100

D)Wilshire 5000

E)Wilshire 3000

A)DJIA

B)S&P 500

C)NASDAQ 100

D)Wilshire 5000

E)Wilshire 3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

51

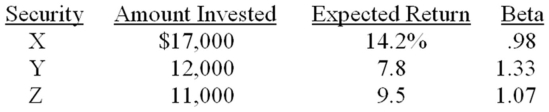

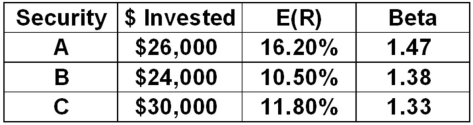

The following portfolio has an expected return of _____ percent and a beta of _____.

A)10.53; 1.13

B)10.99; 1.11

C)11.03; 1.28

D)11.16; 1.11

E)11.11; 1.16

A)10.53; 1.13

B)10.99; 1.11

C)11.03; 1.28

D)11.16; 1.11

E)11.11; 1.16

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

52

Brooke invested $4,500 in the stock market with the expectation of earning 6.25 percent.She actually earned 7.15 percent for the year.What is the amount of her unexpected return?

A)-1.2 percent

B)-0.6 percent

C)0.9 percent

D)1.9 percent

E)2.4 percent

A)-1.2 percent

B)-0.6 percent

C)0.9 percent

D)1.9 percent

E)2.4 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

53

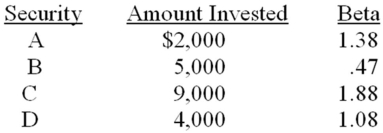

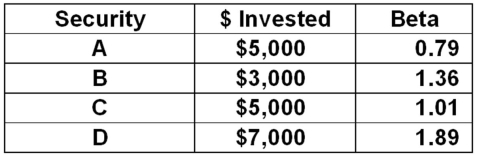

What is the beta of a portfolio which consists of the following?

A)1.01

B)1.24

C)1.26

D)1.29

E)1.32

A)1.01

B)1.24

C)1.26

D)1.29

E)1.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which one of the following combinations will tend to produce the highest rate of return according to the Fama-French three-factor model? Assume beta is constant in all cases.

A)large market capitalization and high book-to-market ratio

B)large market capitalization and low book-to-market ratio

C)small market capitalization and high book-to-market ratio

D)small market capitalization and a book-to-market ratio of 1.0

E)small market capitalization and a low book-to-market ratio

A)large market capitalization and high book-to-market ratio

B)large market capitalization and low book-to-market ratio

C)small market capitalization and high book-to-market ratio

D)small market capitalization and a book-to-market ratio of 1.0

E)small market capitalization and a low book-to-market ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

55

A portfolio consists of one risky asset and one risk-free asset.The risky asset has an expected return of 11.2 percent and a beta of 1.39.The risk-free asset has an expected return of 3.4 percent.How much of the portfolio is invested in the risk-free asset if the portfolio beta is 1.07?

A)16 percent

B)23 percent

C)32 percent

D)45 percent

E)54 percent

A)16 percent

B)23 percent

C)32 percent

D)45 percent

E)54 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

56

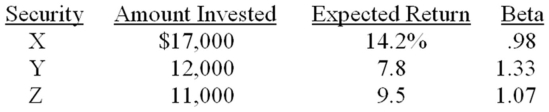

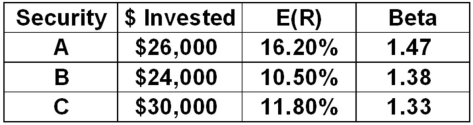

The following portfolio has an expected return of _____ percent and a beta of _____.

A)12.45; 1.38

B)12.84; 1.39

C)13.39; 1.23

D)13.39; 1.40

E)13.45; 1.32

A)12.45; 1.38

B)12.84; 1.39

C)13.39; 1.23

D)13.39; 1.40

E)13.45; 1.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which one of the following statements is true?

A)Risk and return are inversely related.

B)Investors are compensated only for diversifiable risk.

C)The beta of a portfolio may be lower than the lowest beta of any individual security held within the portfolio.

D)How a security affects the risk of a portfolio is less important than the actual risk of the security itself.

E)Investing has two dimensions: risk and return.

A)Risk and return are inversely related.

B)Investors are compensated only for diversifiable risk.

C)The beta of a portfolio may be lower than the lowest beta of any individual security held within the portfolio.

D)How a security affects the risk of a portfolio is less important than the actual risk of the security itself.

E)Investing has two dimensions: risk and return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following correctly identifies the factors included in the Fama-French three-factor model?

A)standard deviation, beta, and company size

B)the risk-free rate, beta, and the market risk premium

C)company size, company industry, and beta

D)price-earnings ratios, beta, and book-to-market ratios

E)beta, company size, and book-to-market ratios

A)standard deviation, beta, and company size

B)the risk-free rate, beta, and the market risk premium

C)company size, company industry, and beta

D)price-earnings ratios, beta, and book-to-market ratios

E)beta, company size, and book-to-market ratios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

59

A portfolio is comprised of two stocks.Stock A comprises 65 percent of the portfolio and has a beta of 1.31.Stock B has a beta of .98.What is the portfolio beta?

A).98

B)1.03

C)1.08

D)1.19

E)1.22

A).98

B)1.03

C)1.08

D)1.19

E)1.22

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

60

The reward-to-risk ratio is 6.8 percent and the risk-free rate is 5.3 percent.What is the expected return on a risky asset if the beta of that asset is 1.03?

A)7.00 percent

B)12.00 percent

C)12.02 percent

D)12.07 percent

E)12.30 percent

A)7.00 percent

B)12.00 percent

C)12.02 percent

D)12.07 percent

E)12.30 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

61

A stock has an expected return of 14.59 percent and a beta of 1.35.What is the risk-free rate if the market rate is 12.7 percent?

A)6.48 percent

B)6.92 percent

C)7.01 percent

D)7.30 percent

E)7.90 percent

A)6.48 percent

B)6.92 percent

C)7.01 percent

D)7.30 percent

E)7.90 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

62

Western Exports stock has a standard deviation of 15.6 percent and a covariance with the market of .0150.The market has a standard deviation of 13.7 percent.What is the correlation of this stock with the market?

A).58

B).61

C).68

D).70

E).77

A).58

B).61

C).68

D).70

E).77

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

63

The common stock of Industrial Technologies has an expected return of 12.4 percent.The market return is 9.2 percent and the risk-free return is 3.87 percent.What is the stock's beta?

A)0.42

B)1.00

C)1.32

D)1.42

E)1.60

A)0.42

B)1.00

C)1.32

D)1.42

E)1.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

64

The common stock of Blasco Books has a standard deviation of 16.4 percent as compared to the market standard deviation of 12.7 percent.The covariance of this stock with the market is .0217.What is the beta of Blasco Books' stock?

A).96

B)1.05

C)1.07

D)1.35

E)1.42

A).96

B)1.05

C)1.07

D)1.35

E)1.42

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

65

A stock has a standard deviation of 25.4 percent and a covariance with the market of .0160.The market has a standard deviation of 12.2 percent.What is the beta of this stock?

A).294

B).572

C).926

D).973

E)1.075

A).294

B).572

C).926

D).973

E)1.075

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

66

The market has an expected return of 11.4 percent and a risky asset with a beta of 1.18 has an expected return of 13 percent.Based on this information,what is the pure time value of money?

A)1.84 percent

B)1.90 percent

C)2.38 percent

D)2.51 percent

E)2.90 percent

A)1.84 percent

B)1.90 percent

C)2.38 percent

D)2.51 percent

E)2.90 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

67

A stock has a beta of 1.58 and an expected return of 16.2 percent.The risk-free rate is 3.8 percent.What is the market risk premium?

A)7.85 percent

B)10.01 percent

C)11.72 percent

D)12.50 percent

E)13.40 percent

A)7.85 percent

B)10.01 percent

C)11.72 percent

D)12.50 percent

E)13.40 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

68

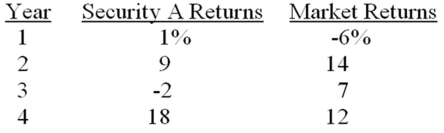

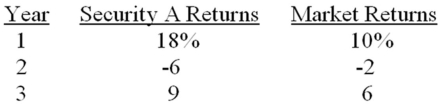

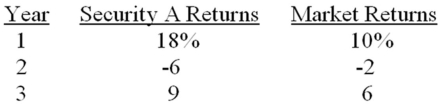

What is the covariance of security A to the market given the following information?

A)23.14

B)29.88

C)48.83

D)99.18

E)114.01

A)23.14

B)29.88

C)48.83

D)99.18

E)114.01

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

69

Stock X has a beta of .95 and an expected return of 10.8 percent.Stock Y has a beta of 1.2 and an expected return of 13.1 percent.What is the risk-free rate of return assuming that both stock X and stock Y are correctly priced?

A)1.10 percent

B)1.20 percent

C)2.06 percent

D)3.30 percent

E)3.50 percent

A)1.10 percent

B)1.20 percent

C)2.06 percent

D)3.30 percent

E)3.50 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

70

Wilson Farms' stock has a beta of .84 and an expected return of 7.8 percent.The risk-free rate is 2.6 percent and the market risk premium is 6 percent.This stock is _____ because the CAPM return for the stock is _____ percent.

A)undervalued; 7.34

B)undervalued; 7.49

C)undervalued; 7.64

D)overvalued; 7.34

E)overvalued; 7.49

A)undervalued; 7.34

B)undervalued; 7.49

C)undervalued; 7.64

D)overvalued; 7.34

E)overvalued; 7.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

71

A risky security has a variance of .036190 and a covariance with the market of .0222.The variance of the market is .01975.What is the correlation of the risky security to the market?

A).51

B).65

C).72

D).83

E).85

A).51

B).65

C).72

D).83

E).85

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

72

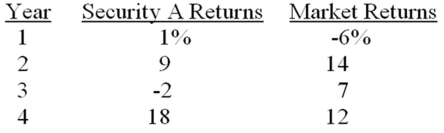

What is the covariance of security A to the market given the following information?

A)507.9

B)514.1

C)517.5

D)523.5

A)507.9

B)514.1

C)517.5

D)523.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

73

The stock of Healthy Eating,Inc.,has a beta of .88.The risk-free rate is 3.8 percent and the market return is 9.6 percent.What is the expected return on Healthy Eating's stock?

A)6.25 percent

B)6.07 percent

C)8.90 percent

D)11.15 percent

E)11.47 percent

A)6.25 percent

B)6.07 percent

C)8.90 percent

D)11.15 percent

E)11.47 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

74

The risk-free rate is 4.1 percent,the market rate is 13.2 percent,and the expected return on a stock is 15.84 percent.What is the beta of the stock?

A).52

B).81

C)1.13

D)1.19

E)1.29

A).52

B).81

C)1.13

D)1.19

E)1.29

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

75

Dinner Foods stock has a beta of 1.45 and an expected return of 13.43 percent.Edwards' Meals stock has a beta of .95 and an expected return of 10.27 percent.Assume that both stocks are correctly priced.Given this,the risk-free rate is _____ percent and the market rate of return is _____ percent.

A)4.02; 11.53

B)4.09; 12.35

C)4.10; 11.53

D)4.27; 10.59

E)4.41; 10.25

A)4.02; 11.53

B)4.09; 12.35

C)4.10; 11.53

D)4.27; 10.59

E)4.41; 10.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

76

Stock A is a risky asset that has a beta of 1.4 and an expected return of 13.2 percent.Stock B is also a risky asset and has a beta of 1.25.The risk-free rate is 5.5 percent.Assuming both stocks are correctly priced,what is the expected return on stock B?

A)11.90 percent

B)12.11 percent

C)12.29 percent

D)12.38 percent

E)12.46 percent

A)11.90 percent

B)12.11 percent

C)12.29 percent

D)12.38 percent

E)12.46 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

77

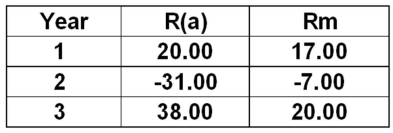

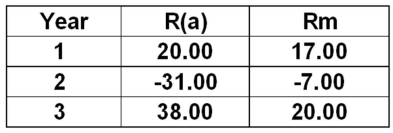

What is the covariance of security A to the market given the following information?

A)75.0

B)80.1

C)83.8

D)87.0

E)91.1

A)75.0

B)80.1

C)83.8

D)87.0

E)91.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

78

Uptown Markets stock has a standard deviation of 16.8 percent and a covariance with the market of .0178.The market has a standard deviation of 13.6 percent.What is the correlation of this stock with the market?

A).74

B).78

C).87

D).89

E).91

A).74

B).78

C).87

D).89

E).91

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

79

Farm Tractors,Inc.,stock has a beta of 1.12 and an expected return of 12.8 percent.The risk-free rate is 3.84 percent.What is the market rate of return?

A)6.67 percent

B)8.90 percent

C)9.08 percent

D)11.84 percent

E)12.63 percent

A)6.67 percent

B)8.90 percent

C)9.08 percent

D)11.84 percent

E)12.63 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck

80

Home Interior's stock has an expected return of 13.2 percent and a beta of 1.28.The market return is 10.7 percent and the risk-free rate is 2.8 percent.This stock is _____ because the CAPM return for the stock is _____ percent.

A)greatly overvalued; 16.50

B)slightly overvalued; 12.91

C)priced correctly; 12.89

D)slightly undervalued; 12.91

E)greatly undervalued; 16.50

A)greatly overvalued; 16.50

B)slightly overvalued; 12.91

C)priced correctly; 12.89

D)slightly undervalued; 12.91

E)greatly undervalued; 16.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 84 في هذه المجموعة.

فتح الحزمة

k this deck