Deck 15: Interest Rates and the Capital Market

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

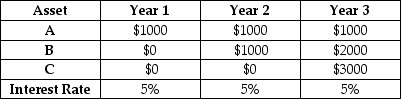

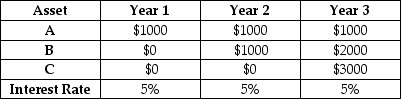

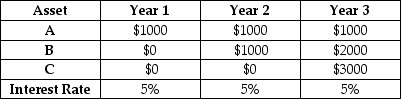

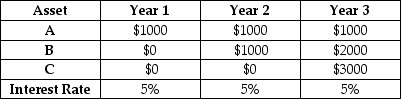

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/107

العب

ملء الشاشة (f)

Deck 15: Interest Rates and the Capital Market

1

What is the most fundamental purpose of the "capital market"?

A)To connect the savings decisions of households with the borrowing decisions of firms.

B)To provide the means by which firms can acquire physical capital.

C)To provide the means by which households and firms can invest financial capital.

D)To connect firms and households who wish to borrow with financial institutions.

E)To connect households who wish to borrow with banks who wish to lend.

A)To connect the savings decisions of households with the borrowing decisions of firms.

B)To provide the means by which firms can acquire physical capital.

C)To provide the means by which households and firms can invest financial capital.

D)To connect firms and households who wish to borrow with financial institutions.

E)To connect households who wish to borrow with banks who wish to lend.

To connect the savings decisions of households with the borrowing decisions of firms.

2

How much would you have to deposit today in a bank account paying 8% annual interest to allow you to withdraw $200 one year from now?

A)$185.19.

B)$216.00.

C)$160.00.

D)$385.19.

E)$200.00.

A)$185.19.

B)$216.00.

C)$160.00.

D)$385.19.

E)$200.00.

$185.19.

3

If the annual rate of interest is 6%,the present value of $100 to be paid every year for three years (beginning one year from now)is

A)$83.90.

B)$251.88.

C)$267.30.

D)$283.02.

E)$300.00.

A)$83.90.

B)$251.88.

C)$267.30.

D)$283.02.

E)$300.00.

$267.30.

4

A firm must evaluate the value of the services that a piece of capital equipment can deliver to the firm over its lifetime.The firm does this by estimating its

A)rate of depreciation.

B)marginal product.

C)marginal revenue product.

D)future value.

E)present value.

A)rate of depreciation.

B)marginal product.

C)marginal revenue product.

D)future value.

E)present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

5

The present value of $100 to be received one year from now,with an annual interest rate of 6%,is

A)$94.00.

B)$94.34.

C)$95.27.

D)$102.13.

E)$106.00.

A)$94.00.

B)$94.34.

C)$95.27.

D)$102.13.

E)$106.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

6

When we consider any future stream of benefits,and we seek to determine its value today,we ________ that steam of benefits using the market interest rate.

A)capitalize

B)collateralize

C)depreciate

D)discount

E)appreciate

A)capitalize

B)collateralize

C)depreciate

D)discount

E)appreciate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

7

Consider the physical equipment that a printing company would purchase in order to print glossy magazines.The equipment itself is considered a(n)________,while the printing services the equipment provides is considered a(n)________.

A)asset; liability

B)flow; opportunity cost

C)stock; flow

D)retained asset; spent asset

E)flow; stock

A)asset; liability

B)flow; opportunity cost

C)stock; flow

D)retained asset; spent asset

E)flow; stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

8

When a firm is making a decision about whether to purchase a new piece of physical capital,it is necessary to evaluate the ________ of services it delivers.The concept of ________ allows the firm to determine how much it would be willing to pay for the new piece of physical capital.

A)stock; present value

B)flow; future value

C)flow; present value

D)stock; future value

A)stock; present value

B)flow; future value

C)flow; present value

D)stock; future value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

9

Financial intermediaries are often the "middlemen" between households and firms and,as such,

A)they reduce the amount of trade by charging high fees for their services.

B)they are not essential for the workings of an economy.

C)they specialize in assessing the risk of various borrowers.

D)are the fundamental determinant of the supply of capital.

E)are the fundamental determinant of the demand for capital.

A)they reduce the amount of trade by charging high fees for their services.

B)they are not essential for the workings of an economy.

C)they specialize in assessing the risk of various borrowers.

D)are the fundamental determinant of the supply of capital.

E)are the fundamental determinant of the demand for capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

10

The concepts of stock and flow are involved in firms' demand for labour and for capital.Which of the following statements is correct?

A)A firm hires a stock of labour services; and purchases a stock of physical capital,which provides a flow of services.

B)Labour and capital are both flow variables because their values change over time.

C)A firm hires a flow of labour services; and purchases a stock of physical capital,which provides a flow of services.

D)Labour and capital are both stock variables because they are providing service at any given moment in time.

E)A firm's demand for both labour and capital is determined by the marginal value each provides to the stock of labour and capital,respectively.

A)A firm hires a stock of labour services; and purchases a stock of physical capital,which provides a flow of services.

B)Labour and capital are both flow variables because their values change over time.

C)A firm hires a flow of labour services; and purchases a stock of physical capital,which provides a flow of services.

D)Labour and capital are both stock variables because they are providing service at any given moment in time.

E)A firm's demand for both labour and capital is determined by the marginal value each provides to the stock of labour and capital,respectively.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

11

A firm can finance its purchase of new capital equipment (investment)in the following ways:

1)purchasing financial capital;

2)borrowing from a bank;

3)using its retained earnings.

A)1 only

B)2 only

C)3 only

D)1 and 3

E)2 and 3

1)purchasing financial capital;

2)borrowing from a bank;

3)using its retained earnings.

A)1 only

B)2 only

C)3 only

D)1 and 3

E)2 and 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

12

The present value of a given future stream of benefits will be lower when the benefits are ________ and the interest rate is ________.

A)nearer in time; lower

B)accruing in the first time period only; lower

C)more distant in time; higher

D)equalized over a ten-year period; zero

E)more distant in time; lower

A)nearer in time; lower

B)accruing in the first time period only; lower

C)more distant in time; higher

D)equalized over a ten-year period; zero

E)more distant in time; lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

13

When we discuss household saving as the supply of capital to financial markets,the term includes which of the following?

A)households' savings accounts

B)education and retirement savings

C)private-sector pension plans

D)Canada Pension Plan and Quebec Pension Plan

E)all of the above

A)households' savings accounts

B)education and retirement savings

C)private-sector pension plans

D)Canada Pension Plan and Quebec Pension Plan

E)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

14

A lottery winner receives a $100 000 cheque now,and a second one in two years.If the annual interest rate is 9%,the present value of his total winnings is

A)$184 168.

B)$200 000.

C)$215 832.

D)$300 000.

E)Not able to determine from the information provided.

A)$184 168.

B)$200 000.

C)$215 832.

D)$300 000.

E)Not able to determine from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

15

The textbook presentation of present value involves an important simplification of reality in order to analyze the concept.That simplification is in assuming that

A)the future stream of MRPs lasts for one period only.

B)the future stream of MRPs of a unit of capital is known with certainty.

C)all units of capital generate an identical stream of MRPs.

D)the future stream of MRPs is constant over time.

E)the interest rate is constant over time.

A)the future stream of MRPs lasts for one period only.

B)the future stream of MRPs of a unit of capital is known with certainty.

C)all units of capital generate an identical stream of MRPs.

D)the future stream of MRPs is constant over time.

E)the interest rate is constant over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the annual interest rate is 5%,the present value of $100 to be received two years from now is

A)$87.70.

B)$90.70.

C)$95.23.

D)$97.00.

E)$110.00.

A)$87.70.

B)$90.70.

C)$95.23.

D)$97.00.

E)$110.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

17

The term "present value" refers to the

A)value that a capital good will have in the future.

B)current interest rate.

C)current purchase price of a capital good.

D)value today of a payment or receipt to occur in the future.

E)value in the future of a payment made today.

A)value that a capital good will have in the future.

B)current interest rate.

C)current purchase price of a capital good.

D)value today of a payment or receipt to occur in the future.

E)value in the future of a payment made today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the annual interest rate is 6%,the present value of $100 paid 3 years from now is

A)$15.15.

B)$40.00.

C)$56.45.

D)$83.96.

E)$94.34.

A)$15.15.

B)$40.00.

C)$56.45.

D)$83.96.

E)$94.34.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

19

If the annual interest rate is 10%,the present value of $100 to be received two years from now is

A)$75.25.

B)$82.64.

C)$90.90.

D)$94.73.

E)$110.00.

A)$75.25.

B)$82.64.

C)$90.90.

D)$94.73.

E)$110.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

20

The formula to calculate the present value of a future payment of $X received t years from now when the annual percentage interest rate is i is

A)PV = $X/(1 + i)t.

B)PV = $X/i.

C)PV = $X/(1 + i).

D)PV = $X(1 + i)t.

E)PV = $X(1 + i).

A)PV = $X/(1 + i)t.

B)PV = $X/i.

C)PV = $X/(1 + i).

D)PV = $X(1 + i)t.

E)PV = $X(1 + i).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the annual interest rate is 10%,the present value of $200 paid 3 years from now is

A)$20.00.

B)$40.00.

C)$56.45.

D)$150.26.

E)$165.28.

A)$20.00.

B)$40.00.

C)$56.45.

D)$150.26.

E)$165.28.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

22

How much would you have to deposit today in a bank account paying 8% annual interest to allow you to withdraw $200 one year from now and still have $200 remaining in the bank?

A)$185.19.

B)$216.00.

C)$370.37.

D)$385.19.

E)none of the above.

A)$185.19.

B)$216.00.

C)$370.37.

D)$385.19.

E)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

23

If the annual interest rate is currently 3.5%,Joan is ________ a $1000 payment in exactly two years.

A)better off accepting $930 right now than

B)better off accepting $950 right now than

C)worse off accepting $940 right now than

D)indifferent between accepting $932.51 right now and

E)indifferent between accepting $935.94 right now and

A)better off accepting $930 right now than

B)better off accepting $950 right now than

C)worse off accepting $940 right now than

D)indifferent between accepting $932.51 right now and

E)indifferent between accepting $935.94 right now and

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

24

Economists use the concept of present value to determine

A)the amount someone would be willing to pay in the future for a discounted value today.

B)the amount someone would be willing to pay today to get a payment or stream of payments in the future.

C)the value in the future of a given stock of physical capital.

D)the marginal revenue product of a unit of capital.

E)the price of a unit of physical capital in the future.

A)the amount someone would be willing to pay in the future for a discounted value today.

B)the amount someone would be willing to pay today to get a payment or stream of payments in the future.

C)the value in the future of a given stock of physical capital.

D)the marginal revenue product of a unit of capital.

E)the price of a unit of physical capital in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

25

Present value is computed by

A)evaluating a stream of future sums resulting from a piece of capital.

B)summing all future payments.

C)multiplying a stream of future sums by the interest rate.

D)discounting a stream of future payments by today's purchase price.

E)discounting a stream of future sums by the interest rate.

A)evaluating a stream of future sums resulting from a piece of capital.

B)summing all future payments.

C)multiplying a stream of future sums by the interest rate.

D)discounting a stream of future payments by today's purchase price.

E)discounting a stream of future sums by the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

26

Carol can borrow $13 000 to buy a used car from the bank at 8% for five years,or from her friend Eric,who is willing to lend her the money at 7% for five years.If Carol accepts Eric's offer,he can expect a lump-sum repayment in five years of approximately

A)$13 544.

B)$15 239.

C)$17 837.

D)$18 233.

E)$19 097.

A)$13 544.

B)$15 239.

C)$17 837.

D)$18 233.

E)$19 097.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

27

The present value of a given future payment is higher the ________ the rate of interest and the ________ distant the payment date.

A)higher; more

B)higher; less

C)lower; more

D)lower; less

A)higher; more

B)higher; less

C)lower; more

D)lower; less

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a competitive market for capital equipment,the purchase price of a piece of capital equipment is predicted to be

A)its current-period MRP.

B)its current-period MRP divided by the interest rate.

C)its last-period MRP divided by the interest rate.

D)the present value of its stream of MRPs.

E)the future value of its stream of MRPs.

A)its current-period MRP.

B)its current-period MRP divided by the interest rate.

C)its last-period MRP divided by the interest rate.

D)the present value of its stream of MRPs.

E)the future value of its stream of MRPs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

29

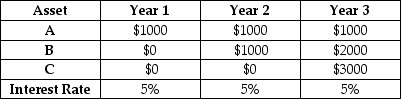

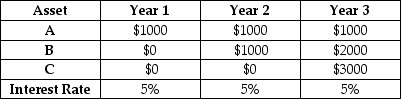

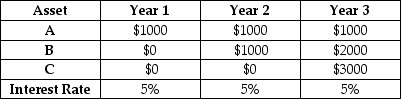

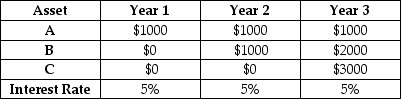

The table below shows the payments at the end of each year from three different physical assets.

TABLE 15-1

TABLE 15-1

Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset B?

A)$3000

B)$3150

C)$2634.70

D)$2590.67

E)$2722.97

TABLE 15-1

TABLE 15-1Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset B?

A)$3000

B)$3150

C)$2634.70

D)$2590.67

E)$2722.97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

30

The table below shows the payments at the end of each year from three different physical assets.

TABLE 15-1

TABLE 15-1

Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset C?

A)2590.67

B)$3000

C)$3150

D)$2722.97

E)$2634.70

TABLE 15-1

TABLE 15-1Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset C?

A)2590.67

B)$3000

C)$3150

D)$2722.97

E)$2634.70

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

31

The table below shows the payments at the end of each year from three different physical assets.

TABLE 15-1

TABLE 15-1

Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.Which asset is the most valuable to a firm contemplating them at the beginning of Year 1?

A)A

B)B

C)C

D)They are equivalent.

E)It cannot be determined with the available data.

TABLE 15-1

TABLE 15-1Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.Which asset is the most valuable to a firm contemplating them at the beginning of Year 1?

A)A

B)B

C)C

D)They are equivalent.

E)It cannot be determined with the available data.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

32

How much would you have to deposit today in a bank account paying 8% annual interest to allow you to withdraw $200,5 years from now?

A)$136.12

B)$142.57

C)$184.17

D)$185.19

E)$293.80

A)$136.12

B)$142.57

C)$184.17

D)$185.19

E)$293.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

33

We can think about the interest rate as the "price" of capital because

A)the interest rate determines the MRP of the capital,which determines its price.

B)the interest rate determines the equilibrium level of investment demand.

C)the interest rate represents the value the firm avoids paying to lenders by purchasing the capital instead.

D)firms use financial capital to purchase physical capital and the interest rate is the "price" of financial capital.

E)this is the amount the firm earns by purchasing the capital.

A)the interest rate determines the MRP of the capital,which determines its price.

B)the interest rate determines the equilibrium level of investment demand.

C)the interest rate represents the value the firm avoids paying to lenders by purchasing the capital instead.

D)firms use financial capital to purchase physical capital and the interest rate is the "price" of financial capital.

E)this is the amount the firm earns by purchasing the capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

34

The table below shows the payments at the end of each year from three different physical assets.

TABLE 15-1

TABLE 15-1

Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset A?

A)$3000

B)$3150

C)$2590.68

D)$2723.24

E)$2857.14

TABLE 15-1

TABLE 15-1Refer to Table 15-1.A,B,and C represent possible purchases of physical capital,each offering a stream of payments as indicated in the table.There are no payments beyond Year 3.The interest rates in each year are also specified in the table.What is the present value (at the beginning of Year 1)of asset A?

A)$3000

B)$3150

C)$2590.68

D)$2723.24

E)$2857.14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

35

The present value of $100 to be received one year from now,with an annual interest rate of 8%,is

A)$85.73.

B)$94.34.

C)$92.59.

D)$102.13.

E)$108.00.

A)$85.73.

B)$94.34.

C)$92.59.

D)$102.13.

E)$108.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

36

How much would you have to deposit today in a bank account paying 8% annual interest to allow you to withdraw $200 each year for the next 2 years,beginning one year from today?

A)$171.47

B)$185.19

C)$356.66

D)$368.00

E)$400.00

A)$171.47

B)$185.19

C)$356.66

D)$368.00

E)$400.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

37

In general,a profit-maximizing firm will purchase a piece of capital equipment if the

A)present value of the stream of future MRPs exceeds the purchase price.

B)present value of the stream of future MRPs falls below the purchase price.

C)simple sum of the future MRPs exceeds the purchase price.

D)simple sum of the future MRPs falls below the purchase price.

E)future value of the stream of MRPs exceeds the purchase price.

A)present value of the stream of future MRPs exceeds the purchase price.

B)present value of the stream of future MRPs falls below the purchase price.

C)simple sum of the future MRPs exceeds the purchase price.

D)simple sum of the future MRPs falls below the purchase price.

E)future value of the stream of MRPs exceeds the purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

38

If the annual interest rate is 7%,the present value of $100 to be received at the end of two years is

A)$87.34.

B)$90.70.

C)$93.46.

D)$97.00.

E)$107.00.

A)$87.34.

B)$90.70.

C)$93.46.

D)$97.00.

E)$107.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

39

Suppose a new piece of capital equipment will deliver a stream of MRPs of $1000 each year for 3 years (beginning one year from today).What is the present value of this stream of benefits,assuming that the annual rate of interest is 5%?

A)$863.86

B)$952.38

C)$1000.00

D)$2591.58

E)$2723.25

A)$863.86

B)$952.38

C)$1000.00

D)$2591.58

E)$2723.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

40

To determine an individual profit-maximizing firm's maximum purchase price for a unit of capital it is necessary to

A)know what competing firms are prepared to pay.

B)compute the present value of the stream of benefits produced by the unit of capital.

C)compute the future value of the stream of benefits produced by the unit of capital.

D)compute the rental price of the unit of capital and the interest rate.

E)know how the interest rate is related to the cost of capital.

A)know what competing firms are prepared to pay.

B)compute the present value of the stream of benefits produced by the unit of capital.

C)compute the future value of the stream of benefits produced by the unit of capital.

D)compute the rental price of the unit of capital and the interest rate.

E)know how the interest rate is related to the cost of capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

41

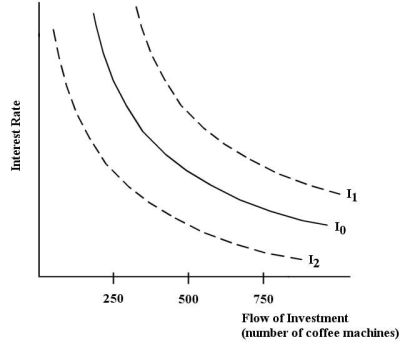

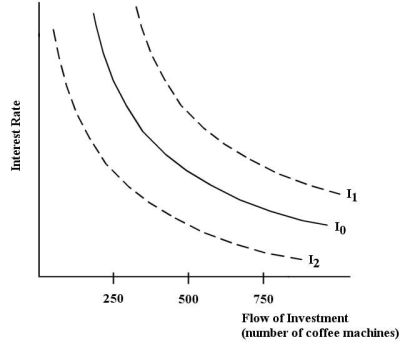

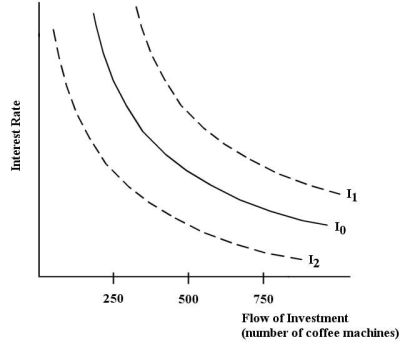

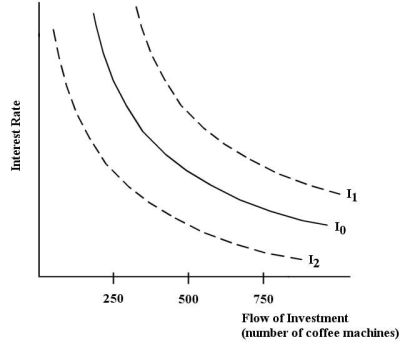

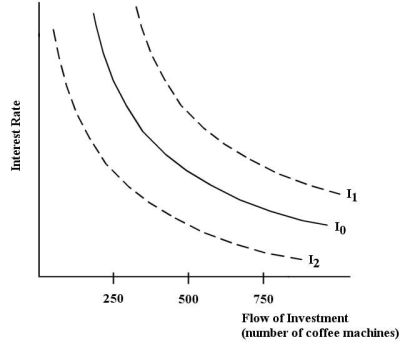

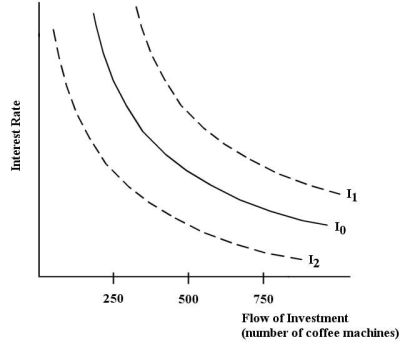

The diagram below shows a firm's demand for its units of capital-coin-operated coffee machines.The firm places its machines in universities and colleges across Canada.  FIGURE 15-1

FIGURE 15-1

Refer to Figure 15-1.One possible explanation for a shift of the firm's investment demand curve from I0 to I2 is

A)an increase in the interest rate.

B)a technological improvement that reduces the cost per cup of coffee.

C)a decrease in the interest rate.

D)an increase in the expected MRP of the coffee machines.

E)demographic changes that lead to a reduction in the growth rate of the student population at universities.

FIGURE 15-1

FIGURE 15-1Refer to Figure 15-1.One possible explanation for a shift of the firm's investment demand curve from I0 to I2 is

A)an increase in the interest rate.

B)a technological improvement that reduces the cost per cup of coffee.

C)a decrease in the interest rate.

D)an increase in the expected MRP of the coffee machines.

E)demographic changes that lead to a reduction in the growth rate of the student population at universities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose a piece of capital equipment will produce an MRP of $100 000 per year for the next three years (beginning one year from now).What is the maximum price a profit-maximizing firm will pay to purchase it if the annual interest rate is 4%?

A)$96 154

B)$88 888

C)$277 498

D)$266 664

E)$288 462

A)$96 154

B)$88 888

C)$277 498

D)$266 664

E)$288 462

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

43

Suppose a piece of capital equipment will produce an MRP of $1000 per year for the next three years (beginning one year from now).What is the maximum price a firm will pay to purchase it today if the annual interest rate is 7%?

A)$816.37

B)$1649.81

C)$2624.32

D)$3210.00

E)$3000

A)$816.37

B)$1649.81

C)$2624.32

D)$3210.00

E)$3000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

44

Suppose a firm producing aircraft engines is considering the purchase of a robotic assembly machine at a price of $4 million.The firm expects the discounted MRP of the machine to be $1 million over each of the first 3 years,and $0.5 million each in years 4 and 5,after which the machine has no value.This firm should

A)not buy the machine because its present value is less than its purchase price.

B)buy the machine because its present value is more than its purchase price.

C)be indifferent about the purchase because its present value is equal to its purchase price.

D)not buy the machine because its marginal cost is greater than its marginal revenue.

E)buy the machine because its marginal cost is less than its marginal revenue.

A)not buy the machine because its present value is less than its purchase price.

B)buy the machine because its present value is more than its purchase price.

C)be indifferent about the purchase because its present value is equal to its purchase price.

D)not buy the machine because its marginal cost is greater than its marginal revenue.

E)buy the machine because its marginal cost is less than its marginal revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

45

The diagram below shows a firm's demand for its units of capital-coin-operated coffee machines.The firm places its machines in universities and colleges across Canada.  FIGURE 15-1

FIGURE 15-1

Refer to Figure 15-1.The downward slope of the firm's investment demand curve can be explained by

A)the negative relationship between the interest rate and the present value of a future stream of MRPs generated by each coffee machine.

B)the negative relationship between the interest rate and the purchase price of the coffee machines.

C)the downward slope of the demand curve for the firm's product-cups of coffee.

D)the relationship between the MRP of the coffee machine and technology improvements to the coffee machines.

E)the downward slope of the marginal cost of capital curve.

FIGURE 15-1

FIGURE 15-1Refer to Figure 15-1.The downward slope of the firm's investment demand curve can be explained by

A)the negative relationship between the interest rate and the present value of a future stream of MRPs generated by each coffee machine.

B)the negative relationship between the interest rate and the purchase price of the coffee machines.

C)the downward slope of the demand curve for the firm's product-cups of coffee.

D)the relationship between the MRP of the coffee machine and technology improvements to the coffee machines.

E)the downward slope of the marginal cost of capital curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

46

Suppose a dairy farmer is considering the purchase of an additional milking machine at a price of $4000.She expects the discounted MRP of the machine in Year 1 to be $1700,in Year 2 to be $1500 and in Year 3 to be $1200,after which the machine has no value.The farmer should

A)buy the machine because its present value is $400 more than its purchase price.

B)buy the machine because its marginal revenue is $400 more than its marginal cost.

C)be indifferent about the purchase because its present value is approximately equal to its purchase price.

D)not buy the machine because its marginal revenue is $400 less than its marginal cost.

E)not buy the machine because its present value is $400 less than its purchase price.

A)buy the machine because its present value is $400 more than its purchase price.

B)buy the machine because its marginal revenue is $400 more than its marginal cost.

C)be indifferent about the purchase because its present value is approximately equal to its purchase price.

D)not buy the machine because its marginal revenue is $400 less than its marginal cost.

E)not buy the machine because its present value is $400 less than its purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

47

A firm's downward-sloping investment demand curve is usually plotted with ________ on the vertical axis.

A)the price of capital equipment

B)MRP

C)the interest rate

D)the capital stock

E)the general price level

A)the price of capital equipment

B)MRP

C)the interest rate

D)the capital stock

E)the general price level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

48

Consider a manufacturing firm that contemplates buying a lathe with an annual MRP of $1000 (beginning one year from now).Suppose the interest rate is 5% per year.If the lathe is obsolete after the fourth MRP is generated,the maximum the firm is prepared to pay now for the lathe is

A)$3019.52.

B)$3546.40.

C)$3723.24.

D)$3910.51.

E)$4000.

A)$3019.52.

B)$3546.40.

C)$3723.24.

D)$3910.51.

E)$4000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

49

In general,a profit-maximizing firm will purchase a unit of capital as long as its purchase price is

A)non-negative.

B)equal to the present value of the stream of marginal revenue product generated by the capital.

C)no less than the present value of the stream of marginal revenue product generated by the capital.

D)no more than the present value of the stream of marginal revenue product generated by the capital.

E)less than its present marginal revenue product.

A)non-negative.

B)equal to the present value of the stream of marginal revenue product generated by the capital.

C)no less than the present value of the stream of marginal revenue product generated by the capital.

D)no more than the present value of the stream of marginal revenue product generated by the capital.

E)less than its present marginal revenue product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose a dairy farmer is considering the purchase of an additional milking machine at a price of $5000.She expects the discounted MRP of the machine in Year 1 to be $1700,in Year 2 to be $1500 and in Year 3 to be $1200,after which the machine has no value.The farmer should

A)buy the machine because its present value is $600 more than its purchase price.

B)buy the machine because its marginal revenue is $600 more than its marginal cost.

C)be indifferent about the purchase because its present value is approximately equal to its purchase price.

D)not buy the machine because its purchase price is $600 less than its present value.

E)not buy the machine because its present value is $600 less than its purchase price.

A)buy the machine because its present value is $600 more than its purchase price.

B)buy the machine because its marginal revenue is $600 more than its marginal cost.

C)be indifferent about the purchase because its present value is approximately equal to its purchase price.

D)not buy the machine because its purchase price is $600 less than its present value.

E)not buy the machine because its present value is $600 less than its purchase price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

51

An increase in market interest rates will

A)increase the amount a firm is willing to pay for a machine that generates future returns.

B)decrease the amount a firm is willing to pay for a machine that generates future returns.

C)not affect the price a firm is willing to pay for a machine that generates future returns.

D)be good for all firms.

E)be bad for all firms.

A)increase the amount a firm is willing to pay for a machine that generates future returns.

B)decrease the amount a firm is willing to pay for a machine that generates future returns.

C)not affect the price a firm is willing to pay for a machine that generates future returns.

D)be good for all firms.

E)be bad for all firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

52

Suppose a piece of capital equipment offers its last MRP of $40 000 in one year,after which it is valueless.At an annual interest rate of 8%,a profit-maximizing firm would be willing to buy this unit of capital if its purchase price is

A)below $37 037.

B)above $37 037.

C)below $40 000.

D)above $40 000.

E)above $40 000,but only at a higher interest rate.

A)below $37 037.

B)above $37 037.

C)below $40 000.

D)above $40 000.

E)above $40 000,but only at a higher interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

53

Consider a firm making a decision to purchase a unit of capital - let's say,a forklift.In terms of capital markets,which of the following would we consider to be the opportunity cost of the forklift?

A)the future stream of MRPs from the forklift

B)the resale value of the forklift after one year

C)the additional revenue to the firm that the forklift would generate in the future

D)the purchase price of the forklift

E)the interest the firm could earn by purchasing a bond instead

A)the future stream of MRPs from the forklift

B)the resale value of the forklift after one year

C)the additional revenue to the firm that the forklift would generate in the future

D)the purchase price of the forklift

E)the interest the firm could earn by purchasing a bond instead

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

54

Suppose a roofing contractor is considering the purchase of an additional truck at a price of $35 000.He expects the discounted MRP of the truck in Year 1 to be $7000,in Year 2 to be $6000,in Year 3 to be $5000,after which he can sell the truck at a present value of $14 000.This contractor should

A)not buy the truck because its marginal cost is greater than its marginal revenue.

B)be indifferent about the purchase because its present value is approximately equal to its purchase price.

C)buy the truck because its present value is more than its purchase price.

D)not buy the truck because its present value is less than its purchase price.

E)buy the truck because its marginal cost is less than its marginal revenue.

A)not buy the truck because its marginal cost is greater than its marginal revenue.

B)be indifferent about the purchase because its present value is approximately equal to its purchase price.

C)buy the truck because its present value is more than its purchase price.

D)not buy the truck because its present value is less than its purchase price.

E)buy the truck because its marginal cost is less than its marginal revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

55

The law of diminishing marginal returns tells us that,generally,the more capital the firm uses,the

A)lower is the firm's interest rate.

B)lower is the MRP of the firm's capital.

C)higher is the MRP of the firm's capital.

D)higher is capital's purchase price.

E)lower is capital's rental price.

A)lower is the firm's interest rate.

B)lower is the MRP of the firm's capital.

C)higher is the MRP of the firm's capital.

D)higher is capital's purchase price.

E)lower is capital's rental price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

56

Under which of the following circumstances will a competitive firm choose to own more capital,assuming that the purchase price of the capital and the interest rate remain unchanged?

A)the stock of capital in the entire economy increases

B)other firms are increasing their stock of capital

C)the lifespan of the capital is reduced

D)technological improvement has made the capital more productive

E)the price of the product the firm produces declines

A)the stock of capital in the entire economy increases

B)other firms are increasing their stock of capital

C)the lifespan of the capital is reduced

D)technological improvement has made the capital more productive

E)the price of the product the firm produces declines

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

57

The present value of a piece of capital equipment that generates future MRPs will increase if

A)the interest rate increases.

B)the interest rate decreases.

C)the MRP values are received farther in the future.

D)the purchase price of the capital asset decreases.

E)the productivity of the capital asset falls.

A)the interest rate increases.

B)the interest rate decreases.

C)the MRP values are received farther in the future.

D)the purchase price of the capital asset decreases.

E)the productivity of the capital asset falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

58

Consider a firm that places coin-operated coffee machines in university buildings.On January 1,2015 the firm has 1500 machines in operation,and on January 1,2016 the firm has 2250 machines in operation.A possible explanation is that

1)there was an increase in productivity of coin-operated coffee machines that reduced the cost per cup of coffee produced;

2)an increase in demand for coffee led to an increase in the price per cup;

3)there was an increase in interest rates.

A)1 only

B)2 only

C)3 only

D)1 or 2

E)2 or 3

1)there was an increase in productivity of coin-operated coffee machines that reduced the cost per cup of coffee produced;

2)an increase in demand for coffee led to an increase in the price per cup;

3)there was an increase in interest rates.

A)1 only

B)2 only

C)3 only

D)1 or 2

E)2 or 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

59

In any given period,which of the following is most likely to determine a firm's flow of investment demand?

A)a change in the firm's optimal flow of investment

B)a change in the firm's optimal capital stock

C)the rate of change of the firm's investment demand

D)the rate of change of the capital stock in the entire economy

E)Any of the above,as they are all the same

A)a change in the firm's optimal flow of investment

B)a change in the firm's optimal capital stock

C)the rate of change of the firm's investment demand

D)the rate of change of the capital stock in the entire economy

E)Any of the above,as they are all the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

60

A decrease in market interest rates will

A)increase the amount a firm is willing to pay for a machine that generates future returns.

B)decrease the amount a firm is willing to pay for a machine that generates future returns.

C)not affect the price a firm is willing to pay for a machine that generates future returns.

D)be good for all firms.

E)be bad for all firms.

A)increase the amount a firm is willing to pay for a machine that generates future returns.

B)decrease the amount a firm is willing to pay for a machine that generates future returns.

C)not affect the price a firm is willing to pay for a machine that generates future returns.

D)be good for all firms.

E)be bad for all firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

61

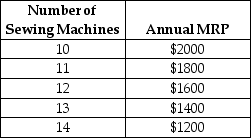

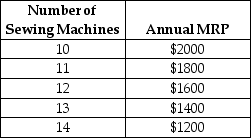

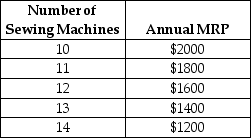

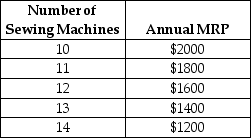

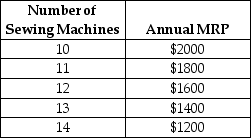

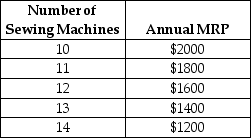

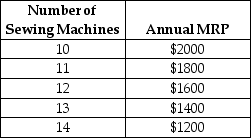

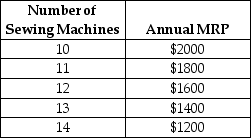

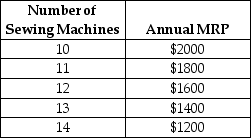

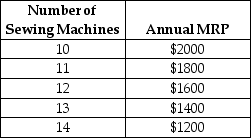

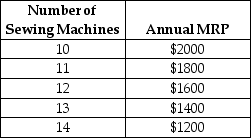

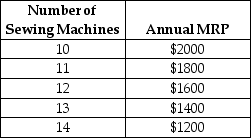

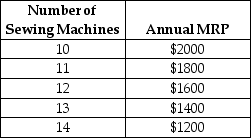

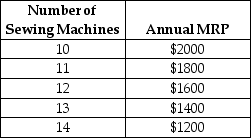

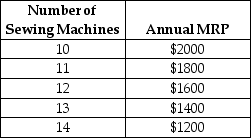

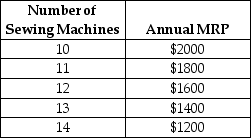

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.Suppose the interest rate is 4%,the purchase price of a sewing machine is $3000,and the firm is holding its optimal capital stock.If the interest rate rises to 7%,how will this firm adjust its capital stock?

A)it will reduce its number of machines from 12 to 11

B)it will reduce its number of machines from 14 to 13

C)it will not change its capital stock

D)it will increase its number of machines from 11 to 12

E)it will increase its number of machines from 13 to 14

TABLE 15-2

TABLE 15-2Refer to Table 15-2.Suppose the interest rate is 4%,the purchase price of a sewing machine is $3000,and the firm is holding its optimal capital stock.If the interest rate rises to 7%,how will this firm adjust its capital stock?

A)it will reduce its number of machines from 12 to 11

B)it will reduce its number of machines from 14 to 13

C)it will not change its capital stock

D)it will increase its number of machines from 11 to 12

E)it will increase its number of machines from 13 to 14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

62

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.What principle will this firm follow to determine the optimal number of sewing machines to own and operate?

A)the marginal revenue products of all the machines should be equal

B)the present value of the future MRPs on the last unit of capital is equal to (or greater than)its purchase price

C)the annual MRP on the last unit of capital should be equal to (or greater than)its purchase price

D)the marginal products of each machine should be equal

E)the present value of the future MRPs should be increasing over time

TABLE 15-2

TABLE 15-2Refer to Table 15-2.What principle will this firm follow to determine the optimal number of sewing machines to own and operate?

A)the marginal revenue products of all the machines should be equal

B)the present value of the future MRPs on the last unit of capital is equal to (or greater than)its purchase price

C)the annual MRP on the last unit of capital should be equal to (or greater than)its purchase price

D)the marginal products of each machine should be equal

E)the present value of the future MRPs should be increasing over time

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

63

A firm's demand for physical capital leads to its ________ and a household's supply of saving leads to its ________.

A)demand for financial capital; supply of financial capital

B)demand for stocks; supply of stocks

C)lending behaviour; borrowing behaviour

D)negative effect on the interest rate; positive effect on the interest rate

E)demand for bonds; supply of bonds

A)demand for financial capital; supply of financial capital

B)demand for stocks; supply of stocks

C)lending behaviour; borrowing behaviour

D)negative effect on the interest rate; positive effect on the interest rate

E)demand for bonds; supply of bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

64

Consider the economy's downward-sloping demand for investment curve.An increase in the interest rate causes

A)a shift of the curve to the right.

B)a movement downward along the curve.

C)no change.

D)a shift of the curve to the left.

E)a movement upward along the curve.

A)a shift of the curve to the right.

B)a movement downward along the curve.

C)no change.

D)a shift of the curve to the left.

E)a movement upward along the curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

65

An economy's upward-sloping supply curve of desired saving is usually plotted with ________ on the vertical axis.

A)the price of capital

B)capital stock

C)the market interest rate

D)technology

E)the general price level

A)the price of capital

B)capital stock

C)the market interest rate

D)technology

E)the general price level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

66

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.If the interest rate is 4%,and the purchase price of a sewing machine is $4000,what is the optimal capital stock (number of sewing machines)for this firm?

A)fewer than 10

B)10

C)11

D)12

E)more than 12

TABLE 15-2

TABLE 15-2Refer to Table 15-2.If the interest rate is 4%,and the purchase price of a sewing machine is $4000,what is the optimal capital stock (number of sewing machines)for this firm?

A)fewer than 10

B)10

C)11

D)12

E)more than 12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

67

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.If the interest rate is 4% and the purchase price of a sewing machine is $2000,what is the optimal capital stock (number of sewing machines)for this firm?

A)11

B)12

C)13

D)exactly 14

E)at least 14

TABLE 15-2

TABLE 15-2Refer to Table 15-2.If the interest rate is 4% and the purchase price of a sewing machine is $2000,what is the optimal capital stock (number of sewing machines)for this firm?

A)11

B)12

C)13

D)exactly 14

E)at least 14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

68

Consider the market for commercial ovens as a factor of production in the commercial bread industry.Assume that all commercial ovens are identical,they have a lifespan of 10 years,and the purchase price is $12 000.The present value of the stream of MRPs from the last oven purchased by each commercial bakery is $16 000.We can expect that

A)profit-maximizing firms will reduce their capital stock of ovens until the PV of the stream of MRPs falls to $12 000.

B)investment demand by all firms will fall until the PV of the stream of MRPs falls to $12 000.

C)investment demand by all firms will rise until all firms have an identical capital stock.

D)the purchase price of commercial ovens will fall until the price is equated with the PV of the stream of MRPs.

E)investment demand by all firms will increase and there will be a tendency for the price of commercial ovens to rise.

A)profit-maximizing firms will reduce their capital stock of ovens until the PV of the stream of MRPs falls to $12 000.

B)investment demand by all firms will fall until the PV of the stream of MRPs falls to $12 000.

C)investment demand by all firms will rise until all firms have an identical capital stock.

D)the purchase price of commercial ovens will fall until the price is equated with the PV of the stream of MRPs.

E)investment demand by all firms will increase and there will be a tendency for the price of commercial ovens to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

69

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.If the interest rate is 4%,what is the present value of the 14th sewing machine (rounded to the nearest dollar)? Note that the stream of MRPs begins one year from now and lasts for 2 years.

A)$1400

B)$2800

C)$4200

D)$2641

E)$2263

TABLE 15-2

TABLE 15-2Refer to Table 15-2.If the interest rate is 4%,what is the present value of the 14th sewing machine (rounded to the nearest dollar)? Note that the stream of MRPs begins one year from now and lasts for 2 years.

A)$1400

B)$2800

C)$4200

D)$2641

E)$2263

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

70

If the interest rate that you could earn on your savings is 4% per year,then your decision to spend $1500 on a big screen TV today "costs" you ________ in potential forgone spending one year from now.

A)$0

B)$60

C)$120

D)$1500

E)$1560

A)$0

B)$60

C)$120

D)$1500

E)$1560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

71

The diagram below shows a firm's demand for its units of capital-coin-operated coffee machines.The firm places its machines in universities and colleges across Canada.  FIGURE 15-1

FIGURE 15-1

Refer to Figure 15-1.One possible explanation for a shift of the firm's investment demand curve from I0 to I1 is

A)an increase in the interest rate.

B)a technological change that increases the cost per cup of coffee.

C)a decrease in the interest rate.

D)an increase in the expected MRP of the coffee machines.

E)demographic changes that lead to a reduction in the growth rate of the student population at universities.

FIGURE 15-1

FIGURE 15-1Refer to Figure 15-1.One possible explanation for a shift of the firm's investment demand curve from I0 to I1 is

A)an increase in the interest rate.

B)a technological change that increases the cost per cup of coffee.

C)a decrease in the interest rate.

D)an increase in the expected MRP of the coffee machines.

E)demographic changes that lead to a reduction in the growth rate of the student population at universities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

72

Choose the best reason for a rightward shift in the economy's investment demand curve.

A)diminishing marginal returns to capital

B)changes in technology that improve the productivity of capital

C)a decrease in the interest rate

D)an increase in the interest rate

E)none of the above would shift the investment demand curve

A)diminishing marginal returns to capital

B)changes in technology that improve the productivity of capital

C)a decrease in the interest rate

D)an increase in the interest rate

E)none of the above would shift the investment demand curve

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

73

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.Suppose the interest rate is 4%,the purchase price of a sewing machine is $3000,and the firm is holding its optimal capital stock.If the interest falls to 2%,how will this firm adjust its capital stock?

A)it will reduce its number of machines from 12 to 11

B)it will reduce its number of machines from 14 to 13

C)it will not change its capital stock

D)it will increase its number of machines from 11 to 12

E)it will increase its number of machines from 13 to 14

TABLE 15-2

TABLE 15-2Refer to Table 15-2.Suppose the interest rate is 4%,the purchase price of a sewing machine is $3000,and the firm is holding its optimal capital stock.If the interest falls to 2%,how will this firm adjust its capital stock?

A)it will reduce its number of machines from 12 to 11

B)it will reduce its number of machines from 14 to 13

C)it will not change its capital stock

D)it will increase its number of machines from 11 to 12

E)it will increase its number of machines from 13 to 14

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

74

The firm's investment demand curve shows

A)the difference between nominal and real interest rates.

B)the equilibrium interest rate.

C)how the firm's desired stock of capital varies with changes in MRP.

D)how the firm's MRP changes with advances in technology.

E)how the firm's desired purchases of new capital vary with the interest rate.

A)the difference between nominal and real interest rates.

B)the equilibrium interest rate.

C)how the firm's desired stock of capital varies with changes in MRP.

D)how the firm's MRP changes with advances in technology.

E)how the firm's desired purchases of new capital vary with the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

75

A technological improvement in the physical capital available to the firm has a similar impact on a firm's desired capital stock as

A)an increase in the interest rate.

B)a decrease in capital's MRP.

C)a reduction in the price of capital goods.

D)a decrease in the price of the firm's product.

E)a shift to the left of the capital's MRP curve.

A)an increase in the interest rate.

B)a decrease in capital's MRP.

C)a reduction in the price of capital goods.

D)a decrease in the price of the firm's product.

E)a shift to the left of the capital's MRP curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

76

The economy's supply curve for saving (financial capital)shows

A)the difference between nominal and real interest rates.

B)the relationship between the flow of saving and the stock of financial assets.

C)how the economy's desired flow of saving varies with changes in the interest rate.

D)how the economy's flow of saving changes with advances in technology.

E)how the economy's stock of capital varies with the interest rate.

A)the difference between nominal and real interest rates.

B)the relationship between the flow of saving and the stock of financial assets.

C)how the economy's desired flow of saving varies with changes in the interest rate.

D)how the economy's flow of saving changes with advances in technology.

E)how the economy's stock of capital varies with the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

77

Consider the economy's downward-sloping demand for investment curve.A decrease in the interest rate causes ________; an improvement in the marginal productivity of capital causes ________.

A)a shift of the curve to the right; a shift of the curve further to the right

B)a movement downward along the curve; a shift of the curve to the left

C)a movement downward along the curve; a shift of the curve to the right

D)a shift of the curve to the left; a movement downward along the curve

E)a movement upward along the curve; a shift of the curve to the right

A)a shift of the curve to the right; a shift of the curve further to the right

B)a movement downward along the curve; a shift of the curve to the left

C)a movement downward along the curve; a shift of the curve to the right

D)a shift of the curve to the left; a movement downward along the curve

E)a movement upward along the curve; a shift of the curve to the right

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

78

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.If the interest rate is 4%,and the purchase price of a sewing machine is $3000,what is the optimal capital stock (number of sewing machines)for this firm?

A)fewer than 10

B)10

C)11

D)12

E)more than 12

TABLE 15-2

TABLE 15-2Refer to Table 15-2.If the interest rate is 4%,and the purchase price of a sewing machine is $3000,what is the optimal capital stock (number of sewing machines)for this firm?

A)fewer than 10

B)10

C)11

D)12

E)more than 12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

79

The firm in the table below produces denim jeans and each unit of capital represents one sewing machine.The MRP for each of machines 10 through 14 is provided.Each sewing machine delivers a stream of MRPs beginning one year from now,for a total of 2 years.Assume that after 2 years each sewing machine is worth nothing.

TABLE 15-2

TABLE 15-2

Refer to Table 15-2.If the annual interest rate is 4%,what is the present value of the 11th sewing machine (rounded to the nearest dollar)? Note that the stream of MRPs begins one year from now and lasts 2 years.

A)$3600

B)$3531

C)$3328

D)$3395

E)$3772

TABLE 15-2

TABLE 15-2Refer to Table 15-2.If the annual interest rate is 4%,what is the present value of the 11th sewing machine (rounded to the nearest dollar)? Note that the stream of MRPs begins one year from now and lasts 2 years.

A)$3600

B)$3531

C)$3328

D)$3395

E)$3772

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck

80

The amount of physical capital is a ________ variable;________.

A)flow; its usefulness lasts over a long period of time

B)flow; it is usually put in place and maintained over a long period of time

C)stock; any flow of investment adds to the current capital stock

D)stock; most equipment is solidly built and lasts for a long time

E)stock; it generally increases its value through use

A)flow; its usefulness lasts over a long period of time

B)flow; it is usually put in place and maintained over a long period of time

C)stock; any flow of investment adds to the current capital stock

D)stock; most equipment is solidly built and lasts for a long time

E)stock; it generally increases its value through use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 107 في هذه المجموعة.

فتح الحزمة

k this deck