Deck 8: Cost-Based Inventories and Cost of Sales

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

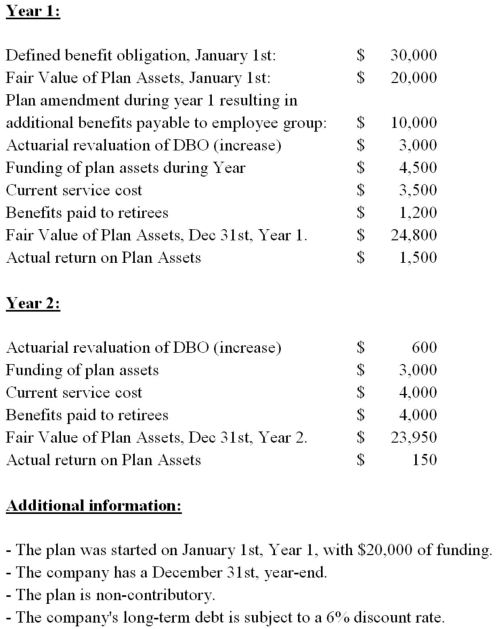

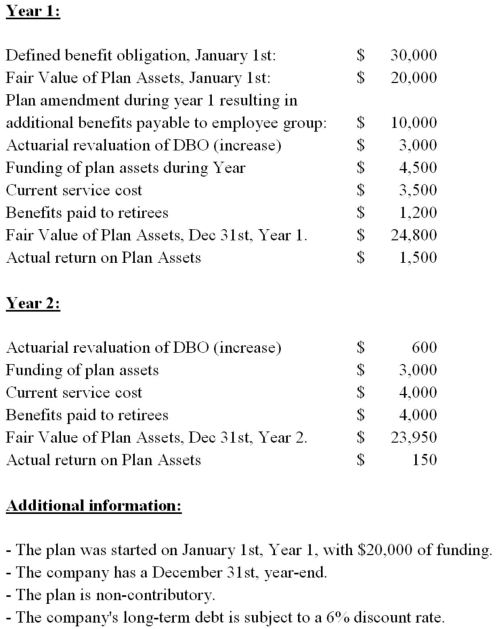

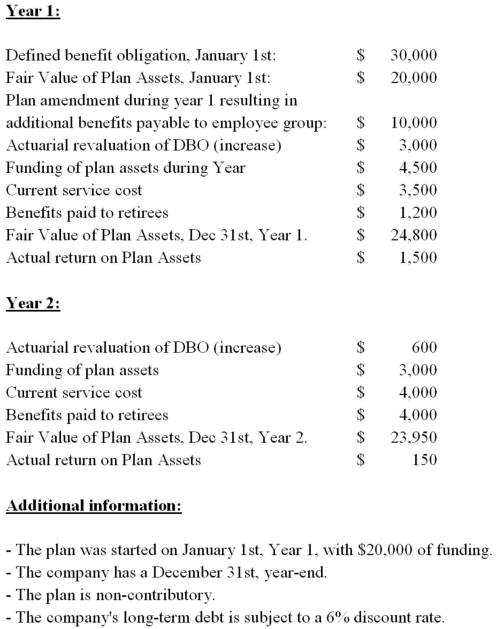

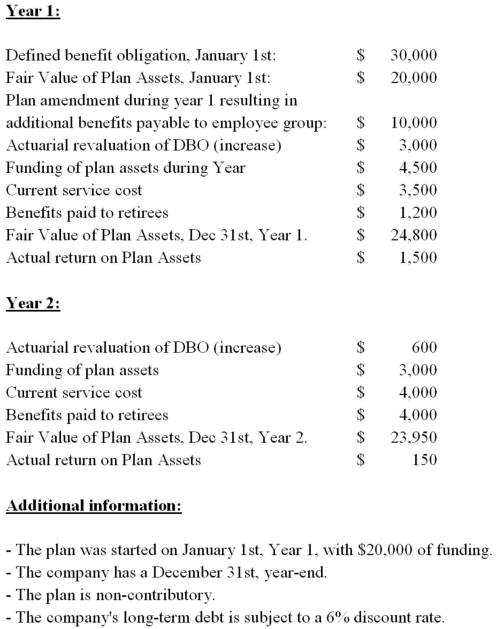

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/93

العب

ملء الشاشة (f)

Deck 8: Cost-Based Inventories and Cost of Sales

1

Current service cost is usually the largest single component of pension expense under a defined benefit pension plan.

True

2

The accumulated benefit and projected unit credit methods both take into account employee salary changes over time.

False

3

In order to be registered,a pension plan must be trusteed.

True

4

Usually,the amount of funding by an employer will exceed the benefits to be paid out to employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

5

Employees are not allowed to make contributions to a defined contribution pension plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

6

Contributions made by an employer to a qualified pension plan usually are taxable to the employee at that time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

7

In a defined contribution pension plan the retirement benefits to the employee are not defined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

8

The accumulated benefit and projected unit credit methods both result in increasing employer contributions to the pension plan over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

9

An employee of XYZ will receive retirement benefits of $1,000 per month if the employment period is 15 years.However,if the employment period is 20 years,the retirement benefits will be $1,300 per month.This is an example of a defined contribution pension plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

10

Post-retirement benefits other than pensions must now be accounted for in a manner similar the way pensions are accounted for.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

11

Past service costs that have vested must be deferred and amortized through pension expense over time,while gains or losses on plan curtailments must be immediately recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

12

Pension plans that are registered meet Revenue Canada requirements and hence qualify for tax advantages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a defined contribution plan,employers run the risk of high pension contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

14

Defined benefit pension plans do not specify benefits per period after retirement,but base the pension benefits directly on the specified contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

15

All three funding approaches result in full funding of a pension plan over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

16

A non-funded pension plan is one where the employee must bear a part of the cost of the plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the simplified approach to accounting for defined benefit pension plans under ASPE,the actuarial cost method used for pension accounting will be different than that used for funding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

18

The formula used to calculate pension expense must necessarily be the same as the formula used to calculate funding to the plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

19

A pension plan is fully funded when the assets in the pension fund are adequate to pay the current retirees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

20

A pension plan that gives an employee the right to retirement benefits which are not contingent upon the employee remaining with the company provides vesting benefits to the employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

21

Pension plans are drafted to meet Revenue Canada requirements so that the benefits received after retirement are not subject to income tax and the contributions by the employer are not a taxable benefit to the employee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

22

A trustee is independent and receives the pension contribution from the employer and invests it in accordance with provincial regulations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

23

For a given employee group,the accumulated benefit method of funding for defined benefit plans results in increasingly larger contributions to the fund over time when compared to both the projected unit credit and level contribution methods.Assume that average salaries increase over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

24

In the long run,the projected unit credit,accumulated benefit,and level contribution methods all provide the same funding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a non-contributory,defined benefit pension plan,the plan assets are composed of the employer's cumulative contributions less cumulative pension benefits paid from the fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

26

Under the simplified approach to accounting for defined benefit pension plans under ASPE,all past service costs and unrecognized actuarial gains and losses must all flow through pension expense immediately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

27

A change in actuarial assumptions is the only possible cause for an actuarial gain or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

28

Pension plans are normally registered with the pension commissioner in the province of jurisdiction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

29

Under the simplified approach to accounting for defined benefit pension plans under ASPE there may be a pension asset ceiling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

30

In accounting for pension costs,any difference between current year's pension expense and contribution into the pension trust should be reported as a(n):

A) offset to pension plan assets.

B) accrued actuarial liability.

C) deferred pension liability/cost.

D) operating expense of the current period.

A) offset to pension plan assets.

B) accrued actuarial liability.

C) deferred pension liability/cost.

D) operating expense of the current period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

31

The vested benefit of an employee in a pension plan represents benefits:

A) accumulated in the pension plan (at fair value).

B) that are not contingent on the employee continuing in the service of the employer.

C) to be paid to the retired employee in the current year.

D) to be paid to the retiring employee in the next year.

A) accumulated in the pension plan (at fair value).

B) that are not contingent on the employee continuing in the service of the employer.

C) to be paid to the retired employee in the current year.

D) to be paid to the retiring employee in the next year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under both IFRS and ASPE,the balance in net pension liability (asset)account will equal the funded status of the registered defined benefit plan in question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

33

IFRS requires that the projected unit credit method be used for both funding purposes and accounting estimates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

34

For income tax purposes,an employee would prefer to make contributions to a qualified pension plan than to a nonqualified pension plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

35

Benefits pursuant to a pension plan that are not contingent upon an employee's continuing service are referred to as:

A) funded.

B) underfunded.

C) insured.

D) vested.

A) funded.

B) underfunded.

C) insured.

D) vested.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

36

Total net pension expense recognized over the life of a pension plan will be in excess of the total amount paid into the pension fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

37

Under a defined contribution pension plan,forfeitures are estimated in advance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a pension plan is not trusteed,a company must report its pension plan assets and accrued pension liability on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

39

Current service costs are the main component of any defined contribution plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

40

Under IFRS,net interest (finance)revenue or expense on defined benefit obligations must always be included within pension expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

41

Changes in defined benefit pension plans that reduce the expected years of future service of present employees are:

A) settlements.

B) adjustments.

C) terminations.

D) curtailments.

A) settlements.

B) adjustments.

C) terminations.

D) curtailments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

42

When a settlement gain or loss arises due to closing a business segment it is recognized as a debit or credit to (in):

A) accrued pension obligation.

B) other costs within discontinued operations.

C) pension expense.

D) accrued/prepaid pension cost.

A) accrued pension obligation.

B) other costs within discontinued operations.

C) pension expense.

D) accrued/prepaid pension cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

43

Conceptually,the employer's current pension obligation if the pension plan is discontinued is the:

A) accrued pension obligation.

B) accumulated benefit obligation.

C) vested benefit obligation.

D) underfunded pension cost.

A) accrued pension obligation.

B) accumulated benefit obligation.

C) vested benefit obligation.

D) underfunded pension cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under IFRS,net interest (finance)expense (revenue)with respect to defined benefit plans is best described as follows:

A) The actual return on plan assets must be reflected as a reduction of pension expense or as finance revenue.

B) A discount rate is applied to the opening projected benefit obligation amount to impute an interest (finance) charge. This amount must be reflected as an increase to pension expense.

C) The net interest (finance) expense (revenue) with respect to defined benefit plans is the difference between the opening fair values of the plan assets and projected benefit obligation. If the value of the projected benefit obligation exceeds the fair value of the plan assets on that date, there will be an increase to pension expense or finance (interest) expense. If the reverse is true, will be a decrease to pension expense or an increase to finance (interest) revenue.

D) The net interest (finance) expense (revenue) with respect to defined benefit plans is the difference between the opening fair values of the plan assets and accumulated benefit obligation. If the value of the accumulated benefit obligation exceeds the fair value of the plan assets on that date, there will be an increase to pension expense. If the reverse is true, will be a decrease to pension expense.

A) The actual return on plan assets must be reflected as a reduction of pension expense or as finance revenue.

B) A discount rate is applied to the opening projected benefit obligation amount to impute an interest (finance) charge. This amount must be reflected as an increase to pension expense.

C) The net interest (finance) expense (revenue) with respect to defined benefit plans is the difference between the opening fair values of the plan assets and projected benefit obligation. If the value of the projected benefit obligation exceeds the fair value of the plan assets on that date, there will be an increase to pension expense or finance (interest) expense. If the reverse is true, will be a decrease to pension expense or an increase to finance (interest) revenue.

D) The net interest (finance) expense (revenue) with respect to defined benefit plans is the difference between the opening fair values of the plan assets and accumulated benefit obligation. If the value of the accumulated benefit obligation exceeds the fair value of the plan assets on that date, there will be an increase to pension expense. If the reverse is true, will be a decrease to pension expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

45

Employers who provide contractual termination benefits must recognize a loss and a related liability when:

A) the employees accept the termination benefit offer.

B) the termination benefit can be reasonably estimated.

C) it is probable that employees will be entitled to the benefit and the amount of the benefit can be reasonably estimated.

D) the termination occurs.

A) the employees accept the termination benefit offer.

B) the termination benefit can be reasonably estimated.

C) it is probable that employees will be entitled to the benefit and the amount of the benefit can be reasonably estimated.

D) the termination occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

46

A firm has a $40,000 balance in its pension liability account.This means:

A) the plan is underfunded.

B) accrued pension obligation is less than plan assets at fair value.

C) pension expense recognized to date exceeds total contributions to the pension plan to date.

D) pension expense recognized to date exceeds plan assets at fair value.

A) the plan is underfunded.

B) accrued pension obligation is less than plan assets at fair value.

C) pension expense recognized to date exceeds total contributions to the pension plan to date.

D) pension expense recognized to date exceeds plan assets at fair value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

47

Recognition of pension expense is primarily based on the:

A) cost principle.

B) revenue principle.

C) matching principle.

D) full disclosure principle.

A) cost principle.

B) revenue principle.

C) matching principle.

D) full disclosure principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

48

ABC has a non-contributory,defined benefit pension plan.Data for 2014 were as follows: Pension plan assets (at fair value)January 1,2014,$240,000,and December 31,2014,$285,000; APO,January 1,2014,$243,000 and December 31,2014,$345,000.The accrued pension obligation was underfunded at the end of 2014 in the amount of:

A) $15,000.

B) $30,000.

C) $45,000.

D) $60,000.

A) $15,000.

B) $30,000.

C) $45,000.

D) $60,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

49

Choose the most complete description of the possible relationship(s)between the discount rate (D)and the expected long-term rate of return on plan assets (R)used for defined benefit pension plans.

A) D > R

B) D < R

C) D = R

D) D can be equal to, greater than, or less than R for any given firm

A) D > R

B) D < R

C) D = R

D) D can be equal to, greater than, or less than R for any given firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

50

Factors affecting estimates of benefits under a post-retirement health care plan include all of the following except:

A) per capita claims cost by age.

B) health care cost trend rates.

C) plan demographics.

D) discount rate.

A) per capita claims cost by age.

B) health care cost trend rates.

C) plan demographics.

D) discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

51

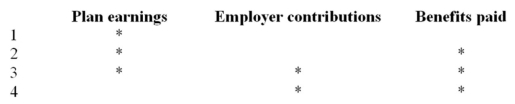

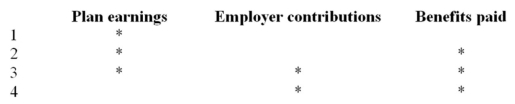

The balance of pension plan assets at fair value,as of any measurement date,reflects the cumulative: (Choose from the four Choices provided below)

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

52

The amount of the expected return on plan assets is usually computed by multiplying the:

A) ending market-related value of the plan assets by the expected long-term rate of return on plan assets.

B) beginning carrying value of the plan assets by the actuary's interest rate.

C) average carrying value of the plan assets by the expected long-term rate of return on plan assets.

D) beginning market-related value of the plan assets by the expected long-term rate of return on plan assets.

A) ending market-related value of the plan assets by the expected long-term rate of return on plan assets.

B) beginning carrying value of the plan assets by the actuary's interest rate.

C) average carrying value of the plan assets by the expected long-term rate of return on plan assets.

D) beginning market-related value of the plan assets by the expected long-term rate of return on plan assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

53

Current costs of a pension plan that occur each year due to service credits earned after the inception of the plan are called:

A) Interest costs.

B) actuarial losses.

C) Past service costs.

D) service costs.

A) Interest costs.

B) actuarial losses.

C) Past service costs.

D) service costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

54

The full eligibility date for an employee covered in a non-pay related other post-employment benefits plan is:

A) the retirement date.

B) the date the employee is eligible for the maximum benefit the plan has to offer.

C) the date the employee is eligible for the benefits he or she is expected to receive.

D) the date the employee attains his or her final salary.

A) the retirement date.

B) the date the employee is eligible for the maximum benefit the plan has to offer.

C) the date the employee is eligible for the benefits he or she is expected to receive.

D) the date the employee attains his or her final salary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

55

Changes in defined benefit pension plans that eliminate or reduce,for a significant number of employees,the accrual of defined benefits for some or all of their future services are:

A) settlements.

B) eliminations.

C) curtailments.

D) terminations.

A) settlements.

B) eliminations.

C) curtailments.

D) terminations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

56

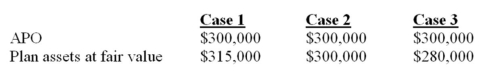

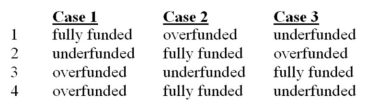

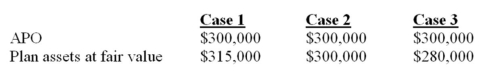

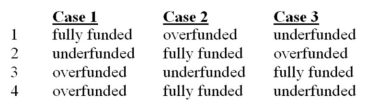

Pension data for ABC for three separate cases were:  The funded status of the APO for each case is:

The funded status of the APO for each case is:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

The funded status of the APO for each case is:

The funded status of the APO for each case is:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

57

RST's pension plan provides retirement benefits of $8,000 per year to all employees who have worked for the company for at least 10 years.Contributions to the plan are made 75 percent by RST and 25 percent by the employees.The pension plan is characterized as both:

A) contributory and defined benefit.

B) funded and defined contribution.

C) defined contribution and defined benefit.

D) defined contribution and contributory.

A) contributory and defined benefit.

B) funded and defined contribution.

C) defined contribution and defined benefit.

D) defined contribution and contributory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

58

Choose the correct statement concerning pensions (defined benefit)and other post-employment benefits.

A) Pension expense has six components; other post-employment benefits expense has only five components.

B) Only pensions require a reconciliation of funded status to be disclosed.

C) Other post-employment benefits payments are more difficult to predict than are pension payments.

D) The entire other post-employment benefits obligation must be recognized in the balance sheet whereas, in most cases, the pension obligation is not.

A) Pension expense has six components; other post-employment benefits expense has only five components.

B) Only pensions require a reconciliation of funded status to be disclosed.

C) Other post-employment benefits payments are more difficult to predict than are pension payments.

D) The entire other post-employment benefits obligation must be recognized in the balance sheet whereas, in most cases, the pension obligation is not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

59

Costs related to a new pension plan that are necessary to "catch up" for services rendered prior to the inception of the pension plan are classified as:

A) actuarial losses.

B) past service costs.

C) retroactive deferred charge.

D) service costs.

E) transition costs.

A) actuarial losses.

B) past service costs.

C) retroactive deferred charge.

D) service costs.

E) transition costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

60

The total gain or loss due to a curtailment should be recognized:

A) when it is probable that a curtailment will occur and the effects are reasonably estimable, for either a gain or a loss.

B) immediately.

C) if a loss, when the employees terminate or the curtailment occurs.

D) if a gain, when it is probable that a curtailment will and the effects are reasonably estimable.

A) when it is probable that a curtailment will occur and the effects are reasonably estimable, for either a gain or a loss.

B) immediately.

C) if a loss, when the employees terminate or the curtailment occurs.

D) if a gain, when it is probable that a curtailment will and the effects are reasonably estimable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

61

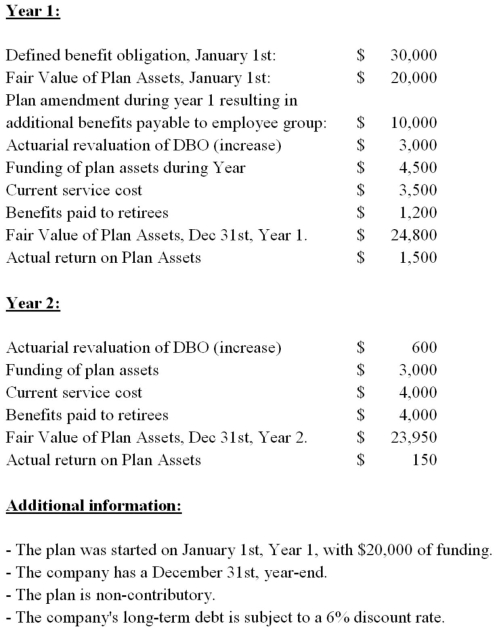

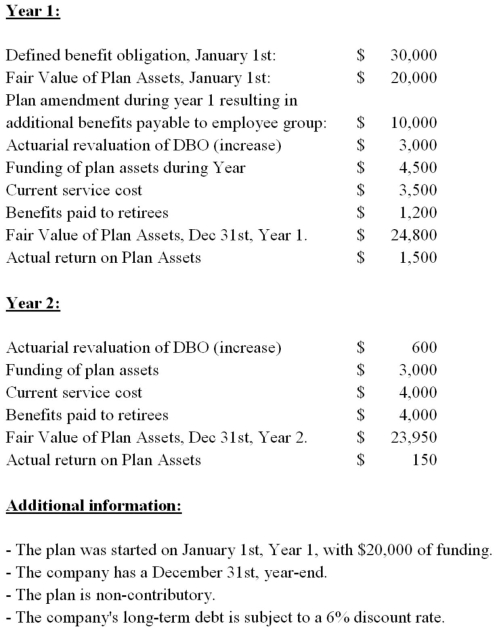

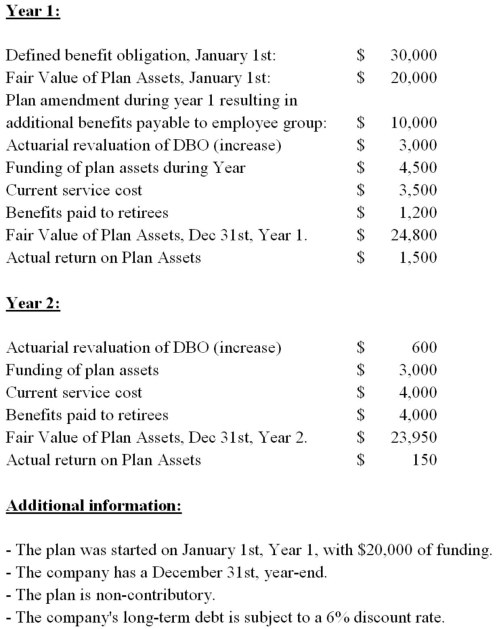

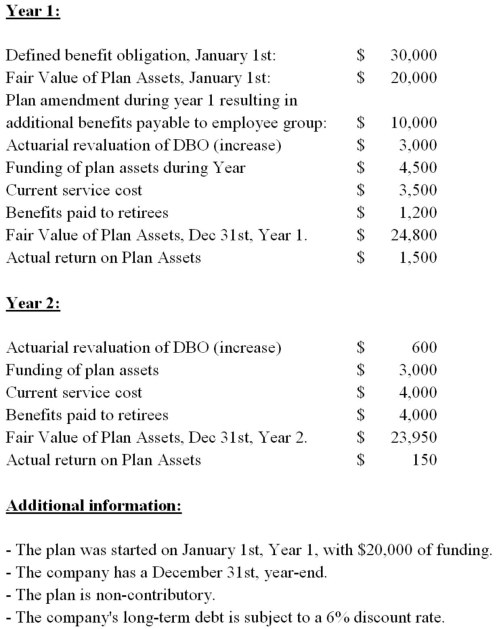

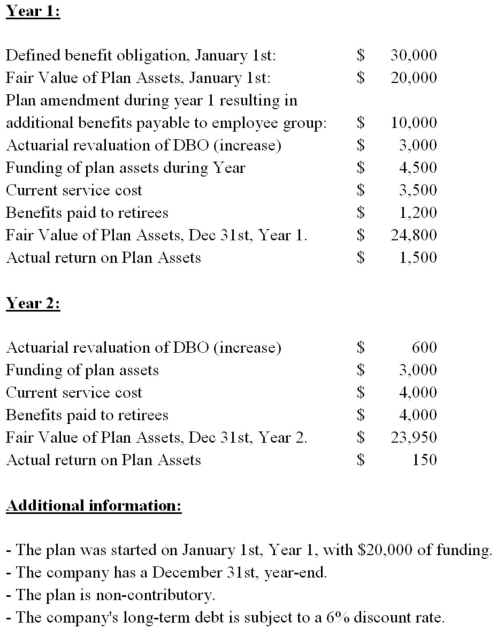

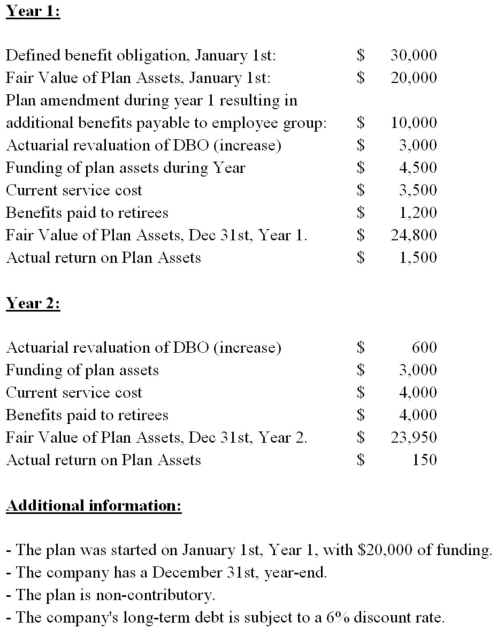

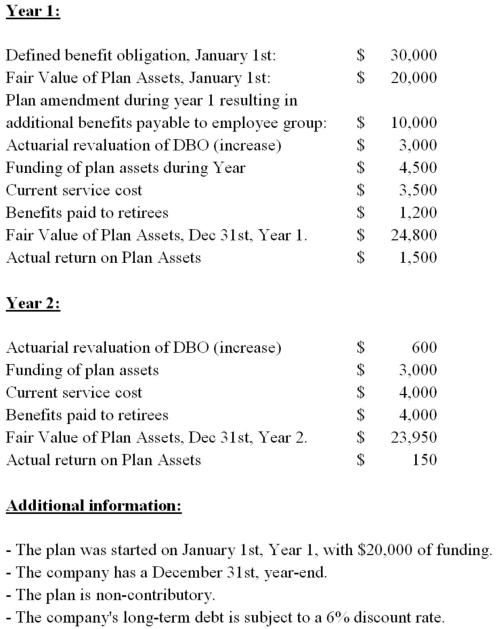

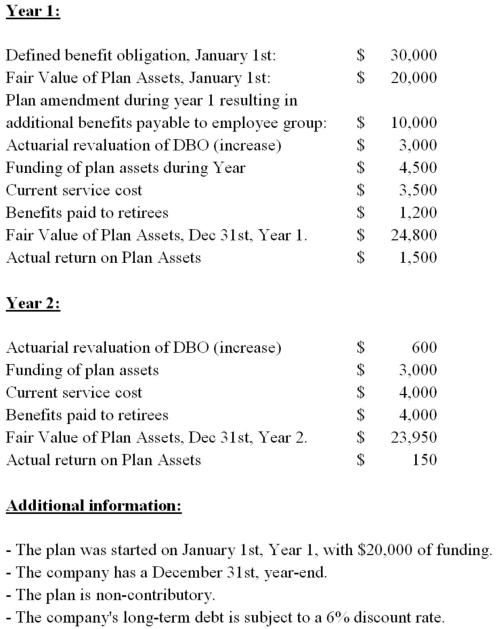

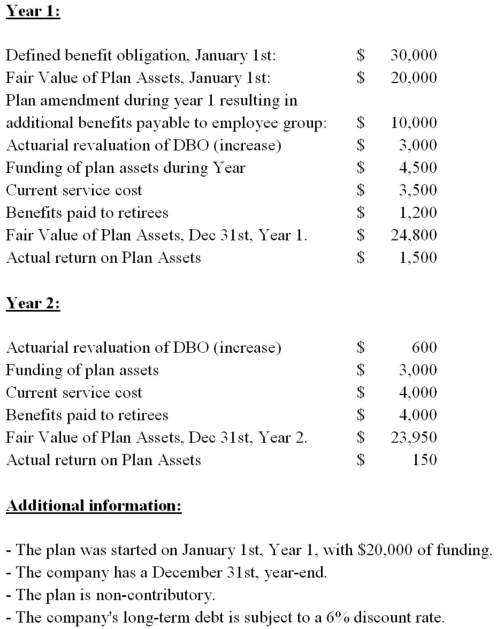

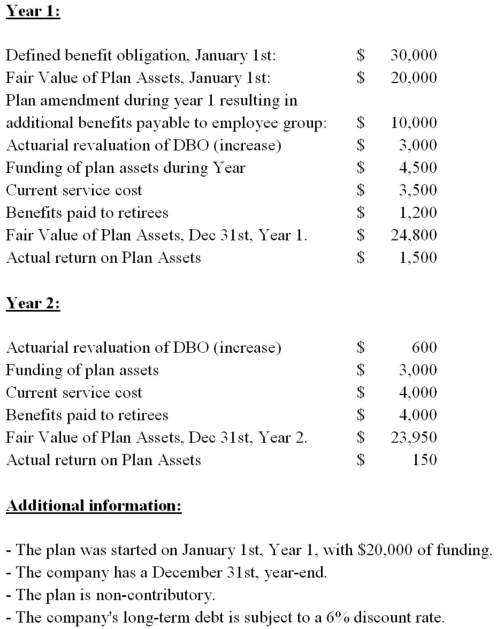

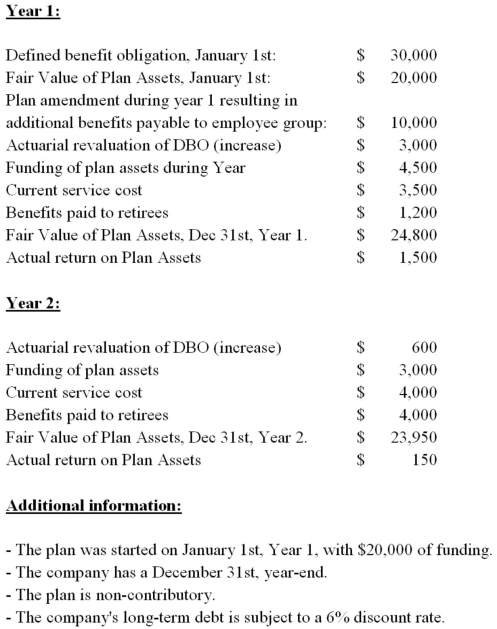

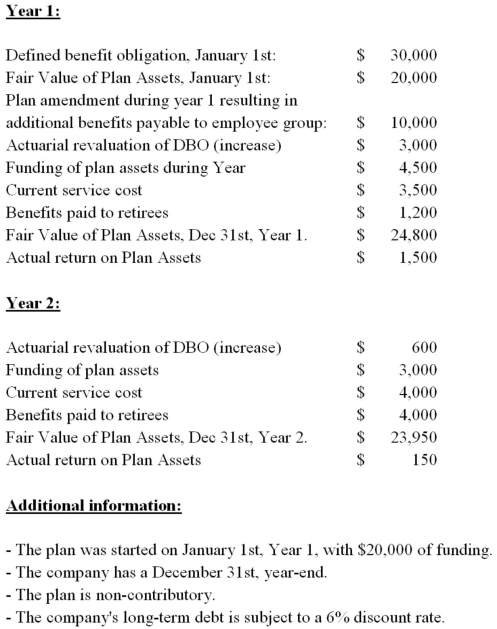

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's balance sheet as per IFRS for Year 1 would show an accumulated other comprehensive income (AOCI)balance of:

Jamieson's balance sheet as per IFRS for Year 1 would show an accumulated other comprehensive income (AOCI)balance of:

A) $3,000 dr.

B) $3,000 cr.

C) $2,700 dr.

D) $2,700 cr.

Jamieson's balance sheet as per IFRS for Year 1 would show an accumulated other comprehensive income (AOCI)balance of:

Jamieson's balance sheet as per IFRS for Year 1 would show an accumulated other comprehensive income (AOCI)balance of:A) $3,000 dr.

B) $3,000 cr.

C) $2,700 dr.

D) $2,700 cr.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

62

All of the following are relevant policy disclosures suggested by the AcSB except:

A) a reconciliation of relevant pension amounts.

B) amount of pension expense for the period, broken down by component.

C) the number of employees.

D) a reconciliation of the defined benefit obligation from the beginning to the end of the year.

E) changes to reserves and other comprehensive income if any.

A) a reconciliation of relevant pension amounts.

B) amount of pension expense for the period, broken down by component.

C) the number of employees.

D) a reconciliation of the defined benefit obligation from the beginning to the end of the year.

E) changes to reserves and other comprehensive income if any.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

63

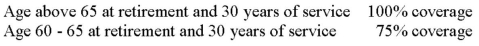

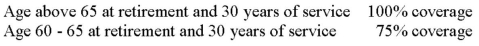

Timu joined the firm 12 years ago and is 42 today.The firm has a post-retirement health care plan with the following coverages for retirees:  Timu is expected to retire at age 63.The present value today of 100% post-retirement health care coverage for Timu is $20,000,considering life expectancy and other factors.The present value of 75% coverage is $14,000.What is the accumulated post-retirement benefit obligation for Timu today?

Timu is expected to retire at age 63.The present value today of 100% post-retirement health care coverage for Timu is $20,000,considering life expectancy and other factors.The present value of 75% coverage is $14,000.What is the accumulated post-retirement benefit obligation for Timu today?

A) $20,000

B) $14,000

C) $8,000

D) $5,600

Timu is expected to retire at age 63.The present value today of 100% post-retirement health care coverage for Timu is $20,000,considering life expectancy and other factors.The present value of 75% coverage is $14,000.What is the accumulated post-retirement benefit obligation for Timu today?

Timu is expected to retire at age 63.The present value today of 100% post-retirement health care coverage for Timu is $20,000,considering life expectancy and other factors.The present value of 75% coverage is $14,000.What is the accumulated post-retirement benefit obligation for Timu today?A) $20,000

B) $14,000

C) $8,000

D) $5,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

64

When a pension plan is ended,the obligation is settled by transferring the assets to:

A) each individual.

B) a financial bank.

C) a trustee.

D) None of these choices are correct.

A) each individual.

B) a financial bank.

C) a trustee.

D) None of these choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

65

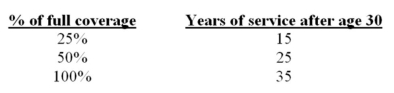

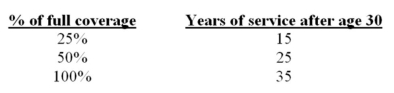

Bonnie joined a firm at age 25 and is expected to retire at 57.The post-retirement benefit plan provides the following coverage given the indicated years of service after age 30.  What is Bonnie's full eligibility date (her age when fully eligible)?

What is Bonnie's full eligibility date (her age when fully eligible)?

A) 57

B) 55

C) 50

D) 60

What is Bonnie's full eligibility date (her age when fully eligible)?

What is Bonnie's full eligibility date (her age when fully eligible)?A) 57

B) 55

C) 50

D) 60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

66

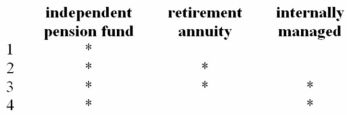

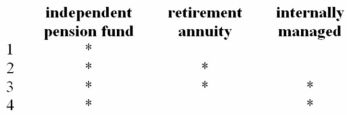

Funding a pension plan may be handled as follows:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

67

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's balance sheet as per IFRS for Year 1 would show a net:

Jamieson's balance sheet as per IFRS for Year 1 would show a net:

A) defined pension asset of $22,300.

B) defined pension liability of $22,300.

C) defined pension asset of $47,100.

D) defined pension liability of $24,800.

Jamieson's balance sheet as per IFRS for Year 1 would show a net:

Jamieson's balance sheet as per IFRS for Year 1 would show a net:A) defined pension asset of $22,300.

B) defined pension liability of $22,300.

C) defined pension asset of $47,100.

D) defined pension liability of $24,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

68

All of the following are relevant policy disclosures suggested by the AcSB except:

A) a reconciliation of pension plan assets from the beginning to the end of the year.

B) description of how expected return on pension plan assets is calculated.

C) actual return on plan assets during the year.

D) principle actuarial assumptions.

E) the risk profile of the employee group.

A) a reconciliation of pension plan assets from the beginning to the end of the year.

B) description of how expected return on pension plan assets is calculated.

C) actual return on plan assets during the year.

D) principle actuarial assumptions.

E) the risk profile of the employee group.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

69

When a company offers termination benefits as the result of a restructuring plan,the special termination benefits should be:

A) recognized with normal pension expense.

B) amortized over the average remaining service period.

C) amortized over a systematic and rational manner.

D) included with the restructuring costs on the income statement.

A) recognized with normal pension expense.

B) amortized over the average remaining service period.

C) amortized over a systematic and rational manner.

D) included with the restructuring costs on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

70

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  The funded status of Jamieson's defined benefit plan as at December 31st,Year 1 is:

The funded status of Jamieson's defined benefit plan as at December 31st,Year 1 is:

A) $22,300 overfunded.

B) $22,300 underfunded.

C) $47,100 underfunded.

D) $24,800 overfunded.

The funded status of Jamieson's defined benefit plan as at December 31st,Year 1 is:

The funded status of Jamieson's defined benefit plan as at December 31st,Year 1 is:A) $22,300 overfunded.

B) $22,300 underfunded.

C) $47,100 underfunded.

D) $24,800 overfunded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

71

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's pension expense as per ASPE for Year 1 would be:

Jamieson's pension expense as per ASPE for Year 1 would be:

A) $41,400.

B) $44,700.

C) $46,800.

D) $40,600.

Jamieson's pension expense as per ASPE for Year 1 would be:

Jamieson's pension expense as per ASPE for Year 1 would be:A) $41,400.

B) $44,700.

C) $46,800.

D) $40,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

72

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's defined benefit obligation as at December 31st,Year 1 would be:

Jamieson's defined benefit obligation as at December 31st,Year 1 would be:

A) $44,100.

B) $44,700.

C) $47,100.

D) $40,600.

Jamieson's defined benefit obligation as at December 31st,Year 1 would be:

Jamieson's defined benefit obligation as at December 31st,Year 1 would be:A) $44,100.

B) $44,700.

C) $47,100.

D) $40,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

73

Pension related estimates (not funding data)are provided by the:

A) employer company.

B) independent actuary.

C) pension fund trustee.

D) employee union.

A) employer company.

B) independent actuary.

C) pension fund trustee.

D) employee union.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

74

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's pension expense as per IFRS for Year 2 would be:

Jamieson's pension expense as per IFRS for Year 2 would be:

A) $49,438.

B) $5,338.

C) $4,000.

D) $1,338.

Jamieson's pension expense as per IFRS for Year 2 would be:

Jamieson's pension expense as per IFRS for Year 2 would be:A) $49,438.

B) $5,338.

C) $4,000.

D) $1,338.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

75

Gains and losses from plan settlements and curtailments should be:

A) amortized over the average remaining service period.

B) amortized over a systematic and rational manner.

C) recognized in income immediately.

D) deferred to the balance sheet.

A) amortized over the average remaining service period.

B) amortized over a systematic and rational manner.

C) recognized in income immediately.

D) deferred to the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

76

The accrued obligation at the beginning of the year was $289,000 and the current service cost for the year is $92,000.Assuming an interest factor of 8%,what is the accrued obligation at the end of the year?

A) $404,120

B) $381,000

C) $403,860

D) $363,660

A) $404,120

B) $381,000

C) $403,860

D) $363,660

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

77

Today is John's 57th birthday and he has served 14 years for his firm.John is expected to retire on his 65th birthday.His firm expects to incur $5,000 of annual net health care claims costs for John beginning one year after his retirement date and continuing each year for a total of seven years (assume seven end of year payments in all).To be fully eligible for these benefits,John must work 20 years.Compute expected post-retirement benefit obligation for John today if the discount rate is 8%.

A) $15,244

B) $12,322

C) $18,916

D) $14,064

A) $15,244

B) $12,322

C) $18,916

D) $14,064

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

78

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's balance sheet as per IFRS for Year 2 would show a net:

Jamieson's balance sheet as per IFRS for Year 2 would show a net:

A) defined pension asset of $26,576.

B) defined pension liability of $26,576.

C) defined pension asset of $48,876.

D) defined pension liability of $48,876.

Jamieson's balance sheet as per IFRS for Year 2 would show a net:

Jamieson's balance sheet as per IFRS for Year 2 would show a net:A) defined pension asset of $26,576.

B) defined pension liability of $26,576.

C) defined pension asset of $48,876.

D) defined pension liability of $48,876.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

79

The accrued obligation at the beginning of the year was $456,000 and the current service cost for the year is $67,000.Assuming an interest factor of 6%,what is the accrued obligation at the end of the year?

A) $523,000

B) $389,000

C) $550,360

D) $554,380

A) $523,000

B) $389,000

C) $550,360

D) $554,380

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck

80

Jamieson Corp.sponsors a defined benefit plan for its employee group. The following data pertains to the plan's first 2 years in existence:  Jamieson's pension expense as per IFRS for Year 1 would be:

Jamieson's pension expense as per IFRS for Year 1 would be:

A) $44,100.

B) $44,700.

C) $43,500.

D) $40,600.

Jamieson's pension expense as per IFRS for Year 1 would be:

Jamieson's pension expense as per IFRS for Year 1 would be:A) $44,100.

B) $44,700.

C) $43,500.

D) $40,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 93 في هذه المجموعة.

فتح الحزمة

k this deck