Deck 6: Revenue Recognition

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

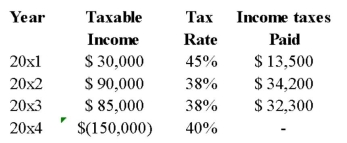

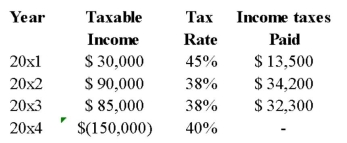

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/98

العب

ملء الشاشة (f)

Deck 6: Revenue Recognition

1

Net operating tax carry backs and carry forwards never result in a cash refund of prior taxes paid but may result in a reduction in taxes for subsequent years.

False

2

Taxes are recovered at the rate at which it was originally paid.The tax rate in the year the loss occurs is not relevant.

True

3

Under income tax laws and regulations a corporation that sustains a net operating loss for the current year may elect to carry back and/or carry forward the loss for income tax purposes.

True

4

The terms "probable" and "more likely than not" refer to probabilities that are greater than or equal to 50%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

5

The use of a valuation allowance account is mandatory under IFRS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

6

In general,deferred income tax assets due to tax loss carry forwards only to the extent that they are likely to be realized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

7

The amount of any unused tax losses must be disclosed on the face of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

8

Under ASPE,deferred income tax assets due to carry forwards may or may not be recognized,depending whether the company uses the taxes payable method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

9

In the year in which a tax loss is incurred,the tax loss must equal the net loss reported on the company's financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

10

A tax loss represents the present and deferred benefit that the company will be able to realize from the tax loss through a reduction of income taxes paid to governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

11

If a corporation incurs a taxable loss,they are entitled to carry the loss back for three years or forward for twenty years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

12

IFRS requires that any Valuation Allowance account balances (if used)be shown separately on the Statement of Financial Position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

13

The recovery of income tax expense is credited to income tax expense (recovery)account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

14

Under IFRS,the income tax expense pertaining to continuing operations must be presented on the face of the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

15

Taxes are recovered at the tax rate in effect during the year of the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

16

A tax benefit represents the present and deferred benefit that the company will be able to realize from the tax loss through a reduction of income taxes paid to governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

17

Companies normally apply tax loss carry backs sequentially.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

18

A company carrying back a loss must use the earliest year first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

19

Under current law,at the end of the year of loss or anytime during the next 15 years,a company may select to either carry back or carry forward-only the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company will show the same income tax expense/benefit regardless of whether or not a valuation allowance account is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

21

When applying tax loss carry backs,most companies have a policy of maximizing their return in the current year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

22

A tax loss represents:

A) the final number of the taxable loss on the tax return.

B) the amount of refund to be received in the year.

C) assistance from the government.

D) the present and deferred benefit that the company will be able to realize from the tax loss through a reduction of income taxes.

A) the final number of the taxable loss on the tax return.

B) the amount of refund to be received in the year.

C) assistance from the government.

D) the present and deferred benefit that the company will be able to realize from the tax loss through a reduction of income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

23

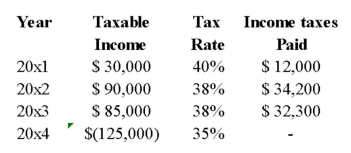

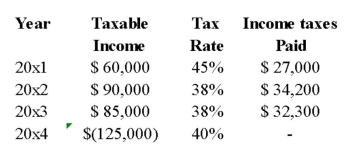

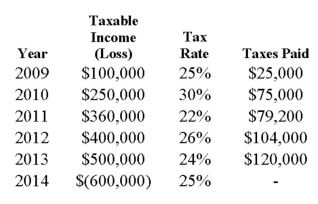

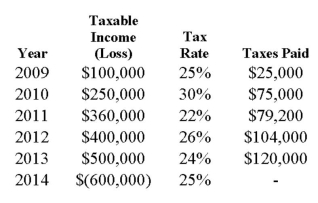

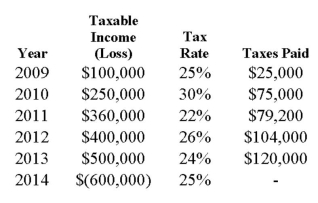

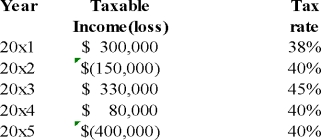

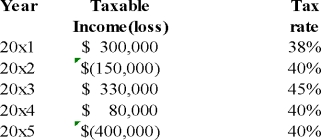

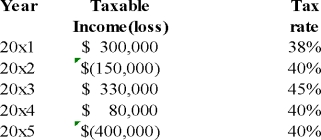

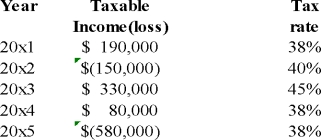

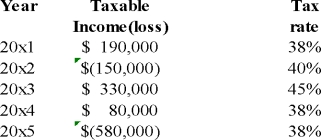

The following information for JMR Corporation is available:  JMR applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

JMR applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

A) $150,000.

B) $0.

C) $48,100.

D) $43,750.

JMR applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

JMR applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:A) $150,000.

B) $0.

C) $48,100.

D) $43,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

24

A tax benefit represents:

A) the final number of the taxable loss on the tax return.

B) the amount of refund to be received in the year.

C) assistance from the government.

D) the present and deferred benefit that the company will be able to realize from the tax loss through a reduction of income taxes.

A) the final number of the taxable loss on the tax return.

B) the amount of refund to be received in the year.

C) assistance from the government.

D) the present and deferred benefit that the company will be able to realize from the tax loss through a reduction of income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

25

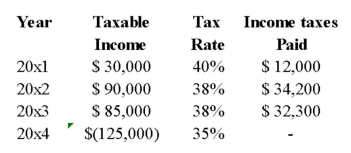

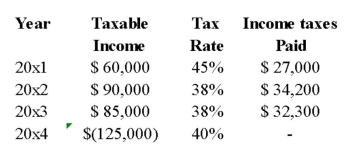

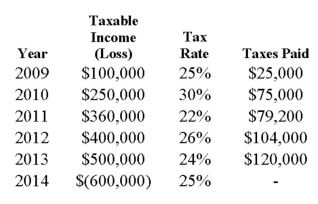

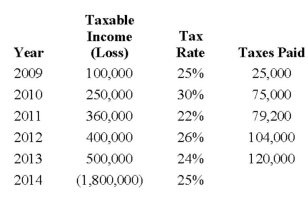

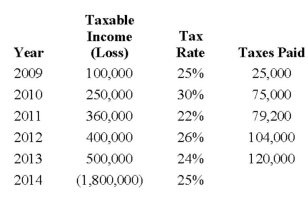

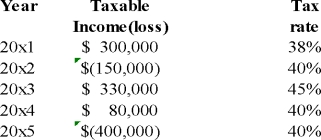

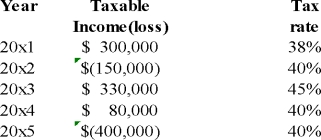

The following information for LAS Corporation is available:  LAS applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

LAS applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

A) $46,600.

B) $0.

C) $52,660.

D) $43,750.

LAS applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

LAS applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:A) $46,600.

B) $0.

C) $52,660.

D) $43,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

26

KG Corporation incurred a tax loss of $345,000.Based on a tax rate of 38%,what is the potential tax benefit?

A) $131,100

B) $345,000

C) $0

D) cannot be determined

A) $131,100

B) $345,000

C) $0

D) cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

27

Better matching is achieved when deferred income tax assets due to carry forwards are fully recognized in the year of the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

28

A company may not file previous years' tax returns to change the amount of CCA claimed if it so wishes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

29

A Corporation that incurs a taxable loss is entitled to offset the loss as follows:

A) Carried back 7 years and forward 3 years

B) Carried back 3 years and forward 20 years

C) Carried back 3 years and forward 10 years

D) Carried back 10 years and forward 3 years

A) Carried back 7 years and forward 3 years

B) Carried back 3 years and forward 20 years

C) Carried back 3 years and forward 10 years

D) Carried back 10 years and forward 3 years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

30

If a potential benefit of a loss carry forward that was previously determined to meet the more likely than not criteria has now been determined not to meet the criteria,it should be reversed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

31

Existing sufficient taxable temporary differences,which will result in taxable income,is one piece of evidence to support a more likely than not criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

32

VB Corporation reported a net loss of $50,000 for accounting purposes.Items included in the loss are golf dues amounting to $3,000,meals and entertainment totalling $10,000,CCA of $10,000,depreciation of $5,000,warranty expenses of $8,000 and warranty expenditures of $6,000.VB's taxable income is:

A) ($45,000)

B) ($51,000).

C) ($57,000).

D) ($58,000).

A) ($45,000)

B) ($51,000).

C) ($57,000).

D) ($58,000).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

33

Existing sufficient taxable permanent differences,which will result in taxable income,is one piece of evidence to support a more likely than not criteria.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

34

Deferred tax amounts must be revalued whenever substantially enacted tax rates change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

35

VB Corporation incurred a tax loss of $86,000.Based on a tax rate of 45% what is the potential tax benefit?

A) $86,000

B) $38,700

C) $0

D) cannot be determined

A) $86,000

B) $38,700

C) $0

D) cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

36

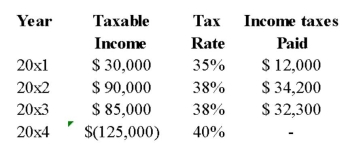

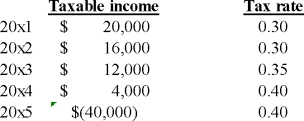

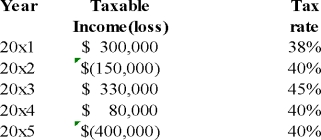

The following information for KEG Corporation is available:  KEG applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

KEG applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

A) $46,600.

B) $51,700.

C) $52,660.

D) $43,750.

KEG applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

KEG applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:A) $46,600.

B) $51,700.

C) $52,660.

D) $43,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

37

CCA is an optional deduction and may be adjusted downwards in order to create taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

38

Carry back and carry forward procedures for temporary differences are always applied,even when there are no temporary differences for deductible items,and there are no current income taxes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

39

JG Corporation incurred a tax loss of $945,000.Based on a tax rate of 38%,what is the potential tax benefit?

A) $0

B) $945,000

C) $359,100

D) cannot be determined

A) $0

B) $945,000

C) $359,100

D) cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

40

Once it is deemed that a potential benefit of a loss carry forward does not meet the more likely than not criteria,the benefit may not be recognized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

41

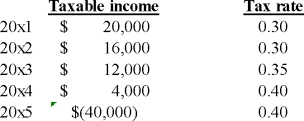

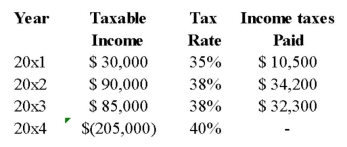

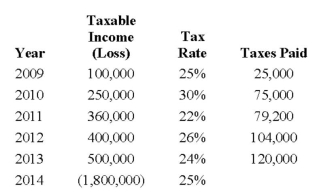

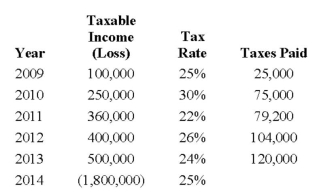

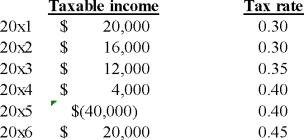

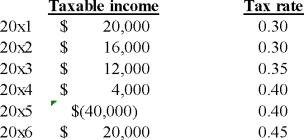

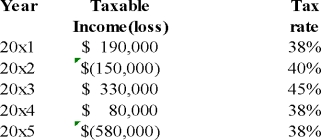

The following data represents the complete taxable income history for a firm:  What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

A) $0

B) $12,000

C) $8,000

D) $3,200

What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?A) $0

B) $12,000

C) $8,000

D) $3,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

42

The following information pertains to XYZ Inc.:  Assuming that XYZ has a policy of applying its tax losses,sequentially,how much would the company be able to recover in taxes through the use of its 2014 tax loss?

Assuming that XYZ has a policy of applying its tax losses,sequentially,how much would the company be able to recover in taxes through the use of its 2014 tax loss?

A) $152,000

B) $133,000

C) $141,600

D) $145,000

Assuming that XYZ has a policy of applying its tax losses,sequentially,how much would the company be able to recover in taxes through the use of its 2014 tax loss?

Assuming that XYZ has a policy of applying its tax losses,sequentially,how much would the company be able to recover in taxes through the use of its 2014 tax loss?A) $152,000

B) $133,000

C) $141,600

D) $145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

43

Choose the best statement with respect to tax rates.

A) The tax rate used to record a deferred income tax asset or liability should be the enacted tax rate at the beginning of the year.

B) The current tax rate should be used to record a deferred income tax asset or liability.

C) The projected tax rate should be used to record a deferred income tax asset or liability.

D) Once recorded, the deferred income tax asset must be maintained at a rate expected to be in effect when the carry forward is utilized.

A) The tax rate used to record a deferred income tax asset or liability should be the enacted tax rate at the beginning of the year.

B) The current tax rate should be used to record a deferred income tax asset or liability.

C) The projected tax rate should be used to record a deferred income tax asset or liability.

D) Once recorded, the deferred income tax asset must be maintained at a rate expected to be in effect when the carry forward is utilized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

44

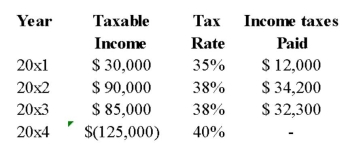

The following information for KAR Corporation is available:  KAR carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

KAR carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

A) $82,000.

B) $77,000.

C) $75,850.

D) $43,750.

KAR carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

KAR carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:A) $82,000.

B) $77,000.

C) $75,850.

D) $43,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

45

JMR Corp.sustained taxable income in 2011 of $50,000 when the tax rate was 40%.In 2012 they suffered a tax loss of $80,000 when the tax rate was 38%.All of the following are true except:

A) JMR Corp. has a potential carry forward of $11,400.

B) A more likely than not criteria is needed to set up the benefit.

C) The tax refund will amount to $12,000.

D) Prior years' tax returns may be amended to create more taxable income.

A) JMR Corp. has a potential carry forward of $11,400.

B) A more likely than not criteria is needed to set up the benefit.

C) The tax refund will amount to $12,000.

D) Prior years' tax returns may be amended to create more taxable income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

46

The following information pertains to XYZ Inc.:  Assuming that XYZ has a policy of tax refund maximization,how much would the company be able to recover in taxes through the use of its 2014 tax loss?

Assuming that XYZ has a policy of tax refund maximization,how much would the company be able to recover in taxes through the use of its 2014 tax loss?

A) $152,000

B) $133,000

C) $141,600

D) $145,000

Assuming that XYZ has a policy of tax refund maximization,how much would the company be able to recover in taxes through the use of its 2014 tax loss?

Assuming that XYZ has a policy of tax refund maximization,how much would the company be able to recover in taxes through the use of its 2014 tax loss?A) $152,000

B) $133,000

C) $141,600

D) $145,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

47

The following information pertains to ABC Inc.:  Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was enacted during 2014.This information would result in:

Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was enacted during 2014.This information would result in:

A) a Deferred Tax Asset - Carry forward in the amount of $108,000.

B) a Deferred Tax Asset - Carry forward in the amount of $135,000.

C) a Deferred Tax Asset - Carry forward in the amount of $47,500.

D) a Deferred Tax Asset - Carry forward in the amount of $38,000.

Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was enacted during 2014.This information would result in:

Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was enacted during 2014.This information would result in:A) a Deferred Tax Asset - Carry forward in the amount of $108,000.

B) a Deferred Tax Asset - Carry forward in the amount of $135,000.

C) a Deferred Tax Asset - Carry forward in the amount of $47,500.

D) a Deferred Tax Asset - Carry forward in the amount of $38,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

48

All of the following are evidence to support recognition of a deferred income tax benefit except:

A) It is acceptable industry practice to recognize the deferred income tax benefit.

B) There are existing taxable temporary differences to absorb the loss.

C) An excess of fair value over the tax basis of the enterprise's net assets in an amount sufficient to realize the deferred income tax asset.

D) A strong earnings history suggesting that losses are not expected to continue.

A) It is acceptable industry practice to recognize the deferred income tax benefit.

B) There are existing taxable temporary differences to absorb the loss.

C) An excess of fair value over the tax basis of the enterprise's net assets in an amount sufficient to realize the deferred income tax asset.

D) A strong earnings history suggesting that losses are not expected to continue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

49

Choose the best statement with respect to tax rates.

A) The tax rate used to record a deferred income tax asset or liability should be the enacted tax rate at the balance sheet date.

B) The current tax rate should be used to record a deferred income tax asset or liability.

C) The projected tax rate should be used to record a deferred income tax asset or liability.

D) None of these answers are correct.

A) The tax rate used to record a deferred income tax asset or liability should be the enacted tax rate at the balance sheet date.

B) The current tax rate should be used to record a deferred income tax asset or liability.

C) The projected tax rate should be used to record a deferred income tax asset or liability.

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

50

Geisler Corp.provided you with the following information for the year ending December 31,2017: Net Income before taxes: $150,000

Depreciation (included in above)$90,000

CCA$250,000

The net book value of the capital assets was $1,100,000,and their UCC was $900,000 on January 1,2017.

A temporary difference of $200,000 is reflected in an accumulated deferred income tax liability (DTL)balance of $90,000 at January 1,2017.

There were no permanent differences.

Taxable income in the three-year carry back period was $400,000.Tax losses are carried back as far as allowable by law.

A tax rate of 45% applies to the current and previous years.

Geisler's 2017 journal entry to record its Deferred Tax amounts would include:

A) a Deferred tax - benefit amount of $62,000.

B) a Deferred tax - expense amount of $62,000.

C) a Deferred tax - benefit amount of $72,000.

D) a Deferred tax - expense amount of $72,000.

Depreciation (included in above)$90,000

CCA$250,000

The net book value of the capital assets was $1,100,000,and their UCC was $900,000 on January 1,2017.

A temporary difference of $200,000 is reflected in an accumulated deferred income tax liability (DTL)balance of $90,000 at January 1,2017.

There were no permanent differences.

Taxable income in the three-year carry back period was $400,000.Tax losses are carried back as far as allowable by law.

A tax rate of 45% applies to the current and previous years.

Geisler's 2017 journal entry to record its Deferred Tax amounts would include:

A) a Deferred tax - benefit amount of $62,000.

B) a Deferred tax - expense amount of $62,000.

C) a Deferred tax - benefit amount of $72,000.

D) a Deferred tax - expense amount of $72,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

51

Geisler Corp.provided you with the following information for the year ending December 31,2017: Net Income before taxes: $150,000

Depreciation (included in above)$90,000

CCA$250,000

The net book value of the capital assets was $1,100,000,and their UCC was $900,000 on January 1,2017.

A temporary difference of $200,000 is reflected in an accumulated deferred income tax liability (DTL)balance of $90,000 at January 1,2017.

There were no permanent differences.

Taxable income in the three-year carry back period was $400,000.Tax losses are carried back as far as allowable by law.

A tax rate of 45% applies to the current and previous years.

As a result of the company's temporary differences,Geisler's 2017 statement of financial position would show:

A) a Deferred tax asset of $162,000.

B) a Deferred tax liability of $162,000.

C) a Deferred tax asset of $49,500.

D) a Deferred tax liability of $49,500.

Depreciation (included in above)$90,000

CCA$250,000

The net book value of the capital assets was $1,100,000,and their UCC was $900,000 on January 1,2017.

A temporary difference of $200,000 is reflected in an accumulated deferred income tax liability (DTL)balance of $90,000 at January 1,2017.

There were no permanent differences.

Taxable income in the three-year carry back period was $400,000.Tax losses are carried back as far as allowable by law.

A tax rate of 45% applies to the current and previous years.

As a result of the company's temporary differences,Geisler's 2017 statement of financial position would show:

A) a Deferred tax asset of $162,000.

B) a Deferred tax liability of $162,000.

C) a Deferred tax asset of $49,500.

D) a Deferred tax liability of $49,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following information for JG Corporation is available:  JG carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

JG carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

A) $48,600.

B) $46,600.

C) $52,660.

D) $59,100.

JG carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:

JG carries applies its tax losses sequentially,that is,tax losses are carried back as far as possible.The taxes recovered for the year ended 2014 amounted to:A) $48,600.

B) $46,600.

C) $52,660.

D) $59,100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

53

Geisler Corp.provided you with the following information for the year ending December 31,2017: Net Income before taxes: $150,000

Depreciation (included in above)$90,000

CCA$250,000

The net book value of the capital assets was $1,100,000,and their UCC was $900,000 on January 1,2017.

A temporary difference of $200,000 is reflected in an accumulated deferred income tax liability (DTL)balance of $90,000 at January 1,2017.

There were no permanent differences.

Taxable income in the three-year carry back period was $400,000.Tax losses are carried back as far as allowable by law.

A tax rate of 45% applies to the current and previous years.

Based on the above information,what is Geisler's tax recovery for 2017?

A) $4,500

B) $0

C) $180,000

D) $40,500

E) cannot be determined

Depreciation (included in above)$90,000

CCA$250,000

The net book value of the capital assets was $1,100,000,and their UCC was $900,000 on January 1,2017.

A temporary difference of $200,000 is reflected in an accumulated deferred income tax liability (DTL)balance of $90,000 at January 1,2017.

There were no permanent differences.

Taxable income in the three-year carry back period was $400,000.Tax losses are carried back as far as allowable by law.

A tax rate of 45% applies to the current and previous years.

Based on the above information,what is Geisler's tax recovery for 2017?

A) $4,500

B) $0

C) $180,000

D) $40,500

E) cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

54

The following information pertains to ABC Inc.:  Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was not known when the 2014 tax return was filed.This information would result in:

Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was not known when the 2014 tax return was filed.This information would result in:

A) a Deferred Tax Asset - Carry forward in the amount of $108,000.

B) a Deferred Tax Asset - Carry forward in the amount of $135,000.

C) a Deferred Tax Asset - Carry forward in the amount of $47,500.

D) a Deferred Tax Asset - Carry forward in the amount of $38,000.

Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was not known when the 2014 tax return was filed.This information would result in:

Assume that ABC Inc.meets the more likely than not criteria for tax loss carry forward recognition.The tax rate for 2015 and beyond is expected to be 20%,and this rate was not known when the 2014 tax return was filed.This information would result in:A) a Deferred Tax Asset - Carry forward in the amount of $108,000.

B) a Deferred Tax Asset - Carry forward in the amount of $135,000.

C) a Deferred Tax Asset - Carry forward in the amount of $47,500.

D) a Deferred Tax Asset - Carry forward in the amount of $38,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company that has sustained a tax loss during the year and is not able to carry it back may potentially do all of the following except:

A) File amended tax returns for previous years changing CCA.

B) Choose not to claim CCA in the current year.

C) Carry it forward the amount for 10 years.

D) Do nothing.

A) File amended tax returns for previous years changing CCA.

B) Choose not to claim CCA in the current year.

C) Carry it forward the amount for 10 years.

D) Do nothing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

56

JMR Corporation suffered a loss in 2013.As a result,the Corporation has an $87,000 accumulated tax loss carry forward.The current tax rate is 40%.The benefit was recorded in the accounts,as JMR believed it was more likely than not to be realized.In 2014 the tax rate goes down to 38% and JMR has not yet used the benefit.Which of the following statements is true?

A) No change to the accounts is necessary

B) Income tax expense should be increased by $1,740

C) Deferred income tax asset-benefit should be increased by $1,740

D) Deferred income tax asset-benefit will not change

A) No change to the accounts is necessary

B) Income tax expense should be increased by $1,740

C) Deferred income tax asset-benefit should be increased by $1,740

D) Deferred income tax asset-benefit will not change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

57

Disclosure related to tax loss carry forwards and carry backs include all of the following except:

A) Current tax benefit from tax loss carry backs and carry forwards should be segregated between continuing operations, discontinued operations and extraordinary items.

B) There should be disclosure of the amount of unrecognized tax losses.

C) Disclosure of the expiry date of unrecognized tax losses.

D) Whether a Valuation Allowance account was used.

A) Current tax benefit from tax loss carry backs and carry forwards should be segregated between continuing operations, discontinued operations and extraordinary items.

B) There should be disclosure of the amount of unrecognized tax losses.

C) Disclosure of the expiry date of unrecognized tax losses.

D) Whether a Valuation Allowance account was used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

58

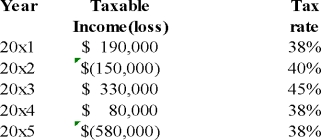

The following data represents the complete taxable income history for a firm:  What is the tax liability for 2016?

What is the tax liability for 2016?

A) $9,000

B) $5,400

C) $8,000

D) $6,000

What is the tax liability for 2016?

What is the tax liability for 2016?A) $9,000

B) $5,400

C) $8,000

D) $6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

59

JMR Corporation suffered a loss in 2013.As a result,the Corporation has a $87,000 accumulated tax loss carry forward at the tax rate of 40%.The benefit was recorded in the accounts as JMR believed it was more likely than not to be realized.In 2014 the tax rate goes up to 45% and JMR has not yet used the benefit.Which of the following statements is true?

A) No change to the accounts is necessary

B) Income tax expense should be increased by $1,740

C) Deferred income tax asset-benefit should be increased by $1,740

D) Income tax expense should be decreased by $4,350

A) No change to the accounts is necessary

B) Income tax expense should be increased by $1,740

C) Deferred income tax asset-benefit should be increased by $1,740

D) Income tax expense should be decreased by $4,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following statements with respect to the required disclosures relating to tax loss carry forwards and carry backs is/are correct?

A) Current tax benefit from tax loss carry backs and carry forwards need not be segregated between continuing operations, discontinued operations.

B) There should be disclosure of the amount of unrecognized tax losses.

C) Disclosure of the expiry date of unrecognized tax losses.

D) All of these statements are correct.

A) Current tax benefit from tax loss carry backs and carry forwards need not be segregated between continuing operations, discontinued operations.

B) There should be disclosure of the amount of unrecognized tax losses.

C) Disclosure of the expiry date of unrecognized tax losses.

D) All of these statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

61

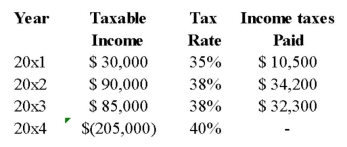

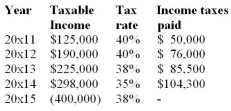

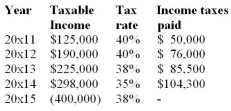

JMR's taxable income for the first five years was as follows:  Calculate the tax recovery in 20x15.

Calculate the tax recovery in 20x15.

Calculate the tax recovery in 20x15.

Calculate the tax recovery in 20x15.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

62

JG Ltd.provided you with the following information:  There are no temporary differences.What is the tax recovery in 2015 assuming that a policy of tax refund maximization is followed?

There are no temporary differences.What is the tax recovery in 2015 assuming that a policy of tax refund maximization is followed?

A) $160,000

B) $169,500

C) $176,500

D) Nil.

There are no temporary differences.What is the tax recovery in 2015 assuming that a policy of tax refund maximization is followed?

There are no temporary differences.What is the tax recovery in 2015 assuming that a policy of tax refund maximization is followed?A) $160,000

B) $169,500

C) $176,500

D) Nil.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

63

Describe the difference between a tax loss and a tax benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

64

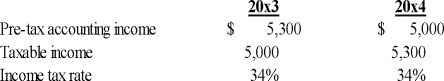

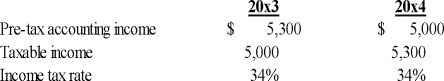

CJM provided the following data related to income tax allocation:  The deferred income tax account showed a zero balance at the start of 2013.There was only one temporary difference,an expense,which was deductible for tax purposes in 2013,but was recorded for accounting purposes in 2014.There are no carry backs or carry forwards and no originating temporary differences in 2014.The journal entry to record the income tax consequences for 2014 would include a:

The deferred income tax account showed a zero balance at the start of 2013.There was only one temporary difference,an expense,which was deductible for tax purposes in 2013,but was recorded for accounting purposes in 2014.There are no carry backs or carry forwards and no originating temporary differences in 2014.The journal entry to record the income tax consequences for 2014 would include a:

A) Debit of $102 to CJM's deferred income tax liability account.

B) Credit of $102 to CJM's deferred income tax liability account.

C) Debit of $102 to CJM's deferred income tax asset account.

D) Credit of $102 to CJM's deferred income tax asset account.

The deferred income tax account showed a zero balance at the start of 2013.There was only one temporary difference,an expense,which was deductible for tax purposes in 2013,but was recorded for accounting purposes in 2014.There are no carry backs or carry forwards and no originating temporary differences in 2014.The journal entry to record the income tax consequences for 2014 would include a:

The deferred income tax account showed a zero balance at the start of 2013.There was only one temporary difference,an expense,which was deductible for tax purposes in 2013,but was recorded for accounting purposes in 2014.There are no carry backs or carry forwards and no originating temporary differences in 2014.The journal entry to record the income tax consequences for 2014 would include a:A) Debit of $102 to CJM's deferred income tax liability account.

B) Credit of $102 to CJM's deferred income tax liability account.

C) Debit of $102 to CJM's deferred income tax asset account.

D) Credit of $102 to CJM's deferred income tax asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

65

Reducing CCA is one tax strategy that a company may employ.All of the following are true except:

A) CCA not claimed in one year is only partially lost for deferred years.

B) Minimizing CCA can create taxable income so that losses may be used.

C) CCA may be eliminated in the carry forward years.

D) Returns may be amended for the previous three years.

A) CCA not claimed in one year is only partially lost for deferred years.

B) Minimizing CCA can create taxable income so that losses may be used.

C) CCA may be eliminated in the carry forward years.

D) Returns may be amended for the previous three years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

66

FGH had a $1,200 temporary difference for deferred gross margin on instalment sales at the end of 2012.This temporary difference will reverse equally during 2013,2014 and 2015.The enacted corporate income tax rate is 48% and government is discussing a reduction in the corporate income tax rates for 2014 and 2015 to 38%.The deferred income tax liability related to this temporary difference at the end of 2013 would be:

A) $192

B) $248

C) $384

D) $576

A) $192

B) $248

C) $384

D) $576

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

67

JR Ltd.provided you with the following information:  There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that tax losses are carried back as far as possible (sequentially)?

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that tax losses are carried back as far as possible (sequentially)?

A) $32,000

B) $176,500

C) $196,000

D) $80,000

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that tax losses are carried back as far as possible (sequentially)?

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that tax losses are carried back as far as possible (sequentially)?A) $32,000

B) $176,500

C) $196,000

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

68

In 2013,JMR Corp.set up a deferred income tax benefit of a tax loss carry forward as the probability of realization was greater than 50%.It is now the end of 2013 and management has determined that 50% of the benefit will not be realized.Management should:

A) Continue to carry the total deferred income tax benefit of the tax loss carry forward.

B) Write down the entire benefit.

C) Write down 50% of the benefit.

D) None of these statements are correct.

A) Continue to carry the total deferred income tax benefit of the tax loss carry forward.

B) Write down the entire benefit.

C) Write down 50% of the benefit.

D) None of these statements are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

69

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

A) $194,100

B) $0

C) $220,000

D) $64,600

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 it was determined that the probability of realization was less than 50%.What would be the carrying amount of the deferred income tax benefit-loss carry forward on the balance sheet at the end of 2016?A) $194,100

B) $0

C) $220,000

D) $64,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

70

Reducing CCA is one tax strategy that a company may employ.All of the following are true except:

A) CCA is an optional deduction and is not lost if not used.

B) Minimizing CCA can create taxable income so that losses may be used.

C) CCA may be eliminated in the carry forward years.

D) Returns may be amended for the previous twenty years.

A) CCA is an optional deduction and is not lost if not used.

B) Minimizing CCA can create taxable income so that losses may be used.

C) CCA may be eliminated in the carry forward years.

D) Returns may be amended for the previous twenty years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

71

MDB had a $1,200 temporary tax difference for deferred gross margin on instalment sales at the end of 2012.This temporary difference will reverse equally during 2013,2014,and 2015.The enacted corporate income tax rate is 25% and Parliament is discussing an increase in the corporate income tax rates for 2014 and 2015 to 35%.The deferred income tax liability related to this temporary difference at the end of 2013 would be:

A) $100

B) $300

C) $200

D) $420

A) $100

B) $300

C) $200

D) $420

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

72

JR Company incurred a loss in 2011,due in part to a fire at one of its plants.The deferred benefit of a loss carry forward was not recognized in the year as the probability of realization was less than 50%.In 2012,JR Company incurred a small loss,but due to large contracts upcoming,it was determined that the probability of realization was greater than 50%.The tax rate for 2011 was 40% and 2012 45%.JR Company should:

A) Record the deferred income tax benefit for 2012 only.

B) Record the deferred income tax benefit for both years using the 40% rate.

C) Record the deferred income tax benefit for both years using the 45% rate.

D) Record the deferred income tax benefit for 2011 only.

A) Record the deferred income tax benefit for 2012 only.

B) Record the deferred income tax benefit for both years using the 40% rate.

C) Record the deferred income tax benefit for both years using the 45% rate.

D) Record the deferred income tax benefit for 2011 only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

73

All of the following are true regarding loss carry forwards except:

A) The probability of realization needs to be greater than 50%.

B) The carry forward benefit is recognized on the balance sheet.

C) Management may choose not to set up the benefit.

D) Any deferred income tax benefit set up should not be subsequently written down.

A) The probability of realization needs to be greater than 50%.

B) The carry forward benefit is recognized on the balance sheet.

C) Management may choose not to set up the benefit.

D) Any deferred income tax benefit set up should not be subsequently written down.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

74

VB Ltd.provided you with the following information:  There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

A) $273,600

B) $127,600

C) $139,500

D) $141,500

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?

There are no temporary differences.The deferred income tax benefit of the loss carry forward was set up in 2015 as the probability of realization was greater than 50%.In 2016 a further loss of $140,000 was incurred.Management determined that they were still more likely than not to realize the loss.The tax rate for 2016 was 45%.What would be the carrying amount of the deferred income tax benefit/loss carry forward on the balance sheet at the end of 2016?A) $273,600

B) $127,600

C) $139,500

D) $141,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

75

How does the existence of a loss in the year impact the accounting of temporary differences?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

76

JR Ltd.provided you with the following information:  There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that a policy of tax refund maximization is followed?

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that a policy of tax refund maximization is followed?

A) $32,000

B) $172,550

C) $176,500

D) $80,000

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that a policy of tax refund maximization is followed?

There are no temporary differences.What will be the amount of the tax refund received in 2015 assuming that a policy of tax refund maximization is followed?A) $32,000

B) $172,550

C) $176,500

D) $80,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

77

XYZ Inc.is a publicly traded company.At the start of the current year,the company had tax loss carry forwards in the amount of $500,000.This amount increased by $100,000 during the year,due to a change in estimate of the company's future earnings targets.The tax rate for the current year is 25%.The enacted tax rate for future years is 20%.The company uses a valuation allowance account to track its tax loss carry forwards.Which of the following correctly describes the balances in XYZ's internal records at the end of the current year?

A) Deferred Tax Asset- Carry forward: $100,000 Dr. Valuation Allowance: $20,000 Cr.

B) Deferred Tax Asset- Carry forward: $125,000 Dr. Valuation Allowance: $25,000 Cr.

C) Deferred Tax Asset- Carry forward: $100,000 Dr. Valuation Allowance: $20,000 Dr.

D) Deferred Tax Asset- Carry forward: $125,000 Dr. Valuation Allowance: $25,000 Dr.

A) Deferred Tax Asset- Carry forward: $100,000 Dr. Valuation Allowance: $20,000 Cr.

B) Deferred Tax Asset- Carry forward: $125,000 Dr. Valuation Allowance: $25,000 Cr.

C) Deferred Tax Asset- Carry forward: $100,000 Dr. Valuation Allowance: $20,000 Dr.

D) Deferred Tax Asset- Carry forward: $125,000 Dr. Valuation Allowance: $25,000 Dr.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

78

What factor would most likely cause a firm to choose the carry forward only option for a net operating loss?

A) Expectations of lower earnings in the future relative to the past.

B) Expectations of higher earnings in the future relative to the past.

C) Expectations of lower tax rates in the future relative to the past.

D) Expectations of higher tax rates in the future relative to the past.

A) Expectations of lower earnings in the future relative to the past.

B) Expectations of higher earnings in the future relative to the past.

C) Expectations of lower tax rates in the future relative to the past.

D) Expectations of higher tax rates in the future relative to the past.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

79

The maximum number of years a tax loss can be carried forward is:

A) 3 years.

B) 20 years.

C) 10 years.

D) 17 years.

A) 3 years.

B) 20 years.

C) 10 years.

D) 17 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

80

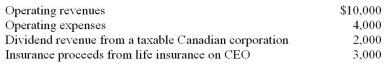

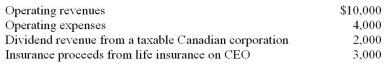

XYZ Ltd.,a taxable Canadian corporation,reported the following revenues and expenses in these amounts for both taxes and financial reporting (the tax rate is 40%).  What is income tax expense for the year?

What is income tax expense for the year?

A) $4,400

B) $3,600

C) $4,000

D) $2,400

What is income tax expense for the year?

What is income tax expense for the year?A) $4,400

B) $3,600

C) $4,000

D) $2,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck