Deck 4: Statements of Financial Position and Changes in Equity; Disclosure Notes

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/127

العب

ملء الشاشة (f)

Deck 4: Statements of Financial Position and Changes in Equity; Disclosure Notes

1

If a financial instrument is an equity instrument in substance,but its legal form is debt,any periodic payments made to investors will be accrued on the company's financial statements as interest expense.

False

2

Perpetual Debt is accounted for as equity.

False

3

Securities issued as debt,but intended by the issuing corporation to be exchanged for shares by the investors at some time prior to maturity,are known as "hybrid securities".

True

4

The proceeds of any bonds sold with detachable stock warrants must be pro-rated between the bonds and the warrants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

5

When stock rights are issued to current shareholders,it may require more than one such right to later acquire one additional share of the stock covered by the rights.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

6

Stock options have no intrinsic value when the market price of the share exceeds its conversion price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

7

Share-based payments to suppliers are valued at the value of the goods or services received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

8

The conversion option attached to convertible bonds,which have a floating conversion price per share,has an intrinsic value which is based on the fair market value of the shares at the time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

9

The accounting classification of a financial instrument is determined by its tax status.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

10

When interest is repayable to investors at a fixed amount per share,the financial instrument in question would be considered debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

11

Assume that a company wishes to grant stock options to a supplier in exchange for services rendered.The company chose to value this exchange at the going market rate charged by the suppliers' competitors.This is an example of a Level 2 Fair Value Hierarchy application.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

12

Management of a company that has convertible bonds outstanding would likely force conversion of its bonds of the fair market value of the shares upon conversion exceeds the fair value of the bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

13

General debt carries a firm commitment to interest payments and repayment of capital at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

14

If cash payments to investors are dependent on one or more future events,the instrument in question would be considered equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

15

When preferred shares are classified as debt,their dividends are deducted from Retained Earnings,thus bypassing earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

16

Retractable preferred shares are those which can be redeemed only at the investor's discretion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

17

Induced conversions of convertible debt arise when the debtor offers a "sweetener" to encourage the creditor to promptly convert the debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

18

Options are ONLY for the purpose of buying or selling financial instruments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

19

The measurement date of a compensatory stock option must precede the date of grant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

20

A financial instrument is any contract that gives rise to a financial asset of one party and a financial liability or equity instrument of another party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under IFRS,forfeitures which occur under a stock-based compensation structure are accrued throughout the vesting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

22

One of the most common forms of hybrid security is convertible debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

23

Under ASPE,forfeitures which occur under a stock-based compensation structure are accrued throughout the vesting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

24

When a bond matures,an investor will cash it in if the market price of the convertible bond is higher than the conversion price of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under ASPE,preferred shares must be classified as equity while shareholder loans must be classified as debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

26

Once the market price of shares rises above the conversion price on convertible bonds,the bond ceases to trade as debt,and is effectively traded as equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

27

When a bond matures,an investor will convert if the market price of the convertible bond is higher than the conversion price of the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under ASPE,convertible debt must always be treated as debt in its entirety.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

29

Even if the underlying share value of a convertible bond never reaches the conversion price,management can still force conversion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

30

If it is the company's option to repay the debentures through the issuance of common shares,the principal component of the bonds is debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

31

An instrument may be classified as equity even though the investor can demand payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

32

Embedded derivatives are those that can be detached and separately sold from their host contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

33

The crucial aspect of debt is that the creditors can demand payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

34

Futures contracts are traded on public exchanges while forward contracts are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

35

An equity item is classified as debt in the financial statements and dividend payments were shown on the financial statements.For income tax purposes,the amounts will not be tax deductible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

36

Cash flow hedges do not exist under ASPE.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

37

An escalation clause will normally cause preferred shares to trade as debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

38

When bonds are converted,it is first necessary to update any accounts relating to bond premium or discount,accrued interest,and foreign exchange gains and losses on foreign currency denominated debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

39

With respect to convertible bonds,whose conversion is mandatory,only the interest stream is valued as debt; the bond principal and conversion features are considered equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

40

To be classified as retractable preferred shares,the cash repayment must either be contractually required or at the option of the investor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

41

In order to determine if,in substance,a complex financial instrument is debt,the answer should be yes to all of the following except:

A) Is the periodic return on capital obligatory?

B) Is the debtor legally obligated to repay the principal at a fixed rate?

C) Is the amount convertible into common shares?

D) Is the debtor legally obligated to repay the principal at the option of the creditor?

A) Is the periodic return on capital obligatory?

B) Is the debtor legally obligated to repay the principal at a fixed rate?

C) Is the amount convertible into common shares?

D) Is the debtor legally obligated to repay the principal at the option of the creditor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

42

Silo Corp.granted to Donna,its superstar accountant,the option to purchase Silo common shares for $10,on Jan.1,20x1.The market price of the shares on that date was $20.The options can be exercised during the period Jan.1,20x4 through Jan.1,20x6.The number of shares under option is determined by a formula based on Silo earnings each year.The number of shares actually under option will be the formula value on Dec.31,20x3.That formula estimated the following number of shares under option at the end of years: 20x1,200; 20x2,300.The formula determined the number of shares at Dec.31,20x3 to be 400.The market prices for Silo shares at the end of years: 20x1,$25; 20x2,$40,20x3,$50.What is the recorded compensation expense for 20x2,for Donna?

A) $7,250

B) $3,000

C) $4,000

D) $4,500

E) $5,000

A) $7,250

B) $3,000

C) $4,000

D) $4,500

E) $5,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

43

A non-compensatory stock option plan means that:

A) Any employee can purchase shares at a discount from the prevailing market price.

B) Top executives are given shares in the company.

C) No shares are given but shareholders are allowed to be purchased on the open market.

D) None of these answers are correct.

A) Any employee can purchase shares at a discount from the prevailing market price.

B) Top executives are given shares in the company.

C) No shares are given but shareholders are allowed to be purchased on the open market.

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

44

A stock option plan is a compensatory plan if:

A) The employee must have worked for the company for one year.

B) The employee must report the option on the employee's current tax return.

C) The employee must work for the company until retirement.

D) It involves a cost to the grantor.

A) The employee must have worked for the company for one year.

B) The employee must report the option on the employee's current tax return.

C) The employee must work for the company until retirement.

D) It involves a cost to the grantor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

45

All of the following are common reasons for a company to issue convertible bonds except:

A) The company prefers to issue shares, but is unsure of the present stock market and the timing.

B) The bonds are issued to controlling shareholders so that they can receive interest payments in preference to other shareholders.

C) A bond that has a favourable component such as a conversion privilege, can carry a lower interest rate than a "straight" bond.

D) All of these answers are correct.

A) The company prefers to issue shares, but is unsure of the present stock market and the timing.

B) The bonds are issued to controlling shareholders so that they can receive interest payments in preference to other shareholders.

C) A bond that has a favourable component such as a conversion privilege, can carry a lower interest rate than a "straight" bond.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

46

Hedge accounting is often performed to minimize any accounting mismatch between the hedged and hedging items and is strictly voluntary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

47

If a company issues debt that is convertible at the corporation's option,in substance,the debt is equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

48

In order to determine if,in substance,a complex financial instrument is equity,the answer should be no to all of the following except:

A) Is the periodic return on capital obligatory?

B) Is the debtor legally obligated to repay the principal at a fixed rate?

C) Is the amount convertible into common shares?

D) Is the debtor legally obligated to repay the principal at the option of the creditor?

A) Is the periodic return on capital obligatory?

B) Is the debtor legally obligated to repay the principal at a fixed rate?

C) Is the amount convertible into common shares?

D) Is the debtor legally obligated to repay the principal at the option of the creditor?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

49

JKC initiated a stock option plan for its three top executives.The plan provided that each executive would receive 6,000 options that would enable each one to purchase 600 shares at the option price.The option price was set at 10 percent below market price at the first exercise date.The options could be exercised after the executives remained as employees of the company for 3 more years.The market price of the shares on the date that the options were granted was $10 per share.The amount of compensation expense the company incurred for the three executives due to the option plan was:

A) $8,100

B) $3,000

C) $600

D) $0

E) Cannot be determined from the information provided.

A) $8,100

B) $3,000

C) $600

D) $0

E) Cannot be determined from the information provided.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

50

General characteristics of convertible bonds that will be converted include all of the following except:

A) management fully intends that the conversion privilege will eventually be attractive to the investors.

B) the investors will convert at or before maturity date.

C) the company will no longer have to repay the principal amount of the bonds.

D) the market price of the shares will drop below the conversion price.

A) management fully intends that the conversion privilege will eventually be attractive to the investors.

B) the investors will convert at or before maturity date.

C) the company will no longer have to repay the principal amount of the bonds.

D) the market price of the shares will drop below the conversion price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

51

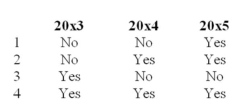

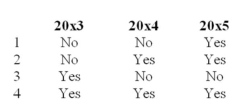

Compensatory stock options were granted to executives on January 1,20x3,with a measurement date of June 30,20x4,for services to be rendered during 20x3,20x4,and 20x5.The excess of the market value of the shares over the option price at the measurement date was reasonably estimable at the date of grant.The stock option was exercised on October 31,20x5.Compensation expense should be recognized in the income statement in which of the following years?

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is an example of a financial asset?

A) Inventory

B) accounts receivable

C) Capital assets

D) Prepaid expenses

A) Inventory

B) accounts receivable

C) Capital assets

D) Prepaid expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

53

Convertible debt that is convertible to a variable number of shares at the investor's option will normally be classified as a liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

54

S Corporation created a stock option plan for its two top executives.The plan provided that each executive would receive 1,000 options,which would enable him or her to purchase 100 shares at 75 percent of the market price on the date the options,became exercisable.The options were exercisable in two years.At the date of granting the options,the market price of the shares was $12 per share.The date of measurement for the stock option plan was the:

A) date of grant.

B) end of the first year.

C) end of the second year.

D) date the employees' exercise their options.

A) date of grant.

B) end of the first year.

C) end of the second year.

D) date the employees' exercise their options.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

55

$10,000 (face value)of bonds was sold with a total of 200 detachable stock warrants attached.Each warrant conveys the right to purchase one common share at a specified price during a specified time period.The market immediately valued the warrants at $2 each.The issue sold for 102.The entry to record the bond issuance would include:

A) dr. bond premium $200

B) dr. owners' equity account $400

C) cr. bonds payable $10,200

D) dr. bond discount $200

A) dr. bond premium $200

B) dr. owners' equity account $400

C) cr. bonds payable $10,200

D) dr. bond discount $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

56

On January 1st,2014 ABC Inc.had invoiced a client in New York for $10,000 US for services rendered that day.ABC did not hedge this receivable.The receivable is due in 60 days.On January 1st,2014,the spot rate was $1US = $1.02CDN.On January 31st,2014,the spot rate was $1US = $1.05CDN.What is the effect of the above information on ABC's January financial statements?

A) A $300 foreign exchange gain.

B) A $300 foreign exchange loss.

C) A $300 credit to OCI.

D) A $300 debit to OCI.

A) A $300 foreign exchange gain.

B) A $300 foreign exchange loss.

C) A $300 credit to OCI.

D) A $300 debit to OCI.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following are requirements for hedge accounting?

A) An existing risk management strategy involving hedging.

B) Designation and documentation of the hedging relationship.

C) Reasonable expectation of hedge effectiveness.

D) All of these answers are correct.

A) An existing risk management strategy involving hedging.

B) Designation and documentation of the hedging relationship.

C) Reasonable expectation of hedge effectiveness.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

58

All of the following are characteristics of stock rights except:

A) The warrants are usually detachable

B) Stock warrants never expire

C) Stock warrants can be exercised without having to trade in the bond

D) Stock warrants can be exercised without having to redeem the bond

A) The warrants are usually detachable

B) Stock warrants never expire

C) Stock warrants can be exercised without having to trade in the bond

D) Stock warrants can be exercised without having to redeem the bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

59

All of the following are examples of derivative instruments except:

A) Foreign exchange forward contracts

B) Interest rate swaps

C) Currency swaps

D) Retractable preferred shares

A) Foreign exchange forward contracts

B) Interest rate swaps

C) Currency swaps

D) Retractable preferred shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

60

Why would a corporation issue retractable preferred share in a private placement rather than a normal debt arrangement?

A) Cash flow

B) Income minimization

C) The tax treatment of intercorporate dividends

D) None of these answers are correct.

A) Cash flow

B) Income minimization

C) The tax treatment of intercorporate dividends

D) None of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

61

VB Ltd.raises $150,000 by issuing a financial instrument that pays interest at a rate of 8% per year to the investor.At the end of the fourth year,the financial instrument is retired for $155,000.If the financial instrument is treated as debt then:

A) The repayment will decrease owners' equity

B) The interest payment decreases retained earnings

C) Retained Earnings is reduced as the interest payment is treated as a dividend distribution

D) Shareholders' equity is increased at issuance

A) The repayment will decrease owners' equity

B) The interest payment decreases retained earnings

C) Retained Earnings is reduced as the interest payment is treated as a dividend distribution

D) Shareholders' equity is increased at issuance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

62

For each type of financial instrument,the reporting enterprise should disclose:

A) The extent and nature of the financial instruments.

B) Significant terms.

C) Significant conditions.

D) All of these answers are correct.

A) The extent and nature of the financial instruments.

B) Significant terms.

C) Significant conditions.

D) All of these answers are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

63

An option is:

A) An obligation to buy something in the future.

B) An obligation to sell something in the future.

C) A debt instrument.

D) The right to buy or sell something in the future.

A) An obligation to buy something in the future.

B) An obligation to sell something in the future.

C) A debt instrument.

D) The right to buy or sell something in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

64

The incremental method to accounting for convertible bonds means that:

A) The proceeds of the bond are allocated on the basis of the relative market values of the straight bond and imbedded stock option

B) The stock option is valued at the difference between the total proceeds of the bond issue and the market value of an equivalent straight bond issue

C) The proceeds of the bond are allocated on the basis of the book values of the straight bond and imbedded stock option

D) None of these answers are correct

A) The proceeds of the bond are allocated on the basis of the relative market values of the straight bond and imbedded stock option

B) The stock option is valued at the difference between the total proceeds of the bond issue and the market value of an equivalent straight bond issue

C) The proceeds of the bond are allocated on the basis of the book values of the straight bond and imbedded stock option

D) None of these answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

65

Credit risk is an issue for financial instruments and must be disclosed because:

A) the company may default on its loan

B) the company may not have enough cash flow to pay suppliers

C) the other parties to financial instruments may not perform their obligations

D) the company may not perform their obligations

A) the company may default on its loan

B) the company may not have enough cash flow to pay suppliers

C) the other parties to financial instruments may not perform their obligations

D) the company may not perform their obligations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

66

JMR Ltd.issued $100,000 of 8%,8 year,non-convertible bond with detachable stock purchase warrants.KER Corp.purchased the entire issue.Each $1,000 bond carries 10 warrants.Each warrant entitles KER to purchase one common share for $20.The bond issue sells for 104 exclusive of accrued interest.Shortly after issuance,the warrants trade for $5 each and the bonds were quoted at 103 ex-warrants.The market value of the bonds and warrants using the proportional method was:

A) $107,000

B) $321,000

C) $605,000

D) $108,000

A) $107,000

B) $321,000

C) $605,000

D) $108,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

67

JMR Ltd.issued $300,000 of 7%,8 year,non-convertible bond with detachable stock purchase warrants.KER Corp.purchased the entire issue.Each $1,000 bond carries 20 warrants.Each warrant entitles KER to purchase one common share for $20.The bond issue sells for 104 exclusive of accrued interest.Shortly after issuance,the warrants trade for $5 each and there was no market value for the bond.In the journal entry,the amount of the payable for the bond is:

A) $339,000

B) $321,000

C) $300,000

D) $350,000

A) $339,000

B) $321,000

C) $300,000

D) $350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

68

Securities issued as debt but intended by the issuing company to be exchanged for shares by the investor prior to maturity are called:

A) hybrid securities

B) discount bonds

C) options

D) convertible debt

A) hybrid securities

B) discount bonds

C) options

D) convertible debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

69

When convertible bonds are submitted for conversion,all of the following must be updated except:

A) Bond premium or discount

B) Accrued interest

C) Cash

D) Foreign exchange gains and losses on foreign currency denominated debt

A) Bond premium or discount

B) Accrued interest

C) Cash

D) Foreign exchange gains and losses on foreign currency denominated debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

70

JMR Ltd.issued $300,000 of 7%,8 year,non-convertible bond with detachable stock purchase warrants.KER Corp.purchased the entire issue.Each $1,000 bond carries 20 warrants.Each warrant entitles KER to purchase one common share for $20.The bond issue sells for 104 exclusive of accrued interest.Shortly after issuance,the warrants trade for $5 each and the bonds were quoted at 103 ex-warrants.The market value of the bonds and warrants using the proportional method was:

A) $339,000

B) $321,000

C) $605,000

D) $350,000

A) $339,000

B) $321,000

C) $605,000

D) $350,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

71

Stock Appreciation Rights (SARS)earned by employees may be settled by issuing (choose the best answer):

A) Cash

B) Shares

C) Promissory notes

D) Cash or Shares

A) Cash

B) Shares

C) Promissory notes

D) Cash or Shares

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

72

JMR Ltd.issued $100,000 of 8%,8 year,non-convertible bond with detachable stock purchase warrants.KER Corp.purchased the entire issue.Each $1,000 bond carries 10 warrants.Each warrant entitles KER to purchase one common share for $20.The bond issue sells for 104 exclusive of accrued interest.Shortly after issuance,the warrants trade for $5 each and the bonds were quoted at 103 ex-warrants.The allocation of the proceeds to bonds using the proportional method was:

A) $107,000

B) $99,185

C) $100,000

D) $108,000

A) $107,000

B) $99,185

C) $100,000

D) $108,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

73

Primary securities that have both debt and equity characteristics are called:

A) hybrid securities

B) discount bonds

C) options

D) convertible debt

A) hybrid securities

B) discount bonds

C) options

D) convertible debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

74

The crucial aspect of debt on the financial statements is:

A) the legal agreement.

B) the interest payments.

C) that the creditors can demand payment.

D) the maturity date.

A) the legal agreement.

B) the interest payments.

C) that the creditors can demand payment.

D) the maturity date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a company issues debt that is convertible at the corporation's option,in substance,the debt is:

A) Debt

B) Equity

C) An Asset

D) Subordinated

A) Debt

B) Equity

C) An Asset

D) Subordinated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a company issues debt that is convertible at the shareholder's option,in substance,the debt is:

A) Debt

B) Equity

C) Debt or Equity

D) Subordinated

A) Debt

B) Equity

C) Debt or Equity

D) Subordinated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

77

VB Ltd.raises $150,000 by issuing a financial instrument that pays interest at a rate of 8% per year to the investor.At the end of the fourth year,the financial instrument is retired for $155,000.If the financial instrument is treated as equity then:

A) The repayment will decrease owners' equity

B) The interest payment decreases retained earnings

C) If premium on repayment was not known, it is recorded as a loss on the income statement

D) Long-term liabilities is increased at issuance

A) The repayment will decrease owners' equity

B) The interest payment decreases retained earnings

C) If premium on repayment was not known, it is recorded as a loss on the income statement

D) Long-term liabilities is increased at issuance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

78

On the statement of cash flows,a hybrid financial instrument should be:

A) Reported as an operating activity

B) Reported as a financial activity

C) Reported as an investing activity

D) Reported according to its individual components

A) Reported as an operating activity

B) Reported as a financial activity

C) Reported as an investing activity

D) Reported according to its individual components

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

79

A company issues a convertible bond.Management can essentially force conversion as long as:

A) The share price is higher than the conversion price

B) The share price is lower than the conversion price

C) The share price is equal to the conversion price

D) None of these answers are correct

A) The share price is higher than the conversion price

B) The share price is lower than the conversion price

C) The share price is equal to the conversion price

D) None of these answers are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck

80

A forward contract is:

A) A debt instrument.

B) The right to sell something in the future.

C) An obligation to buy or sell something in the future.

D) The right to buy something in the future.

A) A debt instrument.

B) The right to sell something in the future.

C) An obligation to buy or sell something in the future.

D) The right to buy something in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 127 في هذه المجموعة.

فتح الحزمة

k this deck