Deck 12: International Bond Market

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 12: International Bond Market

1

Publicly traded Yankee bonds must

A)meet the same regulations as U.S.domestic bonds.

B)meet the same regulations as Eurobonds if sold to Europeans.

C)meet the same regulations as Samurai bonds if sold to Japanese.

D)none of the above

A)meet the same regulations as U.S.domestic bonds.

B)meet the same regulations as Eurobonds if sold to Europeans.

C)meet the same regulations as Samurai bonds if sold to Japanese.

D)none of the above

A

2

A "foreign bond" issue is

A)one denominated in a particular currency but sold to investors in national capital markets other than the country that issued the denominating currency.

B)one offered by a foreign borrower to investors in a national market and denominated in that nation's currency.

C)for example, a German MNC issuing dollar-denominated bonds to U.S.investors.

D)both b) and c)

A)one denominated in a particular currency but sold to investors in national capital markets other than the country that issued the denominating currency.

B)one offered by a foreign borrower to investors in a national market and denominated in that nation's currency.

C)for example, a German MNC issuing dollar-denominated bonds to U.S.investors.

D)both b) and c)

D

3

A "bearer bond" is one that

A)shows the owner's name on the bond.

B)the owner's name is recorded by the issuer.

C)possession is evidence of ownership.

D)both a) and b)

A)shows the owner's name on the bond.

B)the owner's name is recorded by the issuer.

C)possession is evidence of ownership.

D)both a) and b)

C

4

U.S.security regulations require Yankee bonds and U.S.corporate bonds sold to U.S.citizens to be

A)municipal bonds.

B)registered bonds.

C)bearer bonds.

D)none of the above

A)municipal bonds.

B)registered bonds.

C)bearer bonds.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

Proportionately more domestic bonds than international bonds are denominated in the ____________ while more international bonds than domestic bonds are denominated in the _________________

A)Euro and the yen, the dollar and the pound sterling.

B)Dollar and the pound sterling, the euro and the yen.

C)Euro and the pound sterling, the dollar and the yen.

D)Dollar and the yen, the euro and the pound sterling.

A)Euro and the yen, the dollar and the pound sterling.

B)Dollar and the pound sterling, the euro and the yen.

C)Euro and the pound sterling, the dollar and the yen.

D)Dollar and the yen, the euro and the pound sterling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

Eurobonds sold in the United States may not be sold to U.S.citizens.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

The four currencies in which the majority of domestic and international bonds are denominated are

A)U.S.dollar, the euro, the Indian rupee, and the Chinese Yuan.

B)U.S.dollar, the euro, the pound sterling, and the Swiss franc.

C)U.S.dollar, the euro, the Swiss franc, and the yen.

D)U.S.dollar, the euro, the pound sterling, and the yen.

A)U.S.dollar, the euro, the Indian rupee, and the Chinese Yuan.

B)U.S.dollar, the euro, the pound sterling, and the Swiss franc.

C)U.S.dollar, the euro, the Swiss franc, and the yen.

D)U.S.dollar, the euro, the pound sterling, and the yen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

"Bulldog" bonds are

A)dollar-denominated foreign bonds originally sold to U.S.investors.

B)yen-denominated foreign bonds originally sold in Japan.

C)pound sterling-denominated foreign bonds originally sold in the U.K.

D)none of the above

A)dollar-denominated foreign bonds originally sold to U.S.investors.

B)yen-denominated foreign bonds originally sold in Japan.

C)pound sterling-denominated foreign bonds originally sold in the U.K.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

A "registered bond" is one that

A)shows the owner's name on the bond.

B)the owner's name is recorded by the issuer.

C)the owner's name is assigned to a bond serial number recorded by the issuer.

D)all of the above

A)shows the owner's name on the bond.

B)the owner's name is recorded by the issuer.

C)the owner's name is assigned to a bond serial number recorded by the issuer.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

In any given year,rightly 80 percent of new international bonds are likely to be

A)Eurobonds.

B)foreign currency bonds.

C)domestic bonds.

D)none of the above

A)Eurobonds.

B)foreign currency bonds.

C)domestic bonds.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

Because __________ do not have to meet national security regulations,name recognition of the issuer is an extremely important factor in being able to source funds in the international capital market.

A)Eurobonds

B)Foreign bonds

C)Bearer bonds

D)Registered bonds

A)Eurobonds

B)Foreign bonds

C)Bearer bonds

D)Registered bonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

Investors will generally accept a lower yield on ________ than on __________ of comparable terms,making them a less costly source of funds for the issuer to service.

A)bearer bonds, registered bonds

B)registered bonds, bearer bonds

C)Eurobonds, domestic bonds

D)domestic bonds, Eurobonds

A)bearer bonds, registered bonds

B)registered bonds, bearer bonds

C)Eurobonds, domestic bonds

D)domestic bonds, Eurobonds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

In any given year,about what percent of outstanding bonds are likely to be international rather than domestic bonds?

A)70%

B)50%

C)30%

D)5%

A)70%

B)50%

C)30%

D)5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

A "Eurobond" issue is

A)one denominated in a particular currency but sold to investors in national capital markets other than the country that issued the denominating currency.

B)usually a bearer bond.

C)for example a Dutch borrower issuing dollar-denominated bonds to investors in the U.K., Switzerland, and the Netherlands.

D)all of the above

A)one denominated in a particular currency but sold to investors in national capital markets other than the country that issued the denominating currency.

B)usually a bearer bond.

C)for example a Dutch borrower issuing dollar-denominated bonds to investors in the U.K., Switzerland, and the Netherlands.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

In any given year,about what percent of new international bonds are likely to be Eurobonds rather than foreign bonds?

A)80%

B)45%

C)25%

D)15%

A)80%

B)45%

C)25%

D)15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

With a bearer bond,

A)possession is evidence of ownership.

B)the issuer keeps records indicating only who the current owner of a bond is.

C)the owner's name is on the bond.

D)the owner's name is assigned to the bond serial number, but not indicated on the bond.

A)possession is evidence of ownership.

B)the issuer keeps records indicating only who the current owner of a bond is.

C)the owner's name is on the bond.

D)the owner's name is assigned to the bond serial number, but not indicated on the bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

"Samurai" bonds are

A)dollar-denominated foreign bonds originally sold to U.S.investors.

B)yen-denominated foreign bonds originally sold in Japan.

C)pound sterling-denominated foreign bonds originally sold in the U.K.

D)none of the above

A)dollar-denominated foreign bonds originally sold to U.S.investors.

B)yen-denominated foreign bonds originally sold in Japan.

C)pound sterling-denominated foreign bonds originally sold in the U.K.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

Eurobonds are usually

A)bearer bonds.

B)registered bonds.

C)bulldog bonds.

D)foreign currency bonds.

A)bearer bonds.

B)registered bonds.

C)bulldog bonds.

D)foreign currency bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

"Yankee" bonds are

A)dollar-denominated foreign bonds originally sold to U.S.investors.

B)yen-denominated foreign bonds originally sold in Japan.

C)pound sterling-denominated foreign bonds originally sold in the U.K.

D)none of the above

A)dollar-denominated foreign bonds originally sold to U.S.investors.

B)yen-denominated foreign bonds originally sold in Japan.

C)pound sterling-denominated foreign bonds originally sold in the U.K.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

Securities sold in the United States to public investors must be registered with the SEC,and a prospectus disclosing detailed financial information about the issuer must be provided and made available to prospective investors.This encourages foreign borrowers wishing to raise U.S.dollars to use

A)the Eurobond market.

B)their domestic market.

C)bearer bonds.

D)none of the above

A)the Eurobond market.

B)their domestic market.

C)bearer bonds.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

The withholding tax on bond income was originally called the interest equalization tax.

A)You can thank John

B)You can thank Ronald Reagan for imposing this tax.

C)You can thank Jimmy Carter for imposing this tax.

D)You can thank George Washington for imposing this tax.

F)Kennedy for imposing this tax.

A)You can thank John

B)You can thank Ronald Reagan for imposing this tax.

C)You can thank Jimmy Carter for imposing this tax.

D)You can thank George Washington for imposing this tax.

F)Kennedy for imposing this tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

Find the present value of a 2-year Treasury bond that pays a semi-annual coupon,has a coupon rate of 6%,a yield to maturity of 5%,a par value of $1,000 when the yield to maturity is 5%.

A)$1,018.81

B)$1,231.15

C)$699.07

D)none of the above

A)$1,018.81

B)$1,231.15

C)$699.07

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

The vast majority of new international bond offerings

A)make annual coupon payments.

B)have fixed coupon payments.

C)have a fixed maturity.

D)all of the above

A)make annual coupon payments.

B)have fixed coupon payments.

C)have a fixed maturity.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

In terms of the types of instruments offered,

A)the Yankee bond market has been more innovative than the international bond market.

B)the international bond market has been much more innovative than the U.S.market.

C)the most innovations have come from Milan, just like any other fashion.

D)none of the above

A)the Yankee bond market has been more innovative than the international bond market.

B)the international bond market has been much more innovative than the U.S.market.

C)the most innovations have come from Milan, just like any other fashion.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

Global bond issues were first offered in

A)1889

B)1989

C)1999

D)2007

A)1889

B)1989

C)1999

D)2007

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

One unintended consequence of Sarbanes-Oxley

A)is that international companies are starting to prefer issuing eurobonds in the private placement market in the U.S.to avoid costly information disclosure required of registered bonds.

B)is that international companies are starting to prefer to issue Yankee bonds in the private placement market in the U.S.

C)is that international companies are starting to prefer issuing Yankee bonds in the bearer bond market in the U.S.to avoid costly information disclosure required of registered bonds.

D)is that international companies have left the bond market in the U.S.to avoid costly information disclosure required of registered bonds.

A)is that international companies are starting to prefer issuing eurobonds in the private placement market in the U.S.to avoid costly information disclosure required of registered bonds.

B)is that international companies are starting to prefer to issue Yankee bonds in the private placement market in the U.S.

C)is that international companies are starting to prefer issuing Yankee bonds in the bearer bond market in the U.S.to avoid costly information disclosure required of registered bonds.

D)is that international companies have left the bond market in the U.S.to avoid costly information disclosure required of registered bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

Purchasers of global bonds are

A)mainly institutional investors to date.

B)desirous of the increased liquidity of the issues.

C)have been willing to accept lower yields.

D)all of the above

A)mainly institutional investors to date.

B)desirous of the increased liquidity of the issues.

C)have been willing to accept lower yields.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

A "global bond" issue

A)is a very large international bond offering by several borrowers pooled together.

B)is a very large international bond offering by a single borrower that is simultaneously sold in several national bond markets.

C)has higher yields for the purchasers.

D)has a lower liquidity.

A)is a very large international bond offering by several borrowers pooled together.

B)is a very large international bond offering by a single borrower that is simultaneously sold in several national bond markets.

C)has higher yields for the purchasers.

D)has a lower liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

The shorter length of time in bringing a Eurodollar bond issue to market,coupled with the lower rate of interest that borrowers pay for Eurodollar bond financing in comparison to Yankee bond financing,are two major reasons why the Eurobond segment of the international bond market is roughly ________ the size of the foreign bond segment.

A)four times

B)two times

C)ten times

D)one hundred times

A)four times

B)two times

C)ten times

D)one hundred times

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

U.S.corporations

A)are allowed to issue bearer bonds to non-U.S.citizens.

B)are not allowed to issue bearer bonds.

C)are allowed to issue treasury bonds but not T-bills.

D)none of the above

A)are allowed to issue bearer bonds to non-U.S.citizens.

B)are not allowed to issue bearer bonds.

C)are allowed to issue treasury bonds but not T-bills.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

Shelf registration

A)allows the shelves in a set of bookshelves to remain level.

B)allows an issuer to preregister a securities issue, and then "shelve" the securities for later sale.

C)allows an investment bank to increase the fees they charge by charging for storage of the "shelved" securities.

D)eliminates the information disclosure that many foreign firms found objectionable in the foreign bond market.

A)allows the shelves in a set of bookshelves to remain level.

B)allows an issuer to preregister a securities issue, and then "shelve" the securities for later sale.

C)allows an investment bank to increase the fees they charge by charging for storage of the "shelved" securities.

D)eliminates the information disclosure that many foreign firms found objectionable in the foreign bond market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

Find the present value of a 30-year bond that pays an annual coupon,has a coupon rate of 6%,a yield to maturity of 5%,a par value of €1,000 when the yield to maturity is 5%.

A)€1,018.81

B)€1,027.23

C)€1,153.73

D)none of the above

A)€1,018.81

B)€1,027.23

C)€1,153.73

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

Global bond issues

A)can save U.S.issuers 20 basis points relative to domestic bonds, all else equal.

B)tend to have increased liquidity relative to Eurobonds or domestic bonds.

C)have been partially facilitated by rule 144A.

D)all of the above

A)can save U.S.issuers 20 basis points relative to domestic bonds, all else equal.

B)tend to have increased liquidity relative to Eurobonds or domestic bonds.

C)have been partially facilitated by rule 144A.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

A global bond issue denominated in U.S.dollars and issued by U.S.corporations

A)trade as Eurobonds overseas.

B)trade as domestic bonds in the U.S.domestic market.

C)both a) and b)

D)none of the above

A)trade as Eurobonds overseas.

B)trade as domestic bonds in the U.S.domestic market.

C)both a) and b)

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

In contrast to many domestic bonds,which make _________ coupon payments,coupon interest on Eurobonds is typically paid _________

A)semiannual, annually.

B)annual, semiannually.

C)quarterly, semiannually.

D)quarterly, annually.

A)semiannual, annually.

B)annual, semiannually.

C)quarterly, semiannually.

D)quarterly, annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

The vast majority of new international bond offerings

A)are straight fixed-rate notes.

B)are callable and convertible.

C)are convertible adjustable rate.

D)are adjustable rate, with interest rate caps and collars.

A)are straight fixed-rate notes.

B)are callable and convertible.

C)are convertible adjustable rate.

D)are adjustable rate, with interest rate caps and collars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

Find the present value of a 3-year bond that pays an annual coupon,has a coupon rate of 6%,a yield to maturity of 5%,a par value of €1,000 when the yield to maturity is 5%.

A)€1,018.81

B)€1,027.23

C)€1,099.96

D)none of the above

A)€1,018.81

B)€1,027.23

C)€1,099.96

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

SEC Rule 144A

A)allows qualified institution investors in the United States to trade private placements.

B)was designed to make the U.S.capital market more competitive with the Eurobond market.

C)primarily, but not exclusively, impacts Yankee bonds.

D)all of the above

A)allows qualified institution investors in the United States to trade private placements.

B)was designed to make the U.S.capital market more competitive with the Eurobond market.

C)primarily, but not exclusively, impacts Yankee bonds.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Eurobond segment of the international bond market

A)is roughly four times the size of the foreign bond segment.

B)has considerably less regulatory hurdles than the foreign bond segment.

C)typically has a lower rate of interest that borrowers pay in comparison to Yankee bond financing.

D)all of the above

A)is roughly four times the size of the foreign bond segment.

B)has considerably less regulatory hurdles than the foreign bond segment.

C)typically has a lower rate of interest that borrowers pay in comparison to Yankee bond financing.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

Private placement bond issues

A)do not have to meet the strict information disclosure requirements of publicly traded issues.

B)have auditing requirements that do not adhere to publicly traded issues.

C)meet the strict information disclosure requirements of publicly traded issues, but have larger minimum denominations.

D)none of the above

A)do not have to meet the strict information disclosure requirements of publicly traded issues.

B)have auditing requirements that do not adhere to publicly traded issues.

C)meet the strict information disclosure requirements of publicly traded issues, but have larger minimum denominations.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

A ten-year Floating-rate note (FRN)has coupons referenced to 3-month pound LIBOR,and pays coupon interest quarterly.Assume that the current 3-month LIBOR is 3 percent.If the risk premium above LIBOR that the issuer must pay is 1/8 percent,the next period's coupon rate on a £1,000 face value FRN will be

A)£31.25

B)£15.625

C)£30.625

D)£7.8125

A)£31.25

B)£15.625

C)£30.625

D)£7.8125

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

Find the yield to maturity for this floating rate note: The reset date is today; coupons are paid annually according to the formula (LIBOR + ¼ percent); since issuance,there has not been a change in the issuer's credit rating.The bond has ten years to maturity and LIBOR = 3.5 percent.

A)3.5%

B)4%

C)3.75%

D)There is not enough information provided to make a determination.

A)3.5%

B)4%

C)3.75%

D)There is not enough information provided to make a determination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

A convertible bond pays interest annually at a coupon rate of 5% on a par value of $1,000.The bond has 10 years maturity remaining and the discount rate on otherwise identical non-convertible debt is 6.5%.The bond is convertible into shares of common stock at a conversion price of $25 per share (i.e.the bond is exchangeable for 40 shares).Today's closing stock price was $20.What is the floor value of this bond?

A)$800.00

B)$892.17

C)$1,250

D)None of the above

A)$800.00

B)$892.17

C)$1,250

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

Unlike a bond issue,in which the entire issue is brought to market at once,_______ is partially sold on a continuous basis through an issuance facility that allows the borrower to obtain funds only as needed on a flexible basis.

A)a Euro-medium term note issue

B)bearer bond

C)a Euro-long term note issue

D)a Euro-short term note issue

A)a Euro-medium term note issue

B)bearer bond

C)a Euro-long term note issue

D)a Euro-short term note issue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

A five-year floating-rate note has coupons referenced to six-month dollar LIBOR,and pays coupon interest semiannually.Assume that the current six-month LIBOR is 6 percent.If the risk premium above LIBOR that the issuer must pay is 1/8 percent,the next period's coupon rate on a $1,000 face value FRN will be:

A)$29.375

B)$30.000

C)$30.625

D)$61.250

A)$29.375

B)$30.000

C)$30.625

D)$61.250

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider a bond with an equity warrant.The warrant entitles the bondholder to buy 25 shares of the issuer at €50 per share for the lifetime of the bond.The bond is a 30-year zero coupon bond with a €1,000 par value that has a yield to maturity of i€ = 5 percent.The price of the bond is €500.What is the value of the warrant?

A)€231.38

B)€268.62

C)€500

D)none of the above

A)€231.38

B)€268.62

C)€500

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

A convertible bond pays interest annually at a coupon rate of 5% on a par value of $1,000.The bond has 10 years maturity remaining and the discount rate on other-wise identical non-convertible debt is 5%.The bond is convertible into shares of common stock at a conversion price of $25 per share (i.e.the bond is exchangeable for 40 shares).Today's closing stock price was $31.25.What is the floor value of this bond?

A)$800.00

B)$1,000

C)$1,250

D)None of the above

A)$800.00

B)$1,000

C)$1,250

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Floating-rate notes (FRN)

A)experience very volatile price changes between reset dates.

B)are typically medium-term bonds with coupon payments indexed to some reference rate (e.g.LIBOR).

C)appeal to investors with strong need to preserve the principal value of the investment should they need to liquidate prior to the maturity of the bonds.

D)both b) and c)

A)experience very volatile price changes between reset dates.

B)are typically medium-term bonds with coupon payments indexed to some reference rate (e.g.LIBOR).

C)appeal to investors with strong need to preserve the principal value of the investment should they need to liquidate prior to the maturity of the bonds.

D)both b) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

Six-month U.S.dollar LIBOR is currently 4.375%; your firm issued floating-rate notes indexed to six-month U.S.dollar LIBOR plus 50 basis points.What is the amount of the next semi-annual coupon payment per U.S.$1,000 of face value?

A)$43.75

B)$48.75

C)$24.375

D)$46.875

A)$43.75

B)$48.75

C)$24.375

D)$46.875

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

Bonds with equity warrants

A)are really the same as convertible bonds if the prestated price of exercising the warrant is the par value of the bond.

B)can be viewed as straight debt with a call option (technically a warrant) attached.

C)can only be exercised on coupon dates.

D)typically are convertible as well.

A)are really the same as convertible bonds if the prestated price of exercising the warrant is the par value of the bond.

B)can be viewed as straight debt with a call option (technically a warrant) attached.

C)can only be exercised on coupon dates.

D)typically are convertible as well.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

Floating-rate notes

A)are a form of adjustable rate bond.

B)have contractually specified coupon payments, therefore they are fixed rate bonds.

C)always trade at par value.

D)both a) and c)

A)are a form of adjustable rate bond.

B)have contractually specified coupon payments, therefore they are fixed rate bonds.

C)always trade at par value.

D)both a) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

Euro-medium term notes

A)are typically fixed-rate corporate notes issued with maturities ranging from less than a year to about ten years.

B)are typically fixed-rate corporate notes issued with maturities ranging from three years to about ten years.

C)are sold just like bonds in the primary market.

D)none of the above

A)are typically fixed-rate corporate notes issued with maturities ranging from less than a year to about ten years.

B)are typically fixed-rate corporate notes issued with maturities ranging from three years to about ten years.

C)are sold just like bonds in the primary market.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

There are two types of equity related bonds:

A)convertible bonds and dual currency bonds.

B)convertible bonds and kitchen sink bonds.

C)convertible bonds and bonds with equity warrants.

D)callable bonds and exchangeable bonds.

A)convertible bonds and dual currency bonds.

B)convertible bonds and kitchen sink bonds.

C)convertible bonds and bonds with equity warrants.

D)callable bonds and exchangeable bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

The floor value of a convertible bond

A)is the "straight bond" value.

B)is the conversion value.

C)is the minimum of a) and b).

D)is the maximum of a) and b).

A)is the "straight bond" value.

B)is the conversion value.

C)is the minimum of a) and b).

D)is the maximum of a) and b).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

Straight fixed-rate bond issues have

A)a designated maturity date at which the principal of the bond issue is promised to be repaid.During the life of the bond, fixed coupon payments, which are a percentage of the face value, are paid as interest to the bondholders.

B)a designated maturity date at which the principal of the bond issue is promised to be repaid.During the life of the bond, coupon payments, which are a percentage of the face value, are computed according to a fixed formula.

C)a fixed payment, which amortizes the debt, like a house payment or car payment.

D)none of the above

A)a designated maturity date at which the principal of the bond issue is promised to be repaid.During the life of the bond, fixed coupon payments, which are a percentage of the face value, are paid as interest to the bondholders.

B)a designated maturity date at which the principal of the bond issue is promised to be repaid.During the life of the bond, coupon payments, which are a percentage of the face value, are computed according to a fixed formula.

C)a fixed payment, which amortizes the debt, like a house payment or car payment.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

The coupon interest on Eurobonds

A)is paid annually.

B)is paid in cash.

C)is paid in arrears.

D)all of the above

A)is paid annually.

B)is paid in cash.

C)is paid in arrears.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

Floating rate notes behave differently in response to interest rate risk than straight fixed-rate bonds.

A)True since FRNs experience only mild price changes between reset dates, over which time the next period's coupon payment is fixed (assuming, of course, that the reference rate corresponds to the market rate applicable to the issuer).

B)False since all bonds experience an inverse price change when the market rate of interest changes.

C)None of the above

A)True since FRNs experience only mild price changes between reset dates, over which time the next period's coupon payment is fixed (assuming, of course, that the reference rate corresponds to the market rate applicable to the issuer).

B)False since all bonds experience an inverse price change when the market rate of interest changes.

C)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

On a reset date,floating-rate notes

A)experience very volatile price changes.

B)market price will usually gravitate toward par.

C)market price will usually gravitate toward par, unless the borrowers credit rating has declined.

D)both b) and c)

A)experience very volatile price changes.

B)market price will usually gravitate toward par.

C)market price will usually gravitate toward par, unless the borrowers credit rating has declined.

D)both b) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

Eurobonds are usually

A)registered bonds.

B)bearer bonds.

C)floating-rate, callable and convertible.

D)denominated in the currency of the country that they are sold in.

A)registered bonds.

B)bearer bonds.

C)floating-rate, callable and convertible.

D)denominated in the currency of the country that they are sold in.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

Find the price of a 30-year zero coupon bond with a €1,000 par value that has a yield to maturity of i€ = 5 percent.

A)€231.38

B)€432.20

C)€4,321.94

D)none of the above

A)€231.38

B)€432.20

C)€4,321.94

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Zero coupon bonds

A)pay interest at zero percent.

B)are sold at a discount from par value.

C)are attractive to Japanese investors who are not required to pay taxes on capital gains.

D)both a) and b).

A)pay interest at zero percent.

B)are sold at a discount from par value.

C)are attractive to Japanese investors who are not required to pay taxes on capital gains.

D)both a) and b).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

Your firm has just issued five-year floating-rate notes indexed to six-month U.S.dollar LIBOR plus 1/4 percent.What is the amount of the first coupon payment your firm will pay per U.S.$1,000 of face value,if six-month LIBOR is currently 7.2 percent?

A)$36.00

B)$37.25

C)$74.50

D)None of the above

A)$36.00

B)$37.25

C)$74.50

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

A five-year,4 percent Euroyen bond sells at par.A comparable risk five-year,5.5 percent yen/dollar dual-currency bond pays $833.33 at maturity per ¥100,000 of face value.It sells for ¥110,000.What is the implied ¥/$ exchange rate at maturity?

A)¥131/$1.00

B)¥120/$1.00

C)¥110/$1.00

D)¥103/$1.00

A)¥131/$1.00

B)¥120/$1.00

C)¥110/$1.00

D)¥103/$1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

With regard to dual-currency bonds versus comparable straight fixed-rate bonds,

A)dual currency bonds usually trade at a premium to reflect the value of the forward contract implicit in their repayment schedule.

B)the interest on dual-currency bonds is usually lower than on comparable straight fixed-rate debt.

C)the interest on dual-currency bonds is usually higher than on comparable straight fixed-rate debt.

D)none of the above

A)dual currency bonds usually trade at a premium to reflect the value of the forward contract implicit in their repayment schedule.

B)the interest on dual-currency bonds is usually lower than on comparable straight fixed-rate debt.

C)the interest on dual-currency bonds is usually higher than on comparable straight fixed-rate debt.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

"Investment grade" ratings are in the following categories:

A)Moody's: AAA to BBB - S&P's: Aaa to Baa

B)Moody's: Aaa to Baa - S&P's: AAA to BBB

C)Moody's: AAA to A - S&P's: Aaa to A

D)Moody's: Aaa to A - S&P's: AAA to A

A)Moody's: AAA to BBB - S&P's: Aaa to Baa

B)Moody's: Aaa to Baa - S&P's: AAA to BBB

C)Moody's: AAA to A - S&P's: Aaa to A

D)Moody's: Aaa to A - S&P's: AAA to A

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

A 1-year,4 percent euro denominated bond sells at par.A comparable risk 1-year,5.5 percent euro/dollar dual-currency bond pays $1,500 at maturity per €1,000 of face value.It sells for €1,250.What is the implied $/€ exchange rate at maturity?

A)€0.8300/$1.00

B)$1.2048/€1.00

C)$1.25/€1.00

D)$1.50/€1.00

A)€0.8300/$1.00

B)$1.2048/€1.00

C)$1.25/€1.00

D)$1.50/€1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

Consider an 8.5 percent Swiss franc/U.S.dollar dual-currency bonds that pays $666.67 at maturity per SF1,000 of par value.If the bond sells at par,what is the implicit SF/$ exchange rate at maturity? Will the investor be better or worse off at maturity if the actual SF/$ exchange rate is SF1.35/$1.00?

A)SF1.5/$1.00; better off

B)SF1.5/$1.00; worse off

A)SF1.5/$1.00; better off

B)SF1.5/$1.00; worse off

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

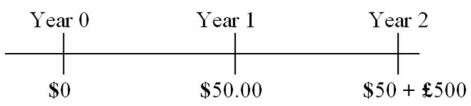

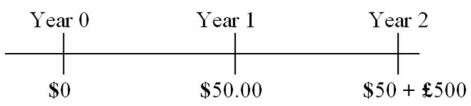

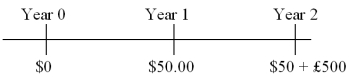

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate)that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

A)$927.62

B)$941.30

C)$965.06

D)$599.00

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

A)$927.62

B)$941.30

C)$965.06

D)$599.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

When the bond sells at par,the implicit SF/$ exchange rate at maturity of a Swiss franc/U.S.dollar dual currency bonds that pay $581.40 at maturity per SF1,000,is

A)SF0.58/$1.00

B)SF1.58/$1.00

C)SF1.72/$1.00

D)SF1.95/$1.00

A)SF0.58/$1.00

B)SF1.58/$1.00

C)SF1.72/$1.00

D)SF1.95/$1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

A 2-year,4 percent euro denominated bond sells at par.A comparable risk 2-year,5.5 percent euro/dollar dual-currency bond pays $1,500 at maturity per €1,000 of face value.It sells for €1,250.What is the implied $/€ exchange rate at maturity?

A)€0.8265/$1.00

B)$1.2099/€1.00

C)$1.25/€1.00

D)$1.50/€1.00

A)€0.8265/$1.00

B)$1.2099/€1.00

C)$1.25/€1.00

D)$1.50/€1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

A five-year,4 percent euro denominated bond sells at par.A comparable risk five-year,5.5 percent euro/dollar dual-currency bond pays $1,500 at maturity per €1,000 of face value.It sells for €1,250.What is the implied $/€ exchange rate at maturity?

A)$1.2266/€1.00

B)€0.8153/$1.00

C)$1.25/€1.00

D)$1.50/€1.00

A)$1.2266/€1.00

B)€0.8153/$1.00

C)$1.25/€1.00

D)$1.50/€1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Consider a British pound-U.S.dollar dual currency bonds that pay £581.40 at maturity per $1,000 of par value.If at maturity,the exchange rate is $1.90 = £1.00,

A)you should insist on getting paid in dollars.

B)investors holding this bond are better off for the exchange rate.

C)the issuer of the bond is worse off for the exchange rate.

D)both b) and c)

A)you should insist on getting paid in dollars.

B)investors holding this bond are better off for the exchange rate.

C)the issuer of the bond is worse off for the exchange rate.

D)both b) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Zero-coupon bonds issued in 2006 are due in 2016.If they were originally sold at 55 percent of face value,the implied yield to maturity at issuance is

A)1.062%.

B)6.16%.

C)8.31%.

D)cannot be determined, need more information.

A)1.062%.

B)6.16%.

C)8.31%.

D)cannot be determined, need more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

A 1-year,4 percent pound denominated bond sells at par.A comparable risk 1-year,5.5 percent pound/dollar dual-currency bond pays $2,000 at maturity per £1,000 of face value.It sells for £900.What is the implied direct $/£ exchange rate at maturity?

A)£0.4405/$1.00

B)$1.2048/£1.00

C)$2.2701/£1.00

D)$2.0000/£1.00

A)£0.4405/$1.00

B)$1.2048/£1.00

C)$2.2701/£1.00

D)$2.0000/£1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

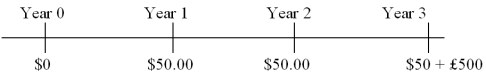

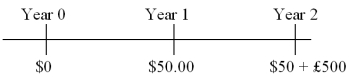

Find the value of a three-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate)that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

A)$927.62

B)$941.30

C)$965.06

D)987.06

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is $ = 2% in the U.S.and £ = 3% in the U.K.

A)$927.62

B)$941.30

C)$965.06

D)987.06

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Standard & Poor's has for years provided credit ratings on international bonds.

A)The ratings reflect the safety of principal for a U.S.investor.

B)Their ratings reflect the creditworthiness of the borrower and not exchange rate uncertainty.

C)Their ratings reflect creditworthiness of the lender and predict the exchange rate expected to prevail at maturity.

D)The ratings are biased since 40 percent of Eurobond issues are rated AAA and 30 percent are AA.

A)The ratings reflect the safety of principal for a U.S.investor.

B)Their ratings reflect the creditworthiness of the borrower and not exchange rate uncertainty.

C)Their ratings reflect creditworthiness of the lender and predict the exchange rate expected to prevail at maturity.

D)The ratings are biased since 40 percent of Eurobond issues are rated AAA and 30 percent are AA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

U.S.citizens must pay tax on the imputed interest represented by the fact that zero coupon bonds price gets a bit closer to par value as each year goes by.If you have a 25-year zero coupon bond with $1,000 par value,how much imputed interest will you record in the coming year if interest rates stay the same at ten percent?

A)$92.30

B)$9.23

C)$0

D)none of the above

A)$92.30

B)$9.23

C)$0

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

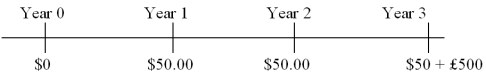

Find the value today of a 2-year dual currency bond with annual coupons (paid in U.S.dollars at a 5 percent coupon rate)that pays £500 per $1,000 par value at maturity.The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

A)$927.77

B)$941.30

C)$965.06

D)$880.65

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; the pound-based yield to maturity is i£ = 4%.A)$927.77

B)$941.30

C)$965.06

D)$880.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

Assuming that the bond sells at par,the implicit $/£ exchange rate at maturity of a British pound-U.S.dollar dual currency bonds that pay £581.40 at maturity per $1,000 of par value is:

A)$1.95/£1.00

B)$1.72/£1.00

C)$1.58/£1.00

D)$0.5814/£1.00

A)$1.95/£1.00

B)$1.72/£1.00

C)$1.58/£1.00

D)$0.5814/£1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

Zero coupon bonds

A)have no interest income.

B)are sold at a premium to par value.

C)gave only capital gains income.

D)both a) and c)

A)have no interest income.

B)are sold at a premium to par value.

C)gave only capital gains income.

D)both a) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck