Deck 5: The Market for Foreign Exchange

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 5: The Market for Foreign Exchange

1

Covered Interest Arbitrage (CIA)activities will result in

A)unstable international financial markets

B)restoring equilibrium quite quickly

C)disintermediation

D)no changes in the markets

A)unstable international financial markets

B)restoring equilibrium quite quickly

C)disintermediation

D)no changes in the markets

B

2

If foreign exchange markets are efficient,all of the following will hold EXCEPT:

A)exchange rates change only when new information arrives

B)exchange rates change randomly

C)incremental changes of exchange rates depend on the current level of the exchange rate

D)the current exchange rate reflects all relevant information

A)exchange rates change only when new information arrives

B)exchange rates change randomly

C)incremental changes of exchange rates depend on the current level of the exchange rate

D)the current exchange rate reflects all relevant information

C

3

The main approaches to forecasting exchange rates are:

A)Efficient market, Fundamental, and Technical approaches

B)Efficient market and Technical approaches

C)Efficient market and Fundamental approaches

D)Fundamental and Technical approaches

A)Efficient market, Fundamental, and Technical approaches

B)Efficient market and Technical approaches

C)Efficient market and Fundamental approaches

D)Fundamental and Technical approaches

A

4

According to the fundamental approach,if all of the regression coefficients are already estimated,all of the following matters in the exchange rate determination EXCEPT

A)The expected rate of grows of domestic money

B)The expected rate of grows of foreign money

C)The historical rate of grows of domestic money

D)The expected rate of real economic growth in the domestic economy

A)The expected rate of grows of domestic money

B)The expected rate of grows of foreign money

C)The historical rate of grows of domestic money

D)The expected rate of real economic growth in the domestic economy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

Canada's competitive position will

A)strengthen when the dollar appreciates more than is warranted by PPP

B)improve when the dollar appreciates more than is warranted by PPP

C)weaken when the dollar appreciates more than is warranted by PPP

D)weaken when the dollar depreciates more than is warranted by PPP

A)strengthen when the dollar appreciates more than is warranted by PPP

B)improve when the dollar appreciates more than is warranted by PPP

C)weaken when the dollar appreciates more than is warranted by PPP

D)weaken when the dollar depreciates more than is warranted by PPP

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

The forward expectations parity states that

A)any forward premium or discount is equal to the expected change in the exchange rate

B)any forward rate is equal to the expected change in the exchange rate

C)the forward premium or discount is equal to the expected change in the real exchange rates

D)the forward premium or discount is equal to the expected change in purchasing power parity

A)any forward premium or discount is equal to the expected change in the exchange rate

B)any forward rate is equal to the expected change in the exchange rate

C)the forward premium or discount is equal to the expected change in the real exchange rates

D)the forward premium or discount is equal to the expected change in purchasing power parity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

Germany has a higher rate of inflation than Japan.The nominal exchange rate is constant.

A)Germany experiences an increase in its real exchange rate

B)Germany experiences a decrease in its real exchange rate

C)Japan experiences an increase in its real exchange rate

D)German goods are cheaper now

A)Germany experiences an increase in its real exchange rate

B)Germany experiences a decrease in its real exchange rate

C)Japan experiences an increase in its real exchange rate

D)German goods are cheaper now

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

When Interest Rate Parity (IRP)holds between two different countries X and Y,your decision to invest your money will:

A)be indifferent between country X and country Y

B)involve forward hedging

C)depend on which country initiated the IRP

D)a and b

A)be indifferent between country X and country Y

B)involve forward hedging

C)depend on which country initiated the IRP

D)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

Covered interest rate arbitrage would not be possible if the forward rate would be:

A)$1.10/€

B)$1.12/€

C)$1.14/€

D)$1.16/€

A)$1.10/€

B)$1.12/€

C)$1.14/€

D)$1.16/€

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

The above mentioned scenario

A)is an example of covered interest arbitrage (CIA), and interest rate parity (IRP) holds

B)is an example of covered interest arbitrage (CIA), and interest rate parity (IRP) does NOT hold

C)is an example of Purchasing Power Parity (PPP), and hyperinflation

D)none of these

A)is an example of covered interest arbitrage (CIA), and interest rate parity (IRP) holds

B)is an example of covered interest arbitrage (CIA), and interest rate parity (IRP) does NOT hold

C)is an example of Purchasing Power Parity (PPP), and hyperinflation

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

If the annual inflation rate is 5.5 percent in the United States and 4 percent in the U.K.,and the dollar depreciated against the pound by 3 percent,then the real exchange rate,assuming that PPP initially held,is:

A)0.07

B)0.98

C)1.05

D)7.3

A)0.07

B)0.98

C)1.05

D)7.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

The net cash flow in one year is

A)$10,690

B)$15,000

C)$46,207

D)$22,000

A)$10,690

B)$15,000

C)$46,207

D)$22,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

Purchasing Power Parity (PPP)theory states that:

A)The exchange rate between currencies of two countries should be equal to the ratio of the countries' price levels.

B)As the purchasing power of a currency sharply declines (due to hyperinflation) that currency will depreciate against stable currencies.

C)The prices of standard commodity baskets in two countries are not related.

D)a and b.

A)The exchange rate between currencies of two countries should be equal to the ratio of the countries' price levels.

B)As the purchasing power of a currency sharply declines (due to hyperinflation) that currency will depreciate against stable currencies.

C)The prices of standard commodity baskets in two countries are not related.

D)a and b.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

Interest Rate Parity (IRP)is best defined as:

A)When a government brings its domestic interest rate in line with other major financial markets

B)When the central bank of a country brings its domestic interest rate in line with its major trading partners

C)A zero arbitrage condition that must hold when international financial markets are in equilibrium

D)None of these

A)When a government brings its domestic interest rate in line with other major financial markets

B)When the central bank of a country brings its domestic interest rate in line with its major trading partners

C)A zero arbitrage condition that must hold when international financial markets are in equilibrium

D)None of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

Uncovered interest rate parity

A)is an arbitrage condition

B)holds most of the time

C)is based on expectations

D)will provide guaranteed but small profits

A)is an arbitrage condition

B)holds most of the time

C)is based on expectations

D)will provide guaranteed but small profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

PPP does not hold well because of the following except

A)barriers to international commodity arbitrage

B)the existence of non-tradables

C)commodity prices are different in different countries

D)the CPI index is calculated using the same basket of goods

A)barriers to international commodity arbitrage

B)the existence of non-tradables

C)commodity prices are different in different countries

D)the CPI index is calculated using the same basket of goods

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which statement about real exchange rates is not true?

A)Real exchange rate changes are caused by changes in nominal exchange rates

B)Real exchange rates measure deviations from PPP

C)Real exchange rates are always unity

D)Real exchange rates affect the international competitive positions of countries

A)Real exchange rate changes are caused by changes in nominal exchange rates

B)Real exchange rates measure deviations from PPP

C)Real exchange rates are always unity

D)Real exchange rates affect the international competitive positions of countries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

The international Fisher effect is the same as the

A)uncovered interest rate parity

B)covered interest rate parity

C)purchasing power parity

D)efficient Fisher effect

A)uncovered interest rate parity

B)covered interest rate parity

C)purchasing power parity

D)efficient Fisher effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

Deviations from interest rate parity exist for all of the following reasons except:

A)transaction costs

B)spreads

C)interest rate differentials

D)capital controls

A)transaction costs

B)spreads

C)interest rate differentials

D)capital controls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

When Interest Rate Parity (IRP)does not hold

A)there is a high degree of inflation

B)the financial markets are in equilibrium

C)there are opportunities for covered interest arbitrage

D)b and c

A)there is a high degree of inflation

B)the financial markets are in equilibrium

C)there are opportunities for covered interest arbitrage

D)b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

The 9-months inflation rate in Great Britain is expected to be 4% p.a.,and the 9-months inflation rate in Switzerland is predicted to be 6% p.a.The real interest rate is 3% in Great Britain.Assume that the parity conditions hold.

a)What is the nominal interest rate in Switzerland?

b)What is the nine-month forward rate of the Swiss franc with respect to the British pound?

c)If the inflation rates are expected to stay unchanged over the next two years,what is the expected spot exchange rate between the British pound and the Swiss franc in two years?

a)What is the nominal interest rate in Switzerland?

b)What is the nine-month forward rate of the Swiss franc with respect to the British pound?

c)If the inflation rates are expected to stay unchanged over the next two years,what is the expected spot exchange rate between the British pound and the Swiss franc in two years?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume the current $/£ exchange rate is 1.7 $/£ and 1-year forward exchange rate is 1.68$/£.The risk-free interest rates at which you can invest in US and UK are 4% and 6% respectively.However,since you do not have a very good credit rating,you can borrow funds only at higher rates.Namely,you can borrow $s at 5% and you can borrow £s at 7%.Is there an arbitrage opportunity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

The 9-months inflation rate in Great Britain is expected to be 4% p.a.,and the 9-months inflation rate in Switzerland is predicted to be 6% p.a.Assume that the parity conditions hold.

a)By what percentage rate do you expect the Swiss franc to appreciate (depreciate)with respect to the British pound over the next nine months,based on purchasing power parity?

b)If the spot rate is pound 0.5/SF,what is the expected spot exchange rate between the Swiss franc and the British pound in nine months?

a)By what percentage rate do you expect the Swiss franc to appreciate (depreciate)with respect to the British pound over the next nine months,based on purchasing power parity?

b)If the spot rate is pound 0.5/SF,what is the expected spot exchange rate between the Swiss franc and the British pound in nine months?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

Assume the current $/£ exchange rate is 1.7 $/£ and 1-year forward exchange rate is 1.68$/£.The risk-free interest rates in US and UK are 4% and 6% respectively.Is there an arbitrage opportunity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

Suppose that the two-months interest rate is 6.0 percent per annum in the United States and 7.0 percent per annum in Germany,and that the spot exchange rate is $1.12/€ and the forward exchange rate,with two-months maturity,is $1.10/€.Assume that an arbitrager can borrow up to $1,000,000 or €892,857. a)What kind of arbitrage is possible?

B)Determine the arbitrage profit that can be made.

C)What would the forward rate have to be so that there would be no arbitrage opportunity?

B)Determine the arbitrage profit that can be made.

C)What would the forward rate have to be so that there would be no arbitrage opportunity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

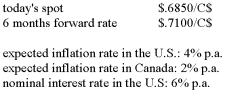

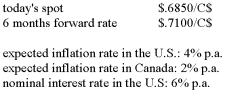

You have the following information:  You are asked to forecast the spot exchange rate between the Canadian dollar and the U.S.dollar in six months.

You are asked to forecast the spot exchange rate between the Canadian dollar and the U.S.dollar in six months.

a)What is your forecast based on purchasing power parity?

b)What is your forecast based on the forward expectations parity?

c)Based on the Fisher effect,what should be the real interest rate in Canada?

d)Why are the two forecasts in a and b different?

You are asked to forecast the spot exchange rate between the Canadian dollar and the U.S.dollar in six months.

You are asked to forecast the spot exchange rate between the Canadian dollar and the U.S.dollar in six months.a)What is your forecast based on purchasing power parity?

b)What is your forecast based on the forward expectations parity?

c)Based on the Fisher effect,what should be the real interest rate in Canada?

d)Why are the two forecasts in a and b different?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose that the two-months interest rate is 8.0 percent per annum in the Canada and 7.0 percent per annum in France,and that the spot exchange rate is $1.50/€ and the forward exchange rate,with one-year maturity,is $1.50/€.Assume that an arbitrager can borrow up to $1,000,000 or €666,666.

a)What kind of arbitrage is possible?

b)Determine the arbitrage profit that can be made.

c)What would the French interest rate have to be so that there would be no arbitrage opportunity?

a)What kind of arbitrage is possible?

b)Determine the arbitrage profit that can be made.

c)What would the French interest rate have to be so that there would be no arbitrage opportunity?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck