Deck 10: Competitive Markets

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/67

العب

ملء الشاشة (f)

Deck 10: Competitive Markets

1

An analysis that determines the equilibrium prices and quantities in more than one market simultaneously is called

A) partial equilibrium analysis

B) general equilibrium analysis

C) externality analysis

D) market equilibrium analysis

A) partial equilibrium analysis

B) general equilibrium analysis

C) externality analysis

D) market equilibrium analysis

B

2

If supply is relatively inelastic when compared with demand in a perfectly competitive market,

A) consumers will share a larger burden of an excise tax than producers.

B) consumers and producers will share the burden of an excise tax equally.

C) producers will share a larger burden of an excise tax than consumers.

D) the incidence of the tax cannot be determined without more information.

A) consumers will share a larger burden of an excise tax than producers.

B) consumers and producers will share the burden of an excise tax equally.

C) producers will share a larger burden of an excise tax than consumers.

D) the incidence of the tax cannot be determined without more information.

C

3

When a perfectly competitive market is in equilibrium,

A) consumer and producer surplus are maximized.

B) price is maximized.

C) quantity is maximized.

D) deadweight loss is positive.

A) consumer and producer surplus are maximized.

B) price is maximized.

C) quantity is maximized.

D) deadweight loss is positive.

A

4

Consider a perfectly competitive market with inverse market supply  and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the equilibrium quantity traded after imposition of the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the equilibrium quantity traded after imposition of the subsidy?

A) Q = 10

B) Q = 12.5

C) Q = 9

D) Q = 7.5

and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the equilibrium quantity traded after imposition of the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the equilibrium quantity traded after imposition of the subsidy?A) Q = 10

B) Q = 12.5

C) Q = 9

D) Q = 7.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

5

Consider a perfectly competitive market with inverse market supply  and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What are the equilibrium price and quantity traded before the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What are the equilibrium price and quantity traded before the subsidy?

A) P = 30; Q = 10

B) P = 25; Q = 12.5

C) P = 32; Q = 9

D) P = 35; Q = 7.5

and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What are the equilibrium price and quantity traded before the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What are the equilibrium price and quantity traded before the subsidy?A) P = 30; Q = 10

B) P = 25; Q = 12.5

C) P = 32; Q = 9

D) P = 35; Q = 7.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

6

Identify the truthfulness of the following statements. I.The profit in a perfectly competitive market is the one that maximizes the economic benefits (the sum of consumer and producer surplus).

II)In a way,statement I represents the "invisible hand" of the marketplace that Adam Smith was discussing in his 1776 classic treatise sometimes referred to as "The Wealth of Nations."

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

II)In a way,statement I represents the "invisible hand" of the marketplace that Adam Smith was discussing in his 1776 classic treatise sometimes referred to as "The Wealth of Nations."

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

7

Consider a perfectly competitive market with market supply  and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?

Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?

A) 72

B) 98

C) 144

D) 196

and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?

Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?A) 72

B) 98

C) 144

D) 196

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

8

Consider a perfectly competitive market with market supply  and market demand

and market demand  What is the equilibrium quantity in this market?

What is the equilibrium quantity in this market?

A) 12

B) 14

C) 16

D) 18

and market demand

and market demand  What is the equilibrium quantity in this market?

What is the equilibrium quantity in this market?A) 12

B) 14

C) 16

D) 18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

9

If the government decides to subsidize a good,it will typically do all of the following except:

A) add to consumer surplus.

B) add to producer surplus.

C) have a positive impact on the government's budget.

D) create a deadweight loss.

A) add to consumer surplus.

B) add to producer surplus.

C) have a positive impact on the government's budget.

D) create a deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

10

In a perfectly competitive market,which of the following will not occur as a result of an excise tax?

A) The market will under-produce relative to the efficient level.

B) Consumer surplus will be higher than with no tax since the tax is imposed on suppliers.

C) Producer surplus will be lower than with no tax.

D) The tax causes a deadweight loss.

A) The market will under-produce relative to the efficient level.

B) Consumer surplus will be higher than with no tax since the tax is imposed on suppliers.

C) Producer surplus will be lower than with no tax.

D) The tax causes a deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

11

Suppose that a market is initially in equilibrium.The initial demand curve is  The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What is the change in consumer surplus due to the tax?

Suppose that the government imposes a $3 tax on this market.What is the change in consumer surplus due to the tax?

A) $450.

B) $420.50.

C) $29.50.

D) $0.50.

The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What is the change in consumer surplus due to the tax?

Suppose that the government imposes a $3 tax on this market.What is the change in consumer surplus due to the tax?A) $450.

B) $420.50.

C) $29.50.

D) $0.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose the government decides to create a price support (floor) on the price of corn,which of the following is a true statement?

A) A binding price support/floor will tend to lower the price of corn for poorer people.

B) If the government does not buy any wheat, there will tend to be an excess supply of wheat in the marketplace, if the price floor is binding.

C) A non-binding price support/floor below the equilibrium price in the market will also lead to a rise in the price of corn.

D) It is likely that the total surplus (consumer surplus plus producer surplus) will rise with a price support program.

A) A binding price support/floor will tend to lower the price of corn for poorer people.

B) If the government does not buy any wheat, there will tend to be an excess supply of wheat in the marketplace, if the price floor is binding.

C) A non-binding price support/floor below the equilibrium price in the market will also lead to a rise in the price of corn.

D) It is likely that the total surplus (consumer surplus plus producer surplus) will rise with a price support program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

13

An analysis that determines the equilibrium prices and quantities in one market holding constant prices in all other markets is called

A) partial equilibrium analysis

B) general equilibrium analysis

C) externality analysis

D) market equilibrium analysis

A) partial equilibrium analysis

B) general equilibrium analysis

C) externality analysis

D) market equilibrium analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

14

When a tax is imposed on the producers of a product,which of the following is incorrect?

A) The consumers and producers each bear some part of the burden.

B) If the demand curve is relatively inelastic, the burden borne by consumers increases.

C) If the supply curve is relatively elastic, the burden borne by consumers increases.

D) If the tax is levied on producers, the producers bear the burden of the tax; if the tax is levied on consumers, the consumers bear the burden of the tax.

A) The consumers and producers each bear some part of the burden.

B) If the demand curve is relatively inelastic, the burden borne by consumers increases.

C) If the supply curve is relatively elastic, the burden borne by consumers increases.

D) If the tax is levied on producers, the producers bear the burden of the tax; if the tax is levied on consumers, the consumers bear the burden of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

15

In a perfectly competitive market,which of the following will not occur as a result of a subsidy?

A) The market will overproduce relative to the efficient level.

B) Consumer surplus will be higher than with no subsidy.

C) Producer surplus will be higher than with no subsidy.

D) There will be no deadweight loss from the subsidy.

A) The market will overproduce relative to the efficient level.

B) Consumer surplus will be higher than with no subsidy.

C) Producer surplus will be higher than with no subsidy.

D) There will be no deadweight loss from the subsidy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

16

Suppose that a market is initially in equilibrium.The initial demand curve is  The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What are the government receipts from the tax?

Suppose that the government imposes a $3 tax on this market.What are the government receipts from the tax?

A) $90.

B) $87.

C) $45.

D) $43.50.

The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What are the government receipts from the tax?

Suppose that the government imposes a $3 tax on this market.What are the government receipts from the tax?A) $90.

B) $87.

C) $45.

D) $43.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

17

Suppose that a market is initially in equilibrium.The initial demand curve is  The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.How much of this $3 is paid for by producers?

Suppose that the government imposes a $3 tax on this market.How much of this $3 is paid for by producers?

A) $0.

B) $1.

C) $1.50.

D) $2.

The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.How much of this $3 is paid for by producers?

Suppose that the government imposes a $3 tax on this market.How much of this $3 is paid for by producers?A) $0.

B) $1.

C) $1.50.

D) $2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

18

It is always the case that

A) the deadweight loss will be lower with a quota system than a tariff system.

B) there will be a deadweight loss from imposing tariffs on imports, even though the government may have a need for the revenue from the tariffs.

C) free trade will lead to a deadweight loss.

D) the deadweight loss will be lower with a tariff system than a quota system.

A) the deadweight loss will be lower with a quota system than a tariff system.

B) there will be a deadweight loss from imposing tariffs on imports, even though the government may have a need for the revenue from the tariffs.

C) free trade will lead to a deadweight loss.

D) the deadweight loss will be lower with a tariff system than a quota system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

19

With an acreage limitation program (compared with the initial situation of no program),which of the following statements is true?

A) The impact on the government's budget is zero, consumer surplus increases and producer surplus decreases.

B) The impact on the government's budget is positive, consumer surplus decreases and producer surplus increases.

C) The impact on the government's budget is negative, consumer surplus increases and producer surplus decreases.

D) The impact on the government's budget is negative, consumer surplus decreases, producer surplus increases, and there is a deadweight loss.

A) The impact on the government's budget is zero, consumer surplus increases and producer surplus decreases.

B) The impact on the government's budget is positive, consumer surplus decreases and producer surplus increases.

C) The impact on the government's budget is negative, consumer surplus increases and producer surplus decreases.

D) The impact on the government's budget is negative, consumer surplus decreases, producer surplus increases, and there is a deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

20

The incidence of a tax depends on

A) whom the tax is levied upon.

B) the relative elasticities of supply and demand.

C) the elasticity of government revenues.

D) the income elasticity of demand for the product.

A) whom the tax is levied upon.

B) the relative elasticities of supply and demand.

C) the elasticity of government revenues.

D) the income elasticity of demand for the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

21

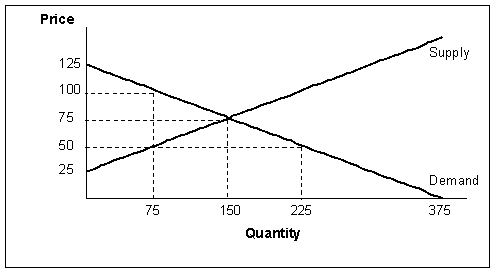

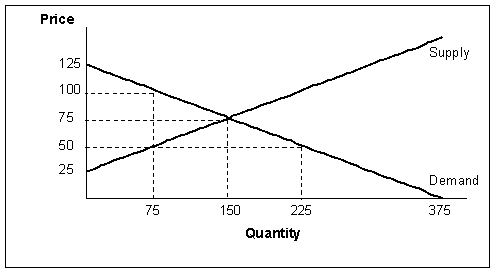

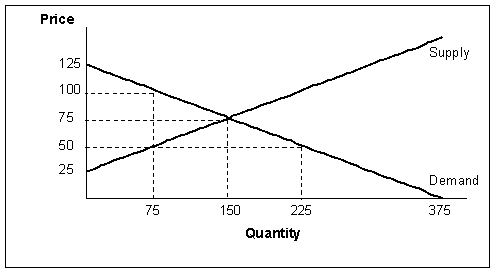

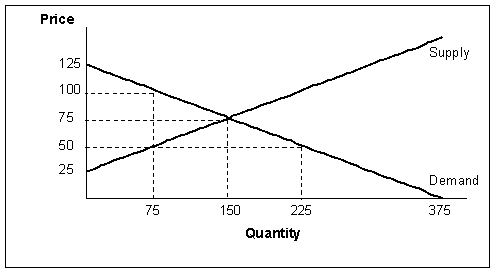

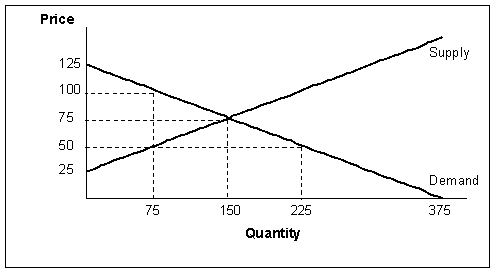

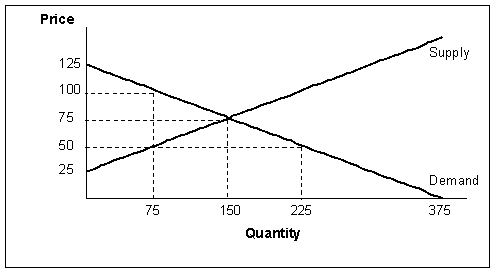

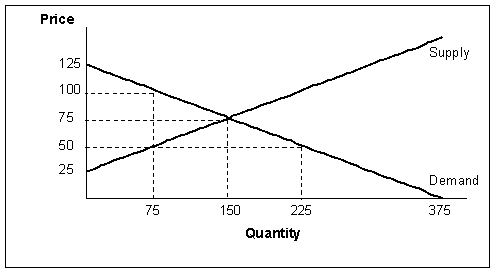

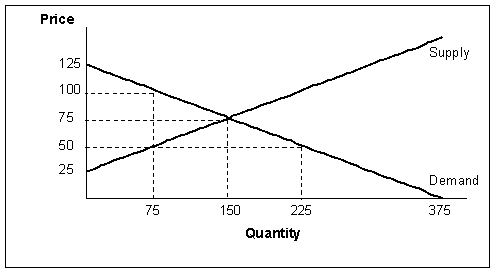

**Reference: Use the following figure to answer the next four questions (24-27).

**Suppose the government sets a price ceiling of $50 in this market.What is the minimum level of deadweight loss with the price ceiling?

A) 7,500

B) 3,750

C) 1,875

D) 937.50

**Suppose the government sets a price ceiling of $50 in this market.What is the minimum level of deadweight loss with the price ceiling?

A) 7,500

B) 3,750

C) 1,875

D) 937.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

22

Suppose that the market for corn is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the most efficient producers are active?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the most efficient producers are active?

A) $9.375

B) $2.25.

C) $1.

D) $0.63.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the most efficient producers are active?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the most efficient producers are active?A) $9.375

B) $2.25.

C) $1.

D) $0.63.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following statements is false?

A) With a price floor, the market will not clear.

B) With a price floor, consumers will buy less of the good than they would in a free market.

C) With a price floor, producer surplus will always increase.

D) With a price floor there will be excess supply.

A) With a price floor, the market will not clear.

B) With a price floor, consumers will buy less of the good than they would in a free market.

C) With a price floor, producer surplus will always increase.

D) With a price floor there will be excess supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

24

Consider a perfectly competitive market with inverse market supply  and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the deadweight loss resulting from the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the deadweight loss resulting from the subsidy?

A) 0, subsidies do not have a deadweight loss

B) 2.5

C) 5

D) 7.5

and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the deadweight loss resulting from the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the deadweight loss resulting from the subsidy?A) 0, subsidies do not have a deadweight loss

B) 2.5

C) 5

D) 7.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

25

Consider a perfectly competitive market with inverse market supply  and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the impact on the government's budget resulting from the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the impact on the government's budget resulting from the subsidy?

A) -45

B) -50

C) -270

D) -300

and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the impact on the government's budget resulting from the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the impact on the government's budget resulting from the subsidy?A) -45

B) -50

C) -270

D) -300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

26

Consider a perfectly competitive market with inverse market supply  and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the increase in consumer surplus resulting from the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the increase in consumer surplus resulting from the subsidy?

A) 17

B) 19

C) 21

D) 23

and inverse market demand

and inverse market demand  Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the increase in consumer surplus resulting from the subsidy?

Suppose the government subsidizes this market with a subsidy of $5 per unit.What is the increase in consumer surplus resulting from the subsidy?A) 17

B) 19

C) 21

D) 23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose that the market for corn is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the least efficient producers are active?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the least efficient producers are active?

A) $9.375

B) $2.25.

C) $1.

D) $0.63.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the least efficient producers are active?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the dead-weight loss (per million bushels) associated with the price floor when the least efficient producers are active?A) $9.375

B) $2.25.

C) $1.

D) $0.63.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a perfectly competitive market,a tariff

A) is another term for an excise tax imposed on any good.

B) sets the price of an imported good.

C) is a tax on an imported good.

D) is the same as an import quota.

A) is another term for an excise tax imposed on any good.

B) sets the price of an imported good.

C) is a tax on an imported good.

D) is the same as an import quota.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

29

In a perfectly competitive market,a production quota

A) sets a limit on the level of imports of a good.

B) has the effect of keeping the market price below the equilibrium level.

C) will create excess supply in the market.

D) creates no deadweight loss.

A) sets a limit on the level of imports of a good.

B) has the effect of keeping the market price below the equilibrium level.

C) will create excess supply in the market.

D) creates no deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

30

Suppose that the market for cigarettes is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What are the new amount traded and the price in this market?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What are the new amount traded and the price in this market?

A) Q = 40; P = 20

B) Q = 20; P = 40

C) Q = 30; P = 30

D) Q = 30; P = 15

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What are the new amount traded and the price in this market?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What are the new amount traded and the price in this market?A) Q = 40; P = 20

B) Q = 20; P = 40

C) Q = 30; P = 30

D) Q = 30; P = 15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following statements is not generally true of a production quota?

A) The market will not clear due to the excess supply of that good.

B) Consumer surplus increases when compared to the market before the quota.

C) Producer surplus may increase or decrease.

D) Some of the consumer surplus will be transferred to producers.

A) The market will not clear due to the excess supply of that good.

B) Consumer surplus increases when compared to the market before the quota.

C) Producer surplus may increase or decrease.

D) Some of the consumer surplus will be transferred to producers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a perfectly competitive market,an import quota

A) sets a minimum level of production that domestic firms must produce.

B) sets a minimum level of imports for a country.

C) sets a maximum level of production that domestic firms may produce.

D) sets a maximum level of imports into a country.

A) sets a minimum level of production that domestic firms must produce.

B) sets a minimum level of imports for a country.

C) sets a maximum level of production that domestic firms may produce.

D) sets a maximum level of imports into a country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose that the market for corn is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.Which of the following best describes the market after the price floor is imposed?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.Which of the following best describes the market after the price floor is imposed?

A) There will be a shortage of 5 million bushels.

B) There will be a surplus of 5 million bushels.

C) There will be a surplus of 7 million bushels.

D) There will be a surplus of 12 million bushels.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.Which of the following best describes the market after the price floor is imposed?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.Which of the following best describes the market after the price floor is imposed?A) There will be a shortage of 5 million bushels.

B) There will be a surplus of 5 million bushels.

C) There will be a surplus of 7 million bushels.

D) There will be a surplus of 12 million bushels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

34

Identify the truthfulness of the following statements. I.In a perfectly competitive market,import quotas and tariffs tend to lead to higher domestic prices and deadweight loss.

II)In a perfectly competitive market,import quotas and tariffs tend to lead to higher domestic prices without the usual deadweight loss that would accompany them.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

II)In a perfectly competitive market,import quotas and tariffs tend to lead to higher domestic prices without the usual deadweight loss that would accompany them.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

35

Suppose that the market for corn is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.What is the equilibrium quantity traded and price in this market?

Quantity is expressed in millions of bushels.What is the equilibrium quantity traded and price in this market?

A) Q = 8; P = 2

B) Q = 2; P = 8

C) Q = 7; P = 3

D) Q = 3; P = 7

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.What is the equilibrium quantity traded and price in this market?

Quantity is expressed in millions of bushels.What is the equilibrium quantity traded and price in this market?A) Q = 8; P = 2

B) Q = 2; P = 8

C) Q = 7; P = 3

D) Q = 3; P = 7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

36

**Reference: Use the following figure to answer the next four questions (24-27).

**Suppose the government sets a price ceiling of $50 in this market.What is the maximum level of consumer surplus with the price ceiling?

A) 16,875

B) 11,250

C) 8,437.50

D) 4,843.75

**Suppose the government sets a price ceiling of $50 in this market.What is the maximum level of consumer surplus with the price ceiling?

A) 16,875

B) 11,250

C) 8,437.50

D) 4,843.75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

37

Suppose that the market for cigarettes is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the level of excess supply in this market?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the level of excess supply in this market?

A) There is no excess supply. There is an excess demand of Q = 30.

B) There is no excess supply or demand.

C) There is an excess supply of Q = 30.

D) There is an excess supply of Q = 20.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the level of excess supply in this market?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the level of excess supply in this market?A) There is no excess supply. There is an excess demand of Q = 30.

B) There is no excess supply or demand.

C) There is an excess supply of Q = 30.

D) There is an excess supply of Q = 20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

38

**Reference: Use the following figure to answer the next four questions (24-27).

**Determine the level of consumer surplus at the market equilibrium.

A) 16,875

B) 11,250

C) 7,500

D) 3,750

**Determine the level of consumer surplus at the market equilibrium.

A) 16,875

B) 11,250

C) 7,500

D) 3,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

39

**Reference: Use the following figure to answer the next four questions (24-27).

**Determine the level of producer surplus at the market equilibrium.

A) 16,875

B) 11,250

C) 7,500

D) 3,750

**Determine the level of producer surplus at the market equilibrium.

A) 16,875

B) 11,250

C) 7,500

D) 3,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose that the market for cigarettes is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.What are the amount traded and the price for this market?

Quantity is expressed in millions of boxes per month.What are the amount traded and the price for this market?

A) Q = 40; P = 20

B) Q = 20; P = 40

C) Q = 30; P = 30

D) Q = 30; P = 15

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.What are the amount traded and the price for this market?

Quantity is expressed in millions of boxes per month.What are the amount traded and the price for this market?A) Q = 40; P = 20

B) Q = 20; P = 40

C) Q = 30; P = 30

D) Q = 30; P = 15

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

41

Suppose that a market is initially in equilibrium.The initial demand curve is  The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What is the dead-weight loss due to the tax?

Suppose that the government imposes a $3 tax on this market.What is the dead-weight loss due to the tax?

A) $3.

B) $2.

C) $1.50.

D) $1.00.

The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What is the dead-weight loss due to the tax?

Suppose that the government imposes a $3 tax on this market.What is the dead-weight loss due to the tax?A) $3.

B) $2.

C) $1.50.

D) $1.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

42

Consider a perfectly competitive market with market supply  and market demand

and market demand  What is consumer surplus in this market?

What is consumer surplus in this market?

A) 98

B) 128

C) 196

D) 256

and market demand

and market demand  What is consumer surplus in this market?

What is consumer surplus in this market?A) 98

B) 128

C) 196

D) 256

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

43

Suppose that the market for corn is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the new equilibrium quantity traded in this market?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the new equilibrium quantity traded in this market?

A) Q = 8;

B) Q = 2;

C) Q = 7

D) Q = 3

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the new equilibrium quantity traded in this market?

Quantity is expressed in millions of bushels.Now suppose that the federal government imposes a price floor of $3 per bushel of corn.What is the new equilibrium quantity traded in this market?A) Q = 8;

B) Q = 2;

C) Q = 7

D) Q = 3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

44

The domestic market for calculators is perfectly competitive and is in equilibrium.Domestic demand is given by Qd = 100 - P and domestic supply is given by Qs = 4P.The world price for calculators is $10.Now,a tariff of $10 is imposed on all imports.How many units of calculators will be imported now?

A) 0

B) 10

C) 30

D) 50

A) 0

B) 10

C) 30

D) 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

45

Consider a perfectly competitive market with market supply  and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market. What is the deadweight loss from this tax?

Suppose the government imposes an excise tax of $4 per unit on this market. What is the deadweight loss from this tax?

A) 2

B) 4

C) 6

D) 8

and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market. What is the deadweight loss from this tax?

Suppose the government imposes an excise tax of $4 per unit on this market. What is the deadweight loss from this tax?A) 2

B) 4

C) 6

D) 8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider a perfectly competitive market with market supply  and market demand

and market demand  What is total surplus in this market?

What is total surplus in this market?

A) 98

B) 128

C) 196

D) 256

and market demand

and market demand  What is total surplus in this market?

What is total surplus in this market?A) 98

B) 128

C) 196

D) 256

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

47

Consider a perfectly competitive market with market supply  and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) before the government imposes the tax?

Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) before the government imposes the tax?

A) 72

B) 98

C) 144

D) 196

and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) before the government imposes the tax?

Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) before the government imposes the tax?A) 72

B) 98

C) 144

D) 196

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

48

The domestic market for calculators is perfectly competitive and is in equilibrium.Domestic demand is given by Qd = 100 - P and domestic supply is given by Qs = 4P.The world price for calculators is $10.Now,a tariff of $10 is imposed on all imports.How much revenue does this policy generate for the government?

A) 0

B) 10

C) 30

D) 50

A) 0

B) 10

C) 30

D) 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

49

If there is an excise tax collected by suppliers of a particular product,when we draw the graph of supply and demand we would normally represent the excise tax by

A) a horizontal shift of the supply curve to the left by the amount of the excise tax.

B) a horizontal shift of the supply curve to the right by the amount of the excise tax.

C) a vertical shift up of the demand curve by the amount of the excise tax.

D) a vertical shift up of the supply curve by the amount of the excise tax.

A) a horizontal shift of the supply curve to the left by the amount of the excise tax.

B) a horizontal shift of the supply curve to the right by the amount of the excise tax.

C) a vertical shift up of the demand curve by the amount of the excise tax.

D) a vertical shift up of the supply curve by the amount of the excise tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

50

Deadweight loss can be explained as

A) An increase in economic benefits resulting due to efficient allocation of resources

B) A reduction in net economic benefits resulting from an inefficient allocation of resources

C) An increase in economic benefits resulting due to inefficient allocation of resources

A) An increase in economic benefits resulting due to efficient allocation of resources

B) A reduction in net economic benefits resulting from an inefficient allocation of resources

C) An increase in economic benefits resulting due to inefficient allocation of resources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

51

In a perfectly competitive market,which of the following will not occur as a result of a subsidy?

A) The market will under-produce relative to the efficient level.

B) Consumer surplus will be higher than with no subsidy.

C) Producer surplus will be higher with no subsidy.

D) The subsidy causes a deadweight loss.

A) The market will under-produce relative to the efficient level.

B) Consumer surplus will be higher than with no subsidy.

C) Producer surplus will be higher with no subsidy.

D) The subsidy causes a deadweight loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

52

Suppose that a market is initially in equilibrium.The initial demand curve is  The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What is the change in producer surplus due to the tax?

Suppose that the government imposes a $3 tax on this market.What is the change in producer surplus due to the tax?

A) $900.

B) $841.

C) $59.

D) $29.50.

The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.What is the change in producer surplus due to the tax?

Suppose that the government imposes a $3 tax on this market.What is the change in producer surplus due to the tax?A) $900.

B) $841.

C) $59.

D) $29.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

53

Suppose that the market for cigarettes is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in consumer surplus (per million boxes) associated with the quota?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in consumer surplus (per million boxes) associated with the quota?

A) $450.

B) $350.

C) $300.

D) $50.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in consumer surplus (per million boxes) associated with the quota?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in consumer surplus (per million boxes) associated with the quota?A) $450.

B) $350.

C) $300.

D) $50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

54

Identify the truthfulness of the following statements. III.In perfectly competitive markets there are no externalities.That is,actions of decision-makers on each others' well being do not extend beyond those effects transmitted by prices.

IV)Partial equilibrium analysis determines equilibrium in a single market,taking the prices and outputs of other markets as fixed.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

IV)Partial equilibrium analysis determines equilibrium in a single market,taking the prices and outputs of other markets as fixed.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

55

Suppose that a market is initially in equilibrium.The initial demand curve is  The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.How much of this $3 tax is paid by consumers?

Suppose that the government imposes a $3 tax on this market.How much of this $3 tax is paid by consumers?

A) $1.

B) $1.50.

C) $2.

D) $3

The initial supply curve is

The initial supply curve is  Suppose that the government imposes a $3 tax on this market.How much of this $3 tax is paid by consumers?

Suppose that the government imposes a $3 tax on this market.How much of this $3 tax is paid by consumers?A) $1.

B) $1.50.

C) $2.

D) $3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

56

Consider a perfectly competitive market with market supply  and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?

Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?

A) 72

B) 98

C) 144

D) 196

and market demand

and market demand  Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?

Suppose the government imposes an excise tax of $4 per unit on this market.What is total surplus (consumer surplus plus producer surplus) after the government imposes the tax?A) 72

B) 98

C) 144

D) 196

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

57

Suppose that the market for cigarettes is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the dead-weight loss (per million boxes) associated with the quota?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the dead-weight loss (per million boxes) associated with the quota?

A) $275.

B) $75.

C) $50.

D) $25.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the dead-weight loss (per million boxes) associated with the quota?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the dead-weight loss (per million boxes) associated with the quota?A) $275.

B) $75.

C) $50.

D) $25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

58

Consider a perfectly competitive market with market supply  and market demand

and market demand  . Suppose the government imposes an excise tax of $4 per unit on this market. What are the net benefits from this tax?

. Suppose the government imposes an excise tax of $4 per unit on this market. What are the net benefits from this tax?

A) 48

B) 144

C) 192

D) 72

and market demand

and market demand  . Suppose the government imposes an excise tax of $4 per unit on this market. What are the net benefits from this tax?

. Suppose the government imposes an excise tax of $4 per unit on this market. What are the net benefits from this tax?A) 48

B) 144

C) 192

D) 72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

59

In a market with an upward-sloping supply curve and a downward-sloping demand curve,the effects of an excise tax are as follows except:

A) Consumer surplus will be lower than with no tax.

B) Producer surplus will be lower than with no tax.

C) The impact on the government budget will be positive.

D) The tax will generally lead to a deadweight gain.

A) Consumer surplus will be lower than with no tax.

B) Producer surplus will be lower than with no tax.

C) The impact on the government budget will be positive.

D) The tax will generally lead to a deadweight gain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

60

The domestic market for calculators is perfectly competitive and is in equilibrium.Domestic demand is given by Qd = 100 - P and domestic supply is given by Qs = 4P.The world price for calculators is $10.How many units of calculators will be imported?

A) 0

B) 10

C) 30

D) 50

A) 0

B) 10

C) 30

D) 50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is not a description of what a tariff can achieve in a perfectly competitive market?

A) A tariff can achieve many of the same goals as an import quota.

B) A tariff can create less domestic deadweight loss than a quota if the tariff revenues are redistributed domestically.

C) A tariff can create greater government revenues than a quota.

D) A tariff creates enough government revenue to completely offset the impact of deadweight loss, thereby increasing total surplus.

A) A tariff can achieve many of the same goals as an import quota.

B) A tariff can create less domestic deadweight loss than a quota if the tariff revenues are redistributed domestically.

C) A tariff can create greater government revenues than a quota.

D) A tariff creates enough government revenue to completely offset the impact of deadweight loss, thereby increasing total surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

62

Suppose that the market for cigarettes is initially in equilibrium and is perfectly competitive.The demand curve can be expressed as  ; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in producer surplus (per million boxes) associated with the quota?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in producer surplus (per million boxes) associated with the quota?

A) $275.

B) $75.

C) $50.

D) $25.

; the supply curve can be expressed as

; the supply curve can be expressed as  Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in producer surplus (per million boxes) associated with the quota?

Quantity is expressed in millions of boxes per month.Now suppose that the federal government imposes a production quota on cigarettes of 30 million boxes per month.What is the change in producer surplus (per million boxes) associated with the quota?A) $275.

B) $75.

C) $50.

D) $25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

63

Identify the truthfulness of the following statements. I.Government purchase programs in agriculture tend not to be more expensive than acreage limitation programs.

II)Government purchase programs in agriculture tend to be politically more palatable than direct cash transfers,even though they induce more deadweight loss.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

II)Government purchase programs in agriculture tend to be politically more palatable than direct cash transfers,even though they induce more deadweight loss.

A) Both I and II are true.

B) Both I and II are false.

C) I is true; II is false.

D) I is false; II is true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following statements regarding a price ceiling in a perfectly competitive market is incorrect?

A) There will be no deadweight loss with the price ceiling.

B) The will be excess demand resulting from the price ceiling.

C) The market will under produce relative to the efficient level.

D) Consumer surplus may either increase or decrease with a price ceiling.

A) There will be no deadweight loss with the price ceiling.

B) The will be excess demand resulting from the price ceiling.

C) The market will under produce relative to the efficient level.

D) Consumer surplus may either increase or decrease with a price ceiling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

65

Acreage limitations are used by the government because

A) They induce less deadweight loss than cash transfers to farmers.

B) they raise the market price of an agricultural product without the surpluses associated with price supports.

C) the government wishes to lower agricultural prices.

D) they are an effective way to feed poor people.

A) They induce less deadweight loss than cash transfers to farmers.

B) they raise the market price of an agricultural product without the surpluses associated with price supports.

C) the government wishes to lower agricultural prices.

D) they are an effective way to feed poor people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

66

Suppose the government decides to create a ceiling on the price of gasoline,which of the following is not likely to be true under the described circumstances?

A) The ceiling will have no effect if the ceiling is above the equilibrium market price.

B) Producer surplus will likely increase if the ceiling is below the equilibrium market price.

C) Producer surplus will be lower with a binding ceiling (below the initial market equilibrium price).

D) The ceiling will lead to shortages if the ceiling is below the initial market price.

A) The ceiling will have no effect if the ceiling is above the equilibrium market price.

B) Producer surplus will likely increase if the ceiling is below the equilibrium market price.

C) Producer surplus will be lower with a binding ceiling (below the initial market equilibrium price).

D) The ceiling will lead to shortages if the ceiling is below the initial market price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck

67

The domestic market for calculators is perfectly competitive and is in equilibrium.Domestic demand is given by Qd = 100 - P and domestic supply is given by Qs = 4P.The world price for calculators is $10.As an alternative to a tariff of $10 per unit,the government considers an outright trade prohibition on calculators.Which is better for the domestic economy?

A) The trade prohibition is better.

B) The tariff is better.

C) The trade prohibition is better for producers; the tariff is better for consumers.

D) Both policies generate exactly the same surpluses.

A) The trade prohibition is better.

B) The tariff is better.

C) The trade prohibition is better for producers; the tariff is better for consumers.

D) Both policies generate exactly the same surpluses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 67 في هذه المجموعة.

فتح الحزمة

k this deck