Deck 14: Options and Risk Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 14: Options and Risk Management

1

A writer of a call option will want the value of the underlying asset to ________ and a buyer of a put option will want the value of the underlying asset to ________.

A)decrease, decrease

B)decrease, increase

C)increase, decrease

D)increase, increase

A)decrease, decrease

B)decrease, increase

C)increase, decrease

D)increase, increase

A

2

The value of a listed put option on a share is lower when ________.

I) the exercise price is higher

II) the contract approaches maturity

III) the share decreases in value

IV) a share split occurs

A)II only

B)II and IV only

C)I, II and III only

D)I, II, III and IV

I) the exercise price is higher

II) the contract approaches maturity

III) the share decreases in value

IV) a share split occurs

A)II only

B)II and IV only

C)I, II and III only

D)I, II, III and IV

A

3

The 14 September 2009 price quotation for a Boeing call option with a strike price of $50 due to expire in November is $3.50 while the share price of Boeing is $51. The premium on one Boeing November 50 call contract is ________.

A)$1

B)$2.50

C)$250.00

D)$350.00

A)$1

B)$2.50

C)$250.00

D)$350.00

D

4

At contract maturity the value of a call option is ________ where X equals the option's strike price and ST is the share price at contract expiration.

A)Max(0, ST - X)

B)Min(0, ST - X)

C)Max(0, X - ST)

D)Min(0, X - ST)

A)Max(0, ST - X)

B)Min(0, ST - X)

C)Max(0, X - ST)

D)Min(0, X - ST)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

All else the same, an American style option will be ________ valuable than a ________ style option.

A)more, European

B)less, European

C)more, Canadian

D)less, Canadian

A)more, European

B)less, European

C)more, Canadian

D)less, Canadian

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

You buy a call option and a put option on General Electric. Both the call option and the put option have the same exercise price and expiration date. This strategy is called a ________.

A)time spread

B)long straddle

C)short straddle

D)money spread

A)time spread

B)long straddle

C)short straddle

D)money spread

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

You write a put option on a share. The profit at contract maturity of the option position is ________ where X equals the option's strike price, ST is the share price at contract expiration and P0 is the original premium of the put option.

A)Max(P0, X - ST - P0)

B)Min(-P0, X - ST - P0)

C)Min(P0, ST - X + P0)

D)Max(0, ST - X - P0)

A)Max(P0, X - ST - P0)

B)Min(-P0, X - ST - P0)

C)Min(P0, ST - X + P0)

D)Max(0, ST - X - P0)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

You purchase a call option on a share. The profit at contract maturity of the option position is ________ where X equals the option's strike price, ST is the share price at contract expiration and C0 is the original purchase price of the option.

A)Max(-C0, ST - X - C0)

B)Min(-C0, ST - X - C0)

C)Max(C0, ST - X + C0)

D)Max(0, ST - X - C0)

A)Max(-C0, ST - X - C0)

B)Min(-C0, ST - X - C0)

C)Max(C0, ST - X + C0)

D)Max(0, ST - X - C0)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

A put option on Snapple Beverage has an exercise price of $30. The current share price of Snapple Beverage is $24.25. The put option is ________.

A)at the money

B)in the money

C)out of the money

D)knocked out

A)at the money

B)in the money

C)out of the money

D)knocked out

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

You purchase one IBM July 120 put contract for a premium of $3. You hold the option until the expiration date when IBM stock sells for $123 per share. You will realise a ________ on the investment.

A)$300 profit

B)$300 loss

C)$500 loss

D)$200 profit

A)$300 profit

B)$300 loss

C)$500 loss

D)$200 profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

The writer of a put option ________.

A)agrees to sell shares at a set price if the option holder desires

B)agrees to buy shares at a set price if the option holder desires

C)has the right to buy shares at a set price

D)has the right to sell shares at a set price

A)agrees to sell shares at a set price if the option holder desires

B)agrees to buy shares at a set price if the option holder desires

C)has the right to buy shares at a set price

D)has the right to sell shares at a set price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

You buy a call option on Summit Corp. with an exercise price of $40 and an expiration date in September and write a call option on Summit Corp. with an exercise price of $40 and an expiration date in October. This strategy is called a ________.

A)time spread

B)long straddle

C)short straddle

D)money spread

A)time spread

B)long straddle

C)short straddle

D)money spread

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

The value of a listed call option on a share is lower when ________.

I) the exercise price is higher

II) the contract approaches maturity

III) the share decreases in value

IV) a share split occurs

A)II, III and IV only

B)I, III and IV only

C)I, II and III only

D)I, II, III and IV

I) the exercise price is higher

II) the contract approaches maturity

III) the share decreases in value

IV) a share split occurs

A)II, III and IV only

B)I, III and IV only

C)I, II and III only

D)I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

A European put option gives its holder the right to ________.

A)buy the underlying asset at the exercise price on or before the expiration date

B)buy the underlying asset at the exercise price only at the expiration date

C)sell the underlying asset at the exercise price on or before the expiration date

D)sell the underlying asset at the exercise price only at the expiration date

A)buy the underlying asset at the exercise price on or before the expiration date

B)buy the underlying asset at the exercise price only at the expiration date

C)sell the underlying asset at the exercise price on or before the expiration date

D)sell the underlying asset at the exercise price only at the expiration date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

You buy a call option on Merritt Corp. with an exercise price of $50 and an expiration date in July and write a call option on Merritt Corp. with an exercise price of $55 with an expiration date in July. This is called a ________.

A)time spread

B)long straddle

C)short straddle

D)money spread

A)time spread

B)long straddle

C)short straddle

D)money spread

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

Advantages of exchange traded options over OTC options include all but which one of the following?

A)Ease and low cost of trading

B)Anonymity of participants

C)Contracts that are tailored to meet the needs of market participants

D)No concerns about counterparty credit risk

A)Ease and low cost of trading

B)Anonymity of participants

C)Contracts that are tailored to meet the needs of market participants

D)No concerns about counterparty credit risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

An American put option gives its holder the right to ________.

A)buy the underlying asset at the exercise price on or before the expiration date

B)buy the underlying asset at the exercise price only at the expiration date

C)sell the underlying asset at the exercise price on or before the expiration date

D)sell the underlying asset at the exercise price only at the expiration date

A)buy the underlying asset at the exercise price on or before the expiration date

B)buy the underlying asset at the exercise price only at the expiration date

C)sell the underlying asset at the exercise price on or before the expiration date

D)sell the underlying asset at the exercise price only at the expiration date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

You write one IBM July 120 call contract for a premium of $4. You hold the option until the expiration date when IBM stock sells for $121 per share. You will realise a ________ on the investment.

A)$300 profit

B)$200 loss

C)$600 loss

D)$200 profit

A)$300 profit

B)$200 loss

C)$600 loss

D)$200 profit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

You purchase one IBM July 120 call contract for a premium of $5. You hold the option until the expiration date when IBM shares sell for $123 per share. You will realise a ________ on the investment.

A)$200 profit

B)$200 loss

C)$300 profit

D)$300 loss

A)$200 profit

B)$200 loss

C)$300 profit

D)$300 loss

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

You invest in the share of Rayleigh Corp. and write a call option on Rayleigh Corp. This strategy is called a ________.

A)covered call

B)long straddle

C)naked call

D)money spread

A)covered call

B)long straddle

C)naked call

D)money spread

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

The ________ is the share price minus exercise price, or the profit that could be attained by immediate exercise of an in-the-money call option.

A)intrinsic value

B)time value

C)stated value

D)discounted value

A)intrinsic value

B)time value

C)stated value

D)discounted value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

An investor purchases a long call at a price of $2.50. The expiration price is $35.00. If the current share price is $35.10, what is the break-even point for the investor?

A)$32.50

B)$35.00

C)$37.50

D)$37.60

A)$32.50

B)$35.00

C)$37.50

D)$37.60

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

Investor A bought a call option that expires in 6 months. Investor B wrote a put option with a 9-month maturity. All else equal, as the time to expiration approaches the value of Investor A's position will ________ and the value of Investor B's position will ________.

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

________ is the most risky transaction to undertake in the share index option markets if the share market is expected to fall substantially after the transaction is completed.

A)Writing an uncovered call option

B)Writing an uncovered put option

C)Buying a call option

D)Buying a put option

A)Writing an uncovered call option

B)Writing an uncovered put option

C)Buying a call option

D)Buying a put option

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

The common stock of the Avalon Corporation has been trading in a narrow range around $40 per share for months and you believe it is going to stay in that range for the next three months. The price of a three-month put option with an exercise price of $40 is $3 and a call with the same expiration date and exercise price sells for $4. What would be a simple options strategy using a put and a call to exploit your conviction about the share price's future movement?

A)Sell a call

B)Purchase a put

C)Sell a straddle

D)Buy a straddle

A)Sell a call

B)Purchase a put

C)Sell a straddle

D)Buy a straddle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

All else equal, call option values are ________ if the ________ is lower.

A)higher; share price

B)higher; exercise price

C)lower; dividend payout

D)lower; share volatility

A)higher; share price

B)higher; exercise price

C)lower; dividend payout

D)lower; share volatility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

What combination of puts and calls can simulate a long stock investment?

A)Long call and short put

B)Long call and long put

C)Short call and short put

D)Short call and long put

A)Long call and short put

B)Long call and long put

C)Short call and short put

D)Short call and long put

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

A share is trading at $50. You believe there is a 60% chance the price of the share will increase by 10% over the next three months. You believe there is a 30% chance the share will drop by 5% and you think there is only a 10% chance of a major drop in price of 20%. At-the-money 3-month puts are available at a cost of $650 per contract. What is the expected dollar profit for a writer of a naked put at the end of three months?

A)$300

B)$200

C)$475

D)$0

A)$300

B)$200

C)$475

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

What strategy could be considered insurance for an investment in a portfolio of shares?

A)Covered call

B)Protective put

C)Short put

D)Straddle

A)Covered call

B)Protective put

C)Short put

D)Straddle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

Before expiration the time value of an out-of-the money share option is ________.

A)equal to the share price minus the exercise price

B)equal to zero

C)negative

D)positive

A)equal to the share price minus the exercise price

B)equal to zero

C)negative

D)positive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

You buy one Hewlett Packard August 50 call contract and one Hewlett Packard August 50 put contract. The call premium is $1.25 and the put premium is $4.50. Your highest potential loss from this position is ________.

A)$125

B)$450

C)$575

D)unlimited

A)$125

B)$450

C)$575

D)unlimited

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

You own $75 000 worth of stock and you are worried the price may fall by year end in 6 months. You are considering either using puts or calls to hedge this position. Given this, which of the following statements is/are correct?

I) One way to hedge your position would be to buy puts. II. One way to hedge your position would be to write calls.

III. If major share price declines are likely the hedging with puts is probably better than hedging with short calls.

A)I only

B)II only

C)I and III only

D)I, II and III

I) One way to hedge your position would be to buy puts. II. One way to hedge your position would be to write calls.

III. If major share price declines are likely the hedging with puts is probably better than hedging with short calls.

A)I only

B)II only

C)I and III only

D)I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose you write a strap and the share price winds up to be $42 at contract expiration. What was your net profit on the strap?

A)$200

B)$300

C)$700

D)$400

A)$200

B)$300

C)$700

D)$400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

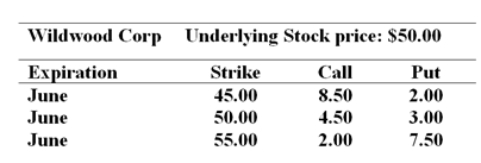

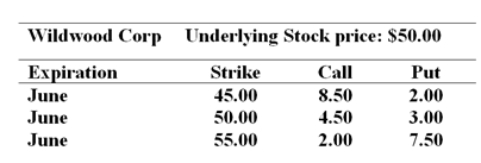

You are cautiously bullish on the common share of the Wildwood Corporation over the next several months. The current price of the share is $50 per share. You want to establish a bullish money spread to help limit the cost of your option position. You find the following option quotes:  Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

A)$1 050

B)$650

C)$400

D)$400 income rather than cost

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.

Ignoring commissions, the cost to establish the bull money spread with calls would be ________.A)$1 050

B)$650

C)$400

D)$400 income rather than cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

You sell one Hewlett Packard August 50 call contract and sell one Hewlett Packard August 50 put contract. The call premium is $1.25 and the put premium is $4.50. Your strategy will pay off only if the share price is ________ in August.

A)either lower than $44.25 or higher than $55.75

B)between $44.25 and $55.75

C)higher than $55.75

D)lower than $44.25

A)either lower than $44.25 or higher than $55.75

B)between $44.25 and $55.75

C)higher than $55.75

D)lower than $44.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

The value of a call option increases with all of the following except ________.

A)share price

B)time to maturity

C)volatility

D)dividend yield

A)share price

B)time to maturity

C)volatility

D)dividend yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

Investor A bought a call option and Investor B bought a put option. All else equal if the underlying share price volatility increases the value of Investor A's position will ________ and the value of Investor B's position will ________.

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

A)increase; increase

B)increase; decrease

C)decrease; increase

D)decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

A put on Sanders stock with a strike price of $35 is priced at $2 per share while a call with a strike price of $35 is priced at $3.50. The maximum per share loss to the writer of an uncovered put is ________ and the maximum per share gain to the writer of an uncovered call is ________.

A)$33.00; $3.50

B)$33.00; $31.50

C)$35.00; $3.50

D)$35.00; $35.00

A)$33.00; $3.50

B)$33.00; $31.50

C)$35.00; $3.50

D)$35.00; $35.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

A 45 call option on a share priced at $50 is priced at $6.50. This call has an intrinsic value of ________ and a time value of ________.

A)$6.50; $0

B)$5.00; $1.50

C)$1.50; $5.00

D)$0; $6.50

A)$6.50; $0

B)$5.00; $1.50

C)$1.50; $5.00

D)$0; $6.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

You purchase one IBM March 120 put contract for a put premium of $10. The maximum profit that you could gain from this strategy is ________.

A)$120

B)$1 000

C)$11 000

D)$12 000

A)$120

B)$1 000

C)$11 000

D)$12 000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

The share price of Ajax Inc. is currently $105. The share price a year from now will be either $130 or $90 with equal probabilities. The interest rate at which investors can borrow is 10%. Using the binomial OPM, the value of a call option with an exercise price of $110 and an expiration date one year from now should be worth ________ today.

A)$11.59

B)$15.00

C)$20.00

D)$40.00

A)$11.59

B)$15.00

C)$20.00

D)$40.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

Research suggests that option pricing models that allow for the possibility of ________ provide more accurate pricing than does the basic Black-Scholes option pricing model.

I) early exercise

II) changing expected returns of the share

III. time varying share price volatility

A)II only

B)I and III only

C)II and III only

D)I, II and III

I) early exercise

II) changing expected returns of the share

III. time varying share price volatility

A)II only

B)I and III only

C)II and III only

D)I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

You are considering purchasing a put option on a share with a current price of $33. The exercise price is $35 and the price of the corresponding call option is $2.25. According to the put-call parity theorem, if the risk-free rate of interest is 4% and there are 90 days until expiration, the value of the put should be ________.

A)$2.25

B)$3.91

C)$4.05

D)$5.52

A)$2.25

B)$3.91

C)$4.05

D)$5.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which one of the following will increase the value of a put option?

A)A decrease in the exercise price

B)A decrease in time to expiration of the put

C)An increase in the volatility of the underlying share

D)An increase in share price

A)A decrease in the exercise price

B)A decrease in time to expiration of the put

C)An increase in the volatility of the underlying share

D)An increase in share price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

In the Black-Scholes model if an option is not likely to be exercised both N(d1) and N(d2) will be close to ________. If the option is definitely likely to be exercised N(d1) and N(d2) will be close to ________.

A)1; 0

B)0; 1

C)-1; 1

D)1: -1

A)1; 0

B)0; 1

C)-1; 1

D)1: -1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

In the Black-Scholes model as the share's price increases the values of N(d1) and N(d2) will ________ for a call and ________ for a put option.

A)increase; decrease

B)increase; increase

C)decrease; increase

D)decrease; decrease

A)increase; decrease

B)increase; increase

C)decrease; increase

D)decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

If you have an extremely 'bullish' outlook on the share market, you could attempt to maximise your rate of return by ________.

A)purchasing out-of-the-money call options

B)purchasing at-the-money bull spreads

C)purchasing in-the-money call options

D)purchasing at-the-money call options

A)purchasing out-of-the-money call options

B)purchasing at-the-money bull spreads

C)purchasing in-the-money call options

D)purchasing at-the-money call options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

Of the variables in the Black-Scholes OPM, the ________ is not directly observable.

A)price of the underlying asset

B)risk-free rate of interest

C)time to expiration

D)variance of the underlying asset return

A)price of the underlying asset

B)risk-free rate of interest

C)time to expiration

D)variance of the underlying asset return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

If you know that a call option will be profitably exercised then the Black-Scholes model price will simplify to ________.

A)S0 - X

B)X - S0

C)S0 - PV(X)

D)PV(X) - S0

A)S0 - X

B)X - S0

C)S0 - PV(X)

D)PV(X) - S0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

A high dividend payout will ________ the value of a call option and ________ the value of a put option.

A)increase; decrease

B)increase; increase

C)decrease; increase

D)decrease; decrease

A)increase; decrease

B)increase; increase

C)decrease; increase

D)decrease; decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

A one dollar increase in a share's price would result in ________ in the call option's value of ________ than one dollar.

A)a decrease; less

B)a decrease; more

C)an increase; less

D)an increase; more

A)a decrease; less

B)a decrease; more

C)an increase; less

D)an increase; more

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

Hedge ratios for long call position are ________ and hedge ratios for long put positions are ________.

A)negative; negative

B)negative; positive

C)positive; negative

D)positive; positive

A)negative; negative

B)negative; positive

C)positive; negative

D)positive; positive

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

Perfect dynamic hedging requires ________.

A)a smaller capital outlay than static hedging

B)less commission expense than static hedging

C)daily rebalancing

D)continuous rebalancing

A)a smaller capital outlay than static hedging

B)less commission expense than static hedging

C)daily rebalancing

D)continuous rebalancing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

If a share price increases, the price of a put option on the share will ________ and the price of a call option on the share will ________.

A)decrease; decrease

B)decrease; increase

C)increase; decrease

D)increase; increase

A)decrease; decrease

B)decrease; increase

C)increase; decrease

D)increase; increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Black-Scholes hedge ratio for a long call option is equal to ________.

A)N(d1)

B)N(d2)

C)N(d1) - 1

D)N(d2) - 1

A)N(d1)

B)N(d2)

C)N(d1) - 1

D)N(d2) - 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is a true statement?

A)The actual value of a call option is greater than its intrinsic value prior to expiration.

B)The intrinsic value of a call option is always greater than its time value prior to expiration.

C)The intrinsic value of a call option is always positive prior to expiration.

D)The intrinsic value of a call option is greater than its actual value prior to expiration.

A)The actual value of a call option is greater than its intrinsic value prior to expiration.

B)The intrinsic value of a call option is always greater than its time value prior to expiration.

C)The intrinsic value of a call option is always positive prior to expiration.

D)The intrinsic value of a call option is greater than its actual value prior to expiration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

According to the put-call parity theorem, the payoffs associated with ownership of a call option can be replicated by ________.

A)shorting the underlying share, borrowing the present value of the exercise price and writing a put on the same underlying share and with the same exercise price

B)buying the underlying share, borrowing the present value of the exercise price and buying a put on the same underlying share and with the same exercise price

C)buying the underlying share, borrowing the present value of the exercise price and writing a put on the same underlying share and with the same exercise price

D)shorting the underlying share, lending the present value of the exercise price and buying a put on the same underlying share and with the same exercise price

A)shorting the underlying share, borrowing the present value of the exercise price and writing a put on the same underlying share and with the same exercise price

B)buying the underlying share, borrowing the present value of the exercise price and buying a put on the same underlying share and with the same exercise price

C)buying the underlying share, borrowing the present value of the exercise price and writing a put on the same underlying share and with the same exercise price

D)shorting the underlying share, lending the present value of the exercise price and buying a put on the same underlying share and with the same exercise price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

The current share price of Alcoa is $70 and the share does not pay dividends. The instantaneous risk free rate of return is 6%. The instantaneous standard deviation of Alcoa's shares is 40%. A put option on this share with an exercise price of $75 and an expiration date 30 days from now. According to the Black-Scholes OPM, you should hold ________ shares of stock per 100 put options to hedge your risk.

A)30

B)34

C)69

D)74

A)30

B)34

C)69

D)74

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

The delta of a put option on a share is always ________.

A)between zero and -1

B)between -1 and 1

C)positive but less than 1

D)greater than 1

A)between zero and -1

B)between -1 and 1

C)positive but less than 1

D)greater than 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

What combination of variables is likely to lead to the lowest time value?

A)Short time to expiration and low volatility

B)Long time to expiration and high volatility

C)Short time to expiration and high volatility

D)Long time to expiration and low volatility

A)Short time to expiration and low volatility

B)Long time to expiration and high volatility

C)Short time to expiration and high volatility

D)Long time to expiration and low volatility

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck