Deck 18: Portfolio Performance Evaluation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/54

العب

ملء الشاشة (f)

Deck 18: Portfolio Performance Evaluation

1

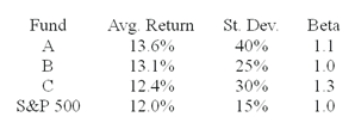

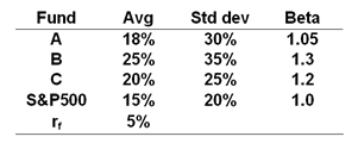

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

A)Fund A

B)Fund B

C)Fund C

D)indeterminable

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.A)Fund A

B)Fund B

C)Fund C

D)indeterminable

B

2

Which one of the following averaging methods is the preferred method of constructing returns series for use in evaluating portfolio performance?

A)Geometric average

B)Arithmetic average

C)Dollar-weighted

D)Internal

A)Geometric average

B)Arithmetic average

C)Dollar-weighted

D)Internal

A

3

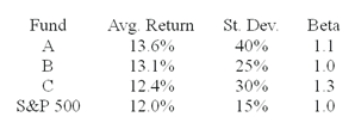

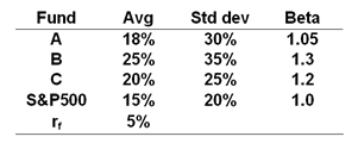

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

A)Fund A

B)Fund B

C)Fund C

D)S&P500

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.A)Fund A

B)Fund B

C)Fund C

D)S&P500

B

4

A managed portfolio has a standard deviation equal to 22% and a beta of 0.9 when the market portfolio's standard deviation is 26%. The adjusted portfolio P________ needed to calculate the M2 measure will have ________ invested in the managed portfolio and the rest in T-bonds.

A)84.6%

B)118%

C)18%

D)15.4%

A)84.6%

B)118%

C)18%

D)15.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

5

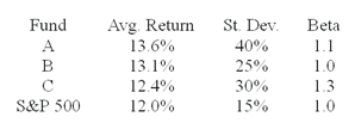

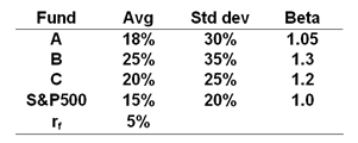

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

A)Fund A

B)Fund B

C)Fund C

D)indeterminable

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.A)Fund A

B)Fund B

C)Fund C

D)indeterminable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

6

Probably the biggest problem with evaluating portfolio performance of actively managed funds is the assumption that ________.

A)the markets are efficient

B)portfolio risk is constant over time

C)diversification pays off

D)security selection is more valuable than asset allocation

A)the markets are efficient

B)portfolio risk is constant over time

C)diversification pays off

D)security selection is more valuable than asset allocation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

7

The M2 measure is a variant of ________.

A)the Sharpe measure

B)the Treynor measure

C)Jensen's alpha

D)the appraisal ratio

A)the Sharpe measure

B)the Treynor measure

C)Jensen's alpha

D)the appraisal ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

8

The ________ calculates the reward-to-risk trade-off by dividing the average portfolio excess return by the portfolio beta.

A)Sharpe measure

B)Treynor measure

C)Jensen measure

D)appraisal ratio

A)Sharpe measure

B)Treynor measure

C)Jensen measure

D)appraisal ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which one of the following performance measures is the Sharpe measure?

A)Average excess return to beta ratio

B)Average excess return to standard deviation ratio

C)Alpha to standard deviation of residuals ratio

D)Average return minus required return

A)Average excess return to beta ratio

B)Average excess return to standard deviation ratio

C)Alpha to standard deviation of residuals ratio

D)Average return minus required return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which one of the following is largely based on forecasts of macroeconomic factors?

A)Security selection

B)Passive investing

C)Market efficiency

D)Market timing

A)Security selection

B)Passive investing

C)Market efficiency

D)Market timing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

11

Your return will generally be higher using the ________ if you time your transactions poorly and your return will generally be higher using the ________ if you time your transactions well.

A)dollar-weighted return method; dollar-weighted return method

B)dollar-weighted return method; time-weighted return method

C)time-weighted return method; dollar-weighted return method

D)time-weighted return method; time-weighted return method

A)dollar-weighted return method; dollar-weighted return method

B)dollar-weighted return method; time-weighted return method

C)time-weighted return method; dollar-weighted return method

D)time-weighted return method; time-weighted return method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consider the Sharpe and Treynor performance measures. When a pension fund is large and well diversified in total and it has many managers, the ________ measure is better for evaluating individual managers while the ________ measure is better for evaluating the manager of a small fund with only one manager responsible for all investments that may not be fully diversified.

A)Sharpe; Sharpe

B)Sharpe; Treynor

C)Treynor; Sharpe

D)Treynor; Treynor

A)Sharpe; Sharpe

B)Sharpe; Treynor

C)Treynor; Sharpe

D)Treynor; Treynor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

13

The comparison universe is ________.

A)the bogey portfolio

B)a set of mutual funds with similar risk characteristics to your mutual fund

C)the set of all mutual funds in the USA

D)the set of all mutual funds in the world

A)the bogey portfolio

B)a set of mutual funds with similar risk characteristics to your mutual fund

C)the set of all mutual funds in the USA

D)the set of all mutual funds in the world

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

14

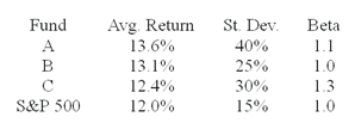

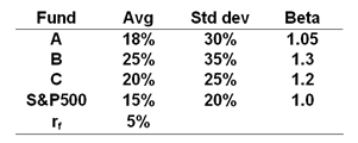

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?

A)0.43%

B)1.25%

C)1.77%

D)1.43%

What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?A)0.43%

B)1.25%

C)1.77%

D)1.43%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

15

Suppose that over the same period two portfolios have the same average return and the same standard deviation of return, but Portfolio A has a higher beta than Portfolio B. According to the Sharpe measure, the performance of Portfolio A ________.

A)is better than the performance of Portfolio B

B)is the same as the performance of Portfolio B

C)is poorer than the performance of Portfolio B

D)cannot be measured since there is no data on the alpha of the portfolio

A)is better than the performance of Portfolio B

B)is the same as the performance of Portfolio B

C)is poorer than the performance of Portfolio B

D)cannot be measured since there is no data on the alpha of the portfolio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

16

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.  What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?

A)12.4%

B)2.38%

C)0.91%

D)3.64%

What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?A)12.4%

B)2.38%

C)0.91%

D)3.64%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

17

Perfect timing ability is equivalent to having ________ on the market portfolio.

A)a call option

B)a futures contract

C)a put option

D)a forward contract

A)a call option

B)a futures contract

C)a put option

D)a forward contract

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

18

The M2 measure of portfolio performance was developed by ________.

A)Modigliani and Treynor

B)Modigliani and Modigliani

C)Merton and Miller

D)Fama and French

A)Modigliani and Treynor

B)Modigliani and Modigliani

C)Merton and Miller

D)Fama and French

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

19

Henriksson found that, on average, betas of funds ________ during market advances.

A)decreased slightly

B)decreased very significantly

C)increased slightly

D)increased very significantly

A)decreased slightly

B)decreased very significantly

C)increased slightly

D)increased very significantly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

20

The contribution of security selection within asset classes to the total excess return was ________.

A)1.5%

B)2.0%

C)2.5%

D)3.5% (.12 - .10.20 + (.1700 - .1500).80 = .0200

A)1.5%

B)2.0%

C)2.5%

D)3.5% (.12 - .10.20 + (.1700 - .1500).80 = .0200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

21

The critical variable in the determination of the success of the active portfolio is the share's ________.

A)alpha/non-systematic risk

B)alpha/systematic risk

C)delta/non-systematic risk

D)delta/systematic risk

A)alpha/non-systematic risk

B)alpha/systematic risk

C)delta/non-systematic risk

D)delta/systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

22

Assume you purchased a rental property for $100 000 and sold it one year later for $115 000 (there was no mortgage on the property). At the time of the sale, you paid $3 000 in commissions and $1 000 in taxes. If you received $10 000 in rental income (all received at the end of the year), what annual rate of return did you earn?

A)6%

B)11%

C)20%

D)25%

A)6%

B)11%

C)20%

D)25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

23

The market timing form of active portfolio management relies on ________ forecasting and the security selection form of active portfolio management relies on ________ forecasting.

A)macroeconomic; macroeconomic

B)macroeconomic; microeconomic

C)microeconomic; macroeconomic

D)microeconomic; microeconomic

A)macroeconomic; macroeconomic

B)macroeconomic; microeconomic

C)microeconomic; macroeconomic

D)microeconomic; microeconomic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

24

Shares A and B have alphas of .01 and betas of .90. Share A has a residual variance of .020 while share B has a residual variance of .016. If Share A represents 2% of an active portfolio, share B should represent ________ of an active portfolio.

A)1.6%

B)2.0%

C)2.2%

D)2.5%

A)1.6%

B)2.0%

C)2.2%

D)2.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

25

Consider the theory of active portfolio management. Shares A and B have the same beta and non-systematic risk. Share A has higher positive alpha than share B. You should want ________ in your active portfolio.

A)equal proportions of shares A and B

B)more of Share A than Share B

C)more of Share B than Share A

D)more information is needed to answer this question

A)equal proportions of shares A and B

B)more of Share A than Share B

C)more of Share B than Share A

D)more information is needed to answer this question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

26

Active portfolio managers try to construct a risky portfolio with ________.

A)a higher Sharpe measure than a passive strategy

B)a lower Sharpe measure than a passive strategy

C)the same Sharpe measure as a passive strategy

D)very few securities

A)a higher Sharpe measure than a passive strategy

B)a lower Sharpe measure than a passive strategy

C)the same Sharpe measure as a passive strategy

D)very few securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

27

The correct measure of timing ability is ________ for a portfolio manager who correctly forecasts 55% of bull markets and 55% of bear markets.

A)-5%

B)5%

C)10%

D)95%

A)-5%

B)5%

C)10%

D)95%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

28

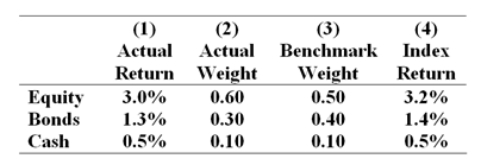

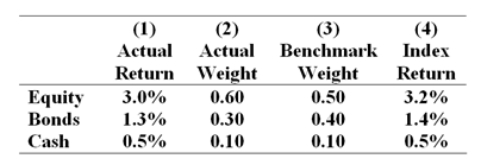

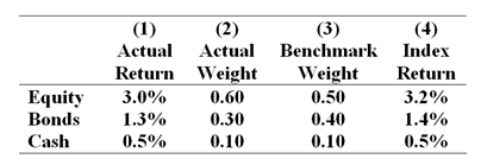

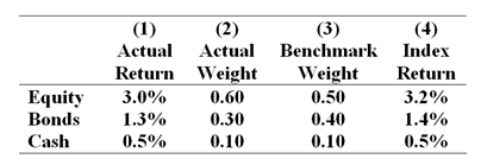

The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3) and the returns of sector indexes in column (4).  What was the bogey's return in the month?

What was the bogey's return in the month?

A)2.07%

B)2.21%

C)2.24%

D)4.80%

What was the bogey's return in the month?

What was the bogey's return in the month?A)2.07%

B)2.21%

C)2.24%

D)4.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

29

The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3) and the returns of sector indexes in column (4).  What was the manager's return in the month?

What was the manager's return in the month?

A)2.07%

B)2.21%

C)2.24%

D)4.80%

What was the manager's return in the month?

What was the manager's return in the month?A)2.07%

B)2.21%

C)2.24%

D)4.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

30

A market timing strategy is one where asset allocation in the share market ________ when one forecasts the share market will outperform treasury bonds.

A)decreases

B)increases

C)remains the same

D)may increase or decrease

A)decreases

B)increases

C)remains the same

D)may increase or decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

31

Portfolio managers Paul Martin and Kevin Krueger each manage $1 000 000 funds. Paul Martin has perfect foresight and the call option value of his perfect foresight is $150 000. Kevin Krueger is an imperfect forecaster and correctly predicts 50% of all bull markets and 70% of all bear markets. The correct measure of timing ability for Kevin Krueger is ________.

A)20%

B)60%

C)75%

D)120%

A)20%

B)60%

C)75%

D)120%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

32

If an investor is a successful market timer, his distribution of monthly portfolio returns will ________.

A)be skewed to the left

B)be skewed to the right

C)exhibit kurtosis

D)exhibit neither skewedness nor kurtosis

A)be skewed to the left

B)be skewed to the right

C)exhibit kurtosis

D)exhibit neither skewedness nor kurtosis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

33

Consider the theory of active portfolio management. Shares A and B have the same positive alpha and the same non-systematic risk. Share A has a higher beta than share B. You should want ________ in your active portfolio.

A)equal proportions of Shares A and B

B)more of Share A than Share B

C)more of Share B than Share A

D)more information is needed to answer this question

A)equal proportions of Shares A and B

B)more of Share A than Share B

C)more of Share B than Share A

D)more information is needed to answer this question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

34

It is very hard to statistically verify abnormal fund performance because of all except which one of the following?

A)Inevitably some fund managers experience streaks of good performance that may just be due to luck

B)The noise in realised rates of return is so large as to make it hard to identify abnormal performance in competitive markets

C)Portfolio composition is rarely stable long enough to identify abnormal performance

D)Even if successful, there is really not much value to be added by active strategies such as market timing

A)Inevitably some fund managers experience streaks of good performance that may just be due to luck

B)The noise in realised rates of return is so large as to make it hard to identify abnormal performance in competitive markets

C)Portfolio composition is rarely stable long enough to identify abnormal performance

D)Even if successful, there is really not much value to be added by active strategies such as market timing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

35

A passive benchmark portfolio is ________.

I) a portfolio where the asset allocation across broad asset classes is neutral and not determined by forecasts of performance of the different asset classes

II) one where an indexed portfolio is held within each asset class

III) often called the bogey

A)I only

B)I and III only

C)II and III only

D)I, II and III

I) a portfolio where the asset allocation across broad asset classes is neutral and not determined by forecasts of performance of the different asset classes

II) one where an indexed portfolio is held within each asset class

III) often called the bogey

A)I only

B)I and III only

C)II and III only

D)I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

36

Portfolio performance is often decomposed into various subcomponents such as the return due to ________.

I) broad asset allocation across security classes

II) sector weightings within equity markets

III) security selection with a given sector

The decision that contributes most to the fund performance is:

A)I

B)II

C)III

D)All contribute equally to fund performance

I) broad asset allocation across security classes

II) sector weightings within equity markets

III) security selection with a given sector

The decision that contributes most to the fund performance is:

A)I

B)II

C)III

D)All contribute equally to fund performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

37

Portfolio managers Paul Martin and Kevin Krueger each manage $1 000 000 funds. Paul Martin has perfect foresight and the call option value of his perfect foresight is $150 000. Kevin Krueger is an imperfect forecaster and correctly predicts 50% of all bull markets and 70% of all bear markets. The value of Kevin Krueger's imperfect forecasting ability is ________.

A)$30 000

B)$67 500

C)$108 750

D)$217 500

A)$30 000

B)$67 500

C)$108 750

D)$217 500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

38

In the Treynor-Black model, the weight of each analysed security in the portfolio should be proportional to its ________.

A)alpha/beta

B)alpha/residual variance

C)beta/residual variance

D)none of the above

A)alpha/beta

B)alpha/residual variance

C)beta/residual variance

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

39

Active portfolio management consists of ________.

I) market timing

II) security selection

III) sector selection within given markets

IV) indexing

A)I and II only

B)II and III only

C)I, II and III only

D)I, II, III and IV

I) market timing

II) security selection

III) sector selection within given markets

IV) indexing

A)I and II only

B)II and III only

C)I, II and III only

D)I, II, III and IV

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

40

In performance measurement the bogey portfolio is designed to ________.

A)measure the returns to a completely passive strategy

B)measure the returns to a similar active strategy

C)measure the returns to a given investment style

D)equal the return on the S&P500

A)measure the returns to a completely passive strategy

B)measure the returns to a similar active strategy

C)measure the returns to a given investment style

D)equal the return on the S&P500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the contribution of security selection to relative performance?

A)-0.15%

B)0.15%

C)-0.3%

D)0.3%

A)-0.15%

B)0.15%

C)-0.3%

D)0.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

42

Morningstar's RAR produce results which are similar but not identical to ________.

A)Jensen's alpha

B)M2

C)the Treynor ratio

D)the Sharpe ratio

A)Jensen's alpha

B)M2

C)the Treynor ratio

D)the Sharpe ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

43

Empirical tests to date show ________.

A)that many investors have earned large rewards by market timing

B)little evidence of market timing ability

C)clear cut evidence of substantial market timing ability

D)evidence that absolutely no market timing ability exists

A)that many investors have earned large rewards by market timing

B)little evidence of market timing ability

C)clear cut evidence of substantial market timing ability

D)evidence that absolutely no market timing ability exists

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

44

A portfolio generates an annual return of 13%, a beta of 0.7 and a standard deviation of 17%. The market index return is 14% and has a standard deviation of 21%. What is Jensen's alpha of the portfolio if the risk-free rate is 5%?

A).017

B).034

C).067

D).078

A).017

B).034

C).067

D).078

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

45

A portfolio generates an annual return of 17%, a beta of 1.2 and a standard deviation of 19%. The market index return is 12% and has a standard deviation of 16%. What is the M2 measure of the portfolio if the risk-free rate is 4%?

A)2.15%

B)2.76%

C)2.94%

D)3.14%

A)2.15%

B)2.76%

C)2.94%

D)3.14%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

46

Consider the theory of active portfolio management. Shares A and B have the same beta and the same positive alpha. Share A has higher non-systematic risk than share B. You should want ________ in your active portfolio.

A)equal proportions of shares A and B

B)more of Share A than Share B

C)more of Share B than Share A

D)more information is needed to answer this question

A)equal proportions of shares A and B

B)more of Share A than Share B

C)more of Share B than Share A

D)more information is needed to answer this question

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

47

A portfolio generates an annual return of 13%, a beta of 0.7 and a standard deviation of 17%. The market index return is 14% and has a standard deviation of 21%. What is the Sharpe measure of the portfolio if the risk-free rate is 5%?

A).3978

B).4158

C).4563

D).4706

A).3978

B).4158

C).4563

D).4706

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

48

A portfolio generates an annual return of 13%, a beta of 0.7 and a standard deviation of 17%. The market index return is 14% and has a standard deviation of 21%. What is the Treynor measure of the portfolio if the risk-free rate is 5%?

A).1143

B).1233

C).1354

D).1477

A).1143

B).1233

C).1354

D).1477

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

49

A portfolio generates an annual return of 13%, a beta of 0.7 and a standard deviation of 17%. The market index return is 14% and has a standard deviation of 21%. What is the M2 measure of the portfolio if the risk-free rate is 5%?

A)0.58%

B)0.68%

C)0.78%

D)0.88%

A)0.58%

B)0.68%

C)0.78%

D)0.88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

50

An attribution analysis will NOT likely contain which of the following components?

A)Asset allocation

B)Index returns

C)Risk-free returns

D)Security selection

A)Asset allocation

B)Index returns

C)Risk-free returns

D)Security selection

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

51

The portfolio that contains the benchmark asset allocation against which a manager will be measured is often called ________.

A)the bogey portfolio

B)the Vanguard Index

C)Jensen's alpha

D)the Treynor measure

A)the bogey portfolio

B)the Vanguard Index

C)Jensen's alpha

D)the Treynor measure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

52

What is the contribution of asset allocation to relative performance?

A)-0.18%

B)0.18%

C)-0.15%

D)0.15%

A)-0.18%

B)0.18%

C)-0.15%

D)0.15%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

53

What was the manager's over- or under-performance for the month?

A)Under-performance = 0.03%

B)Over-performance = 0.03%

C)Over-performance = 0.14%

D)Under-performance = 3%

A)Under-performance = 0.03%

B)Over-performance = 0.03%

C)Over-performance = 0.14%

D)Under-performance = 3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck

54

A fund has excess performance of 1.5%. In looking at the fund's investment breakdown you see that the fund overweighed equities relative to the benchmark and the average return on the fund's equity portfolio was slightly lower than the equity benchmark return. The excess performance for this fund is probably due to ________.

A)security selection ability

B)better sector weightings in the equity portfolio

C)the asset allocation decision

D)finding securities with positive alphas

A)security selection ability

B)better sector weightings in the equity portfolio

C)the asset allocation decision

D)finding securities with positive alphas

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 54 في هذه المجموعة.

فتح الحزمة

k this deck