Deck 3: Governmental Operating Statement Accounts Budgetary Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/80

العب

ملء الشاشة (f)

Deck 3: Governmental Operating Statement Accounts Budgetary Accounting

1

Government-wide financial statements include financial information for all governmental,proprietary,and fiduciary funds.

False

2

Program revenues are distinguished from general revenues on the government-wide statement of activities under GASB standards.

True

3

The legal level of budgetary control represents the administrative level at which expenditures may not exceed appropriations without a formal budgetary amendment.

True

4

Three categories of program revenues are reported in the statement of activities: charges for services,operating grants and contributions,and capital grants and contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

5

All encumbrances must be closed at year-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

6

Budgetary accounts used in the General Fund include Estimated Revenues,Estimated Other Financing Sources,Appropriations,Estimated Other Financing Uses,and Encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

7

The government-wide statement of net position displays the net expense or revenue for each function or program of the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

8

Available means that a revenue or other financing source is expected to be collected during the current fiscal period or within one month of the fiscal year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

9

"Available appropriation" is calculated as the difference between appropriations and the sum of expenditures and encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

10

All purchases of goods and services and all interfund transfers of the General Fund are recorded as Expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

11

Fund-based financial statements are intended to provide detailed financial information about the governmental,proprietary,and fiduciary activities of the primary government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

12

Expenses represent the costs to purchase goods or services,whereas expenditures represent the costs of a goods or services consumed or expired during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

13

An allotment may be described as an internal allocation of funds on a periodic basis usually agreed upon by the department heads and the chief executive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

14

An encumbrance represents the estimated future liability for goods or services resulting from placing a purchase order or signing a contract.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

15

Other financing sources increase fund balance in the same manner as revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

16

GASB standards require that all state and local governments present a statement of revenues,expenditures,and changes in fund balances-budget and actual for the General Fund and major special revenue funds for which annual budgets have been legally adopted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

17

When goods for which an encumbrance has been recorded are received at an invoiced amount that varies from the amount encumbered,the encumbrance is reversed in the amount of the actual invoiced cost of the goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

18

On the government-wide statement of activities,depreciation expense for assets that essentially benefit all functions,such as the city hall,may be reported as a separate line item or on the same line as the General Government or similar function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

19

The numerical difference between (1)current assets and deferred outflows and (2)current liabilities and deferred inflows recorded in governmental funds is denoted as net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

20

In the GASB reporting model,extraordinary items and special items must be reported as separate line items below General Revenues in the statement of activities to distinguish these nonrecurring items from normal recurring general revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

21

When an activity accounted for by the General Fund results in issuance of purchase orders or contracts for goods or services a record must be kept,but no journal entries in the General Fund are necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

22

When supplies ordered for use in an activity accounted for in the General Fund are received at an actual price that is more than the estimated price on the purchase order,the Encumbrance account is:

A) Debited for the estimated price on the purchase order.

B) Credited for the estimated price on the purchase order.

C) Debited for the actual price for the supplies received.

D) Credited for the actual price for the supplies received.

A) Debited for the estimated price on the purchase order.

B) Credited for the estimated price on the purchase order.

C) Debited for the actual price for the supplies received.

D) Credited for the actual price for the supplies received.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

23

Encumbrance accounting is required in the accounting for payroll of governmental funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following accounts of a government is credited when a purchase order is approved?

A) Encumbrances.

B) Encumbrances Outstanding.

C) Vouchers Payable.

D) Appropriations.

A) Encumbrances.

B) Encumbrances Outstanding.

C) Vouchers Payable.

D) Appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following best describes the recommended format for the government-wide statement of activities?

A) Program revenues minus expenses minus other revenues and expenses equals change in net position.

B) Program revenues plus general revenues minus expenses equals change in net position.

C) Program revenues minus expenses plus general revenues equals change in net position.

D) Expenses minus program revenues plus general revenues equals change in net position.

A) Program revenues minus expenses minus other revenues and expenses equals change in net position.

B) Program revenues plus general revenues minus expenses equals change in net position.

C) Program revenues minus expenses plus general revenues equals change in net position.

D) Expenses minus program revenues plus general revenues equals change in net position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following statements is not a statement about expenses that are directly related to a government function or program?

A) They are reported in the government-wide statement of activities at the government-wide level.

B) They include expenses that are specifically associated with a function or program.

C) They include interest on general long-term liabilities.

D) They include depreciation expense on capital assets that are clearly identified with a function or program.

A) They are reported in the government-wide statement of activities at the government-wide level.

B) They include expenses that are specifically associated with a function or program.

C) They include interest on general long-term liabilities.

D) They include depreciation expense on capital assets that are clearly identified with a function or program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

27

Extraordinary items and special items are reported on the government-wide statement of activities

A) With normal recurring general revenues.

B) As separate line items in the Function/Programs section of the statement of activities.

C) As separate line items below General Revenues in the statement of activities.

D) As separate line items above General Revenues.

A) With normal recurring general revenues.

B) As separate line items in the Function/Programs section of the statement of activities.

C) As separate line items below General Revenues in the statement of activities.

D) As separate line items above General Revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

28

Under the modified accrual basis of accounting used by the General Fund,financial resources are considered available if the revenue or other financing source is expected to be collected

A) Within 60 days after year-end.

B) Within 90 days after year-end.

C) During the current fiscal period.

D) During the current fiscal period or a reasonable time after year-end defined by each individual government.

A) Within 60 days after year-end.

B) Within 90 days after year-end.

C) During the current fiscal period.

D) During the current fiscal period or a reasonable time after year-end defined by each individual government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

29

The Expenditures control account of a government is debited when:

A) The supplies budget is recorded.

B) Supplies are ordered.

C) Supplies previously encumbered are received.

D) The invoice for supplies is paid.

A) The supplies budget is recorded.

B) Supplies are ordered.

C) Supplies previously encumbered are received.

D) The invoice for supplies is paid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

30

When the budget of a government is recorded and Appropriations exceeds Estimated Revenues,the Budgetary Fund Balance account is:

A) Credited at the beginning of the year and debited at the end of the year.

B) Credited at the beginning of the year and no entry is made at the end of the year.

C) Debited at the beginning of the year and no entry is made at the end of the year.

D) Debited at the beginning of the year and credited at the end of the year.

A) Credited at the beginning of the year and debited at the end of the year.

B) Credited at the beginning of the year and no entry is made at the end of the year.

C) Debited at the beginning of the year and no entry is made at the end of the year.

D) Debited at the beginning of the year and credited at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not a budgetary account?

A) Encumbrances.

B) Encumbrances Outstanding.

C) Estimated Revenues.

D) Appropriations.

A) Encumbrances.

B) Encumbrances Outstanding.

C) Estimated Revenues.

D) Appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is regarding other financing sources and other financing uses?

A) Both must be reported separately from revenues and expenditures in the statement of revenues, expenditures, and changes in fund balances.

B) These terms are used to distinguish program revenues or expenses from general revenues or expenses.

C) These terms are used for minor revenue or expenditure items that are peripheral to the government's mission.

D) Other financing sources are equivalent to gains and other financing uses are equivalent to losses.

A) Both must be reported separately from revenues and expenditures in the statement of revenues, expenditures, and changes in fund balances.

B) These terms are used to distinguish program revenues or expenses from general revenues or expenses.

C) These terms are used for minor revenue or expenditure items that are peripheral to the government's mission.

D) Other financing sources are equivalent to gains and other financing uses are equivalent to losses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following is not a category of program revenue reported on the statement of activities at the government-wide level?

A) General program revenues.

B) Charges for services.

C) Operating grants and contributions.

D) Capital grants and contributions.

A) General program revenues.

B) Charges for services.

C) Operating grants and contributions.

D) Capital grants and contributions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following items would not appear in a statement of revenues,expenditures,and changes in fund balances prepared for a governmental fund?

A) Depreciation expense.

B) Interfund transfers in.

C) Revenues from property taxes.

D) Expenditures for employee salaries.

A) Depreciation expense.

B) Interfund transfers in.

C) Revenues from property taxes.

D) Expenditures for employee salaries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following accounts is a budgetary account of a governmental fund?

A) Encumbrances Outstanding.

B) Appropriations.

C) Expenditures.

D) Other Financing Sources.

A) Encumbrances Outstanding.

B) Appropriations.

C) Expenditures.

D) Other Financing Sources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the budget for the General Fund is recorded,the required journal entry will include:

A) A credit to Estimated Revenues.

B) A debit to Encumbrances.

C) A credit to Appropriations.

D) A credit to Fund Balance.

A) A credit to Estimated Revenues.

B) A debit to Encumbrances.

C) A credit to Appropriations.

D) A credit to Fund Balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

37

An interim schedule comparing the detail of appropriations,expenditures,and encumbrances should be prepared on an appropriate periodic basis to determine whether appropriations are being expended at the expected rate for the period and for the budget year to date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following would always be classified as a general revenue?

A) Grant proceeds.

B) Special assessment charges for snow removal.

C) Library fines.

D) Fuel taxes earmarked for maintenance of roads and bridges.

A) Grant proceeds.

B) Special assessment charges for snow removal.

C) Library fines.

D) Fuel taxes earmarked for maintenance of roads and bridges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

39

The expenditure classification "Public Safety" is an example of which of the following types of classifications?

A) Activity.

B) Function.

C) Character.

D) Object.

A) Activity.

B) Function.

C) Character.

D) Object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

40

A statement of revenues,expenditures,and changes in fund balances-budget and actual is:

A) Required by GAAP for the General Fund, special revenue funds, and all other governmental fund types for which an annual budget has been adopted.

B) Required by GAAP for internal management reports only; not permitted for external financial reporting.

C) Required by GAAP for all governmental fund types.

D) Optional under GAAP, as long as a budgetary comparison schedule is presented.

A) Required by GAAP for the General Fund, special revenue funds, and all other governmental fund types for which an annual budget has been adopted.

B) Required by GAAP for internal management reports only; not permitted for external financial reporting.

C) Required by GAAP for all governmental fund types.

D) Optional under GAAP, as long as a budgetary comparison schedule is presented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

41

Fund balance may be classified as all of the following except:

A) Restricted.

B) Committed.

C) Uncommitted.

D) Assigned.

A) Restricted.

B) Committed.

C) Uncommitted.

D) Assigned.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

42

A liability is recorded in governmental funds when:

A) Goods or services are ordered.

B) Goods or services are received and the invoice is vouchered.

C) Invoices are paid.

D) The appropriation is reduced.

A) Goods or services are ordered.

B) Goods or services are received and the invoice is vouchered.

C) Invoices are paid.

D) The appropriation is reduced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following fund types uses the current financial resources measurement focus and modified accrual basis of accounting?

A) Enterprise fund.

B) Special revenue fund.

C) Investment trust fund.

D) Pension trust fund.

A) Enterprise fund.

B) Special revenue fund.

C) Investment trust fund.

D) Pension trust fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

44

One characteristic that distinguishes other financing sources from revenues is that other financing sources:

A) Arise from debt issuances or interfund transfers in.

B) Increase fund balances when they are closed at year-end.

C) Provide financial resources for the recipient fund.

D) Have a normal credit balance.

A) Arise from debt issuances or interfund transfers in.

B) Increase fund balances when they are closed at year-end.

C) Provide financial resources for the recipient fund.

D) Have a normal credit balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

45

The County Commission of Canyon County adopted its General Fund budget for the year ending June 30,comprising estimated revenues of $13,200,000 and appropriations of $12,900,000.The budgeted excess of estimated revenues over appropriations will be recorded as: A A credit to Surplus Revenues,$300,000.

B) A debit to Estimated Excess Revenues, $300,000.

C) A credit to Budgetary Fund Balance, $300,000.

D) A memorandum entry only.

B) A debit to Estimated Excess Revenues, $300,000.

C) A credit to Budgetary Fund Balance, $300,000.

D) A memorandum entry only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

46

Under the modified accrual basis of accounting,expenditures generally are not recognized until:

A) They are paid in cash.

B) An obligation is incurred that will be paid from currently available financial resources.

C) Goods or services are ordered.

D) They are approved by the legislative body.

A) They are paid in cash.

B) An obligation is incurred that will be paid from currently available financial resources.

C) Goods or services are ordered.

D) They are approved by the legislative body.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

47

The journal entry to record budgeted revenues will include:

A) A debit to Estimated Revenues.

B) A credit to Estimated Revenues.

C) A debit to Revenues Receivable.

D) Only a memorandum entry is necessary.

A) A debit to Estimated Revenues.

B) A credit to Estimated Revenues.

C) A debit to Revenues Receivable.

D) Only a memorandum entry is necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

48

The process by which a legal valuation is placed on taxable property is called:

A) An appropriation.

B) A property tax levy.

C) Property assessment.

D) Ad valorem determination.

A) An appropriation.

B) A property tax levy.

C) Property assessment.

D) Ad valorem determination.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

49

The expenditure classification "City Attorney" is an example of which of the following types of classification?

A) Function.

B) Organization unit.

C) Character.

D) Program.

A) Function.

B) Organization unit.

C) Character.

D) Program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

50

When the budget for the General Fund is recorded,the required journal entry will include:

A) A credit to Estimated Revenues.

B) A debit to Encumbrances.

C) A debit to Appropriations.

D) Either a debit or credit to Budgetary Fund Balance, as appropriate.

A) A credit to Estimated Revenues.

B) A debit to Encumbrances.

C) A debit to Appropriations.

D) Either a debit or credit to Budgetary Fund Balance, as appropriate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements is regarding the required disclosure of budgetary information?

A) All budgetary disclosures should be presented in the notes to the financial statements.

B) There is one specific format for presenting the budgetary comparison statement.

C) Budgetary comparisons may be presented as a statement or as required supplementary information (RSI).

D) The budgetary reconciliation must focus on the operating statement, but not the statement of position.

A) All budgetary disclosures should be presented in the notes to the financial statements.

B) There is one specific format for presenting the budgetary comparison statement.

C) Budgetary comparisons may be presented as a statement or as required supplementary information (RSI).

D) The budgetary reconciliation must focus on the operating statement, but not the statement of position.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

52

The account "Interfund Transfers In" would be classified in a General Fund statement of revenues,expenditures,and changes in fund balance as a(an):

A) Revenue.

B) Other financing use.

C) Other financing source.

D) Current liability.

A) Revenue.

B) Other financing use.

C) Other financing source.

D) Current liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following depict the typical order of steps in the acquisition of goods and services by an activity accounted for by the General Fund?

A) Appropriation, disbursement, encumbrance, expenditure.

B) Appropriation, encumbrance, expenditure, disbursement.

C) Encumbrance, appropriation, expenditure, disbursement.

D) Encumbrance, appropriation, expenditure, disbursement.

A) Appropriation, disbursement, encumbrance, expenditure.

B) Appropriation, encumbrance, expenditure, disbursement.

C) Encumbrance, appropriation, expenditure, disbursement.

D) Encumbrance, appropriation, expenditure, disbursement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following neither increases nor decreases fund balance of the General Fund during the current period?

A) Deferred inflows of resources.

B) Revenues.

C) Expenditures.

D) Other financing sources.

A) Deferred inflows of resources.

B) Revenues.

C) Expenditures.

D) Other financing sources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

55

The expenditure classification "Current Expenditures" is an example of which of the following types of classifications?

A) Activity.

B) Character.

C) Function.

D) Object.

A) Activity.

B) Character.

C) Function.

D) Object.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

56

When equipment that is to be used by the General Fund is received,how should it be recorded?

A) Capital Asset.

B) Appropriation.

C) Encumbrances.

D) Expenditure.

A) Capital Asset.

B) Appropriation.

C) Encumbrances.

D) Expenditure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

57

The County Commission of Seminole County adopted its General Fund budget for the year ending June 30,comprising estimated revenues of $13,200,000 and appropriations of $12,900,000.Seminole County utilizes the budgetary accounts required by GASB standards.The journal entry to record budgeted appropriations will include:

A) A credit to Appropriations, $12,900,000.

B) A credit to Encumbrances, $12,900,000.

C) A debit to Estimated Expenditures, $12,900,000.

D) A credit to Budgetary Fund Balance, $12,900,000.

A) A credit to Appropriations, $12,900,000.

B) A credit to Encumbrances, $12,900,000.

C) A debit to Estimated Expenditures, $12,900,000.

D) A credit to Budgetary Fund Balance, $12,900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

58

When the budget of a government is adopted and Estimated Revenues exceed Appropriations,the excess is:

A) Credited to Budgetary Fund Balance.

B) Debited to Budgetary Fund Balance.

C) Debited to Encumbrances Outstanding.

D) Credited to Encumbrances Outstanding.

A) Credited to Budgetary Fund Balance.

B) Debited to Budgetary Fund Balance.

C) Debited to Encumbrances Outstanding.

D) Credited to Encumbrances Outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following terms refers to an actual cost rather than an estimate?

A) Budget.

B) Encumbrance.

C) Expenditure.

D) Appropriation.

A) Budget.

B) Encumbrance.

C) Expenditure.

D) Appropriation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following will increase the fund balance of a government at the end of the fiscal year?

A) The sum of revenues and other financing sources is more than the sum of expenditures and other financing uses.

B) Expenditures are more than the difference between revenues and the excess of other financing sources over other financing uses.

C) Revenues are less than the sum of expenditures, other financing sources, and other financing uses.

D) The sum of fund balance, revenues, and other financing sources is more than the sum of expenditures and other financing uses.

A) The sum of revenues and other financing sources is more than the sum of expenditures and other financing uses.

B) Expenditures are more than the difference between revenues and the excess of other financing sources over other financing uses.

C) Revenues are less than the sum of expenditures, other financing sources, and other financing uses.

D) The sum of fund balance, revenues, and other financing sources is more than the sum of expenditures and other financing uses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

61

If a state law requires that local governments prepare General Fund and special revenue fund budgets on a basis that differs from the basis of accounting required by generally accepted accounting principles (GAAP):

A) The actual amounts in the budgetary comparison schedule should be reported using the government's budgetary basis.

B) The actual amounts in the budgetary comparison schedule should be reported on the GAAP basis.

C) Both the budgeted and actual amounts in the budgetary comparison schedule should be reported on the GAAP basis; a separate budget-basis comparison schedule should be prepared for the appropriate state oversight body.

D) Only a budgetary comparison schedule prepared for the appropriate state oversight body is required.

A) The actual amounts in the budgetary comparison schedule should be reported using the government's budgetary basis.

B) The actual amounts in the budgetary comparison schedule should be reported on the GAAP basis.

C) Both the budgeted and actual amounts in the budgetary comparison schedule should be reported on the GAAP basis; a separate budget-basis comparison schedule should be prepared for the appropriate state oversight body.

D) Only a budgetary comparison schedule prepared for the appropriate state oversight body is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

62

How should depreciation expense be reported in the government-wide statement of activities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

63

An interfund transfer of $30,000 was made from the General Fund to the debt service fund.(No previous entries were made regarding this transaction).When this event occurred,indicate whether each of the following accounts of the General Fund should be debited (D),credited (C),or is not affected (N).

_____ 1.Interfund Loan to Debt Service Fund-Noncurrent.

_____ 2.Due from Debt Service Fund.

_____ 3.Cash.

_____ 4.Other Financing Uses-Interfund Transfers Out.

_____ 5.Encumbrances.

_____ 1.Interfund Loan to Debt Service Fund-Noncurrent.

_____ 2.Due from Debt Service Fund.

_____ 3.Cash.

_____ 4.Other Financing Uses-Interfund Transfers Out.

_____ 5.Encumbrances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

64

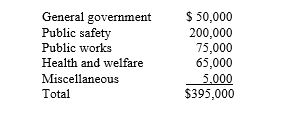

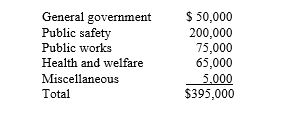

During July 2016,the first month of the 2017 fiscal year,the City of Jackson Hole issued the following purchase orders and contracts:

Show the summary general journal entry to record the issuance of the purchase orders and contracts.You may ignore entries in the subsidiary ledger accounts.

Show the summary general journal entry to record the issuance of the purchase orders and contracts.You may ignore entries in the subsidiary ledger accounts.

Show the summary general journal entry to record the issuance of the purchase orders and contracts.You may ignore entries in the subsidiary ledger accounts.

Show the summary general journal entry to record the issuance of the purchase orders and contracts.You may ignore entries in the subsidiary ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

65

GASB standards suggest the following classification scheme for expenditures:

A.Function

B.Program

C.Organization unit

D.Activity

E.Character

F.Object

For each of the following expenditure items,indicate its correct classification by placing the appropriate letter in the blank space next to the item.

____ 1.Streetlight repair

____ 2.City clerk

____ 3.Salaries and wages

____ 4.Transportation

____ 5.Current operating expenditures

A.Function

B.Program

C.Organization unit

D.Activity

E.Character

F.Object

For each of the following expenditure items,indicate its correct classification by placing the appropriate letter in the blank space next to the item.

____ 1.Streetlight repair

____ 2.City clerk

____ 3.Salaries and wages

____ 4.Transportation

____ 5.Current operating expenditures

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

66

Indicate whether the following revenues should be classified as program revenues or general revenues on the government-wide statement of activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

67

If supplies that were ordered by a department financed by the General Fund are received at an actual price that is less than the estimated price on the purchase order,the department's available balance of appropriations for supplies will be:

A) Decreased.

B) Increased.

C) Unaffected.

D) Either a or b, depending on the department's specific budgetary control procedures.

A) Decreased.

B) Increased.

C) Unaffected.

D) Either a or b, depending on the department's specific budgetary control procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

68

What benefits do financial statement users derive from the net (expense)revenue format used for the government-wide statement of activities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

69

At the time items for which purchase orders had previously been issued are received,indicate whether each of the following accounts of the General Fund should be debited (D),credited (C),or is not affected (N).

_____ 1.Encumbrances

_____ 2.Encumbrances Outstanding

_____ 3.Expenditures

_____ 4.Vouchers payable

_____ 5.Appropriations

_____ 1.Encumbrances

_____ 2.Encumbrances Outstanding

_____ 3.Expenditures

_____ 4.Vouchers payable

_____ 5.Appropriations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

70

Explain the difference between an expenditure and an expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

71

Define the term revenue and distinguish between revenue and other financing sources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

72

The Appropriations account of a governmental fund is credited when:

A) The budgetary accounts are closed.

B) The budget is recorded.

C) Supplies are purchased.

D) Expenditures are recorded.

A) The budgetary accounts are closed.

B) The budget is recorded.

C) Supplies are purchased.

D) Expenditures are recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

73

The revenue classifications recommended by GASB standards are listed below:

A.Taxes

B.Licenses and permits

C.Intergovernmental revenue

D.Charges for services

E.Fines and forfeits

F.Miscellaneous

For each revenue source listed below indicate its correct classification by placing the appropriate letter in the blank space next to the item.

____ 1.Capital grant received by a city from a state

____ 2.Property tax levied by city

____ 3.Library use fees

____ 4.Building permit

____ 5.Speeding ticket

A.Taxes

B.Licenses and permits

C.Intergovernmental revenue

D.Charges for services

E.Fines and forfeits

F.Miscellaneous

For each revenue source listed below indicate its correct classification by placing the appropriate letter in the blank space next to the item.

____ 1.Capital grant received by a city from a state

____ 2.Property tax levied by city

____ 3.Library use fees

____ 4.Building permit

____ 5.Speeding ticket

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

74

How might a citizen become involved in the local government budgeting process?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

75

For what funds do budgetary comparisons need to be presented in connection with the basic financial statements?

A) General Fund.

B) General Fund and all major funds.

C) All governmental funds with legally adopted annual budgets.

D) General Fund and major special revenue funds for which a budget is legally adopted.

A) General Fund.

B) General Fund and all major funds.

C) All governmental funds with legally adopted annual budgets.

D) General Fund and major special revenue funds for which a budget is legally adopted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

76

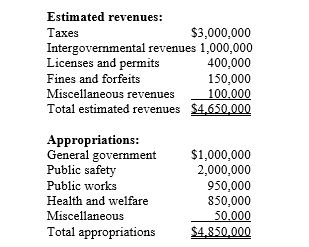

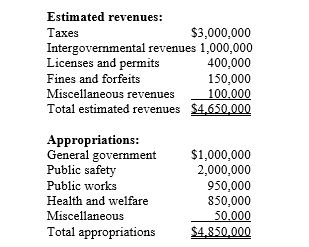

The City of Jackson Hole adopted the following General Fund budget for fiscal year 2017:

Estimated revenues:

Required

Required

Prepare a summary general journal entry to record the adopted budget at the beginning of FY 2017.You may ignore entries in the subsidiary ledger accounts.

Estimated revenues:

Required

RequiredPrepare a summary general journal entry to record the adopted budget at the beginning of FY 2017.You may ignore entries in the subsidiary ledger accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

77

The Encumbrances account is properly termed a:

A) Long-term liability.

B) Reservation of unassigned fund balance.

C) Budgetary account.

D) Current liability if paid within a year; otherwise, long-term debt.

A) Long-term liability.

B) Reservation of unassigned fund balance.

C) Budgetary account.

D) Current liability if paid within a year; otherwise, long-term debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

78

When computers are ordered by the mayor's office,the purchase order should be recorded in the General Fund as a debit to:

A) Encumbrances.

B) Equipment.

C) Expenditures.

D) Appropriations.

A) Encumbrances.

B) Equipment.

C) Expenditures.

D) Appropriations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

79

74.The City of Timberline recorded its FY 2017 property tax levy in the General Fund.It was estimated that $60,000 would be uncollectible.When the tax levy is recorded,indicate whether each of the following accounts of the General Fund should be debited (D),credited (C),or is not affected (N).

_____ 1.Taxes Receivable Current

_____ 2.Deferred Inflow of Resources

_____ 3.Estimated Uncollectible Current Taxes

_____ 4.Revenues

_____ 5.Estimated revenues

_____ 1.Taxes Receivable Current

_____ 2.Deferred Inflow of Resources

_____ 3.Estimated Uncollectible Current Taxes

_____ 4.Revenues

_____ 5.Estimated revenues

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck

80

The Expenditures control account of a government is credited when:

A) Supplies are ordered.

B) Supplies previously encumbered are received.

C) The budget is recorded.

D) Temporary accounts are closed out at the end of the year.

A) Supplies are ordered.

B) Supplies previously encumbered are received.

C) The budget is recorded.

D) Temporary accounts are closed out at the end of the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 80 في هذه المجموعة.

فتح الحزمة

k this deck