Deck 24: Performance Measurement and Responsibility Accounting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/163

العب

ملء الشاشة (f)

Deck 24: Performance Measurement and Responsibility Accounting

1

A department can never be considered to be a profit center.

False

2

A cost center does not directly generate revenues.

True

3

A department that is responsible for maximizing revenues is known as a profit center.

True

4

A selling department is usually evaluated as a profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

5

Departmental information is important and always disclosed to the public as part of the company's annual report and footnotes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

6

Evaluation of the performance of managers of profit centers assumes that the managers can control or influence both costs and revenue generation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

7

The concepts of direct costs and controllable costs are essentially the same; also,indirect costs and uncontrollable costs are essentially the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

8

Indirect expenses should be allocated to departments based upon the benefits received by each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

9

Joint costs can be allocated either using a physical basis or a value basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

10

A department's direct expenses can be entirely avoided if the department manager carefully controls and monitors operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

11

Evaluation of the performance of a department involves only financial measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

12

Generally,it does not matter how cost allocations are designed and explained,because most managers do not care whether the allocations appear to be fair or not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

13

Departmental wage expenses are direct expenses of that department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

14

Investment center is another name for profit center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

15

Direct costs require allocation across departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

16

A responsibility accounting performance report usually compares actual costs to budgeted costs amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

17

Joint costs are a group of several costs incurred in producing or purchasing a single product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

18

The number of hours that a department uses equipment and machinery is a reasonable basis for allocating depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

19

Advertising expense can be reasonably allocated to departments on the basis of sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

20

Controllable costs are the same as direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

21

A useful measure used to evaluate the performance of an investment center is investment center residual income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

22

Departmental income statements are prepared for operating as well as service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

23

A profit center:

A)Incurs costs, but does not directly generate revenues.

B)Incurs costs and directly generates revenues.

C)Has a manager who is evaluated solely on efficiency in controlling costs.

D)Incurs only indirect costs and directly generates revenues.

E)Incurs only indirect costs and generates revenues.

A)Incurs costs, but does not directly generate revenues.

B)Incurs costs and directly generates revenues.

C)Has a manager who is evaluated solely on efficiency in controlling costs.

D)Incurs only indirect costs and directly generates revenues.

E)Incurs only indirect costs and generates revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

24

Investment center managers are evaluated on their use of center assets to generate income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

25

Traditional two-stage cost allocation means that indirect costs are first allocated to both operating and service departments,then operating department costs are allocated to service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

26

A single basis for allocating service department costs to production departments should be used for all service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

27

An accounting system that provides information that management can use to evaluate the profitability and/or cost effectiveness of a department's activities is a:

A)Departmental accounting system.

B)Cost accounting system.

C)Service accounting system.

D)Revenue accounting system.

E)Standard accounting system.

A)Departmental accounting system.

B)Cost accounting system.

C)Service accounting system.

D)Revenue accounting system.

E)Standard accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

28

The difference between a profit center and an investment center is

A)an investment center incurs costs, but does not directly generate revenues.

B)an investment center incurs no costs but does generate revenues.

C)an investment center is responsible for effectively using center assets.

D)an investment center provides services to profit centers.

E)There is no difference; investment center and profit center are synonymous.

A)an investment center incurs costs, but does not directly generate revenues.

B)an investment center incurs no costs but does generate revenues.

C)an investment center is responsible for effectively using center assets.

D)an investment center provides services to profit centers.

E)There is no difference; investment center and profit center are synonymous.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

29

An example of a service department is the human resources department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

30

A measure used to evaluate the manager of an investment center is return on total costs for the investment center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

31

A cost center is a unit of a business that incurs costs but does not directly generate revenues.All of the following are considered cost centers except:

A)Accounting department.

B)Purchasing department.

C)Research department.

D)Advertising department.

E)All of these could be considered cost centers.

A)Accounting department.

B)Purchasing department.

C)Research department.

D)Advertising department.

E)All of these could be considered cost centers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

32

The process of preparing departmental income statements starts with allocating service departments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

33

An expense that does not require allocation between departments is a(n):

A)Common expense.

B)Indirect expense.

C)Direct expense.

D)Administrative expense.

E)All of the options are correct.

A)Common expense.

B)Indirect expense.

C)Direct expense.

D)Administrative expense.

E)All of the options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

34

Departmental contribution to overhead is the same as gross profit generated by that department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

35

A department that incurs costs without directly generating revenues is a:

A)Service center.

B)Production center.

C)Profit center.

D)Cost center.

E)Performance center.

A)Service center.

B)Production center.

C)Profit center.

D)Cost center.

E)Performance center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

36

A unit of a business that not only incurs costs,but also generates revenues,is called a:

A)Performance center.

B)Profit center.

C)Cost center.

D)Responsibility center.

E)Expense center.

A)Performance center.

B)Profit center.

C)Cost center.

D)Responsibility center.

E)Expense center.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

37

Return on investment is a useful measure to evaluate the performance of a cost center manager.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

38

In producing oat bran,the joint cost of milling the oats into bran,oatmeal,and animal feed is considered a direct cost to the oat bran,because the oat bran cannot be produced without incurring the joint cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

39

A joint cost of producing two products can be allocated between those products on the basis of the relative physical quantities of each product produced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

40

Departmental contribution to overhead is the amount of revenues for that department less its direct expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

41

An accounting system that provides information that management can use to evaluate the performance of a department's manager is called a:

A)Cost accounting system.

B)Managerial accounting system.

C)Responsibility accounting system.

D)Financial accounting system.

E)Activity-based accounting system.

A)Cost accounting system.

B)Managerial accounting system.

C)Responsibility accounting system.

D)Financial accounting system.

E)Activity-based accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

42

Within an organizational structure,the person most likely to be evaluated in terms of controllable costs would be:

A)A payroll clerk.

B)A cost center manager.

C)A production line worker.

D)A maintenance worker.

E)All of the individuals would be evaluated in terms of controllable costs.

A)A payroll clerk.

B)A cost center manager.

C)A production line worker.

D)A maintenance worker.

E)All of the individuals would be evaluated in terms of controllable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

43

A report that accumulates the actual costs that a manager is responsible for and their budgeted amounts is a:

A)Segmental accounting report.

B)Managerial cost report.

C)Controllable expense report.

D)Departmental accounting report.

E)Responsibility accounting performance report.

A)Segmental accounting report.

B)Managerial cost report.

C)Controllable expense report.

D)Departmental accounting report.

E)Responsibility accounting performance report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

44

Costs that the manager does not have the power to determine or at least strongly influence are:

A)Variable costs.

B)Uncontrollable costs.

C)Indirect costs.

D)Direct costs.

E)Joint costs.

A)Variable costs.

B)Uncontrollable costs.

C)Indirect costs.

D)Direct costs.

E)Joint costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

45

Costs that the manager has the power to determine or at least strongly influence are called:

A)Uncontrollable costs.

B)Controllable costs.

C)Joint costs.

D)Direct costs.

E)Indirect costs.

A)Uncontrollable costs.

B)Controllable costs.

C)Joint costs.

D)Direct costs.

E)Indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

46

A responsibility accounting system:

A)Is designed to measure the performance of managers in terms of controllable costs.

B)Assigns responsibility for costs to the appropriate managerial level that controls those costs.

C)Should not hold a manager responsible for costs over which the manager has no influence.

D)Can be applied at any level of an organization.

E)All of the choices are correct.

A)Is designed to measure the performance of managers in terms of controllable costs.

B)Assigns responsibility for costs to the appropriate managerial level that controls those costs.

C)Should not hold a manager responsible for costs over which the manager has no influence.

D)Can be applied at any level of an organization.

E)All of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

47

A responsibility accounting performance report displays:

A)Only actual costs.

B)Only budgeted costs.

C)Both actual costs and budgeted costs.

D)Only direct costs.

E)Only indirect costs.

A)Only actual costs.

B)Only budgeted costs.

C)Both actual costs and budgeted costs.

D)Only direct costs.

E)Only indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

48

The most useful allocation basis for the departmental costs of an advertising campaign for a storewide sale is likely to be:

A)Floor space of each department.

B)Relative number of items each department had on sale.

C)Number of customers to enter each department.

D)An equal amount of cost for each department.

E)Proportion of sales of each department.

A)Floor space of each department.

B)Relative number of items each department had on sale.

C)Number of customers to enter each department.

D)An equal amount of cost for each department.

E)Proportion of sales of each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

49

Plans that identify costs and expenses under each manager's control prior to the reporting period are called:

A)Cost accounting systems.

B)Managerial accounting systems.

C)Responsibility accounting systems.

D)Responsibility accounting budgets.

E)Activity-based accounting systems.

A)Cost accounting systems.

B)Managerial accounting systems.

C)Responsibility accounting systems.

D)Responsibility accounting budgets.

E)Activity-based accounting systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

50

The allocation bases for assigning indirect costs include:

A)Only physical bases.

B)Only cost bases.

C)Only value bases.

D)Only unit bases.

E)Any appropriate and reasonable bases.

A)Only physical bases.

B)Only cost bases.

C)Only value bases.

D)Only unit bases.

E)Any appropriate and reasonable bases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

51

In a responsibility accounting system:

A)Controllable costs are assigned to managers who are responsible for them.

B)Each accounting report contains all items allocated to a responsibility center.

C)Organized and clear lines of authority and responsibility are only incidental.

D)All managers at a given level have equal authority and responsibility.

E)All of the choices are correct.

A)Controllable costs are assigned to managers who are responsible for them.

B)Each accounting report contains all items allocated to a responsibility center.

C)Organized and clear lines of authority and responsibility are only incidental.

D)All managers at a given level have equal authority and responsibility.

E)All of the choices are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

52

Allocations of joint product costs can be based on the relative sales values of the products:

A)And never on the relative physical quantities of the products.

B)Plus an adjustment for future excess margins.

C)And not on any other basis.

D)At the "split-off point".

E)Only if the products contain both direct and indirect costs.

A)And never on the relative physical quantities of the products.

B)Plus an adjustment for future excess margins.

C)And not on any other basis.

D)At the "split-off point".

E)Only if the products contain both direct and indirect costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

53

Expenses that are easily traced and assigned to a specific department because they are incurred for the sole benefit of that department are called:

A)Direct expenses.

B)Indirect expenses.

C)Controllable expenses.

D)Uncontrollable expenses.

E)Fixed expenses.

A)Direct expenses.

B)Indirect expenses.

C)Controllable expenses.

D)Uncontrollable expenses.

E)Fixed expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

54

Expenses that are not easily associated with a specific department,and which are incurred for the benefit of more than one department,are:

A)Fixed expenses.

B)Indirect expenses.

C)Direct expenses.

D)Uncontrollable expenses.

E)Variable expenses.

A)Fixed expenses.

B)Indirect expenses.

C)Direct expenses.

D)Uncontrollable expenses.

E)Variable expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

55

Regardless of the system used in departmental cost analysis:

A)Direct costs are allocated, indirect costs are not.

B)Indirect costs are allocated, direct costs are not.

C)Both direct and indirect costs are allocated.

D)Neither direct nor indirect costs are allocated.

E)Total departmental costs will always be the same.

A)Direct costs are allocated, indirect costs are not.

B)Indirect costs are allocated, direct costs are not.

C)Both direct and indirect costs are allocated.

D)Neither direct nor indirect costs are allocated.

E)Total departmental costs will always be the same.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

56

A cost incurred in producing or purchasing two or more products at the same time is a(n):

A)Product cost.

B)Incremental cost.

C)Differential cost.

D)Joint cost.

E)Fixed cost.

A)Product cost.

B)Incremental cost.

C)Differential cost.

D)Joint cost.

E)Fixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

57

Responsibility accounting performance reports:

A)Become more detailed at higher levels of management.

B)Become less detailed at higher levels of management.

C)Are equally detailed at all levels of management.

D)Are useful in any format.

E)Are irrelevant.

A)Become more detailed at higher levels of management.

B)Become less detailed at higher levels of management.

C)Are equally detailed at all levels of management.

D)Are useful in any format.

E)Are irrelevant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

58

The most useful evaluation of a manager's cost performance is based on:

A)Controllable costs.

B)Contribution percentages.

C)Departmental contributions to overhead.

D)Uncontrollable expenses.

E)Direct costs.

A)Controllable costs.

B)Contribution percentages.

C)Departmental contributions to overhead.

D)Uncontrollable expenses.

E)Direct costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

59

The salaries of employees who spend all their time working in one department are:

A)Variable expenses.

B)Indirect expenses.

C)Direct expenses.

D)Responsibility expenses.

E)Unavoidable expenses.

A)Variable expenses.

B)Indirect expenses.

C)Direct expenses.

D)Responsibility expenses.

E)Unavoidable expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

60

A difficult problem in calculating the total costs and expenses of a department is:

A)Determining the gross profit ratio.

B)Assigning direct costs to the department.

C)Assigning indirect expenses to the department.

D)Determining the amount of sales of the department.

E)Determining the direct expenses of the department.

A)Determining the gross profit ratio.

B)Assigning direct costs to the department.

C)Assigning indirect expenses to the department.

D)Determining the amount of sales of the department.

E)Determining the direct expenses of the department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

61

Investment center managers are usually evaluated using performance measures

A)that combine income and assets.

B)that combine income and capital.

C)based on assets only.

D)based on income only.

E)that combine assets and capital.

A)that combine income and assets.

B)that combine income and capital.

C)based on assets only.

D)based on income only.

E)that combine assets and capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

62

Allocating joint costs to products can be based on their relative:

A)Sales values.

B)Direct costs.

C)Gross margins.

D)Total costs.

E)Variable costs.

A)Sales values.

B)Direct costs.

C)Gross margins.

D)Total costs.

E)Variable costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

63

General Chemical produced 10,000 gallons of Breon and 20,000 gallons of Baron.Joint costs incurred in producing the two products totaled $7,500.At the split-off point,Breon has a market value of $6.00 per gallon and Baron $2.00 per gallon.Compute the portion of the joint costs to be allocated to Breon if the value basis is used.

A)$2,500.

B)$3,000.

C)$4,500.

D)$5,625.

E)$1,500.

A)$2,500.

B)$3,000.

C)$4,500.

D)$5,625.

E)$1,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

64

A retail store has three departments,1,2,and 3,and does general advertising that benefits all departments.Advertising expense totaled $50,000 for the year,and departmental sales were as follows.Allocate advertising expense to Department 2 based on departmental sales. Department 1…………………………..$110,000

Department 2………………………….. 213,750

Department 3………………………….. 151,250

A)$11,000.

B)$14,000.

C)$16,667.

D)$22,500.

E)$50,000.

Department 2………………………….. 213,750

Department 3………………………….. 151,250

A)$11,000.

B)$14,000.

C)$16,667.

D)$22,500.

E)$50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

65

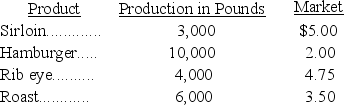

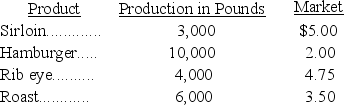

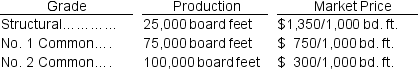

Breon Beef Company uses the relative market value method of allocating joint costs in its production of beef products.Relevant information for the current period follows:

The total joint cost for the current period was $43,000.How much of this cost should Breon Beef allocate to sirloin?

The total joint cost for the current period was $43,000.How much of this cost should Breon Beef allocate to sirloin?

A)$ 0.

B)$ 5,909.

C)$ 8,600.

D)$10,750.

E)$43,000.

The total joint cost for the current period was $43,000.How much of this cost should Breon Beef allocate to sirloin?

The total joint cost for the current period was $43,000.How much of this cost should Breon Beef allocate to sirloin?A)$ 0.

B)$ 5,909.

C)$ 8,600.

D)$10,750.

E)$43,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

66

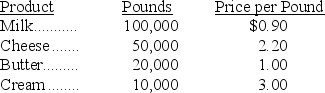

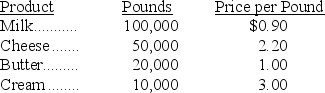

A dairy allocates the cost of unprocessed milk to the production of milk,cream,butter and cheese.For the current period,unprocessed milk was purchased for $240,000,and the following quantities of product and sales revenues were produced.  How much of the $240,000 cost should be allocated to milk?

How much of the $240,000 cost should be allocated to milk?

A)$ 0.

B)$ 86,400.

C)$ 90,000.

D)$133,333.

E)$240,000.

How much of the $240,000 cost should be allocated to milk?

How much of the $240,000 cost should be allocated to milk?A)$ 0.

B)$ 86,400.

C)$ 90,000.

D)$133,333.

E)$240,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

67

In a firm that manufactures clothing,the department that is responsible for actually assembling the garments could best be described as a:

A)Service department.

B)Operating or production department.

C)Cost center.

D)Department in which all of the costs incurred are direct expenses.

E)Department in which all of the costs incurred are indirect expenses.

A)Service department.

B)Operating or production department.

C)Cost center.

D)Department in which all of the costs incurred are direct expenses.

E)Department in which all of the costs incurred are indirect expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

68

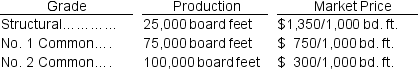

A sawmill paid $70,000 for logs that produced 200,000 board feet of lumber in 3 different grades and amounts as follows:

Compute the portion of the $70,000 joint cost to be allocated to No.2 Common.

Compute the portion of the $70,000 joint cost to be allocated to No.2 Common.

A)$ 0.

B)$17,500.

C)$23,333.

D)$35,000.

E)$70,000.

Compute the portion of the $70,000 joint cost to be allocated to No.2 Common.

Compute the portion of the $70,000 joint cost to be allocated to No.2 Common.A)$ 0.

B)$17,500.

C)$23,333.

D)$35,000.

E)$70,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

69

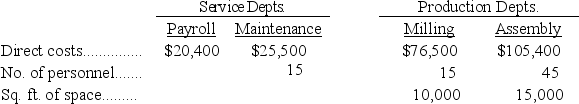

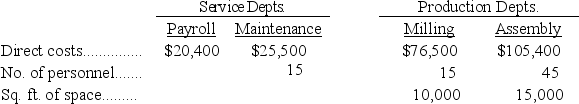

White Company has two service departments and two operating (production)departments.The Payroll Department services all three of the other departments in proportion to the number of employees in each.The Maintenance Department costs are allocated to the two operating departments in proportion to the floor space used by each.Listed below are the operating data for the current period:

The total cost of operating the Milling Department for the current period is:

The total cost of operating the Milling Department for the current period is:

A)$14,280.

B)$15,912.

C)$76,500.

D)$90,780.

E)$92,412.

The total cost of operating the Milling Department for the current period is:

The total cost of operating the Milling Department for the current period is:A)$14,280.

B)$15,912.

C)$76,500.

D)$90,780.

E)$92,412.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

70

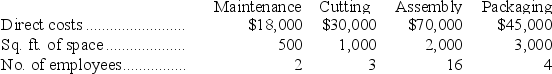

Dresden,Inc.has four departments.Information about these departments is listed below.If allocated maintenance cost is based on floor space occupied by each,compute the amount of maintenance cost allocated to the Cutting Department.

A)$ 2,769.

B)$ 3,000.

C)$ 3,724.

D)$ 6,000.

E)$18,000.

A)$ 2,769.

B)$ 3,000.

C)$ 3,724.

D)$ 6,000.

E)$18,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

71

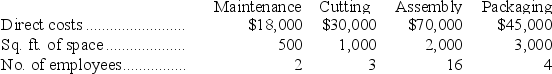

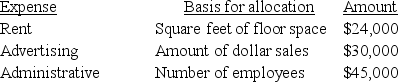

Mace Department store allocates its service department expenses to its various operating (sales)departments.The following data is available:

The following information is available for its three operating (sales)departments:

The following information is available for its three operating (sales)departments:

What is the total expense allocated to Department B?

What is the total expense allocated to Department B?

A)$29,375.

B)$30,462.

C)$30,500.

D)$30,775.

E)$32,160.

The following information is available for its three operating (sales)departments:

The following information is available for its three operating (sales)departments: What is the total expense allocated to Department B?

What is the total expense allocated to Department B?A)$29,375.

B)$30,462.

C)$30,500.

D)$30,775.

E)$32,160.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

72

A company rents a building with a total of 100,000 square feet,which are evenly divided between two floors.The space on the first floor is considered twice as valuable as that on the second floor.The total monthly rent for the building is $30,000.How much of the monthly rental expense should be allocated to a department that occupies 10,000 square feet on the first floor?

A)$6,000.

B)$5,000.

C)$3,000.

D)$4,000.

E)$2,000.

A)$6,000.

B)$5,000.

C)$3,000.

D)$4,000.

E)$2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

73

Wilson Trade School allocates administrative costs to its respective departments based on the number of students enrolled,while maintenance and utilities are allocated per square feet of the classrooms.Based on the information below,what is the total amount allocated to the Automotive Department (rounded to the nearest dollar)if administrative costs for the school were $50,000,maintenance fees were $12,000,and utilities were $6,000?

Department Students Classrooms

Electrical............ 120 10,000 sq.ft.

Automotive……. 70 12,000 sq.ft.

Secretarial……… 50 8,000 sq.ft.

Plumbing………. 40 6,000 sq.ft .

A)$ 0.

B)$17,000.

C)$18,500.

D)$22,667.

E)$30,000.

Department Students Classrooms

Electrical............ 120 10,000 sq.ft.

Automotive……. 70 12,000 sq.ft.

Secretarial……… 50 8,000 sq.ft.

Plumbing………. 40 6,000 sq.ft .

A)$ 0.

B)$17,000.

C)$18,500.

D)$22,667.

E)$30,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

74

Data pertaining to a company's joint production for the current period follows:

A B

Quantities produced…………………. 200 lbs.100 lbs.

Processing cost after

Products are separated…………….. $1,100 $400

Market value at point

Of separation………………………. $8/lb. $16/lb.

Compute the cost to be allocated to Product A for this period's $660 of joint costs if the value basis is used.

A)$330.00.

B)$440.00.

C)$220.00.

D)$194.12.

E)$484.00.

A B

Quantities produced…………………. 200 lbs.100 lbs.

Processing cost after

Products are separated…………….. $1,100 $400

Market value at point

Of separation………………………. $8/lb. $16/lb.

Compute the cost to be allocated to Product A for this period's $660 of joint costs if the value basis is used.

A)$330.00.

B)$440.00.

C)$220.00.

D)$194.12.

E)$484.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

75

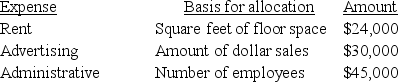

Farber,Inc.,has four departments.The Administrative Department costs are allocated to the other three departments based on the number of employees in each and the Maintenance Department costs are allocated to the Assembly and Packaging Departments based on their occupied space.Data for these departments follows:

The total amount of the Administrative Department's cost that would eventually be allocated to the Packaging Department is:

A)$ 4,800.

B)$12,000.

C)$10,000.

D)$18,000.

E)$13,000.

The total amount of the Administrative Department's cost that would eventually be allocated to the Packaging Department is:

A)$ 4,800.

B)$12,000.

C)$10,000.

D)$18,000.

E)$13,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

76

A sawmill bought a shipment of logs for $40,000.When cut,the logs produced a million board feet of lumber in the following grades.Compute the cost to be allocated to Type 1 and Type 2 lumber,respectively,if the value basis is used. Type 1 - 400,000 bd.ft.priced to sell at $0.12 per bd.ft.

Type 2 - 400,000 bd.ft.priced to sell at $0.06 per bd.ft.

Type 3 - 200,000 bd.ft.priced to sell at $0.04 per bd.ft.

A)$16,000; $16,000.

B)$13,333; $4,444.

C)$40,000; $24,000.

D)$24,000; $12,000.

E)$24,000; $8,000.

Type 2 - 400,000 bd.ft.priced to sell at $0.06 per bd.ft.

Type 3 - 200,000 bd.ft.priced to sell at $0.04 per bd.ft.

A)$16,000; $16,000.

B)$13,333; $4,444.

C)$40,000; $24,000.

D)$24,000; $12,000.

E)$24,000; $8,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

77

Able Company has two operating (production)departments: Assembly and Fabricating.Assembly has 150 employees and occupies 44,000 square feet; Fabricating has 100 employees and occupies 36,000 square feet.Indirect factory expenses for the current period are as follows:

Administration $ 80,000

Maintenance $100,000

Administration is allocated based on workers in each department; maintenance is allocated based on square footage.The total amount of indirect factory expenses that should be allocated to the Assembly Department for the current period is:

A)$ 48,000.

B)$ 55,000.

C)$103,000.

D)$104,000.

E)$110,000.

Administration $ 80,000

Maintenance $100,000

Administration is allocated based on workers in each department; maintenance is allocated based on square footage.The total amount of indirect factory expenses that should be allocated to the Assembly Department for the current period is:

A)$ 48,000.

B)$ 55,000.

C)$103,000.

D)$104,000.

E)$110,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

78

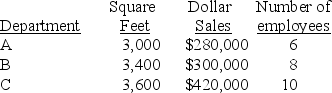

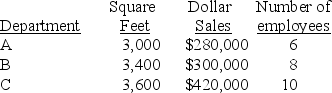

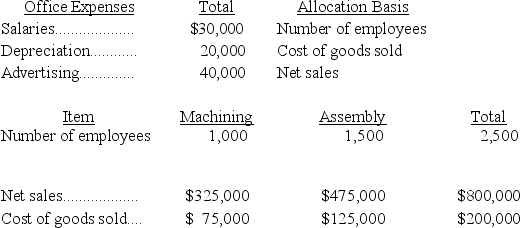

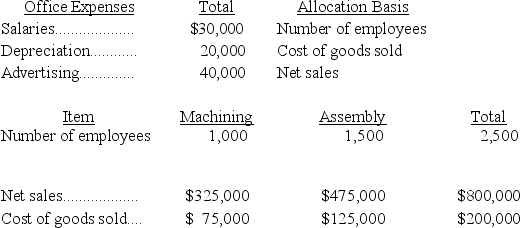

Baker Corporation has two operating departments,Machining and Assembly,and an office.The three categories of office expenses are allocated to the two departments using different allocation bases.The following information is available for the current period:

The amount of the total office expenses that should be allocated to Assembly for the current period is:

The amount of the total office expenses that should be allocated to Assembly for the current period is:

A)$ 35,750.

B)$ 45,000.

C)$ 54,250.

D)$ 90,000.

E)$600,000.

The amount of the total office expenses that should be allocated to Assembly for the current period is:

The amount of the total office expenses that should be allocated to Assembly for the current period is:A)$ 35,750.

B)$ 45,000.

C)$ 54,250.

D)$ 90,000.

E)$600,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

79

Calculating return on total assets for an investment center is defined by the following formula for an investment center:

A)Contribution margin/Ending assets.

B)Gross profit/Ending assets.

C)Net income/Ending assets.

D)Net income/Average invested assets.

E)Contribution margin/Average invested assets.

A)Contribution margin/Ending assets.

B)Gross profit/Ending assets.

C)Net income/Ending assets.

D)Net income/Average invested assets.

E)Contribution margin/Average invested assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck

80

A company pays $15,000 per period to rent a small building that has 10,000 square feet of space.This cost is allocated to the company's three departments on the basis of the amount and value of the space occupied by each.Department One occupies 2,000 square feet of ground-floor space,Department Two occupies 3,000 square feet of ground-floor space,and Department Three occupies 5,000 square feet of second-floor space.If rents for comparable floor space in the neighborhood average $2.20 per square foot for ground-floor space and $1.10 per square foot for second-floor space and the rent is allocated based on the total value of the space,Department One should be charged rent expense for the period of:

A)$4,400.

B)$4,000.

C)$3,000.

D)$2,200.

E)$2,000.

A)$4,400.

B)$4,000.

C)$3,000.

D)$2,200.

E)$2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 163 في هذه المجموعة.

فتح الحزمة

k this deck