Deck 9: Accounting for Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/170

العب

ملء الشاشة (f)

Deck 9: Accounting for Receivables

1

The quality of receivables refers to the likelihood of collection without loss.

True

2

If a credit card sale is made,the seller can either debit Cash or debit Accounts receivable at the time of the sale depending on the type of credit card.

True

3

If a customer owes interest on accounts receivable,Interest Revenue is debited and Accounts Receivable is credited.

False

4

The person that borrows money and signs a promissory note is called the payee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

5

A company borrowed $6,000 by signing a 4-month promissory note at 12%.The total interest on the note is $720.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

6

Credit sales are recorded by crediting an Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

7

A company factored $35,000 of its accounts receivable and was charged a 2% factoring fee.The journal entry to record this transaction would include a debit to Cash of $35,000,a debit to Factoring Fee Expense of $700,and credit to Accounts Receivable of $35,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

8

Companies can report credit card expense as a discount deducted from sales or as a selling expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

9

The maturity date of a note refers to the date the note must be repaid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

10

The formula for computing interest on a note is principal of the note times the annual interest rate times time expressed in fraction of year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

11

As long as a company accurately records total credit sales information,it is not necessary to have separate accounts for specific customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

12

Receivables can be used to obtain cash by either selling them or using them as security for a loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

13

Installment accounts receivable are classified as current assets,even though the installment period is more than one year,if the seller regularly offers customers such terms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

14

Since pledged accounts receivables only serve as collateral for a loan and are not sold,it is not necessary to disclose the pledging.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

15

TechCom's customer,RDA,paid off an $8,300 balance on its account receivable.TechCom should record the transaction as a debit to Accounts Receivable-RDA and a credit to Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

16

A promissory note is a written promise to pay a specified amount of money either on demand or at a definite future date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

17

A company borrowed $1,000 by signing a six month promissory note at 5% interest.The total amount of interest is $25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

18

Sellers generally prefer to receive notes receivable rather than accounts receivable when the credit period is long and the receivable is for a large amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

19

The process of using accounts receivable as security for a loan is known as factoring accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

20

Accounts receivable occur from credit sales to customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

21

A high accounts receivable turnover in comparison with competitors suggests that the firm should tighten its credit policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

22

The materiality constraint permits the use of the direct write-off method of accounting for uncollectible accounts when bad debts are very large in relation to a company's other financial statement items such as sales and net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

23

Installment accounts receivable is another name for aging of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

24

Companies use two methods to account for uncollectible accounts,the direct write-off method and the allowance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

25

The accounts receivable turnover is calculated by dividing net sales by average accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

26

The accounts receivable turnover indicates how often accounts receivable are received and collected during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

27

When using the allowance method of accounting for uncollectible accounts,the entry to record the bad debts expense is a debit to Bad Debts Expense and a credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

28

The percent of accounts receivable method for bad debts estimation uses only income statement account balances to estimate bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

29

After adjustment,the balance in the Allowance for Doubtful Accounts has the effect of reducing accounts receivable to its estimated realizable value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

30

A Company had net sales of $23,000 million,and its average account receivables were $5,860 million.Its accounts receivable turnover is 0.92.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

31

When using the allowance method of accounting for uncollectible accounts,the recovery of a bad debt would be recorded as a debit to Cash and a credit to Bad Debts Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under the allowance method of accounting for uncollectible accounts receivable,no attempt is made to estimate bad debts expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

33

When using the allowance method of accounting for uncollectible accounts,the entry to write off Harold's uncollectible account is a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable - Harold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

34

The aging of accounts receivable involves classifying each account receivable by how long it is past its due date and estimating the percent of each uncollectible class.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

35

The advantage of the allowance method of accounting for bad debts is that it identifies the specific customers who will not pay their bills.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company had net sales of $500,000 and an average accounts receivable of $80,000.Its accounts receivable turnover equals 6.25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

37

The use of an allowance for bad debts is required under the materiality constraint.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

38

The matching principle requires use of the direct write-off method of accounting for bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

39

The direct write-off method of accounting for bad debts records the loss from an uncollectible account receivable when it is determined to be uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

40

The percent of sales method for estimating bad debts assumes that a given percent of a company's credit sales for the period are uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

41

The person who signs a note receivable and promises to pay the principal and interest is the:

A)Maker.

B)Payee.

C)Holder.

D)Receiver.

E)Owner.

A)Maker.

B)Payee.

C)Holder.

D)Receiver.

E)Owner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

42

All of the following are true regarding credit card expense except:

A)Credit card expense may be classified as a "discount" deducted from sales to get net sales.

B)Credit card expense may be classified as a selling expense.

C)Credit card expense may be classified as an administrative expense.

D)Credit card expense is not recorded by the seller.

E)Credit card expense is a fee the seller pays for services provided by the card company.

A)Credit card expense may be classified as a "discount" deducted from sales to get net sales.

B)Credit card expense may be classified as a selling expense.

C)Credit card expense may be classified as an administrative expense.

D)Credit card expense is not recorded by the seller.

E)Credit card expense is a fee the seller pays for services provided by the card company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

43

For legal reasons,it is always a good business practice to accept a note receivable in exchange for an overdue account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

44

Notes receivable are always classified as current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

45

A company received a $1,000,90-day,10% note receivable.The journal entry to record receipt of the note includes a debit to Notes Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

46

A maker who dishonors a note is one who does not pay it at maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

47

A company has $90,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts.Experience suggests that 6% of outstanding receivables are uncollectible.The current credit balance (before adjustments)in the allowance for doubtful accounts is $800.The journal entry to record the adjustment to the allowance account includes a debit to Bad Debts Expense for $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

48

The accounting principle that requires financial statements (including notes)to report all relevant information about the operations and financial condition of a company is called:

A)Relevance.

B)Full disclosure.

C)Evaluation.

D)Materiality.

E)Matching.

A)Relevance.

B)Full disclosure.

C)Evaluation.

D)Materiality.

E)Matching.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

49

The aging method of determining bad debts expense is based on the knowledge that the longer a receivable is past due,the lower the likelihood of collection.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

50

The percent of sales method of estimating bad debts is focused more on realizable value of accounts receivable than matching.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

51

A promissory note received from a customer in exchange for an account receivable:

A)Is a cash equivalent for the recipient.

B)Is an account receivable for the recipient.

C)Is a note receivable for the recipient.

D)Is a short-term investment for the recipient.

E)Is a note payable for the recipient.

A)Is a cash equivalent for the recipient.

B)Is an account receivable for the recipient.

C)Is a note receivable for the recipient.

D)Is a short-term investment for the recipient.

E)Is a note payable for the recipient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

52

A dishonored note receivable is usually reclassified as an account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

53

Sellers allow customers to use credit cards:

A)To avoid having to evaluate a customer's credit standing for each sale.

B)To lessen the risk of extending credit to customers who cannot pay.

C)To speed up receipt of cash from the credit sale.

D)To increase total sales volume.

E)All of the options are reasons for credit card use.

A)To avoid having to evaluate a customer's credit standing for each sale.

B)To lessen the risk of extending credit to customers who cannot pay.

C)To speed up receipt of cash from the credit sale.

D)To increase total sales volume.

E)All of the options are reasons for credit card use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

54

Accounts receivable information for specific customers is important because it reveals:

A)How much each customer has purchased on credit.

B)How much each customer has paid.

C)How much each customer still owes.

D)The basis for sending bills to customers.

E)All of the options are valid reasons.

A)How much each customer has purchased on credit.

B)How much each customer has paid.

C)How much each customer still owes.

D)The basis for sending bills to customers.

E)All of the options are valid reasons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

55

A company has sales of $350,000 and estimates that 0.7% of its sales are uncollectible.The estimated amount of bad debts expense is $2,450.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

56

The practice of placing dishonored notes receivable into accounts receivable keeps only notes that have not matured in the Notes Receivable account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

57

A credit sale of $3,275 to a customer would result in:

A)A debit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable subsidiary ledger.

B)A credit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable subsidiary ledger.

C)A debit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable subsidiary ledger.

D)A credit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable subsidiary ledger.

E)A credit to Sales and a credit to the customer's account in the accounts receivable subsidiary ledger.

A)A debit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable subsidiary ledger.

B)A credit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable subsidiary ledger.

C)A debit to the Accounts Receivable account in the general ledger and a credit to the customer's account in the accounts receivable subsidiary ledger.

D)A credit to the Accounts Receivable account in the general ledger and a debit to the customer's account in the accounts receivable subsidiary ledger.

E)A credit to Sales and a credit to the customer's account in the accounts receivable subsidiary ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a company holds a large number of notes receivable it sometimes sets up a controlling account and a subsidiary ledger for notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

59

A payee of a note always honors a note and pays it in full.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

60

The matching principle requires that accrued interest on outstanding notes receivable be recorded at the end of each accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

61

A company borrowed $10,000 by signing a 180-day promissory note at 11%.The total interest due on the maturity date is.

A)$50

B)$275

C)$550

D)$825

E)$1,100

A)$50

B)$275

C)$550

D)$825

E)$1,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

62

The materiality constraint:

A)States that an amount can be ignored if its effect on financial statements is unimportant to user's business decisions.

B)Requires use of the allowance method for bad debts.

C)Requires use of the direct write-off method.

D)States that bad debts not be written off.

E)Requires that expenses be reported in the same period as the sales they helped produce.

A)States that an amount can be ignored if its effect on financial statements is unimportant to user's business decisions.

B)Requires use of the allowance method for bad debts.

C)Requires use of the direct write-off method.

D)States that bad debts not be written off.

E)Requires that expenses be reported in the same period as the sales they helped produce.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

63

A company factored $45,000 of its accounts receivable and was charged a 3% factoring fee.The journal entry to record this transaction would include a:

A)Debit to Cash of $45,000, a debit to Factoring Fee Expense of $1,350, and credit to Accounts Receivable of $43,650.

B)Debit to Cash of $45,000 and a credit to Accounts Receivable of $45,000.

C)Debit to Cash of $43,650, a debit to Factoring Fee Expense of $1,350, and a credit to Accounts Receivable of $45,000.

D)Debit to Cash of $46,350 and a credit to Accounts Receivable of $46,350.

E)Debit to Cash of $45,000 and a credit to Notes Payable of $45,000.

A)Debit to Cash of $45,000, a debit to Factoring Fee Expense of $1,350, and credit to Accounts Receivable of $43,650.

B)Debit to Cash of $45,000 and a credit to Accounts Receivable of $45,000.

C)Debit to Cash of $43,650, a debit to Factoring Fee Expense of $1,350, and a credit to Accounts Receivable of $45,000.

D)Debit to Cash of $46,350 and a credit to Accounts Receivable of $46,350.

E)Debit to Cash of $45,000 and a credit to Notes Payable of $45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

64

Tepsi's accounts receivable turnover was 9.9 for this year and 11.0 for last year.Craig's turnover was 9.3 for this year and 9.3 for last year.These results imply that:

A)Craig has the better turnover for both years.

B)Tepsi has the better turnover for both years.

C)Craig's turnover is improving.

D)Craig's credit policies are too loose

E)Craig's is collecting its receivables more quickly than Tepsi in both years.

A)Craig has the better turnover for both years.

B)Tepsi has the better turnover for both years.

C)Craig's turnover is improving.

D)Craig's credit policies are too loose

E)Craig's is collecting its receivables more quickly than Tepsi in both years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

65

A company has net sales of $900,000 and average accounts receivable of $300,000.What is its accounts receivable turnover for the period?

A)0.20.

B)5.00

C)20.0

D)73.0

E)3.0

A)0.20.

B)5.00

C)20.0

D)73.0

E)3.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

66

The buyer who purchases and takes ownership of another company's accounts receivable is called a:

A)Payer.

B)Pledger.

C)Factor.

D)Payee.

E)Pledgee.

A)Payer.

B)Pledger.

C)Factor.

D)Payee.

E)Pledgee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

67

A company receives a 10%,90-day note for $1,500.The total interest due on the maturity date is:

A)$ 50.00

B)$150.00.

C)$ 75.00.

D)$ 37.50.

E)$ 87.50.

A)$ 50.00

B)$150.00.

C)$ 75.00.

D)$ 37.50.

E)$ 87.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

68

The matching principle prescribes:

A)That expenses be ignored if their effect on the financial statements is unimportant to users' business decisions.

B)The use of the direct write-off method for bad debts.

C)The use of the allowance method of accounting for bad debts.

D)That bad debts be disclosed in the financial statements.

E)That bad debts not be written off.

A)That expenses be ignored if their effect on the financial statements is unimportant to users' business decisions.

B)The use of the direct write-off method for bad debts.

C)The use of the allowance method of accounting for bad debts.

D)That bad debts be disclosed in the financial statements.

E)That bad debts not be written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

69

A company had net sales of $600,000,total sales of $750,000,and an average accounts receivable of $75,000.Its accounts receivable turnover equals:

A).13

B).80

C)7.75

D)8.00

E)10.00

A).13

B).80

C)7.75

D)8.00

E)10.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

70

The maturity date of a note receivable:

A)Is the day of the credit sale.

B)Is the day the note was signed.

C)Is the day the note is due to be repaid.

D)Is the date of the first payment.

E)Is the last day of the month.

A)Is the day of the credit sale.

B)Is the day the note was signed.

C)Is the day the note is due to be repaid.

D)Is the date of the first payment.

E)Is the last day of the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

71

A company borrowed $10,000 by signing a 180-day promissory note at 11%.The maturity value of the note is:

A)$12,050

B)$12,275

C)$10,550

D)$12,825

E)$13,100

A)$12,050

B)$12,275

C)$10,550

D)$12,825

E)$13,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

72

The account receivable turnover measures:

A)How long it takes to sell accounts receivable to a factor.

B)How often, on average, receivables are received and collected during the period.

C)The relation of cash sales to credit sales.

D)How long it takes to sell merchandise inventory.

E)All of the options are correct.

A)How long it takes to sell accounts receivable to a factor.

B)How often, on average, receivables are received and collected during the period.

C)The relation of cash sales to credit sales.

D)How long it takes to sell merchandise inventory.

E)All of the options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

73

Pledging receivables:

A)Allows firms to raise cash.

B)Allows a firm to retain ownership of its receivables.

C)Does not transfer risk of bad debts to the lender.

D)Should be disclosed in the financial statements.

E)All of the options are correct.

A)Allows firms to raise cash.

B)Allows a firm to retain ownership of its receivables.

C)Does not transfer risk of bad debts to the lender.

D)Should be disclosed in the financial statements.

E)All of the options are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

74

A 90-day note issued on April 10 matures on:

A)July 9.

B)July 10.

C)July 11.

D)July 12.

E)July 13.

A)July 9.

B)July 10.

C)July 11.

D)July 12.

E)July 13.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

75

A promissory note:

A)Is a short-term investment for the maker.

B)Is a written promise to pay a specified amount of money at a certain date.

C)Is a liability to the payee.

D)Is another name for an installment receivable.

E)Cannot be used in payment of an account receivable.

A)Is a short-term investment for the maker.

B)Is a written promise to pay a specified amount of money at a certain date.

C)Is a liability to the payee.

D)Is another name for an installment receivable.

E)Cannot be used in payment of an account receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

76

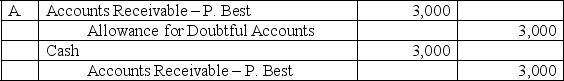

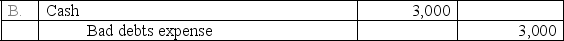

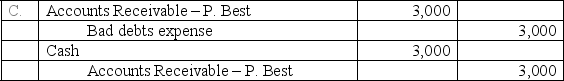

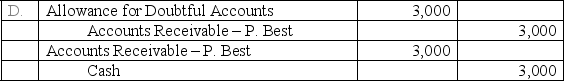

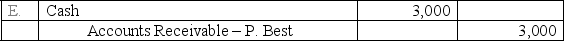

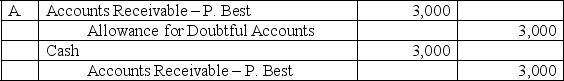

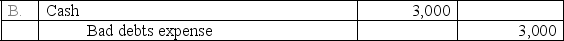

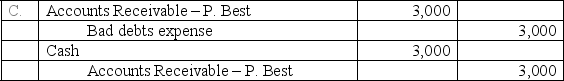

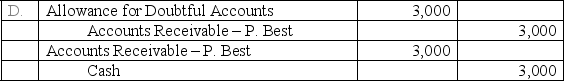

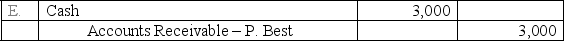

Newton Company uses the allowance method of accounting for uncollectible accounts.On May 3,the Newton Company wrote off the $3,000 uncollectible account of its customer,P.Best.On July 10,Newton received a check for the full amount of $3,000 from Best.On July 10,the entry or entries Newton makes to record the recovery of the bad debt is:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

77

The interest accrued on $6,500 at 6% for 60 days is:

A)$ 36.

B)$ 42.

C)$ 65.

D)$180.

E)$420.

A)$ 36.

B)$ 42.

C)$ 65.

D)$180.

E)$420.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

78

On October 29 of the current year,a company concluded that a customer's $4,400 account receivable was uncollectible and that the account should be written off.What effect will this write-off have on this company's net income and total assets assuming the allowance method is used to account for bad debts?

A)Decrease in net income; no effect on total assets.

B)No effect on net income; no effect on total assets.

C)Decrease in net income; decrease in total assets.

D)Increase in net income; no effect on total assets.

E)No effect on net income; decrease in total assets.

A)Decrease in net income; no effect on total assets.

B)No effect on net income; no effect on total assets.

C)Decrease in net income; decrease in total assets.

D)Increase in net income; no effect on total assets.

E)No effect on net income; decrease in total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

79

The accounts receivable turnover is calculated by:

A)Dividing net sales by average accounts receivable.

B)Dividing net sales by average accounts receivable and multiplying by 365.

C)Dividing average accounts receivable by net sales.

D)Dividing average accounts receivable by net sales and multiplying by 365.

E)Dividing net income by average accounts receivable.

A)Dividing net sales by average accounts receivable.

B)Dividing net sales by average accounts receivable and multiplying by 365.

C)Dividing average accounts receivable by net sales.

D)Dividing average accounts receivable by net sales and multiplying by 365.

E)Dividing net income by average accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

80

The quality of receivables refers to:

A)The creditworthiness of sellers.

B)The speed of collection.

C)The likelihood of collection without loss.

D)Sales turnover.

E)The interest rate.

A)The creditworthiness of sellers.

B)The speed of collection.

C)The likelihood of collection without loss.

D)Sales turnover.

E)The interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck