Deck 8: Cash and Internal Controls

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/193

العب

ملء الشاشة (f)

Deck 8: Cash and Internal Controls

1

Two important limitations of internal control systems are (1)human error or human fraud,and (2)cost-benefit.

True

2

Electronic funds transfer (EFT)is the electronic transfer of cash from one party to another.

True

3

Cash equivalents are short-term highly liquid investment assets that are readily converted to a known cash amount,and have maturities of one year.

False

4

The payee is the person who signs a check,authorizing its payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

5

The use of internal controls provides guaranteed protection against losses due to operating activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

6

Good internal control dictates that a person who controls an asset also maintains that asset's accounting records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

7

The principles of internal control include:

establish responsibilities,maintain adequate records,insure assets,separate recordkeeping from custody of assets,and perform regular and independent reviews.

establish responsibilities,maintain adequate records,insure assets,separate recordkeeping from custody of assets,and perform regular and independent reviews.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

8

Liquidity refers to a company's ability to pay its near-term obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

9

A properly designed internal control system is a key part of systems design,analysis,and performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

10

Fraud does not include collusion,which is necessary to thwart separation of duties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

11

Technology such as cash registers,check protectors,time clocks and personal identification scanners can improve internal control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

12

Internal control in technologically advanced accounting systems depends more on the design and operation of the information system and less on the analysis of its resulting documents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

13

Basic bank services such as bank accounts,bank deposits,and checking contribute to the control and safeguarding of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

14

Technologically advanced accounting systems do not need monitoring for errors because computers always process transactions correctly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

15

Proper internal control means that responsibility for a task is clearly established and assigned to one person.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

16

Separation of duties divides responsibility for a transaction or a series of related transactions between two or more individuals or departments.Separation of duties reduces the risk of error and fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

17

Cancelled checks are checks the bank has paid and deducted from the customer's account during the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

18

Bonding does not discourage loss from theft because employees know that bonding is an insurance policy against loss from theft.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

19

Money orders,cashier's checks,and certified checks are examples of cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

20

Maintaining adequate records is an important internal control principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

21

To streamline a voucher system,procedures for purchasing,receiving,and paying for merchandise can be performed by one department or individual.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

22

When evaluating the days' sales uncollected ratio,generally the less time that money is tied up in receivables the better.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

23

A check involves 3 parties:

the maker who signs the check,the payee who is the recipient,and the bank on which the check is drawn.

the maker who signs the check,the payee who is the recipient,and the bank on which the check is drawn.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

24

On a bank statement,deposits are listed as debits because the bank increases its cash account when the deposit is made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Petty Cash account is a separate checking account used for small amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

26

A voucher system establishes procedures for verifying,approving,and recording obligations for eventual cash disbursement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

27

All disbursements from petty cash should be documented by a petty cash receipt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

28

Internal control devices for banking activities include signature cards,deposit tickets,checks,and bank statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

29

Internal control of cash receipts aims to ensure that all cash received is properly recorded and deposited.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

30

The clerk who has access to the cash in the cash register should not have access to the cash register tape or file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

31

A voucher system's control over cash disbursements begins when a company incurs an obligation that will result in eventual payment of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

32

A debit balance in the Cash Over and Short account reflects an expense and is reported on the income statement as part of general and administrative expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

33

A voucher is an internal document or file used to accumulate information to control cash disbursements and to ensure that a transaction is properly recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the Cash Over and Short account has a debit balance at the end of the period,the amount is reported as miscellaneous revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

35

Control of cash disbursements is important for companies as most large thefts occur from payment of fictitious invoices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

36

The days' sales uncollected ratio measures a company's ability to manage its debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

37

The journal entry for petty cash reimbursement involves a debit to the appropriate expenses and a credit to Petty Cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

38

The days' sales uncollected ratio measures the liquidity of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

39

A voucher system is a set of procedures and approvals designed to control cash disbursements and the acceptance of obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

40

Vouchers should be used only for purchases.Other expenditures do not need to go through the voucher system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

41

Managers place a high priority on internal control systems because the systems assist managers in the:

A)Prevention of avoidable losses.

B)Planning of operations.

C)Monitoring of company performance.

D)Monitoring of employee performance.

E)Assurance that no loss will occur.

A)Prevention of avoidable losses.

B)Planning of operations.

C)Monitoring of company performance.

D)Monitoring of employee performance.

E)Assurance that no loss will occur.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

42

An invoice is an itemized statement of goods prepared by the vendor listing the customer's name,items sold,sales prices,and terms of sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

43

Outstanding checks are checks the bank has paid and deducted from the customer's account during the month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

44

The net method for recording purchases records the purchase invoice at its net amount of any cash discount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

45

After preparing a bank reconciliation,adjustments must be made for items reconciling the bank balance and items reconciling the book balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

46

Deposits in transit are deposits made and recorded by the depositor but not yet recorded on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

47

Under the net method an invoice for $2,000 with terms of 2/10,n/30 should be recorded with a debit to Inventory and a credit to Accounts Payable of $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

48

In order to streamline the purchasing process,department managers should place orders directly with suppliers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

49

A bank reconciliation explains any differences between the balance of a checking account on the depositor's records and the balance reported on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

50

When merchandise is needed,a department manager must inform the purchasing department of its needs by preparing and signing a purchase requisition which lists the merchandise needed and requests that it be purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

51

Factors that cause the bank statement balance for a checking account to be different from the company's checking account balance include:

outstanding checks,deposits in transit,deductions for bank fees,additions for interest,and errors.

outstanding checks,deposits in transit,deductions for bank fees,additions for interest,and errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

52

The entry to increase the balance in petty cash from $50 to $75 would include a credit to Petty Cash of $25.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

53

The Discounts Lost account represents the savings earned in taking advantage of purchase discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

54

It is not necessary for businesses to reconcile their checking accounts since banks keep accurate records and provide internal control support for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

55

An internal control system consists of all of the following policies and procedures except ones designed to:

A)Protect assets.

B)Ensure reliable accounting.

C)Guarantee a return to investors

D)Urge adherence to company policies.

E)Promote efficient operations.

A)Protect assets.

B)Ensure reliable accounting.

C)Guarantee a return to investors

D)Urge adherence to company policies.

E)Promote efficient operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

56

An invoice is a document that is used within a company to notify the appropriate persons that ordered goods have been received and to describe the quantities and condition of the goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

57

The steps to reconcile the beginning balance of the bank statement to the adjusted bank balance include adding outstanding checks,deposits,and bank service charges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a voucher system is used,recording a purchase is initiated by an invoice approval and a voucher,not an invoice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

59

The petty cash fund should be reimbursed when it is nearing zero and at the end of the accounting period when financial statements are prepared.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

60

The voucher register is a journal that is used to record approved vouchers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

61

When two clerks share the same cash register it is a violation of which internal control principle?

A)Establish responsibilities.

B)Maintain adequate records.

C)Insure assets.

D)Bond key employees.

E)Apply technological controls.

A)Establish responsibilities.

B)Maintain adequate records.

C)Insure assets.

D)Bond key employees.

E)Apply technological controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

62

Cash equivalents:

A)Are readily convertible to a known cash amount.

B)Include short-term investments purchased within 3 months of their maturity dates.

C)Have a market value that is not sensitive to interest rate changes.

D)Include short-term U.S.treasury bills.

E)All of the choices are cash equivalents.

A)Are readily convertible to a known cash amount.

B)Include short-term investments purchased within 3 months of their maturity dates.

C)Have a market value that is not sensitive to interest rate changes.

D)Include short-term U.S.treasury bills.

E)All of the choices are cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

63

For which item does a bank NOT issue a debit memorandum?

A)To notify a depositor of all withdrawals through an ATM.

B)To notify a depositor of a fee assessed to the depositor's account.

C)To notify a depositor of a uncollectible check.

D)To notify a depositor of periodic payments arranged in advance, by a depositor.

E)To notify a depositor of a deposit to their account.

A)To notify a depositor of all withdrawals through an ATM.

B)To notify a depositor of a fee assessed to the depositor's account.

C)To notify a depositor of a uncollectible check.

D)To notify a depositor of periodic payments arranged in advance, by a depositor.

E)To notify a depositor of a deposit to their account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

64

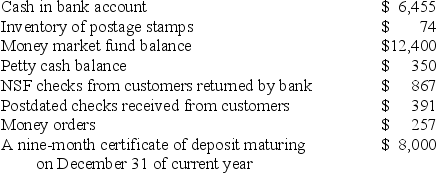

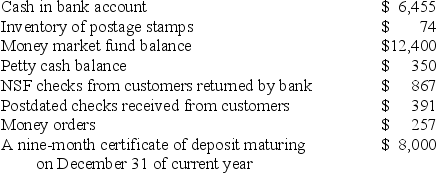

The following information is available for Johnson Manufacturing Company at June 30:

Based on this information,Johnson Manufacturing Company should report Cash and Cash Equivalents on June 30 of:

Based on this information,Johnson Manufacturing Company should report Cash and Cash Equivalents on June 30 of:

A)$15,062

B)$20,146

C)$20,072

D)$19,205

E)$19,462

Based on this information,Johnson Manufacturing Company should report Cash and Cash Equivalents on June 30 of:

Based on this information,Johnson Manufacturing Company should report Cash and Cash Equivalents on June 30 of:A)$15,062

B)$20,146

C)$20,072

D)$19,205

E)$19,462

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

65

A properly designed internal control system:

A)Lowers the company's risk of loss.

B)Insures profitable operations.

C)Eliminates the need for an audit.

D)Requires the use of non-computerized systems.

E)Is not necessary if the company uses a computerized system.

A)Lowers the company's risk of loss.

B)Insures profitable operations.

C)Eliminates the need for an audit.

D)Requires the use of non-computerized systems.

E)Is not necessary if the company uses a computerized system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

66

A bank statement includes:

A)A list of outstanding checks.

B)A list of petty cash amounts.

C)The beginning and the ending balance of the depositor's account.

D)A listing of deposits in transit.

E)All of the choices are included on the bank statement.

A)A list of outstanding checks.

B)A list of petty cash amounts.

C)The beginning and the ending balance of the depositor's account.

D)A listing of deposits in transit.

E)All of the choices are included on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

67

A company's internal control system:

A)Eliminates the company's risk of loss.

B)Monitors company and employee performance.

C)Eliminates human error.

D)Eliminates the need for audits.

E)Eliminates the need for managers' certification of controls.

A)Eliminates the company's risk of loss.

B)Monitors company and employee performance.

C)Eliminates human error.

D)Eliminates the need for audits.

E)Eliminates the need for managers' certification of controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

68

Principles of internal control include all of the following except:

A)Apply technological controls.

B)Maintain minimal assets.

C)Perform regular and independent reviews.

D)Separate recordkeeping from custody of assets.

E)Divide responsibilities for related transactions.

A)Apply technological controls.

B)Maintain minimal assets.

C)Perform regular and independent reviews.

D)Separate recordkeeping from custody of assets.

E)Divide responsibilities for related transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

69

Preparing a bank reconciliation on a monthly basis is an example of:

A)Establishing responsibility.

B)Separation of duties.

C)Protecting assets by proving accuracy of cash records.

D)A technological control.

E)Poor internal control.

A)Establishing responsibility.

B)Separation of duties.

C)Protecting assets by proving accuracy of cash records.

D)A technological control.

E)Poor internal control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

70

Cash,not including cash equivalents,includes:

A)Postage stamps.

B)Coins, currency, and checking accounts.

C)IOUs.

D)Two-year certificates of deposit.

E)Money market funds.

A)Postage stamps.

B)Coins, currency, and checking accounts.

C)IOUs.

D)Two-year certificates of deposit.

E)Money market funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

71

Cash equivalents:

A)Are short-term, highly liquid investment assets.

B)Include 6-month CDs.

C)Include checking accounts.

D)Are recorded in petty cash.

E)Include money orders.

A)Are short-term, highly liquid investment assets.

B)Include 6-month CDs.

C)Include checking accounts.

D)Are recorded in petty cash.

E)Include money orders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

72

Internal control policies and procedures have limitations including:

A)Human error.

B)Human fraud.

C)Cost-benefit principle.

D)Collusion.

E)All of the options are limitations.

A)Human error.

B)Human fraud.

C)Cost-benefit principle.

D)Collusion.

E)All of the options are limitations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

73

Internal control systems are:

A)Developed by the Securities and Exchange Commission for public companies.

B)Developed by the Small Business Administration for non-public companies.

C)Developed by the Internal Revenue Service for all U.S.companies.

D)Required by Sarbanes-Oxley (SOX) to be documented and certified if the company's stock is traded on an exchange.

E)Required only if a company plans to engage in interstate commerce.

A)Developed by the Securities and Exchange Commission for public companies.

B)Developed by the Small Business Administration for non-public companies.

C)Developed by the Internal Revenue Service for all U.S.companies.

D)Required by Sarbanes-Oxley (SOX) to be documented and certified if the company's stock is traded on an exchange.

E)Required only if a company plans to engage in interstate commerce.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

74

Cash equivalents:

A)Include savings accounts.

B)Include checking accounts.

C)Are short-term investments sufficiently close to their maturity date that their value is not sensitive to interest rate changes.

D)Include time deposits.

E)Have no immediate value.

A)Include savings accounts.

B)Include checking accounts.

C)Are short-term investments sufficiently close to their maturity date that their value is not sensitive to interest rate changes.

D)Include time deposits.

E)Have no immediate value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

75

The impact of technology on internal controls includes:

A)Reduced processing errors.

B)Elimination of the need for regular audits.

C)Elimination of the need to bond employees.

D)Elimination of separation of duties.

E)Elimination of fraud.

A)Reduced processing errors.

B)Elimination of the need for regular audits.

C)Elimination of the need to bond employees.

D)Elimination of separation of duties.

E)Elimination of fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

76

Basic bank services include:

A)Bank accounts.

B)Bank deposits.

C)Checking.

D)Electronic funds transfer.

E)All of the choices are basic bank services.

A)Bank accounts.

B)Bank deposits.

C)Checking.

D)Electronic funds transfer.

E)All of the choices are basic bank services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

77

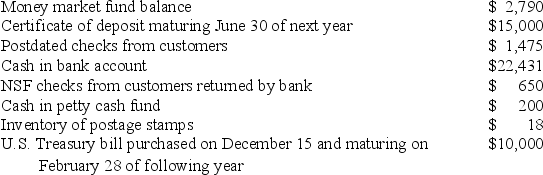

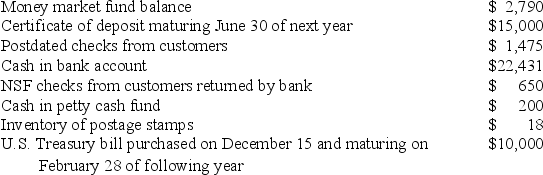

The following information is available for Holland Company at December 31:

Based on this information,Holland Company should report Cash and Cash Equivalents on December 31 of:

Based on this information,Holland Company should report Cash and Cash Equivalents on December 31 of:

A)$35,421

B)$50,421

C)$37,546

D)$36,246

E)$40,439

Based on this information,Holland Company should report Cash and Cash Equivalents on December 31 of:

Based on this information,Holland Company should report Cash and Cash Equivalents on December 31 of:A)$35,421

B)$50,421

C)$37,546

D)$36,246

E)$40,439

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

78

A remittance advice is:

A)An explanation for a payment by check.

B)A bank statement.

C)A voucher.

D)An EFT.

E)A cancelled check.

A)An explanation for a payment by check.

B)A bank statement.

C)A voucher.

D)An EFT.

E)A cancelled check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

79

A check involves three parties:

A)The writer, the cashier, and the bank.

B)The maker, the payee, and the bank.

C)The maker, the manager, and the payee.

D)The bookkeeper, the payee, and the bank.

E)The signer, the cashier, and the company.

A)The writer, the cashier, and the bank.

B)The maker, the payee, and the bank.

C)The maker, the manager, and the payee.

D)The bookkeeper, the payee, and the bank.

E)The signer, the cashier, and the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck

80

Pre-numbered printed checks are an example of which internal control principle?

A)Technological controls.

B)Maintain adequate records.

C)Perform regular and independent reviews.

D)Establish responsibilities.

E)Divide responsibility for related transactions.

A)Technological controls.

B)Maintain adequate records.

C)Perform regular and independent reviews.

D)Establish responsibilities.

E)Divide responsibility for related transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 193 في هذه المجموعة.

فتح الحزمة

k this deck