Deck 15: International Portfolio Investment

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 15: International Portfolio Investment

1

Studies show that international stock markets tend to move more closely together when the volatility is higher.This finding suggests that

A)investors should liquidate their portfolio holdings during turbulent periods.

B)since investors need risk diversification most precisely when markets are turbulent,there may be less benefit to international diversification for investors who liquidate their portfolio holdings during turbulent periods.

C)this kind of correlation is why international portfolio diversification is smart for today's investor.

D)none of the options

A)investors should liquidate their portfolio holdings during turbulent periods.

B)since investors need risk diversification most precisely when markets are turbulent,there may be less benefit to international diversification for investors who liquidate their portfolio holdings during turbulent periods.

C)this kind of correlation is why international portfolio diversification is smart for today's investor.

D)none of the options

B

2

The mean and standard deviation (SD)of monthly returns,over a given period of time,for the stock markets of two countries,X and Y are: Assuming that the monthly risk-free interest rate is 0.25 percent,the Sharpe performance measures,SHP(X)and SHP(Y),and the performance ranks,respectively,for X and Y are:

A)SHP(X)= 0.271,rank = 1,and SHP(Y)= 0.219,rank = 2.

B)SHP(X)= 0.271,rank = 2,and SHP(Y)= 0.219,rank = 1.

C)SHP(X)= 18.84,rank = 1,and SHP(Y)= 23.04,rank = 2.

D)SHP(X)= 23.04,rank = 2,and SHP(Y)= 18.84,rank = 1.

A)SHP(X)= 0.271,rank = 1,and SHP(Y)= 0.219,rank = 2.

B)SHP(X)= 0.271,rank = 2,and SHP(Y)= 0.219,rank = 1.

C)SHP(X)= 18.84,rank = 1,and SHP(Y)= 23.04,rank = 2.

D)SHP(X)= 23.04,rank = 2,and SHP(Y)= 18.84,rank = 1.

SHP(X)= 0.271,rank = 1,and SHP(Y)= 0.219,rank = 2.

3

The "Sharpe performance measure" (SHP)is

A)a "risk-adjusted" performance measure.

B)the excess return (above and beyond the risk-free interest rate)per standard deviation risk.

C)the sensitivity level of a national market to world market movements.

D)a "risk-adjusted" performance measure,as well as the excess return (above and beyond the risk-free interest rate)per standard deviation risk.

A)a "risk-adjusted" performance measure.

B)the excess return (above and beyond the risk-free interest rate)per standard deviation risk.

C)the sensitivity level of a national market to world market movements.

D)a "risk-adjusted" performance measure,as well as the excess return (above and beyond the risk-free interest rate)per standard deviation risk.

D

4

With regard to the OIP,

A)the optimal international portfolio contains investments from every country.

B)the OIP has more return and less risk for all investors.

C)the composition of the optimal international portfolio changes according to IRP.

D)none of the options

A)the optimal international portfolio contains investments from every country.

B)the OIP has more return and less risk for all investors.

C)the composition of the optimal international portfolio changes according to IRP.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

Regarding the mechanics of international portfolio diversification,which statement is true?

A)Security returns are much less correlated across countries than within a county.

B)Security returns are more correlated across countries than within a county.

C)Security returns are about as equally correlated across countries as they are within a county.

D)none of the options

A)Security returns are much less correlated across countries than within a county.

B)Security returns are more correlated across countries than within a county.

C)Security returns are about as equally correlated across countries as they are within a county.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

The "world beta" measures the

A)unsystematic risk.

B)sensitivity of returns on a security to world market movements.

C)risk-adjusted performance.

D)risk of default and bankruptcy.

A)unsystematic risk.

B)sensitivity of returns on a security to world market movements.

C)risk-adjusted performance.

D)risk of default and bankruptcy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

Foreign equities as a proportion of U.S.investors' portfolio wealth rose from about 1 percent in the early 1980s to about ________ by 2015.

A)10 percent

B)27 percent

C)33 percent

D)67 percent

A)10 percent

B)27 percent

C)33 percent

D)67 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

Systematic risk is

A)non-diversifiable risk.

B)the risk that remains even after investors fully diversify their portfolio holdings.

C)non-diversifiable risk and the risk that remains even after investors fully diversify their portfolio holdings.

D)none of the options

A)non-diversifiable risk.

B)the risk that remains even after investors fully diversify their portfolio holdings.

C)non-diversifiable risk and the risk that remains even after investors fully diversify their portfolio holdings.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

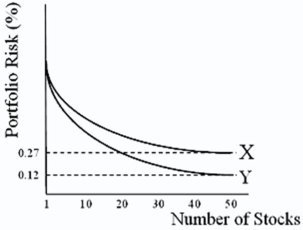

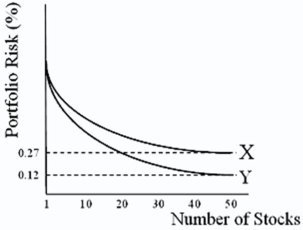

A fully diversified U.S.portfolio is about

A)75 percent as risky as a typical individual stock.

B)27 percent as risky as a typical individual stock.

C)12 percent as risky as a typical individual stock.

D)half as risky as a fully diversified international portfolio.

A)75 percent as risky as a typical individual stock.

B)27 percent as risky as a typical individual stock.

C)12 percent as risky as a typical individual stock.

D)half as risky as a fully diversified international portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

The "Sharpe performance measure" (SHP)is

A)SHP =

B)SHP =

C)SHP = - +

D)none of the options

A)SHP =

B)SHP =

C)SHP = - +

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the graph at shown,X and Y represent

A)U.S.stocks and international stocks.

B)international stocks and U.S.stocks.

C)systematic risk and unsystematic risk.

D)none of the options

A)U.S.stocks and international stocks.

B)international stocks and U.S.stocks.

C)systematic risk and unsystematic risk.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

With regard to the OIP,

A)the composition of the optimal international portfolio is identical for all investors,regardless of home country.

B)the OIP has more return and less risk for all investors,regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors,regardless of home country,if they hedge their risk with currency futures contracts.

D)none of the options

A)the composition of the optimal international portfolio is identical for all investors,regardless of home country.

B)the OIP has more return and less risk for all investors,regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors,regardless of home country,if they hedge their risk with currency futures contracts.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

With regard to estimates of "world beta" measures of the sensitivity of a national market to world market movements,

A)the Japanese stock market is the most sensitive to world market movements.

B)the U.S.stock market is the least sensitive to world market movements.

C)the German stock market is the most sensitive to world market movements,and the Swiss stock market is the least sensitive to world market movements.

D)none of the options

A)the Japanese stock market is the most sensitive to world market movements.

B)the U.S.stock market is the least sensitive to world market movements.

C)the German stock market is the most sensitive to world market movements,and the Swiss stock market is the least sensitive to world market movements.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

You will get more diversification

A)across industries than across countries.

B)across countries than across industries.

C)across stocks and bonds than across countries.

D)none of the options

A)across industries than across countries.

B)across countries than across industries.

C)across stocks and bonds than across countries.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

With regard to the OIP,

A)the composition of the optimal international portfolio is identical for all investors,regardless of home country.

B)the OIP has more return and less risk for all investors,regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors of a particular country,whether or not they hedge their risk with currency futures contracts.

D)none of the options

A)the composition of the optimal international portfolio is identical for all investors,regardless of home country.

B)the OIP has more return and less risk for all investors,regardless of home country.

C)the composition of the optimal international portfolio is identical for all investors of a particular country,whether or not they hedge their risk with currency futures contracts.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

Systematic risk

A)is also known as non-diversifiable risk.

B)is market risk.

C)refers to the risk that remains even after investors fully diversify their portfolio holdings.

D)all of the options

A)is also known as non-diversifiable risk.

B)is market risk.

C)refers to the risk that remains even after investors fully diversify their portfolio holdings.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under the investment dollar premium system,

A)U.K.residents received a premium over the prevailing commercial exchange rate when they sold foreign securities and repatriated the funds to the U.K.

B)U.K.residents had to pay a premium over the prevailing commercial exchange rate when they bought foreign currencies to invest in foreign securities.

C)none of the options

A)U.K.residents received a premium over the prevailing commercial exchange rate when they sold foreign securities and repatriated the funds to the U.K.

B)U.K.residents had to pay a premium over the prevailing commercial exchange rate when they bought foreign currencies to invest in foreign securities.

C)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

In the context of investments in securities (stocks and bonds),portfolio risk diversification refers to

A)the time-honored adage "Don't put all your eggs in one basket."

B)investors' ability to reduce portfolio risk by holding securities that are less than perfectly and positively correlated.

C)the fact that the less correlated the securities in a portfolio,the lower the portfolio risk.

D)all of the options

A)the time-honored adage "Don't put all your eggs in one basket."

B)investors' ability to reduce portfolio risk by holding securities that are less than perfectly and positively correlated.

C)the fact that the less correlated the securities in a portfolio,the lower the portfolio risk.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

With regard to the OIP,

A)the composition of the optimal international portfolio is identical for all investors,regardless of home country.

B)the composition of the optimal international portfolio are varies depending upon the numeraire currency used to measure returns.

C)the composition of the optimal international portfolio is identical for all investors,regardless of home country,if they hedge their risk with currency futures contracts.

D)the composition of the optimal international portfolio are varies depending upon the numeraire currency used to measure returns,and the composition of the optimal international portfolio is identical for all investors (regardless of home country)if they hedge their risk with currency futures contracts.

A)the composition of the optimal international portfolio is identical for all investors,regardless of home country.

B)the composition of the optimal international portfolio are varies depending upon the numeraire currency used to measure returns.

C)the composition of the optimal international portfolio is identical for all investors,regardless of home country,if they hedge their risk with currency futures contracts.

D)the composition of the optimal international portfolio are varies depending upon the numeraire currency used to measure returns,and the composition of the optimal international portfolio is identical for all investors (regardless of home country)if they hedge their risk with currency futures contracts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

The less correlated the securities in a portfolio,

A)the lower the portfolio risk.

B)the higher the portfolio risk.

C)the lower the unsystematic risk.

D)the higher the diversifiable risk.

A)the lower the portfolio risk.

B)the higher the portfolio risk.

C)the lower the unsystematic risk.

D)the higher the diversifiable risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is a true statement?

A)Generally,exchange rate volatility is greater than bond market volatility.

B)When investing in international bonds,it is essential to control exchange risk to enhance the efficiency of international bond portfolios.

C)The real-world evidence suggests that investing in Swiss bonds largely amounts to investing in Swiss currency.

D)all of the options

A)Generally,exchange rate volatility is greater than bond market volatility.

B)When investing in international bonds,it is essential to control exchange risk to enhance the efficiency of international bond portfolios.

C)The real-world evidence suggests that investing in Swiss bonds largely amounts to investing in Swiss currency.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

In May 1995 when the exchange rate was 80 yen per dollar,Japan Life Insurance Company invested ¥800,000,000 in pure-discount U.S.bonds.The investment was liquidated one year later when the exchange rate was 110 yen per dollar.If the rate of return earned on this investment was 46 percent in terms of yen,calculate the dollar amount that the bonds were sold at.

A)$10,618,000

B)$10,720,000

C)$14,600,000

D)none of the options

A)$10,618,000

B)$10,720,000

C)$14,600,000

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

The realized dollar returns for a U.S.resident investing in a foreign market will depend on the return in the foreign market as well as on the exchange rate fluctuations between the dollar and the foreign currency. Calculate the variance of the monthly rate of return in dollar terms,if the variance of the foreign market's return (in terms of its own currency)is 1.14,the variance between the U.S.dollar and the foreign currency is 17.64,the covariance is 2.34,and the contribution of the cross-product term is 0.04.

A)21.16

B)23.50

C)26.89

D)28.65

A)21.16

B)23.50

C)26.89

D)28.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Emerald Energy is an oil exploration and production company that trades on the London stock market.Assume that when purchased by an international investor the stock's price and the exchange rate were £5 and £0.64/$1.00 respectively.At selling time,one year after the purchase date,they were £6 and £0.60/$1.00.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)0.20 percent

B)20.00 percent

C)1.28 percent

D)28.00 percent

A)0.20 percent

B)20.00 percent

C)1.28 percent

D)28.00 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

Assume that you have invested $100,000 in British equities.When purchased the stock's price and the exchange rate were £50 and £0.50/$1.00 respectively.At selling time,one year after purchase,they were £45 and £0.60/$1.00.If the investor had sold £50,000 forward at the forward exchange rate of £0.55/$1.00.The dollar rate of return would be

A)−27.27 percent.

B)−17.42 percent.

C)28.00 percent.

D)−9.09 percent.

A)−27.27 percent.

B)−17.42 percent.

C)28.00 percent.

D)−9.09 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

Assume that you have invested $100,000 in Japanese equities.When purchased the stock's price and the exchange rate were ¥100 and ¥100/$1.00 respectively.At selling time,one year after purchase,they were ¥110 and ¥110/$1.00.The dollar rate of return would be

A)0 percent.

B)4.32 percent.

C)28 percent.

D)−9.09 percent.

A)0 percent.

B)4.32 percent.

C)28 percent.

D)−9.09 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

Assume that you have invested $100,000 in British equities.When purchased,the stock's price and the exchange rate were £50 and £0.50/$1.00 respectively.At selling time,one year after purchase,they were £60 and £0.60/$1.00.If the investor had sold £50,000 forward at the forward exchange rate of £0.55/$1.00.The dollar rate of return would be

A)10.90 percent.

B)7.58 percent.

C)28.00 percent.

D)9.09 percent.

A)10.90 percent.

B)7.58 percent.

C)28.00 percent.

D)9.09 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

Compared with bond markets

A)the risk of investing in foreign stock markets is,to a lesser degree,attributable to exchange rate uncertainty.

B)the risk of investing in foreign stock markets is,to a much greater degree,attributable to exchange rate uncertainty.

C)exchange risk is lower than default risk and interest rate risk.

D)all of the options

A)the risk of investing in foreign stock markets is,to a lesser degree,attributable to exchange rate uncertainty.

B)the risk of investing in foreign stock markets is,to a much greater degree,attributable to exchange rate uncertainty.

C)exchange risk is lower than default risk and interest rate risk.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

Emerald Energy is an oil exploration and production company that trades on the London stock market.Over the past year,the stock has gone from £50 per share to £55,but over the same period,the dollar has depreciated ten percent.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5 percent

B)−1 percent

C)0 percent

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5 percent

B)−1 percent

C)0 percent

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

Bema Gold is an exploration and production company that trades on the Toronto stock exchange.Assume that when purchased by an international investor the stock's price and the exchange rate were CAD5 and CAD1.0/USD0.72 respectively.At selling time,one year after the purchase date,they were CAD6 and CAD1.0/USD1.0.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)−13.60 percent

B)66.67 percent

C)38.89 percent

D)28.00 percent

A)−13.60 percent

B)66.67 percent

C)38.89 percent

D)28.00 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

Assume that you have invested $100,000 in Japanese equities.When purchased,the stock's price and the exchange rate were ¥100 and ¥100/$1.00 respectively.At selling time,one year after purchase,they were ¥110 and ¥110/$1.00.If the investor had sold ¥10,000,000 forward at the forward exchange rate of ¥105/$1.00 the dollar rate of return would be

A)−27.27 percent.

B)4.33 percent.

C)28.00 percent.

D)−9.09 percent.

A)−27.27 percent.

B)4.33 percent.

C)28.00 percent.

D)−9.09 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago.You had invested €10,000 to buy Microsoft shares for $120 per share; the exchange rate was $1.55 per euro.You sold the stock for $135 per share and converted the dollar proceeds into euro at the exchange rate of $1.50 per euro.How much of the return is due to the exchange rate movement?

A)3.75 percent

B)3.33 percent

C)12.50 percent

D)16.25 percent

A)3.75 percent

B)3.33 percent

C)12.50 percent

D)16.25 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

Emerald Energy is an oil exploration and production company that trades on the London stock market.Over the past year,the stock has enjoyed a 20 percent return in pound terms,but over the same period,the exchange rate has fallen from $2.00 = £1 to $1.80 = £1.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5 percent

B)9.25 percent

C)8 percent

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

A)3.5 percent

B)9.25 percent

C)8 percent

D)There is not enough information to compute the investor's annual percentage rate of return in terms of the U.S.dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

Emerald Energy is an oil exploration and production company that trades on the London stock market.Assume that when purchased by an international investor the stock's price and the exchange rate were £5 and £0.64/$1.00 respectively.At selling time,one year after purchase,they were £6 and £0.60/$1.00.If the investor had sold £5,the principal investment amount at the same time that the stock was purchased,forward at the forward exchange rate of £0.60/$1.00.The dollar rate of return would be

A)0.26 percent.

B)26.00 percent.

C)28.00 percent.

D)30.00 percent.

A)0.26 percent.

B)26.00 percent.

C)28.00 percent.

D)30.00 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

A zero-coupon French bond promises to pay €100,000 in five years.The current exchange rate is $1.50 = €1.00 and inflation is forecast at 3 percent in the U.S.and 2 percent in the euro zone per year for the next five years.The appropriate discount rate for a bond of this risk would be 10 percent if it paid in dollars.What is the appropriate price of the bond?

A)£65,196.13 = $97,794.20

B)£62,092.13 = $93,183.20

C)none of the options

A)£65,196.13 = $97,794.20

B)£62,092.13 = $93,183.20

C)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

Bema Gold is an exploration and production company that trades on the Toronto stock exchange.Assume that when purchased by an international investor the stock's price and the exchange rate were CAD5 and CAD1.0/USD0.72 respectively.At selling time,one year after the purchase date,they were CAD6 and CAD1.0/USD1.0.Calculate the investor's annual percentage rate of return in terms of the U.S.dollars if the investor had sold CAD5,the principal investment amount at the same time that the stock was purchased,forward at the forward exchange rate of CAD1/USD.80.

A)-13.60 percent

B)66.67 percent

C)38.89 percent

D)28.00 percent

A)-13.60 percent

B)66.67 percent

C)38.89 percent

D)28.00 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

A zero-coupon British bond promises to pay £100,000 in five years.The current exchange rate is $2.00 = £1.00 and inflation is forecast at 3 percent in the U.S.and 2 percent in the U.K.per year for the next five years.The appropriate discount rate for a bond of this risk would be 10 percent if it paid in dollars.What is the appropriate price of the bond?

A)£62,092.13 = $124,184.26

B)£65,196.13 = $130,392.26

C)£60,000 = $120,000

D)none of the options

A)£62,092.13 = $124,184.26

B)£65,196.13 = $130,392.26

C)£60,000 = $120,000

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose you are a euro-based investor who just sold Microsoft shares that you had bought six months ago.You had invested €10,000 to buy Microsoft shares for $120 per share; the exchange rate was $1.55 per euro.You sold the stock for $135 per share and converted the dollar proceeds into euro at the exchange rate of $1.50 per euro.Compute the rate of return on your investment in euro terms.

A)12.50 percent

B)16.25 percent

C)28.00 percent

D)−9.09 percent

A)12.50 percent

B)16.25 percent

C)28.00 percent

D)−9.09 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

A 5 percent-annual coupon British has a par value of £1,000,matures in five years,and has a yield to maturity of 4 percent.The current exchange rate is $2.00 = £1.00 and inflation is forecast at 3 percent in the U.S.and 2 percent in the U.K.per year for the next five years.If a dollar-based investor used forward contracts to redenominate this bond into dollars,what would be his rate of return?

A)5 percent

B)6 percent

C)7 percent

D)8 percent

A)5 percent

B)6 percent

C)7 percent

D)8 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

Exchange rate fluctuations contribute to the risk of foreign investment through three possible channels (i)the volatility of the investment due to the volatility of the exchange rate

(ii)the contribution of the cross-product term

(iii)its covariance with the local market returns

Which of the following contributes and accounts for most of the volatility?

A)(i)and (ii)

B)(ii)and (iii)

C)(i)and (iii)

D)only (ii)

(ii)the contribution of the cross-product term

(iii)its covariance with the local market returns

Which of the following contributes and accounts for most of the volatility?

A)(i)and (ii)

B)(ii)and (iii)

C)(i)and (iii)

D)only (ii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

Recent studies show that when investors control exchange risk by using currency forward contracts to hedge,

A)international bond portfolios outperform domestic bond portfolios.

B)international bond portfolios dominate domestic stock portfolios in terms of risk-return efficiency.

C)international bond portfolios outperform domestic bond portfolios,and also dominate domestic stock portfolios in terms of risk-return efficiency.

D)none of the options

A)international bond portfolios outperform domestic bond portfolios.

B)international bond portfolios dominate domestic stock portfolios in terms of risk-return efficiency.

C)international bond portfolios outperform domestic bond portfolios,and also dominate domestic stock portfolios in terms of risk-return efficiency.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

The record of investing in U.S.-based international mutual funds

A)shows that most funds have a beta much less than one.

B)shows them to be a raging arbitrage opportunity.

C)shows that they offer less diversification benefits than just investing in U.S.-based MNCs.

D)none of the options

A)shows that most funds have a beta much less than one.

B)shows them to be a raging arbitrage opportunity.

C)shows that they offer less diversification benefits than just investing in U.S.-based MNCs.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

American Depository Receipt (ADRs)represent foreign stocks

A)denominated in U.S.dollars that trade on European stock exchanges.

B)denominated in U.S.dollars that trade on a U.S.stock exchange.

C)denominated in a foreign currency that trade on a U.S.stock exchange.

D)non-registered (bearer)securities.

A)denominated in U.S.dollars that trade on European stock exchanges.

B)denominated in U.S.dollars that trade on a U.S.stock exchange.

C)denominated in a foreign currency that trade on a U.S.stock exchange.

D)non-registered (bearer)securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

The record of investing in U.S.-based stock mutual funds

A)shows that the movements of the U.S.stock market account for about 20 percent of the fluctuations of the value of U.S.-based stock mutual funds.

B)shows that the talent of individual portfolio managers accounts for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds-luck the other ten percent.

C)shows that the movements of the U.S.stock market account for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds.

D)none of the options

A)shows that the movements of the U.S.stock market account for about 20 percent of the fluctuations of the value of U.S.-based stock mutual funds.

B)shows that the talent of individual portfolio managers accounts for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds-luck the other ten percent.

C)shows that the movements of the U.S.stock market account for about 90 percent of the fluctuations of the value of U.S.-based stock mutual funds.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

Advantages of investing in mutual funds known as country funds include

A)speculation in a single foreign market at minimum cost.

B)using them as building blocks of a personal international portfolio.

C)diversification into emerging markets that are otherwise practically inaccessible.

D)all of the options

A)speculation in a single foreign market at minimum cost.

B)using them as building blocks of a personal international portfolio.

C)diversification into emerging markets that are otherwise practically inaccessible.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

Recent studies show that when investors control exchange risk by using currency forward contracts,

A)they can substantially enhance the efficiency of international bond portfolios.

B)they can substantially enhance the efficiency of international stock portfolios.

C)the risk of investing in foreign stock markets can be completely hedged.

D)they can substantially enhance the efficiency of international bond and stock portfolios.

A)they can substantially enhance the efficiency of international bond portfolios.

B)they can substantially enhance the efficiency of international stock portfolios.

C)the risk of investing in foreign stock markets can be completely hedged.

D)they can substantially enhance the efficiency of international bond and stock portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

The record of investing in U.S.-based MNCs

A)shows that the share prices of U.S.-based MNCs behave much like those of domestic firms,without providing effective international diversification.

B)shows that the share prices of U.S.-based MNCs behave much differently than those of domestic firms,providing effective international diversification.

C)shows that the share prices of U.S.-based MNCs behave much like the currency returns of their foreign markets.

D)none of the options

A)shows that the share prices of U.S.-based MNCs behave much like those of domestic firms,without providing effective international diversification.

B)shows that the share prices of U.S.-based MNCs behave much differently than those of domestic firms,providing effective international diversification.

C)shows that the share prices of U.S.-based MNCs behave much like the currency returns of their foreign markets.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Hedge fund advisors typically receive a management fee,often ________ of the fund asset value as compensation,plus performance fee that can be 20-25 percent of capital appreciation.

A)1 to 2 percent

B)10 to 20 basis points

C)10 percent

D)none of the options

A)1 to 2 percent

B)10 to 20 basis points

C)10 percent

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

Hedge fund advisors typically receive a "2-plus-twenty" management fee

A)meaning 2 percent per year of the assets under management,plus performance fee 20 percent of any capital appreciation.

B)meaning 2 percent per year of the assets under management,plus performance fee 20 basis points.

C)meaning 2 percent per year of the assets under management,plus performance fee of 20 percent of the excess return.

D)meaning 2 percent per year of the assets under management,plus performance fee 20 percent of gross return net of the risk-free rate.

A)meaning 2 percent per year of the assets under management,plus performance fee 20 percent of any capital appreciation.

B)meaning 2 percent per year of the assets under management,plus performance fee 20 basis points.

C)meaning 2 percent per year of the assets under management,plus performance fee of 20 percent of the excess return.

D)meaning 2 percent per year of the assets under management,plus performance fee 20 percent of gross return net of the risk-free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

With regard to the past price performance of U.S.-based closed-end country funds,

A)most CECFs behave more like U.S.securities than their corresponding NAVs.

B)most CECFs have track records nearly identical to their currency returns.

C)most CECFs have stock betas of around zero when measured against the S&P 500.

D)none of the options

A)most CECFs behave more like U.S.securities than their corresponding NAVs.

B)most CECFs have track records nearly identical to their currency returns.

C)most CECFs have stock betas of around zero when measured against the S&P 500.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

A zero-coupon Japanese bond promises to pay ¥1,200,000 in five years.The current exchange rate is $1.00 = ¥100 and inflation is forecast at 3 percent in the U.S.and 2 percent in Japan per year for the next five years.The appropriate discount rate for a bond of this risk would be 10 percent if it paid in dollars.What is the appropriate price of the bond?

A)¥782,353.60 = $7,823.54

B)¥745,105.60 = $7,451.06

C)none of the options

A)¥782,353.60 = $7,823.54

B)¥745,105.60 = $7,451.06

C)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

With regard to the past price performance of closed-end mutual funds

A)most funds have traded at both a premium and a discount to NAV.

B)most funds trade on a stock exchange just like a publicly traded corporation.

C)suggests the risk-return characteristics can be quite different from those of the securities underlying the fund.

D)all of the options

A)most funds have traded at both a premium and a discount to NAV.

B)most funds trade on a stock exchange just like a publicly traded corporation.

C)suggests the risk-return characteristics can be quite different from those of the securities underlying the fund.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

Advantages of investing in U.S.-based international mutual funds include

A)lower transactions costs relative to direct investing.

B)circumvention of many legal and institution barriers to direct portfolio investment in many foreign markets.

C)professional management,potentially expertise in security selection,definitely record-keeping.

D)all of the options

A)lower transactions costs relative to direct investing.

B)circumvention of many legal and institution barriers to direct portfolio investment in many foreign markets.

C)professional management,potentially expertise in security selection,definitely record-keeping.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

For those investors who desire international equity exposure,WEBS

A)may well serve as a major alternative to such traditional tools as international mutual funds,ADRs and closed-end country funds.

B)are probably overpriced relative to international mutual funds,ADRs and closed-end country funds.

C)would provide no international equity exposure since they are pools of bonds.

D)none of the options

A)may well serve as a major alternative to such traditional tools as international mutual funds,ADRs and closed-end country funds.

B)are probably overpriced relative to international mutual funds,ADRs and closed-end country funds.

C)would provide no international equity exposure since they are pools of bonds.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

A closed-end mutual fund

A)invests in bonds of a particular maturity,when they mature,the fund closes.

B)trades on a stock exchange just like a publicly traded corporation.

C)always trades at Net Asset Value.

D)all of the options

A)invests in bonds of a particular maturity,when they mature,the fund closes.

B)trades on a stock exchange just like a publicly traded corporation.

C)always trades at Net Asset Value.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

The record of investing in U.S.-based international mutual funds

A)suggests that it is a bad idea-the costs outweigh the benefits for U.S.investors.

B)without exception,they have higher returns than the U.S.market (as proxied by the S&P 500 index)and slightly lower risk.

C)suggests that for the most part,they have higher returns than the U.S.market (as proxied by the S&P 500 index)but with slightly higher risk.

D)none of the options

A)suggests that it is a bad idea-the costs outweigh the benefits for U.S.investors.

B)without exception,they have higher returns than the U.S.market (as proxied by the S&P 500 index)and slightly lower risk.

C)suggests that for the most part,they have higher returns than the U.S.market (as proxied by the S&P 500 index)but with slightly higher risk.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

The majority of ADRS

A)are from such developed countries as Australia and Japan.

B)are from developing nations.

C)are from emerging markets.

D)are from both developing nations and emerging markets.

A)are from such developed countries as Australia and Japan.

B)are from developing nations.

C)are from emerging markets.

D)are from both developing nations and emerging markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

WEBS are

A)World Equity Benchmark Shares.

B)exchange-traded open-end country funds designed to closely track foreign stock market indexes.

C)World Equity Benchmark Shares,and may be described as exchange-traded open-end country funds designed to closely track foreign stock market indexes.

D)none of the options

A)World Equity Benchmark Shares.

B)exchange-traded open-end country funds designed to closely track foreign stock market indexes.

C)World Equity Benchmark Shares,and may be described as exchange-traded open-end country funds designed to closely track foreign stock market indexes.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

With regard to the past performance of U.S.-based closed-end country funds

A)most investors who can invest directly in foreign markets without incurring excessive costs are advised to do so.

B)NAVs offer superior diversification opportunities compared to the CECFs.

C)most investors who can invest directly in foreign markets without incurring excessive costs are advised to do so,and NAVs offer superior diversification opportunities compared to the CECFs.

D)none of the options

A)most investors who can invest directly in foreign markets without incurring excessive costs are advised to do so.

B)NAVs offer superior diversification opportunities compared to the CECFs.

C)most investors who can invest directly in foreign markets without incurring excessive costs are advised to do so,and NAVs offer superior diversification opportunities compared to the CECFs.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

U.S.-based mutual funds known as country funds:

A)Invest in the government securities of different sovereign governments,giving risk-free portfolios effective exchange rate diversification.

B)Invests exclusively in stocks of a single country.

C)Invests exclusively in government securities of a single country.

D)none of the options

A)Invest in the government securities of different sovereign governments,giving risk-free portfolios effective exchange rate diversification.

B)Invests exclusively in stocks of a single country.

C)Invests exclusively in government securities of a single country.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock on margin with only 40 percent down and 60 percent borrowed.The stock pays a $0.30 quarterly dividend,and after one year the investment sells for $54 the exchange has changed from €0.625 per dollar to €0.6875 per dollar.The interest on the margin loan is 1 percent per year.The margin loan is denominated in dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

The return and variance of return to a U.S.dollar investor from investing in individual foreign security i are given by:

A)Ri$ = (1 + Ri)(1 + ei)− 1 and Var(Ri$)= Var(Ri)

B)Ri$ = Ri + ei and Var(Ri$)= Var(Ri)+ Var(ei)

C)Ri$ = (1 + Ri)(1 + ei)- 1 and Var(Ri$)= Var(Ri)+ Var(ei)+ 2Cov(Ri,ei)

D)none of the options

A)Ri$ = (1 + Ri)(1 + ei)− 1 and Var(Ri$)= Var(Ri)

B)Ri$ = Ri + ei and Var(Ri$)= Var(Ri)+ Var(ei)

C)Ri$ = (1 + Ri)(1 + ei)- 1 and Var(Ri$)= Var(Ri)+ Var(ei)+ 2Cov(Ri,ei)

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explanations for Home Bias include

A)domestic securities may provide investors with certain extra services,such as hedging against domestic inflation that foreign securities do not.

B)there may be barriers,for or informal,to investing in foreign securities.

C)investors may face country-specific inflation in violation of PPP.

D)all of the options

A)domestic securities may provide investors with certain extra services,such as hedging against domestic inflation that foreign securities do not.

B)there may be barriers,for or informal,to investing in foreign securities.

C)investors may face country-specific inflation in violation of PPP.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the investor hedges the exchange rate risk when investing internationally

A)the risk-return efficiency is likely to be superior.

B)the expected return to the U.S.dollar investor is approximately the same whether the investor hedges the exchange rate risk in the investment,or remains unhedged.

C)to the extent that the investor establishes an effective hedge to eliminate exchange rate uncertainty,the risk will be reduced.

D)all of the options

A)the risk-return efficiency is likely to be superior.

B)the expected return to the U.S.dollar investor is approximately the same whether the investor hedges the exchange rate risk in the investment,or remains unhedged.

C)to the extent that the investor establishes an effective hedge to eliminate exchange rate uncertainty,the risk will be reduced.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock using 50 percent margin.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.The interest on the margin loan is 1 percent per year.The margin loan was denominated in pounds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

The degree of home bias varies across investors

A)wealthier,more experienced,and sophisticated investors are less likely to exhibit home bias.

B)wealthier,more experienced,and sophisticated investors are more likely to exhibit home bias.

C)wealthier,more experienced,and sophisticated investors are less likely to invest in foreign securities.

D)none of the options

A)wealthier,more experienced,and sophisticated investors are less likely to exhibit home bias.

B)wealthier,more experienced,and sophisticated investors are more likely to exhibit home bias.

C)wealthier,more experienced,and sophisticated investors are less likely to invest in foreign securities.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

68

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock on margin with only 40 percent down and 60 percent borrowed.The stock pays a £0.30 quarterly dividend,and after one year the investment sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.The interest on the margin loan is 1 percent per year.The margin loan is denominated in pounds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

You invested $100,000 in British equities.The stock's price was £50 and the exchange rate was £0.50/$1.00.At selling time,one year after purchase,they were £45 and £0.60/$1.00.Assume the investor sold £50,000 forward at the forward exchange rate of £0.55/$1.00.The dollar rate of return would be

A)−27.27 percent

B)1.09 percent

C)28.00 percent

D)−9.09 percent

A)−27.27 percent

B)1.09 percent

C)28.00 percent

D)−9.09 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.The stock pays a £0.30 quarterly dividend,and after one year the investment sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound,although he sold £10,000 forward at the forward rate of €1.28 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock has no value since the firm is bankrupt.Meanwhile the exchange rate has changed from €1.25 per pound to €1.30 per pound,and he sold £8,000 forward at the forward rate of €1.28 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Hedge funds

A)do not register as an investment company and are not subject to reporting or disclosure requirements.

B)have experienced phenomenal growth in recent years.

C)tend to have relatively low correlations with various stock market benchmarks.

D)all of the options

A)do not register as an investment company and are not subject to reporting or disclosure requirements.

B)have experienced phenomenal growth in recent years.

C)tend to have relatively low correlations with various stock market benchmarks.

D)all of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock using 50 percent margin.One year after investment,the stock pays a $1 dividend,and sells for $54 the exchange has changed from €0.625 per dollar to €0.6875 per dollar.The interest on the margin loan is 1 percent per year.The margin loan was denominated in dollars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a £50 British stock.One year after investment,the stock pays a £1 dividend,and sells for £54 the exchange rate has changed from €1.25 per pound to €1.30 per pound,although he sold £8,800 forward at the forward rate of €1.28 per pound.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Current research suggests that

A)investors can get more diversification with shares of domestic,large-cap stocks.

B)investors can get more diversification with shares of domestic,small-cap stocks.

C)investors can get more diversification with shares of foreign,large-cap stocks.

D)investors can get more diversification with shares of foreign,small-cap stocks.

A)investors can get more diversification with shares of domestic,large-cap stocks.

B)investors can get more diversification with shares of domestic,small-cap stocks.

C)investors can get more diversification with shares of foreign,large-cap stocks.

D)investors can get more diversification with shares of foreign,small-cap stocks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

When a country is more remote,with an uncommon language

A)domestic investors tend to invest more in country's market and less abroad.

B)foreign investors tend to invest less in country's market.

C)domestic investors tend to invest more in country's market.

D)domestic investors tend to invest more in country's market and less abroad,and foreign investors tend to invest less in country's market.

A)domestic investors tend to invest more in country's market and less abroad.

B)foreign investors tend to invest less in country's market.

C)domestic investors tend to invest more in country's market.

D)domestic investors tend to invest more in country's market and less abroad,and foreign investors tend to invest less in country's market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock.The stock pays a $0.30 quarterly dividend,and after one year the investment sells for $54 the exchange has changed from €0.625 per dollar to €0.6875 per dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

Consider a simple exchange risk hedging strategy in which the U.S.dollar based investor sells the expected foreign currency proceeds of a risky investment forward.Although the expected foreign investment proceeds will be converted into U.S.dollars at the known forward exchange rate under this strategy,the unexpected foreign investment proceeds

A)will have to be converted into U.S.dollars at the uncertain forward spot exchange rate.

B)will have to be converted into U.S.dollars at the uncertain future spot exchange rate.

C)will have to be converted into U.S.dollars at the uncertain swap exchange rate.

D)none of the options

A)will have to be converted into U.S.dollars at the uncertain forward spot exchange rate.

B)will have to be converted into U.S.dollars at the uncertain future spot exchange rate.

C)will have to be converted into U.S.dollars at the uncertain swap exchange rate.

D)none of the options

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

Calculate the euro-based return an Italian investor would have realized by investing €10,000 into a $50 American stock.One year after investment,the stock pays a $1 dividend,and sells for $54 the exchange rate has changed from €0.625 per dollar to €0.6875 per dollar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck