Deck 10: Management of Translation Exposure

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 10: Management of Translation Exposure

1

The sensitivity of "realized" domestic currency values of the firm's contractual cash flows denominated in foreign currency to unexpected changes in the exchange rate is

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

transaction exposure.

2

The extent to which the value of the firm would be affected by unexpected changes in the exchange rate is

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

economic exposure.

3

The extent to which the value of the firm would be affected by expected changes in the exchange rate is

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

none of the above

4

Translation exposure refers to

A)accounting exposure.

B)the effect that an unanticipated change in exchange rates will have on the consolidated financial reports of an MNC.

C)the change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency, as a result of exchange rate change fluctuations, when viewed from the perspective of the parent firm.

D)all of the above

A)accounting exposure.

B)the effect that an unanticipated change in exchange rates will have on the consolidated financial reports of an MNC.

C)the change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency, as a result of exchange rate change fluctuations, when viewed from the perspective of the parent firm.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

When exchange rates change

A)the value of a foreign subsidiary's foreign currency denominated assets and liabilities change to new numbers still denominated in the foreign currency.

B)the value of a foreign subsidiary's foreign currency denominated assets and liabilities change when redenominated into the home currency.

C)hedging should be done after the change.

D)none of the above

A)the value of a foreign subsidiary's foreign currency denominated assets and liabilities change to new numbers still denominated in the foreign currency.

B)the value of a foreign subsidiary's foreign currency denominated assets and liabilities change when redenominated into the home currency.

C)hedging should be done after the change.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

How many methods of foreign currency translation have been used in recent years? (U.S.GAAP.)

A)One

B)Two

C)Three

D)Four

A)One

B)Two

C)Three

D)Four

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

The current/noncurrent method of foreign currency translation was generally accepted in the United States from the 1930s until 1975,when

A)FASB 2 became effective.

B)FASB 4 became effective.

C)FASB 6 became effective.

D)FASB 8 became effective.

A)FASB 2 became effective.

B)FASB 4 became effective.

C)FASB 6 became effective.

D)FASB 8 became effective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

The generally accepted method for consolidating the financial reports of an MNC from the 1930s to 1975 was

A)current/noncurrent method.

B)monetary/nonmonetary method.

C)temporal method.

D)current rate method.

A)current/noncurrent method.

B)monetary/nonmonetary method.

C)temporal method.

D)current rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

What does it mean to have redenominated an asset in terms of the dollar?

A)You have undertaken a hedging strategy that gives the asset a constant dollar value.

B)Multiply the foreign currency value of the asset by the spot exchange rate.

C)Undertaken accounting changes to eliminate translation exposure.

D)None of the above

A)You have undertaken a hedging strategy that gives the asset a constant dollar value.

B)Multiply the foreign currency value of the asset by the spot exchange rate.

C)Undertaken accounting changes to eliminate translation exposure.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

Translation exposure,also frequently called accounting exposure,refers to the effect that an unanticipated change in exchange rates will have on the

A)choice of accounting methodology.

B)consolidated financial reports of an MNC.

C)firms competitive position.

D)cash flows realized from foreign operations.

A)choice of accounting methodology.

B)consolidated financial reports of an MNC.

C)firms competitive position.

D)cash flows realized from foreign operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

The sensitivity of the firm's consolidated financial statements to unexpected changes in the exchange rate is

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

A)transaction exposure.

B)translation exposure.

C)economic exposure.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

The recognized methods for consolidating the financial reports of an MNC are

A)short/long term method, current/future method, flexible/inflexible method, and economic/noneconomic method.

B)current/noncurrent method, monetary/nonmonetary method, short/long term method, and current/future method.

C)current/noncurrent method, monetary/nonmonetary method, temporal method, and current rate method.

D)temporal method, current rate method, flexible/inflexible method, and economic/noneconomic method.

A)short/long term method, current/future method, flexible/inflexible method, and economic/noneconomic method.

B)current/noncurrent method, monetary/nonmonetary method, short/long term method, and current/future method.

C)current/noncurrent method, monetary/nonmonetary method, temporal method, and current rate method.

D)temporal method, current rate method, flexible/inflexible method, and economic/noneconomic method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

When exchange rates change,the value of a foreign subsidiary's assets and liabilities denominated in a foreign currency change

A)when they are viewed from the perspective of the subsidiary firm.

B)when they are viewed from the perspective of the parent firm.

C)but this is only of material concern if the parent firm is liquidating the subsidiary in a bankruptcy and is forced to realize the value of the assets and liabilities at the current exchange rate.

D)none of the above

A)when they are viewed from the perspective of the subsidiary firm.

B)when they are viewed from the perspective of the parent firm.

C)but this is only of material concern if the parent firm is liquidating the subsidiary in a bankruptcy and is forced to realize the value of the assets and liabilities at the current exchange rate.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

The difference between accounting exposure and translation exposure

A)translation is about going from one language to another, accounting is just about the numbers.

B)accounting exposure and translation exposure are the same thing.

C)hedging one always involves increasing the other.

D)hedging one might involve increasing the other.

A)translation is about going from one language to another, accounting is just about the numbers.

B)accounting exposure and translation exposure are the same thing.

C)hedging one always involves increasing the other.

D)hedging one might involve increasing the other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

The management of translation exposure is best described as

A)selecting a mechanical means for handling the consolidation process for MNCs that logically deals with exchange rate changes.

B)selecting a mechanical means for handling the consolidation process for MNCs that makes this quarter's accounting numbers as attractive as possible.

C)selecting a mechanical means for handling the consolidation process for MNCs that treats inventory valuation as LIFO on the income statement and FIFO on the balance sheet.

D)selecting a mechanical means for handling the consolidation process for MNCs that treats inventory valuation as FIFO on the income statement and LIFO on the balance sheet.

A)selecting a mechanical means for handling the consolidation process for MNCs that logically deals with exchange rate changes.

B)selecting a mechanical means for handling the consolidation process for MNCs that makes this quarter's accounting numbers as attractive as possible.

C)selecting a mechanical means for handling the consolidation process for MNCs that treats inventory valuation as LIFO on the income statement and FIFO on the balance sheet.

D)selecting a mechanical means for handling the consolidation process for MNCs that treats inventory valuation as FIFO on the income statement and LIFO on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

Under the monetary/nonmonetary method,revenue and expense items associated with nonmonetary accounts,such as cost of goods sold and depreciation,are translated at the historical rate associated with the balance sheet account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

The underlying principle of the current/noncurrent method is that assets and liabilities should be translated based on their maturity.

A)Current assets and liabilities are converted at the current exchange rate in effect when the cash flow associated with the asset or liability actually occurred.Non-current assets and liabilities are translated at the historical exchange rate that prevailed when the asset was recognized.

B)Current assets and liabilities, which by definition have a maturity of one year or less, are converted at the current exchange rate.Non-current assets and liabilities are translated at the historical exchange rate.

C)All assets and liabilities are converted at the current exchange rate.

D)None of the above

A)Current assets and liabilities are converted at the current exchange rate in effect when the cash flow associated with the asset or liability actually occurred.Non-current assets and liabilities are translated at the historical exchange rate that prevailed when the asset was recognized.

B)Current assets and liabilities, which by definition have a maturity of one year or less, are converted at the current exchange rate.Non-current assets and liabilities are translated at the historical exchange rate.

C)All assets and liabilities are converted at the current exchange rate.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is true?

A)The competitive effect is defined as the impact that a currency depreciation may have on the operating cash flow in the foreign currency by altering the firm's competitive position in the marketplace.

B)The conversion effect is defined as a given accounting cash value in a foreign currency that will be converted into a lower dollar amount after currency depreciation.

C)The competitive effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

D)None of the above

A)The competitive effect is defined as the impact that a currency depreciation may have on the operating cash flow in the foreign currency by altering the firm's competitive position in the marketplace.

B)The conversion effect is defined as a given accounting cash value in a foreign currency that will be converted into a lower dollar amount after currency depreciation.

C)The competitive effect is defined as a given operating cash flow in a foreign currency will be converted into a lower dollar amount after a currency depreciation.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

Translation exposure measures

A)the effect that an anticipated change in exchange rates will have on the consolidated financial reports of an MNC.

B)economic exposure.

C)the change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency, as a result of exchange rate change fluctuations, when viewed from the perspective of the parent firm.

D)all of the above

A)the effect that an anticipated change in exchange rates will have on the consolidated financial reports of an MNC.

B)economic exposure.

C)the change in the value of a foreign subsidiaries assets and liabilities denominated in a foreign currency, as a result of exchange rate change fluctuations, when viewed from the perspective of the parent firm.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

The authoritative body in the United States that specifies accounting policy for U.S.business firms and certified public accounting firms.

A)The Federal Accounting Standards Board (FASB).

B)The International Accounting Standards Board (IASB).

C)The Financial Accounting Standards Board (FASB).

D)The Securities and Exchange Commission (SEC)

A)The Federal Accounting Standards Board (FASB).

B)The International Accounting Standards Board (IASB).

C)The Financial Accounting Standards Board (FASB).

D)The Securities and Exchange Commission (SEC)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

The underlying principle of the current rate method is

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following statements is false?

A)Most income statement items under the current/noncurrent method are translated at the average exchange rate for the accounting period.

B)Under the current/noncurrent method, revenue and expense items that are associated with current assets or liabilities, such as depreciation expense, are translated at the historical rate that applies to the applicable balance sheet item.

C)Under the current/noncurrent method, revenue and expense items that are associated with noncurrent assets or liabilities, such as depreciation expense, are translated at the historical rate that applies to the applicable balance sheet item.

D)Depreciation expense is translated at the historical rate that applies to the applicable depreciable asset items.

A)Most income statement items under the current/noncurrent method are translated at the average exchange rate for the accounting period.

B)Under the current/noncurrent method, revenue and expense items that are associated with current assets or liabilities, such as depreciation expense, are translated at the historical rate that applies to the applicable balance sheet item.

C)Under the current/noncurrent method, revenue and expense items that are associated with noncurrent assets or liabilities, such as depreciation expense, are translated at the historical rate that applies to the applicable balance sheet item.

D)Depreciation expense is translated at the historical rate that applies to the applicable depreciable asset items.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

The underlying principle of the monetary/nonmonetary method is

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following is a translation method where the gain or loss due to translation adjustment does not affect reported cash flows?

A)Current/noncurrent method

B)Current rate method

C)Current/future method

D)Short/long term method

A)Current/noncurrent method

B)Current rate method

C)Current/future method

D)Short/long term method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

When using the current/noncurrent method,current assets are defined as

A)inventory that is currently salable.

B)assets with a maturity of one year or less.

C)assets with a maturity of 90 days or less.

D)none of the above

A)inventory that is currently salable.

B)assets with a maturity of one year or less.

C)assets with a maturity of 90 days or less.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

The underlying principle of the monetary/nonmonetary method is

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

According to the monetary/nonmonetary method,monetary balance sheet accounts include

A)for example, cash, marketable securities, accounts receivable, notes payable, accounts payable of a foreign subsidiary.

B)for example stockholders' equity and long term debt.

C)for example inventory paid for in cash, but not working capital.

D)COGs, sales, net income.

A)for example, cash, marketable securities, accounts receivable, notes payable, accounts payable of a foreign subsidiary.

B)for example stockholders' equity and long term debt.

C)for example inventory paid for in cash, but not working capital.

D)COGs, sales, net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

The underlying principle of the current rate method is

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

The underlying principle of the temporal method is

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

The underlying principle of the temporal method is

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

Under which accounting method are most income statement accounts translated at the average exchange rate for the period?

A)Current/noncurrent method

B)Monetary/nonmonetary method

C)Temporal method

D)Current rate method

A)Current/noncurrent method

B)Monetary/nonmonetary method

C)Temporal method

D)Current rate method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

When using the current/noncurrent method,

A)most income statement items are translated at the average exchange rate for the accounting period.

B)revenue and expense items that are associated with noncurrent assets or liabilities are translated at the historical rate that applies to the applicable balance sheet items.

C)depreciation expense is translated at the historical rate that applies to the applicable depreciable asset items.

D)all of the above

A)most income statement items are translated at the average exchange rate for the accounting period.

B)revenue and expense items that are associated with noncurrent assets or liabilities are translated at the historical rate that applies to the applicable balance sheet items.

C)depreciation expense is translated at the historical rate that applies to the applicable depreciable asset items.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

The underlying principle of the current/noncurrent method is

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

A)assets and liabilities should be translated based on their maturity.

B)monetary balance sheet accounts should be translated at the spot rate; nonmonetary accounts are translated at the historical rate in effect when the account was first recorded.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

In comparison to the current/noncurrent method,the monetary/nonmonetary method

A)differs substantially with regard to the treatment of inventory.

B)classifies accounts on the basis of similarity of attributes rather than the similarity of maturities.

C)both a) and b)

D)none of the above

A)differs substantially with regard to the treatment of inventory.

B)classifies accounts on the basis of similarity of attributes rather than the similarity of maturities.

C)both a) and b)

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

Under the current rate method,

A)income statement items are to be translated at the exchange rate at the dates the items are recognized.

B)since a) is generally impractical, an appropriately weighted average exchange rate for the period may be used for translation.

C)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

D)all of the above

A)income statement items are to be translated at the exchange rate at the dates the items are recognized.

B)since a) is generally impractical, an appropriately weighted average exchange rate for the period may be used for translation.

C)all balance sheet accounts are translated at the current exchange rate, except stockholders' equity.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

The underlying philosophy of the monetary/nonmonetary method is that

A)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation is independent of exchange rate changes.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)assets and liabilities should be translated based on their maturity

D)most income statement items are translated at the average exchange rate for the period.Depreciation and cost of goods sold, however, are translated at historical rates if the associated balance sheet accounts are carried at historical costs.

A)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation is independent of exchange rate changes.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)assets and liabilities should be translated based on their maturity

D)most income statement items are translated at the average exchange rate for the period.Depreciation and cost of goods sold, however, are translated at historical rates if the associated balance sheet accounts are carried at historical costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

Since fixed assets and inventory are usually carried at historical costs,

A)the temporal method and the monetary/nonmonetary methods will typically provide the same translation.

B)the current rate method and the monetary/nonmonetary methods will typically provide the same translation.

C)the temporal method and the current/noncurrent methods will typically provide the same translation.

D)none of the above

A)the temporal method and the monetary/nonmonetary methods will typically provide the same translation.

B)the current rate method and the monetary/nonmonetary methods will typically provide the same translation.

C)the temporal method and the current/noncurrent methods will typically provide the same translation.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

Under the current/noncurrent method

A)a foreign subsidiary with current assets in excess of current liabilities will cause a translation gain (loss) if the local currency appreciates (depreciates).

B)a foreign subsidiary with current assets in excess of current liabilities will cause a translation loss (gain) if the local currency appreciates (depreciates).

C)a foreign subsidiary with current assets in excess of current liabilities will cause a translation gain (loss) if the local currency depreciates (appreciates).

D)both b) and c)

A)a foreign subsidiary with current assets in excess of current liabilities will cause a translation gain (loss) if the local currency appreciates (depreciates).

B)a foreign subsidiary with current assets in excess of current liabilities will cause a translation loss (gain) if the local currency appreciates (depreciates).

C)a foreign subsidiary with current assets in excess of current liabilities will cause a translation gain (loss) if the local currency depreciates (appreciates).

D)both b) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

The underlying principle of the current/noncurrent method is

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

A)assets and liabilities should be translated based on their maturity.

B)monetary accounts have a similarity because their value represents a sum of money whose currency equivalent after translation changes each time the exchange rate changes.

C)monetary accounts are translated at the current exchange rate; other accounts are translated at the current exchange rate if they are carried on the books at current value; items carried at historical cost are translated at historic exchange rates.

D)all balance sheet accounts are translated at the current exchange rate, except for stockholders' equity.A "plug" equity account named cumulative translation adjustment (CTA) is used to make the balance sheet balance, since translation gains or losses do not go through the income statement according to this method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

Using the temporal method,monetary accounts such as cash

A)are not translated.

B)are translated at the average exchange rate prevailing over the reporting period.

C)are translated at the current forward exchange rate.

D)are translated at the current spot exchange rate.

A)are not translated.

B)are translated at the average exchange rate prevailing over the reporting period.

C)are translated at the current forward exchange rate.

D)are translated at the current spot exchange rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

FASB 8

A)required taking foreign exchange gains or losses through the income statement.

B)caused reported earnings to fluctuate substantially from year to year.

C)ran into acceptance problems from the accounting profession and MNCs.

D)all of the above

A)required taking foreign exchange gains or losses through the income statement.

B)caused reported earnings to fluctuate substantially from year to year.

C)ran into acceptance problems from the accounting profession and MNCs.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

A U.S.parent firm,as result of its business activities in Germany,has a net exposure of €1,000,000.The consolidated reports were prepared at the year end for the last two successive years.If the exchange rates on these reporting dates changed from $1.00 = €1.10 to $1.00 = €1.00,then the translation exposure report will indicate a "reporting currency imbalance" of

A)$90,910.

B)$0.

C)-$90,910.

D)none of the above

A)$90,910.

B)$0.

C)-$90,910.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

The "reporting currency" is defined in FASB 52 as

A)the currency of the primary economic environment in which the entity operates.

B)the currency in which the MNC prepares its consolidated financial statements.

C)a currency that is not the parent firm's home country currency.

D)both a) and c)

A)the currency of the primary economic environment in which the entity operates.

B)the currency in which the MNC prepares its consolidated financial statements.

C)a currency that is not the parent firm's home country currency.

D)both a) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

The "functional currency" is defined in FASB 52 as

A)the currency of the primary economic environment in which the entity operates.

B)the currency in which the MNC prepares its consolidated financial statements.

C)a currency that is not the parent firm's home country currency.

D)both b) and c)

A)the currency of the primary economic environment in which the entity operates.

B)the currency in which the MNC prepares its consolidated financial statements.

C)a currency that is not the parent firm's home country currency.

D)both b) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

A translation exposure report shows,for each account that is included in the consolidated balance sheet,

A)the amount of foreign exchange exposure that exists for each foreign subsidiary in which the MNC has a material interest.

B)the amount of foreign exchange exposure that exists on a net basis for the firm.

C)the amount of foreign exchange exposure that exists for each foreign currency in which the MNC has exposure.

D)none of the above

A)the amount of foreign exchange exposure that exists for each foreign subsidiary in which the MNC has a material interest.

B)the amount of foreign exchange exposure that exists on a net basis for the firm.

C)the amount of foreign exchange exposure that exists for each foreign currency in which the MNC has exposure.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

The currency of the primary economic environment in which the entity operates is defined in FASB 52 as

A)the "reporting currency".

B)the "functional currency".

C)the "current" currency.

D)none of the above

A)the "reporting currency".

B)the "functional currency".

C)the "current" currency.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

Salient economic factors for determining the functional currency include

A)cash flow indicators.

B)sales price indicators.

C)sales market indicators.

D)all of the above

A)cash flow indicators.

B)sales price indicators.

C)sales market indicators.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the above statements pertain to FASB 52?

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

FASB 52 requires

A)The current rate method of translation in some circumstances and the temporal method in others.

B)The current rate method of translation in some circumstances and the noncurrent method in others.

C)The monetary rate method of translation in some circumstances and the temporal method in others.

D)The current rate method of translation in some circumstances and the monetary method in others.

A)The current rate method of translation in some circumstances and the temporal method in others.

B)The current rate method of translation in some circumstances and the noncurrent method in others.

C)The monetary rate method of translation in some circumstances and the temporal method in others.

D)The current rate method of translation in some circumstances and the monetary method in others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is a translation method where a "plug" equity account called cumulative translation adjustment is used?

A)Current/noncurrent method

B)Current rate method

C)Current/future method

D)Short/long term method

A)Current/noncurrent method

B)Current rate method

C)Current/future method

D)Short/long term method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

Consider a U.S.-based MNC with manufacturing activities in Japan.The result of a change in the ¥-$ exchange rate on the assets and liabilities of the consolidated balance sheet is: Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "balance sheet hedge" of

A)¥200,000,000 more liabilities denominated in yen.

B)¥200,000,000 less assets denominated in yen.

C)both a) or b)

D)none of the above

A)¥200,000,000 more liabilities denominated in yen.

B)¥200,000,000 less assets denominated in yen.

C)both a) or b)

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

When determining the functional currency,

A)if the sales prices for the foreign entity's products are generally not responsive on a short-term basis to exchange rate changes, but are determined more by local competition and government regulation, the local currency should be the functional currency.

B)if there is an active local market for the foreign entity's products the local currency should be the functional currency.

C)if factor of production costs for the foreign entity are primarily, and on a continuing basis, costs for components obtained from the parent's country the functional currency should be the home currency.

D)all of the above

A)if the sales prices for the foreign entity's products are generally not responsive on a short-term basis to exchange rate changes, but are determined more by local competition and government regulation, the local currency should be the functional currency.

B)if there is an active local market for the foreign entity's products the local currency should be the functional currency.

C)if factor of production costs for the foreign entity are primarily, and on a continuing basis, costs for components obtained from the parent's country the functional currency should be the home currency.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

FASB 8 is essentially the

A)current/noncurrent method.

B)monetary/nonmonetary method.

C)temporal method.

D)current rate method.

A)current/noncurrent method.

B)monetary/nonmonetary method.

C)temporal method.

D)current rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the above statements pertain to FASB 8?

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

A)(i)

B)(i) and (ii)

C)(iii) and (iv)

D)(i), (ii), and (iii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

The International Accounting Standards Committee

A)is now known as The International Accounting Standards Board.

B)is charged with accounting standards at the International House of Pancakes.

C)includes many convicted felons among its members.

D)all of the above

A)is now known as The International Accounting Standards Board.

B)is charged with accounting standards at the International House of Pancakes.

C)includes many convicted felons among its members.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

The simplest of all translation methods to apply is

A)current/noncurrent method.

B)monetary/nonmonetary method.

C)temporal method.

D)current rate method.

A)current/noncurrent method.

B)monetary/nonmonetary method.

C)temporal method.

D)current rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

In what year were U.S.MNCs mandated to implement FASB 52?

A)1952

B)1962

C)1972

D)1982

A)1952

B)1962

C)1972

D)1982

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

In implementing FASB 52,

A)the functional currency of the foreign entity must be translated into the reporting currency in which the consolidated statements are reported.

B)the local currency of a foreign entity may not always be its functional currency.If it is not, the temporal method of translation is used to remeasure the foreign entity's books into the functional currency.

C)the current rate method is used to translate from the functional currency to the reporting currency.

D)in some cases, a foreign entity's functional currency may be the same as the reporting currency, in which case translation is not necessary.

E)All of the above are true

A)the functional currency of the foreign entity must be translated into the reporting currency in which the consolidated statements are reported.

B)the local currency of a foreign entity may not always be its functional currency.If it is not, the temporal method of translation is used to remeasure the foreign entity's books into the functional currency.

C)the current rate method is used to translate from the functional currency to the reporting currency.

D)in some cases, a foreign entity's functional currency may be the same as the reporting currency, in which case translation is not necessary.

E)All of the above are true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

The actual translation process prescribed by FASB 52 is

A)a two-stage process.

B)a twelve step program.

C)a five-step process.

D)none of the above.

A)a two-stage process.

B)a twelve step program.

C)a five-step process.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

The stated objectives of FASB 52 are

A)to provide information that is generally compatible with the expected economic effects of a rate change on an enterprise's cash flows and equity.

B)to reflect in consolidated statements the financial results and relationships of the individual consolidated entities as measured in their functional currencies in conformity with U.S.generally accepted accounting principles.

C)both a) and b)

D)none of the above

A)to provide information that is generally compatible with the expected economic effects of a rate change on an enterprise's cash flows and equity.

B)to reflect in consolidated statements the financial results and relationships of the individual consolidated entities as measured in their functional currencies in conformity with U.S.generally accepted accounting principles.

C)both a) and b)

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following are true statements?

A)Since translation exposure does not have an immediate direct effect on operating cash flows, its control is relatively unimportant in comparison to transaction exposure, which involves potential real cash flow losses.

B)Since it is generally not possible to eliminate both translation exposure and transaction exposure, it is more logical to effectively manage transaction exposure.

C)Two ways to control translation risk are: a balance sheet hedge and a derivatives "hedge."

D)All of the above are true statements

A)Since translation exposure does not have an immediate direct effect on operating cash flows, its control is relatively unimportant in comparison to transaction exposure, which involves potential real cash flow losses.

B)Since it is generally not possible to eliminate both translation exposure and transaction exposure, it is more logical to effectively manage transaction exposure.

C)Two ways to control translation risk are: a balance sheet hedge and a derivatives "hedge."

D)All of the above are true statements

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

XYZ Corporation,a U.S.parent firm,has a wholly owned sales affiliate,ABC Ltd.,in the United Kingdom.The affiliate was established to service to the local market. Assume that:

1)the functional currency of ABC is the pound

2)the reporting currency is the dollar

3)the initial exchange rate $1.00 = £ 0.67

ABC's nonconsolidated balance sheets and the footnotes to the financial statements indicate that ABC owes the parent firm £200,000.Assume that,XYZ had made an investment of $500,000 in the affiliate.Under FASB 52,the intercompany debt and investment will appear on the consolidated balance sheet as

A)£200,000.

B)$201,493.

C)$298,507.

D)none of the above

1)the functional currency of ABC is the pound

2)the reporting currency is the dollar

3)the initial exchange rate $1.00 = £ 0.67

ABC's nonconsolidated balance sheets and the footnotes to the financial statements indicate that ABC owes the parent firm £200,000.Assume that,XYZ had made an investment of $500,000 in the affiliate.Under FASB 52,the intercompany debt and investment will appear on the consolidated balance sheet as

A)£200,000.

B)$201,493.

C)$298,507.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

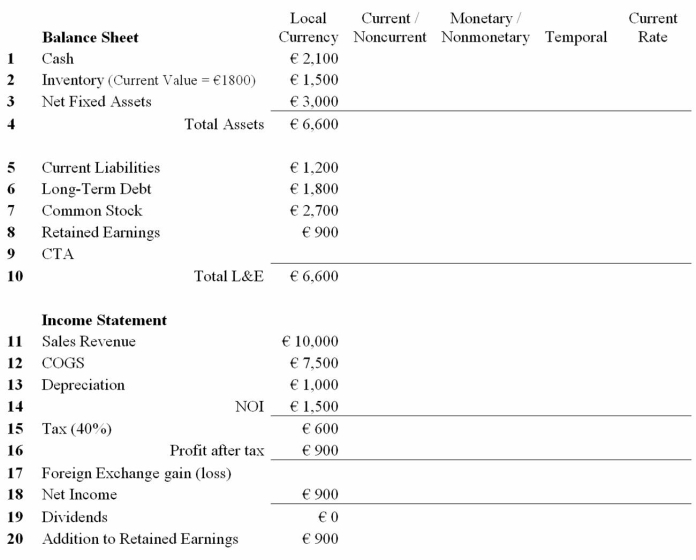

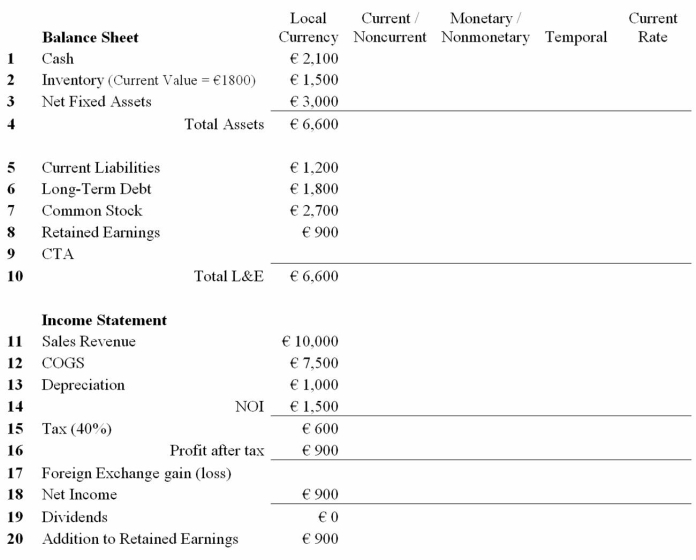

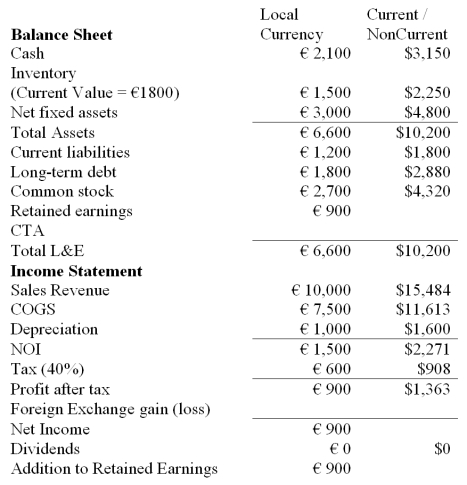

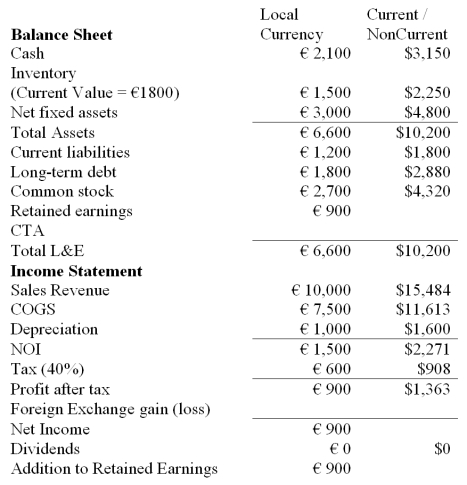

Fill out the 20 missing entries that translate the balance sheet and income statement for this French subsidiary using the Current/Noncurrent Method,the Monetary/Nonmonetary Method,the Temporal Method,and the Current Rate Method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

The source of translation exposure

A)is a mismatch of net assets and net liabilities denominated in the same currency.

B)is a mismatch of net assets and net liabilities denominated in different currencies.

C)is a mismatch of current assets and current liabilities denominated in different currencies.

D)none of the above

A)is a mismatch of net assets and net liabilities denominated in the same currency.

B)is a mismatch of net assets and net liabilities denominated in different currencies.

C)is a mismatch of current assets and current liabilities denominated in different currencies.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

Consider a U.S.-based MNC with manufacturing activities in Japan.The result of a change in the ¥-$ exchange rate on the assets and liabilities of the consolidated balance sheet is: Ignoring transaction exposure in the yen,the translation exposure will indicate a possible need for a "derivatives hedge" of

A)short position in ¥200,000,000 currency futures.

B)long position in ¥200,000,000 currency futures.

C)either a) or b)

D)none of the above

A)short position in ¥200,000,000 currency futures.

B)long position in ¥200,000,000 currency futures.

C)either a) or b)

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

If a foreign entity is only a shell company for carrying accounts that could be carried on the parent's books,

A)the functional currency would generally be the parent's currency.

B)the functional currency would generally be the local currency.

C)there is no reason to hedge transaction exposure.

D)none of the above

A)the functional currency would generally be the parent's currency.

B)the functional currency would generally be the local currency.

C)there is no reason to hedge transaction exposure.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

A balance sheet hedge seeks to

A)eliminate any mismatch of net assets and net liabilities denominated in the same currency.

B)transfer accounting exposure to transaction exposure.

C)create cumulative translation adjustment.

D)none of the above

A)eliminate any mismatch of net assets and net liabilities denominated in the same currency.

B)transfer accounting exposure to transaction exposure.

C)create cumulative translation adjustment.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following are true?

A)Some items that are a source of transaction exposure are also a source of translation exposure.

B)Some items that are a source of transaction exposure are NOT also a source of translation exposure.

C)Both a) and b)

D)None of the above

A)Some items that are a source of transaction exposure are also a source of translation exposure.

B)Some items that are a source of transaction exposure are NOT also a source of translation exposure.

C)Both a) and b)

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

With regard to translation exposure versus operating exposure

A)upper management should be more concerned with translation exposure.

B)any discussion really involves speculation about foreign exchange rate changes.

C)upper management should be more concerned with operating exposure.

D)none of the above

A)upper management should be more concerned with translation exposure.

B)any discussion really involves speculation about foreign exchange rate changes.

C)upper management should be more concerned with operating exposure.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

With regard to foreign currency translation methods used by foreign MNCs,

A)foreign currency translation methods are generally only used by U.S.-based MNCs since foreign firms have a built in hedge by being foreign.

B)are generally the same methods used by U.S.-based firms.

C)are exactly the same methods used by U.S.-based firms since GAAP is GAAP.

D)none of the above are true statements.

A)foreign currency translation methods are generally only used by U.S.-based MNCs since foreign firms have a built in hedge by being foreign.

B)are generally the same methods used by U.S.-based firms.

C)are exactly the same methods used by U.S.-based firms since GAAP is GAAP.

D)none of the above are true statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

A highly inflationary economy is defined in FASB 52 as

A)one that has cumulative inflation of approximately 100 percent or more over a 3-year period.

B)one that has current inflation of approximately 40 percent per year.

C)one that has going-forward expected inflation of approximately 40 percent per year.

D)none of the above

A)one that has cumulative inflation of approximately 100 percent or more over a 3-year period.

B)one that has current inflation of approximately 40 percent per year.

C)one that has going-forward expected inflation of approximately 40 percent per year.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

A derivatives hedge that seeks to eliminate translation exposure

A)eliminate any mismatch of the rate of change in net assets and the rate of change in net liabilities denominated in the same currency.

B)really involves speculation about foreign exchange rate changes.

C)by simultaneously going long and short in currency futures contracts.

D)none of the above

A)eliminate any mismatch of the rate of change in net assets and the rate of change in net liabilities denominated in the same currency.

B)really involves speculation about foreign exchange rate changes.

C)by simultaneously going long and short in currency futures contracts.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

Generally speaking,

A)it is not possible to hedge both translation exposure and transaction exposure simultaneously.

B)if a firm can hedge translation exposure then transaction exposure will be simultaneously hedged.

C)if a firm can hedge transaction exposure then translation exposure will be simultaneously hedged.

D)none of the above

A)it is not possible to hedge both translation exposure and transaction exposure simultaneously.

B)if a firm can hedge translation exposure then transaction exposure will be simultaneously hedged.

C)if a firm can hedge transaction exposure then translation exposure will be simultaneously hedged.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

In highly inflationary economies,FASB 52 requires that the foreign entities' financial statement be remeasured from the local currency "as if the functional currency were the reporting currency".The purpose of this requirement is

A)to prevent large important balance sheet accounts, carried at historical values, from having insignificant values once translated into the reporting currency at the current rate.

B)to prevent games playing in the accounting books.

C)to prevent having to restate the books at a later date.

D)none of the above

A)to prevent large important balance sheet accounts, carried at historical values, from having insignificant values once translated into the reporting currency at the current rate.

B)to prevent games playing in the accounting books.

C)to prevent having to restate the books at a later date.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

The impact of financing in determining the functional currency

A)financing does not impact the choice of functional currency due to the integrated nature of capital markets.

B)if the financing of the foreign entity is primarily denominated in the foreign currency and the debt service obligations are normally handled by the foreign entity, the functional currency is the foreign currency.

C)if the financing of the foreign entity is primarily from the parent, with debt service obligations normally handled by the parent, the functional currency is the home currency.

D)both b) and c)

A)financing does not impact the choice of functional currency due to the integrated nature of capital markets.

B)if the financing of the foreign entity is primarily denominated in the foreign currency and the debt service obligations are normally handled by the foreign entity, the functional currency is the foreign currency.

C)if the financing of the foreign entity is primarily from the parent, with debt service obligations normally handled by the parent, the functional currency is the home currency.

D)both b) and c)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

Under which method does the gain or loss due to translation adjustment not affect reported cash flows,as it does with the other three translation methods?

A)Current/noncurrent method

B)Monetary/nonmonetary method

C)Temporal method

D)Current rate method

A)Current/noncurrent method

B)Monetary/nonmonetary method

C)Temporal method

D)Current rate method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

Under FASB 52,when a net translation exposure exists,

A)a derivatives hedge is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

B)a money market hedge is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

C)a cumulative translation adjustment account is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

D)none of the above

A)a derivatives hedge is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

B)a money market hedge is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

C)a cumulative translation adjustment account is necessary to bring balance to the consolidated balance sheet after an exchange rate change.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

Find the foreign currency gain or loss for this U.S.MNC translating the balance sheet and income statement of a French subsidiary,which keeps its books in euro,but that is translated into U.S.dollars using the current/noncurrent method,the reporting currency of the U.S.MNC.

The subsidiary is at the end of its first year of operation.

The historical exchange rate is $1.60/€1.00 and the most recent exchange rate is $1.50/€

The subsidiary is at the end of its first year of operation.

The historical exchange rate is $1.60/€1.00 and the most recent exchange rate is $1.50/€

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

With regard to research on the stock price reaction to mandated accounting changes such as FASB 52

A)the results suggest that market participants seem to think that changes in reported earnings do not change the actual cash flows in multinational firms.

B)the results suggest that market agents react to "cosmetic" earning changes.

C)the results suggest that market agents do not react to cosmetic earning changes that do not affect value.

D)none of the above

A)the results suggest that market participants seem to think that changes in reported earnings do not change the actual cash flows in multinational firms.

B)the results suggest that market agents react to "cosmetic" earning changes.

C)the results suggest that market agents do not react to cosmetic earning changes that do not affect value.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

Translation exposure,

A)is not entity specific, rather it is currency specific.

B)is not currency specific, rather it is entity specific.

C)involves restatement from Italian to French.

D)none of the above

A)is not entity specific, rather it is currency specific.

B)is not currency specific, rather it is entity specific.

C)involves restatement from Italian to French.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck