Deck 14: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/200

العب

ملء الشاشة (f)

Deck 14: Financial Statement Analysis

1

Financial leverage is negative in which of the following situations?

A) When the return on total assets is less than the rate of return on common shareholders' equity.

B) When total liabilities are less than shareholders' equity.

C) When total liabilities are less than total assets.

D) When the return on total assets is less than the rate of return demanded by creditors.

A) When the return on total assets is less than the rate of return on common shareholders' equity.

B) When total liabilities are less than shareholders' equity.

C) When total liabilities are less than total assets.

D) When the return on total assets is less than the rate of return demanded by creditors.

D

2

Which of the following is true regarding the calculation of return on total assets?

A) The numerator of the ratio consists only of net income.

B) The denominator of the ratio consists of the balance of total assets at the end of the period under consideration.

C) The numerator of the ratio consists of net income plus interest expense multiplied by the tax rate.

D) The numerator of the ratio consists of net income plus interest expense multiplied by one minus the tax rate.

A) The numerator of the ratio consists only of net income.

B) The denominator of the ratio consists of the balance of total assets at the end of the period under consideration.

C) The numerator of the ratio consists of net income plus interest expense multiplied by the tax rate.

D) The numerator of the ratio consists of net income plus interest expense multiplied by one minus the tax rate.

D

3

Last year,Allen Company's average collection period for accounts receivable was 40 days; this year,it increased to 60 days.Which of the following would most likely account for this change?

A) A decrease in accounts receivable relative to sales.

B) A decrease in sales.

C) A relaxation of credit policies.

D) An increase in sales.

A) A decrease in accounts receivable relative to sales.

B) A decrease in sales.

C) A relaxation of credit policies.

D) An increase in sales.

C

4

How is horizontal analysis of financial statements accomplished?

A) By placing statement items on an after-tax basis.

B) By common-size statements.

C) By calculating both earnings per share and the price-earnings ratio.

D) By trend percentages.

A) By placing statement items on an after-tax basis.

B) By common-size statements.

C) By calculating both earnings per share and the price-earnings ratio.

D) By trend percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

5

The gross margin percentage is most likely to be used to assess which of the following?

A) How quickly accounts receivables can be collected.

B) How quickly inventories are sold.

C) The efficiency of administrative departments.

D) The overall profitability of the company's products.

A) How quickly accounts receivables can be collected.

B) How quickly inventories are sold.

C) The efficiency of administrative departments.

D) The overall profitability of the company's products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

6

An increase in the market price of a company's common shares will immediately affect which of the following?

A) Dividend yield ratio.

B) Debt-to-equity ratio.

C) Earnings per common share.

D) Dividend payout ratio.

A) Dividend yield ratio.

B) Debt-to-equity ratio.

C) Earnings per common share.

D) Dividend payout ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

7

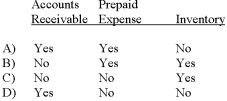

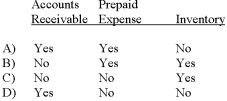

Which of the following accounts would be included in the calculation of the acid-test ratio?

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

8

What will be the effect of a sale of a piece of equipment at book value for cash?

A) An increase in working capital.

B) A decrease in working capital.

C) A decrease in the debt-to-equity ratio.

D) An increase in net income.

A) An increase in working capital.

B) A decrease in working capital.

C) A decrease in the debt-to-equity ratio.

D) An increase in net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a firm has a high current ratio but a low acid-test ratio,one can conclude which of the following?

A) The firm has a large outstanding accounts receivable balance.

B) The firm has a large investment in inventory.

C) The firm has a large amount of current liabilities.

D) The firm's financial leverage is very high.

A) The firm has a large outstanding accounts receivable balance.

B) The firm has a large investment in inventory.

C) The firm has a large amount of current liabilities.

D) The firm's financial leverage is very high.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Miller Company's current ratio is greater than 1.0 to 1.By paying off some of its accounts payable using cash,what would be the effect on the company's current ratio?

A) An increase.

B) A decrease.

C) Remain unchanged.

D) Impossible to determine from the information given.

A) An increase.

B) A decrease.

C) Remain unchanged.

D) Impossible to determine from the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which one of the following would increase the working capital of a company?

A) Cash payment of payroll taxes payable.

B) Refinancing a short-term note payable with a two-year note payable.

C) Cash collection of accounts receivable.

D) Payment of a 20-year mortgage payable with cash.

A) Cash payment of payroll taxes payable.

B) Refinancing a short-term note payable with a two-year note payable.

C) Cash collection of accounts receivable.

D) Payment of a 20-year mortgage payable with cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a loss resulting from an earthquake is classified as extraordinary,which of the following disclosures meets the minimum requirements in Canada?

A) Two earnings per share figures,one before and the other after the net of tax effect of the extraordinary loss.

B) One earnings per share figure that ignores the extraordinary loss.

C) One earnings per share figure,net of the before-tax effect of the extraordinary loss.

D) One earnings per share figure,net of the after-tax effect of the extraordinary loss.

A) Two earnings per share figures,one before and the other after the net of tax effect of the extraordinary loss.

B) One earnings per share figure that ignores the extraordinary loss.

C) One earnings per share figure,net of the before-tax effect of the extraordinary loss.

D) One earnings per share figure,net of the after-tax effect of the extraordinary loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

13

Earnings per common share will immediately increase as a result of which of the following?

A) The sale of additional common shares by the company.

B) An increase in the dividends paid to common shareholders by the company.

C) An increase in the company's net income.

D) The issuance of bonds by the company to finance construction of new buildings.

A) The sale of additional common shares by the company.

B) An increase in the dividends paid to common shareholders by the company.

C) An increase in the company's net income.

D) The issuance of bonds by the company to finance construction of new buildings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

14

The market price of XYZ Company's common shares dropped from $25 to $21 per share.The dividend paid per share remained unchanged.How would the company's dividend payout ratio change?

A) Increase.

B) Decrease.

C) Remain unchanged.

D) Impossible to determine without more information.

A) Increase.

B) Decrease.

C) Remain unchanged.

D) Impossible to determine without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is NOT a potential source of financial leverage?

A) Bonds payable.

B) Accounts payable.

C) Preferred shares.

D) Retained earnings.

A) Bonds payable.

B) Accounts payable.

C) Preferred shares.

D) Retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

16

If a company converts a short-term note payable into a long-term note payable,what would be the effect of this transaction?

A) A decrease in working capital and an increase in the current ratio.

B) A decrease in both working capital and the current ratio.

C) A decrease in both the current ratio and the acid-test ratio.

D) An increase in both working capital and the current ratio.

A) A decrease in working capital and an increase in the current ratio.

B) A decrease in both working capital and the current ratio.

C) A decrease in both the current ratio and the acid-test ratio.

D) An increase in both working capital and the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

17

Rahner Company has a current ratio of 1.75 to 1.This ratio will decrease if Rahner Company engages in which of the following transactions?

A) Borrows cash using a six-month note.

B) Pays the taxes payable that have been a current liability.

C) Pays the following month's rent on the last day of the year.

D) Sells inventory for more than its cost.

A) Borrows cash using a six-month note.

B) Pays the taxes payable that have been a current liability.

C) Pays the following month's rent on the last day of the year.

D) Sells inventory for more than its cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

18

If a company's bonds bear an interest rate of 8%,its tax rate is 30%,and its assets are generating an after-tax return of 7%,what would be the leverage?

A) Positive.

B) Negative.

C) Neither positive nor negative.

D) Impossible to determine without knowing the return on common shareholders' equity.

A) Positive.

B) Negative.

C) Neither positive nor negative.

D) Impossible to determine without knowing the return on common shareholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

19

Desktop Co.presently has a current ratio of 1.2 to 1 and an acid-test ratio of 0.8 to 1.What will be effect of prepaying next year's office rent of $50,000?

A) No effect on either the company's current ratio or its acid-test ratio.

B) No effect on the company's current ratio but will decrease its acid-test ratio.

C) A decrease in both the company's current ratio and its acid-test ratio.

D) An increase in both the company's current ratio and its acid-test ratio.

A) No effect on either the company's current ratio or its acid-test ratio.

B) No effect on the company's current ratio but will decrease its acid-test ratio.

C) A decrease in both the company's current ratio and its acid-test ratio.

D) An increase in both the company's current ratio and its acid-test ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company's current ratio and acid-test ratios are both greater than 1.0 to 1.If obsolete inventory is written off,what would be the effect?

A) A decrease in the acid-test ratio.

B) An increase in the acid-test ratio.

C) An increase in net working capital.

D) A decrease in the current ratio.

A) A decrease in the acid-test ratio.

B) An increase in the acid-test ratio.

C) An increase in net working capital.

D) A decrease in the current ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

21

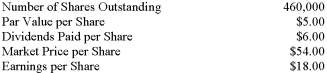

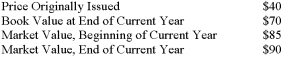

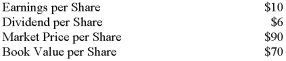

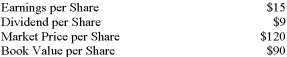

Information concerning the common shares of Morris Company as of the end of the company's fiscal year is presented below:  The dividend yield ratio is closest to which of the following?

The dividend yield ratio is closest to which of the following?

A) 11.1%.

B) 33.3%.

C) 50.0%.

D) 120.0%.

The dividend yield ratio is closest to which of the following?

The dividend yield ratio is closest to which of the following?A) 11.1%.

B) 33.3%.

C) 50.0%.

D) 120.0%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

22

The net accounts receivable for Andante Company were $150,000 at the beginning of the most recent year and $190,000 at the end of the year.If the accounts receivable turnover for the year was 8.5,and 15% of total sales were cash sales,what were the total sales for the year?

A) $1,445,000.

B) $1,500,000.

C) $1,700,000.

D) $1,900,000.

A) $1,445,000.

B) $1,500,000.

C) $1,700,000.

D) $1,900,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following events is unique to the calculation of fully diluted earnings per share?

A) An extraordinary gain or loss resulting from fire.

B) Issuance of common share.

C) Issuance of bonds that can be converted to common shares.

D) Issuance of participating and cumulative preferred shares.

A) An extraordinary gain or loss resulting from fire.

B) Issuance of common share.

C) Issuance of bonds that can be converted to common shares.

D) Issuance of participating and cumulative preferred shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

24

Cameron Company had 50,000 common shares issued and outstanding during the year just ended.The following information pertains to these shares:  The total dividend on common shares for the year was $400,000.What was Cameron Company's dividend yield ratio for the year?

The total dividend on common shares for the year was $400,000.What was Cameron Company's dividend yield ratio for the year?

A) 8.89%.

B) 9.41%.

C) 11.43%.

D) 20.00%.

The total dividend on common shares for the year was $400,000.What was Cameron Company's dividend yield ratio for the year?

The total dividend on common shares for the year was $400,000.What was Cameron Company's dividend yield ratio for the year?A) 8.89%.

B) 9.41%.

C) 11.43%.

D) 20.00%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

25

Selected data from Sheridan Corporation's year-end financial statements are presented below.The difference between average and ending inventory is immaterial.  What were Sheridan's sales for the year?

What were Sheridan's sales for the year?

A) $240,000.

B) $480,000.

C) $800,000.

D) $1,200,000.

What were Sheridan's sales for the year?

What were Sheridan's sales for the year?A) $240,000.

B) $480,000.

C) $800,000.

D) $1,200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

26

Arlberg Company's net income last year was $250,000.The company had 150,000 common shares and 80,000 preferred shares.There was no change in the number of common or preferred shares outstanding during the year.The company declared and paid dividends last year of $1.30 per common share and $1.40 per preferred share.The earnings per common share was closest to which of the following?

A) $0.37.

B) $0.92.

C) $1.67.

D) $2.41.

A) $0.37.

B) $0.92.

C) $1.67.

D) $2.41.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

27

Perlman Company had 100,000 common shares and 20,000 preferred shares at the end of the year just completed.Preferred shareholders received total dividends of $140,000.Common shareholders received total dividends of $210,000.If the dividend payout ratio for the year was 70%,what was the net income for the year?

A) $147,000.

B) $287,000.

C) $300,000.

D) $440,000.

A) $147,000.

B) $287,000.

C) $300,000.

D) $440,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

28

Fulton Company's price-earnings ratio is 8.0,and the market price of its common shares is $32.The company has 3,000 shares of preferred shares outstanding,with each share receiving a dividend of $3.What is the earnings per common share?

A) $3.

B) $4.

C) $7.

D) $10.

A) $3.

B) $4.

C) $7.

D) $10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

29

Crawler Company's net income last year was $80,000.The company paid dividends on preferred shares of $10,000,and its average common shareholders' equity was $400,000.The company's return on common shareholders' equity for the year was closest to which of the following?

A) 2.5%.

B) 17.5%.

C) 20.0%.

D) 22.5%.

A) 2.5%.

B) 17.5%.

C) 20.0%.

D) 22.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

30

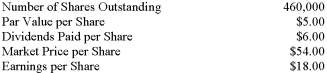

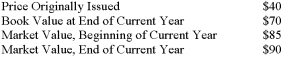

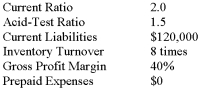

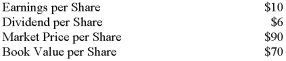

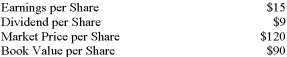

The following data have been taken from your company's financial records for the current year:  What is the price-earnings ratio?

What is the price-earnings ratio?

A) 1.67 to 1.

B) 7.00 to 1.

C) 9.00 to 1.

D) 15.00 to 1.

What is the price-earnings ratio?

What is the price-earnings ratio?A) 1.67 to 1.

B) 7.00 to 1.

C) 9.00 to 1.

D) 15.00 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

31

Crabtree Company's net income last year was $50,000.The company paid dividends on preferred shares of $20,000,and its average common shareholders' equity was $440,000.The company's return on common shareholders' equity for the year was closest to which of the following?

A) 4.5%.

B) 6.8%.

C) 11.4%.

D) 15.9%.

A) 4.5%.

B) 6.8%.

C) 11.4%.

D) 15.9%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

32

Arget Company's net income last year was $600,000.The company had 150,000 common shares and 60,000 preferred shares.There was no change in the number of common or preferred shares outstanding during the year.The company declared and paid dividends last year of $1.10 per common share and $0.60 per preferred share.The earnings per common share was closest to which of the following?

A) $2.90.

B) $3.76.

C) $4.00.

D) $4.24.

A) $2.90.

B) $3.76.

C) $4.00.

D) $4.24.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

33

Selected financial data for Irvington Company appear below:  During the year,the company paid dividends of $10,000 on its preferred shares.The company's net income for the year was $120,000.The company's return on common shareholders' equity for the year was closest to which of the following?

During the year,the company paid dividends of $10,000 on its preferred shares.The company's net income for the year was $120,000.The company's return on common shareholders' equity for the year was closest to which of the following?

A) 17%.

B) 19%.

C) 23%.

D) 25%.

During the year,the company paid dividends of $10,000 on its preferred shares.The company's net income for the year was $120,000.The company's return on common shareholders' equity for the year was closest to which of the following?

During the year,the company paid dividends of $10,000 on its preferred shares.The company's net income for the year was $120,000.The company's return on common shareholders' equity for the year was closest to which of the following?A) 17%.

B) 19%.

C) 23%.

D) 25%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

34

Crasler Company's net income last year was $100,000.The company paid dividends on preferred shares of $20,000,and its average common shareholders' equity was $580,000.The company's return on common shareholders' equity for the year was closest to which of the following?

A) 3.4%.

B) 13.8%.

C) 17.2%.

D) 20.7%.

A) 3.4%.

B) 13.8%.

C) 17.2%.

D) 20.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

35

Arquandt Company's net income last year was $550,000.The company had 150,000 common shares and 50,000 preferred shares outstanding.There was no change in the number of common or preferred shares outstanding during the year.The company declared and paid dividends last year of $1.20 per common share and $1.70 per preferred share.The earnings per common share was closest to which of the following?

A) $2.47.

B) $3.10.

C) $3.67.

D) $4.23.

A) $2.47.

B) $3.10.

C) $3.67.

D) $4.23.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

36

Brachlan Company's net income last year was $80,000,and its interest expense was $20,000.Total assets at the beginning of the year were $660,000,and total assets at the end of the year were $620,000.The company's income tax rate was 30%.The company's return on total assets for the year was closest to which of the following?

A) 12.5%.

B) 13.4%.

C) 14.7%.

D) 15.6%.

A) 12.5%.

B) 13.4%.

C) 14.7%.

D) 15.6%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

37

Braverman Company's net income last year was $75,000,and its interest expense was $10,000.Total assets at the beginning of the year were $650,000,and total assets at the end of the year were $610,000.The company's income tax rate was 30%.The company's return on total assets for the year was closest to which of the following?

A) 11.9%.

B) 12.4%.

C) 13.0%.

D) 13.5%.

A) 11.9%.

B) 12.4%.

C) 13.0%.

D) 13.5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

38

Brawer Company's net income last year was $55,000,and its interest expense was $20,000.Total assets at the beginning of the year were $660,000,and total assets at the end of the year were $620,000.The company's income tax rate was 30%.The company's return on total assets for the year was closest to which of the following?

A) 8.6%.

B) 9.5%.

C) 10.8%.

D) 11.7%.

A) 8.6%.

B) 9.5%.

C) 10.8%.

D) 11.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

39

The total assets of the Philbin Company on January 1 were $2.3 million and on December 31 were $2.5 million.Net income for the year was $188,000.Dividends for the year were $75,000,interest expense was $70,000,and the tax rate was 30%.The return on total assets for the year was closest to which of the following?

A) 6.8%.

B) 9.5%.

C) 9.9%.

D) 10.8%.

A) 6.8%.

B) 9.5%.

C) 9.9%.

D) 10.8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

40

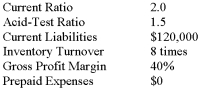

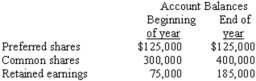

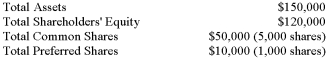

The following data have been taken from your company's financial records for the current year:  What is the price-earnings ratio?

What is the price-earnings ratio?

A) 6.0 to 1.

B) 7.5 to 1.

C) 8.0 to 1.

D) 12.5 to 1.

What is the price-earnings ratio?

What is the price-earnings ratio?A) 6.0 to 1.

B) 7.5 to 1.

C) 8.0 to 1.

D) 12.5 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

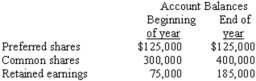

41

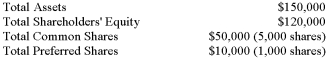

The following account balances have been provided for the end of the most recent year:  What is the book value per common share?

What is the book value per common share?

A) $20.

B) $22.

C) $25.

D) $28.

What is the book value per common share?

What is the book value per common share?A) $20.

B) $22.

C) $25.

D) $28.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

42

Granger Company had $180,000 in sales on account last year.The beginning accounts receivable balance was $10,000,and the ending accounts receivable balance was $18,000.The company's average collection period (age of receivables)was closest to which of the following?

A) 20.28 days.

B) 28.39 days.

C) 36.50 days.

D) 56.78 days.

A) 20.28 days.

B) 28.39 days.

C) 36.50 days.

D) 56.78 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

43

Eastham Company's accounts receivable were $600,000 at the beginning of the year and $800,000 at the end of the year.Cash sales for the year were $300,000.The accounts receivable turnover for the year was 5 times.What were Eastham Company's total sales for the year?

A) $800,000.

B) $1,300,000.

C) $3,300,000.

D) $3,800,000.

A) $800,000.

B) $1,300,000.

C) $3,300,000.

D) $3,800,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

44

Dragin Company's working capital is $36,000,and its current liabilities are $61,000.The company's current ratio is closest to which of the following?

A) 0.41 to 1.

B) 0.59 to 1.

C) 1.59 to 1.

D) 2.69 to 1.

A) 0.41 to 1.

B) 0.59 to 1.

C) 1.59 to 1.

D) 2.69 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

45

Dratif Company's working capital is $33,000,and its current liabilities are $80,000.The company's current ratio is closest to which of the following?

A) 0.41 to 1.

B) 0.59 to 1.

C) 1.41 to 1.

D) 3.42 to 1.

A) 0.41 to 1.

B) 0.59 to 1.

C) 1.41 to 1.

D) 3.42 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

46

Frabine Company had $150,000 in sales on account last year.The beginning accounts receivable balance was $14,000,and the ending accounts receivable balance was $18,000.The company's accounts receivable turnover was closest to which of the following?

A) 4.69 times.

B) 8.33 times.

C) 9.38 times.

D) 10.71 times.

A) 4.69 times.

B) 8.33 times.

C) 9.38 times.

D) 10.71 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

47

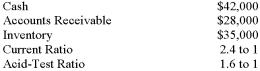

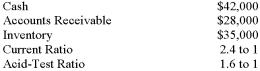

Ben Company has the following data for the year just ended:  What were Ben Company's current liabilities?

What were Ben Company's current liabilities?

A) $35,000.

B) $43,750.

C) $50,400.

D) $63,000.

What were Ben Company's current liabilities?

What were Ben Company's current liabilities?A) $35,000.

B) $43,750.

C) $50,400.

D) $63,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

48

Selected year-end data for the Brayer Company are presented below:  The company has no prepaid expenses,and inventories remained unchanged during the year.Based on these data,the company's inventory turnover ratio for the year was closest to which of the following?

The company has no prepaid expenses,and inventories remained unchanged during the year.Based on these data,the company's inventory turnover ratio for the year was closest to which of the following?

A) 1.20 times.

B) 1.67 times.

C) 2.33 times.

D) 2.40 times.

The company has no prepaid expenses,and inventories remained unchanged during the year.Based on these data,the company's inventory turnover ratio for the year was closest to which of the following?

The company has no prepaid expenses,and inventories remained unchanged during the year.Based on these data,the company's inventory turnover ratio for the year was closest to which of the following?A) 1.20 times.

B) 1.67 times.

C) 2.33 times.

D) 2.40 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

49

Frantic Company had $130,000 in sales on account last year.The beginning accounts receivable balance was $10,000,and the ending accounts receivable balance was $16,000.The company's accounts receivable turnover was closest to which of the following?

A) 5.00 times.

B) 8.13 times.

C) 10.00 times.

D) 13.00 times.

A) 5.00 times.

B) 8.13 times.

C) 10.00 times.

D) 13.00 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

50

Eral Company has $17,000 in cash,$3,000 in marketable securities,$36,000 in current receivables,$24,000 in inventories,and $45,000 in current liabilities.The company's acid-test (quick)ratio is closest to which of the following?

A) 0.44 to 1.

B) 0.80 to 1.

C) 1.24 to 1.

D) 1.78 to 1.

A) 0.44 to 1.

B) 0.80 to 1.

C) 1.24 to 1.

D) 1.78 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

51

At the end of the year just completed,Orem Company's total current liabilities were $75,000,and its total long-term liabilities were $225,000.Working capital at year-end was $100,000.If the company's debt-to-equity ratio is 0.30 to 1,total long-term assets must equal which of the following?

A) $1,000,000.

B) $1,125,000.

C) $1,225,000.

D) $1,300,000.

A) $1,000,000.

B) $1,125,000.

C) $1,225,000.

D) $1,300,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

52

Erack Company has $15,000 in cash,$4,000 in marketable securities,$38,000 in current receivables,$18,000 in inventories,and $40,000 in current liabilities.The company's acid-test (quick)ratio is closest to which of the following?

A) 0.95 to 1.

B) 1.33 to 1.

C) 1.43 to 1.

D) 1.88 to 1.

A) 0.95 to 1.

B) 1.33 to 1.

C) 1.43 to 1.

D) 1.88 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

53

Harwichport Company has a current ratio of 3.5 to 1 and an acid-test ratio of 2.8 to 1.Current assets equal $175,000,of which $5,000 consists of prepaid expenses.What must be Harwichport Company's inventory?

A) $30,000.

B) $35,000.

C) $40,000.

D) $50,000.

A) $30,000.

B) $35,000.

C) $40,000.

D) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

54

Starrs Company has current assets of $300,000 and current liabilities of $200,000.Which of the following transactions would increase its working capital?

A) Prepayment of $50,000 of next year's rent.

B) Refinancing $50,000 of short-term debt with long-term debt.

C) Acquisition of land valued at $50,000 by issuing new common shares.

D) Purchase of $50,000 of marketable securities for cash.

A) Prepayment of $50,000 of next year's rent.

B) Refinancing $50,000 of short-term debt with long-term debt.

C) Acquisition of land valued at $50,000 by issuing new common shares.

D) Purchase of $50,000 of marketable securities for cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

55

Grapp Company had $130,000 in sales on account last year.The beginning accounts receivable balance was $18,000,and the ending accounts receivable balance was $16,000.The company's average collection period (age of receivables)was closest to which of the following?

A) 44.92 days.

B) 47.73 days.

C) 50.54 days.

D) 95.46 days.

A) 44.92 days.

B) 47.73 days.

C) 50.54 days.

D) 95.46 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

56

Draban Company's working capital is $38,000,and its current liabilities are $59,000.The company's current ratio is closest to which of the following?

A) 0.36 to 1.

B) 0.64 to 1.

C) 1.64 to 1.

D) 2.55 to 1.

A) 0.36 to 1.

B) 0.64 to 1.

C) 1.64 to 1.

D) 2.55 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

57

Marcy Corporation's current ratio is currently 1.75 to 1.The firm's current ratio cannot fall below 1.5 to 1 without violating agreements with its bondholders.If current liabilities are presently $250 million,what is the maximum new short-term debt that can be issued to finance an equivalent amount of inventory expansion?

A) $41.67 million.

B) $62.50 million.

C) $125.00 million.

D) $375.00 million.

A) $41.67 million.

B) $62.50 million.

C) $125.00 million.

D) $375.00 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

58

Erambo Company has $11,000 in cash,$6,000 in marketable securities,$27,000 in current receivables,$8,000 in inventories,and $51,000 in current liabilities.The company's acid-test (quick)ratio is closest to which of the following?

A) 0.53 to 1.

B) 0.75 to 1.

C) 0.86 to 1.

D) 1.02 to 1.

A) 0.53 to 1.

B) 0.75 to 1.

C) 0.86 to 1.

D) 1.02 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

59

Grave Company had $150,000 in sales on account last year.The beginning accounts receivable balance was $14,000,and the ending accounts receivable balance was $10,000.The company's average collection period (age of receivables)was closest to which of the following?

A) 24.33 days.

B) 29.20 days.

C) 34.07 days.

D) 58.40 days.

A) 24.33 days.

B) 29.20 days.

C) 34.07 days.

D) 58.40 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

60

Fracus Company had $100,000 in sales on account last year.The beginning accounts receivable balance was $14,000,and the ending accounts receivable balance was $16,000.The company's accounts receivable turnover was closest to which of the following?

A) 3.33 times.

B) 6.25 times.

C) 6.67 times.

D) 7.14 times.

A) 3.33 times.

B) 6.25 times.

C) 6.67 times.

D) 7.14 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

61

PFM Company has sales of $210,000,interest expense of $8,000,a tax rate of 30%,and a net profit after tax of $35,000.What is PFM Company's times interest earned ratio?

A) 4.375 times.

B) 5.375 times.

C) 7.250 times.

D) 15.500 times.

A) 4.375 times.

B) 5.375 times.

C) 7.250 times.

D) 15.500 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

62

During the year just ended,James Company purchased $425,000 of inventory.The inventory balance at the beginning of the year was $175,000.If the cost of goods sold for the year was $450,000,what was the inventory turnover for the year?

A) 2.57 times.

B) 2.62 times.

C) 2.77 times.

D) 3.00 times.

A) 2.57 times.

B) 2.62 times.

C) 2.77 times.

D) 3.00 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

63

Last year,Jabber Company had a net income of $180,000,income tax expense of $62,000,and interest expense of $20,000.The company's times interest earned was closest to which of the following?

A) 4.90 times.

B) 9.00 times.

C) 10.00 times.

D) 13.10 times.

A) 4.90 times.

B) 9.00 times.

C) 10.00 times.

D) 13.10 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

64

For Year 2,what was the gross margin as a percentage of sales?

A) 5%.

B) 10%.

C) 40%.

D) 60%.

A) 5%.

B) 10%.

C) 40%.

D) 60%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

65

Last year,Jackson Company had a net income of $160,000,income tax expense of $66,000,and interest expense of $20,000.The company's times interest earned was closest to which of the following?

A) 3.70 times.

B) 8.00 times.

C) 9.00 times.

D) 12.30 times.

A) 3.70 times.

B) 8.00 times.

C) 9.00 times.

D) 12.30 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

66

Last year,Dunn Company purchased $1,920,000 of inventory.The cost of good sold was $1,800,000,and the ending inventory was $360,000.What was the inventory turnover?

A) 5.0 times.

B) 5.3 times.

C) 6.0 times.

D) 6.4 times.

A) 5.0 times.

B) 5.3 times.

C) 6.0 times.

D) 6.4 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

67

Harker Company,a retailer,had cost of goods sold of $160,000 last year.The beginning inventory balance was $26,000,and the ending inventory balance was $20,000.The company's inventory turnover was closest to which of the following?

A) 3.48 times.

B) 6.15 times.

C) 6.96 times.

D) 8.00 times.

A) 3.48 times.

B) 6.15 times.

C) 6.96 times.

D) 8.00 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

68

Harris Company,a retailer,had cost of goods sold of $290,000 last year.The beginning inventory balance was $26,000,and the ending inventory balance was $24,000.The company's inventory turnover was closest to which of the following?

A) 5.80 times.

B) 11.15 times.

C) 11.60 times.

D) 12.08 times.

A) 5.80 times.

B) 11.15 times.

C) 11.60 times.

D) 12.08 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

69

Irappa Company,a retailer,had cost of goods sold of $170,000 last year.The beginning inventory balance was $28,000,and the ending inventory balance was $26,000.The company's average sale period (turnover in days)was closest to which of the following?

A) 55.82 days.

B) 57.97 days.

C) 60.12 days.

D) 115.94 days.

A) 55.82 days.

B) 57.97 days.

C) 60.12 days.

D) 115.94 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

70

Karma Company has total assets of $190,000 and total liabilities of $90,000.The company's debt-to-equity ratio is closest to which of the following?

A) 0.32 to 1.

B) 0.47 to 1.

C) 0.53 to 1.

D) 0.90 to 1.

A) 0.32 to 1.

B) 0.47 to 1.

C) 0.53 to 1.

D) 0.90 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

71

Mariah Company had a times interest earned ratio of 3.0 for the year just ended.The company's tax rate was 40%,and the interest expense for the year was $25,000.What was Mariah Company's after-tax net income?

A) $25,000.

B) $30,000.

C) $50,000.

D) $75,000.

A) $25,000.

B) $30,000.

C) $50,000.

D) $75,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

72

McGraw Electronics showed Bonds Payable of $7,500,000 in 2011 and $8,000,000 in 2010 on its comparative Balance Sheet.The percentage change is closest to:

A) 6.6%.

B) (6.6)%.

C) 6.3%.

D) (6.3)%.

A) 6.6%.

B) (6.6)%.

C) 6.3%.

D) (6.3)%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

73

Irawaddy Company,a retailer,had cost of goods sold of $230,000 last year.The beginning inventory balance was $24,000,and the ending inventory balance was $22,000.The company's average sale period (turnover in days)was closest to which of the following?

A) 34.91 days.

B) 36.50 days.

C) 38.09 days.

D) 73.00 days.

A) 34.91 days.

B) 36.50 days.

C) 38.09 days.

D) 73.00 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

74

Martin Company reported an extraordinary after-tax loss of $180,000,resulting from an earthquake.What must have been the before-tax loss if Martin's marginal income tax rate was 40%?

A) $72,000.

B) $108,000.

C) $300,000.

D) $450,000.

A) $72,000.

B) $108,000.

C) $300,000.

D) $450,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

75

Karl Company has total assets of $170,000 and total liabilities of $110,000.The company's debt-to-equity ratio is closest to which of the following?

A) 0.33 to 1.

B) 0.39 to 1.

C) 0.65 to 1.

D) 1.83 to 1.

A) 0.33 to 1.

B) 0.39 to 1.

C) 0.65 to 1.

D) 1.83 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

76

The times interest earned ratio of McHugh Company was 4.5 times.The interest expense for the year was $20,000,and the company's tax rate was 40%.What was the company's net income?

A) $22,000.

B) $42,000.

C) $54,000.

D) $66,000.

A) $22,000.

B) $42,000.

C) $54,000.

D) $66,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

77

Krakov Company has total assets of $170,000 and total liabilities of $80,000.The company's debt-to-equity ratio is closest to which of the following?

A) 0.32 to 1.

B) 0.47 to 1.

C) 0.53 to 1.

D) 0.89 to 1.

A) 0.32 to 1.

B) 0.47 to 1.

C) 0.53 to 1.

D) 0.89 to 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

78

Harton Company,a retailer,had cost of goods sold of $250,000 last year.The beginning inventory balance was $20,000,and the ending inventory balance was $22,000.The company's inventory turnover was closest to which of the following?

A) 5.95 times.

B) 11.36 times.

C) 11.90 times.

D) 12.50 times.

A) 5.95 times.

B) 11.36 times.

C) 11.90 times.

D) 12.50 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

79

Last year,Javer Company had a net income of $200,000,income tax expense of $74,000,and interest expense of $20,000.The company's times interest earned was closest to which of the following?

A) 5.30 times.

B) 10.00 times.

C) 11.00 times.

D) 14.70 times.

A) 5.30 times.

B) 10.00 times.

C) 11.00 times.

D) 14.70 times.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck

80

Irally Company,a retailer,had cost of goods sold of $150,000 last year.The beginning inventory balance was $26,000,and the ending inventory balance was $24,000.The company's average sale period (turnover in days)was closest to which of the following?

A) 58.40 days.

B) 60.83 days.

C) 63.27 days.

D) 121.67 days.

A) 58.40 days.

B) 60.83 days.

C) 63.27 days.

D) 121.67 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 200 في هذه المجموعة.

فتح الحزمة

k this deck