Deck 18: International Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

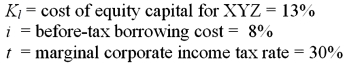

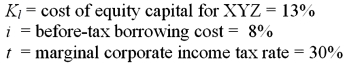

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/102

العب

ملء الشاشة (f)

Deck 18: International Capital Budgeting

1

The firm's tax rate is 34%. The firm's pre-tax cost of debt is 8%; the firm's debt-to-equity ratio is 3; the risk-free rate is 3%; the beta of the firm's common stock is 1.5; the market risk premium is 9%. What is the firm's cost of equity capital?

A)33.33%

B)10.85%

C)13.12%

D)16.5%

E)None of the above

A)33.33%

B)10.85%

C)13.12%

D)16.5%

E)None of the above

D

2

Capital budgeting analysis is very important, because it

A)involves, usually expensive, investments in capital assets.

B)has to do with the productive capacity of a firm.

C)will determine how competitive and profitable a firm will be.

D)all of the above

A)involves, usually expensive, investments in capital assets.

B)has to do with the productive capacity of a firm.

C)will determine how competitive and profitable a firm will be.

D)all of the above

D

3

When using the APV methodology, what is the NPV of the depreciation tax shield?

A)$32,051.52

B)$25,777.35

C)$22,794.65

D)$97,152.98

E)None of the above

A)$32,051.52

B)$25,777.35

C)$22,794.65

D)$97,152.98

E)None of the above

B

4

The financial manager's responsibility involves

A)increasing the per share price of the company's stock at any cost and by any means, ways and fashion that is possible.

B)the shareholder wealth maximization.

C)which capital projects to select.

D)both b and c

A)increasing the per share price of the company's stock at any cost and by any means, ways and fashion that is possible.

B)the shareholder wealth maximization.

C)which capital projects to select.

D)both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

5

Today is January 1, 2009. The state of Iowa has offered your firm a subsidized loan. It will be in the amount of $10,000,000 at an interest rate of 5% and have ANNUAL (amortizing) payments over 3 years. The first payment is due today and your taxes are due January 1 of each year on the previous year's income. The yield to maturity on your firm's existing debt is 8%. What is the APV of this subsidized loan? If you rounded in your intermediate steps, the answer may be slightly different from what you got. Choose the closest.

A)-$3,497,224.43

B)$417,201.05

C)$840,797

D)None of the above

A)-$3,497,224.43

B)$417,201.05

C)$840,797

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

6

What is the unlevered after-tax incremental cash flow for year 30?

A)$12,432,300

B)$12,225,390

C)$12,332,300

D)$12,485,000

E)None of the above

A)$12,432,300

B)$12,225,390

C)$12,332,300

D)$12,485,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

7

Assume that the firm will partially finance the project with a subsidized $3,000,000 interest only 30-year loan at 8.0 percent APR with annual payments. Note that eight percent is less than the 10 percent that they normally borrow at. What is the NPV of the loan?

A)$198,469

B)$53,979.83

C)$102,727.55

D)$1,334,851.09

E)None of the above

A)$198,469

B)$53,979.83

C)$102,727.55

D)$1,334,851.09

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

8

What is the levered after-tax incremental cash flow for year 0?

A)-$1,010,000

B)-$1,000,000

C)-$660,000

D)-$2,100,000

E)None of the above

A)-$1,010,000

B)-$1,000,000

C)-$660,000

D)-$2,100,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

9

Perhaps the most important decisions that confront the financial manager are

A)which capital projects to select.

B)the correct capital structure for the firm.

C)the correct capital structure for projects.

D)none of the above

A)which capital projects to select.

B)the correct capital structure for the firm.

C)the correct capital structure for projects.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

10

The firm's tax rate is 34%. The firm's pre-tax cost of debt is 8%; the firm's debt-to-equity ratio is 3; the risk-free rate is 3%; the beta of the firm's common stock is 1.5; the market risk premium is 9%. What is the required return on assets?

A)33.33%

B)10.85%

C)13.12%

D)16.5%

E)None of the above

A)33.33%

B)10.85%

C)13.12%

D)16.5%

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

11

The required return on assets is 18%. The firm can borrow at 12.5%; firm's target debt to value ratio is 3/5. The corporate tax rate is 34%, and the risk-free rate is 4% and the market risk premium is 9.2 percent. What is the weighted average cost of capital?

A)12.15%

B)13.02%

C)14.33%

D)23.45%

E)None of the above

A)12.15%

B)13.02%

C)14.33%

D)23.45%

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

12

What is the NPV of the project using the WACC methodology?

A)$49,613.03

B)$58,028.68

C)$102s,727.55

D)$315,666.16

E)None of the above

A)$49,613.03

B)$58,028.68

C)$102s,727.55

D)$315,666.16

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

13

What is the NPV of the project using the WACC methodology?

A)$58,028.68

B)$49,613.03

C)$48,300.47

D)$102,727.55

E)None of the above Using the cash flow menu of a financial calculator: CF0 = -$100,000; C01 = $39,800; F01 = 4; C02 = $43,100; I = rWACC = 11.20; NPV = $48,300.47

A)$58,028.68

B)$49,613.03

C)$48,300.47

D)$102,727.55

E)None of the above Using the cash flow menu of a financial calculator: CF0 = -$100,000; C01 = $39,800; F01 = 4; C02 = $43,100; I = rWACC = 11.20; NPV = $48,300.47

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

14

What is the levered after-tax incremental cash flow for year 30?

A)$9,027,390

B)$9,234,300

C)$9,134,300

D)$9,287,000

E)None of the above

A)$9,027,390

B)$9,234,300

C)$9,134,300

D)$9,287,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

15

Today is January 1, 2009. The state of Iowa has offered your firm a subsidized loan. It will be in the amount of $10,000,000 at an interest rate of 5% and have ANNUAL (amortizing) payments over 3 years. The first payment is due December 31, 2009 and your taxes are due January 1 of each year on the previous year's income. The yield to maturity on your firm's existing debt is 8%. What is the APV of this subsidized loan? Note that I did not round my intermediate steps. If you did, your answer may be off by a bit. Select the answer closest to yours.

A)-$3,497,224.43

B)$417,201.05

C)$840,797

D)None of the above

A)-$3,497,224.43

B)$417,201.05

C)$840,797

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

16

What is the levered after-tax incremental cash flow for year 1?

A)$4,300

B)-$202,610

C)-$95,700

D)$57,000

E)None of the above

A)$4,300

B)-$202,610

C)-$95,700

D)$57,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

17

What is the unlevered after-tax incremental cash flow for year 2?

A)-$4,610

B)$102,300

C)$202,300

D)$255,000

E)None of the above

A)-$4,610

B)$102,300

C)$202,300

D)$255,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

18

What is the unlevered after-tax incremental cash flow for year 0?

A)-$3,660,000

B)-$5,100,000

C)-$4,000,000

D)-$4,010,000

E)None of the above

A)-$3,660,000

B)-$5,100,000

C)-$4,000,000

D)-$4,010,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is the NPV of the project using the APV methodology?

A)$49,613.03

B)$198,469

C)$102,727.55

D)$149,580.12

E)None of the above

A)$49,613.03

B)$198,469

C)$102,727.55

D)$149,580.12

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

20

When using the APV methodology, what is the NPV of the interest tax shield?

A)$9,666.51

B)$12,019.32

C)$9,377.31

D)$7,000.73

E)None of the above

A)$9,666.51

B)$12,019.32

C)$9,377.31

D)$7,000.73

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

21

Your firm's existing bonds trade with a yield to maturity of eight percent. The state of Missouri has offered to loan your firm $10,000,000 at zero percent for five years. Repayment will be of the form of $2,000,000 per year for five years the first payment is due in one year. What is the value of this offer?

A)$4,729,622.75

B)$2,014,579.93

C)$0

D)$196,929.88

E)None of the above

A)$4,729,622.75

B)$2,014,579.93

C)$0

D)$196,929.88

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

22

The required return on equity for an all-equity firm is 10.0%. They currently have a beta of one and the risk-free rate is 5% and the market risk premium is 5%. They are considering a change in capital structure to a debt-to-equity ratio of ½ the tax rate is 40%, the pre-tax cost of debt is 8%. Find the beta if this firm changes capital structure.

A)1.12

B)1

C)7.4%

D)None of the above

A)1.12

B)1

C)7.4%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the levered after-tax incremental cash flow for year 4?

A)-$281,704,000

B)$465,152,000

C)-$194,848,000

D)$460,796,000

E)None of the above

A)-$281,704,000

B)$465,152,000

C)-$194,848,000

D)$460,796,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

24

Using the flow to equity methodology, what is the value of the equity claim?

A)-$1,540,000

B)$446,570,866.00

C)$36,580,767.55

D)$470,953,393.70

E)$30,716,236.13

A)-$1,540,000

B)$446,570,866.00

C)$36,580,767.55

D)$470,953,393.70

E)$30,716,236.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

25

Using the APV method, what is the value of the debt side effects?

A)$239,072,652.70

B)$66,891,713.66

C)$59,459,301.03

D)$660,000,000

E)None of the above

A)$239,072,652.70

B)$66,891,713.66

C)$59,459,301.03

D)$660,000,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

26

The required return on equity for an all-equity firm is 10.0%. They are considering a change in capital structure to a debt-to-equity ratio of ½ the tax rate is 40%, the pre-tax cost of debt is 8%. Find the new cost of capital if this firm changes capital structure.

A)14.93%

B)8.67%

C)7.40%

D)None of the above

A)14.93%

B)8.67%

C)7.40%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

27

Using the APV method, what is the value of this project to an all-equity firm?

A)-$46,502,288.10

B)$12,494,643.75

C)$36,580,767.55

D)-$67,163,445.12

E)$59,459,301.03

A)-$46,502,288.10

B)$12,494,643.75

C)$36,580,767.55

D)-$67,163,445.12

E)$59,459,301.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

28

Using the weighted average cost of capital methodology, what is the NPV? I didn't round my intermediate steps. If you do, you're not going to get the right answer.

A)-$1,406,301.25

B)$12,494,643.75

C)$36,580,767.55

D)$108,994.618.20

E)$59,459,301.03

A)-$1,406,301.25

B)$12,494,643.75

C)$36,580,767.55

D)$108,994.618.20

E)$59,459,301.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

29

The required return on equity for a levered firm is 10.60%. The debt to equity ratio is ½ the tax rate is 40%, the pre-tax cost of debt is 8%. Find the cost of capital if this firm were financed entirely with equity.

A)10%

B)12%

C)8.67%

D)None of the above

A)10%

B)12%

C)8.67%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

30

What is the levered after-tax incremental cash flow for year 4?

A)$281,704,000

B)$465,152,000

C)-$194,848,000

D)$460,796,000

E)None of the above

A)$281,704,000

B)$465,152,000

C)-$194,848,000

D)$460,796,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

31

Using the flow to equity methodology, what is the value of the equity claim?

A)-$1,540,000

B)$446,570,866.00

C)$36,580,767.55

D)$470,953,393.70

E)$30,716,236.13

A)-$1,540,000

B)$446,570,866.00

C)$36,580,767.55

D)$470,953,393.70

E)$30,716,236.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

32

In the APV model

A)interest tax shields are discounted at i.

B)operating cash flows are discounted at Ku.

C)depreciation tax shields are discounted at i.

D)all of the above

A)interest tax shields are discounted at i.

B)operating cash flows are discounted at Ku.

C)depreciation tax shields are discounted at i.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

33

What is the levered after-tax incremental cash flow for year 2?

A)$185,796,000

B)$215,152,000

C)$267,952,000

D)$284,848,000

E)None of the above

A)$185,796,000

B)$215,152,000

C)$267,952,000

D)$284,848,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

34

Using the APV method, what is the value of this project to an all-equity firm?

A)-$46,502,288.10

B)$12,494,643.75

C)$36,580,767.55

D)-$67,163,445.12

E)$59,459,301.03

A)-$46,502,288.10

B)$12,494,643.75

C)$36,580,767.55

D)-$67,163,445.12

E)$59,459,301.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

35

Using the weighted average cost of capital methodology, what is the NPV? I didn't round my intermediate steps. If you do, you're not going to get the right answer.

A)-$1,406,301.25

B)$12,494,643.75

C)$36,580,767.55

D)$108,994.618.20

E)$59,459,301.03

A)-$1,406,301.25

B)$12,494,643.75

C)$36,580,767.55

D)$108,994.618.20

E)$59,459,301.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

36

What proportion of the firm is financed by debt for a firm that expects a 15% return on equity, a 12% return on assets, and a 10% return on debt? The tax rate is 25%.

A)20%

B)1/3

C)60%

D)2/3

E)80%

A)20%

B)1/3

C)60%

D)2/3

E)80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

37

Using the APV method, what is the value of the debt side effects?

A)$239,072,652.70

B)$66,891,713.66

C)$59,459,301.03

D)$660,000,000

E)None of the above

A)$239,072,652.70

B)$66,891,713.66

C)$59,459,301.03

D)$660,000,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

38

Your firm is in the 34% tax bracket. The yield to maturity on your existing bonds is 8%. The state of Georgia offers to loan your firm $1,000,000 with a TWO year AMORTIZING loan at a 5% rate of interest and ANNUAL payments due at the END OF THE YEAR. The interest will be deductible at the time that you pay. What is the APV of this below-market loan to your firm? I did not round any of my intermediate steps. You might be a little bit off. Pick the answer closest to yours.

A)$64,157.38

B)$417,201.05

C)$840,797

D)None of the above

A)$64,157.38

B)$417,201.05

C)$840,797

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

39

The firm's tax rate is 34%. The firm's pre-tax cost of debt is 8%; the firm's debt-to-equity ratio is 3; the risk-free rate is 3%; the beta of the firm's common stock is 1.5; the market risk premium is 9%. Calculate the weighted average cost of capital.

A)33.33%

B)8.09%

C)9.02%

D)16.5%

E)None of the above

A)33.33%

B)8.09%

C)9.02%

D)16.5%

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is the levered after-tax incremental cash flow for year 2?

A)$185,796,000

B)$215,152,000

C)$267,952,000

D)$284,848,000

E)None of the above

A)$185,796,000

B)$215,152,000

C)$267,952,000

D)$284,848,000

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

41

What is the expected return on equity for a tax-free firm with a 15% expected return on assets that pays 12% on its debt, which totals 25% of assets?

A)24%

B)15.60%

C)16%

D)20%

E)15.75%

A)24%

B)15.60%

C)16%

D)20%

E)15.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

42

What is CF0 in dollars?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

43

Some of the factors (with selected explanations) used in calculating the basic "net present value" and the "incremental" cash flows of a capital project are: (i) - expected after-tax terminal value, including recapture of working capital

(ii) - net income, which belongs to the equity holders of the firm

(iii) - initial investment at inception

(iv) - depreciation, and the fact that depreciation is a noncash expense (i.e. it is removed from the calculation of net income, for tax purposes, but added back because it did not actually flow out of the firm)

(v) - weighted-average cost of capital

(vi) - the firm's after-tax payment of interest to debtholders

(vii) - economic life of the capital project in years

The "incremental" cash flows of a capital project is calculated by using:

A)(i), (ii), and (iii)

B)(ii), (iv), and (vi)

C)(i), (iii), (v), and (vii)

D)(iv), (v), (vi), and (vii)

(ii) - net income, which belongs to the equity holders of the firm

(iii) - initial investment at inception

(iv) - depreciation, and the fact that depreciation is a noncash expense (i.e. it is removed from the calculation of net income, for tax purposes, but added back because it did not actually flow out of the firm)

(v) - weighted-average cost of capital

(vi) - the firm's after-tax payment of interest to debtholders

(vii) - economic life of the capital project in years

The "incremental" cash flows of a capital project is calculated by using:

A)(i), (ii), and (iii)

B)(ii), (iv), and (vi)

C)(i), (iii), (v), and (vii)

D)(iv), (v), (vi), and (vii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

44

What is the expected return on equity for firm in the 40% tax bracket with a 15% expected return on assets that pays 12% on its debt, which totals 25% of assets?

A)24%

B)15.60%

C)16%

D)20%

E)15.75%

A)24%

B)15.60%

C)16%

D)20%

E)15.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the €-denominated NPV of this project? I did not round my intermediate steps, if you did, select the answer closest to yours.

A)€5,563.23

B)€2,270.79

C)€7,223.14

D)€3,554.29

E)There is not enough information (e.g. U.S. inflation) to do this problem.

A)€5,563.23

B)€2,270.79

C)€7,223.14

D)€3,554.29

E)There is not enough information (e.g. U.S. inflation) to do this problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

46

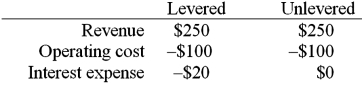

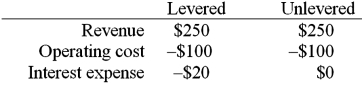

Given the following information for a levered and unlevered firm, calculate the difference in the cash flow available to investors. Assume the corporate tax rate is 40%. (Hint: Calculate the tax savings arising form the tax deductibility of interest payments).

A)$8

B)$18

C)$78

D)$90

A)$8

B)$18

C)$78

D)$90

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following statements is false about "borrowing capacity"?

A)it is an especially important point in international capital budgeting analysis because of the frequency of large concessionary loans.

B)it creates tax shields for APV analysis regardless of how the project is actually financed.

C)is synonymous to the "project debt".

D)is based on the firm's optimal capital structure.

A)it is an especially important point in international capital budgeting analysis because of the frequency of large concessionary loans.

B)it creates tax shields for APV analysis regardless of how the project is actually financed.

C)is synonymous to the "project debt".

D)is based on the firm's optimal capital structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

48

The adjusted present value (APV) model that is suitable for an MNC is the basic net present value (NPV) model expanded to

A)distinguish between the market value of a levered firm and the market value of an unlevered firm.

B)discern the blocking of certain cash flows by the host country from being legally remitted to the parent.

C)consider foreign currency fluctuations or extra taxes imposed by the host country on foreign exchange remittances.

D)all of the above

A)distinguish between the market value of a levered firm and the market value of an unlevered firm.

B)discern the blocking of certain cash flows by the host country from being legally remitted to the parent.

C)consider foreign currency fluctuations or extra taxes imposed by the host country on foreign exchange remittances.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

49

As of today, the spot exchange rate is €1.00 = $1.25 and the rates of inflation expected to prevail for the next year in the U.S. is 2% and 3% in the euro zone. What is the one-year forward rate that should prevail?

A)€1.00 = $1.2379

B)€1.00 = $1.2139

C)€1.00 = $0.9903

D)$1.00 = €1.2623

A)€1.00 = $1.2379

B)€1.00 = $1.2139

C)€1.00 = $0.9903

D)$1.00 = €1.2623

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

50

In the context of the capital budgeting analysis of an MNC that has strong foreign competitors, "lost sales" refers to

A)the cannibalization of existing projects by new projects.

B)the entire sales revenue of a new foreign manufacturing facility representing the incremental sales revenue of the new project.

C)both a and b

D)none of the above

A)the cannibalization of existing projects by new projects.

B)the entire sales revenue of a new foreign manufacturing facility representing the incremental sales revenue of the new project.

C)both a and b

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

51

Some of the factors (with selected explanations) used in calculating the basic "net present value" and the "incremental" cash flows of a capital project are: (i) - expected after-tax terminal value, including recapture of working capital

(ii) - net income, which belongs to the equity holders of the firm

(iii) - initial investment at inception

(iv) - depreciation, and the fact that depreciation is a noncash expense (i.e. it is removed from the calculation of net income, for tax purposes, but added back because it did not actually flow out of the firm)

(v) - weighted-average cost of capital

(vi) - the firm's after-tax payment of interest to debtholders

(vii) - economic life of the capital project in years

The "net present value" of a capital project is calculated by using:

A)(i), (ii), and (iii)

B)(ii), (iv), and (vi)

C)(i), (iii), (v), and (vii)

D)(iv), (v), (vi), and (vii)

(ii) - net income, which belongs to the equity holders of the firm

(iii) - initial investment at inception

(iv) - depreciation, and the fact that depreciation is a noncash expense (i.e. it is removed from the calculation of net income, for tax purposes, but added back because it did not actually flow out of the firm)

(v) - weighted-average cost of capital

(vi) - the firm's after-tax payment of interest to debtholders

(vii) - economic life of the capital project in years

The "net present value" of a capital project is calculated by using:

A)(i), (ii), and (iii)

B)(ii), (iv), and (vi)

C)(i), (iii), (v), and (vii)

D)(iv), (v), (vi), and (vii)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

52

Sensitivity analysis in the calculation of the adjusted present value (APV) allows the financial manager to

A)analyze all of the risks (business, economic, exchange rate uncertainty, political, etc.) inherent in the investment.

B)more fully understand the implications of planned capital expenditures.

C)consider in advance actions that can be taken should an investment not develop as anticipated.

D)all of the above

A)analyze all of the risks (business, economic, exchange rate uncertainty, political, etc.) inherent in the investment.

B)more fully understand the implications of planned capital expenditures.

C)consider in advance actions that can be taken should an investment not develop as anticipated.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

53

As of today, the spot exchange rate is €1.00 = $1.25 and the rates of inflation expected to prevail for the next three years in the U.S. is 2% and 3% in the euro zone. What spot exchange rate should prevail three years from now?

A)€1.00 = $1.2379

B)€1.00 = $1.2139

C)€1.00 = $0.9903

D)$1.00 = €1.2623

A)€1.00 = $1.2379

B)€1.00 = $1.2139

C)€1.00 = $0.9903

D)$1.00 = €1.2623

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

54

As of today, the spot exchange rate is €1.00 = $1.50 and the rates of inflation expected to prevail for the next year in the U.S. is 2% and 3% in the euro zone. What is the one-year forward rate that should prevail?

A)€1.00 = $1.5147

B)€1.00 = $1.4854

C)€1.00 = $0.6602

D)$1.00 = €0.6602

A)€1.00 = $1.5147

B)€1.00 = $1.4854

C)€1.00 = $0.6602

D)$1.00 = €0.6602

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

55

Today is January 1, 2009. The state of Iowa has offered your firm a subsidized loan. It will be in the amount of $10,000,000 at an interest rate of 5% and have ANNUAL (amortizing) payments over 3 years. The first payment is due today and your taxes are due January 1 of each year on the previous year's income. The yield to maturity on your firm's existing debt is 8%. What is the APV of this subsidized loan? Note that I did not round my intermediate steps. If you did, your answer may be off by a bit. Select the answer closest to yours.

A)$406,023.10

B)$840,797

C)$64,157.38

D)$20,659.77

E)None of the other answers are within $100 of my answer

A)$406,023.10

B)$840,797

C)$64,157.38

D)$20,659.77

E)None of the other answers are within $100 of my answer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

56

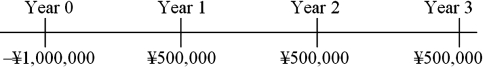

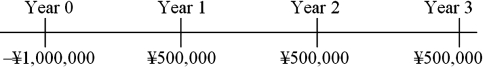

The spot exchange rate is ¥125 = $1. The U.S. discount rate is 10%; inflation over the next three years is 3% per year in the U.S. and 2% per year in Japan. Calculate the dollar NPV of this project.  I did not round my intermediate steps, if you did, select the answer closest to yours.

I did not round my intermediate steps, if you did, select the answer closest to yours.

A)$267,181.87

B)$14,176.67

C)$2,536.49

D)$2,137.46

E)None of the above

I did not round my intermediate steps, if you did, select the answer closest to yours.

I did not round my intermediate steps, if you did, select the answer closest to yours.A)$267,181.87

B)$14,176.67

C)$2,536.49

D)$2,137.46

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

57

What is CF1 in dollars?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

58

Assume that XYZ Corporation is a leveraged company with the following information:  Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

A)35%

B)40%

C)45%

D)50%

Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.A)35%

B)40%

C)45%

D)50%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

59

The ABC Company, a U.S.-based MNC, plans to establish a subsidiary in Spain to manufacture and sell water pumps. ABC has total assets of $80 million, of which $60 million is equity financed. The remainder is financed with debt. ABC considers its current capital structure optimal. The construction cost of the facility in Spain is estimated to be €8,500 million, of which €6,500 million is to be financed at a below-market rate of interest arranged by the Spanish government. The proposed project will increase the borrowing capacity by

A)€1,215 million.

B)€2,215 million.

C)€3,215 million.

D)€4,215 million.

A)€1,215 million.

B)€2,215 million.

C)€3,215 million.

D)€4,215 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

60

An Italian firm is considering selling its line of coin-operated cappuccino machines in the U.K. The business risk will be identical to the firm's existing line of business in the euro zone, the cost of capital in the euro zone is i€ = 10%. The expected inflation rate over the next two years in the U.K. is 3% per year and 2% per year in the euro zone. The spot exchange rates are $1.80 = £1.00 and $1.15 = €1.00

The pound sterling denominated cash flows are as follows:

The pound sterling denominated cash flows are as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is the dollar-denominated IRR?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

62

Find the break-even price (in dollars) and break-even quantity for the U.S. project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

63

Find the euro-zone cost of capital to compute is the dollar-denominated NPV of this project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

64

What is the dollar-denominated IRR of this project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

65

Find the dollar cash flows to compute the dollar-denominated NPV of this project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

66

What is the euro-denominated IRR of this project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

67

What is the euro-denominated IRR of this project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

68

Find the dollar cash flows to compute the dollar-denominated NPV of this project.

Please note that your answer is worth ZERO POINTS if it does not contain currency symbols.

Please note that your answer is worth ZERO POINTS if it does not contain currency symbols.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

69

What is the NPV of the U.S.-based project to the Irish firm?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

70

What is the dollar-denominated IRR of this project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

71

What is the euro-denominated IRR?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

72

What is the dollar-denominated IRR of this project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

73

What is CF5 in dollars?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

74

Find the ex post IRR in euro for the French firm if they undertake the project today and then the exchange rate falls to S1(€|£) = €1.80 per £.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

75

Find the dollar cash flows to compute the dollar-denominated NPV of this project.

Your answer is worth ZERO POINTS if it does not contain currency symbols such as $, £, €, ¥!

Your answer is worth ZERO POINTS if it does not contain currency symbols such as $, £, €, ¥!

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

76

Find the ex post IRR in euro for the French firm if they undertake the project today and then the exchange rate rises to S1(€|£) = €2.20 per £.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

77

Find the euro-zone cost of capital to compute is the dollar-denominated NPV of this project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

78

Find the euro-zone cost of capital to compute is the dollar-denominated NPV of this project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

79

Repeat the above project analysis assuming that the Irish firm could replicate the project in Ireland. (i.e. cash flow out the project in Ireland and find break-even price (in €), quantity, NPV, IRR (in euro not dollars).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck

80

What is the euro-denominated IRR of this project?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 102 في هذه المجموعة.

فتح الحزمة

k this deck