Deck 11: International Banking and Money Market

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 11: International Banking and Money Market

1

A bank may establish a multinational operation for the reason of regulatory advantage. The underlying rationale being that

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

D

2

A bank may establish a multinational operation for the reason of retail defensive strategy. The underlying rationale being that

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

B

3

A domestic bank that follows a multinational client abroad to preserve that banking relationship

A)is playing the role of the desperate housewife in this relationship.

B)is pursuing a wholesale defensive strategy.

C)is pursuing a retail defensive strategy.

D)none of the above

A)is playing the role of the desperate housewife in this relationship.

B)is pursuing a wholesale defensive strategy.

C)is pursuing a retail defensive strategy.

D)none of the above

B

4

Banks that both perform traditional commercial banking functions and engage in investment banking activities are often called

A)international service banks.

B)investment banks.

C)commercial banks.

D)merchant banks.

A)international service banks.

B)investment banks.

C)commercial banks.

D)merchant banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

A domestic bank that becomes a multinational bank to prevent erosion by foreign banks of the traveler's checks, touring, and foreign business market

A)is playing the role of the desperate housewife in this relationship.

B)is pursuing a wholesale defensive strategy.

C)is pursuing a retail defensive strategy.

D)none of the above

A)is playing the role of the desperate housewife in this relationship.

B)is pursuing a wholesale defensive strategy.

C)is pursuing a retail defensive strategy.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

Major distinguishing features between domestic banks and international banks are

A)the types of deposits they accept.

B)the types of loans and investments they make.

C)membership in loan syndicates.

D)all of the above

A)the types of deposits they accept.

B)the types of loans and investments they make.

C)membership in loan syndicates.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

A bank may establish a multinational operation for the reason of prestige. The underlying rationale being that

A)local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country than they can obtain from their own domestic banks.

B)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

C)very large multinational banks have high perceived prestige, liquidity, and deposit safety that can be used to attract clients abroad.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

A)local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country than they can obtain from their own domestic banks.

B)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

C)very large multinational banks have high perceived prestige, liquidity, and deposit safety that can be used to attract clients abroad.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

An Edge Act bank is typically located in a state different from that of its parent in order to get around the prohibition on interstate branch banking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

A bank may establish a multinational operation for the reason of low marginal costs. The underlying rationale being that

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)managerial and marketing knowledge developed at home can be used abroad with low marginal costs.

D)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)managerial and marketing knowledge developed at home can be used abroad with low marginal costs.

D)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

10

Edge Act banks are not prohibited from owning equity in business corporations, unlike domestic commercial banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

A U.S.-based multinational bank

A)would not have to provide deposit insurance and meet reserve requirements on foreign currency deposits.

B)would have to provide deposit insurance and meet reserve requirements on foreign currency deposits.

C)would not have to provide deposit insurance but would have to meet reserve requirements on foreign currency deposits.

D)would have to provide deposit insurance but not meet reserve requirements on foreign currency deposits.

A)would not have to provide deposit insurance and meet reserve requirements on foreign currency deposits.

B)would have to provide deposit insurance and meet reserve requirements on foreign currency deposits.

C)would not have to provide deposit insurance but would have to meet reserve requirements on foreign currency deposits.

D)would have to provide deposit insurance but not meet reserve requirements on foreign currency deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

Multinational banks are often not subject to the same regulations as domestic banks.

A)There may be increased need to publish adequate financial information.

B)There may be reduced need to publish adequate financial information.

C)There requirements to publish adequate financial information are the same.

D)None of the above

A)There may be increased need to publish adequate financial information.

B)There may be reduced need to publish adequate financial information.

C)There requirements to publish adequate financial information are the same.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

Merchant banks are different from traditional commercial banks in what way(s)?

A)Merchant banks can engage in investment banking activities.

B)Merchant banks can arrange for foreign exchange transactions.

C)Merchant banks can assist their clients in hedging exchange rate risk.

D)All of the above

A)Merchant banks can engage in investment banking activities.

B)Merchant banks can arrange for foreign exchange transactions.

C)Merchant banks can assist their clients in hedging exchange rate risk.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

International banks are different from domestic banks in what way(s)?

A)International banks can arrange trade financing.

B)International banks can arrange for foreign exchange transactions.

C)International banks can assist their clients in hedging exchange rate risk.

D)All of the above

A)International banks can arrange trade financing.

B)International banks can arrange for foreign exchange transactions.

C)International banks can assist their clients in hedging exchange rate risk.

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

A bank may establish a multinational operation for the reason of knowledge advantage. The underlying rationale being that

A)local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country than they can obtain from their own domestic banks.

B)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

C)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

D)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

A)local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country than they can obtain from their own domestic banks.

B)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

C)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

D)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

Banking tends to be

A)a low marginal cost industry.

B)a high marginal cost industry.

C)a constant average cost industry.

D)none of the above

A)a low marginal cost industry.

B)a high marginal cost industry.

C)a constant average cost industry.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

Since international banks have the facilities to trade foreign exchange,

A)they generally also make a market as a dealer in foreign exchange.

B)they generally also make a market as a dealer in foreign exchange derivatives.

C)they generally also trade foreign exchange products for their own account.

D)none of the above

A)they generally also make a market as a dealer in foreign exchange.

B)they generally also make a market as a dealer in foreign exchange derivatives.

C)they generally also trade foreign exchange products for their own account.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

Currently, the biggest bank in the world is

A)Citigroup.

B)Bank of America.

C)UBS.

D)The World Bank.

A)Citigroup.

B)Bank of America.

C)UBS.

D)The World Bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

A bank may establish a multinational operation for the reason of risk reduction. The underlying rationale being that

A)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

B)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

C)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

D)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

A)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

B)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

C)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

D)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

By far the most important international finance centers are

A)New York and London.

B)New York, London, and Tokyo.

C)New York, London, Tokyo, Paris, and Zurich.

D)New York, London, Tokyo, Paris, Zurich, and Frankfurt.

A)New York and London.

B)New York, London, and Tokyo.

C)New York, London, Tokyo, Paris, and Zurich.

D)New York, London, Tokyo, Paris, Zurich, and Frankfurt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

A foreign branch bank

A)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

B)operates like a local bank, but legally is a part of the parent bank.

C)is subject to domestic regulation only.

D)all of the above

A)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

B)operates like a local bank, but legally is a part of the parent bank.

C)is subject to domestic regulation only.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

A foreign branch bank

A)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

B)operates like a local bank, but legally is a part of the parent bank.

C)is subject to domestic regulation only.

D)all of the above

A)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

B)operates like a local bank, but legally is a part of the parent bank.

C)is subject to domestic regulation only.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

A foreign branch bank operates like a local bank, but legally

A)it is a part of the parent bank.

B)a branch bank is subject to both the banking regulations of its home country and the country in which it operates.

C)a branch bank is subject to only the banking regulations of its home country and not the country in which it operates.

D)both a and b

A)it is a part of the parent bank.

B)a branch bank is subject to both the banking regulations of its home country and the country in which it operates.

C)a branch bank is subject to only the banking regulations of its home country and not the country in which it operates.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following are reasons why a bank may establish a multinational operation?

A)Low marginal and transaction costs

B)Home nation information services, and prestige

C)Growth and risk reduction

D)All of the above

A)Low marginal and transaction costs

B)Home nation information services, and prestige

C)Growth and risk reduction

D)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

A representative office

A)is what lawyers' offices are called in Mexico.

B)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

C)is a small service facility staffed by correspondent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

D)none of the above

A)is what lawyers' offices are called in Mexico.

B)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

C)is a small service facility staffed by correspondent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

A bank may establish a multinational operation for the reason of growth. The rationale being that

A)growth prospects in a home nation may be limited by a market largely saturated with the services offered by domestic banks.

B)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

C)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

D)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

A)growth prospects in a home nation may be limited by a market largely saturated with the services offered by domestic banks.

B)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

C)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

D)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

A representative office

A)is a way for the parent bank to provide its MNC clients with a level of service greater than that provided through merely a correspondent relationship.

B)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

C)is a step up from a correspondent relationship, but below a foreign branch.

D)all of the above

A)is a way for the parent bank to provide its MNC clients with a level of service greater than that provided through merely a correspondent relationship.

B)is a small service facility staffed by parent bank personnel that is designed to assist MNC clients of the parent bank in dealings with the bank's correspondents.

C)is a step up from a correspondent relationship, but below a foreign branch.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

Why would a U.S. bank open a foreign branch bank?

A)Because this form of bank organization can allow a U.S. bank to provide a fuller range of services for its MNC customers than it can through a representative office.

B)To avoid U.S. banking regulation on transactions routed through that foreign country.

C)Because this form of organization allows the bank to service MNC clients at low cost and without the need of having bank personnel located in the country.

D)both a and b

A)Because this form of bank organization can allow a U.S. bank to provide a fuller range of services for its MNC customers than it can through a representative office.

B)To avoid U.S. banking regulation on transactions routed through that foreign country.

C)Because this form of organization allows the bank to service MNC clients at low cost and without the need of having bank personnel located in the country.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

A bank may establish a multinational operation for the reason of transaction costs. The underlying rationale being that

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

A correspondent bank relationship is established when

A)two banks maintain deposits with one another.

B)two banks write to each other about the credit conditions of their countries.

C)a group of banks form a syndicate to spread out the risk and cost of a large bond offering.

D)all of the above

A)two banks maintain deposits with one another.

B)two banks write to each other about the credit conditions of their countries.

C)a group of banks form a syndicate to spread out the risk and cost of a large bond offering.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

The current exchange rate is £1.00 = $2.00. Compute the correct balances in Bank A's correspondent account(s) with bank B if a currency trader employed at Bank A buys £45,000 from a currency trader at bank B for $90,000 using its correspondent relationship with BankB.

A)Bank A's dollar-denominated account at B will rise by $90,000.

B)Bank B's dollar-denominated account at A will fall by $90,000.

C)Bank A's pound-denominated account at B will rise by £45,000.

D)Bank B's pound-denominated account at A will rise by £45,000.

A)Bank A's dollar-denominated account at B will rise by $90,000.

B)Bank B's dollar-denominated account at A will fall by $90,000.

C)Bank A's pound-denominated account at B will rise by £45,000.

D)Bank B's pound-denominated account at A will rise by £45,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

The most popular way for a U.S. bank to expand overseas is

A)branch banks.

B)representative offices.

C)subsidiary banks.

D)affiliate banks.

A)branch banks.

B)representative offices.

C)subsidiary banks.

D)affiliate banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

A bank may establish a multinational operation for the reason of home country information services. The underlying rationale being that

A)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

B)local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country than they can obtain from their own domestic banks.

C)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

D)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

A)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

B)local firms may be able to obtain from a foreign subsidiary bank operating in their country more complete trade and financial market information about the subsidiary's home country than they can obtain from their own domestic banks.

C)the foreign bank subsidiary can draw on the parent bank's knowledge of personal contacts and credit investigations for use in that foreign market.

D)greater stability of earnings is possible with international diversification. Offsetting business and monetary policy cycles across nations reduces the country-specific risk of any one nation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

The current exchange rate is €1.00 = $1.50. Compute the correct balances in Bank A's correspondent account(s) with bank B if a currency trader employed at Bank A buys €100,000 from a currency trader at bank B for $150,000 using its correspondent relationship with Bank B.

A) Bank A's dollar-denominated account at B will fall by $150,000.

B) Bank B's dollar-denominated account at A will fall by $150,000.

C) Bank A's pound-denominated account at B will fall by €100,000.

D) Bank B's pound-denominated account at A will rise by €100,000.

A) Bank A's dollar-denominated account at B will fall by $150,000.

B) Bank B's dollar-denominated account at A will fall by $150,000.

C) Bank A's pound-denominated account at B will fall by €100,000.

D) Bank B's pound-denominated account at A will rise by €100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

A bank may establish a multinational operation for the reason of wholesale defensive strategy. The underlying rationale being that

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

A)banks follow their multinational customers abroad to prevent the erosion of their clientele to foreign banks seeking to service the multinational's foreign subsidiaries.

B)multinational banking operations help a bank prevent the erosion of its traveler's check, tourist, and foreign business markets from foreign bank competition.

C)by maintaining foreign branches and foreign currency balances, banks may reduce transaction costs and foreign exchange risk on currency conversion if government controls can be circumvented.

D)multinational banks are often not subject to the same regulations as domestic banks. There may be reduced need to publish adequate financial information, lack of required deposit insurance and reserve requirements on foreign currency deposits, and the absence of territorial restrictions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

The current exchange rate is £1.00 = $2.00. Compute the correct balances in Bank A's correspondent account(s) with bank B if a currency trader employed at Bank A buys £45,000 from a currency trader at bank B for $90,000 using its correspondent relationship with Bank B.

A) Bank A's dollar-denominated account at B will fall by $90,000.

B) Bank B's dollar-denominated account at A will rise by $90,000.

C) Bank A's pound-denominated account at B will rise by £45,000.

D) Bank B's pound-denominated account at A will fall by £45,000.

E) All of the above are correct

A) Bank A's dollar-denominated account at B will fall by $90,000.

B) Bank B's dollar-denominated account at A will rise by $90,000.

C) Bank A's pound-denominated account at B will rise by £45,000.

D) Bank B's pound-denominated account at A will fall by £45,000.

E) All of the above are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

Consider a U.S. importer desiring to purchase merchandise from a Dutch exporter invoiced in euros, at a cost of €160,000. The U.S. importer will contact his U.S. bank (where of course he has an account denominated in U.S. dollars) and inquire about the exchange rate, which the bank quotes as €0.6250/$1.00. The importer accepts this price, so his bank will proceed to ____________ the importer's account in the amount of ____________.

A)Debit; $256,000

B)Credit; €512,100

C)Credit; $500,000

D)Debit; €100,000

A)Debit; $256,000

B)Credit; €512,100

C)Credit; $500,000

D)Debit; €100,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

Correspondent bank services include

A)prepaid postage and packing materials.

B)letters of introduction.

C)foreign exchange conversions.

D)both b and c

A)prepaid postage and packing materials.

B)letters of introduction.

C)foreign exchange conversions.

D)both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

Why would a U.S. bank open a foreign branch bank instead of a foreign chartered subsidiary?

A)This form of bank organization allows the bank to be able to extend a larger loan to a customer than a locally chartered subsidiary bank of the parent.

B)To slow down check clearing and maximize the bank's float.

C)To avoid U.S. banking regulation.

D)Both a and c

A)This form of bank organization allows the bank to be able to extend a larger loan to a customer than a locally chartered subsidiary bank of the parent.

B)To slow down check clearing and maximize the bank's float.

C)To avoid U.S. banking regulation.

D)Both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

Correspondent bank relationships can be beneficial

A)because a bank can service its MNC clients at a very low cost.

B)because a bank can service its MNC clients without the need to have personnel in many different countries.

C)because a bank can service its MNC clients without developing its own foreign facilities to service its clients.

D)all of the above

A)because a bank can service its MNC clients at a very low cost.

B)because a bank can service its MNC clients without the need to have personnel in many different countries.

C)because a bank can service its MNC clients without developing its own foreign facilities to service its clients.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

The core of the international money market is

A)the Eurocurrency market.

B)the market for foreign exchange.

C)the futures forwards and options markets on foreign exchange.

D)none of the above

A)the Eurocurrency market.

B)the market for foreign exchange.

C)the futures forwards and options markets on foreign exchange.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

An Offshore banking center is

A)a country whose banking system is organized to permit external accounts beyond the normal economic activity of the county.

B)is external to any government, frequently located on old oil drilling platforms located in international waters.

C)a country like North Korea.

D)none of the above

A)a country whose banking system is organized to permit external accounts beyond the normal economic activity of the county.

B)is external to any government, frequently located on old oil drilling platforms located in international waters.

C)a country like North Korea.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

In reference to capital requirements, value-at-risk analysis

A)refers to traditional bank loans and deposits.

B)refers to a "risk-focused" approach to determining adequate bank capital.

C)provides a level of confidence measure of the probability of the maximum loss that can occur during a period of time.

D)both b and c

A)refers to traditional bank loans and deposits.

B)refers to a "risk-focused" approach to determining adequate bank capital.

C)provides a level of confidence measure of the probability of the maximum loss that can occur during a period of time.

D)both b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

Edge Act banks

A)are not prohibited from owning equity in business corporations.

B)are prohibited from owning equity in business corporations.

C)both a and b

D)None of the above

A)are not prohibited from owning equity in business corporations.

B)are prohibited from owning equity in business corporations.

C)both a and b

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

Offshore banks

A)are frequently located on old oil drilling platforms located in international waters.

B)are often located in "pariah" countries like North Korea and Iran.

C)operate as branches or subsidiaries of the parent bank.

D)none of the above

A)are frequently located on old oil drilling platforms located in international waters.

B)are often located in "pariah" countries like North Korea and Iran.

C)operate as branches or subsidiaries of the parent bank.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Eurocurrency market

A)is only in Europe.

B)is an external banking system that runs parallel to the domestic banking system of the country that issued the currency.

C)has languished following monetary union in Europe.

D)none of the above

A)is only in Europe.

B)is an external banking system that runs parallel to the domestic banking system of the country that issued the currency.

C)has languished following monetary union in Europe.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

The primary activities of offshore banks

A)include money laundering where banking secrecy laws are strict.

B)is to seek deposits and grant loans in currencies other than the currency of the host government.

C)involve check clearing of large bags of checks.

D)none of the above

A)include money laundering where banking secrecy laws are strict.

B)is to seek deposits and grant loans in currencies other than the currency of the host government.

C)involve check clearing of large bags of checks.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

Edge Act banks

A)can accept foreign deposits, extend trade credit, finance foreign projects abroad, trade foreign currencies, and engage in investment banking activities with U.S. citizens involving foreign securities.

B)are federally chartered subsidiaries of U.S. banks that are physically located in the United States and are allowed to engage in a full range of international banking activities.

C)can underwrite securities, but can only be located in states on the edge of the U.S.

D)both a and b

A)can accept foreign deposits, extend trade credit, finance foreign projects abroad, trade foreign currencies, and engage in investment banking activities with U.S. citizens involving foreign securities.

B)are federally chartered subsidiaries of U.S. banks that are physically located in the United States and are allowed to engage in a full range of international banking activities.

C)can underwrite securities, but can only be located in states on the edge of the U.S.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

The major legislation controlling the operation of foreign banks in the U.S.

A)specifies that foreign branch banks operating in the U.S. must comply with U.S. banking regulations just like U.S. banks.

B)specifies that foreign branch banks operating in the U.S. must comply with their country-of-origin banking regulations just like U.S. banks operating abroad.

C)specifies that the "shell" branches are illegal for U.S. and foreign banks.

D)both a and c

A)specifies that foreign branch banks operating in the U.S. must comply with U.S. banking regulations just like U.S. banks.

B)specifies that foreign branch banks operating in the U.S. must comply with their country-of-origin banking regulations just like U.S. banks operating abroad.

C)specifies that the "shell" branches are illegal for U.S. and foreign banks.

D)both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

An affiliate bank is

A)a locally incorporated bank that is wholly owned by a foreign parent.

B)a locally incorporated bank that is majority owned by a foreign parent.

C)a locally incorporated bank that is partially owned (but not controlled) by a foreign parent.

D)both a and b

A)a locally incorporated bank that is wholly owned by a foreign parent.

B)a locally incorporated bank that is majority owned by a foreign parent.

C)a locally incorporated bank that is partially owned (but not controlled) by a foreign parent.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which banks cannot accept foreign deposits?

A)Domestic banks located in the U.S.

B)Edge Act banks located in the U.S.

C)Subsidiary banks located overseas

D)Foreign branches located overseas

A)Domestic banks located in the U.S.

B)Edge Act banks located in the U.S.

C)Subsidiary banks located overseas

D)Foreign branches located overseas

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

LIBOR

A)is a market rate, analogous to the U.S. Federal Funds rate.

B)is a government set rate, like the discount rate.

C)is the rate at which banks in London will accept interbank deposits.

D)none of the above

A)is a market rate, analogous to the U.S. Federal Funds rate.

B)is a government set rate, like the discount rate.

C)is the rate at which banks in London will accept interbank deposits.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

Both subsidiary and affiliate banks

A)operate under the banking laws of the country in which they are incorporated.

B)operate under the banking laws of the U.S.

C)can underwrite securities, but not accept dollar-denominated deposits.

D)both a and b

A)operate under the banking laws of the country in which they are incorporated.

B)operate under the banking laws of the U.S.

C)can underwrite securities, but not accept dollar-denominated deposits.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

In reference to capital requirements,

A)bank capital adequacy refers to the amount of equity capital a bank holds as reserves against impaired loans.

B)bank capital adequacy refers to the amount of debt capital a bank holds as reserves against risky assets to reduce the probability of bank failure.

C)most bank regulators agree with the doctrine of "less is more".

D)none of the above

A)bank capital adequacy refers to the amount of equity capital a bank holds as reserves against impaired loans.

B)bank capital adequacy refers to the amount of debt capital a bank holds as reserves against risky assets to reduce the probability of bank failure.

C)most bank regulators agree with the doctrine of "less is more".

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

LIBOR

A)is the London Interbank Offered Rate.

B)is the reference rate in London for Eurodollar deposits.

C)one of several reference rates in London: there is a LIBOR for Eurodollars, Euroyen, Euro-Canadian dollars, and even euro.

D)all of the above

A)is the London Interbank Offered Rate.

B)is the reference rate in London for Eurodollar deposits.

C)one of several reference rates in London: there is a LIBOR for Eurodollars, Euroyen, Euro-Canadian dollars, and even euro.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

Eurocurrency

A)is the euro, the common currency of Europe.

B)is a time deposit of money in an international bank located in a county different from the country that issued the currency.

C)is a demand deposit of money in an international bank located in a county different from the country that issued the currency.

D)either b or c

A)is the euro, the common currency of Europe.

B)is a time deposit of money in an international bank located in a county different from the country that issued the currency.

C)is a demand deposit of money in an international bank located in a county different from the country that issued the currency.

D)either b or c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

Edge Act banks are so-called becauseE. Edge of New Jersey sponsored the 1919 amendment to Section 25 of the Federal Reserve Act to allow U.S. banks to be competitive with the services foreign banks could supply their customers.

A)the are Federally chartered subsidiaries of U.S. banks that are physically located in the United States and are allowed to engage in a full range of international banking activities.

B)Senator Walter

C)they can only be chartered in states that are on the borders of the United States-on the "edge" of the map.

D)none of the above

A)the are Federally chartered subsidiaries of U.S. banks that are physically located in the United States and are allowed to engage in a full range of international banking activities.

B)Senator Walter

C)they can only be chartered in states that are on the borders of the United States-on the "edge" of the map.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

U.S. banks that establish subsidiary and affiliate banks

A)are allowed to underwrite securities.

B)must provide FDIC insurance on their foreign-currency denominated demand deposits.

C)can underwrite securities, but not accept dollar-denominated deposits.

D)both a and b

A)are allowed to underwrite securities.

B)must provide FDIC insurance on their foreign-currency denominated demand deposits.

C)can underwrite securities, but not accept dollar-denominated deposits.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

A subsidiary bank is

A)a locally incorporated bank that is wholly owned by a foreign parent.

B)a locally incorporated bank that is majority owned by a foreign parent.

C)a locally incorporated bank that is partially owned (but not controlled) by a foreign parent.

D)both a and b

A)a locally incorporated bank that is wholly owned by a foreign parent.

B)a locally incorporated bank that is majority owned by a foreign parent.

C)a locally incorporated bank that is partially owned (but not controlled) by a foreign parent.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

Foreign banks that establish subsidiary and affiliate banks in the U.S.

A)tend to locate in states that are major centers of financial activity.

B)tend to locate in the highly populous states of New York, California, Illinois, Florida, Georgia, and Texas.

C)can underwrite securities, but not accept dollar-denominated deposits.

D)both a and b

A)tend to locate in states that are major centers of financial activity.

B)tend to locate in the highly populous states of New York, California, Illinois, Florida, Georgia, and Texas.

C)can underwrite securities, but not accept dollar-denominated deposits.

D)both a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

Since SR < AR, then

A)ABC Bank will pay XYZ Bank a cash settlement at the beginning of the 91-day FRA period.

B)XYZ Bank will pay ABC Bank a cash settlement at the beginning of the 91-day FRA period.

C)ABC Bank will pay XYZ Bank a cash settlement at the end of the 91-day FRA period.

D)XYZ Bank will pay ABC Bank a cash settlement at the end of the 91-day FRA period.

A)ABC Bank will pay XYZ Bank a cash settlement at the beginning of the 91-day FRA period.

B)XYZ Bank will pay ABC Bank a cash settlement at the beginning of the 91-day FRA period.

C)ABC Bank will pay XYZ Bank a cash settlement at the end of the 91-day FRA period.

D)XYZ Bank will pay ABC Bank a cash settlement at the end of the 91-day FRA period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

You entered in to a 3 × 6 forward rate agreement that obliged you to borrow $10,000,000 at 3%. Suppose at the maturity of the FRA, the correct interest rate is 3½%. Clearly you are better off since you have the ability to borrow $10,000,000 for 3 months at 3% instead of 3½%. What is the payoff at the maturity of the FRA?

A)Net payment of $12,391.57 to you

B)Net payment of $12,500 to you

C)Net payment of $50,000 to you

D)Net payment of $48,309.18 to you

A)Net payment of $12,391.57 to you

B)Net payment of $12,500 to you

C)Net payment of $50,000 to you

D)Net payment of $48,309.18 to you

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

Approximately ___ of wholesale Eurobank external liabilities come from fixed time deposits, the remainder from Negotiable Certificates of Deposit.

A)50%

B)75%

C)90%

D)None of the above

A)50%

B)75%

C)90%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

Eurodollars refers to dollar deposits when the depository bank is located in

A)Europe.

B)Europe, and the Caribbean.

C)Outside the United States.

D)United States.

A)Europe.

B)Europe, and the Caribbean.

C)Outside the United States.

D)United States.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

A bank bought a "three against six" FRA. Payment is made when?

A)At the end of 3 months

B)At the end of 6 months

C)At the end of 9 months

D)None of the above

A)At the end of 3 months

B)At the end of 6 months

C)At the end of 9 months

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

A forward rate agreement (FRA) is a contract between two banks

A)that allows the Eurobank to hedge the interest rate risk in mismatched deposits and credits.

B)in which the buyer agrees to pay the seller the increased interest cost on a notional amount if interest rates fall below an agreed rate, and the seller agrees to pay the buyer the increased interest cost if interest rates increase above the agreed rate.

C)that is structured to capture the maturity mismatch in standard-length Eurodeposits and credits.

D)all of the above

A)that allows the Eurobank to hedge the interest rate risk in mismatched deposits and credits.

B)in which the buyer agrees to pay the seller the increased interest cost on a notional amount if interest rates fall below an agreed rate, and the seller agrees to pay the buyer the increased interest cost if interest rates increase above the agreed rate.

C)that is structured to capture the maturity mismatch in standard-length Eurodeposits and credits.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

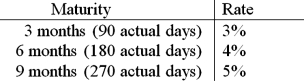

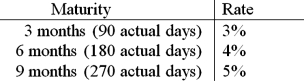

You are a bank and your customer asks you to quote an agreed-upon rate for a 3 × 9 FRA. You observe the following rates.  What rate should you quote?

What rate should you quote?

A)5.96%

B)4.96%

C)1.94%

D)None of the above

What rate should you quote?

What rate should you quote?A)5.96%

B)4.96%

C)1.94%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

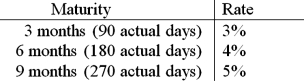

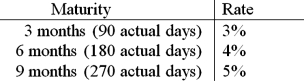

You are a bank and your customer asks you to quote an agreed-upon rate for a 3 × 6 FRA. You observe the following rates:  What rate should you quote?

What rate should you quote?

A)5.96%

B)4.96%

C)2.48%

D)None of the above

What rate should you quote?

What rate should you quote?A)5.96%

B)4.96%

C)2.48%

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

Eurocredits

A)are credit cards that work in the euro zone.

B)short- to medium-term loans of Eurocurrency extended by Eurobanks to corporations, sovereign governments, nonprime banks, or international organizations.

C)short- to medium-term loans of Eurocurrency extended by Eurobanks to corporations, sovereign governments, nonprime banks, or international organizations.

D)none of the above

A)are credit cards that work in the euro zone.

B)short- to medium-term loans of Eurocurrency extended by Eurobanks to corporations, sovereign governments, nonprime banks, or international organizations.

C)short- to medium-term loans of Eurocurrency extended by Eurobanks to corporations, sovereign governments, nonprime banks, or international organizations.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

The rate charged by banks with excess funds is referred to as the interbank offered rate; they will accept interbank deposits at the interbank bid rate.

A)The spread is generally 1/8 of 1 percent for most major Eurocurrencies.

B)The spread is generally referred to as "the TED spread".

C)The spread is generally referred to as the bid-ask commission.

D)None of the above

A)The spread is generally 1/8 of 1 percent for most major Eurocurrencies.

B)The spread is generally referred to as "the TED spread".

C)The spread is generally referred to as the bid-ask commission.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

71

A bank bought a "three against six" $5,000,000 FRA for a three-month period beginning three months from today and ending six months from today. The reason that the bank bought the FRA was to hedge: the bank accepted a 3-month deposit and made a six-month loan. The agreement rate with the seller is 5.0%. Assume that three months from today the settlement rate is 5.25%. Who pays whom? How much? When? The actual number of days in the FRA is 90.

A)The bank pays $3,0084.52 at the end of 3 months

B)The bank pays $3,0084.52 at the end of 6 months

C)The counterparty pays $3,0084.52 at the end of 3 months

D)The counterparty pays $3,0084.52 at the end of 6 months

A)The bank pays $3,0084.52 at the end of 3 months

B)The bank pays $3,0084.52 at the end of 6 months

C)The counterparty pays $3,0084.52 at the end of 3 months

D)The counterparty pays $3,0084.52 at the end of 6 months

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

A bank sold a 3 × 9 FRA. Payment is made when?

A)At the end of 3 months

B)At the end of 6 months

C)At the end of 9 months

D)None of the above

A)At the end of 3 months

B)At the end of 6 months

C)At the end of 9 months

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

The LIBOR rate for euro

A)is EURIBOR.

B)is a government set rate.

C)is the rate at which Interbank deposits of euro are offered by one prime bank to another in the euro zone.

D)both a and c

A)is EURIBOR.

B)is a government set rate.

C)is the rate at which Interbank deposits of euro are offered by one prime bank to another in the euro zone.

D)both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

Eurocredits

A)are often so large that individual banks cannot handle them.

B)short- to medium-term loans of Eurocurrency extended by Eurobanks to corporations, sovereign governments, nonprime banks, or international organizations.

C)frequently require the use of a banking syndicate.

D)all of the above

A)are often so large that individual banks cannot handle them.

B)short- to medium-term loans of Eurocurrency extended by Eurobanks to corporations, sovereign governments, nonprime banks, or international organizations.

C)frequently require the use of a banking syndicate.

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

In the wholesale money market, denominations

A)are at least $10,000, but sizes of $100,000 or larger are more typical.

B)are at least $100,000, but sizes of $500,000 or larger are more typical.

C)are at least $500,000, but sizes of $1,000,000 or larger are more typical.

D)none of the above

A)are at least $10,000, but sizes of $100,000 or larger are more typical.

B)are at least $100,000, but sizes of $500,000 or larger are more typical.

C)are at least $500,000, but sizes of $1,000,000 or larger are more typical.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

Eurocredits feature rollover pricing.

A)Rollover pricing was created on Eurocredits so that Eurobanks do not end up paying more on Eurocurrency time deposits than they earn from the loans.

B)Because of the rollover pricing feature, a Eurocredit may be viewed as a series of shorter-term loans, where at the end of each time period (generally three or six months), the loan is rolled over and the base lending rate is repriced to current LIBOR over the next time interval of the loan.

C)The lending rate on these Eurocredits is stated as LIBOR + X percent, where X is the lending margin charged depending upon the creditworthiness of the borrower. LIBOR is reset according to a set schedule.

D)All of the above are true

A)Rollover pricing was created on Eurocredits so that Eurobanks do not end up paying more on Eurocurrency time deposits than they earn from the loans.

B)Because of the rollover pricing feature, a Eurocredit may be viewed as a series of shorter-term loans, where at the end of each time period (generally three or six months), the loan is rolled over and the base lending rate is repriced to current LIBOR over the next time interval of the loan.

C)The lending rate on these Eurocredits is stated as LIBOR + X percent, where X is the lending margin charged depending upon the creditworthiness of the borrower. LIBOR is reset according to a set schedule.

D)All of the above are true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

77

ABC International has borrowed $4,000,000 at LIBOR plus a lending margin of .65 percent per annum on a three-month rollover basis from Barclays in London. Three month LIBOR is currently 5.5 percent, but ABC is worried about an increase in three-month LIBOR 3 months from now. What could they do to hedge?

A)Buy a 3 × 6 FRA in the amount of $4 million.

B)Sell a 3 × 6 FRA in the amount of $4 million.

C)Buy a 3 × 3 FRA in the amount of $4 million.

D)Buy a 3 × 9 FRA in the amount of $4 million.

A)Buy a 3 × 6 FRA in the amount of $4 million.

B)Sell a 3 × 6 FRA in the amount of $4 million.

C)Buy a 3 × 3 FRA in the amount of $4 million.

D)Buy a 3 × 9 FRA in the amount of $4 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

ABC International can borrow $4,000,000 at LIBOR plus a lending margin of .65 percent per annum on a three-month rollover basis from Barclays in London. Three month LIBOR is currently 5.5 percent. Suppose that over the second three-month interval LIBOR falls to 5.0 percent. How much will ABC pay in interest to Barclays over the six-month period for the Eurodollar loan?

A)$50,000

B)$100,000

C)$118,000

D)$120,000

A)$50,000

B)$100,000

C)$118,000

D)$120,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

A bank agrees to buy from a customer a "three against six" FRA at the market rate for such instruments. How can the bank hedge this obligation?

A)Go long a 6-month Eurodollar deposit in the amount of the FRA at the current 6-month rate financed by going short a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate.

B)Go short a 6-month Eurodollar deposit in the amount of the FRA at the current 6-month rate; go long a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate.

C)Borrow a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate.

D)None of the above

A)Go long a 6-month Eurodollar deposit in the amount of the FRA at the current 6-month rate financed by going short a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate.

B)Go short a 6-month Eurodollar deposit in the amount of the FRA at the current 6-month rate; go long a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate.

C)Borrow a 3-month Eurodollar deposit in the amount of the FRA at the current 3-month rate.

D)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

Teltrex International can borrow $3,000,000 at LIBOR plus a lending margin of .75 percent per annum on a three-month rollover basis from Barclays in London. Suppose that three-month LIBOR is currently 5 17⁄32 percent. Further suppose that over the second three-month interval LIBOR falls to 5 1⁄8 percent. How much will Teltrex pay in interest to Barclays over the six-month period for the Eurodollar loan?

A)$79,921.875

B)$91,171.88

C)$96,174.39

D)$364,687.52

A)$79,921.875

B)$91,171.88

C)$96,174.39

D)$364,687.52

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck