Deck 22: Corporate Valuation and Governance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/27

العب

ملء الشاشة (f)

Deck 22: Corporate Valuation and Governance

1

Which of the following will NOT be regarded as being a barrier to hostile takeovers?

A)targeted share repurchases

B)shareholder rights provisions

C)restricted voting rights

D)cumulative voting

A)targeted share repurchases

B)shareholder rights provisions

C)restricted voting rights

D)cumulative voting

D

2

Which action can be an adverse move for corporate governance?

A)making the CEO the chairman of the board

B)decreasing the board size

C)increasing the seats of independent directors in the board up to 80%

D)paying board members with stock rather than salary

A)making the CEO the chairman of the board

B)decreasing the board size

C)increasing the seats of independent directors in the board up to 80%

D)paying board members with stock rather than salary

A

3

A poison pill is also known as a corporate restructuring.

False

4

Simonyan Inc.forecasts a free cash flow of $40 million in Year 3,i.e.,at t = 3,and it expects FCF to grow at a constant rate of 5% thereafter.If the weighted average cost of capital is 10% and the cost of equity is 15%,what is the horizon value,in millions at t = 3?

A)$840

B)$882

C)$926

D)$972

A)$840

B)$882

C)$926

D)$972

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

5

Based on the corporate valuation model,Bernile Inc.'s value of operations is $750 million.Its balance sheet shows $50 million of short-term investments that are unrelated to operations,$100 million of accounts payable,$100 million of notes payable,$200 million of long-term debt,$40 million of common stock (par plus paid-in-capital),and $160 million of retained earnings.What is the best estimate for the firm's value of equity,in millions?

A)$450

B)$475

C)$500

D)$525

A)$450

B)$475

C)$500

D)$525

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

6

Akyol Corporation is undergoing a restructuring,and its free cash flows are expected to be unstable during the next few years.However,FCF is expected to be $50 million in Year 5,i.e.,FCF at t = 5 equals $50 million,and the FCF growth rate is expected to be constant at 6% beyond that point.If the weighted average cost of capital is 12%,what is the horizon value (in millions) at t = 5?

A)$757

B)$797

C)$839

D)$883

A)$757

B)$797

C)$839

D)$883

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

7

The two most important issues in corporate governance are (1) the rules that cover the board's ability to fire the CEO and (2) the rules that cover the CEO's ability to remove members of the board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

8

Leverage has unclear impact on corporate value as debt can reduce one aspect of agency costs (wasteful spending),but it may increase another (underinvestment).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which statement regarding the corporate valuation model is NOT correct?

A)The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends.

B)The corporate valuation model discounts free cash flows by the required return on equity.

C)The corporate valuation model can be used to find the value of a division.

D)An important step in applying the corporate valuation model is forecasting the firm's pro forma financial statements.

A)The corporate valuation model can be used both for companies that pay dividends and those that do not pay dividends.

B)The corporate valuation model discounts free cash flows by the required return on equity.

C)The corporate valuation model can be used to find the value of a division.

D)An important step in applying the corporate valuation model is forecasting the firm's pro forma financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

10

Value-based management focuses on sales growth,profitability,capital requirements,the weighted average cost of capital,and the dividend growth rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

11

Based on the corporate valuation model,the value of a company's operations is $900 million.Its balance sheet shows $70 million in accounts receivable,$50 million in inventory,$30 million in short-term investments that are unrelated to operations,$20 million in accounts payable,$110 million in notes payable,$90 million in long-term debt,$20 million in preferred stock,$140 million in retained earnings,and $280 million in total common equity.If the company has 25 million shares of stock outstanding,what is the best estimate of the stock's price per share?

A)$23.00

B)$25.56

C)$28.40

D)$31.24

A)$23.00

B)$25.56

C)$28.40

D)$31.24

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose Leonard,Nixon,& Shull Corporation's projected free cash flow for next year is $100,000,and FCF is expected to grow at a constant rate of 6%.If the company's weighted average cost of capital is 11%,what is the value of its operations?

A)$1,714,750

B)$1,805,000

C)$1,900,000

D)$2,000,000

A)$1,714,750

B)$1,805,000

C)$1,900,000

D)$2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

13

Based on the corporate valuation model,the value of a company's operations is $1,200 million.The company's balance sheet shows $80 million in accounts receivable,$60 million in inventory,and $100 million in short-term investments that are unrelated to operations.The balance sheet also shows $90 million in accounts payable,$120 million in notes payable,$300 million in long-term debt,$50 million in preferred stock,$180 million in retained earnings,and $800 million in total common equity.If the company has 30 million shares of stock outstanding,what is the best estimate of the stock's price per share?

A)$24.90

B)$27.67

C)$30.43

D)$33.48

A)$24.90

B)$27.67

C)$30.43

D)$33.48

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

14

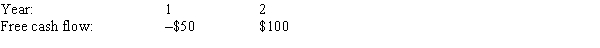

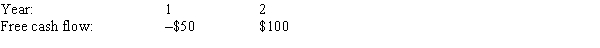

Leak Inc.forecasts the free cash flows (in millions) shown below.If the weighted average cost of capital is 11% and FCF is expected to grow at a rate of 5% after Year 2,what is the Year 0 value of operations,in millions? Assume that the ROIC is expected to remain constant in Year 2 and beyond (and do not make any half-year adjustments).

A)$1,456

B)$1,529

C)$1,606

D)$1,686

A)$1,456

B)$1,529

C)$1,606

D)$1,686

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

15

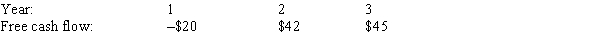

A company forecasts the free cash flows (in millions) shown below.The weighted average cost of capital is 13%,and the FCFs are expected to continue growing at a 5% rate after Year 3.Assuming that the ROIC is expected to remain constant in Year 3 and beyond,what is the Year 0 value of operations,in millions?

A)$331

B)$348

C)$367

D)$386

A)$331

B)$348

C)$367

D)$386

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

16

The corporate valuation model cannot be used unless a company doesn't pay dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following are agency relationships in a company?

A)shareholders and creditors

B)employees and unions

C)outside owners and inside owner/managers

D)both a and c

A)shareholders and creditors

B)employees and unions

C)outside owners and inside owner/managers

D)both a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

18

Zhdanov Inc.forecasts that its free cash flow in the coming year,i.e.,at t = 1,will be -$10 million,but its FCF at t = 2 will be $20 million.After Year 2,FCF is expected to grow at a constant rate of 4% forever.If the weighted average cost of capital is 14%,what is the firm's value of operations,in millions?

A)$158

B)$167

C)$175

D)$184

A)$158

B)$167

C)$175

D)$184

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

19

Suppose Yon Sun Corporation's free cash flow during the just-ended year (t = 0) was $100 million,and FCF is expected to grow at a constant rate of 5% in the future.If the weighted average cost of capital is 15%,what is the firm's value of operations,in millions?

A)$948

B)$998

C)$1,050

D)$1,103

A)$948

B)$998

C)$1,050

D)$1,103

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

20

The CEO of BMI Industries has been granted some stock options that have provisions similar to most other executive stock options.If BMI's stock underperforms the market,these options will necessarily be worthless.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

21

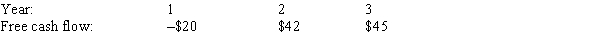

Vasudevan Inc.forecasts the free cash flows (in millions) shown below.If the weighted average cost of capital is 13% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3,what is the Year 0 value of operations,in millions?

A)$586

B)$617

C)$648

D)$680

A)$586

B)$617

C)$648

D)$680

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following best describes the condition under which an agency relationship arises?

A)when a principal contracts employees to work overtime.

B)when a principal negotiates a new wage contract with a union.

C)when a principal delegates decision-making authority to another party on behalf of the firm

D)when shareholders vote to decline a dividend payment.

A)when a principal contracts employees to work overtime.

B)when a principal negotiates a new wage contract with a union.

C)when a principal delegates decision-making authority to another party on behalf of the firm

D)when shareholders vote to decline a dividend payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following best describes what rate of return should be used when finding the present value of a series of cash flows?

A)Free cash flows should be discounted at the firm's average cost of debt capital to find the value of its operations.

B)Free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

C)Free cash flows should be discounted at the firm's cost of equity capital (preferred and common) to find the value of its operations.

D)Free cash flows should be discounted at the firm's cost of preferred equity capital and pre-tax cost of debt capital to find the value of its operations.

A)Free cash flows should be discounted at the firm's average cost of debt capital to find the value of its operations.

B)Free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

C)Free cash flows should be discounted at the firm's cost of equity capital (preferred and common) to find the value of its operations.

D)Free cash flows should be discounted at the firm's cost of preferred equity capital and pre-tax cost of debt capital to find the value of its operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

24

Manitoba Skate Co.'s free cash flow in the previous year was $1,250,000,and FCF is expected to grow at a constant rate of 2%.If the company's weighted average cost of capital is 17%,what is the value of its operations?

A)$8,000,000

B)$8,333,333

C)$8,500,000

D)$12,000,000

A)$8,000,000

B)$8,333,333

C)$8,500,000

D)$12,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

25

Based on the corporate valuation model,Hunsader's value of operations is $300 million.The balance sheet shows $20 million of short-term investments that are unrelated to operations,$50 million of accounts payable,$90 million of notes payable,$30 million of long-term debt,$40 million of preferred stock,and $100 million of common equity.The company has 10 million shares of stock outstanding.What is the best estimate of the stock's price per share?

A)$13.72

B)$14.44

C)$15.20

D)$16.00

A)$13.72

B)$14.44

C)$15.20

D)$16.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

26

Suppose Toronto Corp.'s free cash flow in the previous year was $250,000,and FCF is expected to grow at a constant rate of 5%.If the company's weighted average cost of capital is 15%,what is the value of its operations?

A)$2,625,000

B)$2,500,000

C)$2,900,000

D)$2,000,000

A)$2,625,000

B)$2,500,000

C)$2,900,000

D)$2,000,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose BC Corp.'s free cash flow in the previous year was $50,000,and FCF is expected to grow at a constant rate of 3%.If the company's weighted average cost of capital is 15%,what is the value of its operations?

A)$416,667

B)$500,000

C)$900,000

D)$429,167

A)$416,667

B)$500,000

C)$900,000

D)$429,167

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 27 في هذه المجموعة.

فتح الحزمة

k this deck