Deck 16: Auditing Operations and Completing the Audit

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 16: Auditing Operations and Completing the Audit

1

Common to future purchase commitments is the fact that they should be recorded as liabilities at discounted values as of year-end.

False

2

Internal control over payroll is enhanced when the personnel department distributes payroll checks.

False

3

Analytical procedures are required as a part of the

A)Detailed tests of balances.

B)Internal control assessment.

C)Procedures performed near the end of the audit.

D)Substantive testing.

A)Detailed tests of balances.

B)Internal control assessment.

C)Procedures performed near the end of the audit.

D)Substantive testing.

C

4

If not adjusted,a situation in which the total likely misstatement in the financial statements exceeds a material amount is likely to lead to an audit report modification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

Dual dating of an audit report extends the auditors' liability for disclosure through the later date for all areas of the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

Subsequent events that provide additional evidence as to conditions that existed at the balance sheet date may result in adjusting journal entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following procedures would an auditor most likely perform while evaluating audit findings at the conclusion of an audit?

A)Obtain assurance from the entity's attorney that all material litigation has been disclosed in the financial statements.

B)Verify the clerical accuracy of the entity's proof of cash and its bank cutoff statement.

C)Determine whether reportable conditions have been corrected.

D)Develop an estimate of the total likely misstatement in the financial statements.

A)Obtain assurance from the entity's attorney that all material litigation has been disclosed in the financial statements.

B)Verify the clerical accuracy of the entity's proof of cash and its bank cutoff statement.

C)Determine whether reportable conditions have been corrected.

D)Develop an estimate of the total likely misstatement in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

In auditing the balance sheet,most revenue and expense accounts are also audited.Which accounts are most likely to be audited when auditing Accounts Receivable?

A)Sales and Cost of Goods Sold.

B)Interest and Bad Debt Expense.

C)Sales and Bad Debt Expense.

D)Interest and Cost of Goods Sold.

A)Sales and Cost of Goods Sold.

B)Interest and Bad Debt Expense.

C)Sales and Bad Debt Expense.

D)Interest and Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

When auditing the statement of cash flows of a profitable,growing company which combination is most likely?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Normally,general risk contingencies need not be disclosed in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Auditors should perform audit procedures relating to subsequent events?

A)Through year end.

B)Through issuance of the audit report.

C)Through the date of the audit report.

D)For a reasonable period after year end.

A)Through year end.

B)Through issuance of the audit report.

C)Through the date of the audit report.

D)For a reasonable period after year end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following ledger accounts would be least likely to be analyzed in detail by auditors?

A)Miscellaneous revenue.

B)Professional fees.

C)Travel expense.

D)Repairs and maintenance.

A)Miscellaneous revenue.

B)Professional fees.

C)Travel expense.

D)Repairs and maintenance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

The audit of which of the following balance sheet accounts does not normally result in verification of an income statement account?

A)Cash.

B)Accounts receivable.

C)Property, plant and equipment.

D)Intangible assets.

A)Cash.

B)Accounts receivable.

C)Property, plant and equipment.

D)Intangible assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

An example of an internal control weakness is to assign the payroll department the responsibility for:

A)Preparing the payroll expense distribution.

B)Preparing the payroll checks.

C)Authorizing increases in pay.

D)Preparing journal entries for payroll expense.

A)Preparing the payroll expense distribution.

B)Preparing the payroll checks.

C)Authorizing increases in pay.

D)Preparing journal entries for payroll expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

Shortly after year-end Zero Corporation was informed of the bankruptcy of Bingo.Zero Corporation showed a receivable of $10,000 due from Bingo as of year-end-none of which seems recoverable.The receivable had been questionable for some time as Bingo had been experiencing financial difficulties for the past several years.Yet,Bingo's bankruptcy did not occur until after Zero Corporation's year-end.Under these circumstances:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

The Miscellaneous Revenue account should only be analyzed if it is material in amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

In the audit of a nonpublic company,the auditors have a responsibility to report on all FASB-required supplementary information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

If management fails to list an unasserted claim in the letter of inquiry to a lawyer,the lawyer is not required to inform the auditors of the omission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

Analytical procedures are often used for verification of income statement accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

The statement that best expresses the auditor's responsibility with respect to events occurring between the balance sheet date and the end of his audit is that:

A)The auditor has no responsibility for events occurring in the subsequent period unless these events affect transactions recorded on or before the balance sheet date.

B)The auditor's responsibility is to determine that a proper cutoff has been made and that transactions recorded on or before the balance sheet date actually occurred.

C)The auditor is fully responsible for events occurring in the subsequent period and should extend all detailed procedures through the last day of field work.

D)The auditor is responsible for determining that a proper cutoff has been made and performing a general review of events occurring in the subsequent period.

A)The auditor has no responsibility for events occurring in the subsequent period unless these events affect transactions recorded on or before the balance sheet date.

B)The auditor's responsibility is to determine that a proper cutoff has been made and that transactions recorded on or before the balance sheet date actually occurred.

C)The auditor is fully responsible for events occurring in the subsequent period and should extend all detailed procedures through the last day of field work.

D)The auditor is responsible for determining that a proper cutoff has been made and performing a general review of events occurring in the subsequent period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following information need not be reported on in the auditors' report if the information is considered to be properly stated after performing appropriate procedures?

A)FASB-required supplementary information.

B)Other information in documents containing audited financial statements.

C)Supplementary information in relation to the financial statements as a whole.

D)GASB-required supplementary information.

A)FASB-required supplementary information.

B)Other information in documents containing audited financial statements.

C)Supplementary information in relation to the financial statements as a whole.

D)GASB-required supplementary information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

If,after issuing an audit report,the auditors find that they have failed to perform certain significant audit procedures they should first:

A)Attempt to determine whether their report is still being relied upon by third parties.

B)Notify regulatory agencies.

C)Notify legal counsel.

D)Wait until the beginning of the next year's audit to determine whether misstatements have occurred.

A)Attempt to determine whether their report is still being relied upon by third parties.

B)Notify regulatory agencies.

C)Notify legal counsel.

D)Wait until the beginning of the next year's audit to determine whether misstatements have occurred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not a procedure normally performed while completing the audit?

A)Obtain a lawyer's letter.

B)Obtain a representations letter.

C)Perform an overall review using analytical procedures.

D)Obtain confirmation of capital stockholdings from shareholders.

A)Obtain a lawyer's letter.

B)Obtain a representations letter.

C)Perform an overall review using analytical procedures.

D)Obtain confirmation of capital stockholdings from shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

A refusal by a lawyer to furnish information related to litigation included in the letter of inquiry is likely to result in:

A)Confirmation of related lawsuits with the claimants.

B)Qualification of the audit report.

C)An assessment that loss of the litigation is probable.

D)An adverse opinion.

A)Confirmation of related lawsuits with the claimants.

B)Qualification of the audit report.

C)An assessment that loss of the litigation is probable.

D)An adverse opinion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

Material loss contingencies should be recorded in the financial statements if available information indicates it is probable that a loss had been sustained prior to the balance sheet date and the amount of such loss can be reasonably estimated.These considerations will affect the audit report as follows:

A)If a loss has been recorded in accordance with these criteria, the auditor may issue an unqualified opinion but is required to point out the contingency in an explanatory paragraph of the report.

B)If a loss meets these criteria but is disclosed in the financial statement notes rather than being recorded therein, the auditor may issue an unqualified opinion, but is required to point out the contingency in an explanatory paragraph of the report.

C)If a loss meets these criteria but is disclosed in the financial statement notes rather than being recorded therein, the auditor may issue an unqualified opinion, but should consider adding an explanatory paragraph as a means of emphasizing the disclosure.

D)If a loss is probable but the amount cannot be reasonably estimated and is disclosed in the notes to the financial statements rather than being recorded therein, the auditor may issue an unqualified opinion.

A)If a loss has been recorded in accordance with these criteria, the auditor may issue an unqualified opinion but is required to point out the contingency in an explanatory paragraph of the report.

B)If a loss meets these criteria but is disclosed in the financial statement notes rather than being recorded therein, the auditor may issue an unqualified opinion, but is required to point out the contingency in an explanatory paragraph of the report.

C)If a loss meets these criteria but is disclosed in the financial statement notes rather than being recorded therein, the auditor may issue an unqualified opinion, but should consider adding an explanatory paragraph as a means of emphasizing the disclosure.

D)If a loss is probable but the amount cannot be reasonably estimated and is disclosed in the notes to the financial statements rather than being recorded therein, the auditor may issue an unqualified opinion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following subsequent events might require an adjustment to the client's financial statements?

A)A business combination with another company.

B)Loss on the sale of a closely-held investment.

C)Loss of plant and equipment due to a fire.

D)Retirement of bonds payable at a loss.

A)A business combination with another company.

B)Loss on the sale of a closely-held investment.

C)Loss of plant and equipment due to a fire.

D)Retirement of bonds payable at a loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following is not a procedure that is designed to provide evidence about the existence of loss contingencies?

A)Obtaining a lawyers' letter.

B)Confirming accounts payable.

C)Reviewing the minutes of board of directors' meetings.

D)Review correspondence with banks.

A)Obtaining a lawyers' letter.

B)Confirming accounts payable.

C)Reviewing the minutes of board of directors' meetings.

D)Review correspondence with banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following procedures is not a procedure that is completed near the end of the engagement?

A)Review cash transactions.

B)Review to identify subsequent events.

C)Obtain the lawyer's letter.

D)Obtain the letter of representations.

A)Review cash transactions.

B)Review to identify subsequent events.

C)Obtain the lawyer's letter.

D)Obtain the letter of representations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

Management estimates the company's allowance for doubtful accounts as $200,000,and the auditors develop an estimate that suggests that the amount should be between $230,000 and $250,000.The known misstatement in this situation is:

A)$0

B)$30,000

C)$40,000

D)$50,000

A)$0

B)$30,000

C)$40,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following types of matters do not generally require disclosure in the financial statements?

A)General risk contingencies.

B)Commitments.

C)Loss contingencies.

D)Liabilities to related parties.

A)General risk contingencies.

B)Commitments.

C)Loss contingencies.

D)Liabilities to related parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not a procedure that auditors typically perform to search for significant events during the period after year-end but prior to the audit report date?

A)Review minutes of board of directors' meeting.

B)Review the latest available interim financial statements.

C)Inquire about any unusual adjustments made subsequent to the balance sheet date.

D)Review changes in internal control during the period subsequent to the balance sheet date.

A)Review minutes of board of directors' meeting.

B)Review the latest available interim financial statements.

C)Inquire about any unusual adjustments made subsequent to the balance sheet date.

D)Review changes in internal control during the period subsequent to the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

Auditors must communicate internal control "significant deficiencies" to:

A)The audit committee.

B)The shareholders.

C)The SEC.

D)The Federal Trade Commission.

A)The audit committee.

B)The shareholders.

C)The SEC.

D)The Federal Trade Commission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

An example of an internal control weakness is to assign the personnel department responsibility for:

A)Distribution of paychecks.

B)Hiring personnel.

C)Authorizing deductions from pay.

D)Interviewing employees for jobs.

A)Distribution of paychecks.

B)Hiring personnel.

C)Authorizing deductions from pay.

D)Interviewing employees for jobs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following audit procedures is aimed at determining whether every name on the company payroll is an employee actually on the job?

A)A surprise observation of a paycheck distribution.

B)A test of payroll extensions.

C)Analytical comparisons of budgeted to actual payroll expense.

D)Comparison of payee names on canceled payroll checks with the payroll register.

A)A surprise observation of a paycheck distribution.

B)A test of payroll extensions.

C)Analytical comparisons of budgeted to actual payroll expense.

D)Comparison of payee names on canceled payroll checks with the payroll register.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

Authorization of which of the following is least likely to be found during a review of the minutes of the board of directors?

A)Dividends.

B)New debt issuance.

C)New bank accounts.

D)Writeoff of trade accounts receivable.

A)Dividends.

B)New debt issuance.

C)New bank accounts.

D)Writeoff of trade accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

The review of audit working papers by the audit partner is normally completed:

A)Prior to year-end.

B)Immediately as each working paper is completed.

C)Near the completion of the audit.

D)After issuance of the audit report, but prior to required subsequent event review procedures.

A)Prior to year-end.

B)Immediately as each working paper is completed.

C)Near the completion of the audit.

D)After issuance of the audit report, but prior to required subsequent event review procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

An approach that quantifies the total likely misstatement as of the current year-end based on the effects of reflecting misstatements during the current year (and not considering any unadjusted previous year misstatements)is referred to as the:

A)Evaluation materiality approach.

B)Iron curtain approach.

C)Projected misstatement approach.

D)Rollover approach.

A)Evaluation materiality approach.

B)Iron curtain approach.

C)Projected misstatement approach.

D)Rollover approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

Management estimates the company's allowance for doubtful accounts as $200,000,and the auditors develop an estimate that suggests that the amount should be between $230,000 and $250,000.The likely misstatement in this situation is:

A)$0

B)$30,000

C)$40,000

D)$50,000

A)$0

B)$30,000

C)$40,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

In evaluating whether there is a sufficiently low probability of material misstatement in the financial statements,the auditors accumulate:

A)Likely misstatements in the financial statements.

B)Known misstatements in the financial statements.

C)Known, projected and other estimated misstatements in the financial statements.

D)Known, projected and potential misstatements in the financial statements.

A)Likely misstatements in the financial statements.

B)Known misstatements in the financial statements.

C)Known, projected and other estimated misstatements in the financial statements.

D)Known, projected and potential misstatements in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

Specific misstatement in one of a client's 2,000 accounts receivable is referred to as a(n):

A)Extrapolation difference.

B)Known misstatement.

C)Likely misstatement.

D)Projected misstatement.

A)Extrapolation difference.

B)Known misstatement.

C)Likely misstatement.

D)Projected misstatement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following statements ordinarily is not included among the written client representations made by the chief executive officer and the chief financial officer?

A)Sufficient audit evidence has been made available to the auditor to permit the issuance of an unqualified opinion."

B)"There are no unasserted claims or assessments that our lawyer has advised us are probable of assertion and must be disclosed."

C)"We have no plans or intentions that may materially affect the carrying value or classification of assets and liabilities."

D)"No events have occurred subsequent to the balance sheet date that would require adjustment to, or disclosure in, the financial statements."

A)Sufficient audit evidence has been made available to the auditor to permit the issuance of an unqualified opinion."

B)"There are no unasserted claims or assessments that our lawyer has advised us are probable of assertion and must be disclosed."

C)"We have no plans or intentions that may materially affect the carrying value or classification of assets and liabilities."

D)"No events have occurred subsequent to the balance sheet date that would require adjustment to, or disclosure in, the financial statements."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

The date the auditor grants the client permission to use the audit report in connection with the financial statements is the:

A)Last day of significant field work.

B)Report cutoff date.

C)Report release date.

D)Representation date.

A)Last day of significant field work.

B)Report cutoff date.

C)Report release date.

D)Representation date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following is an analytical procedure that should be applied to the income statement?

A)Select sales and expense items and trace amounts to related supporting documents.

B)Ascertain that the net income amount in the statement of cash flows agrees with the net income amount in the income statement.

C)Obtain from the proper client representatives, the beginning and ending inventory amounts that were used to determine costs of sales.

D)Compare the actual revenues and expenses with the corresponding figures of the previous year and investigate significant differences.

A)Select sales and expense items and trace amounts to related supporting documents.

B)Ascertain that the net income amount in the statement of cash flows agrees with the net income amount in the income statement.

C)Obtain from the proper client representatives, the beginning and ending inventory amounts that were used to determine costs of sales.

D)Compare the actual revenues and expenses with the corresponding figures of the previous year and investigate significant differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

A common audit procedure in the audit of payroll transactions involves tracing selected items from the payroll journal to employee time cards that have been approved by supervisory personnel.This procedure is designed to provide evidence in support of the audit proposition that:

A)Only bona fide employees worked and their pay was properly computed.

B)Jobs on which employees worked were charged with the appropriate labor cost.

C)Internal control relating to payroll disbursements are operating effectively.

D)Employees worked the number of hours for which their pay was computed.

A)Only bona fide employees worked and their pay was properly computed.

B)Jobs on which employees worked were charged with the appropriate labor cost.

C)Internal control relating to payroll disbursements are operating effectively.

D)Employees worked the number of hours for which their pay was computed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

With respect to issuance of an audit report which is dual dated for a subsequent event occurring after the completion of field work but before issuance of the auditors' report,the auditors' responsibility for events occurring subsequent to the date of the audit report:

A)Extended to include all events occurring until the date of the last subsequent event referred to.

B)Limited to the specific event referred to.

C)Limited to all events occurring through the date of issuance of the report.

D)Extended to include all events occurring through the date of submission of the report to the client.

A)Extended to include all events occurring until the date of the last subsequent event referred to.

B)Limited to the specific event referred to.

C)Limited to all events occurring through the date of issuance of the report.

D)Extended to include all events occurring through the date of submission of the report to the client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

To minimize the opportunities for fraud,unclaimed cash payroll should be:

A)Deposited in a safe deposit box.

B)Held by the payroll custodian.

C)Deposited in a special bank account.

D)Held by the controller.

A)Deposited in a safe deposit box.

B)Held by the payroll custodian.

C)Deposited in a special bank account.

D)Held by the controller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following material events occurring subsequent to the balance sheet date would require an adjustment to the financial statements before they could be issued?

A)Sale of long-term debt or capital stock.

B)Loss of a plant as a result of a flood.

C)Major purchase of a business which is expected to double the sales volume.

D)Settlement of litigation in excess of the recorded liability.

A)Sale of long-term debt or capital stock.

B)Loss of a plant as a result of a flood.

C)Major purchase of a business which is expected to double the sales volume.

D)Settlement of litigation in excess of the recorded liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

A client's previous two years of financial statements understated estimated warranty payable by $30,000 and $50,000 respectively,immaterial amounts.This year the auditors estimate that the accrual is understated by an additional $60,000.In this year's audit $100,000 represents a material amount.Assuming that the entire understatement is to be recorded,following SEC SAB 108 the decrease in this year's income due to these understatements is:

A)$0

B)$60,000

C)$110,000

D)$140,000

A)$0

B)$60,000

C)$110,000

D)$140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

An auditor's decision concerning whether or not to "dual date" the audit report is based upon the auditor's willingness to:

A)Extend auditing procedures.

B)Accept responsibility for year-end adjusting entries.

C)Permit inclusion of a note captioned: event (unaudited) subsequent to the date of the auditor's report.

D)Assume responsibility for resolving all events subsequent to the issuance of the auditor's report.

A)Extend auditing procedures.

B)Accept responsibility for year-end adjusting entries.

C)Permit inclusion of a note captioned: event (unaudited) subsequent to the date of the auditor's report.

D)Assume responsibility for resolving all events subsequent to the issuance of the auditor's report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

A client's previous two years financial statements understated estimated warranty payable by $30,000 and $50,000 respectively,immaterial amounts.This year the auditors estimate that the accrual is understated by an additional $60,000.In this year's audit $55,000 represents a material amount.Assuming that the entire understatement is to be recorded,following SEC SAB 108 the decrease in this year's income due to these understatements is:

A)$0

B)$60,000

C)$110,000

D)$140,000

A)$0

B)$60,000

C)$110,000

D)$140,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

One reason why the independent auditors perform analytical procedures on the client's operations is to identify:

A)Weaknesses of a material nature in internal control.

B)Non-compliance with prescribed control procedures.

C)Improper separation of accounting and other financial duties.

D)Unusual transactions.

A)Weaknesses of a material nature in internal control.

B)Non-compliance with prescribed control procedures.

C)Improper separation of accounting and other financial duties.

D)Unusual transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

The purpose of segregating the duties of distributing payroll checks and hiring personnel is to:

A)Separate the custody of assets from the accounting for those assets.

B)Establish clear lines of authority and responsibility.

C)Separate duties within the accounting function.

D)Separate the authorization of transactions from the custody of related assets.

A)Separate the custody of assets from the accounting for those assets.

B)Establish clear lines of authority and responsibility.

C)Separate duties within the accounting function.

D)Separate the authorization of transactions from the custody of related assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

An approach that quantifies the total likely misstatement as of the current year-end based on the effects of reflecting all misstatements existing in the balance sheet at the end of the current year,irrespective of whether the misstatements occurred in the current or previous years is referred to as the:

A)Evaluation materiality approach.

B)Iron curtain approach.

C)Projected misstatement approach.

D)Rollover approach.

A)Evaluation materiality approach.

B)Iron curtain approach.

C)Projected misstatement approach.

D)Rollover approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is not correct relating to representation letters?

A)They are ordinarily dated as of the date of the audit report.

B)They are signed by members of top management.

C)They must be obtained for audits.

D)They often serve as a substitute for the application of other procedures.

A)They are ordinarily dated as of the date of the audit report.

B)They are signed by members of top management.

C)They must be obtained for audits.

D)They often serve as a substitute for the application of other procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following auditing procedures is ordinarily performed last?

A)Reading of the minutes of the directors' meetings.

B)Confirming accounts payable.

C)Obtaining a management representation letter.

D)Testing of the purchasing function.

A)Reading of the minutes of the directors' meetings.

B)Confirming accounts payable.

C)Obtaining a management representation letter.

D)Testing of the purchasing function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

The auditors' primary means of obtaining corroboration of management's information concerning litigation is a:

A)Letter of audit inquiry to the client's lawyer.

B)Letter of corroboration from the auditor's lawyer upon review of the legal documentation.

C)Confirmation of claims and assessments from the other parties to the litigation.

D)Confirmation of claims and assessments from an officer of the court presiding over the litigation.

A)Letter of audit inquiry to the client's lawyer.

B)Letter of corroboration from the auditor's lawyer upon review of the legal documentation.

C)Confirmation of claims and assessments from the other parties to the litigation.

D)Confirmation of claims and assessments from an officer of the court presiding over the litigation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

Auditors often request that the audit client send a letter of inquiry to those attorneys who have been consulted with respect to litigation,claims,or assessments.The primary reason for this request is to provide the auditors with:

A)An estimate of the dollar amount of the probable loss.

B)An expert opinion as to whether a loss is possible, probable or remote.

C)Information concerning the progress of cases to date.

D)Corroborative audit evidence.

A)An estimate of the dollar amount of the probable loss.

B)An expert opinion as to whether a loss is possible, probable or remote.

C)Information concerning the progress of cases to date.

D)Corroborative audit evidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

It would be appropriate for the payroll accounting department to be responsible for which of the following functions?

A)Approval of employee time records.

B)Maintenance of records of employment, discharges, and pay increases.

C)Preparation of periodic governmental reports as to employees' earnings and withholding taxes.

D)Distribution of paychecks to employees.

A)Approval of employee time records.

B)Maintenance of records of employment, discharges, and pay increases.

C)Preparation of periodic governmental reports as to employees' earnings and withholding taxes.

D)Distribution of paychecks to employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

A CPA reviews a client's payroll procedures.The CPA would consider internal control to be less than effective if a payroll department supervisor was assigned the responsibility for:

A)Reviewing and approving time reports for subordinate employees.

B)Distributing payroll checks to employees.

C)Hiring subordinate employees.

D)Initiating requests for salary adjustments for subordinate employees.

A)Reviewing and approving time reports for subordinate employees.

B)Distributing payroll checks to employees.

C)Hiring subordinate employees.

D)Initiating requests for salary adjustments for subordinate employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following is the best reason why the auditors should consider observing a client's distribution of regular payroll checks?

A)Separation of payroll duties is less than adequate for effective internal control.

B)Total payroll costs are a significant part of total operating costs.

C)The auditors did not observe the distribution of the entire regular payroll during the audit in the prior year.

D)Employee turnover is excessive.

A)Separation of payroll duties is less than adequate for effective internal control.

B)Total payroll costs are a significant part of total operating costs.

C)The auditors did not observe the distribution of the entire regular payroll during the audit in the prior year.

D)Employee turnover is excessive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Auditors are concerned with the existence of loss contingencies that may affect the client's financial statements.One way that the auditors obtain evidence about existing loss contingencies is through the lawyer's letter.

a.Describe the information that the auditors wish to obtain about the litigation being handled by a lawyer.

b.Describe three other procedures that are used by auditors to discover existing loss contingencies.

a.Describe the information that the auditors wish to obtain about the litigation being handled by a lawyer.

b.Describe three other procedures that are used by auditors to discover existing loss contingencies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

A nonpublic client has provided required supplementary information with its audited financial statements.The auditor's proper reporting responsibility includes:

A)An emphasis of matter paragraph should be added to the audit report.

B)A separate report should be issued on the required supplementary information.

C)An adverse opinion on the required supplementary information.

D)The required supplementary information should not be referred to.

A)An emphasis of matter paragraph should be added to the audit report.

B)A separate report should be issued on the required supplementary information.

C)An adverse opinion on the required supplementary information.

D)The required supplementary information should not be referred to.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

The auditors' best course of action with respect to "other information (not including required supplemental information)" included in an annual report containing the auditors' report is to:

A)Indicate in the auditors' report, that the "other financial information" is only compiled.

B)Consider whether the "other financial information" is accurate by performing a limited review.

C)Obtain written representations from managements as to the material accuracy of the "other financial information."

D)Read and consider the manner of presentation of the "other financial information."

A)Indicate in the auditors' report, that the "other financial information" is only compiled.

B)Consider whether the "other financial information" is accurate by performing a limited review.

C)Obtain written representations from managements as to the material accuracy of the "other financial information."

D)Read and consider the manner of presentation of the "other financial information."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

To which of the following matters would materiality limits not apply when obtaining written client representations?

A)Violations of state labor regulations.

B)Disclosure of line-of-credit arrangements.

C)Information about related party transactions.

D)Instances of fraud involving management.

A)Violations of state labor regulations.

B)Disclosure of line-of-credit arrangements.

C)Information about related party transactions.

D)Instances of fraud involving management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

Auditors must be concerned with events that occur subsequent to the balance sheet date,because the events may need to be reflected in the financial statements.

a.Describe the two general types of subsequent events.

b.What is the auditors' responsibility with respect to detecting subsequent events?

c.List three audit procedures that are used by the auditors to search for subsequent events.

a.Describe the two general types of subsequent events.

b.What is the auditors' responsibility with respect to detecting subsequent events?

c.List three audit procedures that are used by the auditors to search for subsequent events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

The auditor's primary means of obtaining corroboration of management's information concerning litigation is a:

A)Letter of audit inquiry to the client's lawyer.

B)Letter of corroboration from the auditor's lawyer upon review of the legal documentation.

C)Confirmation of claims and assessments from the other parties to the litigation.

D)Confirmation of claims and assessments from an officer of the court presiding over the litigation.

A)Letter of audit inquiry to the client's lawyer.

B)Letter of corroboration from the auditor's lawyer upon review of the legal documentation.

C)Confirmation of claims and assessments from the other parties to the litigation.

D)Confirmation of claims and assessments from an officer of the court presiding over the litigation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

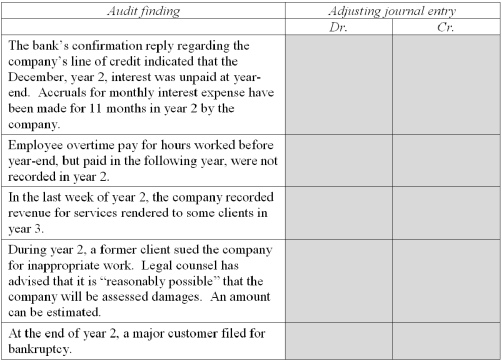

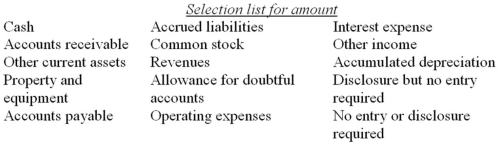

67

During the course of the year 2 audit of Smithsone Company,the auditor discovered the following situations that may or may not require an adjusting journal entry.Each audit finding is independent of any of the other findings.Select the account or accounts that would comprise the adjusting journal entry,if required,to correct the audit finding.Accounts may be used once,more than once,or not at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

An auditor will ordinarily examine invoices from lawyers primarily in order to:

A)Substantiate accruals.

B)Assess the legal ramifications of litigation in progress.

C)Estimate the dollar amount of contingent liabilities.

D)Identify possible unasserted litigation, claims and assessments.

A)Substantiate accruals.

B)Assess the legal ramifications of litigation in progress.

C)Estimate the dollar amount of contingent liabilities.

D)Identify possible unasserted litigation, claims and assessments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

In the course of the audit of financial statements for the purpose of expressing an opinion thereon,the auditors will normally prepare a schedule of unadjusted differences for which the auditors did not propose adjustment when they were identified.What is the primary purpose served by this schedule?

A)To point out to the responsible client officials the errors made by various company personnel.

B)To summarize the adjustments that must be made before the company can prepare and submit its federal tax return.

C)To identify the potential financial statement effects of misstatement or disputed items that were considered immaterial when discovered.

D)To summarize the misstatements made by the company so that corrections can be made after the audited financial statements are released.

A)To point out to the responsible client officials the errors made by various company personnel.

B)To summarize the adjustments that must be made before the company can prepare and submit its federal tax return.

C)To identify the potential financial statement effects of misstatement or disputed items that were considered immaterial when discovered.

D)To summarize the misstatements made by the company so that corrections can be made after the audited financial statements are released.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck