Deck 5: Audit Evidence and Documentation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 5: Audit Evidence and Documentation

1

Which of the following is required documentation in an audit?

A)A list of major accounts.

B)A flowchart of the client's organization.

C)A written audit program.

D)A memo setting forth the scope of the audit.

A)A list of major accounts.

B)A flowchart of the client's organization.

C)A written audit program.

D)A memo setting forth the scope of the audit.

C

2

Which of the following is correct concerning a "fraud risk factor"?

A)It may affect the auditor's assessment of fraud risk.

B)It requires modification of planned audit procedures.

C)It is also a material weakness in internal control.

D)If it involves senior management, it is likely to result in resignation of the auditor.

A)It may affect the auditor's assessment of fraud risk.

B)It requires modification of planned audit procedures.

C)It is also a material weakness in internal control.

D)If it involves senior management, it is likely to result in resignation of the auditor.

A

3

To be effective,analytical procedures performed near the end of the audit should be performed by

A)The partner performing the quality review of the audit.

B)A beginning staff accountant who has had no other work related to the engagement.

C)A manager or partner who has a comprehensive knowledge of the client's business and industry.

D)The CPA firm's quality control manager.

A)The partner performing the quality review of the audit.

B)A beginning staff accountant who has had no other work related to the engagement.

C)A manager or partner who has a comprehensive knowledge of the client's business and industry.

D)The CPA firm's quality control manager.

C

4

The most reliable form of documentary evidence generally is considered to be documents created by the client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

When the risk of material misstatement for an account is high,the auditors may perform additional substantive procedures to restrict detection risk to a lower level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is not an assertion relating to classes of transactions?

A)Accuracy.

B)Sufficiency.

C)Cutoff.

D)Classification.

A)Accuracy.

B)Sufficiency.

C)Cutoff.

D)Classification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

The primary purpose of a letter of representations is to obtain additional evidence about specific accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

The auditors should propose an adjusting journal entry for all material related-party transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

Financial statement assertions are established for classes of transactions,

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

When performing a financial statement audit,auditors are required to explicitly assess the risk of material misstatement due to:

A)Fraud.

B)Misappropriation.

C)Illegal Acts.

D)Business risk.

A)Fraud.

B)Misappropriation.

C)Illegal Acts.

D)Business risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

Further audit procedures include:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

Assertions that have a meaningful bearing on whether an account balance,transaction class or disclosure is fairly stated are referred to as:

A)Appropriate assertions.

B)Sufficient assertions.

C)Relevant assertions.

D)Reliable assertions.

A)Appropriate assertions.

B)Sufficient assertions.

C)Relevant assertions.

D)Reliable assertions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

The use of lead schedules is designed to increase the detail of the working trial balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

The professional standards consider calculating depreciation expense a "routine" transaction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

In performing analytical procedures,the auditors may use dollar amounts,physical quantities,or percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

The components of the risk of misstatement are:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

As planning materiality is decreased,the auditor should plan more work on individual accounts to.

A)Find smaller misstatements.

B)Find larger misstatements.

C)Increase the tolerable misstatement in the accounts.

D)Decrease the risk of assessing control risk too low.

A)Find smaller misstatements.

B)Find larger misstatements.

C)Increase the tolerable misstatement in the accounts.

D)Decrease the risk of assessing control risk too low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

Working papers of continuing audit interest usually are filed with the administrative working papers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

A vendor's invoice is an example of documentary evidence created by a third party and held by the client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

Adjusting journal entries are ordinarily recorded by the client,while reclassifying journal entries need not be recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not a financial statement assertion relating to account balances?

A)Completeness

B)Existence.

C)Rights and obligations.

D)Recorded value and discounts.

A)Completeness

B)Existence.

C)Rights and obligations.

D)Recorded value and discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is generally true about the sufficiency of audit evidence?

A)The amount of evidence that is sufficient varies inversely with the acceptable risk of material misstatement.

B)The amount of evidence concerning a particular account varies inversely with the materiality of the account.

C)The amount of evidence concerning a particular account varies inversely with the inherent risk of the account.

D)When evidence is appropriate with respect to an account it is also sufficient.

A)The amount of evidence that is sufficient varies inversely with the acceptable risk of material misstatement.

B)The amount of evidence concerning a particular account varies inversely with the materiality of the account.

C)The amount of evidence concerning a particular account varies inversely with the inherent risk of the account.

D)When evidence is appropriate with respect to an account it is also sufficient.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following groups are not considered a specialist by AICPA Professional Standards:

A)Appraisers.

B)Internal auditors.

C)Engineers.

D)Geologists.

A)Appraisers.

B)Internal auditors.

C)Engineers.

D)Geologists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

An auditor is performing an analytical procedure that involves comparing a client's ratios with other companies in the same industry.This technique is referred to as:

A)Vertical analysis.

B)Horizontal analysis.

C)Cross-sectional analysis.

D)Comparison analysis.

A)Vertical analysis.

B)Horizontal analysis.

C)Cross-sectional analysis.

D)Comparison analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

An auditor compared the current-year gross margin with the prior-year gross margin to determine if cost of sales is reasonable.What type of audit procedure was performed?

A)Test of transactions.

B)Analytical procedures.

C)Test of controls.

D)Test of details.

A)Test of transactions.

B)Analytical procedures.

C)Test of controls.

D)Test of details.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following is not a basic procedure used in an audit?

A)Risk assessment procedures.

B)Substantive procedures.

C)Tests of controls.

D)Tests of direct evidence.

A)Risk assessment procedures.

B)Substantive procedures.

C)Tests of controls.

D)Tests of direct evidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

Analytical procedures are required at the risk assessment stage and as:

A)Tests of internal control.

B)Substantive procedures.

C)A part of the final overall review.

D)Computer generated procedures.

A)Tests of internal control.

B)Substantive procedures.

C)A part of the final overall review.

D)Computer generated procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

In auditing an asset valued at fair value,which of the following potentially provides the auditor with the strongest evidence?

A)A price for a similar asset obtained from an active market.

B)An appraisal obtained discounting future cash flows.

C)Management's judgment of the cost to purchase an equivalent asset.

D)The historical cost of the asset.

A)A price for a similar asset obtained from an active market.

B)An appraisal obtained discounting future cash flows.

C)Management's judgment of the cost to purchase an equivalent asset.

D)The historical cost of the asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following is a basic approach often used by auditors to evaluate the reasonableness of accounting estimates?

A)Confirmation.

B)Observation.

C)Reviewing subsequent events or transactions.

D)Analyzing corporate organizational structure.

A)Confirmation.

B)Observation.

C)Reviewing subsequent events or transactions.

D)Analyzing corporate organizational structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

During financial statement audits,auditors seek to restrict which type of risk?

A)Control risk.

B)Detection risk.

C)Inherent risk.

D)Account risk.

A)Control risk.

B)Detection risk.

C)Inherent risk.

D)Account risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

An auditor should expect that fair value is the price that would be received to sell an asset in an orderly transaction between the market participants at the:

A)Acquisition date of the asset.

B)Audit report date.

C)Expected replacement date of the asset.

D)Measurement date (ordinarily the date of the financial statements).

A)Acquisition date of the asset.

B)Audit report date.

C)Expected replacement date of the asset.

D)Measurement date (ordinarily the date of the financial statements).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

The auditors of Smith Electronics wish to limit the audit risk of material misstatement in the test of accounts receivable to 5 percent.They believe that inherent risk is 100%,and there is a 40% risk that material misstatement could have bypassed the client's system of internal control.What is the maximum detection risk the auditors should specify in their substantive procedures of details of accounts receivable?

A)5%.

B)12.5%.

C)42.7%.

D)60%.

A)5%.

B)12.5%.

C)42.7%.

D)60%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

CPA wishes to use a representation letter as a substitute for performing other audit procedures.Doing so:

A)Violates professional standards.

B)Is acceptable, but should only be done when cost justified.

C)Is acceptable, but only for non-public clients.

D)Is acceptable and desirable under all conditions.

A)Violates professional standards.

B)Is acceptable, but should only be done when cost justified.

C)Is acceptable, but only for non-public clients.

D)Is acceptable and desirable under all conditions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is true about analytical procedures?

A)Performing analytical procedures results in the most reliable form of evidence.

B)Analytical procedures are tests of controls used to evaluate the quality of a client's internal control.

C)Analytical procedures are used for planning, but they should not be used to obtain evidence as to the reasonableness of specific account balances.

D)Analytical procedures are used in risk assessment, as a substantive procedure for specific accounts, and near the completion of the audit of the audited financial statements.

A)Performing analytical procedures results in the most reliable form of evidence.

B)Analytical procedures are tests of controls used to evaluate the quality of a client's internal control.

C)Analytical procedures are used for planning, but they should not be used to obtain evidence as to the reasonableness of specific account balances.

D)Analytical procedures are used in risk assessment, as a substantive procedure for specific accounts, and near the completion of the audit of the audited financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

An auditor is performing an analytical procedure that involves comparing a client's account balances over time.This technique is referred to as:

A)Vertical analysis.

B)Horizontal analysis.

C)Cross-sectional analysis.

D)Comparison analysis.

A)Vertical analysis.

B)Horizontal analysis.

C)Cross-sectional analysis.

D)Comparison analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

An auditor plans to apply substantive tests to the details of asset and liability accounts as of an interim date rather than as of the balance sheet date.The auditor should be aware that this practice

A)Eliminates the use of certain statistical sampling methods that would otherwise be available.

B)Presumes that the auditor will reperform the tests as of the balance sheet date.

C)Should be especially considered when there are rapidly changing economic conditions.

D)Potentially increases the risk that errors that exist at the balance sheet date will not be detected.

A)Eliminates the use of certain statistical sampling methods that would otherwise be available.

B)Presumes that the auditor will reperform the tests as of the balance sheet date.

C)Should be especially considered when there are rapidly changing economic conditions.

D)Potentially increases the risk that errors that exist at the balance sheet date will not be detected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

Which of the following best describes the reason that auditors are concerned with the detection of related party transactions?

A)The financial statements must often be adjusted for the effects of material related party transactions.

B)Material related party transactions must be disclosed in the notes to the financial statements.

C)The substance of related party transactions will differ from their form.

D)In a related party transaction one party has the ability to exercise significant influence over the other party.

A)The financial statements must often be adjusted for the effects of material related party transactions.

B)Material related party transactions must be disclosed in the notes to the financial statements.

C)The substance of related party transactions will differ from their form.

D)In a related party transaction one party has the ability to exercise significant influence over the other party.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

The inspection of a vendor's invoice by the auditors is:

A)Direct evidence about occurrence of a transaction.

B)Physical evidence about occurrence of a transaction.

C)Documentary evidence about occurrence of a transaction.

D)Part of the client's accounting system.

A)Direct evidence about occurrence of a transaction.

B)Physical evidence about occurrence of a transaction.

C)Documentary evidence about occurrence of a transaction.

D)Part of the client's accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not considered to be an analytical procedure?

A)Comparisons of financial statement amounts with source documents.

B)Comparisons of financial statement amounts with nonfinancial data.

C)Comparisons of financial statement amounts with budgeted amounts.

D)Comparisons of financial statement amounts with comparable prior year amounts.

A)Comparisons of financial statement amounts with source documents.

B)Comparisons of financial statement amounts with nonfinancial data.

C)Comparisons of financial statement amounts with budgeted amounts.

D)Comparisons of financial statement amounts with comparable prior year amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following best describes the problem with the use of published industry averages for analytical procedures?

A)Lack of comparability.

B)Lack of sufficiency.

C)Lack of accuracy.

D)Lack of availability.

A)Lack of comparability.

B)Lack of sufficiency.

C)Lack of accuracy.

D)Lack of availability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

The audit time budget is an example of:

A)A supporting schedule.

B)An administrative working paper.

C)A lead schedule.

D)A corroborative working paper.

A)A supporting schedule.

B)An administrative working paper.

C)A lead schedule.

D)A corroborative working paper.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following expressions is least likely to be included in a client's representation letter?

A)No events have occurred subsequent to the balance sheet date that require adjustment to, or disclosure in, the financial statements.

B)The company has complied with all aspects of contractual agreements that would have a material effect on the financial statements in the event of noncompliance.

C)Management acknowledges responsibility for illegal actions committed by employees.

D)Management has made available all financial statements, including notes.

A)No events have occurred subsequent to the balance sheet date that require adjustment to, or disclosure in, the financial statements.

B)The company has complied with all aspects of contractual agreements that would have a material effect on the financial statements in the event of noncompliance.

C)Management acknowledges responsibility for illegal actions committed by employees.

D)Management has made available all financial statements, including notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

An example of an analytical procedure is the comparison of:

A)Financial information with similar information regarding the industry in which the entity operates.

B)Recorded amounts of major disbursements with appropriate invoices.

C)Results of a statistical sample with the expected characteristics of the actual population.

D)EDP generated data with similar data generated by a manual accounting system.

A)Financial information with similar information regarding the industry in which the entity operates.

B)Recorded amounts of major disbursements with appropriate invoices.

C)Results of a statistical sample with the expected characteristics of the actual population.

D)EDP generated data with similar data generated by a manual accounting system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is not a function of working papers?

A)Provide support for the auditors' report.

B)Provide support for the accounting records.

C)Aid partners in planning and conducting future audits.

D)Document staff compliance with generally accepted auditing standards.

A)Provide support for the auditors' report.

B)Provide support for the accounting records.

C)Aid partners in planning and conducting future audits.

D)Document staff compliance with generally accepted auditing standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

An auditor is performing an analytical procedure that involves developing common-size financial statements.This technique is referred to as:

A)Vertical analysis.

B)Horizontal analysis.

C)Cross-sectional analysis.

D)Comparison analysis.

A)Vertical analysis.

B)Horizontal analysis.

C)Cross-sectional analysis.

D)Comparison analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following ultimately determines the specific audit procedures necessary to provide independent auditors with a reasonable basis for the expression of an opinion?

A)The audit time budget.

B)The auditors' judgment.

C)Generally accepted accounting quality standards.

D)The auditors' working papers.

A)The audit time budget.

B)The auditors' judgment.

C)Generally accepted accounting quality standards.

D)The auditors' working papers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

A schedule listing account balances for the current and previous years,and columns for adjusting and reclassifying entries proposed by the auditors to arrive at the final amount that will appear in the financial statement,is referred to as a:

A)Working trial balance.

B)Lead schedule.

C)Summarizing schedule.

D)Supporting schedule.

A)Working trial balance.

B)Lead schedule.

C)Summarizing schedule.

D)Supporting schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

The auditors must obtain written client representations that normally should be signed by:

A)The president and the chairperson of the board.

B)The treasurer and the internal auditor.

C)The chief executive officer and the chief financial officer.

D)The corporate counsel and the audit committee chairperson.

A)The president and the chairperson of the board.

B)The treasurer and the internal auditor.

C)The chief executive officer and the chief financial officer.

D)The corporate counsel and the audit committee chairperson.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

The auditors use analytical procedures during the course of an audit.The most important phase of performing these procedures is the:

A)Vouching of all data supporting various ratios.

B)Investigation of significant variations and unusual relationships.

C)Comparison of client-computed statistics with industry data on a quarterly and full-year basis.

D)Recalculation of industry date.

A)Vouching of all data supporting various ratios.

B)Investigation of significant variations and unusual relationships.

C)Comparison of client-computed statistics with industry data on a quarterly and full-year basis.

D)Recalculation of industry date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

When considering the use of management's written representations as audit evidence about the completeness assertion,an auditor should understand that such representations:

A)Complement, but do not replace, substantive procedures designed to support the assertion.

B)Constitute sufficient evidence to support the assertion when considered in combination with a moderate assessed level of control risk.

C)Are generally sufficient audit evidence to support the assertion regardless of the assessed level of control risk.

D)Replace the assessed level of control risk as evidence to support the assertions.

A)Complement, but do not replace, substantive procedures designed to support the assertion.

B)Constitute sufficient evidence to support the assertion when considered in combination with a moderate assessed level of control risk.

C)Are generally sufficient audit evidence to support the assertion regardless of the assessed level of control risk.

D)Replace the assessed level of control risk as evidence to support the assertions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

Failure to detect material dollar errors in the financial statements is a risk which the auditors primarily mitigate by:

A)Performing substantive procedures.

B)Performing tests of controls.

C)Assessing control risk.

D)Obtaining a client representation letter.

A)Performing substantive procedures.

B)Performing tests of controls.

C)Assessing control risk.

D)Obtaining a client representation letter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following is not a basic approach often used by auditors to evaluate the reasonableness of accounting estimates?

A)Confirmation of amounts.

B)Review of management's process of development.

C)Independent development of an estimate.

D)Review of subsequent events.

A)Confirmation of amounts.

B)Review of management's process of development.

C)Independent development of an estimate.

D)Review of subsequent events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following statements relating to audit evidence is the most accurate statement?

A)Audit evidence gathered by an auditor from outside an enterprise is reliable.

B)Accounting data developed under satisfactory conditions of internal control are more relevant than data developed under unsatisfactory internal control conditions.

C)Oral representations made by management are not valid evidence.

D)The auditor must obtain sufficient appropriate audit evidence.

A)Audit evidence gathered by an auditor from outside an enterprise is reliable.

B)Accounting data developed under satisfactory conditions of internal control are more relevant than data developed under unsatisfactory internal control conditions.

C)Oral representations made by management are not valid evidence.

D)The auditor must obtain sufficient appropriate audit evidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is not a typical analytical procedure?

A)Study of relationships of the financial information with relevant nonfinancial information.

B)Comparison of the financial information with similar information regarding the industry in which the entity operates.

C)Comparison of recorded amounts of major disbursements with appropriate invoices.

D)Comparison of the financial information with budgeted amounts.

A)Study of relationships of the financial information with relevant nonfinancial information.

B)Comparison of the financial information with similar information regarding the industry in which the entity operates.

C)Comparison of recorded amounts of major disbursements with appropriate invoices.

D)Comparison of the financial information with budgeted amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following statements is generally correct about audit evidence?

A)The auditor's direct personal knowledge, obtained through observation and inspection, is more persuasive than information obtained indirectly from independent outside sources.

B)To be appropriate, audit evidence must be sufficient.

C)Accounting data alone may be considered sufficient appropriate audit evidence to issue an unqualified opinion on financial statements.

D)Appropriateness of audit evidence refers to the amount of corroborative evidence to be obtained.

A)The auditor's direct personal knowledge, obtained through observation and inspection, is more persuasive than information obtained indirectly from independent outside sources.

B)To be appropriate, audit evidence must be sufficient.

C)Accounting data alone may be considered sufficient appropriate audit evidence to issue an unqualified opinion on financial statements.

D)Appropriateness of audit evidence refers to the amount of corroborative evidence to be obtained.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following would not necessarily be considered a related party transaction?

A)Payment of a bonus to the president.

B)Purchases from another corporation that is controlled by the corporation's chief stockholder.

C)Loan from the corporation to a major stockholder.

D)Sale of land to the corporation by the spouse of a director.

A)Payment of a bonus to the president.

B)Purchases from another corporation that is controlled by the corporation's chief stockholder.

C)Loan from the corporation to a major stockholder.

D)Sale of land to the corporation by the spouse of a director.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

The date of the management representation letter should coincide with the:

A)Date of the auditor's report.

B)Balance sheet date.

C)Date of the latest subsequent event referred to in the notes to the financial statements.

D)Date of the engagement agreement.

A)Date of the auditor's report.

B)Balance sheet date.

C)Date of the latest subsequent event referred to in the notes to the financial statements.

D)Date of the engagement agreement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

A schedule set up to combine similar general ledger accounts,the total of which appears on the working trial balance as a single amount,is referred to as a:

A)Supporting schedule.

B)Lead schedule.

C)Corroborating schedule.

D)Reconciling schedule.

A)Supporting schedule.

B)Lead schedule.

C)Corroborating schedule.

D)Reconciling schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is not a primary purpose of audit working papers?

A)To coordinate the examination.

B)To assist in preparation of the audit report.

C)To support the financial statements.

D)To provide evidence of the audit work performed.

A)To coordinate the examination.

B)To assist in preparation of the audit report.

C)To support the financial statements.

D)To provide evidence of the audit work performed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

An independent auditor finds that the Simmer Corporation occupies office space,at no charge,in an office building owned by a shareholder.This finding indicates the existence of:

A)Management fraud.

B)Related party transactions.

C)Window dressing.

D)Weak internal control.

A)Management fraud.

B)Related party transactions.

C)Window dressing.

D)Weak internal control.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

Working papers that record the procedures used by the auditor to gather evidence should be:

A)Considered the primary support for the financial statements being examined.

B)Viewed as the connecting link between the books of account and the financial statements.

C)Designed to meet the circumstances of the particular engagement.

D)Destroyed when the audited entity ceases to be a client.

A)Considered the primary support for the financial statements being examined.

B)Viewed as the connecting link between the books of account and the financial statements.

C)Designed to meet the circumstances of the particular engagement.

D)Destroyed when the audited entity ceases to be a client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

In preparing for an audit of the retail footwear division of a major retail organization,the auditor gathered the following information about the organization's stores: Management has centralized purchasing and uses a model based upon previous year's sales with adjustments for trends in the market place,e.g.,the trend to more casual shoes.A staff auditor has suggested that the centralized purchasing may be one of the reasons for the lower level of profitability in the Mid-Central Region.Which of the following would be the best single audit procedure to address the staff auditor's assertion?

A)Take a sample of receiving documents at stores and trace to purchase orders to determine the length of time between the purchase and delivery of the goods.

B)Interview store managers in the Mid-Central Region to determine their attitude toward centralized purchasing.

C)Perform an inventory count at selected stores in the Mid-Central Region and determine if adjustments are needed to the perpetual records.

D)Perform a product-line analysis of sales and purchases in the Mid-Central Region and compare with other regions.

A)Take a sample of receiving documents at stores and trace to purchase orders to determine the length of time between the purchase and delivery of the goods.

B)Interview store managers in the Mid-Central Region to determine their attitude toward centralized purchasing.

C)Perform an inventory count at selected stores in the Mid-Central Region and determine if adjustments are needed to the perpetual records.

D)Perform a product-line analysis of sales and purchases in the Mid-Central Region and compare with other regions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

In preparing for an audit of the retail footwear division of a major retail organization,the auditor gathered the following information about the organization's stores: An auditor performs analytical procedures that involve comparing the gross margins of various divisional operations with those of other divisions and with the individual division's performance in previous years.The auditor notes a significant increase in the gross margin at one division.The auditor does some preliminary investigation and also notes that there were no changes in products,production methods,or divisional management during the year.Based on the above information,the most likely cause of the increase in gross margin would be:

A)An increase in the number of competitors selling similar products.

B)A decrease in the number of suppliers of the material used in manufacturing the product.

C)An overstatement of year-end inventory.

D)An understatement of year-end accounts receivable.

A)An increase in the number of competitors selling similar products.

B)A decrease in the number of suppliers of the material used in manufacturing the product.

C)An overstatement of year-end inventory.

D)An understatement of year-end accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Analytical procedures are substantive procedures that may be used to provide evidence about specific accounts and classes of transactions.

a.Describe three major types of comparisons the auditor might make in performing analytical procedures.

b.At what stages of the audit are analytical procedures performed and what purpose do they serve at each stage?

a.Describe three major types of comparisons the auditor might make in performing analytical procedures.

b.At what stages of the audit are analytical procedures performed and what purpose do they serve at each stage?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

Audit working papers are an integral part of an examination in accordance with generally accepted auditing standards.

a.Describe three major functions of the audit working papers.

b.Distinguish between the permanent working paper file and the current working paper file.

a.Describe three major functions of the audit working papers.

b.Distinguish between the permanent working paper file and the current working paper file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

In preparing for an audit of the retail footwear division of a major retail organization,the auditor gathered the following information about the organization's stores: Based on the previous information,which of the following preliminary conclusions can the auditor use as a basis for further investigations?

A)Sales per store are directly related to the size of the store.

B)Sale clerks are less productive in larger size stores.

C)Gross margin is directly related to the size of the store.

D)Average square feet of store correlates with the number of stores in the district.

A)Sales per store are directly related to the size of the store.

B)Sale clerks are less productive in larger size stores.

C)Gross margin is directly related to the size of the store.

D)Average square feet of store correlates with the number of stores in the district.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

In preparing for an audit of the retail footwear division of a major retail organization,the auditor gathered the following information about the organization's stores: Which of the following statements is not correct regarding the auditor's further analysis?

A)The Mid-Central Region has fewer average full-time equivalent employees per store than the other regions per store.

B)The other regions all generate higher sales per square foot than the Mid-Central Region.

C)The Mid-Central Region has the highest average wages per full-time equivalent employee.

D)The largest contributor to total corporate profits is the Southwest Region.

A)The Mid-Central Region has fewer average full-time equivalent employees per store than the other regions per store.

B)The other regions all generate higher sales per square foot than the Mid-Central Region.

C)The Mid-Central Region has the highest average wages per full-time equivalent employee.

D)The largest contributor to total corporate profits is the Southwest Region.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

Although the quantity,type,and content of working papers will vary with the circumstances,the working papers generally would include the:

A)Copies of those client records examined by the auditor during the course of the engagement.

B)Evaluation of the efficiency and competence of the audit staff assistants by the partner responsible for the audit.

C)Auditor's comments concerning the efficiency and competence of client management personnel.

D)Auditing procedures followed and the testing performed in obtaining audit evidence.

A)Copies of those client records examined by the auditor during the course of the engagement.

B)Evaluation of the efficiency and competence of the audit staff assistants by the partner responsible for the audit.

C)Auditor's comments concerning the efficiency and competence of client management personnel.

D)Auditing procedures followed and the testing performed in obtaining audit evidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

In general,which of the following statements is correct with respect to ownership,possession,or access to working papers prepared by a CPA firm in connection with an audit?

A)The working papers may be obtained by third parties where they appear to be relevant to issues raised in litigation.

B)The working papers are subject to the privileged communication rule which, in a majority of jurisdictions, prevents third-party access to the working papers.

C)The working papers are the property of the client after the client pays the fee.

D)The working papers must be retained by the CPA firm for a period of ten years.

A)The working papers may be obtained by third parties where they appear to be relevant to issues raised in litigation.

B)The working papers are subject to the privileged communication rule which, in a majority of jurisdictions, prevents third-party access to the working papers.

C)The working papers are the property of the client after the client pays the fee.

D)The working papers must be retained by the CPA firm for a period of ten years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

In obtaining sufficient appropriate audit evidence,the work of which type or types of specialists may be relied upon?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

Assertions with high inherent risk are least likely to involve:

A)Complex calculations.

B)Difficult accounting issues.

C)Routine transactions.

D)Significant judgment by management.

A)Complex calculations.

B)Difficult accounting issues.

C)Routine transactions.

D)Significant judgment by management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

What type of transactions ordinarily have high inherent risk because they involve management judgments or assumptions in formulating accounting balances?

A)Estimation.

B)Nonroutine.

C)Qualified.

D)Routine.

A)Estimation.

B)Nonroutine.

C)Qualified.

D)Routine.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

In preparing for an audit of the retail footwear division of a major retail organization,the auditor gathered the following information about the organization's stores: Management is concerned about the lower level of profitability in the Mid-Central Region.Which of the following would be a reasonable possible explanation(s)of the lower profitability for the Mid-Central Region?

I.The lower number of stores in the Mid-Central Region.

II.Sales employees are not as productive in generating sales as those in other regions.

III.The Mid-Central Region has a lower gross margin.

A)I only.

B)II only.

C)II and III only.

D)I, II and III.

I.The lower number of stores in the Mid-Central Region.

II.Sales employees are not as productive in generating sales as those in other regions.

III.The Mid-Central Region has a lower gross margin.

A)I only.

B)II only.

C)II and III only.

D)I, II and III.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

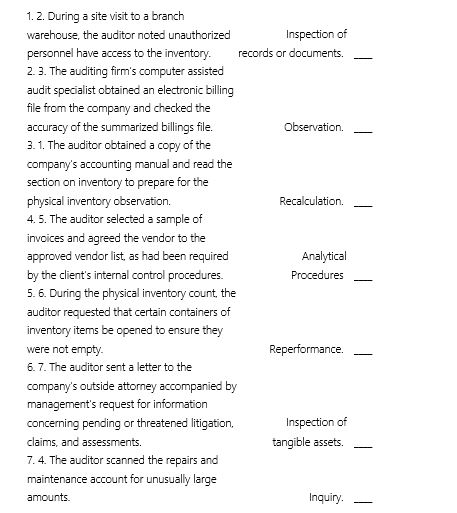

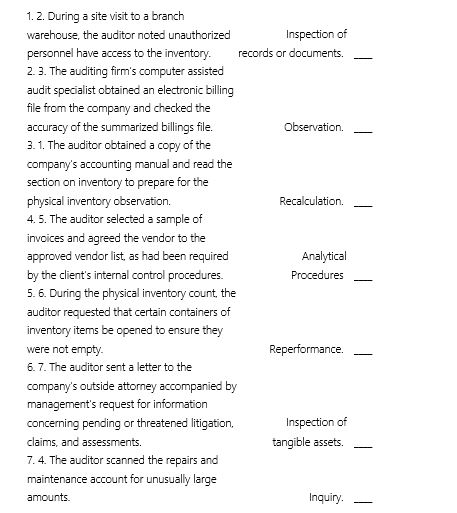

For each of the audit procedures listed below select the type of audit procedure,if any,that the auditor performed.A type of audit procedure may be selected once or not at all.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

In evaluating an entity's accounting estimates,one of the auditor's objectives is to determine whether the estimates are

A)Prepared in a satisfactory control environment.

B)Consistent with industry guidelines.

C)Based on verifiable objective assumptions.

D)Reasonable in the circumstances.

A)Prepared in a satisfactory control environment.

B)Consistent with industry guidelines.

C)Based on verifiable objective assumptions.

D)Reasonable in the circumstances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

During an audit engagement pertinent data are prepared and included in the audit working papers.The working papers primarily are considered to be:

A)A client-owned record of conclusions reached by the auditors who performed the engagement.

B)Evidence supporting financial statements.

C)Support for the auditors' representations as to compliance with generally accepted auditing standards.

D)A record to be used as a basis for the following year's engagement.

A)A client-owned record of conclusions reached by the auditors who performed the engagement.

B)Evidence supporting financial statements.

C)Support for the auditors' representations as to compliance with generally accepted auditing standards.

D)A record to be used as a basis for the following year's engagement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

The date on which no information may be deleted from audit documentation is the

A)Client's year-end.

B)Documentation completion date.

C)Last date of significant fieldwork.

D)All of these are incorrect in that no information may ever be deleted from audit documentation.

A)Client's year-end.

B)Documentation completion date.

C)Last date of significant fieldwork.

D)All of these are incorrect in that no information may ever be deleted from audit documentation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

The permanent file section of the working papers that is kept for each audit client most likely contains:

A)Review notes pertaining to questions and comments regarding the audit work performed.

B)A schedule of time spent on the engagement by each individual auditor.

C)Correspondence with the client's legal counsel concerning pending litigation.

D)Narrative descriptions of the client's accounting procedures and controls.

A)Review notes pertaining to questions and comments regarding the audit work performed.

B)A schedule of time spent on the engagement by each individual auditor.

C)Correspondence with the client's legal counsel concerning pending litigation.

D)Narrative descriptions of the client's accounting procedures and controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

Confirmation would be most effective in addressing the existence assertion for the:

A)Addition of a milling machine to a machine shop.

B)Payment of payroll during regular course of business.

C)Inventory held on consignment.

D)Granting of a patent for a special process developed by the organization.

A)Addition of a milling machine to a machine shop.

B)Payment of payroll during regular course of business.

C)Inventory held on consignment.

D)Granting of a patent for a special process developed by the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

Concerning retention of working papers,the Sarbanes-Oxley Act:

A)Has no provisions.

B)Requires permanent retention.

C)Requires retention for at least 7 years.

D)Requires retention for a period of 4 or less years.

A)Has no provisions.

B)Requires permanent retention.

C)Requires retention for at least 7 years.

D)Requires retention for a period of 4 or less years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck