Deck 14: Government Spending,Taxation,and the National Debt: Who Wins and Who Loses

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 14: Government Spending,Taxation,and the National Debt: Who Wins and Who Loses

1

A cash payment from the government to an individual,based on need,is an example of a

A)Transfer payment

B)Government purchase of a service

C)Government purchase of a good

D)Transaction payment

E)Government receipt

A)Transfer payment

B)Government purchase of a service

C)Government purchase of a good

D)Transaction payment

E)Government receipt

A

2

An efficient level of government expenditures is that level where

A)Total costs are minimized

B)Total benefits are maximized

C)Marginal benefits are equal to marginal costs

D)Marginal benefits are greater than marginal costs

E)Marginal benefits are less than marginal costs

A)Total costs are minimized

B)Total benefits are maximized

C)Marginal benefits are equal to marginal costs

D)Marginal benefits are greater than marginal costs

E)Marginal benefits are less than marginal costs

C

3

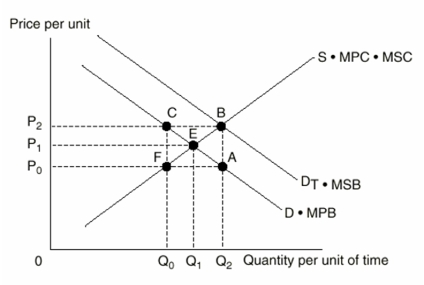

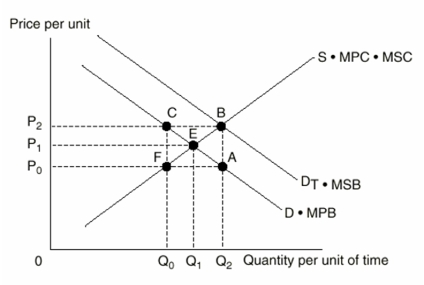

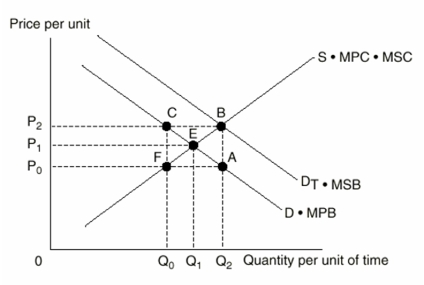

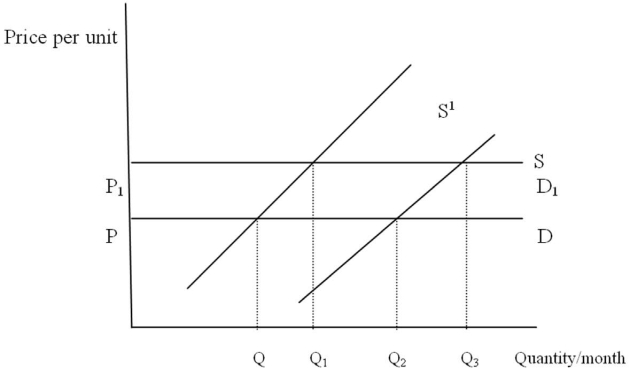

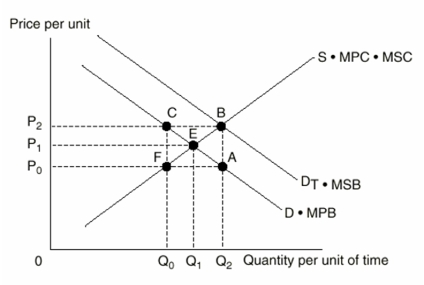

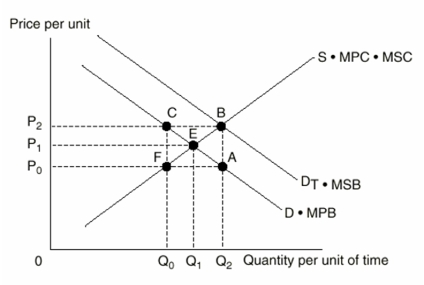

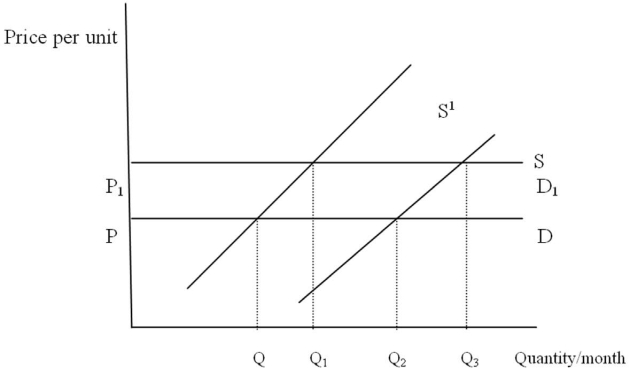

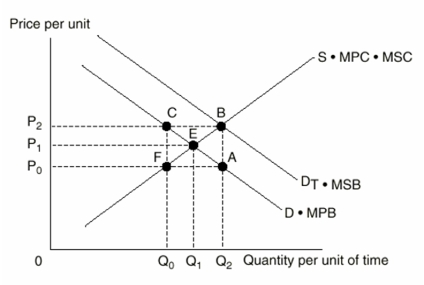

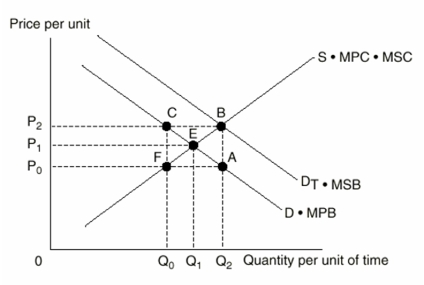

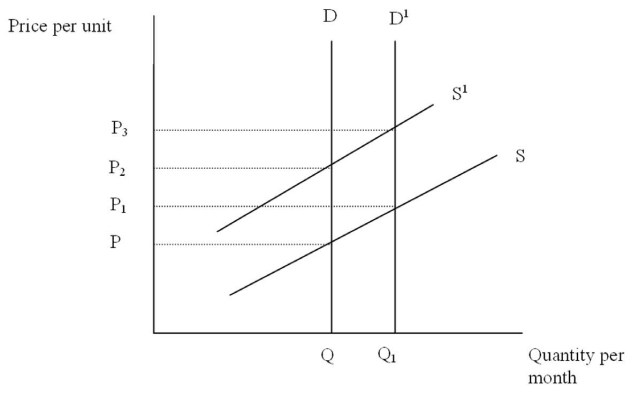

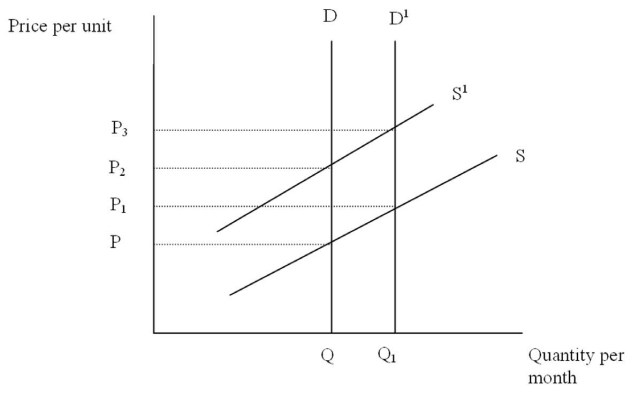

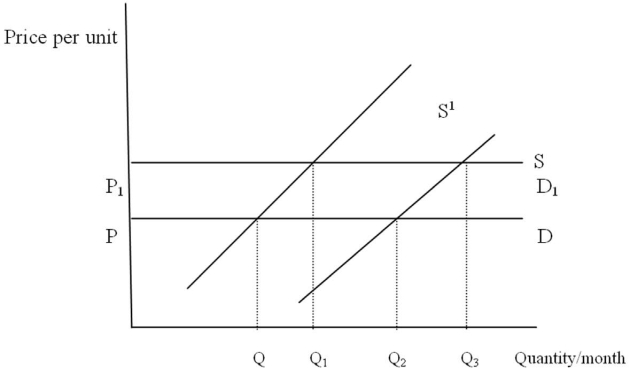

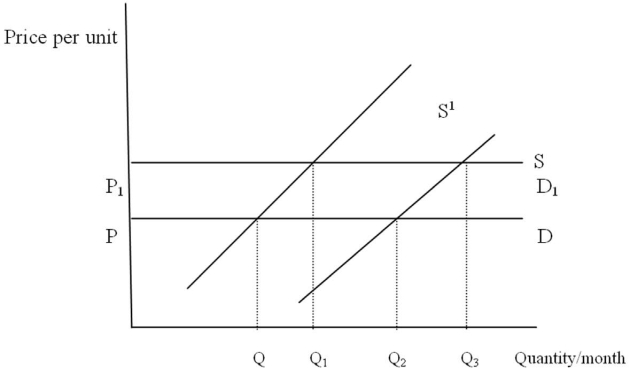

The Following Questions Refer to the graph below.

Assuming no external benefits or costs,the efficient price and quantity would be

A)P2,Q2

B)P2,Q1

C)P1,Q1

D)P0,Q0

E)P0,Q2

Assuming no external benefits or costs,the efficient price and quantity would be

A)P2,Q2

B)P2,Q1

C)P1,Q1

D)P0,Q0

E)P0,Q2

C

4

Total government expenditures currently represent approximately what percentage of GDP?

A)20%

B)30%

C)40%

D)50%

E)10%

A)20%

B)30%

C)40%

D)50%

E)10%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

According to the equimarginal principle,the efficient level of government expenditures occurs when the benefit of the last dollar spent for each government purchase is

A)Greater than the benefit of the last dollar spent in the private sector

B)Less than the benefit of the last dollar spent in the private sector

C)Equal to the benefit of the last dollar spent in the private sector

D)Paid for out of current tax collections

E)None of the above

A)Greater than the benefit of the last dollar spent in the private sector

B)Less than the benefit of the last dollar spent in the private sector

C)Equal to the benefit of the last dollar spent in the private sector

D)Paid for out of current tax collections

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

A national crime lab used to prevent criminal activity nationwide is an example of a

A)Negative externality

B)Positive externality

C)Transfer payment

D)Public good

E)Private good

A)Negative externality

B)Positive externality

C)Transfer payment

D)Public good

E)Private good

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

The fears of people concerning distribution of taxes are related to

A)Equity or justice in taxation

B)Ample evidence that there are tax inequities in the tax system at all levels of government

C)The complete lack of understanding that people have about the purpose of taxes

D)Both (a)and (b)

E)All of the above

A)Equity or justice in taxation

B)Ample evidence that there are tax inequities in the tax system at all levels of government

C)The complete lack of understanding that people have about the purpose of taxes

D)Both (a)and (b)

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

Where marginal benefits are greater than the marginal costs,government expenditures should

A)Be increased

B)Remain the same

C)Be decreased then increased to their original level

D)Be increased then decreased to their original level

E)Do none of the above

A)Be increased

B)Remain the same

C)Be decreased then increased to their original level

D)Be increased then decreased to their original level

E)Do none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Public goods and services have characteristics that make them

A)Possible to exclude people from consuming them

B)Less available for one person when another consumes them

C)Easy to provide through private markets

D)All of the above

E)None of the above

A)Possible to exclude people from consuming them

B)Less available for one person when another consumes them

C)Easy to provide through private markets

D)All of the above

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

Assuming positive externalities in consumption,the type of government action that could bring about an efficient level of production would be

A)A tax levied on each unit produced equal to marginal external costs

B)A tax levied on each unit produced greater than marginal external costs

C)A subsidy on each unit consumed equal to marginal external benefits

D)A subsidy on each unit consumed greater than marginal external benefits

E)None of the above

A)A tax levied on each unit produced equal to marginal external costs

B)A tax levied on each unit produced greater than marginal external costs

C)A subsidy on each unit consumed equal to marginal external benefits

D)A subsidy on each unit consumed greater than marginal external benefits

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

An efficient level of government expenditures is that level at which

A)Marginal benefits exceed marginal costs

B)Total benefits equal total costs

C)The net benefits to society are maximized

D)The total costs are minimized

E)None of the above

A)Marginal benefits exceed marginal costs

B)Total benefits equal total costs

C)The net benefits to society are maximized

D)The total costs are minimized

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

A payment from the government to a federal employee is a

A)Transfer payment

B)Government purchase of a service

C)Government purchase of a good

D)Transaction payment

E)Government receipt

A)Transfer payment

B)Government purchase of a service

C)Government purchase of a good

D)Transaction payment

E)Government receipt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

The fears of people concerning the size of government are

A)Always without any foundation

B)Well-founded in some instances and not well-founded in some instances

C)Difficult to appreciate

D)Due to low income and low educational levels of many people

E)Based solely on economic efficiency

A)Always without any foundation

B)Well-founded in some instances and not well-founded in some instances

C)Difficult to appreciate

D)Due to low income and low educational levels of many people

E)Based solely on economic efficiency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

An efficient tax would be a tax for which

A)The excess burden" from taxes is zero

B)Taxes should have a neutral effect on the operation of the economy

C)Taxes should be levied at progressive rates

D)(a)and (b)

E)All of the above

A)The excess burden" from taxes is zero

B)Taxes should have a neutral effect on the operation of the economy

C)Taxes should be levied at progressive rates

D)(a)and (b)

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

Characteristics of public goods and services include which of the following?

A)The demand for these goods and services is divisible on the basis of individual quantity demanded

B)The supply of these goods and services is generally not divisible into small units

C)These goods and services are easily provided by the market system

D)The costs of these goods fall on other than the buyer

E)None of the above

A)The demand for these goods and services is divisible on the basis of individual quantity demanded

B)The supply of these goods and services is generally not divisible into small units

C)These goods and services are easily provided by the market system

D)The costs of these goods fall on other than the buyer

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Tax equity means that

A)All people should pay equal taxes

B)Only the "rich" should pay taxes

C)People in the same economic circumstances should pay equal taxes,and people in different economic circumstances should pay unequal taxes

D)The distribution of income after taxes should be equal

E)None of the above

A)All people should pay equal taxes

B)Only the "rich" should pay taxes

C)People in the same economic circumstances should pay equal taxes,and people in different economic circumstances should pay unequal taxes

D)The distribution of income after taxes should be equal

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

The size of government is growing at

A)A slower rate than the rest of the economy

B)Approximately the same rate as the rest of the economy

C)A faster rate than the rest of the economy

D)Twice the rate of the rest of the economy

E)A negative rate

A)A slower rate than the rest of the economy

B)Approximately the same rate as the rest of the economy

C)A faster rate than the rest of the economy

D)Twice the rate of the rest of the economy

E)A negative rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

Assuming negative externalities in production,the type of government action that could bring about an efficient level of production would be

A)A tax levied on each unit produced equal to marginal external costs

B)A tax levied on each unit produced greater than marginal external costs

C)A subsidy to consumers equal to marginal external benefits

D)A subsidy to consumers greater than marginal external benefits

E)None of the above

A)A tax levied on each unit produced equal to marginal external costs

B)A tax levied on each unit produced greater than marginal external costs

C)A subsidy to consumers equal to marginal external benefits

D)A subsidy to consumers greater than marginal external benefits

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following is an example of a public good or service?

A)A public highway

B)Free cheese offered by the government

C)Food stamps

D)Social security

E)Automobiles

A)A public highway

B)Free cheese offered by the government

C)Food stamps

D)Social security

E)Automobiles

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

Shifting income from those who are relatively productive to those who are relatively unproductive,say through taxes and subsidies,must be based on

A)Sound economic principles

B)The laws of demand and supply

C)The values of people as to what constitutes a "fair" distribution of income

D)Marginal cost and marginal benefit

E)Both (a)and (d)

A)Sound economic principles

B)The laws of demand and supply

C)The values of people as to what constitutes a "fair" distribution of income

D)Marginal cost and marginal benefit

E)Both (a)and (d)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

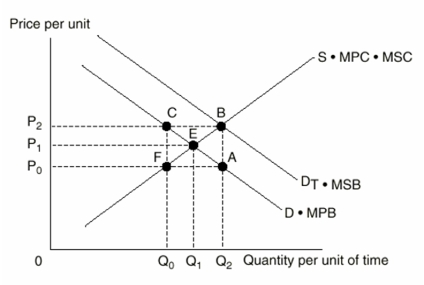

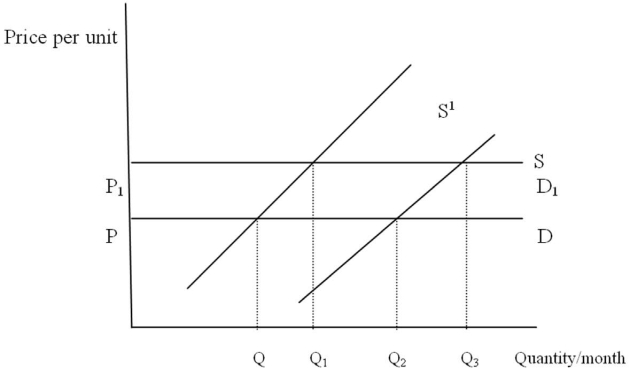

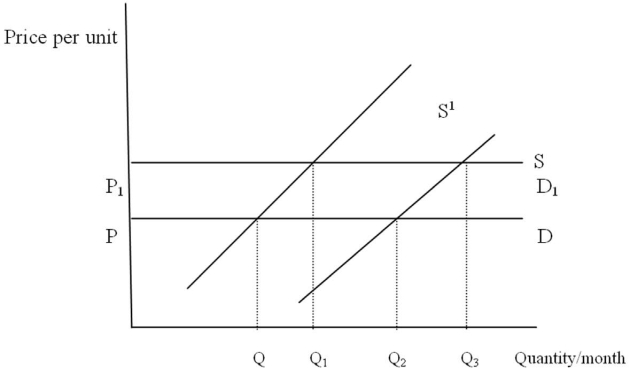

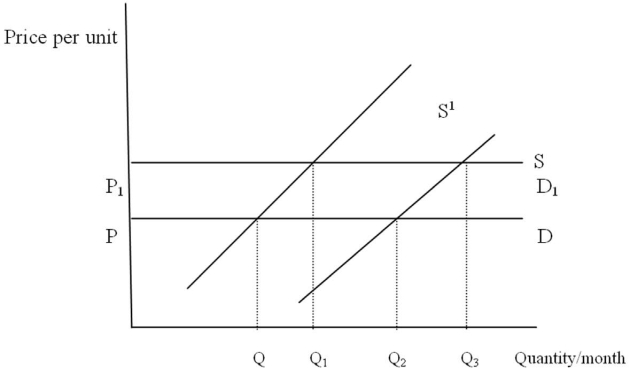

The Following Questions Refer to the graph below.

To assure consumers purchase the efficient quantity when there are positive external benefits,the government would lower price to

A)P2

B)P1

C)P2- P1

D)P0- P1

E)P0

To assure consumers purchase the efficient quantity when there are positive external benefits,the government would lower price to

A)P2

B)P1

C)P2- P1

D)P0- P1

E)P0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Following Questions Refer to the graph below.

If external benefits are associated with the consumption of the good,consumers could be induced to purchase the efficient quantity if the price were set at

A)P2

B)P1

C)P0

D)0

E)None of the above

If external benefits are associated with the consumption of the good,consumers could be induced to purchase the efficient quantity if the price were set at

A)P2

B)P1

C)P0

D)0

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

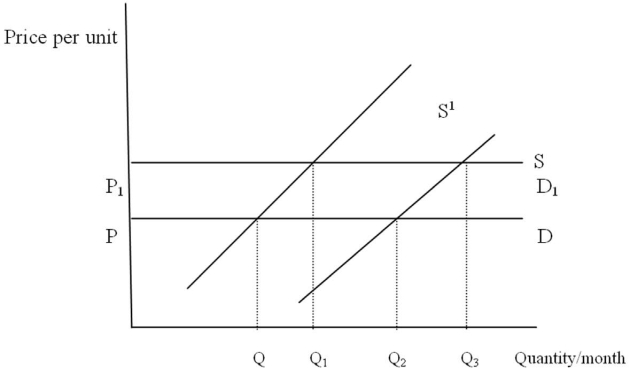

23

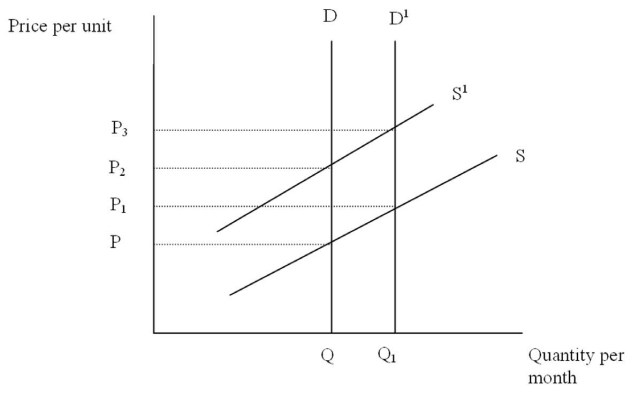

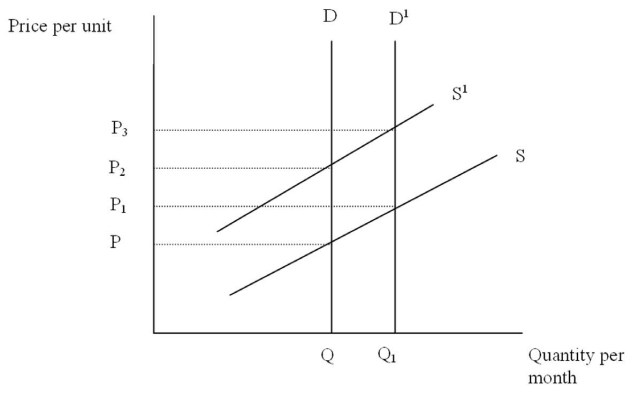

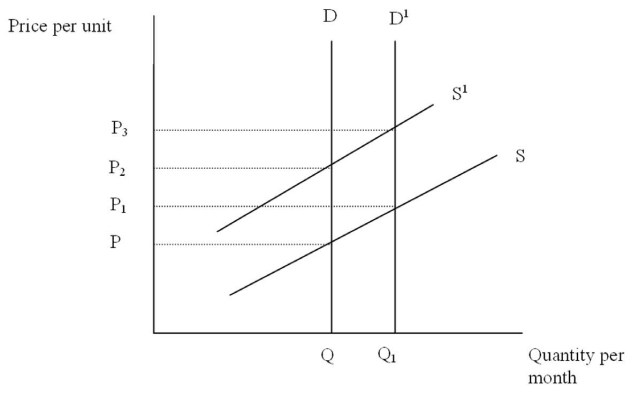

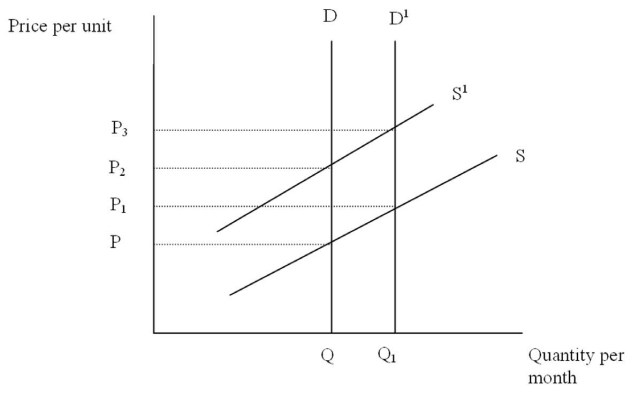

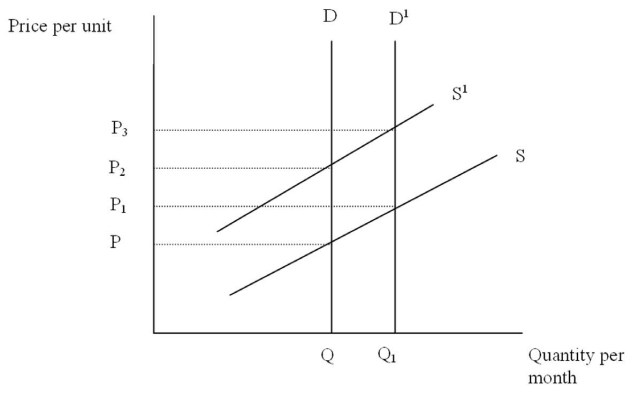

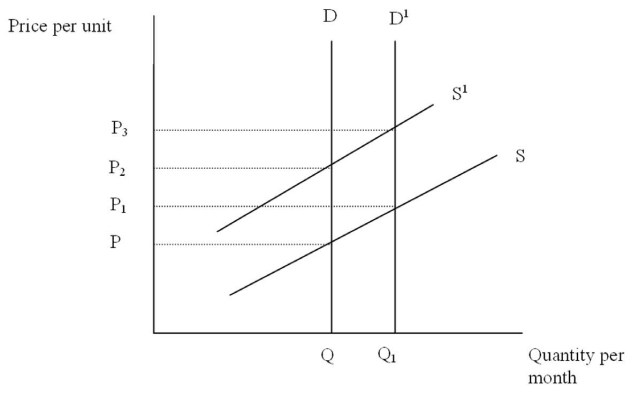

The Following Questions Refer to the graph below.

Which of the following shifts represents the effect of a tax on this good levied independent of output?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

Which of the following shifts represents the effect of a tax on this good levied independent of output?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Following Questions Refer to the graph below.

Which of the following shifts represents the effect of a tax on this good levied independent of output?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

Which of the following shifts represents the effect of a tax on this good levied independent of output?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Following Questions Refer to the graph below.

The demand curve for this product can be described as

A)Perfectly elastic

B)Perfectly inelastic

C)Unitary elastic

D)Hyper elastic

E)Price elastic

The demand curve for this product can be described as

A)Perfectly elastic

B)Perfectly inelastic

C)Unitary elastic

D)Hyper elastic

E)Price elastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

A progressive tax rate means that the ratio of tax collections to income

A)Falls as income rises

B)Rises as income rises

C)Remains the same as income rises

D)Either (a)and (b)

E)May fall,rise,or remain the same as income rises

A)Falls as income rises

B)Rises as income rises

C)Remains the same as income rises

D)Either (a)and (b)

E)May fall,rise,or remain the same as income rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Following Questions Refer to the graph below.

Suppose there are external benefits associated with the production of the gooD.The efficient price and quantity are

A)P2,Q2

B)P2,Q1

C)P1,Q1

D)P0,Q0

E)P0,Q2

Suppose there are external benefits associated with the production of the gooD.The efficient price and quantity are

A)P2,Q2

B)P2,Q1

C)P1,Q1

D)P0,Q0

E)P0,Q2

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

The ability to pay the principle of taxation suggests that people with more income should pay more taxes.This means that

A)Progressive income rates are consistent with the ability to pay principle

B)Proportional income rates are consistent with the ability to pay principle

C)Regressive income rates may or may not be consistent with the ability to pay principle depending on the rate of regression

D)Sales taxes are consistent with the ability to pay principle

E)None of the above

A)Progressive income rates are consistent with the ability to pay principle

B)Proportional income rates are consistent with the ability to pay principle

C)Regressive income rates may or may not be consistent with the ability to pay principle depending on the rate of regression

D)Sales taxes are consistent with the ability to pay principle

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

In the US,major sources of tax revenues are:

A)Income taxes at the federal level,property taxes at the state level

B)Sales taxes at the federal level and income taxes and property taxes at the state level

C)Income taxes at the federal level and income and sales taxes at the state level

D)Income taxes at the federal level and payroll taxes at the state level

A)Income taxes at the federal level,property taxes at the state level

B)Sales taxes at the federal level and income taxes and property taxes at the state level

C)Income taxes at the federal level and income and sales taxes at the state level

D)Income taxes at the federal level and payroll taxes at the state level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is the major tax source of the federal government?

A)Income taxes

B)Excise taxes

C)Property taxes

D)Wealth taxes

E)Sales taxes

A)Income taxes

B)Excise taxes

C)Property taxes

D)Wealth taxes

E)Sales taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

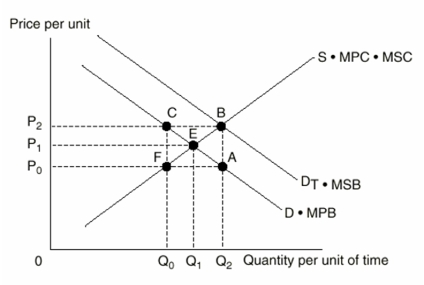

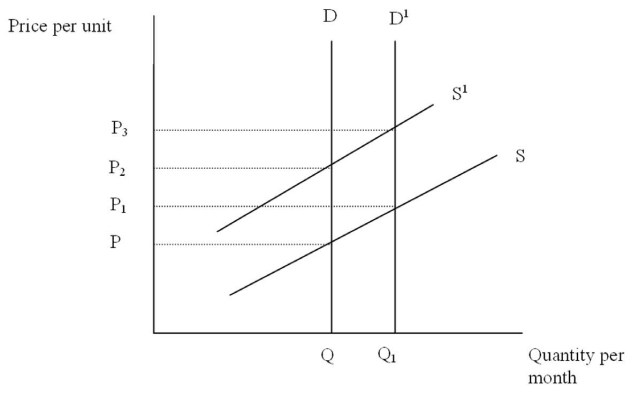

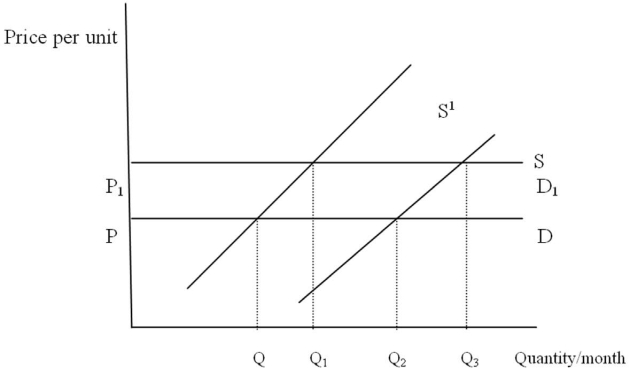

The Following Questions Refer to the graph below.

Given demand curve D,if an output tax per unit of P- P2 is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)It can not be determined

Given demand curve D,if an output tax per unit of P- P2 is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)It can not be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

The Following Questions Refer to the graph below.

Given demand curve D,if an output tax per unit of P- P1 is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)Cannot be determined

Given demand curve D,if an output tax per unit of P- P1 is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

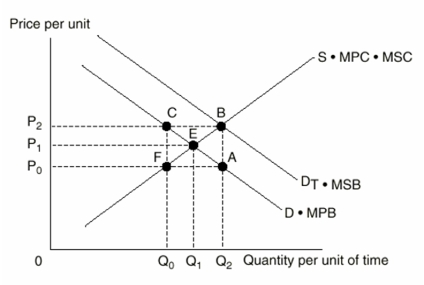

The Following Questions Refer to the graph below.

The demand curve for this product can be described as

A)Perfectly elastic

B)Perfectly inelastic

C)Unitary elastic

D)Hyper elastic

E)Price elastic

The demand curve for this product can be described as

A)Perfectly elastic

B)Perfectly inelastic

C)Unitary elastic

D)Hyper elastic

E)Price elastic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

A tax levied independent of output,such as a tax levied on net income of corporations,will

A)Be shifted if demand is more elastic than supply

B)Be shifted if supply is more elastic than demand

C)Not be shifted in the short run if the most profitable output has been selected before the tax

D)Be shifted in the short run if the most profitable output has been selected before the tax

E)Do none of the above

A)Be shifted if demand is more elastic than supply

B)Be shifted if supply is more elastic than demand

C)Not be shifted in the short run if the most profitable output has been selected before the tax

D)Be shifted in the short run if the most profitable output has been selected before the tax

E)Do none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Following Questions Refer to the graph below.

Marginal external benefits are represented on the graph as the distance

A)AB

B)Q2A

C)EA

D)CF

E)AF

Marginal external benefits are represented on the graph as the distance

A)AB

B)Q2A

C)EA

D)CF

E)AF

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

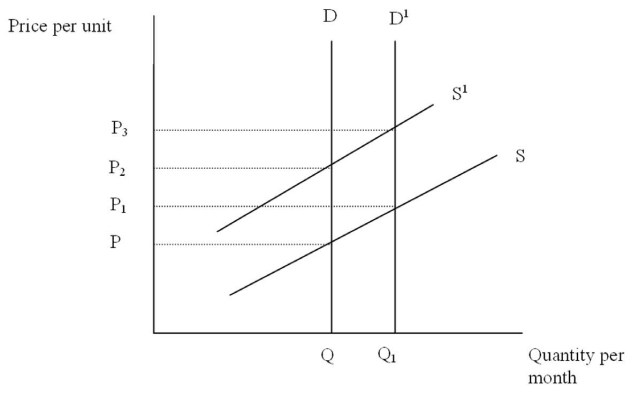

The Following Questions Refer to the graph below.

Which of the following shifts represents the effect of an output tax levied on this good?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

Which of the following shifts represents the effect of an output tax levied on this good?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

The Following Questions Refer to the graph below.

Given demand curve D,if a tax independent of output is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)Cannot be determined

Given demand curve D,if a tax independent of output is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

An output tax will be shifted completely

A)Backward if demand is price inelastic

B)Forward if demand is perfectly price inelastic

C)Forward if demand is price elastic

D)Backward,regardless of elasticity

E)All of the above

A)Backward if demand is price inelastic

B)Forward if demand is perfectly price inelastic

C)Forward if demand is price elastic

D)Backward,regardless of elasticity

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Following Questions Refer to the graph below.

Given demand curve D,if a tax independent of output is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)Cannot be determined

Given demand curve D,if a tax independent of output is levied on this good,how much of the tax will be shifted forward?

A)None

B)One-fourth

C)Half

D)All

E)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

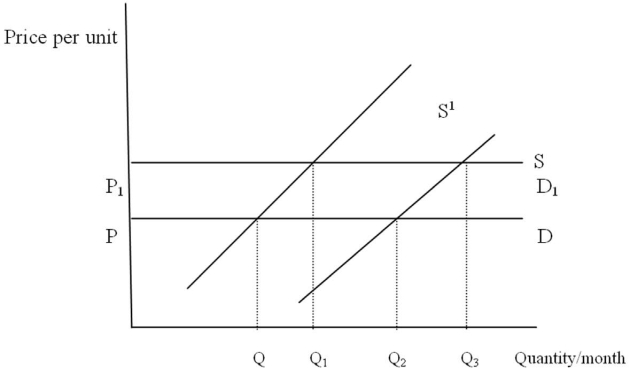

40

The Following Questions Refer to the graph below.

Which of the following shifts represents the effect of an output tax levied on this good?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

Which of the following shifts represents the effect of an output tax levied on this good?

A)D to D1

B)D1 to D

C)S to S1

D)S1 to S

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

Regressive tax rates mean that the ratio of tax collections to income

A)Falls as income rises

B)Rises as income rises

C)Remains the same as income rises

D)Remains the same as income falls

E)Falls as income falls

A)Falls as income rises

B)Rises as income rises

C)Remains the same as income rises

D)Remains the same as income falls

E)Falls as income falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

The gasoline tax is often used to illustrate the benefits received principle of taxation because

A)Everyone benefits from the gasoline tax

B)Those who pay the tax receive benefits,since the revenues are used for road and highway construction and maintenance

C)The amount we pay is consistent with our incomes

D)Everyone knows when they pay the tax

E)The gasoline tax is a poor example of the benefits received principle

A)Everyone benefits from the gasoline tax

B)Those who pay the tax receive benefits,since the revenues are used for road and highway construction and maintenance

C)The amount we pay is consistent with our incomes

D)Everyone knows when they pay the tax

E)The gasoline tax is a poor example of the benefits received principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

Vertical equity implies that

A)People in different states should pay the same taxes

B)People with comparable incomes should pay the same taxes

C)People in different economic circumstances should pay different amounts

D)Taxes should rise as the size of your family increases

E)Taxes should be based upon how tall the taxpayer is

A)People in different states should pay the same taxes

B)People with comparable incomes should pay the same taxes

C)People in different economic circumstances should pay different amounts

D)Taxes should rise as the size of your family increases

E)Taxes should be based upon how tall the taxpayer is

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Suppose one individual earns $25,000 per year and another individual earns $15,000 per year.If the individual earning $25,000 per year pays $750 more per year in taxes than the person earning $15,000,this is an illustration of

A)The benefits received principle

B)The ability to pay principle

C)The equal tax treatment principle

D)The equitable payment doctrine

E)None of the above

A)The benefits received principle

B)The ability to pay principle

C)The equal tax treatment principle

D)The equitable payment doctrine

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

If demand for a product is perfectly inelastic,an output tax will be shifted

A)Completely backward

B)Completely forward

C)Completely to the poor

D)Completely to the rich

E)Completely to the producer

A)Completely backward

B)Completely forward

C)Completely to the poor

D)Completely to the rich

E)Completely to the producer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

A tax that is shifted forward is a tax that falls on

A)The consumer in the form of higher prices

B)The producer through lower sales

C)The government

D)Foreign investors

E)None of the above

A)The consumer in the form of higher prices

B)The producer through lower sales

C)The government

D)Foreign investors

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

If we levy a tax on profits that is neither shifted neither forward nor backward,it is

A)An output tax

B)An input tax

C)A tax independent of output

D)A tax dependent on output

E)None of the above

A)An output tax

B)An input tax

C)A tax independent of output

D)A tax dependent on output

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

Proportional tax rates mean that the ratio of tax collection to income

A)Falls as income rises

B)Rises,as income rises

C)Remains the same as income rises

D)Rises as income falls

E)Falls as income falls

A)Falls as income rises

B)Rises,as income rises

C)Remains the same as income rises

D)Rises as income falls

E)Falls as income falls

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Government borrowing is argued to have the effect of raising interest rates-the "crowding-out effect." In conjunction with government spending,does government spending and borrowing have a positive or negative impact on the economy?

A)Negative,since borrowing exceeds spending

B)A positive impact,since expenditures often exceed borrowing

C)A neutral effect,since the budget is always in balance

D)Government spending and borrowing have a minimal effect on the economy

E)Government spending and borrowing must be considered separately

A)Negative,since borrowing exceeds spending

B)A positive impact,since expenditures often exceed borrowing

C)A neutral effect,since the budget is always in balance

D)Government spending and borrowing have a minimal effect on the economy

E)Government spending and borrowing must be considered separately

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose there are two individuals who each earn $25,000 per year.One individual pays $2,500 in taxes and the other pays $2,000.This is a violation of

A)The benefits received principle

B)The ability to pay principle

C)Vertical equity

D)Horizontal equity

E)None of the above

A)The benefits received principle

B)The ability to pay principle

C)Vertical equity

D)Horizontal equity

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following countries has the lowest taxes collected (as a percent of GDP)?

A)The United States

B)Germany

C)Italy

D)France

E)The United Kingdom

A)The United States

B)Germany

C)Italy

D)France

E)The United Kingdom

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

The federal government lowered tax rates in

A)1986 and 2001

B)1986

C)2001

D)Neither year

E)1909 and has raised them ever since

A)1986 and 2001

B)1986

C)2001

D)Neither year

E)1909 and has raised them ever since

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

The US federal personal income tax is an example of a(n)

A)Regressive tax rate structure

B)Proportional tax rate structure

C)Progressive tax rate structure

D)More regressive than proportional tax rate structure

E)Equitable tax rate structure

A)Regressive tax rate structure

B)Proportional tax rate structure

C)Progressive tax rate structure

D)More regressive than proportional tax rate structure

E)Equitable tax rate structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the ratio of tax collections to income rises as income rises,then the tax rate is

A)Regressive

B)Proportional

C)Progressive

D)Regressive then proportional

E)None of the above

A)Regressive

B)Proportional

C)Progressive

D)Regressive then proportional

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

The highest effective federal tax rate in the United States falls on which income category?

A)The lowest quintile

B)The middle quintile

C)The top 10%

D)The top 5%

E)The top 1%

A)The lowest quintile

B)The middle quintile

C)The top 10%

D)The top 5%

E)The top 1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

At the federal level,the largest revenue generating tax is the

A)Corporate income tax

B)Personal income tax

C)Property tax

D)Sales tax

E)Customs duty

A)Corporate income tax

B)Personal income tax

C)Property tax

D)Sales tax

E)Customs duty

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

The highest effective federal tax rate in the United States is approximately

A)10%

B)15%

C)20%

D)24%

E)34%

A)10%

B)15%

C)20%

D)24%

E)34%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

A tax that is shifted backward is a tax that falls on

A)The consumer in the form of higher prices

B)The owners of resources in the form of lower resource prices

C)The government

D)Foreign investors

E)None of the above

A)The consumer in the form of higher prices

B)The owners of resources in the form of lower resource prices

C)The government

D)Foreign investors

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

A tax system that will not alter the distribution of income is

A)Proportional

B)Regressive

C)Slightly progressive

D)Very progressive

E)None of the above

A)Proportional

B)Regressive

C)Slightly progressive

D)Very progressive

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

The federal tax system in the United States can be described as

A)Regressive

B)Highly progressive

C)Slightly progressive

D)Proportional

E)None of the above

A)Regressive

B)Highly progressive

C)Slightly progressive

D)Proportional

E)None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

The fears that people have concerning government are related to the size of government and the distribution of taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

The 1986 Tax Reform Act ________ the number of tax brackets and _______ the highest tax bracket.

A)Increased; increased

B)Increased; decreased

C)Decreased; increased

D)Decreased; decreased

E)Decreased; did not change

A)Increased; increased

B)Increased; decreased

C)Decreased; increased

D)Decreased; decreased

E)Decreased; did not change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

The federal government ended its most recent period of budget surpluses and returned to deficits in

A)1999

B)2000

C)2001

D)2002

E)2003

A)1999

B)2000

C)2001

D)2002

E)2003

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Enforcement and collection of personal income taxes is the responsibility of the

A)Treasury Department

B)Individual state governments

C)Federal Reserve System

D)Internal Revenue Service

E)Department of Labor

A)Treasury Department

B)Individual state governments

C)Federal Reserve System

D)Internal Revenue Service

E)Department of Labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

Retiring the federal debt will

A)Decrease the supply of government bonds

B)Increase government bond prices

C)Lower the interest rate on government bonds

D)Decrease the demand for money

E)Do all of the above

A)Decrease the supply of government bonds

B)Increase government bond prices

C)Lower the interest rate on government bonds

D)Decrease the demand for money

E)Do all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

The single most important source of tax revenue for the local governments in the United States is the

A)Real property tax

B)Personal income tax

C)National sales tax

D)Cigarette tax

E)Inheritance tax

A)Real property tax

B)Personal income tax

C)National sales tax

D)Cigarette tax

E)Inheritance tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

An increase in government borrowing will cause which of the following?

A)A decrease in the demand for loanable funds

B)A decrease in the supply of bonds

C)An increase in the interest rate

D)An increase in the price of bonds

E)All of the above

A)A decrease in the demand for loanable funds

B)A decrease in the supply of bonds

C)An increase in the interest rate

D)An increase in the price of bonds

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

Government transfer payments,such as public assistance payments and social security payments,have been a constant percentage of the GDP since 1960.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

Government purchases of goods and services have remained a constant percentage of the GDP for the last two decades.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

Since 2004,the highest personal income tax bracket has been

A)10%

B)15%

C)25%

D)28%

E)35%

A)10%

B)15%

C)25%

D)28%

E)35%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

Some of the fears that people have concerning government are well-founded and some are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

The federal deficit was increased in 2002 as a result of

A)The 2001 recession

B)The war on terrorism

C)The 2001 tax cut

D)Increased defense spending

E)All of the above

A)The 2001 recession

B)The war on terrorism

C)The 2001 tax cut

D)Increased defense spending

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Federal debt reduction will cause which of the following?

A)A decrease in the interest rate

B)An increase in private investment

C)A decrease in the supply of bonds

D)An increase in the price of bonds

E)All of the above

A)A decrease in the interest rate

B)An increase in private investment

C)A decrease in the supply of bonds

D)An increase in the price of bonds

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

Before an intelligent decision can be made about whether government is too large or small,the benefits and costs must be weigheD.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a government bond with a maturity value of $10,000 sells for $9,000 and pays annual interest of $1,000,what is the rate of interest on the bond?

A)1%

B)10%

C)11.1%

D)88.9%

E)90%

A)1%

B)10%

C)11.1%

D)88.9%

E)90%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

Government expenditures have grown faster than the GDP since 1958,representing about fifty percent of GDP today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

The Economic Growth and Taxpayer Relief Reconciliation Act passed by Congress and signed by President George W.Bush did which of the following?

A)Immediately cut federal tax rates by one-third

B)Gave a $300 check to each taxpayer

C)Decreased the tax on income from financial investments

D)Decreased the federal budget deficit

E)Increased the number of personal income tax brackets

A)Immediately cut federal tax rates by one-third

B)Gave a $300 check to each taxpayer

C)Decreased the tax on income from financial investments

D)Decreased the federal budget deficit

E)Increased the number of personal income tax brackets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

The first budget surplus since 1969 occurred in

A)1993

B)1995

C)1998

D)1999

E)2000

A)1993

B)1995

C)1998

D)1999

E)2000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

The budget surpluses of the late 1990's and the early 2000's could be attributed to which of the following government policies?

A)The Value Added Tax Act

B)The Tax Reform Act of 1986

C)The Economic Growth and Taxpayer Relief Reconciliation Act

D)Increased government debt

E)All of the above

A)The Value Added Tax Act

B)The Tax Reform Act of 1986

C)The Economic Growth and Taxpayer Relief Reconciliation Act

D)Increased government debt

E)All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

The federal government uses taxes to

A)Generate revenue

B)Encourage saving for education and retirement

C)Discourage certain behaviors

D)Promote the purchase of houses

E)Do all of the above

A)Generate revenue

B)Encourage saving for education and retirement

C)Discourage certain behaviors

D)Promote the purchase of houses

E)Do all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck